Professional Documents

Culture Documents

Faulu Kenya

Uploaded by

Jesse LordOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Faulu Kenya

Uploaded by

Jesse LordCopyright:

Available Formats

FAULU KENYA

Faulu Kenya is a Deposit Taking Micro-Finance Company, registered in Kenya under the Micro-Finance Act which is regulated by the Central Bank of Kenya. Faulu was founded as a programme of Food for the Hungry International (FHI), a Christian relief and development organisation based in Phoenix Arizona in USA and has grown to become an MFI that offers both savings and credit services to millions of Kenyans. FHI recognised that there were unique needs of low-income people in rural and urban areas and that sustainable economic development for the marginalised poor is a priority issue in the developing world. To address these issues, FHI established Faulu Africa Network, a regional micro finance network operating in Kenya, Uganda and Tanzania. FHI began with a pilot phase of micro enterprise lending in the Mathare slums east of Nairobi in 1992. As the methodologies and systems were defined, it formally became the Faulu Loan Scheme in 1992. Thereafter, in 1993, a commitment was made to expand the programme and major funding availed. Finally in October 1994, Faulu Kenya officially came into being and was registered as a limited liability company in 1999. Valuable support was received in the formative years from USAID, DFID and the European Union. Faulu Kenya is currently a sustainable and profitable micro finance institution. Faulu Kenya has grown tremendously over the last 16 years, with over 90 outlets throughout Kenya. These outlets are currently serving over 250,000 clients. There are now more than 1500 members of staff in the outlets and at the Business Support Center (Head Office). PRODUCTS. CREDIT PRODUCTS: Mkopo Biashara This is a business loan available to people involved in business. It has three levels designed to help you from small beginnings to a bigger operation. You are given a grace period before starting repayment. Mkopo Biashara - Daraja 1 Terms ' Waiting period for first loan eligibility for group members ' 4 weeks. ' One should have attended Loan Orientation Seminar if it is a first loan. ' Saving of the required loan security fund to secure the loan required. ' Group members and Faulu officers business appraisal. ' Group members' guarantee for the customer's loan for group based loans. Benefits ' Easy access requirements. ' Flexible repayment period. ' Quick processing. ' Convenient and affordable. ' Access to refinancing. ' Weekly reports on loan status. Mkopo Biashara - Daraja 2

1 / 11

FAULU KENYA

Terms ' Waiting period for first loan eligibility for group members ' 4 weeks. ' One should have attended Loan orientation seminar. ' Saving of the required loan security fund to secure the loan required. ' Group members and Faulu officers business appraisal. ' Group members' guarantee for the customer's loan for group based loans. Benefits ' Easy access requirements. ' Flexible repayment period. ' Quick processing. ' Convenient and affordable. ' Access to refinancing. ' Weekly reports on loan status. Mkopo Biashara - Daraja 3 Terms ' One must have serviced a Daraja 2 loan successfully to qualify. ' Group members and Faulu officers business appraisal. ' Group members' guarantee for the customer's loan for group based loans. Benefits ' Easy access requirements. ' Flexible repayment period. ' Quick processing. ' Convenient and affordable. ' Access to refinancing. ' Weekly reports on loan status. Mkopo Hisa Purpose ' Faulu Kenya has seen the need among it's clientele to diversify their investments in channels that also diversify their risks. Hence, Faulu has identified one such area that clients can easily access, The Nairobi Stock Exchange. This loan product allows Faulu Kenya clients to buy shares of listed companies as a way of investing their monies for both short and long-term returns. ' This product's objective is to encourage savings for capital accumulation and getting for clients an alternative income stream. Terms ' Waiting period for first loan eligibility for group members ' 4 weeks. ' One should have attended Loan orientation seminar if it is a first loan. ' Saving of the required loan security fund to secure the loan required. ' Group members and Faulu officers' business appraisal. ' Group members' guarantee for the customer's loan for group based loans.

2 / 11

FAULU KENYA

Benefits ' An avenue for one to acquire savings for capital accumulation and an alternative income stream. ' Convenient weekly installments. ' Interest waiver reward for early repayments. ' Convenient and easy access requirements. Mkopo Elimu Purpose ' An educational loan product that allows one to meet their children's school fees or their own if they want to pursue further education or training and also purchase books, uniforms etc. ' This facility is available to both Faulu and non-Faulu clients. ' Faulu clients can access the loan even if they have another loan that they are servicing as long as they fulfill the required terms. Terms ' Waiting period for first loan eligibility for group members ' 4 weeks. ' One should have attended Loan orientation seminar if it is a first loan. ' Saving of the required loan security fund to secure the loan required. ' Group members and Faulu officers business appraisal. ' Group members' guarantee for the customer's loan for group based loans. Benefits ' Meets a variety of educational financial needs over and above fees such as books, uniforms etc. ' Convenient and flexible disbursement with cheques written directly to institutions. ' Interest waiver reward for early payments. Mkopo Kilimo Purpose ' A loan product that involves Faulu financing on-farm activities for farmers at their level. ' The farmers will be able to apply for loans, then repay with the proceeds from their produce at harvest. Terms ' Waiting period for first loan eligibility for group members ' 4 weeks. ' One should have attended Loan orientation seminar if it is a first loan. ' Saving of the required loan security fund to secure the loan required. ' Group members and Faulu officer's business appraisal. ' Group members' guarantee for the customer's loans for group based loans. Benefits ' Convenient- you get it when you need it and repayment is based on your harvest cash flows. ' Timely and reliable- season-based disbursements for early preparation and purchase of inputs.

3 / 11

FAULU KENYA

' Flexibility on repayment terms - has an optional grace period for ease of payments on the clients. ' Interest waiver incentive on early repayments. Customer reward- Customers enjoy interest reduction on subsequent loans. ' It has a refinancing option through a top-up facility for one to take advantage of emerging opportunities. Maisha Bora Purpose ' Loan product that facilitates the acquisition of new assets by clients from suppliers country-wide. ' Asset Acquisition: Specifically for the economically active poor who would like to build their asset base for the purpose of getting access to larger loans using the assets acquired. They would take this loan given that they can get the asset as they make payments through the year. ' Replacement of old assets: This mainly is by those who already have the assets but would like to replace the old with new. ' Replacement of lost/ destroyed property: Especially for the IDPs. ' Business Expansion: e.g. for landlords who would want to build more rental houses given that the materials are also available under this product. Terms ' Waiting period for first loan eligibility for group members ' 4 weeks. ' One should have attended Loan orientation seminar if it is a first loan. ' Saving of the required loan security fund to secure the loan required. ' Group members and Faulu officers' business appraisal. ' Group members guarantee for the customer's loan for group based loans. Benefits ' Easy accessibility to assets. ' Flexible and convenient weekly installments. ' No hidden charges. ' Own choice of supplier for assets. Imara Loan Purpose Loan product used for various purposes by the civil servants, TSC members and employees such as:-. ' Asset Acquisition. ' School fees. ' Business working capital. ' Emergency needs. Terms

4 / 11

FAULU KENYA

' One must be a TSC member or a civil servant on permanent basis. ' 2 colour passport pictures, original and copy of national ID and employment ID. ' 3 latest pay slips. ' Minimum of two guarantors in cases where the loan amount is more than Kshs.100,000. Benefits ' No collaterals required. ' Flexible repayment period. ' Quick processing. ' Convenient and affordable. ' Top up facility. SAVINGS PRODUCTS Hazina Account:Hazina is an ideal savings account that offers you a great opportunity to save in small amounts for a rainy day. It also enables you meet your day to day financial obligations such as food expenses, rent, medical bills, emergencies and any other bills in a stress free manner. It is affordable and convenient to operate. Benefits ' Easy account opening ' Affordable and flexible ' 24 hours easy access to your money through multiple service outlets across the country i.e Faulu Branches, ATMs, Mobile phones and appointed agents ' Secure place to save (Licensed by Central Bank of Kenya) ' Premium interest rates on your savings Features ' Account opening balance of Ksh. 200 ' Minimum operating balance of Ksh. 200 ' Competitive interest rates of up to 4% p.a on balances above Ksh 3,000 ' Unlimited withdrawals ' Free Daraja card ' 2 free statements annually ' No monthly ledger fees ' No account maintenance fees Hazina Plus We understand that saving for your goals requires hard work and discipline. Hazina Plus gives you a pure savings solution to enable you accumulate your savings and achieve your life's aspirations. Benefits ' Easy account opening requirements ' Affordable ' Secure place to save (Licensed by Central Bank of Kenya)

5 / 11

FAULU KENYA

' Premium interest rates on your savings Features ' Account opening balance of Ksh. 200/' Minimum operating balance of Ksh. 200/' Competitive interest rates of up to 6% p.a on all balances ' 2 free statements annually on request ' Free Daraja card ' One free withdrawal per quarter. Extra withdrawals will attract a fee ' No monthly ledger fees ' No account maintenance fees Lengo Account Lengo enables you to work towards achieving your short and long term goals. All you have to do is determine your financial target and duration of time over which you will save to achieve your goal.Benefits ' Easy to open and maintain ' Competitive interest rates of up to 6% p.a on all balances above Ksh 3,000 ' Free transfer from your Hazina account ' Automatic access to a loan facility ' Security for your money ' Check off facility for the salaried ' Guaranteed returns ' Free bankers cheque on maturity Features ' Account opening balance of Ksh. 300 ' Minimum operating balance of Ksh. 300 ' Minimum savings plan of 3 months and up to a maximum of 10 years ' Minimum monthly deposit of Ksh. 100 Head Office PO BOX 60240-00200 Nairobi Kenya Email : info@faulukenya.co.ke 3877290-3/7; 3872183/4; 3867504, 3874857 Business Support Centre Ngong Lane, Off Ngong Road P O Box 60240

6 / 11

FAULU KENYA

00200 City Square Nairobi Tel: 3877290 '3 /7; 3872183/4; 3867503 Fax: 3867504, 3874857 NAIROBI AREA EAST NAIROBI BURUBURU BURUBURU ARCADE TEL. 020 787972 RONGAI -FORMER NATIONAL BANK BUILDING TEL. 020 3871894 LIMURU - KIMUCHU HOUSE TEL: 020 3871894 KIBERA -FORT JESUS TEL. 020 3871894 JOGOO ROAD- NACICO PLAZA TEL. 020 2230357 CENTRAL NAIROBI -BITHA PLAZA TEL. 6752774 NGONG-OROK PLAZA TEL. 020 3871894 GIKOMBA - KIAWAMBUGU BUILDING TEL: 020 2230357 KISERIAN - BETSY COURT TEL: 020 3871894 KAWANGWARE -FORMER CDF BUILDING TEL. 020 3871894 GITHURAI TEL: 6752774 WEST NAIROBI - BERMUDA PLAZA TEL: 020 3871894 CENTRAL AREA KARATINA - RHINO HOUSE

7 / 11

FAULU KENYA

TEL. 061 72398 NYERI - KONAHAUTHI HOUSE TEL. 061 2030181 KIAMBU - RUMATHI HOUSE TEL. 020 2369826 MURANGA - NGEKA HOUSE TEL. 060 31320 NANYUKI - JIWA HOUSE TEL. 020 2369824 THIKA - ABOVE HFCK BANK TEL. 067 21983 KERUGOYA - WANJAO HOUSE TEL. 068 30809 GITHUNGURI - KARU HOUSE TEL. 020 2369826 EASTERN REGION MACHAKOS - BONDENI HOUSE TEL: 044 20071 TALA - TALA HOUSE TEL: 020 787972 KITENGELA - MILELE COMPLEX TEL. 044 20071 KITUI - CENTRAL TRADE CENTRE HOUSE TEL. 044 20071 MERU - MWALIMU PLAZA TEL. 064 31353 NKUBU - AMCOK BUILDING TEL. 064 31353 MAUA - MAUA METHODIST SYNOD BUILDING TEL. 064 31353

8 / 11

FAULU KENYA

CHUKA - IRUMA BUILDING TEL. 064 31353 ISIOLO - SAADA BUILDING TEL. 064 31353 EMBU - SPARKO BUILDING TEL 068 30809 MWEA TEL. 068 30809 MATUU - BIDII HOUSE TEL. 067 21983 MWINGI -OSAVINYA BUILDING TEL. 067 21983 EMALI - MBILO BUILDING TEL: 044 20071 WOTE -DOUBLE KEY BUILDING TEL: 044 20071 WESTERN & NORTH RIFT BUNGOMA BUNGOMA TEACHER'S PLAZA TEL. 020 2369827 WEBUYE - HILLSIDE BUILDING TEL. 020 2369827 MUMIAS - KHOLERA HOUSE TEL. 020 2369827 KAKAMEGA - WALIA CENTRE TEL. 020 2369827 KITALE BRANCH - VICTOR HOUSE TEL. 054 30044 MOI'S BRIDGE - SAMOEI HOUSE TEL: 054 30044 KAPENGURIA -SIMKO PLAZA TEL. 054 30044

9 / 11

FAULU KENYA

ELDORET EAST & WEST ELDORET - JAPARA BUILDING TEL. 053 2060482 KAPSABET - KENCOM HOUSE 053 2060482 BOMET - KIPSIGIS TEACHERS SACCO TEL. 052 22431 KERICHO - ISAN ARCADE TEL. 052 20862 LITEIN -TEGUTO PLAZA TEL. 052 20862 CHEPSEON-CDF BUILDING TEL. 052 20862 KISUMU -JUBILEE INSURANCE HOUSE TEL. 020 2111225 BONDO TEL: 020 2111225 BUSIA TEL. 020 2369827 OL KALOU TEL.06532014 CENTRAL AND SOUTH RIFT NAKURU - GATE HOUSE TEL. 051 2216053 NJORO - STAGE VIEW BUILDING TEL: 051 721571 ELDAMA RAVIN - REJAJA HOUSE TEL. 051 2216053 NAIVASHA - JOSTAS BUILDING TEL. 020 2054461 NJABINI TEL. 020 2054461 NAROK - MAA TOWERS TEL. 020 3516867

10 / 11

FAULU KENYA

MOLO - DUBAI PLAZA 2000 TEL. 051 721571 OLENGURUONE -BIDII BUILDING TEL. 051 72157 NYAHURURU - KIMWA CENTRE TEL. 065 32014 MARALAL - ARK HOUS TEL: 065 32014 KINAMBA TEL. 065 32014 RUMURUTI TEL.06532014 KABARNET TEL. 051 2216053 COAST REGION MALINDI - LAMU ROAD COMPLEX BUILDING TEL. 042 20403 MPEKETONI - JENIPHAT BUILDING 042-20403 KONGOWEA TEL. 041 2492986 CHANGAMWE - GIDDI MART BUILDING TEL: 041 2492986 UKUNDA - SAIDI MINI PLAZA TEL. 041 2492986 VOI OFFICE - POTTERS HOUSE COMPLEX TEL: 041 2492986 MOMBASA BRANCH-MPC BUILDING TEL: 041 2492986 Bookmark and Share

11 / 11

You might also like

- T6 LendingDocument7 pagesT6 Lendingkhongst-wb22No ratings yet

- Canara BankDocument15 pagesCanara BankeswariNo ratings yet

- Personal Loans and Financing in FullertonfinalDocument51 pagesPersonal Loans and Financing in Fullertonfinalvipultandonddn100% (1)

- Commercial Banking: BBIT (Hons.) 5th SemesterDocument20 pagesCommercial Banking: BBIT (Hons.) 5th SemestershomoshoNo ratings yet

- Chala ReportDocument10 pagesChala Reportabdi100% (6)

- Chala ReportDocument10 pagesChala ReportJOKER MulualemNo ratings yet

- Final Project For Print Out of Fullerton IndiaDocument51 pagesFinal Project For Print Out of Fullerton IndiaVinay Bairagi100% (1)

- 1.1 BackgroundDocument24 pages1.1 BackgroundhahaNo ratings yet

- Allied Bank - Case StudyDocument32 pagesAllied Bank - Case StudyKathlyn Kaye Sanchez100% (1)

- Chapter Four: Micro-Financing InstitutionsDocument16 pagesChapter Four: Micro-Financing InstitutionsBekele DemissieNo ratings yet

- Final Project For Print Out of Fullerton IndiaDocument51 pagesFinal Project For Print Out of Fullerton IndiasnehalchittapurNo ratings yet

- Finmarket Lecture 5Document13 pagesFinmarket Lecture 5Rosie PosieNo ratings yet

- The Strengthening of A Microfinance InstitutionDocument18 pagesThe Strengthening of A Microfinance InstitutionSam OdhiamboNo ratings yet

- Bus Finance PesentationDocument33 pagesBus Finance PesentationDawn Juliana AranNo ratings yet

- SKS Microfinance CompanyDocument7 pagesSKS Microfinance CompanyMonisha KMNo ratings yet

- Finance Assigbment No 2 WaleedDocument16 pagesFinance Assigbment No 2 WaleedSaad AhmedNo ratings yet

- National Bank Limited Term PaperDocument5 pagesNational Bank Limited Term Paperafmzzantalfbfa100% (1)

- Presentation (6) Business FinanceDocument17 pagesPresentation (6) Business FinancecycygajatorNo ratings yet

- Microfinance Bank Proposal AjiboyeDocument12 pagesMicrofinance Bank Proposal AjiboyeYkeOluyomi Olojo81% (16)

- Non Performong Assets ProjectDocument74 pagesNon Performong Assets ProjectbudatijagadeeshNo ratings yet

- General Banking - Credit OperationsDocument11 pagesGeneral Banking - Credit OperationsGnana SambandamNo ratings yet

- Entrepreneur Ch 6Document37 pagesEntrepreneur Ch 6Getahun AbebawNo ratings yet

- 4 Types of Short-Term LoansDocument2 pages4 Types of Short-Term LoansQQ Loan MalaysiaNo ratings yet

- Unit 4 MFRBDocument46 pagesUnit 4 MFRBSweety TuladharNo ratings yet

- An Internship Is A Temporary Position With An Emphasis On On - The-Job TrainingDocument13 pagesAn Internship Is A Temporary Position With An Emphasis On On - The-Job TrainingAdithya JeeshNo ratings yet

- MCB Islamic BankingDocument5 pagesMCB Islamic BankingMirza Sohail BaigNo ratings yet

- Epangelia Promised Land-1Document11 pagesEpangelia Promised Land-1philipsmiracle93No ratings yet

- Akshaya Credit 2Document8 pagesAkshaya Credit 2Antonette FernandesNo ratings yet

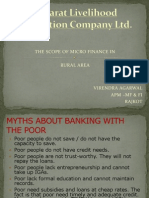

- The Scope of Micro Finance in Rural AreaDocument23 pagesThe Scope of Micro Finance in Rural AreavirugargNo ratings yet

- LM Business Finance Q3 W5 Module 7Document16 pagesLM Business Finance Q3 W5 Module 7Minimi LovelyNo ratings yet

- Micro-Financing ProgramDocument21 pagesMicro-Financing ProgramRizzvillEspinaNo ratings yet

- Term PaperDocument8 pagesTerm PaperAce Hulsey TevesNo ratings yet

- G12 Buss Finance W5 LASDocument16 pagesG12 Buss Finance W5 LASEvelyn DeliquinaNo ratings yet

- About Janshakti Multi State Co-operative SocietyDocument59 pagesAbout Janshakti Multi State Co-operative SocietyPanav Mohindra100% (1)

- Business vs Consumer LoansDocument10 pagesBusiness vs Consumer LoansDandreb SardanNo ratings yet

- BASIC Bank Employee Certification LetterDocument2 pagesBASIC Bank Employee Certification LettertanviriubdNo ratings yet

- Bank CreditDocument5 pagesBank Creditnhan thanhNo ratings yet

- Entrepreneur's Handbook: Establishing a Successful Money Broker BusinessFrom EverandEntrepreneur's Handbook: Establishing a Successful Money Broker BusinessNo ratings yet

- Final Project of Fin 433Document43 pagesFinal Project of Fin 433UpomaAhmedNo ratings yet

- AJDFI - Principles of Credit - PPP - 16nov2012Document51 pagesAJDFI - Principles of Credit - PPP - 16nov2012Fretchie SenielNo ratings yet

- Sources of Finance Table Dominic ClarkDocument4 pagesSources of Finance Table Dominic Clarkapi-285196994No ratings yet

- IfsDocument6 pagesIfsShrutvee GoswamiNo ratings yet

- Overview of Exim Bank LimitedDocument17 pagesOverview of Exim Bank LimitedShoyeb MahmudNo ratings yet

- Consumer Loan Granted For Personal (Medical), Family (Education, Vacation), or HouseholdDocument8 pagesConsumer Loan Granted For Personal (Medical), Family (Education, Vacation), or Householdaliwaqas48797No ratings yet

- Term Paper On Credit Operations of Bank in Bangladesh Course Title: Bank Fund Management Course Code: FIN-435Document33 pagesTerm Paper On Credit Operations of Bank in Bangladesh Course Title: Bank Fund Management Course Code: FIN-435Tuhin KhalekuzzamanNo ratings yet

- Financial Due-Diligence in IslamDocument14 pagesFinancial Due-Diligence in IslamfashdeenNo ratings yet

- A Comparison of The Finance Companies in BangladeshDocument27 pagesA Comparison of The Finance Companies in BangladeshAnik MuidNo ratings yet

- Practical AttachmentDocument9 pagesPractical AttachmentEbsa Ademe100% (7)

- What Is BankDocument19 pagesWhat Is BankSunayana BasuNo ratings yet

- Financial Literacy Program on Debt ManagementDocument13 pagesFinancial Literacy Program on Debt ManagementAmi NeiNo ratings yet

- Unit 4 Bank Deposits and LendingDocument30 pagesUnit 4 Bank Deposits and LendingSAHILNo ratings yet

- HabibMetro Mera MustaqbilDocument15 pagesHabibMetro Mera MustaqbilRashid Shah100% (1)

- Consumer Finance and Venture CapitalDocument3 pagesConsumer Finance and Venture CapitalBalachandar ThirumalaiNo ratings yet

- Sip Project SBI HomeloanDocument45 pagesSip Project SBI HomeloanAkshay RautNo ratings yet

- Banking Products Assignment FINAL 2Document19 pagesBanking Products Assignment FINAL 2satyabhagatNo ratings yet

- Product Disclosure Sheet: KFH Murabahah Personal Financing-I Government. KFH Murabahah Personal Financing-I GovernmentDocument5 pagesProduct Disclosure Sheet: KFH Murabahah Personal Financing-I Government. KFH Murabahah Personal Financing-I GovernmentYushairizal IbrahimNo ratings yet

- KMBL Gujrat Internship ReportDocument42 pagesKMBL Gujrat Internship Reportbbaahmad890% (1)

- Analyzing SIBL's retail banking products and servicesDocument22 pagesAnalyzing SIBL's retail banking products and servicesHumayun KabirNo ratings yet

- 10 Productivity Tips For MFI Staff by Dr.N.JeyaseelanDocument2 pages10 Productivity Tips For MFI Staff by Dr.N.JeyaseelanJeyaseelanNo ratings yet

- Consumer FinanceDocument36 pagesConsumer FinanceAditya0% (1)

- 8 BPI Family Savings Bank V ST Michael Medical Center, GR 205469, March 25, 2015Document2 pages8 BPI Family Savings Bank V ST Michael Medical Center, GR 205469, March 25, 2015Nea TanNo ratings yet

- Chan Wan vs. Tan Kim Facts:: ST NDDocument5 pagesChan Wan vs. Tan Kim Facts:: ST NDDANICA FLORESNo ratings yet

- United States Vs Todd Chrisley, Julie Chrisley, Peter TarantinoDocument27 pagesUnited States Vs Todd Chrisley, Julie Chrisley, Peter TarantinoKatie Joy100% (2)

- Business Law Mockboard 2013 With AnswersDocument7 pagesBusiness Law Mockboard 2013 With AnswersKyla DizonNo ratings yet

- Conveyance in Favour of Mortgagee - EnglishDocument4 pagesConveyance in Favour of Mortgagee - EnglishThirupathi GovindasamyNo ratings yet

- Petitioners vs. vs. Respondents Gines N. Abellana Dionisio U. FloresDocument8 pagesPetitioners vs. vs. Respondents Gines N. Abellana Dionisio U. FloresKizzy EspiNo ratings yet

- Secured Transactions Torts and Damages Preference of Credits Examination QuestionsDocument14 pagesSecured Transactions Torts and Damages Preference of Credits Examination QuestionsPilacan KarylNo ratings yet

- Construction Loan GuaranteeDocument11 pagesConstruction Loan GuaranteeGeorgeNo ratings yet

- Deposit Subscription: Eda Mini ProjectDocument41 pagesDeposit Subscription: Eda Mini ProjectARCHANA RNo ratings yet

- Sara Barz - TransUnion Personal Credit Report - 20141116 PDFDocument14 pagesSara Barz - TransUnion Personal Credit Report - 20141116 PDFSaraBarz50% (2)

- Foreclosure Auction of 1,000sqm Property in Taal, BatangasDocument1 pageForeclosure Auction of 1,000sqm Property in Taal, BatangasVAT CLIENTS100% (1)

- PNB Own a Philippine Home Loan FAQsDocument4 pagesPNB Own a Philippine Home Loan FAQsJasper CruzNo ratings yet

- Credit Derivatives: CDS, CDO and CLO: SimplifiedDocument5 pagesCredit Derivatives: CDS, CDO and CLO: Simplifiedmani singhNo ratings yet

- Cancellation of Sale DeedDocument3 pagesCancellation of Sale DeedNachiketh JuristNo ratings yet

- OBLICON REVIEWER Article 1156Document3 pagesOBLICON REVIEWER Article 1156Oh SeluringNo ratings yet

- Sale of Immovable Property ProjectDocument20 pagesSale of Immovable Property ProjectSyed renobaNo ratings yet

- Calculate Interest Earned and Principal Balances for CD, Bonds, and LoansDocument18 pagesCalculate Interest Earned and Principal Balances for CD, Bonds, and LoansV ANo ratings yet

- ACORD 28 Evidence of Commercial Property InsuranceDocument2 pagesACORD 28 Evidence of Commercial Property InsurancecookseyecuritycorpNo ratings yet

- Northern Cpa Review: Business Law Law On SalesDocument16 pagesNorthern Cpa Review: Business Law Law On SalesAvocado HunterNo ratings yet

- Compilation of Special LawsDocument3 pagesCompilation of Special Lawserica pejiNo ratings yet

- How Swaps Work: An Overview of the Different Types of SwapsDocument3 pagesHow Swaps Work: An Overview of the Different Types of SwapsJohana ReyesNo ratings yet

- B.H Berkenkotter Vs Cu UnjiengDocument2 pagesB.H Berkenkotter Vs Cu UnjiengDenDenciio Barćelona100% (1)

- Legal vs Equitable Title: Understanding Property OwnershipDocument5 pagesLegal vs Equitable Title: Understanding Property OwnershipJulian100% (3)

- Duties and Rights of Bankers and CustomersDocument33 pagesDuties and Rights of Bankers and CustomersMichael TochukwuNo ratings yet

- Chapter-15 Banking and CreditDocument35 pagesChapter-15 Banking and Creditamita venkateshNo ratings yet

- Deed of Sale Vehicle Mortgage AssumptionDocument2 pagesDeed of Sale Vehicle Mortgage AssumptionDreamclips Photo0% (1)

- Deed of Sale With Assumption of MortgageDocument2 pagesDeed of Sale With Assumption of MortgageNica09_forever100% (1)

- ApplicationDocument2 pagesApplicationFabian SandovalNo ratings yet

- The Fraud of Bank Loans: & Theft of Labor by The U.S. Banking SystemDocument62 pagesThe Fraud of Bank Loans: & Theft of Labor by The U.S. Banking SystemK100% (3)

- Impact of Microcredit in PhilippinesDocument3 pagesImpact of Microcredit in PhilippinesAra LimNo ratings yet