Professional Documents

Culture Documents

Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010

Uploaded by

hk_warriorsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010

Uploaded by

hk_warriorsCopyright:

Available Formats

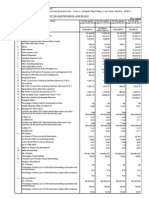

Indiabulls Securities Limited (as standalone entity)

Unaudited Financial Results for the quarter ended December 31, 2010

(Rupees in Lakhs)

Particulars 1 a) Income from Operations b) Other Operating Income Total 2 Expenditure a) Employees Cost b) Depreciation / Amortisation c) Operating Expenses d) Administrative & Other Expenses Total 3 Profit from Operations before Other Income, Interest & Exceptional Items (1-2) 4 Other Income 5 Profit before Interest & Exceptional Items (3+4) 6 Interest and Finance Charges 7 Profit after Interest but before Exceptional Items (5-6) 8 Exceptional Items 9 Profit from Ordinary Activities before Tax (7-8) 10 Tax expense (including Deferred Tax and Wealth Tax ) 11 Net Profit from Ordinary Activities after Tax (9-10) 12 Extraordinary Items (net of tax expense Rs. NIL) 13 Net Profit for the period (11-12) 14 Preference Dividend for the period (Including corporate dividend tax thereon) 15 Paid-up Equity Share Capital (Face Value of Rs. 2 per Equity Share) 16 Paid-up Preference Share Capital 17 Reserves excluding Revaluation Reserves as per Balance Sheet as at March 31, 2010 18 Earnings per Share before extraordinary items (Face Value of Rs. 2 per Equity Share) Earnings per Share before extraordinary items (Face Value of Rs.2 per -Basic (Amount in Rs.) Earnings per Share before extraordinary items (Face Value of Rs.2 per -Diluted (Amount in Rs.) Earnings per Share after extraordinary items (Face Value of Rs. 2 per Equity Share) Earnings per Share before extraordinary items (Face Value of Rs.2 per -Basic (Amount in Rs.) Earnings per Share before extraordinary items (Face Value of Rs.2 per -Diluted (Amount in Rs.) 19 Public Shareholding - Number of Equity Shares - Percentage of shareholding 20 Promoters and promoter group Shareholding a) Pledged/Encumbered - Number of shares - Percentage of shares (as a % of the total shareholding of promoter and promoter group) - Percentage of shares (as a % of the total share capital of the company) b) Non-encumbered - Number of shares - Percentage of shares (as a % of the total shareholding of promoter and promoter group) - Percentage of shares (as a % of the total share capital of the company)

Quarter ended 31.12.10 31.12.09 (Unaudited) (Unaudited) 8,315.36 6,828.21 1,073.77 1,066.00 9,389.13 7,894.21 3,562.04 443.78 766.93 1,706.44 6,479.19 2,909.94 267.24 3,177.18 1,202.82 1,974.36 1,974.36 691.40 1,282.96 1,282.96 4,622.25 0.56 0.54 0.56 0.54 162,399,086 70.27% 3,273.20 525.40 678.57 1,129.81 5,606.98 2,287.23 56.33 2,343.56 440.83 1,902.73 1,902.73 758.60 1,144.13 1,144.13 5,068.39 0.45 0.43 0.45 0.43 174,593,196 68.89%

Nine months ended 31.12.10 31.12.09 (Unaudited) (Unaudited) 24,488.95 22,689.88 3,128.97 3,427.97 27,617.92 26,117.85 10,645.44 1,388.17 2,248.63 4,738.44 19,020.68 8,597.24 1,081.82 9,679.06 3,309.67 6,369.39 6,369.39 2,131.37 4,238.02 4,238.02 4,622.25 1.84 1.80 1.84 1.80 162,399,086 70.27% 9,236.84 1,621.71 2,154.83 3,486.20 16,499.58 9,618.27 687.69 10,305.96 1,352.63 8,953.33 8,953.33 3,113.82 5,839.51 5,839.51 18.11 5,068.39 2.30 2.19 2.30 2.19 174,593,196 68.89%

Year ended 31.03.10 (Audited) 29,206.56 4,553.77 33,760.33 13,357.18 2,121.54 2,781.41 4,912.85 23,172.98 10,587.35 715.07 11,302.42 1,907.99 9,394.43 9,394.43 3,272.68 6,121.75 6,121.75 18.11 4,598.81 17,394.30 2.43 2.34 2.43 2.34 156,538,241 68.08%

68,713,425 100.00% 29.73%

68,713,425 100.00% 27.11%

68,713,425 100.00% 29.73%

68,713,425 100.00% 27.11%

68,713,425 100.00% 29.88%

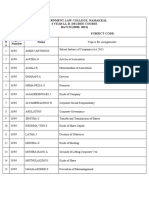

Notes to Financial Results: The standalone financial results of Indiabulls Securities Limited ('IBSL', 'the Company') for the quarter ended December 31, 2010 have been reviewed by the Audit Committee and approved by the Board of Directors at its meeting held on January 25, 2011. The financial results pertaining to IBSL as a standalone entity have been subjected to a limited review by the Statutory Auditors of the Company. 2 During the current quarter, upon exercise of stock options vested in terms of "Indiabulls Securities Limited Employees Stock Option Scheme - 2008", by certain eligible employees and receipt of full consideration therefore, the Compensation Committee of the Board of Directors of the Company at its meeting held on November 24, 2010, has allotted an aggregate of 28,275 (Twenty Eight Thousand Two Hundred Seventy Five) Equity shares of face value Rs. 2/- each to such employees. Consequent to the said allotment, the paid-up Equity share capital of the Company stands increased from Rs. 4,621.68 Lacs divided into 23,10,84,236 Equity shares of face value Rs. 2/- each to Rs. 4,622.25 Lacs divided into 23,11,12,511 Equity shares of face value Rs. 2/- each. 3 The interim dividend of Re. 1.00 per equity share (50% of the face value of Rs. 2/- per equity share) amounting to Rs. 2,310.84 Lacs (excluding corporate dividend tax) was approved at the meeting of the Board of Directors of the Company held on October 18, 2010 and was transferred by the Company on October 22, 2010 into the designated Dividend Account. 4 Segment Results (Rupees in Lakhs)

1

Quarter ended Particulars

1

Nine months ended 31.12.10 (Unaudited) 27,617.92 27,617.92 27,617.92 31.12.09 (Unaudited) 26,111.73 6.12 26,117.85 26,117.85

Year ended 31.03.10 (Audited) 33,689.15 71.18 33,760.33 33,760.33

31.12.10 (Unaudited)

31.12.09 (Unaudited) 7,889.20 5.01 7,894.21 7,894.21

Segment Revenue Broking & related activities 9,389.13 Others Total 9,389.13 Less: Inter Segment Revenue Income from Operations 9,389.13 2 Segment Results Profit before Tax and Interest Broking & related activities 3,029.64 Others Total 3,029.64 (i) Less: Interest 1,047.22 (ii) Add: Other un-allocable Income net off unallocable expenditure (8.06) Total Profit Before Tax 1,974.36 3 Capital Employed (Segment Assets - Segment Liabilities) Broking & related activities 21,457.00 Others Unallocable Capital Employed 2,283.40 Total 23,740.40 Note: "Other" business segment constitutes investment and dealing in tradable securities and arbitrage transaction in securities. 5 Number of Investor Complaints received and disposed off during the quarter ended December 31, 2010:

6

2,233.04 5.01 2,238.05 295.57 (39.75) 1,902.73 35,114.43 (623.93) 34,490.50

8,673.33 8,673.33 2,807.13 503.19 6,369.39 21,457.00 2,283.40 23,740.40

9,817.00 6.12 9,823.12 924.20 54.41 8,953.33 35,114.43 (623.93) 34,490.50

10,641.69 71.18 10,712.87 1,324.13 5.69 9,394.43 34,635.03 (12,641.92) 21,993.11

Opening: Nil, Received: 248, Disposed Off: 248, Pending: Nil. Figures for the prior year / periods have been regrouped and / or reclassified wherever considered necessary to conform to the current period's presentation. Registered Office: F-60, Malhotra Building, 2nd Floor, Connaught Place, New Delhi 110 001. For and on behalf of Board of Directors

Place : Mumbai Date : January 25, 2011

Divyesh B. Shah CEO & Director

You might also like

- Financial Results & Limited Review For June 30, 2015 (Company Update)Document7 pagesFinancial Results & Limited Review For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- Audited Result 2010 11Document2 pagesAudited Result 2010 11Priya SharmaNo ratings yet

- India BullsDocument2 pagesIndia Bullsrajesh_d84No ratings yet

- BHL Fin Res 2011 12 q1 MillionDocument2 pagesBHL Fin Res 2011 12 q1 Millionacrule07No ratings yet

- Britannia Industries Q2 FY2012 Financial ResultsDocument2 pagesBritannia Industries Q2 FY2012 Financial Resultspvenkatesh19779434No ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- SIDBI Financial Result DEC 2010 EnglishDocument2 pagesSIDBI Financial Result DEC 2010 EnglishSunil GuptaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2013 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNo ratings yet

- Q3 Results 201112Document3 pagesQ3 Results 201112Bishwajeet Pratap SinghNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- NFL Results March 2010Document3 pagesNFL Results March 2010Siddharth ReddyNo ratings yet

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument2 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- GARWARE-WALL ROPES Q1 2008 FINANCIAL RESULTSDocument1 pageGARWARE-WALL ROPES Q1 2008 FINANCIAL RESULTSJatin GuptaNo ratings yet

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Vadilal Industries LimitedDocument29 pagesVadilal Industries LimitedSubhash YadavNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- SL No Year Ended 30.6.2011 (Reviewed) 30.6.2010 (Reviewed) 31.3.2011 (Audited) Particulars Quarter EndedDocument4 pagesSL No Year Ended 30.6.2011 (Reviewed) 30.6.2010 (Reviewed) 31.3.2011 (Audited) Particulars Quarter EndedZhang Jing CarrieNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Pdfnews PDFDocument5 pagesPdfnews PDFMurthy KarumuriNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Fin Resu Dec 12Document1 pageFin Resu Dec 12Adil SiddiquiNo ratings yet

- Consolidated2010 FinalDocument79 pagesConsolidated2010 FinalHammna AshrafNo ratings yet

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Document1 pagePDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Q1FY2013Document1 pageQ1FY2013Suresh KumarNo ratings yet

- Q1 FY09 TablesDocument3 pagesQ1 FY09 TablesPerminder Singh KhalsaNo ratings yet

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisNo ratings yet

- HCL Technologies LTD 170112Document3 pagesHCL Technologies LTD 170112Raji_r30No ratings yet

- 634085163601250000financial Highlights0310-Correcte-1Document2 pages634085163601250000financial Highlights0310-Correcte-1arunnair1985No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- NTBCL Q1 FY2012 Financial ResultsDocument4 pagesNTBCL Q1 FY2012 Financial ResultsAlok SinghalNo ratings yet

- Unaudited Financial Results For The Quarter Ended 30Th June, 2011Document1 pageUnaudited Financial Results For The Quarter Ended 30Th June, 2011Ayush JainNo ratings yet

- Balance Sheet As at 31 March, 2011: ST STDocument14 pagesBalance Sheet As at 31 March, 2011: ST STLambourghiniNo ratings yet

- Annual ReportDocument1 pageAnnual ReportAnup KallimathNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Regd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)Document1 pageRegd. Office: B-214, Phase II, Distt. Gautam Budh Nagar, Noida - 201305 (U.P.)nitin2khNo ratings yet

- FinancialResult 30062012Document3 pagesFinancialResult 30062012Raghu NathNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- Bc Technology Group Limited B C 科 技 集 團 有 限 公 司: Interim Results Announcement For The Six Months Ended 30 June 2020Document30 pagesBc Technology Group Limited B C 科 技 集 團 有 限 公 司: Interim Results Announcement For The Six Months Ended 30 June 2020aalalalNo ratings yet

- DLF Fy010Document4 pagesDLF Fy010Anonymous dGnj3bZNo ratings yet

- Mothersum Standalone Results Q3 FY2012Document4 pagesMothersum Standalone Results Q3 FY2012kpatil.kp3750No ratings yet

- IFCI Q3 FY10 financial resultsDocument3 pagesIFCI Q3 FY10 financial resultsnitin2khNo ratings yet

- Financial Results For Sept 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Consolidated Financial Statements: Auditor's ReportDocument29 pagesConsolidated Financial Statements: Auditor's ReportPankaj DuggalNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Userfiles Financial 6fDocument2 pagesUserfiles Financial 6fTejaswini SkumarNo ratings yet

- LGE 2010 4Q ConsolidationDocument89 pagesLGE 2010 4Q ConsolidationSaba MasoodNo ratings yet

- 28th Annual Report-2022Document165 pages28th Annual Report-2022titu_1552No ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- HKSE Announcement of 2011 ResultsDocument29 pagesHKSE Announcement of 2011 ResultsHenry KwongNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- 2008 LCCI Level 2 (2507) Series 3 Model AnswersDocument17 pages2008 LCCI Level 2 (2507) Series 3 Model AnswersTracy Chan0% (1)

- Government Law College Company Law AssignmentsDocument5 pagesGovernment Law College Company Law AssignmentsshivaNo ratings yet

- PPFCF PPFAS Monthly Portfolio Report January 31 2023Document15 pagesPPFCF PPFAS Monthly Portfolio Report January 31 2023Raghunatha ReddyNo ratings yet

- Bank of BanksDocument73 pagesBank of BanksJash GadaNo ratings yet

- Bank Statement Big ConamsaDocument79 pagesBank Statement Big ConamsaSIN24horasNo ratings yet

- Recognizing Employee ContributionsDocument19 pagesRecognizing Employee ContributionsahmedjameelNo ratings yet

- Seven Pillars InstituteDocument4 pagesSeven Pillars InstituteAnil BambuleNo ratings yet

- Sample Qualified Written Request 1Document5 pagesSample Qualified Written Request 1derrick1958100% (2)

- Neural Network in Financial AnalysisDocument33 pagesNeural Network in Financial Analysisnp_nikhilNo ratings yet

- John KuhnDocument1 pageJohn KuhnsiegelgallagherNo ratings yet

- Fundamental Analysis Covering EICDocument15 pagesFundamental Analysis Covering EICsatinderpalkaurNo ratings yet

- Employer Branding: A Brand Equity Based Literature Review and Research AgendaDocument2 pagesEmployer Branding: A Brand Equity Based Literature Review and Research AgendaAishwarya BorgaonkarNo ratings yet

- Shareholders Agreement (Two Shareholders)Document18 pagesShareholders Agreement (Two Shareholders)Legal Forms90% (10)

- Application For Surrender of MembershipDocument13 pagesApplication For Surrender of MembershipSagar NagbhujangeNo ratings yet

- Mutual Fund PPT 123Document53 pagesMutual Fund PPT 123Sneha SinghNo ratings yet

- Process of IPO in IndiaDocument4 pagesProcess of IPO in IndiaBasappaSarkarNo ratings yet

- Market Wrap PUBLIC BANKDocument4 pagesMarket Wrap PUBLIC BANKzarifmasriNo ratings yet

- Hedge Fund Book V5Document133 pagesHedge Fund Book V5whackz100% (3)

- Geostellar PetitionDocument6 pagesGeostellar PetitionJohn Bringardner100% (1)

- Financial Stability Committee DraftDocument379 pagesFinancial Stability Committee DraftLogisticsMonsterNo ratings yet

- 3 Introduction To Income TaxDocument53 pages3 Introduction To Income TaxEphreen Grace MartyNo ratings yet

- MBA Finance ProjectDocument73 pagesMBA Finance Projectsabaris477No ratings yet

- A Study On Working Capital Management in Strides Shasun Limited at CuddaloreDocument75 pagesA Study On Working Capital Management in Strides Shasun Limited at Cuddaloreashok kumar100% (3)

- Mutual FundsDocument18 pagesMutual FundsnishaNo ratings yet

- Managerial Fin - Midterm Cheat - Copy2Document2 pagesManagerial Fin - Midterm Cheat - Copy2JoseNo ratings yet

- Bid Bond, Performance Bond, Payment BondDocument1 pageBid Bond, Performance Bond, Payment Bondsapkotamonish0% (1)

- Gamboa V Teves G.R. 176579Document2 pagesGamboa V Teves G.R. 176579Dino Bernard LapitanNo ratings yet

- CapmDocument3 pagesCapmTalha SiddiquiNo ratings yet

- Aman Gupta Mini Project 2Document81 pagesAman Gupta Mini Project 2Suneet kumarNo ratings yet

- Arihant Upsc Indian Economy Practice Set 5. CB1198675309Document5 pagesArihant Upsc Indian Economy Practice Set 5. CB1198675309Lavita Deka100% (1)