Professional Documents

Culture Documents

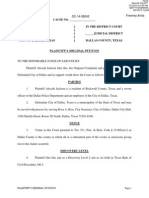

Responsive Documents - Department of Education: Regarding For-Profit Education: 8/17/2011 - 11-00026-F 2woodward

Uploaded by

CREWOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Responsive Documents - Department of Education: Regarding For-Profit Education: 8/17/2011 - 11-00026-F 2woodward

Uploaded by

CREWCopyright:

Available Formats

Page 1 of 212

Woodward, Jennifer

From: Woodward, Jennifer

Sent:

To:

Sunday, November 14, 2010 10:10 AM

Minor, Robin; Gust, Mary

Subj ect: FW: another ABC News undercover investigation

FYI.

From: Georgia

Sent: November 2010 8:55 AM

To: Jennifer; WolffJ Russell

Subject: FW: another ABC News undercover investigation

FYI

From: James

Sent: November 13J 2919 10:56 AM

To: Martha; Justin; Eduardo; YuanJ Georgia; Steve;

Tony; Joanne

Cc: David

Subject: FW: another ABC News undercover investigation

ABC found a college recruiting felons for a criminal justice program. Video is online.

http://abcnews.go. com/Thelaw/abc-news-investigates-profit-education- recruiters-caught-

offering/story?id=12122004&page=1\

ABC News Investigates For- Profit Education Again: Recruiters Caught Offering Bad Advice

Despite ABC News' Previous Report, Some Recruiters Still Give Grossly Misleading Information

As a former Criminal Justice professor for the for- profit Remington Coll ege in Houston,

Larry Stewart said he was shocked when he discovered several convicted fel ons in his criminal

justice classes.

"My very first class, I had a husband and wife who, he had done 13 years at the Texas

Department of Corrections for a home invasion, robberyJ" he said.

"And his wife had done three years for trafficking drugs across state lines."

According to Stewart, the felons in his class told him that recruiters for the school said

they could work in law enforcement.

"I said, 'And you want to do what?'" he said. "They said, 'Well, we want to go into criminal

justice.' And I said, 'You can never get a job in criminal j ustice. ' And they said, 'Well,

the recruiters said that we can.'"

It isn't the first time recruiters for for-profit school s have been accused of misleading

people. ABC News conducted an investigation in August that exposed recruiters from the

country's biggest for-profit college, University of Phoenix, for giving incorrect advice to

prospective education majors.

In that investigation, we sent in one of our producers undercover who asked about becoming a

teacher in New York State. The recruiter told him a degree from the University of Phoenix

1

would enable him to take the state

and become a certified teacher in New

York. This was not true. The recruiter also encouraged the ABC News producer to take out the

maximum amount of financial aid allowabl e, including interest-bearing student loans -- even

if it was more t han he needed.

Experts say students who have attended for-profit schools are defaulting on their federal

student loans at an alarming rate, which, they add, may contribute to the next big financial

crisis.

After speaking with Stewart, ABC News conducted another undercover investigation recently,

this time at Remington College. We sent in a prospective student with a felony conviction,

undercover, to talk to a recruiter about enrolling in the college's criminal justice program.

Student: "I have -- a felony from 2ees."

Recruiter: "OK, 2005, OK . And what is it?"

Student: "Theft"

Recruiter: "We will definitely work with you, especially when you know it up front. And that

helps us a lot.

When we know your history and your situation up front. We know exactly what, you know, kind

of a target area you wanna be in -- sheriff's department, corrections."

The recruiter also told our undercover student that he couldn't be a cop, but there were a

variety of opportunities in law enforcement for people with felony convictions.

Remington College Recruiter Caught Giving False Information

Recruiter: "Sheriff's, corrections, jail ers -- we put everybody in all those places all the

time ... even border patrol, if you ever thought about it. Because, see, that ' s something

else that you could do that's still in the realm of criminal justice."

Despite the recruiter ' s assurances, that ' s actually not true for the state of Texas .

According to the Texas Department of Public Safety, a person with a felony conviction cannot

work for any sheriff's department, or as a corrections officer in the state of Texas, and

generally that's the case for border patrol positions as well.

A spokesman for Remington told ABC News that before students enroll in their criminal justice

program, they must sign a document acknowledging that they may not be abl e to work in law

enforcement with a criminal record .

This particular recruiter at Remington made her misleading statements just mont hs after

Harris Miller, a spokesman for the Associ ation of Private Sector Colleges and Universities,

admitted that for-profit schools need to clean up their act.

When asked why he thought the for-profit industry was in the hot seat, Miller said at the

time, "We're under fire for a couple of reasons. One reason is we're making mistakes."

He added, "our schools and my board of directors is committed to making changes . .. we have a

zero tolerance policy. That means once in a while you have to take an employee and take him

out in the back and shoot him-- not literally-- but you have to dismiss employees."

ABC News first talked to Miller in August after the initial investigation, when he promised

to improve the for- profit industry's recruiting standards. But despite his assurances, ABC

News found that Remington wasn't the only for-profit college whose recruiters were still

trying to sell misleading information to prospective students.

2

Page 3 of 212

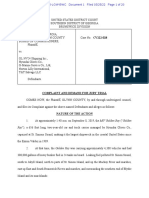

DeVry Coll ege Recruiter Touts Overblown Success Rate

At DeVry College of New York, ABC News sent a producer undercover to speak with one of the

school's recruiters about becoming a certified teacher in New York through its program.

Recruiter: "Last year, 88 percent of our graduates were actually workin' in their field

within six months of graduation, OK? So, when we go through it later, you know, we'll show

you the breakdown by, you know, degree and by program and everything like t hat, so you can

kinda understand what, you know, where the number's coming from. But, I mean, 88 percent in,

you know, 2ee9 -- I guess, dependin' on where you come from. But with the economy and

everything, you know, most people look at that as--"

Producer: "That's pretty good."

Recruiter: "--a pretty good rate."

But the recruiter's claims were grossly misleading.

Based on DeVry's numbers, many of the graduates the recruiter was referring to had jobs to

begin with that DeVry was taking credit for.

A spokeswoman for the DeVry College of New York sent a statement sent to ABC News via email

in response to our investigation of the college's numbers, saying, "We make no apologies for

counting these employed students in our employment statistics and disclose this fact openly

in our print collateral, web site and admissions materials. We have been consistently

reporting our employment statistics in a similar fashion for over 3a years. Many, if not most

institutions of higher education also treat these employed students as part of their employed

population."

Click HERE to read a letter to ABC News from DeVry College of New York.

In a statement to ABC News about the issues with for- profit colleges, Sen. Tom Harkin, D-

Iowa, the c hairman of the Senate Committee on Health, Education, Labor and Pensions, said:

"Each aspect of for-profit colleges ' relationships with their students that I've investigated

so far often features misrepresentation or manipulation -- it appears job placement claims

are no different.

Misleading students and the American public about job placement rates is yet another example

of for- profit colleges putting their shareholders before their students . Just as a lender

shouldn't mislead an advertisement American into a mortgage they can't afford, an

institution of higher education should not lead a prospective student into loan debt with

misleading promises of post -graduation job prospects."

When we spoke with him i n August, Miller attempted to explain what happened with recruiters

at other for- profit colleges.

"In some cases ... for whatever reason, because of poor training, because of rogue employees or

because they're getting the wrong message from above -- whatever the reason, somebody is

doing things wrong too widespread and we're going to change that," he told ABC News.

Some critics of for-profit schools believe the industry is out to enroll students because it

means big money for them. An enormous, publically-traded industry, for-profit colleges

received $24 billion in federal funds in 2ee9 and had an enrollment of 1. 4 million students,

according to the Government Accountability Office. Tuition for some is more than $2e,eee per

school year.

3

"Every institution of higher education has

in more money than goes out, otherwise

the school'll close down," Miller said in his interview after our initial investigation.

"Your tax status has nothing to do with whether you're Harvard Universi ty ... or whether you're

a 'tax-status: for-profit' institution."

Miller added that despite aggressive recruiting methods, money is not the biggest goal of

these for- profit institutions.

"It can't be profit first, because if you're not turning out a quality student, you're not

gonna be able to continue in business-- because students have choices," he said . "They don't

have to go to one of our institutions. They can choose to go to a state college if they have

relatively open enrollment. They can choose to go to a community college. So unless we can

show quality outcomes systematically, there's no way these schools will be able to continue

to operate."

After ABC News' first investigation into the University of Phoenix, it seems as though some

improvements h ave been made at that particular for-profit institution. University of Phoenix

president Bill Pepicello told ABC News that the college has stopped compensating its

recruiters based on the number of students they enroll.

University of Phoenix Changed Recruiting Policy After First ABC News Investigation

Upon learning of the change, ABC News again, twice, sent in an undercover producer to speak

with a University of Phoenix recruiter to ask about getting a teaching certificate in New

York through the school ' s program. This time, the recruiter did not offer any misleading

advice.

Recruiter: "If you live in the state of New York, we can't enroll for education for you

because the New York requirement for education is totally different than what we can enroll

for."

Despite the change at University of Phoenix, Remington's former Criminal Justice professor,

Larry Stewart, said he remains skeptical of the for-profit college industry because it makes

so much money.

"They're more concerned about the bottom line. What is the bottom figure on this student," he

said. "They look at, 'How much money did we make this term or this quarter?'"

Click HERE to read 20e9 employment data submitted to ABC News from DeVry College of New York.

ABC News' Lauren Effron contributed to this report

advertisement

4

Woodward, Jennifer

From:

Sent:

To:

Subj ect:

Page 5 of 212

email@addthis.com on behalf of nanshep12@gmail.com

Thursday, August 19, 2010 3:07PM

Woodward, Jennifer

For-Profit Education: ABC News Goes Undercover to Investigate Recruiters at the University

of Phoenix - ABC News

Pretty soon you'll tell me not to send you any more emails - I wondered though if you had

seen this?

http://abcnews.go.com/Thelaw/profit-education-abc-news-undercover-investigate-recruiters-

university/story?id=ll411379

This message was sent by nanshep12@gmail . com via http://addthis.com. Please note that

AddThis does not verify email addresses.

Make sharing easier with the AddThis Toolbar: http://www. addthis.com/go/toolbar-em

1

Page 6 of 212

Woodward, Jennifer

From: jwa@ix. netcom. com

Sent:

To:

Subject:

Friday, May 28, 2010 12:32 PM

Woodward, Jennifer; Russei.Wolff@ed.gov

(RE Kaplan

FYI

JOHN ANDREWS

813 8771867

- - -- -- - Forwarded message follows ------- http:/jmotherjones.com/mojo/2010/05/steve-eisman-

big- short-michael -lewis

Steve Eisman's Next Big Short : For-Profit

Colleges

n By Andy Kroll

Thu May. 27, 2010 4:55AM PDT

Steve Eisman, the outspoken investor whose huge wager against the

subprime mortgage market was chronicled by author Michael Lewis in his

bestselling book The Big Short, has set sights on a new target : for-profit colleges of

the kind of you might see advertised on daytime TV and at bus stops. Think ITT

Educational Services, Corinthian Colleges, or Education Management Corporation.

In a speech t i tled "Subprime Goes to College, " delivered Wednesday at the Ira

Sohn Investment Research Conference, Eisman bl asted the for-profit

education industry, likening these compani es to the seamy mortgage brokers

who peddled explosive subprime loans over the past two decades. "Until

recently, I thought that there would never again be an opportunity to be

involved with an industry as socially destructive and morally bankrupt as the

subprime mortgage industry. I was wrong," Eisman said. "The for - profit

education industry has proven equal to the task. " (All of Eisman's remarks here

come from a copy of his prepared remarks obtained by Mother Jones.)

Eisman, a blunt, no-frills portfolio manager at FrontPoint Financial Services Fund, a

Morgan Stanley subsidiary, became an overnight sensation as one of the main

characters in Lewis ' latest . After witnessing the first wave of subprime madness in

the 1990s, Eisman grew skeptical of the industry as a whole, Lewis writes . Then,

when subpri me surged again in the 2000s, he put his knowledge to work. Needless

to say, he's a lot richer than he was t wo years ago.

The for - profi t education sector has soared over the past decade, making

companies like ITTand Apollo Group into heavyweights . Driving much of the

growth, Eisman explained, was the sector's easy access to federally

guaranteed debt through Title IV student loans. In 2009, he said, for-profit

educators raked in almost one-quarter of the $89 billion in available Title IV

loans and grants, despite having only 10 percent of the nation's

postsecondary students.

Ei sman attributes the industry's success to a Bush administrati on that

stripped away regulations and increased the private sector's access to public

funds . "The government, the students, and the taxpayer bear all the risk and

the for-profit industry reaps all the rewards,"Eisman said . "This is similar to

1

the subprime mortgage sector in that the

bore far less

risk than the investors in their mortgage paper." (Calls to several for-profit

including ITTand were not immediately returned.)

Another similarity between subprime lending and for-profit education is

Eisman said: Both push low-income Americans into something they can't

afford"in the schools ' pricey programs that leave the students heavily

in debt; what's the degrees they get mean little in the real world: "With

billboards lining the poorest neighborhoods in America and recruiters trolling

casinos and homeless shelters"and I mean that literally"the for-profits have

become increasingly adept at pitching the dream of a better life and higher

earnings to the most vulnerable."

Eisman went on to cite the industry ' s dropout rates of 50-plus percent as

another sign of poor quality; the numbers are likely he given

that the industry reports them voluntarily . "How good could the product be if dropout

rates are so stratospheric?" he asked. "Default rates are already starting to

skyrocket . It's just like subprime"which grew at any cost and kept weakening its

underwriting standards to grow."

How does this kind of industry even stay in business? Eisman

has much to do with accreditation. There are two main tiers of college

accreditation: national and regional"the latter being the more valuable. (Big schools

like Yale and the University of Michigan are regionally accredited.) As Pulitzer Prize-

winner Dan Golden has reported

1

for-profit colleges with the weaker national

accreditation have started acquiring financially troubled colleges for their regional

accreditation. In a Bloomberg Golden cites ITT's acquisition of New

Hampshire-based Daniel Webster College in June 2009 for $20 million) a purchase

that could ultimately reap $1 billion or more for ITT.

Eisman saved the ugliest part for last: As he sees it, the industry's era of

massive profits"ITT is more profitable on a margin basis than he

notes"are about to end, thanks to new government regulations in the

pipeline . He predicts big hits to the per-share earnings of Apollo ITT,

Corinthian Colleges, Education Management Corporation, and the Washington

Post Company"which owns and relies on Kaplan for profitability. For ITT and

Corinthian, Eisman foresees 2010 losses of nearly 40 to S0 percent . Regarding

EDMC, he noted in his prepared remarks that the company's 2010 fiscal estimate is

"massively negative."

Eisman ended with a warning:

Are we going to do this all over again? We just loaded up one generation of

Americans with mortgage debt they afford to pay back. Are we going to

load up a new generation with student loan debt they can never afford to pay

back? The industry is now 25 percent of Title IV money on its way to 40

percent. If its growth is stopped now and it is policed, the problem can be

stopped. It is my hope that this administration sees the nature of the problem

and begins to act now. If the gainful employment rule goes through as then

this is only the beginning of the policing of this industry.

But if nothing is done, then we are on the cusp of a new social disaster.

Not all experts on the for-profit education foresee such an ominous future.

Trace Urdan, a managing director at Signal Hill who analyzes the industry, told

Mother Jones earlier this week that pending regulation from Washington could

indeed complicate the future for for-profit colleges. He added, however, that "if you're

short on the industry right now

1

you think there's a game-over scenario on the

way""something Urdan himself doesn't necessarily see happening. Should the

Education Department strongly crack down on for-profit schools, Urdan said he

predicted losses of 8 to 12 percentnfar less than Eisman's 40 to S0 percent

projection.

--- ---- End of forwarded message -------

2

John W. Andrews, Esq .

Andrews Law Group

3220 Henderson Blvd.

Tampa, Fl 33609

ph. 813-877-1867

fx. 813-872-8298

jwa@ix.netcom.com

Page 8 of 212

3

Page 9 of 212

Woodward, Jennifer

From: Guthrie, Marty

Sent: Friday, August 06, 2010 7:55AM

Woodward, Jennifer; Wolff, Russell

McCullough, Carney

To:

Cc:

Subject: FW: Student Lending Analytics Slog

FYI

From: noreply+feedproxy@google.com [mailto:noreply+feedproxy@google.com] On Behalf Of Student Lending

Analytics Blog

Sent: Friday, August 06, 2010 4:27AM

To: Guthrie, Marty

Subject: Student Lending Analytics Blog

Student Lending Analytics Blog

r a ~ :

The Difference Five Weeks Makes

Posted: 05 Aug 201o 11:48 AM PDT

June 23, 2010: President and CEO of Career College Association, A Response to Steve Eisman, at National

Press Club

"It is no secret that the career education sector is under attack by short sellers, trial lawyers, self-styled

consumer advocates, and some traditional academics. Although they should know better, these critics use

anecdotes to generalize and to make sweeping condemnations of our sector. They seize on admittedly

flawed government data to make the most extreme statistical arguments. They exploit the same small

cadre of so-called third party experts to generate critical comments. And they recycle old news to give

currency to new allegations. In short, they twist the truth to serve their self-interest."

August 4 , 2010: From Career College Association press release "GAO Report Deemed Deeply Troubling:"

"The Career College Association (CCA) said the recent findings of a Government Accountability Office

(GAO) report on admissions and financial aid practices at several private sector colleges and universities

is deeply troubling and, notwithstanding multiple safeguards that schools already take, and the oversight

provided by the "triad" of federal and state regulators and accrediting bodies, it will institute a series of

immediate steps to help its members assure full compliance with regulations and accreditation

requirements in all areas.

"Even if the problems cited in the GAO report are limited to a few individuals at a few institutions, we can

have zero tolerance for bad behavior," said CCA President and CEO Harris N. Miller. "As educators, our

commitment must always be to put students first, even if that means taking action against individual

1

Page 10 of212

employees or institutions that color outside the lines. We understand that employees can make mistakes,

but it is up to employers to take the set of comprehensive and multifaceted preventative and corrective

actions that minimize the risk of such problems and correct those that occur.

Wondering What Happened When Incentive Compensation Rules Were

Tightened in 1992?

Posted: 05 Aug 2010 11:32 AM PDT

From SLA post in November 2009 (which includes a table showing the percentage of student loans

coming from students at for-profit institutions:

At 22.1% in 2008-09, the proprietary sector is nearing their two decade high of 24.2% share of federal

student loan volume which they reached in 1990, just prior to the Nunn report and the ban on

incentive compensation in 1992.

In the decade where this ban on incentive compensation was weakened through the introduction of

twelve "safe harbors" in 2002, the percentage of federal loans going to proprietary schools has grown

from 12% in 2000 to 22.1% in 2008-09. I can't prove causality, but it is interesting to note that in the

period following the ban from 1993 to 2000, the proprietary sector's share of the federal loan market,

despite annual gyrations, remained almost unchanged from 11.5% in 1993 to 12.0% in 2000.

The Department of Education has proposed regulations to eliminate the safe harbors and go back to

the earlier ban on incentive compensation. Following the GAO report and hearing, University of Phoenix in a press

release today indicated that they would be making the following changes to their compensation plans:

"In addition, as previously announced, beginning November 1 of this year the University plans to roll out a

new student counselor compensation framework, which has been in development and testing for more

than a year ... A firm decision to change the way counselors are evaluated and compensated, including a

commitment to completely eliminate admission targets as a component of compensation."

Three questions:

What will the admissions counselors compensation be based upon (and what behaviors will this

compensation structure encourage)? As anyone who has managed salespeople knows, they respond to

incentives!

Will competitors be following suit with compensation changes or just waiting until they are forced to when

the new regulations take effect?

How sharply will enrollment growth decline as a result of the new compensation structures (and all the

negative publicity swirling in the sector)?

2

You are subscribed to email updates from Student Lending Analytics Blog

To stop receiving these emails, you may unsubscribe now.

Google Inc., 20 West Kinzie, Chicago IL USA 60610

3

Email delivery powered by Google

Woodward, Jennifer

From:

Sent:

To:

Cc:

Subject:

Page 12 of 212

Guthrie, Marty

Friday, August 06, 2010 7:55AM

Woodward, Jennifer; Wolff, Russell

McCullough, Garney

FW: Student Lending Analytics Slog

FYI-Wanted to share this in case you guys haven't seen this from SLA. Incentive comp info toward the end.

I'll forward today's SLA message (which also includes incentive comp info) shortly.

From: noreply+feedproxy@google.com [mailto:noreply+feedproxy@google.com] On Behalf Of Student Lending

Analytics Blog

Sent: Thursday, August 05, 2010 4:24AM

To: Guthrie, Marty

Subject: Student Lending Analytics Blog

Student Lending Analytics Blog

Pell Grants Rise 61% in 2009-10 Academic Year; 45% of Students Now Receiving Pell

Grants

What's Happening In Private Student Loan Land?

Reactions to Senate Hearing on For-Profit Marketing Practices

Highlights from Hearing on For-Profit Marketing Tactics

Pell Grants Rise 61% in 2009-10 Academic Year; 45% of Students Now

Receiving Pell Grants

Posted: 05 Aug 2010 12:10 AM PDT

I might have titled this post: A Sign of the Times ...

The Federal Student Aid Data Center site updated figures last month for Pell Grants. Here are stats on

recipients, grants and average grant size for the past four years with annual changes in the right hand columns:

Acad. Yr.

06-07

07-08

08-09

Recipients

(in millions)

5.29

5.69

6.32

Grants Average

(In $MM) Grant Size

$12,792 $2,419

$14,675 $2,580

$18,284 $2,892

1

Avg

Recipients Grants Grant Size

8%

11%

15%

25%

7%

12%

09-10 8.23 $29,361

Page 13 of212

$3,566 30% 61% 23%

Observations:

The 61% growth in Pell Grants to an annual figure of $29-4 billion was driven by both a 30% increase in

recipients to 8.23 million and a 23% increase in average grant size to $3,566. The maximum Pell Grant

for the 2009-10 academic year was $5,350. The maximum grant is $5,550 for the 2010-11 academic year.

With NCES estim ating that 18.4 million studen ts would attend two year and four-year institutions in

fall 2009, that would mean almost 45% of those in attendance received a Pell Grant for 2009-10. If you

assume 100% of students at proprietary schools are Pell-eligib1e, that suggests that about 1 in 4 students

at public and private non-profits are Pell-eligible.

For those wondering how the percentage of recipients and grants broke out by sector, 63% of grant

recipients and 62% of the grant volumes came from students at public institutions with for-profits next at

25% of recipients and dollar value of grants (Recipients and Grants in Millions):

School Type Recipients Gr ants

PRIVATE-NONPROFIT 1.01 $3,877

PROPRJETARY 2.06 $7,339

PUBLIC 5. 16 $18,145

8.23 $29,361

PRIVATE-NONPROFIT 12% 13%

PROPRIETARY 25% 25%

PUBLIC 63% 62%

100% 100%

What's Happening In Private Student Loan Land?

Posted: 04 Aug 2010 11=44 PM PDT

I thought I would provide a brief update of several new developments with private student loans:

Two states have formalized their fixed-rate private student loan products for 2010-11:

Vermont Student Assistance Corporation (VSAC) is offering a private student loan with fixed rates

ranging from 6.9% to 7.75% [dependent on repayment option selected] and fees ranging from o% to 5%

[dependent on credit scores]. Applications will be available in early August.

Maine Educational Loan Authority (MELA.) is offering a private student loan with a fixed rate of 7-75%

and a 4% guarantee fee. Interest payments are required during the in-school period.

Several lenders have recently tweaked (or announced an upcoming change) the range of interest rates on their

2

private loan products (each dropping below the minimum or "as low as" interest rate on their

loans):

Discover reduced the minimum starting interest rate on their variable-rate private loans to 3.75% (from

4.25%). This is Discover's first change to interest rate ranges since June tst of last year.

Chase will be reducing their minimum starting interest rate on their variable-rate private loans to 3-94%

(from 4.14%). Chase has changed their interest rate ranges on several occasions this year (note that some

of the changes were driven by an increase in UBOR during the year):

Pre-March 1st: 4-40% to 9-75%

March 1st: 4.15% to 8.75%

July 1st: 4.14% to 9-79%

As of August 6th: 3-94% to 9-79%

And in other news ...

In late July, the New York Post reported that Sallie Mae had hired Goldman Sachs to help it explore "options." The

company has made no secret that they are carefully evaluating their restructuring options (from New York Times):

"According to The New York Post the student lender hired Gol dman Sachs to advise on a sale or

spinoff of its student-loan servicing business and its $145 billion government-subsidized loan portfolio.

The company is also mulling the possibility of converting part if its platform into a traditional deposit-

taking bank, The Post said."

Citibank's Student Loan Corporation reported a 40% decline in private loan originations in the quarter ending

June 30, which is traditionally a seasonally slow quarter. For 2009-10 academic year, Student Loan Corporation

originated close to $900 million in private loans, a 47% reduction from the 2008-09 academic year. I also came

across an article citing a banking aualyst, Dick Bove, who expressed this opinion of whether Student Loan Corp. would

be sold:

''The ability to sell Student Loan at this time is nil," he said, noting that perhaps in two or three years,

after the financial markets settle, a sale may occur."

Reactions to Senate Hearing on For-Profit Marketing Practices

Posted: 04 Aug 2010 u:oo PM PDT

US Names Apollo, Corinthian, Kaplan In For-Profit Probe (Wall Street Journal) includes company and the

3

n

. . , . th Paoe 15 o f ~ 1 i .

career co ege associations reactions to e GAO report ana .Senate hearing:

Kaplan: "A Kaplan spokesman said in an emailed statement the company had initiated investigations at the

two schools named by the GAO "immediately upon learning of the incidents" and has suspended

enrollment at its Pembroke Pines, Fla., campus. Investigations at that campus and the Riverside, Calif.,

campus continue. The spokesman said Kaplan "will take all necessary actions" against employees violating

the company's standards and code of conduct."

University of Phoenix: "An Apollo representative said the company has initiated an internal investigation

and it, too, would take "immediate and decisive disciplinary action" if it finds employees in violation of

policies meant to protect students."

Career College Association: "The Career College Association, a trade group, announced late Tuesday in

response to the GAO's findings that it would enhance its top-down compliance training programs and

institute a "mystery shopper" program immediately in the hopes of heading off some criticism. "Even if

the problems cited in the GAO report are limited to a few individuals at a few institutions, we can have

zero tolerance for bad behavior," President and Chief Executive Harris Miller said in a statement. "We will

continue to add to this 'zero tolerance' program until all such doubts about our sector are removed."

GAO: 15 for-profit colleges used deceptive recruiting tactics (Washington Post) had this reaction from

WAPO executives (the Washington Posts owns Kaplan, one of the schools cited in the report):

"In a joint statement, Donald E. Graham, chairman and chief executive ofThe Washington Post Co., and

AndrewS. Rosen, chairman and chief executive of Kaplan Inc., described the tactics revealed in the

videotaped interviews as "sickening."

"They violate in every way the principles on which Kaplan is run," they said in a statement posted on The

Washington Post Co.'s Web site. "The GAO and the Senate [Health, Education, Labor and Pensions

Committee] have done us a favor. We will do everything in our power to eliminate such conduct from

Kaplan's education institutions."

W APO also highlighted the fact that most of the companies investigated were the largest in the industry

[representing almost 43% of the 1.8 million students enrolled in for-profits]:

"Many of the largest for-profit entities were named among the 15 sites targeted by GAO investigators:

University of Phoenix, with more than 400,000 students; Argosy University, part of the 136,000-student

Education Management Corp.; Kaplan College, part of the 119,000-student Kaplan Higher Education

operation owned by The Washington Post Co.; and Everest College, part of the uo,ooo-student

Corinthian Colleges."

Lawmakers Focus Ire on Accreditors for Abuses at For-Profit Colleges (Chronicle of Higher Education)

noted the failings of oversight and enforcement at the Dept. of Education and accreditation bodies:

'The rest of the hearing focused on assigning blame for the abuses. Pressed by la\vmakers, Mr. Kutz

faulted the Education Department, saying it has failed in its oversight of the sector. While there are

4

. . Pag' 16 of 212

regula nons m place to protect students from misleaaing and aggressive sales, they're not being enforced,

he said. "It certainly seemed like a wild, wild West out there," he said, urging government regulators to

step up their monitoring offor-profit recruiting and to punish colleges whose employees violate the

rules ...

As for the accreditation process, here is one exchange that the Chronicle captured:

"Do you think maybe your rigorous standards aren't rigorous enough?" asked Senator Franken, of

Minnesota.

"I believe the standards themselves are rigorous," Mr. McComis replied. "In these cases, the schools'

compliance with the standards fell short."

Asked by Senator Harkin why the accreditor hadn't found problems at the three institutions, Mr.

McComis replied that the accreditation process isn't designed to catch "the sort of fraud the GAO bas

alleged."

'We don't secret shop," he said. "So in the normal course of an evaluation, I'm not sure we'd find those

occurrences."

That answer appeared to infuriate Mr. Harkin, who said it was "apparent to me that we need a hearing on

accreditation."

Senator to Review Accreditation of For-Profit Colleges (NY Times) highlighted Harkin's cal1 for a focus on

the accreditation process:

"As part of the expanding Congressional scrutiny of for-profit colleges, Senator Tom Harkin announced

at a hearing on Wednesday that he plans to examine their accreditation process ... Mr. Harkin questioned

Michale McComis, executive director of the Accrediting Commission of Career Schools and Colleges,

about why his group had found so few violations over the last two years in more than 6oo visits to

institutions it accredits when the Government Accountability Office found problems at every one it

visited."

'Tight' Rules Sought for For-Profit Colleges (USA Today) noted that some lawmakers are seeking a more

comprehensive look across all types of higher education institutions:

"Some lawmakers called for an expanded exploration t o include practices of traditional non-profit public

and private colleges. 'The for-profit sector should not be examined in a vacuum," said Sen. Mike Enzi,

R-Wyo."

Ironic that on the day of the Senate hearing about misleading recruiting tactics, Career Education filed an 8-K with

the SEC that contained the following (from WaJl Street Journal, emphasis is mine):

"Career Education said in a filing with the Securities and Exchange Commission Wednesday that the

government's recommendations could "materially and adversely affect our business," with proposals

5

d

. . . inful !Page 17 of 2_1,2 f

regar mg recruiter compensation, ga emp oyment, the definition o a credit hour and liability for

making misrepresentative statements having the most potential impact."

For-Profit Colleges Hit with Claims of Fraud, Aggressive Recruiting (Christian Science Monitor) provided

details of the testimony of the former recruiter at Westwood College:

"Another witness at the hearing was Joshua Pruyn, who spoke about working as an admissions

representative for Alta College Inc. in Denver. He was trained in sales tactics, including interviewing

students to find the "pain points" in their lives that could be used to pressure them to enroll, such as

worries about being in a dead-end job. Misleading potential students to make enrollment targets was

standard practice and was rewarded with incentives such as trips, he said.

Mr. Pruyn quit after nearly 6 months. The final straw, be said, was discovering that students who wanted

to withdraw and clearly would eventually dropout (including a military person who was called up for

active duty) were pressured to stay enrolled for at least 14 days because after that point , the school could

keep federal money that the student had been awarded."

Highlights from Hearing on For-Profit Marketing Tactics

Posted: 04 Aug 2010 11:42 AM PDT

Just finished watching a few hours of the Senate HELP committee hearing: For-Profit Schools: The Student

Recruitment Process.

Highlights:

The first half of the hearing focused on the GAO report which hit yesterday and included videotape (here is

a link to the video) demonstrating the fraudulent and deceptive marketing practices uncovered.

Senator Harkin will be sending an information and document request to 30 for-profit schools tomorrow. He

is planning on holding another hearing in September to "get to the bottom of this." He seemed most

interested in graduation rates and churn rates but I would be surprised if he didn't ask about recruitment

practices also.

Harkin also seemed interested in finding a legislative solution to this issue. He described the Dept. of

Education regulations on program integrity to be a good "first step" but expressed concern that

regulations can be changed too easily by future administrations, using the "safe harbors" of incentive

compensation as an example.

The accreditation process also will be coming under additional scrutiny too with Senator Franken, in

particular, focusing his line of questioning on the issue of how well accreditors are ensuring that their

rigorous standards are being adhered to.

I missed the first 30 minutes of the hearing but the committee "named names" of the colleges investigated in

6

the GAO report (from Barrons):

Page 18 of21 2

Case 1: University of Phoenix, Arizona

Case 2: Everest College, Arizona

Case 3: Westech College, California

Case 4: Kaplan College, California

Cases: Potomac College, Washmgton, DC

Case 6: Bennet College, Washington, DC

Case 7: Medvance Institute, Florida

Case 8: Kaplan College, Florida

Case 9: College of Office Tech, illinois

Case 10: Argosy College, lllinois

Case u: U of Phoenix, Pennsylvania

Case 12: Anthem Institute, Pennsylvania

Case 13: Westwood College, Texas

Case 14: Everest College, Texas

Case 15: ATI Career Training, Texas

Other notes that I scribbled down (hope to have a transcript up in 24 hours):

Here is a transcript of the video provided at the hearing: http:/ jv.ww.gao.govjvideofilesjgao-I0-948t/gao-

I0-948t.txt with some statements made by admissions reps.:

"You gotta look at it- I owe $8s,ooo to University of Florida. Will I pay it back? Probably not. I look

at life a little differently than most people. I look at life as tomorrow is never promised."

"Most doctors are walking around with over $250,ooo in student loans ... but it's workable, you

know, it's really workable. And the ... a lot of people have student Ioans ... but the best thing about

it, it's not like a car note, where if you don't pay they're gonna come after you.''

When a prospect wanted to learn more about financial aid, the admission supervisor had this to say

before tearing up their application: "So, honestly, I gotta tell you, I totally understand your

7

Page 19 of2"2 .

concern, but I really, With all due respect, I don't bebeve you're ready to take that step, penod.

That paper could say $40,000. And in your situation, and at your stage in life, you should be

ready to make your investment of time and money necessary to get you to where you should be at

this point. But you're not. And we're trying to help you get there and trying to help you ...

understand it, but there's ... What are you really afraid of? There has to be something more."

GAO investigation showed that 6 of the 15 admission counselors would not provide financial aid information

until the student bad signed an enrollment agreement and paid an application fee. Investigator said it It's

not not hard to find fraudulent and deceptive practices; the big difference is the vast amount of money is

coming from American taxpayers.

Isakson suggested that there should be a focus on enforcing current laws and asked what Dept. of Education

was going to do to enforce Program Participation Agreements.

Sen. Burr made two comments: Department of Education should look at elimination of incentives and their

role in the willingness of counselors to break the law. Also, rattled off statistics on graduation rates at

both for-profit and non-profit institutions in his state.

GAO investigator's take on current oversight and enforcement regime: "Given what we saw it looked like the

"wild, wild west."

Sen. Mikulski referred to admissions counselors as "bounty hunters" and described students encountering a

"black hole of debt, disappointment and heartbreak."

With several admissions counselors in the investigation recommending that prospects falsify their FAFSA,

several senators recommended linking the FAFSA forms to the IRS database for verification purposes.

Panel2

David Hawkins of the National Association for College Admission Counseling highlighted the information

asymmetry between prospect and admissions counselor akin to the subprime mortgage industry which makes

students vulnerable to being misled in the process. Also highlighted the role of the "safe harbors" that were added to

the incentive compensation ban as "effectively gutting" that ban and "providing a roadmap for institutions to

circumvent the law as originally designed" and leading to these "boiler room sales tactics."

GAO found 32 violations of incentive compensation since 1998

Here is history of incentive pay issue as posted earlier

Michael McComis , Executive Director, Accrediting Commission of Career Schools and Colleges, Arlington, VA

discussed the accreditation process including the triad system which includes federal and state regulators in addition

to accreditors. He described a multi-step process including student surveys, on-site visits, interim reviews and a

robust compliant process. He concluded by saying that ACCSC would look forward to working with Congress to

8

strengthen the process.

Page20of212

Joshua Pruyn , former Admissions Representative, Alta College, Inc., Denver, CO described the daily grind of

being on the front lines of selling on-line education to the masses. He described being trained in a 7-step sales

process, described the interview with a prospect as "psychological game" after initial training. Prospective students

are referred to as "leads." He described the importance of "starts" with the focus on having a student in program for

at least 14 days, after which the schools keeps the federal financial aid. Described how one Asst. Director received

the "Best Liar award" at team celebration. Also discussed the obfuscation behind the internal private loan program

offered by Westwood including a) not to call it a loan but instead "Westwood would step in to help" b) need to pay

$150 while in school (which didn't keep loan balance from increasing) and 3) 12% interest on the loans.

Questions to panelists

Compensating admissions directors based on students enrolled is common practice; what's wrong with

that?

Hawkins: Since safe harbors, we have been collecting stories; lawsuits, media reports. We have 10 pages of bullet

summaries of this evidence. There is no doubt in my mind because of safe harbors that there is preponderance of

evidence that this is industry practice. How much more evidence do we need? There is significant need for

counseling for low-income students and when you don't provide it they are at a disadvantage and when you give

them misinformation ...

What are the rigorous standards used by accreditors to ensure schools only admit students that are

accurately and fully informed?

McComis: rrhis was the most pointed line of questioning with Senator Franken highlighting the fact that

three of the schools from the GAO investigation were accredited by ACCSC]. In the end, McComis said that his

commission will look to see if there is more they can do on diligence [Later Sen. Harkin made the point that

ACCSC made 629 on-site evaluations and didn't find any substantial non-compliance while GAO randomly

sampled 3 institutions and had adverse findings at all of them].

You are subscribed to email updates from Student Lending Analvtics Blog

To stop receiving these emails, you may unsubscribe now.

Google Inc . 20 West Kinzie, Chicago ll USA 60610

9

Email delivery powered by Google

Woodward, Jennifer

From:

Sent:

To:

Subject:

Page 21 of 212

Finley, Steve

Wednesday, June 23, 2010 9:08 AM

Siegel, Brian; Burton, Vanessa; Scaniffe, Dawn; Morelli, Denise; Marinucci, Fred; Jenkins,

Harold; Woodward, Jennifer; Wolff, Russell; Sann, Ronald; Wanner, Sarah; Varnovitsky,

Natash a

Chronicle article

Interesting article in the Chronicle about the upcoming oversight hearing on for-profit institutions, possible effects on

other schools, and the general lack of information about life-time default rates for institutions.

http://chronicle.com/article/New-Grilling-of-For-Profits/66020/

Worth reading for that discussion, but also interesting to see that some large for-profit schools are starting to give

students a form of "try it and see if you like it" option:

Kaplan is cautiously testing out one solution. Beginning thi s past March, Mr. Smith said, the university began a

pilot program in which new students ca11 emoll conditionally and then leave after three \>.

1

eeks, without anv debt

or any transcript, if they fi nd they cannot handle the work.

"It is a substantial hit to revenue," he said of the trial course structure, "but the fact of the matter is it's

absolutely the right kind of thing to do." The for-profit Universitv ofPboenix, the nation's largest university

system, is advertising a similar trial svstem.

1

Page 22 of 212

Woodward, Jennifer

From: Woodward, Jennifer

Sent: Friday, November 12, 2010 11:20 AM

To: Jenkins, Harold; Marinucci, Fred; Siegel, Brian; Wolff, Russell ; Finley, Steve; Morelli, Denise;

Wanner, Sarah; Yuan, Georgia; Sann, Ronald; Thompson, Lauren; Kolotos, John;

McCullough, Carney; Guthrie, Marty

Subject: FW: Academe Today: For-Profit Colleges May Be at Brink of a Major Reset

Note the first article by Ms. Blumenstyk. There are links within that article to other articles about the GE public hearings

last week.

The comments are very interesting.

From: The Chronicle [daily-html@chronicle.com]

Sent: Friday, November 12, 2010 5:00AM

To: The Chronicle

Subject: Academe Today: For-Profit Colleges May Be at Brink of a Major Reset

Friday November 12, 2010

Subscribe to the Chronicle!

..J

Subscribe to this newsletter J Stop receiving this newsletter J

Top Stories

For-Profit Colleges May Be at Brink of a Major Reset

By Goldie Blumenstyk

Companies are seeing slower enrollment growth, tempering expectations, and adopting new strategies.

Analysts say this is just the beginning.

ADA Compliance Is a 'Major 0

Vulnerability' for Online Programs x

At most colleges, meeting standards is in the

hands of individual faculty members or their

departments, rather than any central office, a

survey found.

ndiana U. Anatomy Program

o-<rn""'"" New Life to Study of

rs

Katherine Mangan

Indiana University Northwest encourages the

families of body donors to meet the students

who learn from the donors' loved ones.

Despite Violence, British Students Plan

More Protests Against Austerity

Measures

By A isha Labi

~ u h l i c officials set about track in{! down

1

Page 23 of 212

perpetrators of the storming of Conservative

Party headquarters.

More News

New NCAA President Hints at His Pt;orities in Remarks to Faculty Reps

1

California Community-College Leaders to Recommend One Million New Graduates by 2020

I A Composer's Muse Takes the Form of a Technology Institute

The Ticker: News From Around the Web

Provost at Bowie State Who Drew Faculty Complaints WiU Leave

Wedding Announcement Costs Gay Administrator Her Job at a Catholic College

Trustees Fall Short in Fund Raising, Survey Finds

AP Italian Is Coming Back

Postcards: Great College Towns Across America

Never a Bad Meal, or a Meal That's Bad for the Community

A visit to Beloit College's slow-food co-op, where student members take control of what they eat.

From the New Global Edition

India's Business Leaders Applaud Progress on Higher Educat ion

By Shailaja Neelakantan

At a recent summit, the country's higher-education minister asked the private sector to take part in

improving the system.

WorldWise: Why Brazil's Standardized Entrance Test Deserves t o Be Salvaged

Despite major problems, the exam is worth saving to help make higher education more accessible, says

Ben Wildavsky.

Commentary

'The Washington Post' and the Perils of For-Profit Colleges

By Stephen Burd

The newspaper's parent company owns Kaplan Inc. and a share of Corinthian Colleges,

presenting a conflict of interest in its coverage of the for-profit industry.

The Chronicle Revi ew

tudent Bodies

y Jill Silos-Rooney

What's the appropriate reaction to students who expose themselves to more than

knowledge?

Brainstorm: Printing Money Blues

Sensible social safety nets would be better than desperate monetary stunts for stabilizing our economy,

writes Teresa Ghilarducci.

Brainstorm: Imagine a University Run by Demons From the ld

In what ways would a Second Life University differ from an actual one? asks Gina Barreca.

Advice

i

I

i

. Tips for Graduate Students

., Lisa Patrick Bentley

i . if you take the reviewers' advice, revise your proposal, and it still gets

t . clown?

J

2

Page 24 of 212

ProfHacker: Use RSS to Keep Up With Favorite Online Services

From Gmail to You Tube, Tungle to Remember the Milk, many of the most popular online services

maintain blogs that provide news, tips, and tutorials covering how to use their product.

From The Chronicle's Slogs

Buildings & Grounds

Ranking the Most-Affordable College Towns

If you want to live cheaply, try living near Ball State University, the University of Buffalo, or nearly

anywhere in Ohio.

Players

Leaders in College Sports Remain

Largely White and Male

Of the 120 athletic directors at the nation's

most-competitive college sports programs, all

but 19 are white men, a new report says.

Arts & Academe

Art Students' Mental Health: A

Complicated Picture

The need "to be creative on demand" entails

stresses that are particular, and particularly

intense, therapists say.

From Arts & Letters Daily

We can't say we didn't know enough. Our recent L--------------------'

housing bubble was inflated despite-partly

because of-amazing computer power, reams of

data, and sophisticated models. More

Announcements

Will the Classroom of the Future Be Virtual, Face to Face, or a Hybrid?

The Chronicle's special report takes a close look at how virtual education has gone mainstream in the

classroom. Purchase Instant Delivery of the 20 l 0 Online Learning report at The Chronicle Store.

The Chronicle's Home Page I News I Opinion I Latest Jobs I Career Advice I Blogs

Did a friend send you this? Go here for your own copy.

In addition to this report, The Chronicle publishes free e-mail newsletters on technology, community colleges,

hiring, and the world of ideas. You can also create an unlimited number of search agents so that you receive e-

mail notification of available jobs in academe that meet your criteria.

The Chronicle of Higher Education website contains a mix of free and premium content For full access to the

premium content, please purchase a subscription to our weekly newspaper.

Manage your account:

Retrieve user name 1 Reset your password 1

(c) 2010 The Chronicle of Higher Education

1255 23rd Street NW

Washington, DC 20037

3

Page 25 of 212

Woodward, Jennifer

From: McDade, John

Sent:

To:

Monday, October 26, 2009 6:28 PM

Woodward, Jennifer

Subject : Re: Article

FSL:

Congratulations! Job well done - I can't wait to read it.

Regarding IC, I'll try to take a look at it.

Talk later,

John Me.

Sent from my BlackBerry Wireless Handheld

From: Woodward, Jennifer

To: McDade, John

Sent: Mon Oct 26 17:02:43 2009

Subject: RE: Article

Feel free to stop over anytime with t hat bleach ... my place sure could use a little TLC. Anyway, I got the Brief

from Hell fi led at 5. My head hurts! I'll send you a pdf of it tomorrow. Thanks again for all you insights. If you

have any on the big IC, (Incentive Comp), please let me know, as that is my most specific assignment as

attorney-advisor.

From: McDade, John

Sent: Monday, October 26, 2009 8:39AM

To: Woodward, Jennifer

Subject: Article

F L.

Good morning!

Interesting article below from the Inside Hi gher Ed website

FYI - my apartment floors needed a drastic cleaning (even broke out the bleach), and I did not get a chance to review any

of the items.

Talk later,

1

Page 26 of 212

YF w

+++++++++++++++++++++++++++++++

In the Crosshairs?

October 26, 2009

Share This Story

http://www.insidehighered.com/news/2009/10/26/regs#

Education Department officials have been insisting for months that, despite the warnings of some

Wall Street analysts to the contrary, the federal government is not intent on intensifying its regulation

of for-profit higher education.

That assertion got a little harder to believe on Friday, when the department announced the

composition of a committee charged with negotiating a set of new federal regulations related to the

integrity of federal financial aid programs. Given the issues on the panel's agenda, its membership

leans notably toward critics of the for-profit sector of higher education, and decidedly short on

representatives of the colleges.

Department officials, however, reject the idea that the panel they've appointed is unbalanced.

As is typically the case in the federal negotiated rul e making process (which is explained here), the

department's September 9 announcement inviting nominations for the committees said it would

populate the panels with people who "represent the interests significantly affected by the topics

proposed for negotiations."

In this case, the topics under the overall rubric of the integrity of federal financial aid programs include

such things as incentive compensation for college recruiters and the use of tests to gauge students'

"ability to benefit" from a higher education, which are heavily used by for-profit universities,

community colleges, and other open-access institutions.

The goal of negotiating committees like this one (and another t he department is creating to look at

foreign institutions) is to try to reach unanimous agreement on a set of recommendations for

proposed regulatory changes, to provide to the education secretary. Disapproval from any single

negotiator can torpedo the whole process, giving the federal agency that sponsors the session- in

this case the Education Department-- free rein to propose whatever it wants.

It was inevitable that any group of officials deemed to have an interest in issues related to potential

financial aid fraud and abuse would contain some people who don't like for-profit colleges. The

institutions have long been viewed with skepticism by consumers' rights groups that (citing many

historical examples and a smaller number of high-profile recent ones) accuse some of the institutions

of preying on low-income students by charging comparatively high tuitions and underdelivering on

their promises of good jobs.

2

So it's no surprise that the committee

Department contains consumer and

student advocates with a track record of criticizing for-profit colleges. The student members (one

primary representative and an alternate) come from two student groups, U.S. PIRG and the United

States Student Association, that frequently take aim at for-profit colleges. Both groups signed a letter

this month, for instance, that urged Congress to toughen its regulation of private student loans made

by for-profit colleges.

The panel also features two consumer advocates. One, Margaret Reiter, is a lawyer who, as deputy

attorney general in California, sued Corinthian Colleges. Inc., for "a persistent pattern of unlawful

conduct" that included allegedly inflating job placement data and falsifying government records.

(Corinthian settled for $6.5 million in 2007.) Her alternate, Deanne Loonin, represents the National

Consumer Law Center, which published a 2005 study called "Making the Numbers Count: Why

Proprietary School Performance Data Doesn't Add Up and What Can Be Done About lt."

What's more unexpected, perhaps, is that the group gathered by the department to negotiate a set of

issues that relate heavily to for-profit institutions contains so many other members with a clearly

stated antipathy toward the sector, and so few members from for-profit institutions themselves.

As is common, the financial integrity committee includes one representative (plus an alternate) from

each of the major sectors of higher education-- public two-year (Richard Heath of Anne Arundel

Community College), public four-year (Philip Asbury of the University of North Carolina at Chapel

Hill), private four-year (Todd Jones of the Association of Independent Colleges and Universities of

Ohio) and for-profit colleges (Elaine Neely of Kaplan Higher Education). Aside from Neely, who can

be counted on to advocate for the career college sector, none is known to be particularly a friend or

foe of for-profit higher education.

But bas.ed on their track records or previous statements, it's fair to expect several of the officials

selected by the department to represent various other "communities of interest" to take a sharply

skeptical view of for-profit colleges.

Jim Simpson, associate vice president of workforce development and adult education at Florida State

College (formerly Florida Community College at Jacksonville), was appointed to fill a slot designed to

represent the interests of "work force development." Simpson traveled to Denver in June to speak at

one of three regional hearings the department held to solicit views on the issues it should explore in

negotiated rule making, and he closed his presentation (which can be found on Page 35 of this

transcript} with a stinging critique of for-profit colleges.

He flew to Denver, Simpson said, in part to "put a human face on what happens when schools take

advantage of lax regulations." He then recounted the story of a student who applied to his institution

after having made the honor roll at an unidentified for-profit university-- "despite later test results ...

that placed the student at an elementary school level in mathematics, language and reading,"

Simpson said.

"This student and their family took out $16,000 in student loans to pay for a two-year degree from a

for-profit university that was clearly only interested in tuition money obtained from federally backed

student loans," he said. "It is a travesty that they were encouraged to take out huge student loans

when their daughter has almost no chance of getting a job that would allow the eventual repayment of

those loans."

College presidents are represented in the negotiation process by Terry W. Hartle, senior vice

president for government and public affairs at the American Council on Education. Hartle typically

3

stays above the fray in the regular political traditional colleges and for-profit

higher education. But ACE, as the lead lobbying group for higher education, almost always sides with

traditional colleges in policy debates, and the Career College Association, the leading lobbying group

for for-profit institutions, withdrew from ACE in a public spat earlier this decade.

The Education Department chose David Hawkins, director of public policy at the National Association

for College Admission Counseling, to represent the interests of admissions officers on the negotiating

team. Like several major higher education associations, NACAC does not let for-profit colleges into its

membership.

And Hawkins, who writes widely about ethics and other issues in higher education, wrote a 2007

article challenging the notion that for-profit institutions are doing a good job of serving students from

low-income backgrounds.

"During the long-running debate over the current reauthorization of the Higher Education Act,

lobbyists for the for-profit institutions would have you believe that 'traditional' colleges and universities

are fighting against the for-profit colleges in a spiteful legislative contest," Hawkins wrote. "In reality,

the 'contest' in Washington is one to preserve the integrity of student-aid programs in an environment

characterized by increasingly aggressive recruiting, indiscriminate admissions and loan financing --

often with little to no regard for the student's ability to benefit or repay - and questionable ' return on

investment' for many students lured in by the publicly traded for-profit colleges' massive

advertisement complex."

Apart from Neely, the Kaplan senior vice president of regulatory affairs, and her alternate, David

Rhodes, president of the School of Visual Arts, the only other negotiator who appears likely to

advocate for for-profit institutions is, by design, is Anthony Mirando, who as president of the National

Accrediting Commission of Cosmetology Arts and Sciences was appointed to represent national

accrediting agencies.

(Other negotiating teams in the recent past contained just one representative of for-profit colleges,

too, but they were focused on topics-- such as accreditation and student loans -- that did not

disproportionately affect those institutions. The loan team contained multiple lenders, and the

accreditation team three or four accrediting officials.)

Officials of the for-profit higher education sector had argued --to no avail --that given the growth of

for-profit colleges and the emphasis in this round of rule making on issues that could directly affect

them, the department should consider appointing more than one person from the institutions to the

negotiating team.

Harris N. Miller, president and CEO of the Career College Association, declined to comment on the

makeup of the negotiating panel, which begins its work a week from today.

Officials at the Education Department offered only a one-line statement in response. "The make-up of

this committee is similar to past committees and we remain committed to ensuring that it reflects key

constituencies," said Justin Hamilton, a spokesman.

But Barmak Nassirian, associate executive director of the American Association of Collegiate

Registrars and Admissions Officers, vigorously challenged the assertion that the negotiating team

appointed by the department is tilted against for-profit colleges, and that the department has it in for

the sector.

4

Nassirian specifically disputed the notion that R a \ ~ \ r ~ s

2

and others (including Nassirian himself} who

have criticized for-profit colleges in the past are biased against the colleges. Hawkins has criticized

the colleges' use of incentive compensation for recruiters, Nassirian said, because he believes such

payments "inevitably lead to abuse" in the admissions world that Hawkins's group oversees.

"But on the rest of the issues, he is a fairly moderate guy, and I don't know that he is any harsher on

the for-profit sector than the nonprofit sector," Nassirian said. Like many experts on financial aid and

higher education, Nassirian said, Hawkins believes "it's in everybody's interest that these programs

be able to demonstrate accountability and program integrity, or else the billions of dollars that are

being devoted to them could be redirected elsewhere."

For-profit colleges have "legitimate concerns ... that they not be subjected to utterly destructive

requirements," Nassirian said. But if the institutions are feeling picked on by the new administration,

that may have more to do with the fact that the previous White House and Education Department

were soft on the sector, greatly softening the very same regulations on executive compensation that

are now under review in the upcoming negotiations.

"I can understand why, from the perspective of the last eight years of the Bush administration, any

change can only be perceived as a change for the worse" for for-profit colleges, Nassirian said. "But

when you judge the matter from the perspective of the taxpayers who fund the system, all the

department has asked them to do is to be more reasonable. There is a new mindset in this

administration that every dollar needs to be reasonably accounted for, and that money is not being

wasted. I don't believe that the good for-profit schools want to contest that view."

-Doug Lederman

5

Woodward, Jennifer

From:

Sent.:

To:

Subject:

b

b) 5)

Page30of212

Woodward, Jennifer

Thursday, December 09, 2010 12:07 PM

Wolff, Russell; Finley, Steve; Yuan, Georgia; Kvaal , James; Bergeron, David

RE: Follow-up [DeVry]

1

- ------ --- -------------

from: Sova, Alexandra -

Sent: Tuesday, December 07, 2010 9:53AM

To: 'Thomas Parrott, Sharon'; Yuan, Georgia

Subject: RE: Follow-up

Dear Sharon,

Thank you for your email. I am happy to hear you had a beneficial meeting with the Department.

Sincerely,

Alexandra Sova

Alexandra Sova

Assistant to the Deputy Secretary

U.S. Department of Education

Alexandra .Sova @ed .gov

202.401.9965

----------

From: Thomas Parrott, Sharon [mailto:sthomasparrott@devry.com]

Sent: Monday, December 06, 2010 6:37PM

To: Yuan, Georgia

Cc: Private - Miller, Anthony

Subject: Follow-up

Hi Georgia,

It was great to visit with you during DeVry's meeting with Secretary Duncan a few weeks ago. I was particularly pleased

to hear that we share the process of "side by side" review of new regulations to further our understanding of what they

really say.

I am following up with you at Secretary Miller's suggestion, regarding our recent discussion at the Department

concerning the new program integrity rules. I would very much appreciate an opportunity to share some thoughts that

we have on solutions that meet both the letter and spirit of the new rules, while providing additional clarity to colleges

and universities. I am happy to call or visit with you at your earliest convenience.

Best,

Sharon

Sharon Thomas Parrott

Senior Vice President

Government and Regulatory Affairs

Chief Compliance Officer

DeVry Inc.

3005 Highland Parkway

Downers Grove, ll 60615-5799

p: 630.515.3146

f: 630-353-3968

c: 312-485-3225

e: stparrot@devry.edu

www .devryinc.com

3

Woodward, Jennifer

From: Wolff, Russell

Sent:

To:

Thursday, January 07, 2010 4:16PM

Finley, Steve

Subject: FW: UOP meeting

What t he f-- does t hat mean? And, no, I was not a " bee".

- ---------------- -------

From: Jenkins, Harold

Sent: Thursday, January 07, 2010 3:59 PM

To: Sann, Ronald

Cc: Marinucd, Fred; Finley, Steve; Wolff, Russell; Woodward, Jennifer

Subject: RE: UOP meeting

Thanks to all who commented. I passed the comments on to Bob.

From: Sann, Ronald

Sent: Thursday, January 07, 2010 2:05 PM

To: Jenkins, Harold

Cc: Marinucci, Fred; Finley, Steve; Wolff, Russell; Woodward, Jennifer

Subject: RE: UOP meeting

Harold,

I agree. I think it's up to Bob whether to meet with them, but to the extent this covers issues in the

current reg.-neg., we should avoid providing UOP, or any other school, with special access. If a

meeting is held, we should be included.

Ron

From: Jenkins, Harold

Sent: Thursday, January 07, 2010 1:17 PM

To: Marinucci, Fred; Wolff, Russell; Woodward, Jennifer; Finley, Steve; Sann, Ronald

Subject: FW: UOP meeting

Importance: High

Comments invited. I would highly recommend that he include someone from this office, but I don't

know a basis for recommending against a meeting. Steve and Ron, I am including you in view of

ongoing reg neg; could we say that in view of reg neg it would be inappropriate now to give one

school a private channel for propounding its proposals?

I want to get back to Bob this afternoon. Thanks.

Harold

From: Shireman, Bob

Sent: Thursday, January 07, 2010 1:09PM

1

To: Jenkins, Harold

Subject: UOP meeting

Importance: High

From: Julie Shroyer <jshroyer@wheatgr.com>

To: Shireman, Bob

Sent: Thu Jan 07 11:54:23 2010

Subject: Hello and Meeting Request

Dear Bob,

Page 34 of 212

I hope the new year is t reating you well. Just left you a voice mail message but realize it may be easier to send you a

note via email. Would love to tell you about my family's visit to our friends the Kim/Paterson family in the Netherlands

(Dec. 26-Jan. 1). Feel free to have lucinda call me too because she may be even more interested. All of us should figure

out how to do time overseas.

As I indicated in my voice mail, I would also like to submit a formal meeting request for Apollo. We are hoping that you

may have time in your schedule sometime over the next few weeks. Here are the specifics:

Meeting Participants:

Greg Cappelli, CEO, Apollo

Terri Bishop, Director/Vice President External Affairs, Apollo

Julie Shroyer, Sr VP, Wheat Government Relations (consultant to Apollo/University of Phoenix)

Purpose:

To discuss ideas for implementing various student/consumer protections (e.g., related to borrowing practices,

disclosures, etc.) and the technology that Apollo is developing to support compliance and academic quality and

innovation.

When:

Preferably as soon as possible or within the next few weeks.

Thank you so much for your consideration of the request. I look forward to hearing from you and seeing you soon.

Best,

Julie

Julie E. Shroyer

Senior VP

Wheat Government Relations

1201 S. Eads Street, Suite Two

Arlington, VA 22202

(703) 271-8760

jshroyer@wheatgr.com

2

Page 35 or 212

Woodward, Jennifer

From: Wolff, Russell

Sent:

To:

Tuesday, December 08, 200910:17 AM

Woodward, Jennifer

Subject: FW: article on the proposed elimination of the incentive comp safe harbors

-----Original Message- - ---

From: Shireman, Bob

Sent: Monday, December 07, 2089 8:35 PM

To: Wolff, Russell

Cc: Woodward, Jennifer

Subject: RE : article on the proposed elimination of the incentive comp safe harbors

From: Wolff, Russell

Sent: Monday, December 87, 2889 3:11 PM

To: Shireman , Bob

Cc: Woodward, Jennifer

Subject: FW: article on the proposed elimination of the incentive comp safe harbors

Bob:

Russ

http: //higheredwatch. newamerica . net/blogmain

At Long Last, Department of Education Puts the Interests of Students

First<http://higheredwatch.newamerica.net/blogposts/2889/at_long_last_the_department_of_educa

tion_takes_a_stand_to_safeguard_students-24548>

* By

* Stephen Surd

December 3, 2999

At Higher Ed Watch, we have repeatedly called on federal policymakers to strengthen

regulations

<http://higheredwatch.newamerica.net/blogs/education_policy/2997/11/easing_restrictions_trade

_schools> that aim to prevent unscrupulous for-profit colleges and trade schools from taking

advantage of financially needy students . Our calls, however, have gone largely unheeded as

Congress, under both Republican and Democratic leadership, has continued t o weaken these

rules<http ://higheredwatch. newamerica.net/blogposts/2008/ our_bi ggest_disappointments_with_fin

al_higher_ed_bill-19290> . At the same time, the Department of Education has long coddled the

for- profit higher education sector by continually t urning a bli nd eye to widespread

allegations of fraud and abuse at some of the nation' s l argest chains of proprietary schools.

But this week, the Obama administration let the sector know, i n no uncertain terms, that

those days are over.

1

On Monday, the Department of Education regulatory proposals

<http://www.ed.gov/policy/highered/reg/hearulemaking/2ee9/integrity-session2-issues.pdf> that

aim to strengthen the integrity of the federal student aid programs and prevent unscrupulous

for-profit colleges and trade schools from taking advantage of the low- income and working-

class students they tend to enroll. A top goal for the Obama administration is to stop these

institutions from deliberately recruiting and admitting unqualified students, who end up

taking on huge amounts of debt for training from which they are unlikely to benefit.

The most significant of these preliminary proposals is one that Higher Ed Watch has long

called for

<http://higheredwatch.newamerica.net/blogposts/2e09/rewriting_the_rules_on_trade_schools_to_b

etter_safeguard_students-19140> -- reversing changes that the Bush administration made to the

Department of Education,s regulations enforcing a federal law barring colleges from

compensating recruiters based on their success in enrolling students.

As we have previously