Professional Documents

Culture Documents

Sikkim Manipal University 4 Semester Spring 2011

Uploaded by

Alaji Bah CireOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sikkim Manipal University 4 Semester Spring 2011

Uploaded by

Alaji Bah CireCopyright:

Available Formats

Sikkim Manipal University 4th Semester Spring 2011

Name

: Alaji Mamadou Cire BAH

Roll No.

: 540910685

Subject : International Business Management Subject Code : MB0037

Program

: MBA Semester 4

University University

Sikkim Manipal

Learning Centre : KnowledgeWorkz Limited (02544)

1

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

MBA SEMESTER 4 INTERNATIONAL BUSINESS MANAGEMENTMB0037 SET - 2

1. What is WTO? What is GATT? Explain both. Answer: What is WTO? The World Trade Organization (WTO) is an organization that intends to supervise and liberalize international trade. The organization officially commenced on January 1, 1995 under the Marrakech Agreement replacing the General Agreement on Tariffs and Trade (GATT), which commenced in 1948. The organization deals with regulation of trade between participating countries; it provides a framework for negotiating and formalizing trade agreements, and a dispute resolution process aimed at enforcing participants' adherence to WTO agreements which are signed by representatives of member governments and ratified by their parliaments. Most of the issues that the WTO focuses on derive from previous trade negotiations, especially from the Uruguay Round (1986 1994). The organization is currently endeavoring to persist with a trade negotiation called the Doha Development Agenda (or Doha Round), which was launched in 2001 to enhance equitable participation of poorer countries which represent a majority of the world's population. However, the negotiation has been dogged by "disagreement between exporters of agricultural bulk commodities and countries with large numbers of subsistence farmers on the precise terms of a 'special safeguard measure' to protect farmers from surges in imports. At this time, the future of the Doha Round is uncertain." The WTO has 153 members, representing more than 97% of the world's population, and 30 observers, most seeking membership. The WTO is governed by a ministerial conference, meeting every two years; a general council, which implements the conference's policy decisions and is responsible for day-to-day

2

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

administration; and a director-general, who is appointed by the ministerial conference. The WTO's headquarters is at the Centre William Rappard Geneva Switzerland. A Brief History of GATT The WTOs Predecessor, The GATT, Was Established on a Provisional Basis after the Second World War in the wake of other new multilateral institutions dedicated to international economic cooperation notably the "Britton Woods" institutions now known as the World Bank and the International Monetary Fund. The original 23 GATT countries were among over 50 which agreed a draft Charter for an International Trade Organization (ITO) a new specialized agency of the United Nations. The Charter was intended to provide not only world trade disciplines but also contained rules relating to employment, commodity agreements, restrictive business practices, international investment and services. In an effort to give an early boost to trade liberalization after the Second World War and to begin to correct the large overhang of protectionist measures which remained in place from the early 1930s-tariff negotiations were opened among the 23 founding GATT "contracting parties" in 1946. This first round of negotiations resulted in 45,000 tariff concessions affecting $10 billion or about one-fifth of world trade. It was also agreed that the value of these concessions should be protected by early and largely "provisional" acceptance of some of the trade rules in the draft ITO Charter. The tariff concessions and rules together became known as the General Agreement on Tariffs and Trade and entered into force in January 1948. Although the ITO Charter was finally agreed at a UN Conference on Trade and Employment in Havana in March 1948, ratification in national legislatures proved impossible in some cases. When the United States government announced, in 1950, that it would not seek Congressional ratification of the Havana Charter, the ITO was effectively dead. Despite its provisional nature,

3

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

the GATT remained the only multilateral instrument governing international trade from 1948 until the establishment of the WTO. Although, in its 47 years, the basic legal text of the GATT remained much as it was in 1948, there were additions in the form of "plural-lateral voluntary membership agreements and continual efforts to reduce tariffs. Much of this was achieved through a series of "trade rounds". 2. What is MNCs? Explain the 3 stages of evolution. Answer: MNCs: or multinational corporations are businesses that operate in more than one country. Usually these companies have a center of operations or some head office in one country, with sub-offices and/or other facilities located in other countries. These facilities may be connected to the head office or parent company through a merger or as some form of subsidiary company. Multinational Corporations are large companies that can do business locally and internationally. Most multinational corporations operating today come from the US, Japan, and Western Europe. Popular brands we know today are products of multinational corporations. These brands include Coca-Cola the best known softdrink brand in many countries, Nike known worldwide for quality shoes and apparel, Honda car and motorcycle maker from Japan, and many others. Multinational corporations penetrate new markets or countries through business mergers or acquisitions, sequential market entry, and/or joint ventures with other smaller businesses. Coming in as a foreign investment, MNCs capitalize on their size and resources to take over companies in a new country. With tightening competition, many MNCs are in the lookout for companies to acquire or merge with, not only to boost sales but also to gain market share from other industry players. Sequential Market Entry is also one option for MNCs to gain presence in a new market. In this way, one MNC may opt to start small and invest in one product at a time. Little by little, the product line will be increased

4

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

to boost presence in the area. MNCs also do joint ventures with existing players in a particular country. In this way, the venture partner may retain some autonomy from the parent MNC while enjoying the benefits of technology and/or expertise transfer. Many agree that the entry of multinational corporations can greatly help the economy of a particular country. But skeptics also believe that MNCs are selfish and are only concerned of their business bottom line. They are seen as too large and too powerful as many of them have some sort of influence over governments, which will lead to exploitation especially to developing economies. Three Stages of Evolution: a. Export stage: initial inquiries=firms rely on export agents expansion of export sales further expansion=foreign sales branch or assembly operations (to save transport cost) b. Foreign Production Stage There is a limit to foreign sales (tariffs, NTBs) DFI versus Licensing Once the firm chooses foreign production as a method of delivering goods to foreign markets, it must decide whether to establish a foreign production subsidiary or license the technology to a foreign firm. Licensing Licensing is usually first experience (because it is easy) e.g.: Kentucky Fried Chicken in the U.K.

5

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

it does not require any capital expenditure it is not risky payment = a fixed % of sales Problem: the mother firm cannot exercise any managerial control over the licensee (it is independent) The licensee may transfer industrial secrets to another independent firm, thereby creating a rival. Direct Investment: It requires the decision of top management because it is a critical step. It is risky (lack of information) (US firms tend to establish subsidiaries in Canada first. Singer Manufacturing Company established its foreign plants in Scotland and Australia in the 1850s) plants are established in several countries Licensing is switched from independent producers to its subsidiaries. export continues c. Multinational Stage The company becomes a multinational enterprise when it begins to plan, organize and coordinate production, marketing, R&D, financing, and staffing. For each of these operations, the firm must find the best location. 3. Mention the differences between currency markets and exchange rate markets in the context of international business environment. Answer: The exchange rate regimes adopted by countries in todays international monetary and financial system, and the system itself, are profoundly different from those envisaged at the 1944 meeting at Bretton Woods establishing the IMF and the World Bank. In the Bretton Woods system:

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

exchange rates were fixed but adjustable. This system aimed both to avoid the undue volatility thought to characterize floating exchange rates and to prevent competitive depreciations, while permitting enough flexibility to adjust to fundamental disequilibrium under international supervision; private capital flows were expected to play only a limited role in financing payments imbalances, and widespread use of controls would prevent instability in such flows; temporary official financing of payments imbalances, mainly through the IMF, would smooth the adjustment process and avoid unduly sharp correction of current account imbalances, with their repercussions on trade flows, output, and employment. In the current system, exchange rates among the major currencies (principally the U.S. dollar, the euro, and Japanese yen) fluctuate in response to market forces, with short-run volatility and occasional large medium-run swings (Figure 1). Some medium-sized industrial countries also have market determined floating rate regimes, while others have adopted harder pegs, including some European countries outside the euro area. Developing and transition economies have a wide variety of exchange rate arrangements, with a tendency for many but by no means all countries to move toward increased exchange rate flexibility. This variety of exchange rate regimes exists in an environment with the following characteristics: partly for efficiency reasons, and also because of the limited effectiveness of capital controls, industrial countries have generally abandoned such controls and emerging market economies have gradually moved away from them. The growth of international capital flows and globalization of financial markets has also been spurred by the revolution in telecommunications and information technology, which has dramatically lowered transaction costs in financial markets and further promoted the liberalization and deregulation of international financial transactions;

7

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

international private capital flows finance substantial current account imbalances, but the changes in these flows appear also sometimes to be a cause of macroeconomic disturbances or an important channel through which they are transmitted to the international system; Developing and transition countries have been increasingly drawn into the integrating world economy, in terms of both their trade in goods and services and of financial transactions. Lessons from the recent crises in emerging markets are that for such countries with important linkages to global capital markets, the requirements for sustaining pegged exchange rate regimes have become more demanding as a result of the increased mobility of capital. Therefore, regimes that allow substantial exchange rate flexibility are probably desirable unless the exchange rate is firmly fixed through a currency board, unification with another currency, or the adoption of another currency as the domestic currency (dollarization). Flexible exchange rates among the major industrial country currencies seem likely to remain a key feature of the system. The launch of the euro in January 1999 marked a new phase in the evolution of the system, but the European Central Bank has a clear mandate to focus monetary policy on the domestic objective of price stability rather than on the exchange rate. Many mediumsized industrial countries, and developing and transition economies, in an environment of increasing capital market integration, may also continue to maintain market-determined floating rates, although more countries could may adopt harder pegs over the longer term. Thus, prospects are that: exchange rates among the euro, the yen, and the dollar are likely to continue to exhibit volatility, and schemes to reduce volatility are neither likely to be adopted, nor to be desirable as they prevent monetary policy from being devoted consistently to domestic stabilization objectives; several of the transition countries of central and eastern Europe, especially those preparing for membership in the European Union, are likely to seek to establish over time the policy disciplines and institutional structures required to make possible the eventual adoption of the euro.

8

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

The approach taken by the IMF continues to be to advise member countries on the implications of adopting different exchange rate regimes, to consider the choice of regime to be a matter for each country to decide and to provide policy advice that is consistent with the maintenance of the chosen regime.

4.

a. Explain the role of privatization in international business. b. Mention the relevance of these international commercial terms: FCA, EXW,DES, CIF and DDP Answer: a. Role of privatization in international business Economists generally agreed on the need for speed in carrying out liberalization and stabilization. But on privatization of large enterprises, there was a debate on whether to have a rapid transfer of assets from the state to the private sector or to adopt a more gradual approach. Advocates of rapid privatization called for eliminating state ownership by giving assets to citizens, for instance, through vouchers that gave their holders the right and means to purchase state-owned companies on sale. They were motivated by considerations of fairness, a desire to give ordinary citizens a stake in the economy. They also perceived a need to seize the window of opportunity that had opened for privatization before the state bureaucracies regrouped and resisted the process. Others advocated a more gradual scaling back of state enterprises as new private sector firms emerged in the economy. They were in favour of the privatization of enterprises through the sale of assets to those likely to work on improving the performance of the companies. They also stressed the imposition of hard budget constraints on enterprises so that chronic loss makers would be forced out, leaving the more profitable enterprises to attract investors. Hungary followed this gradualist approach to privatization, and it appears to have proved more conducive to genuine restructuring of enterprises.

9

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

By contrast, experience has shown some of the pitfalls of the rapid privatization approach. In the Czech Republic, for instance, the assets transferred to millions of ordinary citizens in the first phase of rapid privatization were sold by the recipients and ended up being consolidated in investment funds. But there was no genuine restructuring of enterprises, either because the investment funds lacked the capital to develop them or because the funds were in turn controlled by state-owned banks that did not impose hard budget constraints. The weak growth performance of the Czech Republic in the late-1990s, relative to other CEE countries, is attributed in part to its weak enterprise reforms. Rapid privatization fared even worse in Russia. The countrys mass privatization programme of 1992-94 transferred ownership of over 15,000 firms into private hands. However, contrary to expectations, insider privatization did not lead to self-induced restructuring of firms. It was hoped that secondary trading would introduce outside ownership, and that transparent methods would be used in the second wave of privatization of remaining firms still in state hands. Neither hope was fulfilled. Insiders were wary of relinquishing control; workers feared the cost-cutting that might occur under outside control, and managers found it easier to keep enterprises alive by lobbying the state for subsidies than to foster competitive performance through involvement of outsiders.The second wave of privatization, in particular the so-called "loansfor-shares" scheme, was non-transparent and systematically excluded foreign investors and banks in favour of parties with ties to government interests. Overall, the experience of the transition economies suggests that privatized firms tend to restructure more quickly and perform better than comparable firms that remain in state ownership, but only if complementary conditions are met. These conditions include the presence of hard budget constraints and competition, effective standards of corporate governance, and an effective legal structure and property rights. In contrast to the mixed experience on privatization of large enterprises, the privatization of small scale enterprises has been generally successful and has been completed in all but five countries.

10

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

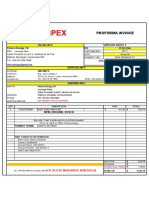

b. FCA {+ the named point of departure} Free Carrier The delivery of goods on truck, rail car or container at the specified point (depot) of departure, which is usually the sellers premises, or a named railroad station or a named cargo terminal or into the custody of the carrier, at sellers expense. The point (depot) at origin may or may not be a customs clearance centre. Buyer is responsible for the main carriage/freight, cargo insurance and other costs and risks. EXW {+ the named place} Ex Works Ex means from. Works means factory, mill or warehouse, which are the sellers premises. EXW applies to goods available only at the sellers premises. Buyer is responsible for loading the goods on truck or container at the sellers premises, and for the subsequent costs and risks. In practice, it is not uncommon that the seller loads the goods on truck or container at the sellers premises without charging loading fee. In the quotation, indicate the named place (sellers premises) after the acronym EXW, for example EXW Kobe and EXW San Antonio. The term EXW is commonly used between the manufacturer (seller) and export-trader (buyer), and the export-trader resells on other trade terms to the foreign buyers. Some manufacturers may use the term Ex Factory, which means the same as Ex Works. DES {+ the named port of destination} Delivered Ex Ship

11

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

The delivery of goods on board the vessel is at the named port of destination (discharge) at sellers expense. Buyer assumes the unloading fee, import customs clearance, payment of customs duties and taxes, cargo insurance, and other costs and risks. In the export quotation, indicate the port of destination (discharge) after the acronym DES, for example DES Helsinki and DES Stockholm. CIF {+ the named port of destination} Cost, Insurance and Freight The cargo insurance and delivery of goods is to the named port of destination (discharge) at the sellers expense. Buyer is responsible for the import customs clearance and other costs and risks. In the export quotation, indicate the port of destination (discharge) after the acronym CIF, for example CIF Pusan and CIF Singapore. Under the rules of the INCOTERMS 1990, the term CIF is used for ocean freight only. However, in practice, many importers and exporters still use the term CIF in the air freight. DDP {+ the named point of destination} Delivered Duty Paid The seller is responsible for most of the expenses, which include the cargo insurance, import customs clearance, and payment of customs duties and taxes at the buyers end, and the delivery of goods to the final point at destination, which is often the project site or buyers premises. The seller may opt not to insure the goods at his/her own risks. In the export quotation, indicate the point of destination (discharge) after the acronym DDP, for example DDP Bujumbura and DDP Mbabane.

12

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

5. Give short notes on Letter of credit and Bill of Lading Answer: Letter of Credit A letter of credit is a document issued mostly by a financial institution which usually provides an irrevocable payment undertaking (it can also be revocable, confirmed, unconfirmed, transferable or others e.g. back to back: revolving but is most commonly irrevocable/confirmed) to a beneficiary against complying documents as stated in the credit. Letter of Credit is abbreviated as an LC or L/C, and often is referred to as a documentary credit, abbreviated as DC or D/C, documentary letter of credit, or simply as credit (as in the UCP 500 and UCP 600). Once the beneficiary or a presenting bank acting on its behalf, makes a presentation to the issuing bank or confirming bank, if any, within the expiry date of the LC, comprising documents complying with the terms and conditions of the LC, the applicable UCP and international standard banking practice, the issuing bank or confirming bank, if any, is obliged to honour irrespective of any instructions from the applicant to the contrary. In other words, the obligation to honour (usually payment) is shifted from the applicant to the issuing bank or confirming bank, if any. Non-banks can also issue letters of credit however parties must balance potential risks. Letters of credit accomplish their purpose by substituting the credit of the bank for that of the customer, for the purpose of facilitating trade. There are basically two types: commercial and standby. The commercial letter of credit is the primary payment mechanism for a transaction, whereas the standby letter of credit is a secondary payment mechanism. Bill of Lading: A Bill of Lading is a type of document that is used to acknowledge the receipt of a shipment of goods and is an essential document in transporting goods overland to the exporters international carrier. A through Bill of Lading involves the use of at least two different modes of transport from road, rail, air and sea. The term derives from the noun "bill", a schedule of costs for services

13

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

supplied or to be supplied, and from the verb "to lade" which means to load a cargo onto a ship or other form of transport. In addition to acknowledging the receipt of goods, a Bill of Lading indicates the particular vessel on which the goods have been placed, their intended destination, and the terms for transporting the shipment to its final destination. Inland, ocean, through, and airway bill are the names given to bills of lading. 6. Discuss the entry methods in international business with relevant examples. Answer: Trade is increasingly global in scope today. There are several reasons for this. One significant reason is technological because of improved transportation and communication opportunities today, trade is now more practical. Thus, consumers and businesses now have access to the very best products from many different countries. Increasingly rapid technology lifecycles also increases the competition among countries as to who can produce the newest in technology. In part to accommodate these realities, countries in the last several decades have taken increasing steps to promote global trade through agreements such as the General Treaty on Trade and Tariffs, and trade organizations such as the World Trade Organization (WTO), North American Free Trade Agreement (NAFTA), and the European Union (EU). Stages in the International Involvement of a Firm We discussed several stages through which a firm may go as it becomes increasingly involved across borders. A purely domestic firm focuses only on its home market, has no current ambitions of expanding abroad, and does not perceive any significant competitive threat from abroad. Such a firm may eventually get some orders from abroad, which are seen either as an irritation (for small orders, there may be a great deal of effort and cost involved in obtaining relatively modest revenue) or as "icing on the cake." As the firm begins to export more, it enters the export stage, where little effort is made to market the product abroad, although an increasing number of foreign orders are filled. In the international stage, as certain country markets begin to appear

14

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

especially attractive with more foreign orders originating there, the firm may go into countries on an ad hoc basis that is, each country may be entered sequentially, but with relatively little learning and marketing efforts being shared across countries. In the multi-national stage, some efficiency is pursued by standardizing across a region (e.g., Central America, West Africa, or Northern Europe). Finally, in the global stage, the focus centres on the entire World market, with decisions made optimize the products position across markets the home country is no longer the centre of the product. An example of a truly global company is Coca Cola. Note that these stages represent points on a continuum from a purely domestic orientation to a truly global one; companies may fall in between these discrete stages, and different parts of the firm may have characteristics of various stages for example, the pickup truck division of an auto-manufacturer may be largely domestically focused, while the passenger car division is globally focused. Although a global focus is generally appropriate for most large firms, note that it may not be ideal for all companies to pursue the global stage. For example, manufacturers of ice cubes may do well as domestic, or even locally centred, firms. Methods of entry With rare exceptions, products just dont emerge in foreign markets overnight a firm has to build up a market over time. Several strategies, which differ in aggressiveness, risk, and the amount of control that the firm is able to maintain, are available: Exporting is a relatively low risk strategy in which few investments are made in the new country. A drawback is that, because the firm makes few if any marketing investments in the new country, market share may be below potential. Further, the firm, by not operating in the country, learns less about the market (What do consumers really want? Which kinds of advertising campaigns are most successful? What are the most effective methods of distribution?) If an importer is willing to do a good job of marketing, this arrangement may represent a "win-win" situation, but it

15

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

may be more difficult for the firm to enter on its own later if it decides that larger profits can be made within the country. Licensing and franchising are also low exposure methods of entry you allow someone else to use your trademarks and accumulated expertise. Your partner puts up the money and assumes the risk. Problems here involve the fact that you are training a potential competitor and that you have little control over how the business is operated. For example, American fast food restaurants have found that foreign franchisees often fail to maintain American standards of cleanliness. Similarly, a foreign manufacturer may use lower quality ingredients in manufacturing a brand based on premium contents in the home country. Contract manufacturing involves having someone else manufacture products while you take on some of the marketing efforts yourself. This saves investment, but again you may be training a competitor. Direct entry strategies, where the firm either acquires a firm or builds operations "from scratch" involve the highest exposure, but also the greatest opportunities for profits. The firm gains more knowledge about the local market and maintains greater control, but now has a huge investment. In some countries, the government may expropriate assets without compensation, so direct investment entails an additional risk. A variation involves a joint venture, where a local firm puts up some of the money and knowledge about the local market.

16

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

Sikkim Manipal University 4th Semester Spring 2011

17

Alaji Mamadou Cire BAH 540910685

MB0037 SET2

You might also like

- Sustaining Contractual Business: an Exploration of the New Revised International Commercial Terms: Incoterms®2010From EverandSustaining Contractual Business: an Exploration of the New Revised International Commercial Terms: Incoterms®2010No ratings yet

- Master of Business Administration-MBA Semester 4 MB0037 - International Business Management - 3 Credits Assignment Set-2Document7 pagesMaster of Business Administration-MBA Semester 4 MB0037 - International Business Management - 3 Credits Assignment Set-2chichakar1No ratings yet

- World Trade Organization (WTO)Document8 pagesWorld Trade Organization (WTO)qaiserNo ratings yet

- Pgdibo Ibo 03 2019 20Document15 pagesPgdibo Ibo 03 2019 20waliapiyush1993No ratings yet

- Term Paper On WtoDocument4 pagesTerm Paper On Wtoafdtakoea100% (1)

- Wto, Imf, Trims, TripsDocument11 pagesWto, Imf, Trims, TripsSaklain SakibNo ratings yet

- WTO Trade Agreement in UAE: (Advantages)Document3 pagesWTO Trade Agreement in UAE: (Advantages)ChahatBhattiAliNo ratings yet

- Business EnvironmentDocument58 pagesBusiness EnvironmentAnand KumarNo ratings yet

- Trade Law 19Document13 pagesTrade Law 19Raghav GoyalNo ratings yet

- Wto GPDocument5 pagesWto GPkomal kumariNo ratings yet

- UntitledDocument6 pagesUntitledHj FfgNo ratings yet

- Assi - Ib-Mbat-302Document10 pagesAssi - Ib-Mbat-302singhsomendra624No ratings yet

- International Monetary Fund World Trade OrganizationDocument2 pagesInternational Monetary Fund World Trade OrganizationRumzGNo ratings yet

- Financial Institution IIDocument19 pagesFinancial Institution IIVikash kumarNo ratings yet

- IBM - Unit - IIDocument38 pagesIBM - Unit - IIKarthikeyan RNo ratings yet

- Definition of Wto NewDocument40 pagesDefinition of Wto NewDominic GouveiaNo ratings yet

- Be Co-4 MaterialDocument20 pagesBe Co-4 MaterialGanti Bharani bhargavNo ratings yet

- Course No: EMIS-512 Course Title: International Business Group Term Paper Title: World Trade Organization (WTO)Document20 pagesCourse No: EMIS-512 Course Title: International Business Group Term Paper Title: World Trade Organization (WTO)smitanade10No ratings yet

- Wto - World Trade OrganizationDocument16 pagesWto - World Trade OrganizationS3B4S :3No ratings yet

- Research Paper On WtoDocument8 pagesResearch Paper On Wtogw2wr9ss100% (1)

- World Trade OrganizationDocument36 pagesWorld Trade OrganizationJitin DhingraNo ratings yet

- Solution Manual For International Business A Managerial Perspective 8 e 8th Edition 0133506290Document26 pagesSolution Manual For International Business A Managerial Perspective 8 e 8th Edition 0133506290BethRowenfed100% (39)

- World Trade OrgaisationDocument21 pagesWorld Trade OrgaisationHasanjon SharipovNo ratings yet

- MODULE 6 - 'Free Trade' Trade RestrictionsDocument9 pagesMODULE 6 - 'Free Trade' Trade RestrictionschingNo ratings yet

- Ijrim Volume 2, Issue 6 (June 2012) (ISSN 2231-4334) World Trade Organization: Its Impact On Indian EconomyDocument7 pagesIjrim Volume 2, Issue 6 (June 2012) (ISSN 2231-4334) World Trade Organization: Its Impact On Indian EconomySatyanarayana AmarapinniNo ratings yet

- The WTO World Trade Organisation World Trade OrganisationDocument19 pagesThe WTO World Trade Organisation World Trade Organisationnyamatullah7866523No ratings yet

- Environmental ImpactDocument5 pagesEnvironmental ImpactMhyr Pielago CambaNo ratings yet

- Topic: How World Trade Organization (WTO) Promotes International BusinessDocument4 pagesTopic: How World Trade Organization (WTO) Promotes International BusinessSaima AkterNo ratings yet

- AN Assignment ON "World Trade Organization": Submitted byDocument20 pagesAN Assignment ON "World Trade Organization": Submitted byIMRAN ALAM100% (1)

- WTO and IndiaDocument13 pagesWTO and IndiaMeenakshiVuppuluriNo ratings yet

- Handbook Rules of Origin 1Document22 pagesHandbook Rules of Origin 1Mauricio Padilla100% (1)

- Lesson 1 - Trade in The Global Economy: Program OutcomesDocument15 pagesLesson 1 - Trade in The Global Economy: Program OutcomesDORENA ANIE LILINo ratings yet

- Assignment: World Trade OrganizationDocument6 pagesAssignment: World Trade OrganizationmgvarshaNo ratings yet

- Project Report On "World Trade OrganizationDocument27 pagesProject Report On "World Trade Organizationmars2580No ratings yet

- Written ReportDocument23 pagesWritten ReportMary Melody CaldinoNo ratings yet

- Comilla University: Department of MarketingDocument17 pagesComilla University: Department of MarketingMurshid IqbalNo ratings yet

- Term Paper On World Trade OrganizationDocument6 pagesTerm Paper On World Trade Organizationafdttjujo100% (1)

- The Emergence of Global InstitutionsDocument16 pagesThe Emergence of Global InstitutionsIshrat AminNo ratings yet

- MPIB7103 Assignment 1 (201805)Document12 pagesMPIB7103 Assignment 1 (201805)Masri Abdul LasiNo ratings yet

- International Business ManagementDocument96 pagesInternational Business ManagementA vyasNo ratings yet

- Section - 1Document12 pagesSection - 1vinodkumarsajjanNo ratings yet

- China and The WTODocument12 pagesChina and The WTOSaul M Hernandez HernandezNo ratings yet

- MB0053 - International Business Management - 4 Credits (Book ID:B1315) Assignment (60 Marks)Document7 pagesMB0053 - International Business Management - 4 Credits (Book ID:B1315) Assignment (60 Marks)Prashant Kolar0% (1)

- Imf & WtoDocument2 pagesImf & WtoAbigail TrevinoNo ratings yet

- Internatinal MarketingWTO RM MCOMDocument33 pagesInternatinal MarketingWTO RM MCOMYuvrajNo ratings yet

- Project On WTODocument18 pagesProject On WTOPranav ViraNo ratings yet

- Chapter 2 - Tutorial QuestionsDocument5 pagesChapter 2 - Tutorial QuestionsYou Pang PhuahNo ratings yet

- Research Paper On World Trade OrganizationDocument4 pagesResearch Paper On World Trade Organizationgrgdazukg100% (1)

- Assignment - Economic Analysis For Business DecissionsDocument8 pagesAssignment - Economic Analysis For Business DecissionsMichelle NaickerNo ratings yet

- 02 - Dmba402 - International Business ManagementDocument7 pages02 - Dmba402 - International Business ManagementHari KNo ratings yet

- Assignment 3 - Jamelarin, Carolyn CDocument5 pagesAssignment 3 - Jamelarin, Carolyn CDA YenNo ratings yet

- WTODocument35 pagesWTOdibya_85100% (10)

- World Trade OrganizationDocument6 pagesWorld Trade OrganizationFRANCIS EDWIN MOJADONo ratings yet

- What Is Globalisation: Globalisation - Its Benefits and DrawbacksDocument9 pagesWhat Is Globalisation: Globalisation - Its Benefits and Drawbacksbruhaspati1210No ratings yet

- Wto Research Paper TopicsDocument6 pagesWto Research Paper Topicsepfdnzznd100% (1)

- WTO and Pakistan: Submitted To: Dr. Bilal Aziz Submitted By: M.Tayyab Subject: WTODocument28 pagesWTO and Pakistan: Submitted To: Dr. Bilal Aziz Submitted By: M.Tayyab Subject: WTOMoghees AliNo ratings yet

- Economic Analysis For Business DecissionsDocument8 pagesEconomic Analysis For Business DecissionsMichelle NaickerNo ratings yet

- HKDSE BAFS ch1 Notes About WTO CEPA APECDocument9 pagesHKDSE BAFS ch1 Notes About WTO CEPA APECcwtNo ratings yet

- Thesis WtoDocument5 pagesThesis Wtojessicamyerseugene100% (2)

- MF0007-Spring 2011Document8 pagesMF0007-Spring 2011Alaji Bah CireNo ratings yet

- MF0008-Spring 2011Document11 pagesMF0008-Spring 2011Alaji Bah CireNo ratings yet

- Sikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Document11 pagesSikkim Manipal University Sikkim Manipal University 4 Semester Spring 2011Alaji Bah CireNo ratings yet

- Sikkim Manipal University 4 Semester Spring 2011Document19 pagesSikkim Manipal University 4 Semester Spring 2011Alaji Bah CireNo ratings yet

- MF0009-Spring 2011Document15 pagesMF0009-Spring 2011Alaji Bah CireNo ratings yet

- Project CoverDocument1 pageProject CoverAlaji Bah CireNo ratings yet

- History of Micro FinanceDocument8 pagesHistory of Micro FinanceAlaji Bah CireNo ratings yet

- Project ReportDocument110 pagesProject ReportAlaji Bah CireNo ratings yet

- Project CoverDocument1 pageProject CoverAlaji Bah CireNo ratings yet

- Blue Giant Dock Leveler Model CHDocument20 pagesBlue Giant Dock Leveler Model CHHelen DwyerNo ratings yet

- Export Invoice 010Document3 pagesExport Invoice 010neha khanejaNo ratings yet

- 250 412-21-01986-412025 Aml BL eDocument2 pages250 412-21-01986-412025 Aml BL eAra SyidaNo ratings yet

- Von Duprin Price Book Revised 8/13Document136 pagesVon Duprin Price Book Revised 8/13Security Lock DistributorsNo ratings yet

- LSW678 London Market Offshore Mobile Unit Form 12 97Document20 pagesLSW678 London Market Offshore Mobile Unit Form 12 97boby100% (1)

- Cash Management Questionnaire AllentownDocument14 pagesCash Management Questionnaire Allentownqkhan2000No ratings yet

- Mareva Sample AffidavitDocument3 pagesMareva Sample AffidavitAisyah BalkisNo ratings yet

- PVH, PVB, PVQ, Pve Piston PumpsDocument6 pagesPVH, PVB, PVQ, Pve Piston PumpslizxcanoNo ratings yet

- BMTI Short Sea Report 2011WK50Document7 pagesBMTI Short Sea Report 2011WK50Ben PerryNo ratings yet

- Ships and Major Port ActivitiesDocument14 pagesShips and Major Port ActivitiesManju ManjuNo ratings yet

- Material Means of TransportationDocument14 pagesMaterial Means of TransportationJSARAYNo ratings yet

- 8 - Integrating The Supply ChainDocument31 pages8 - Integrating The Supply ChainArunkumarNo ratings yet

- G.R. No. L-25748 - Consolidated Terminals, Inc. v. Artex DevelopmentDocument5 pagesG.R. No. L-25748 - Consolidated Terminals, Inc. v. Artex DevelopmentAj SobrevegaNo ratings yet

- S.N O. Services Normal Vehicle: Phone: 011-45004321 Email: - WebsiteDocument6 pagesS.N O. Services Normal Vehicle: Phone: 011-45004321 Email: - Websitesridevibalaji0% (2)

- MSC82 14 1Document7 pagesMSC82 14 1Valentino LoboNo ratings yet

- Champaran Gurukul: Banking Made EasyDocument5 pagesChamparan Gurukul: Banking Made EasybiplabmajumderNo ratings yet

- 19 He Heacock Vs MacondrayDocument5 pages19 He Heacock Vs MacondrayMary Louise R. ConcepcionNo ratings yet

- Modes of Transportation and Their DifficultiesDocument51 pagesModes of Transportation and Their DifficultiesSuresh Babu Reddy100% (1)

- Bucket ElevatorsDocument36 pagesBucket Elevatorsioanchi100% (1)

- Manual On Cargo Clearance Process (E2m Customs Import Assessment System)Document43 pagesManual On Cargo Clearance Process (E2m Customs Import Assessment System)Musa Batugan Jr.100% (1)

- Logistics CostDocument8 pagesLogistics CostBhavini ModiNo ratings yet

- Selection of Main Dimensions and Calculation of Basic Ship Design ValuesDocument11 pagesSelection of Main Dimensions and Calculation of Basic Ship Design Valuesshyroro2010No ratings yet

- Transport History ReportDocument40 pagesTransport History Reportim_verstyleNo ratings yet

- Reefer GuideDocument46 pagesReefer GuideJuan Carlos Ibarguen100% (2)

- City LinkDocument15 pagesCity Linkwanatiqah8967% (3)

- Containerization PalletizationDocument4 pagesContainerization PalletizationGayatri NaiduNo ratings yet

- Panama Decree Law No. 45 PDFDocument2 pagesPanama Decree Law No. 45 PDFCarl FranksNo ratings yet

- Rotor Tales - Fall 2002Document16 pagesRotor Tales - Fall 2002William RiosNo ratings yet

- Fe191120a PDFDocument1 pageFe191120a PDFjose gregorio mata cabezaNo ratings yet

- Indigo Airlines Case StudyDocument5 pagesIndigo Airlines Case StudyDebottam BhattacharyyaNo ratings yet