Professional Documents

Culture Documents

Tax Notes

Uploaded by

Mianne ManguiatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Notes

Uploaded by

Mianne ManguiatCopyright:

Available Formats

A.

Concept and Nature: Estate tax is a tax on the right of the deceased person to transmit his estate to his lawful heirs and beneficiaries. It is not a tax on property. Estate tax is held to be an excise tax imposed on the privilege of transmitting property upon the death of the owner. The estate tax is generated by death and accrues at the time of death. It is governed by the law in force at the time of death notwithstanding the postponement of the actual possession or enjoyment of the estate by the beneficiary. B. Properties Includable In Gross Estate or Gross Gift: 1. Citizen or resident decedent or donor: a) Real or immovable property, wherever located. b) Personal property, tangible or intangible, wherever located.(PD1457, 6/11/78) 2. Non-resident alien: a) Real or immovable property located in the Philippines. b) Tangible personal property located in the Philippines. c) Intangible personal property with situs in the Philippines subject to rule of reciprocity exemption.

the

C. Properties Considered Situated in the Philippines: 1. Franchise which must be exercised in the Philippines. 2. Shares, obligations or bonds issued by corporation or sociedad anonima organized or constituted in the Philippines. 3. Shares, obligations or bonds issued by a foreign corporation eighty- five per centum of the business of, which is located in the Philippines. 4. Shares, obligations or bonds issued by a foreign corporation if such shares, obligations or bonds have acquired a business situs in the Philippines. 5. Shares or rights in any partnership, business or industry established in the Philippines. D. Composition of the Gross Estate: 1. Real and personal property, whether tangible or intangible or mixed. 2. Decedent's interest in property. 3. Proceeds of life insurance. 4. Taxable transfers. 5. Transfers for insufficient consideration. E. Proceeds of Life Insurance: 1. Includable in gross estate: a) Revocable beneficiary. b) Appointed beneficiary is the estate, executor or administrator. 2. Not includable in gross estate: a) Received from the GSIS and SSS. F. Taxable Transfers: 1. Transfer in contemplation of death (3-year presumption repealed by PD 1705, 8/1/80) 2. Transfer with retention or reservation of certain rights. 3. Revocable transfer. 4. Transfers of property under general power of appointment. a) Existence of general power of appointment held by the decedent. b) Exercise of such power by the decedent by will or by deed intended to take effect upon death. c) Passing of property by virtue of such death. 5. Transfers for insufficient consideration.

a) Covers only the excess of the fair market value over the value of the consideration. b) Transfer was made in contemplation of death, otherwise will be subject to donors's tax, G. Kinds of Property: 1. By Nature: a) Real or immovable property. b) Personal property, tangible or intangible. 2. By Ownership: a) Exclusive capital or paraphernal property. b) Conjugal or community property. H. Valuation of Gross Estate or Gift: 1. Valuation date - Time of death or gift. 2. Basis of valuation: a) Real properties (land) 1) Prior to August 31, 1969 - Comm. Act 466 2) September 1, 1969 to August 13, 1974 -R.A. 611 3) August 14, 1974 to November 24, 1976 - PD 539 4) November 25, 1976 to December 31, 1985 - PD 1054 5) January 1, 1986 - Present - PD 1994 b) Improvements 1) June 10, 1986 to February 4, 1988 - RAMO 3-86 2) February 5, 1988 to February 18, 1991 - RAMO 1-88 3) February 19, 1991 to 1994 - RAMO 2-91 4) 1994-FMV per TD (Latest TD) c) Shares of stocks, obligations or bonds - RAMO 1-82 d) Usufruct, annuities, use or habitation - Formula using American Tropical Experience Table. Beginning January 1, 1998, the valuation shall take into account the probable life of the beneficiary in accordance with the latest Basic Standard Mortality Table. e) Foreign currency and cash in bank - Peso value at exchange rate at the time of death. f) Other personal properties - Fair market value at the time of death. I. Personal Properties: 1. Shares of stocks, bonds and securities. 2. Interest in partnerships, business or industry. 3. Cash on hand and in banks. 4. Machineries, transportation equipments, farm implements, tools, farm animals, etc. 5. Antiques, jewelry, silverware, paintings, etchings, engravings, books, statues, vases, oriental rugs, collection of stamps and coins. 6. Household furnitures, fixtures, appliances and other personal effects. 7. Usufruct, annuities, use or habitation. 8. Mortgage notes, participation certificates, judgements, obligations and action which have for their object movables or demandable sums. 9. Goodwill, patents, and trademarks. J. Exclusions and Exemption from the Gross Estate: 1. Exempted under Special Laws and Exemptions by Omission: a) GSIS proceeds/benefits b) Accruals from SSS

c) Proceeds of life insurance where the beneficiary is irrevocably appointed. d) Proceeds of life insurance under a group insurance taken by the employer (Not taken out by the decedent upon his own life) e) WAR damage payments. f) USVA -RA 136. g) Properties held in trust by decedent. h) Transfer by way of bonafide sales. i) Transfer of property to the National Government or to any of its political subdivisions. j) Separate property of the surviving spouse. 2. Exempted under the Tax Code: a) Merger of usufruct in the owner of the naked title. b) Transmission or delivery of the inheritance or legacy by the fiduciary heir or legatee to the fideicommissary. c) Transmission from the first heir, legatee or donee in favor of another beneficiary in accordance with the desire of the predecessor. d) All bequests, devises, legacies or transfers to social welfare,cultural and charitable institutions, no part of the net income of which inures to the benefit of any individual, provided that not more than 30% of which shall be used for administration purposes (PD 507, 1974) K. Allowable Deductions: 1. Expenses, losses, indebtedness and taxes: a) Funeral expenses: 1) CA 466 (July 1, 1939) - 5% of gross estate 2) PD 69 (January 1, 1973) - 5% of gross estate but not exceeding P50,000.00 3) RA 7499 (July 28, 1992)- 5% of gross estate but not exceeding P100,000.00. 4) RA 8424 (January 1, 1998)- 5% of gross estate but not exceeding P200,000.00 b) Judicial expenses. c) Claims against the estate d) Claims against insolvent persons e) Unpaid mortgages or indebtedness f) Unpaid taxes g) Losses 2. Transfer for public purposes 3. Vanishing deduction (Property previously taxed) Requisites: a) Present decedent must have died within five (5) years from the date of death of prior decedent or date of gift. b) The property with respect to which deduction is claimed must have formed part of the gross estate situated in the Philippines of the prior decedent or taxable gift of the donor. c) The property must be identified as the same property received from the prior decedent or donor or the one received in exchange therefore. d) The estate taxes on the gift must have been finally determined and paid. e) No vanishing deduction on the property was allowed to the prior estate

PROCEDURE IN COMPUTING THE VANISHING DEDUCTION: a) Determine the initial value of the property previously taxed; Rule - Value of "Property previously Taxed" in computing the estate tax or donor's tax of the prior transfer or that of the present decedent's estate, whichever is lower. b) Deduct any mortgage or lien on the "Property Previously Taxed" paid by the present decedent prior to his death, where such mortgage or lien was a deduction from the gross estate of the prior decedent or gift of the donor. This is the "Initial Basis". c) The "Initial Basis" in Step (b) shall be further reduced by the following ratio of the expenses, losses, indebtedness, taxes or transfer for public purposes: Initial Basis ------------- X Gross estate

Expenses, losses, indebtedness taxes, transfer for public use

d) Compute the final basis of PPT: Initial Basis (Step (b) x x x Less: Limitation (Step (c ) x x x Final Basis (Amount subject to vanishing deduction) x x x e) Determine the year interval between the date of death of the prior and present decedent or date of gift and death of present decedent to find the applicable percentage deduction: 0 1 2 3 4 5 - 1 year - 100% - 2 " - 80% - 3 " - 60% - 4 " - 40% - 5 " - 20% over - 0%

The final basis (Step (d) multiplied by the percentage deduction (Step (e) will be the vanishing deduction allowable.

HYPOTHETICAL EXAMPLE OF COMPUTATION OF VANISHING DEDUCTION: "A" a Filipino, married and resident of the Philippines died on July 31, 1998 leaving the following properties: Conjugal properties ---------------------------------- P7,000,000.00 Conjugal family home--------------------------------- 3,000,000.00 Property valued for P4,000,000 was inherited from his father who died on June 30, 1997 together with a mortgage loan of P1,000,000 which was paid by "A" on April 30, 1998 ------------------- 5,000,000.00 Gross estate ------------------------------------- P15,000,000.00 Less: Deductions: Expenses, losses, indebtedness, taxes & transfer for public use ---------- P2,000,000

Share of surviving spouse: Conjugal properties ------ P10,000,000 Less: Conjugal deduction 2,000,000 Net conjugal estate ------ P 8,000,000 1/2 share of surviving spouse ------------ 4,000,000 Family home ----------------------------- 1,000,000 Vanishing deduction (80%) Inherited property -------- P 4,000,000 Less: Mortgage paid ------- 1,000,000 Initial basis [Step (b)]------ 3,000,000 Less:3,000,000 x P2,000,000 -- 400,000 15,000,000 Final basis [Step (d)] ------ P 2,600,000 80% Vanishing deduction [Step (e)] ----- 2,080,000 Total deductions ----------------------------------Net taxable estate -----------------------------------Computation of estate tax: P5,000,000 ---------------- P465,000 920,000 @ 15% -------138,000 Total estate tax due -------------------------------P 603,000 9,080,000 P5,920,000

ESTATE TAX RATES: (R.A. 8424) THE ESTATE TAX SHALL BE Exempt PLUS Below P200,000 5% P15,000 135,000 465,000 1,215,000 8% 11% 15% 20% P200,000 500,000 2,000,000 5,000,000 10,000,000 OF EXCESS OVER

4. Share of the surviving spouse in the net conjugal properties 5. Family Home - Amount allowable is equivalent to the current or fair market value or zonal value of the decedent's family home, whichever is higher, but not exceeding P1,000,000. a) Must not exceed the value included in the gross estate or P1,000,000, whichever is lower.

b) The amount in excess of P1,000,000 shall be subject to estate tax. c) Must be the decedent's family home as certified to by the Barangay Captain in the locality. d) Only one (1) family home may be claimed. 6. Standard Deduction of P1,000,000. 7. Medical Expenses incurred within one year from death in an amount not exceeding P500,000.00. 8. Amount Received by heirs under RA No. 4917. 9. Deductions allowable to a non-resident decedent who is not a citizen of the Philippines: a) A proportion of the expenses, losses, indebtedness and taxes: Formula: Phil. Gross Estate ------------------ X World Gross estate Expenses, losses indebtedness & taxes

b) Transfer for public purposes c) Vanishing deduction d) Share of surviving spouse - Depending on the property relationship of the husband and wife in the country where they are national. L. Tax Credit For Estate Taxes Paid To A Foreign Country: 1. The estate tax due shall be credited with the amount of estate tax imposed by a foreign country on property located in said foreign country and included in the decedent's gross estate in the Philippines. 2. Limitation on credit - The amount of credit for estate tax paid to a foreign country shall not exceed the proportion of the tax due in the Philippines which the decedent's net estate situated within such country bears to his entire net estate. 3. The total amount of credit shall not exceed the proportion of the tax here in the Philippines which the decedent's net estate situated outside the Philippines bears to his entire net estate. M. Reciprocity Provision On Transfer Tax Imposition: 1. The property involved is intangible personal property. 2. The decedent or donor at the time of death or donation was a citizen and resident of a foreign country. 3. That the foreign country did not impose a transfer tax of any character in respect of intangible personal property owned by a Filipino citizen not residing in said foreign country, or 4. The laws of the foreign country allow a similar exemption from transfer taxes or death taxes of every character or description in respect of intangible personal property owned by citizens of the Philippines not residing in that foreign country.

You might also like

- Guidelines On Estate and Donor 1Document4 pagesGuidelines On Estate and Donor 1indieNo ratings yet

- Guidelines On Estate and Donor's TaxDocument14 pagesGuidelines On Estate and Donor's Taxkatreena ysabelle89% (9)

- Estate Taxation Guide for Northern CPA ReviewDocument18 pagesEstate Taxation Guide for Northern CPA ReviewJane Oblena100% (1)

- ACAE 18 - Deduction From Gross EstateDocument4 pagesACAE 18 - Deduction From Gross Estatechen dalitNo ratings yet

- Module 1 Estate TaxationDocument7 pagesModule 1 Estate TaxationKirstein Hammet DionilaNo ratings yet

- TRANSFER TAXES - UpdatedDocument33 pagesTRANSFER TAXES - UpdatedBogs QuitainNo ratings yet

- ESTATE TAX SUMMARYDocument35 pagesESTATE TAX SUMMARYRhea Mae Sa-onoyNo ratings yet

- Estate Tax: Sec. 84 To Sec. 97 National Internal Revenue CodeDocument29 pagesEstate Tax: Sec. 84 To Sec. 97 National Internal Revenue CodeJoie Tarroza-LabuguenNo ratings yet

- Estate Tax Chapter SummaryDocument4 pagesEstate Tax Chapter SummaryPJ PoliranNo ratings yet

- Transfer Taxation: Estate Taxation: CDD In-House CPA Review Rex B. Banggawan, CPA, MBA TaxationDocument14 pagesTransfer Taxation: Estate Taxation: CDD In-House CPA Review Rex B. Banggawan, CPA, MBA TaxationAnonymous l13WpzNo ratings yet

- Deductions From Gross EstateDocument34 pagesDeductions From Gross Estatesmosaldana.cvtNo ratings yet

- 602Document2 pages602Raynamae SalayaNo ratings yet

- Booklet 1 Introduction To Transfer Tax - Estate TaxDocument51 pagesBooklet 1 Introduction To Transfer Tax - Estate Taxsunkist0091No ratings yet

- Estate Tax Rates GuideDocument3 pagesEstate Tax Rates GuideBudigoy IbarraNo ratings yet

- Exemptions and Exclusions TaxDocument5 pagesExemptions and Exclusions TaxJade RogieNo ratings yet

- Chapter 2 - Deductions From The Gross EstateDocument9 pagesChapter 2 - Deductions From The Gross EstateElla Marie WicoNo ratings yet

- HEHEDocument22 pagesHEHEKenNo ratings yet

- Estate Tax Gross Estate GuideDocument6 pagesEstate Tax Gross Estate GuideCharry Ramos67% (3)

- TX12 - Estate TaxDocument14 pagesTX12 - Estate TaxPatrick Kyle AgraviadorNo ratings yet

- Estate Tax GuideDocument12 pagesEstate Tax GuideEspregante RoselleNo ratings yet

- Estate and Donor's TaxDocument6 pagesEstate and Donor's TaxKimberly SendinNo ratings yet

- Deductions From The Gross EstateDocument14 pagesDeductions From The Gross Estatejungoos100% (1)

- Cpa Reviewer in TaxationDocument34 pagesCpa Reviewer in TaxationMika MolinaNo ratings yet

- Estate Tax Explained: Rates, Deductions, Filing RequirementsDocument13 pagesEstate Tax Explained: Rates, Deductions, Filing RequirementsJeriane Carissa DigaNo ratings yet

- Tax q2 ReviewerDocument3 pagesTax q2 ReviewerDanika S. SantosNo ratings yet

- Estate TaxDocument19 pagesEstate TaxJay RamirezNo ratings yet

- Gross Estate Tax QuizzerDocument6 pagesGross Estate Tax QuizzerLloyd Sonica100% (1)

- Estate Tax - Review QuestionnaireDocument17 pagesEstate Tax - Review QuestionnaireCleah WaskinNo ratings yet

- Estate TaxDocument47 pagesEstate TaxCarmela Jimenez50% (2)

- Deductions: Philippines Gross Estate World Gross Estate Deductible LITDocument3 pagesDeductions: Philippines Gross Estate World Gross Estate Deductible LITMaria LopezNo ratings yet

- Estate Tax DeductionsDocument10 pagesEstate Tax DeductionsKwinie Corpuz0% (1)

- Nature of Estate and Donor's TaxDocument18 pagesNature of Estate and Donor's TaxSheila Mae Hoybia Urgel100% (2)

- Transfer Taxes Explained: Estate Tax, Donor's Tax, and MoreDocument101 pagesTransfer Taxes Explained: Estate Tax, Donor's Tax, and MoreAngelo IvanNo ratings yet

- Estate TaxDocument5 pagesEstate TaxToki BatumbakalNo ratings yet

- Notes in Estate TaxDocument32 pagesNotes in Estate TaxAngelyn SamandeNo ratings yet

- Tax 2 4Document9 pagesTax 2 4amlecdeyojNo ratings yet

- Vanishing Deductions From The Grss EstateDocument7 pagesVanishing Deductions From The Grss EstateSenianna HaleNo ratings yet

- Procedure in Computing Vanishing DeductionDocument5 pagesProcedure in Computing Vanishing DeductionDon Tiansay100% (5)

- 7 Estate TaxDocument69 pages7 Estate TaxClaire diane CraveNo ratings yet

- Tax Reviewer - Transfer TaxesDocument21 pagesTax Reviewer - Transfer TaxesFrances Lipnica Pabilane100% (2)

- Estate Tax and Donor's Tax (Discussion Type - Article)Document14 pagesEstate Tax and Donor's Tax (Discussion Type - Article)Michelle Escudero FilartNo ratings yet

- Shall File A Return Under OathDocument17 pagesShall File A Return Under OathMixx MineNo ratings yet

- Estate Tax Post Quiz Answer KeyDocument8 pagesEstate Tax Post Quiz Answer KeyMichael AquinoNo ratings yet

- ReviewerDocument2 pagesReviewerJesse MoranteNo ratings yet

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDocument6 pagesEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandeNo ratings yet

- A Business Other Transfer TaxesDocument37 pagesA Business Other Transfer TaxesShielle AzonNo ratings yet

- BusTax - Chapter 3 MODULEDocument8 pagesBusTax - Chapter 3 MODULETimon CarandangNo ratings yet

- Gross-Estate-Lecture-January-7-2020 2Document12 pagesGross-Estate-Lecture-January-7-2020 2jonahNo ratings yet

- Group 1 Bus - TaxDocument69 pagesGroup 1 Bus - TaxJemar MarquezNo ratings yet

- Estate Tax Guide for Citizens and Non-ResidentsDocument22 pagesEstate Tax Guide for Citizens and Non-ResidentsAmy Olaes DulnuanNo ratings yet

- Tax Estate TaxDocument13 pagesTax Estate TaxAlbert Baclea-an100% (1)

- Estate Tax: Difference With Income Tax (Ter)Document7 pagesEstate Tax: Difference With Income Tax (Ter)Equi TinNo ratings yet

- Estate & Donors TaxDocument31 pagesEstate & Donors TaxMea De San AndresNo ratings yet

- Tax SummaryDocument15 pagesTax SummaryCassiopeia Cashmere GodheidNo ratings yet

- Revenue Regulations No. 2-2003Document22 pagesRevenue Regulations No. 2-2003Kiko RoxasNo ratings yet

- 603Document2 pages603Raynamae SalayaNo ratings yet

- Estate and Donor's Tax RatesDocument15 pagesEstate and Donor's Tax Ratesmiss independentNo ratings yet

- The Treasure Hunter's Guide To INDIANA'S LOST & BURIED TREASURES, Volume I: THE Treasure Hunter's Field Guide to GHOST TOWNS & HISTORIC SITES, PLACER GOLD & DIAMONDSFrom EverandThe Treasure Hunter's Guide To INDIANA'S LOST & BURIED TREASURES, Volume I: THE Treasure Hunter's Field Guide to GHOST TOWNS & HISTORIC SITES, PLACER GOLD & DIAMONDSNo ratings yet

- Sectors Contributing To India's GDPDocument5 pagesSectors Contributing To India's GDPachala24_shahNo ratings yet

- Oracle Concepts and Architecture Database StructuresDocument102 pagesOracle Concepts and Architecture Database StructuresPallavi KirtaneNo ratings yet

- Financial Management in Public Service Delivery in Zambia A Brief Literature ReviewDocument4 pagesFinancial Management in Public Service Delivery in Zambia A Brief Literature ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Module 4 - Housekeeping (Occupational Safety)Document20 pagesModule 4 - Housekeeping (Occupational Safety)Sam100% (1)

- Drama Club Funding RequestDocument6 pagesDrama Club Funding RequestkesiaoprandiNo ratings yet

- Social Entrepreneurship 101: Online Course SyllabusDocument7 pagesSocial Entrepreneurship 101: Online Course SyllabusWilliam PoonNo ratings yet

- Resume FinalDocument2 pagesResume Finalapi-507705451No ratings yet

- 90 Maraguinot V NLRCDocument4 pages90 Maraguinot V NLRCfullgrinNo ratings yet

- Job Safety Analysis - N2 PurgingDocument3 pagesJob Safety Analysis - N2 Purgingbenjamin alingNo ratings yet

- Partnership Formation and Capital AccountsDocument13 pagesPartnership Formation and Capital AccountsKristine BlancaNo ratings yet

- 01 - EN - Why Invest in Tribe - Accor Global Development - FEB2020Document66 pages01 - EN - Why Invest in Tribe - Accor Global Development - FEB2020Ivan DidiNo ratings yet

- Transfer of Service Connection 2Document2 pagesTransfer of Service Connection 2Ramachandran MeledathNo ratings yet

- Financial Regulation PGXgeOhDocument384 pagesFinancial Regulation PGXgeOhlibardobenavidesNo ratings yet

- Patent filing status updateDocument4 pagesPatent filing status updateaccount infoNo ratings yet

- Revised Corporation Code (RA No. 11232) - Title V - BylawsDocument3 pagesRevised Corporation Code (RA No. 11232) - Title V - Bylawsshella vienNo ratings yet

- Bull Final Q223Document99 pagesBull Final Q223Elijah CherubNo ratings yet

- M. Carole Jordal, RNFA Honored As A Professional of The Year For 2020 by Strathmore's Who's Who Worldwide PublicationDocument2 pagesM. Carole Jordal, RNFA Honored As A Professional of The Year For 2020 by Strathmore's Who's Who Worldwide PublicationPR.comNo ratings yet

- FlipHTML5, A Fantastic Tool For Converting PDF To Flipbook For FreeDocument2 pagesFlipHTML5, A Fantastic Tool For Converting PDF To Flipbook For FreeHasan TareqNo ratings yet

- IFR Magazine - Issue 2413 11 December 2021Document84 pagesIFR Magazine - Issue 2413 11 December 2021Gabriel Ho Kwan LeeNo ratings yet

- Wholesale FBA Proposal TemplateDocument5 pagesWholesale FBA Proposal Templateneeraj punjwaniNo ratings yet

- NPV & IRR TemplateDocument7 pagesNPV & IRR TemplateDimas AriotejoNo ratings yet

- Custom PDFDocument99 pagesCustom PDFrohit singhNo ratings yet

- Johannesburg Society of Advocates V Edeling 2019 (Document8 pagesJohannesburg Society of Advocates V Edeling 2019 (remo modumaelaNo ratings yet

- Optimize supply chain efficiency with an MSc in SCMDocument2 pagesOptimize supply chain efficiency with an MSc in SCMAbhishek Ajay DeshpandeNo ratings yet

- Engineering Economy and AccountingDocument2 pagesEngineering Economy and Accountingrjay.malonzo.mNo ratings yet

- Federal Court Rules Employees Entitled to Priority Creditor StatusDocument82 pagesFederal Court Rules Employees Entitled to Priority Creditor StatusmacgrelaNo ratings yet

- NICEHoldingsInvestorsRelations 2020 3Q ENGDocument31 pagesNICEHoldingsInvestorsRelations 2020 3Q ENGSimonasNo ratings yet

- Service Quality, Customer Satisfaction and Loyalty in An Internet Service ProvidersDocument13 pagesService Quality, Customer Satisfaction and Loyalty in An Internet Service ProvidersJhunry TañolaNo ratings yet

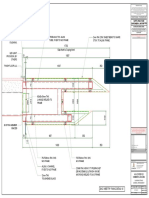

- Axis-Copper Pod-Connection Details-26.06.23Document1 pageAxis-Copper Pod-Connection Details-26.06.23Tamanna ShenoyNo ratings yet

- BABOR Phytoactive Combination in The Official BABOR Online Shop BABOR SkincareDocument1 pageBABOR Phytoactive Combination in The Official BABOR Online Shop BABOR SkincareDexterite Makeup ArtistNo ratings yet