Professional Documents

Culture Documents

Accounting

Uploaded by

Mayurdhvajsinh JadejaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting

Uploaded by

Mayurdhvajsinh JadejaCopyright:

Available Formats

What are the groups under which errors in accounting are placed?

Errors in accounting are placed in the following main groups: - Error of Omission - Error of Commission - Error of Principle - Compensating Error

What are the types of errors which have an effect on Trial Balance?

Following are the types of errors which affect agreement of Trial Balance: - Wrong totalling of subsidiary books - Posting on the wrong side of the account - Posting of the wrong amount - Omission of posting an amount in the ledger - Error of balancing

What type of errors do not affect the Trial Balance?

Following are the types of errors which do not affect the Trial Balance: - Compensating Error - Errors of Principle - Errors of Omission - Errors of Commission - Wrong amount recorded in the subsidiary books

What steps would you take to locate the errors in case Trial Balance disagrees?

In case Trial Balance disagrees, following steps should be taken to locate the errors: -Totalling of all the subsidiary books and trial balance should be checked carefully. -Opening balances of all the accounts are properly brought down in the current years books of account. -Ledger accounts have been properly balanced and the balances of ledger accounts have been correctly shown in the trial balance. -To locate some errors the difference in the trial balance in halved. -Another way is dividing the difference in the trial balance by 9. -If the difference gets divisible without leaving any reminder that indicates the transposition of the amounts. -To locate certain other errors, current year trial balance can be compared with the trial balance of the previous year.

What measures would you take to rectify the errors?

If the trial balance does not agree, in such case to close the books of accounts the difference in the trial balance is posted in a suspense account and then the trial balance is tallied. As the balance in the Suspense account needs to be nil. Thus, attempts are made to locate the errors and the rectification is

made through suspense account. It should be remembered that Suspense account exists till the time all the errors are located and rectified making the balance of Suspense account nil. The other way of rectifying the errors is by passing rectification entries. These entries are passed when the errors which affect two account and do not affect the agreement in the Trial balance. In this method of rectification the following steps are taken: - First find out the wrong entry passed - Second, write the correct entry which should have passed. - Third, to nullify the wrong effect, reverse the same and reinstate the correct by passing rectification entry. For e.g.: Rs. 200 received from Ravi have been credited to Ram. Wrong Entry: Cash A/c----------Dr. 200 To, Ram A/c 200 Correct Entry: Cash A/c----------Dr. 200 To, Ravi A/c 200 Rectification Entry: Ram A/c--------Dr. 200 To, Ravi A/c 200 To, Ravi A/c 200

What is cost accountancy? What are the objects of Cost Accountancy?

Cost accountancy is the application of costing and cost accounting principles, methods and techniques to the science, art and practice of cost control and the ascertainment of profitability as well as the presentation of information for the purpose of managerial decision making. Following are the objects of Cost Accountancy: -Ascertainment of Cost and Profitability -Determining Selling Price -Facilitating Cost Control -Presentation of information for effective managerial decision -Provide basis for operating policy -Facilitating preparation of financial or other statements

What is the difference between costing and cost accounting?

Costing is the process of ascertaining costs whereas cost accounting is the process of recording various costs in a systematic manner, in order to prepare statistical date to ascertain cost.

What is cost centre?

Cost centre is defined as a location, machine, person, department, division, or any equipment or group of these, in relation to which direct and indirect costs may be ascertained and used for the purpose of cost control. Thus, an organisation for the costing purposes is divided in convenient units and one of the convenient units is known as cost centre. Example: collecting, sorting, washing of clothes are the various activities which are separate cost centre in a laundry. The cost centre facilitates this function of cost control. Thus, correct identification of cost centre is a prerequisite for the successful implementation of cost accounting process. This also facilitates the fixation of responsibility in the correct manner.

Compare the following:

a.) Impersonal and personal cost centres: Impersonal Cost Centre: consist items of impersonal nature like an equipment or location. Example of Impersonal Cost Centre: a department, a branch, a region of sale, etc. Personal Cost Centre: consist items of personal nature like a person or a group of persons. Example of Personal Cost Centre: Regional Manager, Sales Manager, Marketing Manger, etc. b.) Production and service cost centres: Production Cost Centre: is the place where the production activity is carried on. Example of Production Cost Centre: a assembly shop, a paint shop etc. Service Cost Centre: is the place where all types of assistance are given to the production activities. Example of Service Cost Centre: the store department, the labour office, the account/costing department etc.

Explain fixed, variable and semi-variable costs.

Fixed Cost is the cost which remains constant or unaffected by variations in the volume of output within a given period of time. Example: Rent or rates, Insurance charges, etc. Variable Cost is the cost which varies directly in proportion with every increase or decrease in the volume of output with a given a period of time. Example: Wages paid to labours, cost of direct material, consumable stores, etc. Semi-variable Cost is the cost which is neither fixed nor variable in nature. These remain fixed at certain level of operations while may vary proportionately at other levels of operations. Example: maintenance cost, repairs, power, etc.

Explain controllable and uncontrollable costs.

Controllable Cost are the costs which can be influenced by the action of a specified member of the undertaking. They are incurred in a particular responsibility centres can be influenced by the action of the executive heading that responsibility centre. For example: Direct labour cost, direct material cost, direct expenses controllable by the shop level management. Uncontrollable Cost are the costs which cannot be influenced by the action of a specified member of the undertaking. For example: a foreman incharge of a tool room can only control costs pertaining to the same department and the matters which come directly under his control, not the costs apportioned to other department. The expenditure which is controllable by an individual may be uncontrollable by another individual.

Explain Normal and Abnormal Costs.

Normal Cost are the normal or regular costs which are incurred in the normal conditions during the normal operations of the organization. They are the sum of actual direct materials cost, actual labour cost and other direct expense. Example: repairs, maintenance, salaries paid to employees. Abnormal Cost are the costs which are unusual or irregular which are not incurred due to abnormal situation s of the operations or productions. Example: destruction due to fire, shut down of machinery, lock outs, etc.

Explain Opportunity Cost and Differential Cost.

Opportunity Cost is the cost incurred by the organisation when one alternative is selected over another. For example: A person has Rs. 100000 and he has two options to invest his money, either invests in fixed deposit scheme or buy a land with the money. If he decides to put is money to buy the land then the loss of interest which he could have received on fixed deposit would be an opportunity cost. Differential Cost is the difference between the costs of two alternatives. It includes both cost increase and cost decrease. It can be either variable or fixed. Example: Cost of first alternative = 10000; Cost of second alternative = 5000; Differential Cost = 10000 5000 = 5000

Explain Sunk Cost.

Sunk Cost is the sum that has already been incurred and cannot be recovered by any decision made now or in future. This cost is also called stranded cost. Example: A special purpose machine was bought by a company for Rs. 100000. The machine was used to make the product for which it was bought and now it is obsolete and cannot be sold. And it will be unwise to continue using that obsolete product to recover the original cost of the machine. In order words, Rs. 100000 already spent on that machine cannot be recovered in future. Such costs are said to be sunk costs and should be ignored in decision making process.

What are the various elements of costs?

There are three elements of cost: -Material Cost: This is the cost of material or the commodity used by the organisation for its production purpose. Material is the substance, from which a product is made. Thus, it may be in a raw or a manufactured state. It can be direct or indirect. -Direct Material Cost forms an integral part of the finished product and is identified with the individual cost centre. It is also described as process material, stores material, production material, etc. Example: Raw materials purchased or purchased primary packing material, etc. -Indirect Material Cost is used for ancillary purposes of the business and cannot be conveniently identified with the individual cost centre. Example: Consumable stores, oil and waste, printing and stationery material etc. -Labour Cost: This is the cost, incurred in the form of remuneration paid to the employees or labours of the organisation. The workforce required to convert material into finished product is called labour. It can be direct or indirect. -Direct Labour Cost is the cost incurred on those employees who directly take part in the manufacturing process and easily identified with the individual cost centre. -Indirect Labour Cost is the cost incurred on those employees who do not directly take part in the manufacturing process and cannot identified with the individual cost centre. Example: salary of foreman, salesmen, directors salary, etc. -Expenses: are the costs of services provided to the organisation. It can be direct or indirect. -Direct Expenses are the expenses which can be directly identified with the individual cost centres. Example: hire charges of machinery, cost of defective work for a particular job or contract etc. -Indirect Expenses are the expenses which cannot be directly identified with the individual cost centres. Example: rent, lighting, telephone expenses, etc.

Compare Financial Accounting and Cost Accounting.

1) Financial Accounting protects the interests of the outsiders dealing with the organization e.g shareholders, creditors etc. Whereas reports of Cost Accounting is used for the internal purpose by the management to enable the same in discharging various functions in a proper manner. 2) Maintenance of Financial Accounting records and preparation of financial statements is a legal requirement whereas Cost Accounting is not a legal requirement. 3) Financial Accounting is concerned about the calculation of profits and state of affairs of the organization as whole whereas Cost accounting deals in cost ascertainment and calculation of profitability of the individual products, departments etc. 4) Financial Accounting considers only transactions of historical financial nature whereas Cost Accounting considers not only historical data but also future events. 5) Financial Accounting reports are prepared in the standard formats in accordance with GAAP whereas Cost accounting information is reported in whatever form management wants

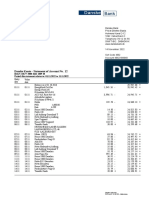

Question: Mr. A extracted a Trial Balance at 31 st December 2005 and found that it did not balance. He posted the difference to a Suspense Account. Later he found the following errors which accounted for the difference:

1. The total of $365 for Discount Allowed for the month of July05 had been posted to the credit side of Discount Received Account. 2. A payment of $ 210 to Mr A from a debtor Mr XY had been posted to the credit of Mr TEY in error.

3.

4. 5.

Mr A had paid $ 2,640 wages and supplied materials costing $960 to his own employees in building a store at the rear of his factory. No adjustment had been made. A payment of $56 for Postage had been posted to that account as $65 Mr A bought new fitting for his factory costing $1,800 but this transaction had been posted to the Purchases Account

6.

A payment of $96 for an electricity bill had been entered in the Cash Book but the double entry had not been made.

a) Mr. As Journal Entries Item No 1 Date Dec 31 Particulars Discount Received A/c Discount Allowed A/c Suspense A/c Being correction of Discount Allowed $365 wrongly Dr ($) 365 365 730 Cr ($)

credited to Discount Received Account 2 Dec 31 Mr TEY Account Mr XY Account Being correction of payments $2,100 by Mr XY wrongly credited to Mr TEY account 3 Dec 31 Drawings Account Wages Accoount Purchases Account Being correction of error on Wages paid $2,640 and material used $960 for own store) 4 Dec 31 Suspense Account Postage Account Being correction of Postage overstated $9 in Postage Account) 5 Dec 31 Fittings Account Purchases Account Being correction of new fittings purchased wrongly debited to Purchases account 6 Dec 31 Drawings Account Wages Accoount Purchases Account Being correction of error on Wages paid $2,640 and material used $960 for own store) 6 Dec 31 Electricity Account Suspense Account Being correction of electricity paid $96 not posted to that account (b) Suspense Account 96 96 3,600 2,640 960 1,800 1,800 9 9 3,600 2,640 960 210 210

2005 Dec 31 Difference as per Trial Balance Postage

$ 817 9 826

2005 Dec 31 Discount allowed Discount received Electricity

$ 365 365 96 826

Question: When the trial balance of XYZ Ltd as at 30/9/08 was prepared, a difference was found. A Suspense Account was created in order to achieve the balance: Examination of the books showed the following: Discount allowed of $76 had been credited to the Discount Received Account 1. A sale of $151 to Mr. A had been posted correctly to the personal account but entered in the Sales Day Book as $115 2. A cheque received from Mr. B entered correctly in the Cash Book as $766 had been posted to the companys account as $760 3. The purchase of new machinery for $1,200 had been posted to the Stock Account. Depreciation is ignored for the year in which the machinery is purchased 4. A sale of $265 to Mr. C had not been posted to his account 5. A petty cash balance of $100 was omitted from Trial Balance 6. Bank interest charges of $720 were correctly entered in the Cash Boo but the other side of the double entry had been omitted. Required: (a) Prepare Journal entries to correct the above errors, without narrations (14 marks) (b) Prepare a Suspense Account (7 marks) (c) Final accounts, prepared from the original trial balance, show the working capital to be $16,217. Prepare a statement showing the effect of the above correction of this figure ( 4 marks)

(a) Journal entries to correct errors ( without narrations) Debit($) 1 Discount Received Discount Allowed Suspense 76 76 152 Credit($)

Suspense Sales

36 36 6 6 1,200 1,200 265 265 100 100 720 720

Suspense Mr. B

Machinery Stock

Mr. C Suspense

Petty Cash Suspense

Bank Interest Charges Suspense

(b) Suspense Account Debit($) 30/9/08 Difference as per Trial Balance Mr. B Sales 1,195 6 36 30/9/08 Discount Received Discount Allowed Mr. C Bank Interest Charges 76 76 265 100 720 1,237

(c) Statement of the Correction on Working Capital

Credit($)

1,237

($) Working Capital as per Original Trial Balance (given)

($) 16,217

Add: Mr. C Petty Cash

265 100 365 16,582

Less: Mr. B Stock Working Capital after adjustments

6 1,200 (1,206) 15,376

Table 1: Types of error Error type 1 Omission - a transaction is not recorded at all 2 Error of commission - an item is entered to the correct side of the wrong account (there is a debit and a credit here, so the records balance) 3 Error of principle - an item is posted to the correct side of the wrong type of account, as when cash paid for plant repairs (expense) is debited to plant account (asset) (errors of principle are really a special case of errors of commission, and once again there is a debit and a credit) 4 Error of original entry - an incorrect figure is entered in the records and then posted to the correct account Example: Cash $1,000 for plant repairs is entered as $100; plant repairs account is debited with $100 5 Reversal of entries - the amount is correct, the accounts used are correct, but the account that should have been debited is credited and vice versa Example: Factory employees are used for plant maintenance: Correct entry: Debit: Plant maintenance Credit: Factory wages Easily done the wrong way round 6 Addition errors - figures are incorrectly added in a ledger account 7 Posting error a an entry made in one record is not posted at all b an entry in one record is incorrectly posted to another Examples: cash $10,000 entered in the cash book for the purchase of a car is: a not posted at all b posted to Motor cars account as $1,000 8 Trial balance errors - a balance is omitted, or incorrectly Suspense account involved? No No

No

No

No

Yes

Yes

Yes

extracted, in preparing the trial balance 9 Compensating errors - two equal and opposite errors leave the Yes, to correct each trial balance balancing (this type of error is rare, and can be because of the errors as a deliberate second error has been made to force the balancing of the discovered records or to conceal a fraud) For examination purposes we are more often concerned with the second of these differences and error correction.

Correcting errors

Errors 1 to 5, when discovered, will be corrected by means of a journal entry between the accounts affected. Errors 6 to 9 also require journal entries to correct them, but one side of the journal entry will be to the suspense account opened for the difference in the records. Type 8, trial balance errors, are different. As the suspense account records the difference, an entry to it is needed, because the error affects the difference. However, there is no ledger entry for the other side of the correction - the trial balance is simply amended.

An illustrative question

The bookkeeping system of Turner is not computerised, and at 30 September 20X8 the bookkeeper was unable to balance the accounts. The trial balance totals were: Debit $1,796,100 Credit $1,852,817 Nevertheless, he proceeded to prepare draft financial statements, inserting the difference as a balancing figure in the balance sheet. The draft profit and loss account showed a profit of $141,280 for the year ended 30 September 20X8. He then opened a suspense account for the difference and began to check through the accounting records to find the difference. He found the following errors and omissions: 1. $8,980 - the total of the sales returns book for September 20X8, had been credited to the purchases returns account. 2. $49,600 paid for an item of plant purchased on 1 April 20X8 had been debited to plant repairs account. The company depreciates its plant at 20% per annum on a straight line basis, with proportional depreciation in the year of purchase. 3. The cash discount totals for the month of September 20X8 had not been posted to the general ledger accounts. The figures were: Discount allowed $836 Discount received $919 4. $580 insurance prepaid at 30 September 20X7 had not been brought down as an opening balance 5. The balance of $38,260 on the telephone expense account had been omitted from the trial balance

6. A car held as a non-current asset had been sold during the year for $4,800. The proceeds of sale were entered in the cash book but had been credited to the sales account in the general ledger. The original cost of the car $12,000, and the accumulated depreciation to date $8,000, were included in the motor vehicles account and the accumulated depreciation account. The company depreciates motor vehicles at 25% per annum on a straight line basis with proportionate depreciation in the year of purchase but none in the year of sale. Required: a Open a suspense account for the difference between the trial balance totals. Prepare the journal entries necessary to correct the errors and eliminate the balance on the suspense account. Narratives are not required. (10 marks) b Draw up a statement showing the revised profit after correcting the above errors. (6 marks) Total (16 marks) Discussion The approach to the question should be: 1 Read the requirement paragraph at the end of the question. 2 Attack the question - note that narratives are not required. Begin by opening the suspense account. Which side? More debit is needed to balance the trial balance, so debit the suspense account with $56,717. Then deal with the errors in order: 1. Sales returns should have been debited to the sales returns account and they have been credited to the purchases returns account. There are two errors here - the wrong account has been used and an entry which should have been a debit has been entered as a credit. The suspense account entry must therefore be for 2 x $8,980 or $17,960. 2. An error of principle - no suspense account entry. Depreciation must be adjusted. 3. Items have not been posted, therefore the suspense account is involved. 4. Effectively a posting error - the suspense account is again involved. 5. A trial balance error must affect the suspense account - but no ledger entry. 6. This one needs thought. Take it one sentence at a time. Is the suspense account involved? No, because we have an error of commission followed by some unrecorded transactions. Attempt Part (a) of the question before studying the answer as detailed in Table 2. Let's now turn to Part (b). The most convenient format for the answer is two columns for - and +. Set them up and enter the adjustments appropriately. Which of the errors affect the profit? In fact they all do. Attempt Part (b) now before looking at the answer detailed in Table 3. Table 2: Answer - Part (A)

Suspense Account $ Difference Discount received 56,717 Sales returns 919 Purchases returns Discount allowed Insurance Telephone (trial balance) 57,636 $ 8,980 8,980 8,980 9,600 9,600 960 960 836 836 919 919 580 580 38,260 38,260 4,800 4,800 12,000 12,000 8,000 8,000 $ 8,980 8,980 836 580 38,260 57,636 $ 8,980

Journal entries

1 Sales returns account Suspense account Purchases returns account Suspense account 2 Plant account Plant repairs account Depreciation (income statement) Plant depreciation account 3 Discount allowed account Suspense account Suspense account Discount received account 4 Insurance account Suspense account 5 Trial balance (no ledger entry) Suspense account 6 Sales account Motor vehicles disposal account Motor vehicles disposal account Motor vehicles asset account Motor vehicles depreciation account Motor vehicles disposal account

Motor vehicles disposal account Income statement Table 3: Answer - Part (b)

800 800

Adjustment to profit

$ Profit as in draft income statement 1 Sales returns adjustment (2 x $8,980) 2 Plant: reduction in repairs depreciation - 6/12 x 20% x $9,600 3 Discount allowed Discount received 4 Insurance - opening balance omitted 5 Telephone expense omitted 6 Profit on sale of car Proceeds taken out of sales Revised net profit Some hints on preparing suspense accounts

+ $ 141,280 9,600

17,960 960 836 919 580 38,260 800 4,800 63,396 152,599 (63,396) 89,203

Does a correction involve the suspense account? The type of error determines this. Practice, and study of Table 1 should ensure that you see immediately which errors affect the balancing of the records and hence the suspense account. Which side of the suspense account must an entry go? This is one of the most awkward problems in preparing suspense accounts. The best way of solving it is to ask yourself which side the entry needs to be on in the other account concerned. The suspense account entry is then obviously to the opposite side. Look out for errors with two aspects. In the illustrative question earlier, error 1 is a case in point. An entry has been made to the wrong account, but also to the wrong side of the wrong account. Both errors must be corrected. It is very easy to fall into the trap of correcting only one of the errors, especially when working quickly under examination conditions.

In accordance with international accounting standard, the following are the basic key terms used in depreciation accounting for fixed assets:

1.

DEPRECIATION is the allocation of the depreciable amount of an asset over its estimated useful life. Depreciation for the accounting period is charged over net profit or loss for the period either directly or indirectly

2.

DEPRECIABLE ASSETS are assets which :

are expected to be used during more than one accounting period; have a limited useful life; and are held by an enterprise for use in the production or supply of goods and services, for rental to others, or for administrative purposes

3.

USEFUL LIFE is either:

the period over which a depreciable asset is expected to be used by the enterprise; or the number of production or similar units expected to be obtained from the asset by the enterprise

4.

DEPRECIABLE AMOUNT of a depreciable asset is the historical cost or other amount substituted for historical cost in the financial statements, less the estimated residual value.

You might also like

- Financial InstrumentsDocument68 pagesFinancial Instrumentspsy media100% (3)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Reviewer 2, Fundamentals of Accounting 2Document22 pagesReviewer 2, Fundamentals of Accounting 2Hunson Abadeer100% (2)

- Bank StatementDocument5 pagesBank Statementshahbaz alamNo ratings yet

- Forensic Biology and Serology Exam AnswersDocument13 pagesForensic Biology and Serology Exam AnswersMayurdhvajsinh Jadeja100% (3)

- Definition of CostingDocument22 pagesDefinition of CostingmichuttyNo ratings yet

- Cuck Cost Accounting PDFDocument119 pagesCuck Cost Accounting PDFaponojecy50% (2)

- Accounting Basics for Non-AccountantsDocument129 pagesAccounting Basics for Non-Accountantsdesikan_r100% (7)

- Assignment Question Paper Departmental Accounting PDFDocument17 pagesAssignment Question Paper Departmental Accounting PDFpiyush agarwal50% (2)

- AR Training Manual - Basic Concepts - PDFDocument93 pagesAR Training Manual - Basic Concepts - PDFAlaa Mostafa100% (13)

- Nuvali Sales Agency Net IncomeDocument4 pagesNuvali Sales Agency Net IncomeDivine CuasayNo ratings yet

- RoundingDocument65 pagesRoundingSourav Kumar100% (1)

- Overhead CostsDocument44 pagesOverhead CostsOmnia HassanNo ratings yet

- Explain How Do Managerial Accountants Support Strategic DecisionsDocument10 pagesExplain How Do Managerial Accountants Support Strategic DecisionsAmanuel GirmaNo ratings yet

- Cost and Management Accounting MMS Second SemesterDocument5 pagesCost and Management Accounting MMS Second SemesterTilottama KokateNo ratings yet

- Danske Bank StatementDocument1 pageDanske Bank StatementalysNo ratings yet

- Empanelled Hospitals Under RSBY in GujaratDocument67 pagesEmpanelled Hospitals Under RSBY in GujaratMayurdhvajsinh JadejaNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Cost Management Accounting April 2021Document10 pagesCost Management Accounting April 2021Nageshwar SinghNo ratings yet

- Universidad Tecnológica de Coahuila Production Cost Accounting ClassDocument13 pagesUniversidad Tecnológica de Coahuila Production Cost Accounting ClassEdgar IbarraNo ratings yet

- Nature of ExpenseDocument7 pagesNature of ExpenseAayush SinghNo ratings yet

- Nature and Scope of Cost & Management Accounting: Unit 1Document24 pagesNature and Scope of Cost & Management Accounting: Unit 1umang8808No ratings yet

- WWW - Globalcma.in: Cost Accounting Interview QuestionsDocument12 pagesWWW - Globalcma.in: Cost Accounting Interview Questionsjawed ahmerNo ratings yet

- Cost AccountingDocument15 pagesCost AccountingADNo ratings yet

- Cost StatementDocument24 pagesCost StatementankitahandaNo ratings yet

- Chapter IIIDocument37 pagesChapter IIISyed Aziz HussainNo ratings yet

- Cost Accounting Lecture NotesDocument12 pagesCost Accounting Lecture NotesMd. Ahsanur RahmanNo ratings yet

- Cost of AccountingDocument9 pagesCost of Accountingnadeemahad98No ratings yet

- 11th Sem - Cost ACT 1st NoteDocument5 pages11th Sem - Cost ACT 1st NoteRobin420420No ratings yet

- Q.1 Selected Financial Information About Vijay Merchant CompanyDocument11 pagesQ.1 Selected Financial Information About Vijay Merchant CompanyUttam SinghNo ratings yet

- Assignment 1 BUSI 3008Document21 pagesAssignment 1 BUSI 3008Irena MatuteNo ratings yet

- Chapter 2 Key Measures RelationshipsDocument8 pagesChapter 2 Key Measures RelationshipsMelody MagallanesNo ratings yet

- Cost accounting: Overhead allocationDocument10 pagesCost accounting: Overhead allocationbiscuit ovhalNo ratings yet

- Facilitates Preparation of Financial StatementsDocument7 pagesFacilitates Preparation of Financial Statementsankitasaatpute21No ratings yet

- Cost Accounting NotesDocument5 pagesCost Accounting NotesapkavishuNo ratings yet

- What Is AccountingDocument34 pagesWhat Is AccountingGohar MahmoodNo ratings yet

- MB0041 AccountsDocument10 pagesMB0041 AccountsvermaksatishNo ratings yet

- MB 0042Document30 pagesMB 0042Rehan QuadriNo ratings yet

- Cost AccountingDocument26 pagesCost AccountingdivinamariageorgeNo ratings yet

- Cost AccountingDocument28 pagesCost AccountingVirendra JhaNo ratings yet

- Unit 3 CC 4 PDFDocument28 pagesUnit 3 CC 4 PDFKamlesh AgrawalNo ratings yet

- Capture 4Document6 pagesCapture 4sagung anindyaNo ratings yet

- What is a Costing System ExplainedDocument4 pagesWhat is a Costing System ExplainedNeriza PonceNo ratings yet

- Cost Accounting: Information For Decision Making: Learning ObjectivesDocument11 pagesCost Accounting: Information For Decision Making: Learning ObjectivesJohn OpeñaNo ratings yet

- Cost Classification and TerminologyDocument13 pagesCost Classification and TerminologyHussen AbdulkadirNo ratings yet

- Overhead Cost and Labour CostDocument8 pagesOverhead Cost and Labour CostMAAN SINGHANIANo ratings yet

- Accountancy SectionDocument124 pagesAccountancy Sections7k1994No ratings yet

- Cost and Management Accounting: Dr. Tripti TripathiDocument51 pagesCost and Management Accounting: Dr. Tripti TripathiHarendra Singh BhadauriaNo ratings yet

- Departmentalisation, Allocation and Apportionment of OverheadsDocument12 pagesDepartmentalisation, Allocation and Apportionment of OverheadsDivya ChhabraNo ratings yet

- Elements of Cost: Management Accounting Costs Profitability GaapDocument8 pagesElements of Cost: Management Accounting Costs Profitability GaapstefdrocksNo ratings yet

- Measuring Performance of Responsibility CentersDocument30 pagesMeasuring Performance of Responsibility CentersRajat SharmaNo ratings yet

- ACC 304 Oral First TermDocument3 pagesACC 304 Oral First TermMahmudul HasanNo ratings yet

- Management Accounting Notes1Document170 pagesManagement Accounting Notes1Anish Gambhir100% (1)

- Accounting and Costing For Managers: Submitted To - Dr. Harendra KumarDocument4 pagesAccounting and Costing For Managers: Submitted To - Dr. Harendra KumarFaisal NumanNo ratings yet

- Managerial Accounting: Cost TerminologyDocument18 pagesManagerial Accounting: Cost TerminologyHibaaq Axmed100% (1)

- Re Answers To The Questions of My ReportDocument9 pagesRe Answers To The Questions of My ReportFrancis Paul ButalNo ratings yet

- Management Accountion SCDocument5 pagesManagement Accountion SCadnanshaikh09No ratings yet

- Unit 10 - Cost Accounting - ESP Int - L Banking and FinanceDocument35 pagesUnit 10 - Cost Accounting - ESP Int - L Banking and FinanceDamMayXanhNo ratings yet

- Q1.Solu:-: Fixed Budget:-A Budget Which Is Made Without Regard To PotentialDocument8 pagesQ1.Solu:-: Fixed Budget:-A Budget Which Is Made Without Regard To PotentialkumarranachauhanNo ratings yet

- CMA FullDocument22 pagesCMA FullHalar KhanNo ratings yet

- CMA FullDocument22 pagesCMA FullHalar KhanNo ratings yet

- 1 Cost AccountingDocument31 pages1 Cost Accountingarchana_anuragiNo ratings yet

- MIA 1 NotesDocument47 pagesMIA 1 Notesmarlynrich3652No ratings yet

- Cost accounting objectives and functionsDocument6 pagesCost accounting objectives and functionsZ the officerNo ratings yet

- Cost and Cost ClassificationDocument10 pagesCost and Cost ClassificationAmod YadavNo ratings yet

- Atp 106 LPM Accounting - Topic 6 - Costing and BudgetingDocument17 pagesAtp 106 LPM Accounting - Topic 6 - Costing and BudgetingTwain JonesNo ratings yet

- Acca Paper 1.2Document25 pagesAcca Paper 1.2anon-280248No ratings yet

- MANAGERIAL ACCOUNTING - Test 1Document5 pagesMANAGERIAL ACCOUNTING - Test 1Saad AhmedNo ratings yet

- Period Cost Is Related To Level of Production and SaleDocument6 pagesPeriod Cost Is Related To Level of Production and SaleMd. Saiful AlamNo ratings yet

- A. Detailed Organizational Structure of Finance DepartmentDocument22 pagesA. Detailed Organizational Structure of Finance Departmentk_harlalkaNo ratings yet

- Anand Pandey COSTINGDocument8 pagesAnand Pandey COSTINGAnand PandeyNo ratings yet

- Cost Accounting EssentialsDocument28 pagesCost Accounting Essentialssaerah_8899No ratings yet

- Introduction, Concepts and Overview of Financial Attest Audit ManualDocument47 pagesIntroduction, Concepts and Overview of Financial Attest Audit ManualMayurdhvajsinh JadejaNo ratings yet

- Ethics Paper RASDocument22 pagesEthics Paper RASMayurdhvajsinh JadejaNo ratings yet

- DO IT YOURSELF Guide PDFDocument81 pagesDO IT YOURSELF Guide PDFNARINDERNo ratings yet

- CCC Result BMJDocument12 pagesCCC Result BMJMayurdhvajsinh JadejaNo ratings yet

- The Gujarat Forest ManualDocument26 pagesThe Gujarat Forest ManualMayurdhvajsinh JadejaNo ratings yet

- ICISA Noida CalenderDocument1 pageICISA Noida CalenderMayurdhvajsinh JadejaNo ratings yet

- Where Does The Gender Mainstreaming Strategy Come From?Document2 pagesWhere Does The Gender Mainstreaming Strategy Come From?Luiza BouharaouaNo ratings yet

- Bmsgirls Admission FormDocument4 pagesBmsgirls Admission FormMayurdhvajsinh JadejaNo ratings yet

- Cga Orders Implementation of Pay Fixation Orders in Terms of The Honble Cat Principal Bench New Delhis Order Dated 6th March 2017Document1 pageCga Orders Implementation of Pay Fixation Orders in Terms of The Honble Cat Principal Bench New Delhis Order Dated 6th March 2017Mayurdhvajsinh JadejaNo ratings yet

- DIRECTORATE OF FORENSIC SCIENCE DOCUMENTDocument1 pageDIRECTORATE OF FORENSIC SCIENCE DOCUMENTMayurdhvajsinh JadejaNo ratings yet

- BMSG Joining InstructionsDocument10 pagesBMSG Joining InstructionsMayurdhvajsinh JadejaNo ratings yet

- 6 Environmental Behaviorism PDFDocument79 pages6 Environmental Behaviorism PDFnty32No ratings yet

- EL Form Central GovernmentDocument2 pagesEL Form Central GovernmentMayurdhvajsinh Jadeja67% (3)

- Dairy Farming All One Should Know To Start WithDocument7 pagesDairy Farming All One Should Know To Start WithMayurdhvajsinh JadejaNo ratings yet

- Chief Officer 09-04-2017Document8 pagesChief Officer 09-04-2017Mayurdhvajsinh JadejaNo ratings yet

- Bank Fee Receipt TemplateDocument2 pagesBank Fee Receipt TemplateMayurdhvajsinh JadejaNo ratings yet

- Duties and Powers of Sub Divisional OfficerDocument5 pagesDuties and Powers of Sub Divisional OfficerMayurdhvajsinh Jadeja33% (3)

- Dairy ProjectDocument13 pagesDairy ProjectpradipsdNo ratings yet

- Dairy Farming: Nsic Project ProfilesDocument3 pagesDairy Farming: Nsic Project Profilesrengachen100% (3)

- Divisional Accountant 21-01-2017 AKDocument4 pagesDivisional Accountant 21-01-2017 AKMayurdhvajsinh JadejaNo ratings yet

- Lab Tech Model Paper 2Document11 pagesLab Tech Model Paper 2Mayurdhvajsinh JadejaNo ratings yet

- 50 Cows PR PDFDocument3 pages50 Cows PR PDFMayurdhvajsinh JadejaNo ratings yet

- Sunday School-AMS 1Document1 pageSunday School-AMS 1Mayurdhvajsinh JadejaNo ratings yet

- Asst Tribal Dev 18-12-2016Document22 pagesAsst Tribal Dev 18-12-2016Mayurdhvajsinh JadejaNo ratings yet

- 008 VGL 0831108Document1 page008 VGL 0831108varunvnNo ratings yet

- Forensic MCQ 2Document14 pagesForensic MCQ 2Mayurdhvajsinh JadejaNo ratings yet

- Final Selection DYSO DYMAMDocument22 pagesFinal Selection DYSO DYMAMMayurdhvajsinh JadejaNo ratings yet

- Financial Accounting and Taxation Using TallyDocument7 pagesFinancial Accounting and Taxation Using TallySanjay KumarNo ratings yet

- Acc Tally & Peachtree-BANKDocument13 pagesAcc Tally & Peachtree-BANKfcmitcNo ratings yet

- Pre2 Notesl Leo CcbrpocDocument15 pagesPre2 Notesl Leo CcbrpocCarla Jane Mirasol ApolinarioNo ratings yet

- Accounting for Merchandising OperationsDocument10 pagesAccounting for Merchandising OperationsSKY StationeryNo ratings yet

- Chap 002Document73 pagesChap 002Tony TaiNo ratings yet

- Acc 3 - RRNDDocument27 pagesAcc 3 - RRNDHistory and EventNo ratings yet

- Acc Account Name Trial Balance Debit CreditDocument6 pagesAcc Account Name Trial Balance Debit CreditNofi NurlailaNo ratings yet

- Private bank account detailsDocument7 pagesPrivate bank account detailsHARRY THE GREATNo ratings yet

- BL Actg 6153 Lec 1926S Fundamentals of Acctg TP 1B 1Document347 pagesBL Actg 6153 Lec 1926S Fundamentals of Acctg TP 1B 1angel diaz100% (2)

- AGIS Questions and AnswersDocument5 pagesAGIS Questions and AnswersHimanshu MadanNo ratings yet

- Chap 4 MNGT Acctng PDFDocument4 pagesChap 4 MNGT Acctng PDFRose Ann YaboraNo ratings yet

- Balance of Payments Format and NumericalsDocument10 pagesBalance of Payments Format and NumericalsSarthak Gupta100% (2)

- Jan 24Document2 pagesJan 24charnold miolNo ratings yet

- Answers For The ActivityDocument36 pagesAnswers For The ActivityLakshyaNo ratings yet

- Business organization quiz answersDocument209 pagesBusiness organization quiz answersAaron Carter Kennedy100% (1)

- Profit Prior To IncorporationDocument12 pagesProfit Prior To Incorporationhk7012004No ratings yet

- Business Costing GuideDocument9 pagesBusiness Costing GuideELPASPI RICO0% (1)

- Booker JonesDocument3 pagesBooker JonesCrystal Laksono PranotoNo ratings yet

- Accountancy OTQ Class XIDocument231 pagesAccountancy OTQ Class XIno oneNo ratings yet

- BSBFIA401 AT2 Record of Transactions Carlos Quintero Ocampo 01Document2 pagesBSBFIA401 AT2 Record of Transactions Carlos Quintero Ocampo 01Zenith ShresthaNo ratings yet

- Trial balance quizDocument4 pagesTrial balance quizNguyen Ho Tu Anh (K16 HCM)No ratings yet