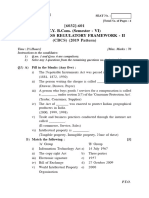

Professional Documents

Culture Documents

Chapter II of The Income..............................

Uploaded by

Amaan KhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter II of The Income..............................

Uploaded by

Amaan KhanCopyright:

Available Formats

Chapter II of the Income-tax Act contains a number of provisions in sections 10 to 13A which exclude various kind of incomes from

the purview of taxation. Section 10 enumerates a number of incomes at one place, which are otherwise incomes, but which are not to be included in the income for the purpose of taxation under the Income-tax Act provides that the agricultural income will be considered for the purpose of determining the rate of tax levied on non -agricultural income. Section 10A exempts the income of any newly established undertaking in a free trade zone. Section 10B exempts the income of any newly established 100% export oriented undertaking. Section 11 exempts the income of any charitable or religious trust or institution. Section 12 deems voluntary contributions to a charitable or religious trust or institution as the income from property held under the trust and, thus, exempts the contributions received by any charitable or religious trust or institution. Section 13A exempts the income of poli tical parties. Incomes enumerated in section 10 can be classified under two broad heads, namely that : (A) (B) Incomes which are not to be included in the income without any further consideration, and Incomes which are not to be included in the income on satisfaction of some further condition or conditions. A. The incomes enumerated below are exempt from tax 1 .Agricultural income Section 10(1) (This incomes has to be considered for determining the rate of tax applicable to the other income) 2. Any sum received by an individual as a member of a Hindu undivided family from income of the family or from the income of the impartible estate of the family. Section 10(2) 3. Share of profit of a person from a firm, which is separately assessed and where he is a partner. (This clause was introduced by the Finance Act, 1992, w.e.f. 1.4.1993, consequent upon taxation of the income of a firm separately at a flat rate)Section 10(2A) 4. Any receipts which are of casual and non-recurring nature, to the extent mentioned below : (i) not exceeding rupees two thousand five hundred in respect of winning from races including horse races, (ii) rupees five thousand in any other case.Section 10(3) 5. Any payment made under the Bhopal Gas Leak Disaster (Processing of Claims) Act, 1985 or any scheme framed thereunder. Section 10(10BB) 6. Any scholarship granted to meet the cost of education.Section 10(16) 7. Any payment, whether in cash or kind, by way of any award instituted in public interest by the Central Government or any State Government or by any other body approved by the Central Government in this behalf. Section 10(17A) 8. Annual value of one palace occupied by a former ruler. Section 10(19A) 9. Income of a local authority under the heads ncome from House

Property, Capital Gains, ncome from other sources or income from supply of commodity or service within its jurisdiction or income from supply of water or electricity in its jurisdiction o r outside its jurisdiction.Section 10(20) 10. Any income of an authority constituted under a law for satisfying the housing need or for planning, development or improvement of cities, towns or villages. Section 10(20A) 11. Any income of an authority established in a state, whether kwon as Khadi and Village Industries Board or by any other name of the development of khadi and village industries in the state.Section 10(23BB) 12. Any income by way of property income and income from other sources of a registered trade union or an association or registered trade unions. Section 10(24) 13. Income in the form of interest on securities or the capital gains on transfer of the securities received by a person on behalf of a statutory provident fund or any income received on behalf of recognized provident fund, approved superannuation fund, approved gratuity fund etc. Section 10(25) 14. Income of Employees State Insurance Fund.Section 10(25A) 15. Any income of a corporation established by the Central Government or any State Government for promoting the interests of the members of a minority community. Section 10(26BB) B. The incomes enumerated below are exempt from tax subject to fulfillment of certain conditions 1. Any interest received by a non-resident from specified securities or bonds, and any income received as premium on redemption of such bonds. 2. Any interest received by an individual on moneys standing to his credit in Non-resident (External) Account maintained by him with any bank in India in accordance with the Foreign Exchange Regulation Act.Section 10(4)(i) 3. Any interest from notified Savings Certificates received by an Indian citizen or an individual of Indian origin, being a non -resident, provided that the certificates have been subscribed to in convertible foreign exchange remitted from outside India in accordance with the provisions of Foreign Exchange Regulation Act.Section 10(4B) 4. The value of leave travel concession provided to an individual and his family by an employer or a former employer in connection with his proceeding on leave to any place in India, or for proceeding to any place in India on retirement or termination of his services. Section 10(5) 5. Any tax paid by the employer of an individual, being a non-resident technician for a period of 48 months. Section 10(5B) 6. Any passage moneys or the value of concessional passage received by a foreign national from his employer for himself, spouse and children from proceeding outside India on leave or retirement.Section 10(6)(i) 7. Any remuneration received by a foreign diplomat or a member of his staff.Section 10(6)(ii) 8. Remuneration received by a foreign citizen as an employee of a foreign enterprise if his stay in India does not exceed 90 days. Section 10(6)(vi) 9. Any income by way of salary received by a non-resident foreign citizen as a member of ships crew provided his total stay in India in that previous year does not exceed 90 days. Section 10(6)(viii)

10 .Any remuneration received by a foreign national as an employee of a foreign government deputized in India for training in a government establishment or concern or a public sector undertaking. Section 10(6)(xi) 11. Any tax paid on behalf or a foreign company on income by way of Royalty or fees for technical services.Section 10(6A) 12 . Any tax paid on behalf of a non-resident or a foreign company by the Government or India concern on income under an approved agreement Section 10(6B) 13. Any tax payable on behalf of a foreign state or a foreign enterprise in respect of the dry lease of an aircraft under an approved agreement.Section10(6BB) 14. Income arising to specified foreign companies from services provided in or outside India in respect of projects connected with the security of India Section 10(6C) 15. Any allowance or perquisites granted by the Government of India to its employees rendering services outside India. Section 10(7) 16. Any sum received by an individual, who is assigned duties in India, fro m a foreign government by way of remuneration in connection with an y sponsored co-operative technical assistance program with government of a foreign state and income of family members of such employee accruing or arising outside India. Section 10(8) and Section10(9) 17. Any remuneration or fees, paid out of funds made available to an international organization, received by a non-resident/non-Indian citizen consultant or the remuneration paid by such a consultant to any individual. Section10(8A) 18. Any remuneration received by a consultant referred to in clause (8A) in connection with a technical assistance programme or project in accordance with the agreement between the Central Government and an agency, or the remuneration paid by the consultant to any individual. Section10(8B) 19. Any sum received as Death-cum-Retirement gratuity as prescribed. Section 10(10) 20. Any payment in commutation of pension subject to the limits specified. Section 10(10A) 21. Any payment as leave encashment in respect of earned leave paid to the retiring employees. Section 10(10AA) 22. Any amount received as retrenchment compensation by a workman under the Industrial Disputes Act. Section 10(10B) 23. Any amount by way of compensation received from a public sector company at the time of voluntary retirement, not exceeding rupees five lakhs. Section10(10C) 24. Any sum received on life insurance policy, not being a Key man insurance policy, including any sum received as bonus. Section 10(10D) 25. Any payment from provident fund. Section 10(11) 26. Accumulated balance in a recognized provident fund. Section 10(12) 27. Any payment from an approved superannuation fund. Section 10(13) 28. House rent allowance subject to certain limits. Section 10(13A) 29. Special allowance or benefit granted to an employee to meet expenses incurred wholly and exclusively in performance of the duty. Section 10(14) 30. Any income received by a public financial institution as exchange ri se premium in certain cases. Section 10(14A)

31. Any interest from or premium received on redemption of certain exempted securities. Section 10(15) 32. Any income by way of daily allowance or constituency allowance received as a Member of Parliament or State Legislature and any other allowance not exceeding Rs.600/- per month. Section 10(17) 33. Any income of an approved scientific research association. Section 10(21) 34. Any income of a notified news agency Section 10(22B) 35. Any income of an approved sports association Section 10(23) 36. Any income other than income from property or income received for rendering any specific service or income by way of interest or dividends of professional bodies approved by the Central Government. 37. Any income received by an person on behalf of any Regimental Fund or non-public fund established by the armed forces of the Union for the welfare of the past and present members of such forces or their dependents. Section 10(23AA) 38. Any income of a fund established for welfare of employees. Section 10(23AAA) 39. Any income of pension fund set up by LIC. Section 10(23AAB) 40. Any income of a public charitable trust or a registered society, approved by Khadi and Village Industries Commission, existing solely for the development of Khadi or Village Industries. 41. Any income of any body or authority established, constituted or appointed under any statue for the purpose of administration of public, religious or charitable trusts or endowments or societies for religious or charitable purpose. Section 10(23BBA) 42. Any income of the European Economic Community derived in India by way of interest, dividends or capital gains from specified investments. Section 10(23BBB) 43. Any income of SAARC Fund for Regional Projects, set up under the Colombo Declaration. Section 10(23BBC) 44. Any income received by any person on behalf of specified national funds and approved public charitable trust or institution, and any income of a university or an educational institution financed mainly by the Government or a hospital mainly financed by the Government, and existing not for profit. Section 10(23C) 45. Any income of a registered Mutual Fund or a fund set up by a public sector bank or a public financial institution. Section 10(23C) 46. Any income of a notified Exchange Risk Administration Fund. Section 10(23E) 47. Any income by way of dividends or long -term capital gains of a venture capital fund or a venture capital company from investment in a venture capital undertaking. Section 10(23F) 48. any income by way of dividend, interest or long-term capital gains of an infrastructure fund or an infrastructure company from investment in shares or long-term finance of an infrastructure facility. Section 10(23G) 49. Any income of a member of schedule tribe, residing in Nagaland, manipur, Tripura, Arunachal Prades, Mizoram and Ladakh from any source in those areas or income by way of dividends or interest on securities. Section 10(26) 50. Any income of a statutory Central or State corporation or a body or an institution, financed by the government formed for promoting the

interests of members of scheduled castes, scheduled tribes or other backward classes. 51. Any income of co-operative society formed for promoting interest of members of scheduled castes or scheduled tribes. (Section 10(27) 52. Any income of a marketing authority from letting of godowns or warehouses. Section 10(29) 53. Income by ay of subsidy from Tea Board for replanting or replacement of tea bushes or for the purpose of rejuvenation or consolidation of areas used for cultivation of tea in India. Section 10(30) 54. Income by way of subsidy received from the respective Board by the planters or rubber, coffee or cardamom. Section 10(31) 55. Income of a minor child, whose income is includible under Section 64(1A) in the income of the parent, upto Rs.1,500/ -. Section 10(32) 56. Any income by way of dividends distributed by an Indian company. Section 10(33) Section 10A : Any income of a newly established industrial undertaking in a free trade zone. Section 10(A) Section 10B : Any income f a newly established hundred percent export oriented undertaking. Section 10(B) 1. Any income derived from property held under a trust for charitable or religious purposes to the extent to which it is applied for such purposes in India. If such income is set apart or accumulated for such purposes, then if such income does not exceed 25% of the income from the property. Section 11(1)(a) 2. Any income derived from property held under a trust in part for charitable or religious purposes to the extent to which it is applied for such purposes in India., If such income is set apart or accumulated for such purposes, then if such income does not exceed 25% of the income from the property. The exemption is available if the trust was created before 1.4.1952. Section 11(1)(b) 3. Any income derived from property held under a trust for charitable purposes to the extent to which it is applied for such purposes outside India provided that it promotes international welfare in which India is interested. Section 11(1)(c) 4. Voluntary contributions received by a trust or an institution towards its corpus. Section 11(1)(d) 5. Voluntary contributions received by a trust created wholly for charitable or religious purposes will be deemed to be the income derived from property held for charitable or religious purposes. Thus, such contributions will be exempt as provided in Section11. Section 12 Section 13A : Income of a political party under the head ncome from House Propertyor ncome from other sourcesor any income from voluntary contributions. Section 13A

Income Exempt from Tax

All receipts which give rise to income are taxable unless they are specifically exempted from tax under the Act. Such exempted income are enumerated in section 10 of the Act. The same are summarised in the table below:Section Nature of Income Exemption limit, if any 1 2 3 10(1) Agricultural income 10(2) Share from income of HUF 10(2A) Share of profit from firm 10(3) Casual and non-recurring Winnings from races Rs.2500/receipts other receipts Rs.5000/10(10D) Receipts from life Insurance Policy 10(16) Scholarships to meet cost of education 10(17) Allowances of MP and MLA. For MLA not exceeding Rs. 600/- per month 10(17A) Awards and rewards (i) from awards by Central/State Government (ii) from approved awards by others (iii) Approved rewards from Central & State Governments 10(26) Income of Members of Only on income arising in those scheduled tribes residing in areas or interest on securities or certain areas in North Eastern dividends States or in the Ladakh region. 10(26A) Income of resident of Ladakh On income arising in Ladakh or outside India 10(30) (i) Subsidy from Tea Board under approved scheme of replantation 10(31) (ii) Subsidy from concerned Board under approved Scheme of replantation 10(32) Minor's income clubbed with Upto Rs. 1,500/individual 10(33) Dividend from Indian Companies, Income from units of Unit Trust of India and Mutual Funds, and income from Venture Capital Company/fund. 10(A) Profit of newly established undertaking in free trade zones electronic hardware technology park on software technology park for 10 years (net beyond 10 year from 2000-01) 10(B) Profit of 100% export oriented undertakings manufacturing articles or things or computer software for 10 years (not beyond 10 years from 200001) 10(C) Profit of newly established undertaking in I.I.D.C or I.G.C. in North-Eastern Region for 10 years Income from interest

10(15)(i)(iib)(iic)

10(15)(iv)(h)

10(15)(iv)(i)

10(15)(vi) 10(15)(vii) Income from Salary 10(5)

Interest, premium on To the extent mentioned in redemption or other paymentsnotification from notified securities, bonds, Capital investment bonds, Relief bonds etc. Income from interest payable by a Public Sector Company on notified bonds or debentures Interest payable by Government on deposits made by employees of Central or State Government or Public Sector Company of money due on retirement under a notified scheme Interest on notified Gold Deposit bonds Interest on notified bonds of local authorities Leave Travel assistance/ concession Not to exceed the amount payable by Central Government to its employees Exemption in respect of income in the from of tax paid by employer for a period upto 48 months

10(5B)

10(7)

10(8)

10(10)

10(10A)

10(10AA)

Remuneration of technicians having specialised knowledge and experience in specified fields (not resident in any of the four preceding financial years) whose services commence after 31.3.93 and tax on whose remuneration is paid by the employer Allowances and perquisites by the government to citizens of India for services abroad Remuneration from foreign governments for duties in India under Cooperative technical assistance programmes. Exemption is provided also in respect of any other income arising outside India provided tax on such income is payable to that Government. Death-cum-retirement Gratuity(i) from Government (ii) Under payment of Gratuity Amount as per Sub-sections (2), Act 1972 (3) and (4) of the Act. (iii) Any other Upto one-half months salary for each year of completed service. Commutation of Pension(i) from government, statutory Corporation etc. (ii) from other employers Where gratuity is payable value of 1/3 pension. Where gratuity is not payable - value of 1/2 pension. (iii) from fund set up by LIC u/s 10(23AAB) Encashment of unutilised

Upto an amount equal to 10 months salary or Rs. 1,35,360/which ever is less 10(10B) Retrenchment compensation Amount u/s. 25F(b) of Industrial Dispute Act 1947 or the amount notified by the government, whichever is less. 10(10C) Amount received on voluntary Amount as per the Scheme retirement or termination of subject to maximum of Rs. 5 service or voluntary separation lakh under the schemes prepared as per Rule 2BA from public sector companies, statutory authorities, local authorities, Indian Institute of Technology, specified institutes of management or under any scheme of a company or Cooperative Society 10(11) Payment under Provident Fund Act 1925 or other notified funds of Central Government 10(12) Payment under recognised To the extent provided in rule 8 provident funds of Part A of Fourth Schedule 10(13) Payment from approved Superannuation Fund 10(13A) House rent allowance least of(i) actual allowance (ii) actual rent in excess of 10% of salary (iii) 50% of salary in Mumbai, Chennai, Delhi and Calcutta and 40% in other places 10(14) Prescribed [See Rule 2BB (1)] To the extent such expenses are special allowances or benefits actually incurred. specifically granted to meet expenses wholly necessarily and exclusively incurred in the performance of duties 10(18) Pension including family pension of recipients of notified gallantry awards Exemptions to Non-citizens only 10(6)(i)(a) and (b) (i) passage money from employer for the employee and his family for home leave outside India (ii) Passage money for the employee and his family to 'Home country' after retirement/termination of service in India. 10(6)(ii) Remuneration of members of diplomatic missions in India and their staff, provided the members of staff are not engaged in any business or profession or another

earned leave (i) from Central or State government (ii) from other employers

employment in India. Remuneration of employee of foreign enterprise for services rendered during his stay in India in specified circumstances provided the stay does not exceed 90 days in that previous year. 10(6)(xi) Remuneration of foreign Government employee on training in certain establishments in India. Exemptions to Non-residents only Refer Chapter VII (Para 7.1.1) Chapter VIII (Para 8.4) Chapter IX Chapter X (Para 10.4) Exemptions to Non-resident Indians (NRIs) only Refer Chapter XI Exemptions to funds, institutions, etc. 10(14A) Public Financial Institution from exchange risk premium received from person borrowing in foreign currency if the amount of such premium is credited to a fund specified in section 10(23E) 10(15)(iii) Central Bank of Ceylon from interest on securities 10(15)(v) Securities held by Welfare Commissioners Bhopal Gas Victims, Bhopal from Interest on securities held in Reserve Bank's SGL Account No. SL/DH-048 10(20) any local Authority (a) Business income derived from Supply of water or electricity any where. Supply of other commodities or service within its own jurisdictional area. (b) Income from house property, other sources and capital gains. 10(20A) Housing or other Development authorities 10(21) Approved Scientific Research Association 10(23) Notified Sports Association/ Institution for control of cricket, hockey, football, tennis or other notified games. 10(23A) Notified professional All income except from house association/institution property, interest or dividends on investments and rendering of any specific services 10(23AA) Regimental fund or Non-public fund 10(23AAA) Fund for welfare of employees or their dependents. 10(6)(vi)

10(23AAB) 10(23B)

10(23BB) 10(23BBA)

10(23BBB)

10(23BBC) 10(23C)

10(23D) 10(23E) 10(23EA)

10(23FB)

10(23G)

10(24) 10(25)(i)

10(25)(ii) 10(25)(iii) 10(25)(iv) 10(25)(v) 10(25A) 10(26B)(26BB) and (27)

10(29) 10(29A)

Fund set up by LIC of India under a pension scheme Public charitable trusts or registered societies approved by Khadi or Village Industries commission Any authority for development of khadi or village industries Societies for administration of public, religious or charitable trusts or endowments or of registered religious or charitable Societies. European Economic Community from Income from interest, dividend or capital gains SAARC Fund Certain funds for relief, charitable and promotional purposes, certain educational or medical institutions Notified Mutual Funds Notified Exchange Risk Administration Funds Notified Investors Protection Funds set up by recognised Stock Exchanges Venture capital Fund/ company Income from invest ment in set up to raise funds for invest venture capital undertaking ment in venture Capital undertaking Infrastructure capital fund, or Income from dividend, interest infrastructure capital company and long term capital gains from investment in approved infrastructure enterprise Registered Trade Unions Income from house property and other sources Provident Funds Interest on securities and capital gains from transfer of such securities Recognised Provident Funds Approved Superannuation Funds Approved Gratuity Funds Deposit linked insurance funds Employees State Insurance Fund Corporation or any other body set up or financed by and government for welfare of scheduled caste/ scheduled tribes/backward classes or minorities communities Marketing authorities Income from letting of godown and warehouses Certain Boards such as coffee Board and others and specified Authorities

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- BUDGETING SUCKS Garrett Gunderson Dale ClarkeDocument136 pagesBUDGETING SUCKS Garrett Gunderson Dale ClarkeRich Diaz100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- FIDIC Model Services Agreement 5th Ed 2017Document48 pagesFIDIC Model Services Agreement 5th Ed 2017William StewardNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Alpha Omega College Cardiff ProspectusDocument15 pagesAlpha Omega College Cardiff ProspectusKaro López RendónNo ratings yet

- Philamlife vs. Auditor GeneralDocument2 pagesPhilamlife vs. Auditor GeneralCML100% (1)

- Securities and Exchange Commission and Insurance Commission College Assurance Plan Philippines (Cap) Bersamin, JDocument3 pagesSecurities and Exchange Commission and Insurance Commission College Assurance Plan Philippines (Cap) Bersamin, JGertrude ArquilloNo ratings yet

- Rural Marketing - InsuranceDocument106 pagesRural Marketing - InsurancesinghinkingNo ratings yet

- EXCHANGE Control Regulations, 1996 - Statutory Instrument 109 of 1996Document37 pagesEXCHANGE Control Regulations, 1996 - Statutory Instrument 109 of 1996Riana Theron MossNo ratings yet

- Different Types of Revival SchemesDocument2 pagesDifferent Types of Revival SchemesNavi KaushalNo ratings yet

- DraftDocument6 pagesDraftMauricio Montaño MelgarNo ratings yet

- Arogya Sanjeevani PremiumDocument16 pagesArogya Sanjeevani PremiumGiriMahaNo ratings yet

- Template Contract For ProcurementDocument9 pagesTemplate Contract For Procurementapi-338883409No ratings yet

- Marine P&I Primary Proposal FormDocument4 pagesMarine P&I Primary Proposal FormgrandeNo ratings yet

- Stock AuditDocument5 pagesStock AuditCA Santosh SrivastavaNo ratings yet

- REPORTDocument33 pagesREPORTshivamNo ratings yet

- An Introduction To RV InsuranceDocument2 pagesAn Introduction To RV InsuranceABINo ratings yet

- Skydive Consent Waiver PDFDocument2 pagesSkydive Consent Waiver PDFInsanPauziNo ratings yet

- Moodys Analytics Risk Perspective Risk Data ManagementDocument148 pagesMoodys Analytics Risk Perspective Risk Data ManagementMinh Phuc HuynhNo ratings yet

- Star Health StrategyDocument21 pagesStar Health StrategyadarshNo ratings yet

- Certificate of InsuranceDocument4 pagesCertificate of Insurancekurundwadesandy007No ratings yet

- Sem. - Vi ( 2019 Pattern)Document115 pagesSem. - Vi ( 2019 Pattern)Anil Arun JayshreeNo ratings yet

- 4-FF Cruz Vs CADocument6 pages4-FF Cruz Vs CAJoan Dela CruzNo ratings yet

- Internship ReportDocument54 pagesInternship ReportKeerat KhoranaNo ratings yet

- UI Story Card Exercise SolutionDocument20 pagesUI Story Card Exercise SolutionBhadang BoysNo ratings yet

- 110201181684-1 Authorization LetterDocument4 pages110201181684-1 Authorization LetterASHISH BANSALNo ratings yet

- Full FormDocument7 pagesFull FormRachit Dixit100% (1)

- PCE Tutorial (24jan2018) - 2 - 4362Document238 pagesPCE Tutorial (24jan2018) - 2 - 4362cn YmNo ratings yet

- 9252 - Insurance Law - R.A. No. 2427Document4 pages9252 - Insurance Law - R.A. No. 2427dahpne saquianNo ratings yet

- Climate Stress TestsDocument11 pagesClimate Stress TestsaasgroupNo ratings yet

- Pag-IBIG Fund Invites Offers to Purchase 500 PropertiesDocument41 pagesPag-IBIG Fund Invites Offers to Purchase 500 PropertiesBronsky MezgoNo ratings yet

- Financial statement summaryDocument3 pagesFinancial statement summaryAMIT SINGHNo ratings yet