Professional Documents

Culture Documents

Kone Writeup Final

Uploaded by

junk_987654Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kone Writeup Final

Uploaded by

junk_987654Copyright:

Available Formats

EWMBA 269: Pricing

KONEs MonoSpace Launch in the German Market

KONEs MonoSpace Launch in the German Market

2011

Executive Summary:

KONEs launch in Germany is an incredible opportunity for it to showcase its revolutionary Monospace product. However, what goals should KONE pursue in this market introduction? We discuss the high level objectives that KONE should set: 1) Grabbing a larger market shares in the mid-tier non-hydraulic segment 2) Positioning MonoSpace and Eco-Disc product for future growth 3) Restoring some balance in the two-part pricing revenue model. Based on these goals, we explore the strategic choices KONE has to achieve these goals and discuss the merits and disadvantages of the different approaches. Based on prevailing market conditions and the high level objectives, a Neutral Market Pricing is deemed to be most appropriate. This targets the geared traction customers in the residential market and sets a pricing level between the current PT and PU segments. Necessary next steps for capacity planning, promotion, and communication needed to build a coherent launch strategy are listed. Finally, long term steps needed to develop a successful corporate strategy for MonoSpace/Eco-Disc are touched upon.

Industry Analysis

After a wave of restructuring and consolidation, the worldwide elevator market in the early 90s was dominated by 5 large players: Otis (USA), Schindler (Switzerland), KONE (Finland), Mitsubishi Electric (Japan), and Thyssen (Germany). Although KONE was the third largest elevator company, it was far smaller than the market leaders, who generated twice the revenue. KONE had also divested its nonelevator businesses and was entirely dependent on its performance in this competitive market. In Europe, KONEs top competitors were Otis, Schindler and Thyssen. KONE had the largest market share in the Netherlands, where geared traction elevators were the most abundant. Otis had the largest market share in France and UK, where hydraulic elevators were much more popular. At this time, revenue in the elevator business was generated by a two part pricing system: new equipment ($9B) and service ($13B). All the large players sold equipment as well as provided post installation service. The volume and type of elevators sold largely depended on factors such as urbanization, population density, and government support of public housing. Choice of elevator technology depended on various factors such as travel height, speed, comfort, machine room requirements, drive systems, controls, cabin size, interior finishing and price. A key distinction was related to the type of drive system used to lift the elevator cabin. The primary drive technologies currently available were gearless (high speed), geared (medium speed) traction, and hydraulic, with hydraulic being the most popular due to its lower price. Both these technologies required a machine room to be built above the elevator shaft (PT), to the side of the top shaft (PU), or

KONEs MonoSpace Launch in the German Market

2011

on the bottom floor (PU and PH). These machine rooms typically accounted for about one-quarter of the total elevator costs (equipment and installation). The number of people involved in making the purchasing decision for an elevator varied greatly based on the size and cost of the building (complex DMU/DMP). Even for the same type of building, the importance of features differed based on the specific decision maker. For a low rise property, decision makers could include the property owner, a construction company manager, an architect, a construction company purchasing agent, or a building service manager. While owners/developers typically cared more about the upfront costs for an elevator, owners/landlords cared about the lifetime costs for an elevator but did not care much about comfort and aesthetics. A lack of innovation in product development had resulted in commoditization of the market, and competitors competed fiercely on price for new elevator installations. While equipment was often sold at or below cost, the major players maintained high margins on the annual service contracts, which were approximately 5% of the purchase price of the elevator. Low barriers to entry in the service market, due to relatively simple elevator technology, steady demand and high margins, attracted many new, smaller competitors. These smaller competitors offered better pricing and faster service, but for the moment, 80% of service contracts still flowed directly to the original elevator manufacturer.

German Market

Germany was a critical market because of its large size (15,500 total units annually) and its global reputation as a technology leader. In 1995, the construction boom that started in Germany in 1988, ended abruptly and as a result, demand for new elevators was expected to drop 15% by 2000. The majority of construction was residential with 74% of elevator installations in low-rise residential buildings. Of this, hydraulic elevators accounted for 60% of the elevator installations in low-rise buildings with geared traction elevators making up the rest. Two thirds of the geared traction units were of the more expensive (PU) type.

German Elevator Market

Low-rise

44%

Mid/High-rise Hydraulic - PH

26%

74% 20% 10%

Geared Traction - PU Geared Traction - PT

Total German Market

Low-rise Residential Market

KONEs MonoSpace Launch in the German Market

2011

Schindler had the highest market share in terms of units sold, followed by Otis, Thyssen and KONE, other mid-sized held approximately 46% of the German elevator market. All the large players provided 24-hour service and had sales and manufacturing facilities in Germany. The mid-sized players operated regionally and typically sold 100 to 300 elevators per year. Several smaller players operated in various cities, but they lacked manufacturing facilities and focused on the purchase and assembly of components and installation as well as local service. In Germany, smaller contractors who possessed limited technical knowledge typically built residential buildings. As a result, these contractors usually relied on the architects to select elevators. KONE managers believed that in the German residential market the final purchase decision was made by the general contractor 50% of the time, by the architect 40% of the time and by the property developer 10% of the time.

Product Benefits

KONEs MonoSpace elevator design is based on an innovative component called the EcoDisc. This innovation equips the MonoSpace with capabilities similar to those of geared traction elevators, but with improved comfort, better aesthetics and a number of short term and long term cost savings. The following list details the benefits that differentiate the MonoSpace from current elevator designs: Tangible benefits Quantifiable benefits that can be measure by the customer: o Energy efficiency : The EcoDisc power unit consumes 50% less energy than a comparable geared traction elevator and 33% less energy than a comparable hydraulic elevator. Furthermore, the lower energy requirement allows less expensive wiring and fuses to be used. The total energy savings based on the France entry amounted to DM2,091 (FF5,000) per year [Beneficiary : Owner] o Space/ Installation cost savings (machine-room-less): MonoSpace elevators in low-mid rise buildings do not require a machine room, which typically occupies 11 SQM of space. Therefore, the cost to build such a room and the opportunity cost of the space occupied can be eliminated. Machine room installation costs account for 25% of the total cost of installation, and for the case of a PT installation, the savings amount to DM37,500. [Beneficiary : Owner] o Easier and shorter installation: Installing a MonoSpace elevator requires 60 fewer hours than a comparable geared traction elevator. It also does not require scaffolding, which further reduces the complexity and the cost of installation. Such cost savings were estimated to be 5% of the total installation cost (i.e. For a PT elevator, these savings amount to DM3,750). [Beneficiary : Owner/Contractor] Intangible benefits Difficult to quantify, but can differentiate the product: o Safety & Environmental friendliness: Unlike Hydraulic elevators, MonoSpace elevators are oil free, thus, eliminating hazards associated with using large amounts of oil and the negative environmental impact of an any oil leaks. [Beneficiary : Owner]

KONEs MonoSpace Launch in the German Market

2011

Aesthetics & Design flexibility: The machine-room-less design gives architects the freedom to use all of the surrounding space for aesthetic purposes. [Beneficiary : Architect] Ride-comfort: The speed control of the MonoSpace results in a more comfortable ride compared to that of the geared traction and hydraulic elevators. [Beneficiary : Owner/Tenants]

Customer Benefits Offered Comfort Safety

Least Important/ Not Quantifiable

Decision Makers Tenants/Users Building Service Managers Structural Engineers

Property Developers Architects

Aesthetics, Look Energy Savings Low Maintenance Cost

Low Equipment and Installation Cost

Most Important/ Quantifiable

Contractors Owners/Landlords

Buyer

No Machine Room

Seller

Clearly, the MonoSpace elevator is a differentiated product that offers a variety of tangible and intangible benefits to everyone involved in the decision making process. Some of the tangible benefits can be realized instantly (installation costs savings for example), while others accrue over time (energy savings). Detailed calculations are included in Exhibit 1, but the following list highlights the value of each benefit: Machine-room-less installation cost savings (PT): Other installation cost savings (time saved, easy): Annual energy efficiency related savings: DM37,500 DM3,750 DM2,091

Lessons from Prior Market Introductions

KONEs previous forays into the Dutch, French and British markets offer valuable lessons that should be applied to the launch in Germany. The Netherlands demonstrated the power of being the market leader and the importance of designing a marketing campaign that carefully targeted DMUs. KONE leveraged its position as market leader and also offered face-to-face and individual presentations that were very effective in selling the benefits of MonoSpace. In addition, they created an easy mechanism for the architects and contractors to drop

KONEs MonoSpace Launch in the German Market

2011

in plans by offering electronic designs on a CD Rom. Kone now has market knowledge that when positioned against geared traction elevators in the correct environment, MonoSpace will have outstanding sales. The market launch in the UK showed how cost sensitive buyers will react to an uncompetitive price. Also, the unique segmenting of the UK market into a bifurcated market made up of only top-of-the-line and rock-bottom elevators meant that Monospace lacked an appropriate target segment to attack. France also had the same broad demand in the mid-range, mid-quality elevator of the Dutch market, but KONEs marketing outreach program was much more haphazard and less directed. This coupled with KONEs much smaller market share helps explain the lackluster results in the French market. Although there were valuable lessons learned, differences between these individual markets and the German market must be considered. The Netherlands is a much smaller market that was already dominated by KONE, and hence, competitors willingness to fight for this market may have been muted. In addition, this was a bit of an anomalous market where geared traction elevators were 5% less expensive than hydraulic elevators. Some of the UK results must be discounted because of the bipolar nature of the market and the effect of the required 15,000 transfer price. Differences between the French and German markets included the regulatory environment and the prevalence of the two-stage bidding process in Germany.

Pricing Objectives and Role for MonoSpace

The two lukewarm market introductions in the UK and France make the MonoSpace introduction in German market especially critical in building credibility and market acceptance for this revolutionary product. Though facing a competitive marketplace both in Germany and globally, KONEs development of the MonoSpace product gives it a fundamentally superior product with which to achieve some key objectives. 1. KONE must move into the mid-tier geared traction segment because it represents a large untapped market 2. KONEs introduction and pricing strategy in the German market should position MonoSpace as a future flagship product that can eventually carry a large bulk of its global product line by expanding sales into the growing mid-tier market without cannibalizing its share of the PH segment. 3. Kone should try to restore margins that have eroded over the years and recapture some of the service revenue that had begun to leak to the smaller start-ups.

KONEs MonoSpace Launch in the German Market

2011

Strategic Consideration in MonoSpaces Price

Focusing on the high level objectives stated above, KONE must determine the market segments and by extension, the competitors, they will target through the prices they set. A pricing window should be determined by calculating the added economic value MonoSpace provides over existing products and adding this to the most appropriate reference value. In this section, we consider the qualitative advantages and disadvantages of the different approaches to dividing the economic benefit with the customer. Later, we delve into a detailed quantitative analysis of the four-floor, residential pricing model. The case for skimming: For KONE, this approach would entail pricing near the very top of the price window and retaining most of the economic benefit created by MonoSpace. The emphasis is high profit margins rather than large volumes (i.e. SOM). Pros: Emphasizes profit margins Higher price conveys benefits of MonoSpace to the market and reinforces the message that MonoSpace is a revolutionary product Does not upset other current players in the market and minimizes their reaction Helps improve revenue model to the benefit of the KONE and the industry Gives KONE the most room to maneuver and change future pricing (as it is easier to lower prices than to increase them) Cons: Price may be too high since not all benefits are enjoyed by all the decision makers Total economic value of MonoSpace will not be enjoyed until later (since many customers have already designed machine rooms into their buildings) Harder to sell benefits of the product to the customer since they receive a smaller portion of their value Need a very skilled, experienced sales force that can carefully market the high value of each of these benefits to the customized segments

KONEs MonoSpace Launch in the German Market

2011

The case for penetration: For KONE, this means pricing near the bottom of the price window and giving the customer most of the economic value created by MonoSpace. Pros : Easier to sell benefits to the customer Volume play that will likely increase revenue results in Germany Likely short lead time makes it important to establish strong first mover advantage Cons: Will incite a far greater reaction from stronger competitors in the segment Increases reliance on the equipment loss leader- service revenue model May make it harder to position the rest of the product line in the future May cannibalize sales of its low rise PH product The Neutral Market option: Because of the prevailing competitive landscape, our recommendation is to pursue a neutral market pricing strategy that targets geared traction elevators customers in the low-to-mid rise residential market. A key objective in Germany is for a successful launch that can be used to evangelize MonoSpaces benefits and position it in future market and geographic segments. For this, KONE need to sell units and reach as many people as possible while balancing the ability to position this product in the future. It is imperative to begin growing the MonoSpace ecosystemmaking architects aware of the design flexibility, selling owners on the operating efficiencies, demonstrating savings to contractors, and even making consumers aware of the comforts and intangible benefits to MonoSpace. The present competitive landscape makes skimming an unattractive option because KONE will not reach enough customers. The benefits of MonoSpace are distributed to several different DMUs and some of the benefits are difficult to quantify or may accrue in the future. For example, developers may not be concerned with future energy cost savings that are enjoyed by landlords in the future. Other benefits such as the cost savings from the removal of the machine room cannot be realized initially until the MonoSpace market matures and architects and contractors design buildings to MonoSpaces abilities. In addition, selling individual DMUs on the full value of these benefits will be difficult with KONEs limited sales force in Germany. There are also several important factors that discouraged the use of a penetration strategy. As the fourth largest player in Germany, KONE is vulnerable to retaliatory actions taken by the market guerillas that would react strongly to a low price incursion into the PH market. In particular, the hydraulic market is the heart of the residential low rise market and also represents the most cost sensitive segment. It will take time to build the EcoDisc technology into a vibrant product line and KONE lacks the deep resources of its competitors to engage in a price war at this moment. Even though the PU and PT

8

KONEs MonoSpace Launch in the German Market

2011

products are a much smaller piece of the total market, for KONE, it still represents huge incremental revenue gains that it is currently missing. In the residential market, KONEs geared traction products brought in only DM3.3 million (8% of KONEs revenue) out of the DM333 million residential geared traction market. Moreover, a low price interferes with the ability to position MonoSpace as an anchor of the future. It erodes the message that this is a new revolutionary product and makes it more difficult to segment and position future EcoDisc products as KONE drives improvements in this technology. A price based on a penetration strategy also squanders the opportunity to improve on the current revenue model. With production costs equal to those of a hydraulic elevator, MonoSpace has the ability to re-establish some margins without disrupting customers price expectations. This rebalancing of the revenue model means profits on elevator equipment can be restored and the threat from the service ankle biters can be minimized. For all these reasons, a neutral pricing strategy that prices MonoSpace in between the PT and PU levels seems to strike the right balance between immediate sales and future positioning. It allows time to grow the ecosystem while increasing chances for a successful German launch; it maintains current revenues from existing hydraulic markets by minimizing cannibalization. This price level preserves the current discrete product segments and leaves KONE well placed with respect to margins, product positioning, and flexibility for future expansion.

PERFORMANCE

Gearless

PT

MO NO

PU

PS

PH

PRICE

Quantitative analysis of 4-floor pricing: A quantitative analysis for the 4-floor residential elevator illustrates the pricing procedure in detail. In general, the top feasible pricing level is the differentiation value added to the reference value, but the final division of this value is determined by many factors such as market power and pricing strategy. Because this is a B2B transaction and benefits are defused among the DMUs, we used only the immediate, tangible cost savings in our benefit pricing model. (Exhibit 1)

KONEs MonoSpace Launch in the German Market

2011

Comfort Oil-Free Aesthetic Energy savings Accrues over time % of Economic Value shared w/ Customer* Intangible

MONOSPACE

REFERENCES

PU: DM124,000 (price+V) PT: DM116,250 (price+V) DM102,000 (PU base 50% value retained)

Positive Differentiation Value

Installation Cost Savings

MachineRoom-Less Savings

Total Economic Value

DM95,625 (PT base 50% value retained)

PH: DM93,000 (price+V) PU: DM80,000 (current price)

Reference Value

DM76,500 (PH base 50% value retained)

PT: DM75,000 (current price)

DM65,217 (cost) PH: DM60,000 (current price)

* Total retained portion of the savings is 50%

Assuming that switching costs and other negative differentiation values are close to zero, we get a total differentiation value of 33,000 DM. Because we are not the market leader and for the reasons detailed earlier, we recommend that KONE give the consumer at least 50% of the economic value (V) created by the MonoSpace product. This entire exercise leaves us with a price recommendation of DM 76,500, which sits between the PU and PT price range and results in a price ladder shown above.

Supporting Decisions

Because of the sales process in Germany (customer initiates contact and sales reps work one-on-one with the customer) and the complex web between benefits and the DMUs, it is critical that KONEs sales force be equipped with both the capacity and the necessary skills to complete the sale. KONEs sales force is currently outnumbered 5 to 1 and given the possibility that the competition may not accommodate the MonoSpace entry, the size of the sales force must increase to support the growth plan. Furthermore, it is important to align the market entry strategy with the time needed to build that sales force. The sales force must be trained to communicate the benefits to the relevant collaborators and DMUs. It is also important to get the necessary approvals to certify the MonoSpace for use in Germany. As shown in France, any delay in that approval can give the competition the opportunity to prepare a more effective retaliation effort. Furthermore, it could raise customer doubts about the reliability and safety of the MonoSpace design. The promotion strategy for MonoSpace is the last, key aspect of the entry strategy. The most effective way to communicate the value of the MonoSpace is through demonstration and a one-on-one sales

10

KONEs MonoSpace Launch in the German Market

2011

effort. The marketing effort must target each decision making group with its most valuable benefits. Also, the scale of the marketing effort must align well with the objective of a controlled neutral entry into a smaller segment and then slowly gain traction and expand as the target market grows. Therefore, when choosing to communicate the value proposition, it is more important to prioritize depth rather than breadth in the MonoSpace discussions.

Tactical Go-to-Market Recommendations

This section describes tactical actions that support our overall market launch strategy. Target audience: Communication of the benefits to each decision maker must be customized and focused on their individual benefits. It is important that these constituencies are not grouped together, and they must be presented material specific to their needs. Marketing Kit: As a result, we recommend a combination of sales-visits, targeted seminars, a media kit that includes a video CD, and advertisements in subscription based monthly trade journals. This effort can scale as KONE develops a larger team and a stronger foothold. Pilot projects/Live demonstrations: Because this is a new technology with a number of intangible and experiential benefits, it is important to have several installations around the country for demonstration purposes. These installations must be designed so that architects can appreciate the freedom they will have, owners can quantify the savings, and for contractors to experience the ease of installation. Supplier power concerns: Customers may have concerns about price gouging once they have designed their buildings for MonoSpace. Other concerns could arise over switching costs if KONE were to decide to suddenly discontinue the product line. KONE can demonstrate its commitment by offering contracts that offer price guarantees once building designs are finalized and penalty clauses if the MonoSpace line is discontinued. New technology: With any innovation, concerns about reliability may arise. KONE can offer customers warranties or bundles with a 1-year service contract included free of charge (KONEs estimated cost for maintenance is DM2,100 per year). Furthermore, KONE can emphasize its leadership position in other markets and its history in delivering reliable innovative product to reassure customers. Maintenance and Distribution: KONE must also undertake the proper capacity planning and build-up to guarantee capacity needs on both the new equipment and service side can be met.

11

KONEs MonoSpace Launch in the German Market

2011

Long Term Actions

Kone must continue to invest in technology development to both expand the capabilities of the EcoDisc technology and drive down costs. KONE should consider increasing its R&D expenditures (1.5% of revenues) to close the spending gap with the market leaders. This will enable KONE to maintain its technology lead and extend a high end EcoDisc solution higher up the price/performance line. Cost reductions will also enable KONE to sell cost competitive low end EcoDisc solutions closer to the PH segment. In the future as this product line gains breadth, further market segmentation can transition MonoSpace products into a far reaching product line that completely spans the low to medium range segments. In addition, as it grows its technological and organization capabilities, KONE should devise entry plans in the fast growing markets in Asia.

12

KONEs MonoSpace Launch in the German Market

2011

Appendix: Supporting Calculations

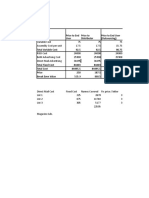

-Exhibit 1Computations for key figures used in pricing the MonoSpace

Annual savings Fuse cost (PH) Fuse cost (GT) - Fuse cost (Mono) = Fuse Savings (Mono/GT) + Energy savings (FF5000) = Total annual savings MonoSpace cost PH selling price Discount PH cost (DM) = MonoSpace cost Total installation cost savings (DM) Equipment cost Total costs (2x Equip) Machine room cost Saving = 5% of install cost = Total installation cost savings MonoSpace pricing guide (DM) Elevator current prices Retained value of savings MonoSpace price Maintenance service cost (DM) Total number of serviced units Total Revenue % of revenue (service) % of service (maintenance) Avg. Service contract value (annual) Profit margin (based on Germany) Cost of maintenance contract Contribution Margin MonoSpace price - MonoSpace cost = Contribution margin per unit Contribution margin percent Promotion costs Sales visit (4 visits / week ) Video conversion Video distribution (1000 units) Seminar / with Demo (1 per month) Trade press (monthly journal, 1 per month) Total promotion costs DM USD $1,000 $500 $38 $463 $1,000 $1,463 USD

2,091 DM 60,000 65,217 65,217 65,217 PH 60,000 120,000 30,000 3,000 33,000 PH 60000 16500 76500 DM 425,000 2,200,000,000 1,364,000,000 1,063,920,000 2,503 16.1% 2,100 DM 76,500.00 65,217.39 11,282.61 17.3% DM 100,000 20,000 5,000 120,000 19,200 264,200

8.0%

$13,043 PT 75,000 150,000 37,500 3,750 41,250 PT 75000 20625 95625 USD PU 80,000 160,000 40,000 4,000 44,000 PU 80000 22000 102000

25.0% 5.0%

50.0%

62.0% 78.0%

$1,469

Notes: Maintenance service cost was computed to be 3% of the selling price on average based on the revenue generated, profit margins figures and the number of elevators under contract. This is slightly different from the 5% mentioned in the case

13

KONEs MonoSpace Launch in the German Market

2011

-Exhibit 2MonoSpace price comparison across various markets

KONE 1996 (in local currency) Netherlands France United Kingdom Germany PH (Hydraulic) PT (Traction) PU (Traction) MonoSpace % Premium (Min) % Premium (Max) 65,000 62,000 68,000 69,000 1.47% 11.29% 150,000 180,000 20.00% 20.00% 15,800 30,000 30,750 2.50% 94.62% 60,000 75,000 80,000 76,500 -4.38% 27.50%

DG FF Pounds DM

KONE 1996 (in $) Netherlands France United Kingdom Germany

PH (Hydraulic) PT (Traction) PU (Traction) MonoSpace % Premium (Min) % Premium (Max) 40,625 38,750 42,500 43,125 1.47% 11.29% 30,000 0 36,000 20.00% 20.00% 24,308 46,154 0 47,308 2.50% 94.62% 41958 52448 55944 53497 -4.37% 28%

14

KONEs MonoSpace Launch in the German Market

2011

-Exhibit 3German Market demand forecast and KONEs projected profitability

(KONE is retaining 50% of value created; result is +3% SOM in 1st year and +1.5% thereafter)

Demand forecast (units) Low Rise (74% of market) GT (40% of LR) PU (66.6% of GT) PT (33.3% of GT) KONE's market share At current market share PU PT GT total Hydraulic total Assumptions levers Increase in Market Share - Annual Value retained

74.0% 40.0% 66.7% 33.3%

1996 11,126 4,450 2,967 1,483 1996 1,024 20 61 82 942

1997 10,782 4,313 2,875 1,438 1997 992 20 60 79 913

1998 10,438 4,175 2,783 1,392 1998 960 19 58 77 883

1999 10,094 4,037 2,692 1,346 1999 929 19 56 74 854

2000 9,750 3,900 2,600 1,300 2000 897 18 54 72 825

9.2% 2.0% 6.0%

3.0% 50.0%

Profitability w/ MonoSpace - DM Increased share Unit contribution margin Promotion - free service cost Total profit from equipment sale Maintenance profits (80% share) Communication costs Total profit (DM)

16.0%

3.0% 1996 334 11,283 (2,100) 3,763,775 0 (264,200) 3,499,575

4.5% 1997 485 11,283 0 5,474,107 264,057 (264,200) 5,473,964

6.0% 1998 626 11,283 0 7,065,869 465,983 (264,200) 7,267,652

7.5% 1999 757 11,283 0 8,541,160 710,069 (264,200) 8,987,029

9.0% 2000 877 11,283 0 9,899,981 992,987 (264,200) 10,628,769

MonoSpace Price Maximum value price (PH base) Discounted price (PH base) Premium over PU Premium over PT Premium over PH

USD $65,035 $53,497 (4.4%) 2.0% 27.5%

DM 93,000 76,500

Notes: In 1996, we will offer 1-year service for free In 1997 and later years, we will resume normal service offerings for the MonoSpace Maintenance has a 16% profit margin, and we are only servicing 80% of the elevators sold (20% is serviced by local contractors)

15

KONEs MonoSpace Launch in the German Market

2011

-Exhibit 4Sensitivity Analysis Profitability f (SOM)

(SOM will change with the portion of value shared with customers) [40% to 60% retained value @ 1% to 3% SOM]

Y1996 1% 2% 3% Y1997 1% 2% 3% Y1998 1% 2% 3% Y1999 1% 2% 3% Y2000 1% 2% 3%

40% 1,356,146.16 2,978,592.62 4,601,039.08 40% 2,182,220.53 4,628,641.05 7,075,061.58 40% 2,935,305.49 6,134,810.98 9,334,316.47 40% 3,652,265.14 7,568,730.29 11,485,195.43 40% 4,331,990.01 8,928,180.02 13,524,370.03

50% 988,991.46 2,244,283.22 3,499,574.98 50% 1,648,521.43 3,561,242.85 5,473,964.28 50% 2,246,417.29 4,757,034.58 7,267,651.87 50% 2,819,543.14 5,903,286.29 8,987,029.43 50% 3,366,789.51 6,997,779.02 10,628,768.53

60% 621,836.76 1,509,973.82 2,398,110.88 60% 1,114,822.33 2,493,844.65 3,872,866.98 60% 1,557,529.09 3,379,258.18 5,200,987.27 60% 1,986,821.14 4,237,842.29 6,488,863.43 60% 2,401,589.01 5,067,378.02 7,733,167.03

16

KONEs MonoSpace Launch in the German Market

2011

-Exhibit 5Profitability forecast based on different value retention percentages

Millions (DM)

9.00 8.00 7.00 6.00 5.00

4.00

3.00 2.00 1.00 0.00 60% retained

50% retained

1996 1,356,146.16 2,244,283.22 2,398,110.88

1997 2,182,220.53 3,561,242.85 3,872,866.98

1998 2,935,305.49 4,757,034.58 5,200,987.27

1999 3,652,265.14 5,903,286.29 6,488,863.43

2000 4,331,990.01 6,997,779.02 7,733,167.03

40% retained

17

You might also like

- Kone Case AnalysisDocument4 pagesKone Case AnalysisUmesh SonawaneNo ratings yet

- KONE Case Analysis - 18021141055Document6 pagesKONE Case Analysis - 18021141055meghanaNo ratings yet

- Kone ElevatorsDocument2 pagesKone Elevatorslordavenger0% (1)

- Harvard Business School Kone The MonoSpace Launch in Germany (R)Document3 pagesHarvard Business School Kone The MonoSpace Launch in Germany (R)pijathiNo ratings yet

- KoneDocument3 pagesKonemansie139No ratings yet

- Kone Case AnalysisDocument6 pagesKone Case AnalysisNikit Tyagi50% (2)

- Case Analysis Kone MonospaceDocument2 pagesCase Analysis Kone Monospacesameerrd100% (1)

- Kone Case AnalysisDocument7 pagesKone Case AnalysisPaskalis Sergius Noeng0% (2)

- Kone CaseDocument6 pagesKone CaseSachin SuryavanshiNo ratings yet

- Kone MonospaceDocument11 pagesKone MonospacekarsocoolNo ratings yet

- Kone Case StudyDocument10 pagesKone Case StudyRajib Hasan100% (4)

- Marketing PlanDocument21 pagesMarketing PlanBianca van Niekerk100% (1)

- Assignment 1 - B2B MarketingDocument4 pagesAssignment 1 - B2B MarketingNik100% (1)

- Kone:: Written Analysis of The CaseDocument5 pagesKone:: Written Analysis of The CaseGoenka Vicky100% (1)

- KONE CaseDocument10 pagesKONE CaseAnkit GargNo ratings yet

- Harvard Business School Kone The MonoSpace Launch in Germany RDocument3 pagesHarvard Business School Kone The MonoSpace Launch in Germany RmichaelNo ratings yet

- Mono Space 2Document12 pagesMono Space 2Cheryl Kang100% (1)

- KONEDocument14 pagesKONEAlok PokharnaNo ratings yet

- KOneDocument13 pagesKOnevijaygopal2100% (2)

- LoctiteDocument19 pagesLoctiteAbhi_The_RockstarNo ratings yet

- Otis Case StudyDocument7 pagesOtis Case StudyWarren VanName100% (1)

- Uniglobe Case StudyDocument7 pagesUniglobe Case StudyHarish G RautNo ratings yet

- Otis Elevator Case Anaysis and SummaryDocument4 pagesOtis Elevator Case Anaysis and SummaryVaibhav_Bunty_3971100% (2)

- Loctite Case StatsDocument8 pagesLoctite Case StatsBharat SinghNo ratings yet

- Case MethodDocument10 pagesCase MethodEka Moses MarpaungNo ratings yet

- LRDocument14 pagesLRasaNo ratings yet

- SchindlerDocument7 pagesSchindlerShaina DewanNo ratings yet

- Loctite International Case Analysis - Group 1Document3 pagesLoctite International Case Analysis - Group 1Subhrodeep Das0% (1)

- Respuestas Amore PacificDocument7 pagesRespuestas Amore Pacificlaura rNo ratings yet

- Ge Healthcare India (B)Document6 pagesGe Healthcare India (B)Rahul SethiNo ratings yet

- PV Technologies, Inc.: Were They Asleep at The Switch?Document12 pagesPV Technologies, Inc.: Were They Asleep at The Switch?Sumedh Bhagwat0% (1)

- Dendrite InternationalDocument9 pagesDendrite InternationalSaurabh Srivastava0% (1)

- OtisDocument18 pagesOtisharpreetbawa0% (1)

- Group 6 - IMC Assignment Lipton BriskDocument6 pagesGroup 6 - IMC Assignment Lipton BriskSpandanNandaNo ratings yet

- B2B - Group 3 - Jackson Case StudyDocument5 pagesB2B - Group 3 - Jackson Case Studyriya agrawallaNo ratings yet

- Otis Elevator - IT Case AnalysisDocument3 pagesOtis Elevator - IT Case AnalysisRishi Kothari100% (2)

- Dell Computers: Field Service For Corporate Clients (A) : Group Number: 7Document4 pagesDell Computers: Field Service For Corporate Clients (A) : Group Number: 7someone specialNo ratings yet

- Grp5 SecB FormPrintDocument4 pagesGrp5 SecB FormPrintshubhamagrawal1994100% (3)

- Loctite CorporationDocument7 pagesLoctite Corporationhanuman2450% (8)

- Dendrite InternationalDocument9 pagesDendrite InternationalAbhishek VermaNo ratings yet

- Loctite-Corporation Mid TermDocument16 pagesLoctite-Corporation Mid TermPreeti SoniNo ratings yet

- HCL TechnologiesDocument4 pagesHCL Technologiesashwarya yagnikNo ratings yet

- IMC - Benecol - Sec B - Group 11Document11 pagesIMC - Benecol - Sec B - Group 11MOHD SHAHWAZ 21No ratings yet

- Interface Raise: - Raising The Bar in Sustainability Consulting Group 2IDocument10 pagesInterface Raise: - Raising The Bar in Sustainability Consulting Group 2IRishabh KothariNo ratings yet

- Dell Computers: Field Service For Corporate Clients: Group - 8Document6 pagesDell Computers: Field Service For Corporate Clients: Group - 8satyander malwalNo ratings yet

- Dendrite InternationalDocument6 pagesDendrite InternationalRajan MishraNo ratings yet

- Dominion Motors & Controls, LTDDocument7 pagesDominion Motors & Controls, LTDMahnoor MaalikNo ratings yet

- Giovanni Case SlidesDocument20 pagesGiovanni Case SlidesManishaNo ratings yet

- Business To Business Marketing Dendrite International: Presentation By: Group No-5Document9 pagesBusiness To Business Marketing Dendrite International: Presentation By: Group No-5Shalom SamuelNo ratings yet

- Sparsh Nephrocare - IMC Interim ReportDocument11 pagesSparsh Nephrocare - IMC Interim ReportSamyak RajNo ratings yet

- PGP 21 198 SapDocument2 pagesPGP 21 198 SapSonaliCaffreyNo ratings yet

- Business To Business Marketing: Section - A Group No. - 08Document2 pagesBusiness To Business Marketing: Section - A Group No. - 08Nirosha NagarajNo ratings yet

- b2b Marketing Case 8 KONE - 0002Document20 pagesb2b Marketing Case 8 KONE - 0002Sab IneNo ratings yet

- NTT DoCoMoDocument16 pagesNTT DoCoMoShubham GuptaNo ratings yet

- Deloitte and Touche Consulting Group (SKS)Document6 pagesDeloitte and Touche Consulting Group (SKS)Akash KumarNo ratings yet

- Business MarketingDocument17 pagesBusiness MarketingSyed D Kings'No ratings yet

- Kone Case StudyDocument10 pagesKone Case StudyTarun GargNo ratings yet

- Kone - The Monospace Launch: YOU' I'Document7 pagesKone - The Monospace Launch: YOU' I'Metin AğayaNo ratings yet

- Group 7: Section-Y PGDM-2Document10 pagesGroup 7: Section-Y PGDM-2AdilNo ratings yet

- b2b Kone Case StudyDocument2 pagesb2b Kone Case StudyAmod ApastambNo ratings yet

- Manfredo Tafuri There Is No Criticism Just HistoryDocument6 pagesManfredo Tafuri There Is No Criticism Just HistoryPedro FelizesNo ratings yet

- Brief For MHADA Plot Development in MumbaiDocument17 pagesBrief For MHADA Plot Development in Mumbairajendrajsh62No ratings yet

- What Is Architectural ResearchDocument6 pagesWhat Is Architectural ResearchFanel ContrerasNo ratings yet

- Guidelines On Design For Safety in Buildings and StructuresDocument46 pagesGuidelines On Design For Safety in Buildings and StructuresFrank StephensNo ratings yet

- Hotel Facility Design and Architectural ConstructionDocument5 pagesHotel Facility Design and Architectural ConstructionMark Gella Delfin75% (4)

- Essential Guide Archi PDFDocument38 pagesEssential Guide Archi PDFb100% (1)

- Case StudyDocument33 pagesCase StudyMuhammad HaroonNo ratings yet

- Question Bank - SAR 1501-Professional Practice and Ethics - IDocument5 pagesQuestion Bank - SAR 1501-Professional Practice and Ethics - IJuvilasri Vignesh NKNo ratings yet

- Landscape Furniture Design: Project # 1Document3 pagesLandscape Furniture Design: Project # 1SAMRAH IQBALNo ratings yet

- Suman Chanda CV Oct 23Document3 pagesSuman Chanda CV Oct 23Suman Sudhangsu ChandaNo ratings yet

- Principal Cloud ArchitectDocument2 pagesPrincipal Cloud Architectaustinfru7No ratings yet

- Arjen Oosterman, Ole Bouman, Rem Koolhaas, Mark Wigley, Jeffrey Inaba - Volume 17 - Content Management (Vol 17) (2008) PDFDocument160 pagesArjen Oosterman, Ole Bouman, Rem Koolhaas, Mark Wigley, Jeffrey Inaba - Volume 17 - Content Management (Vol 17) (2008) PDFJosé Cervantes GuerreroNo ratings yet

- Adf19 03 PDFDocument100 pagesAdf19 03 PDFpamela4122No ratings yet

- Expanding Architectural Practice To Advance Social Justice Social Architecture Creates Equitable ShelterDocument166 pagesExpanding Architectural Practice To Advance Social Justice Social Architecture Creates Equitable ShelterVictra JuliiNo ratings yet

- Toaz - Info Community Architecture PRDocument15 pagesToaz - Info Community Architecture PRRodelito GaroboNo ratings yet

- Basic Elements of Landscape Architectural Design - MaxawYDocument318 pagesBasic Elements of Landscape Architectural Design - MaxawYAshley MutaiNo ratings yet

- BrochureDocument29 pagesBrochurechetnaNo ratings yet

- Services & Scope of Work of An ArchitectDocument6 pagesServices & Scope of Work of An ArchitectIVYMARIE BELCHEZNo ratings yet

- The Architects Guide To Residential Design (Malone, Michael James) (Z-Library)Document408 pagesThe Architects Guide To Residential Design (Malone, Michael James) (Z-Library)Arch. KhantSheinNo ratings yet

- Devi Balika & Kynsey SrilankaDocument205 pagesDevi Balika & Kynsey SrilankaGaurav TanwerNo ratings yet

- Building Information Modeling in Sri LankaDocument29 pagesBuilding Information Modeling in Sri LankaYasu ApzNo ratings yet

- Rib A Code of Professional ConductDocument8 pagesRib A Code of Professional ConductOsbert De CostaNo ratings yet

- It HubDocument6 pagesIt HubArvin CelizNo ratings yet

- EPM PM20 - Project Completion and HandoverDocument19 pagesEPM PM20 - Project Completion and HandoverZzzdddNo ratings yet

- Cartea PrestigeDocument73 pagesCartea PrestigeAndra DumitrescuNo ratings yet

- Atif CV (Architect) PKDocument2 pagesAtif CV (Architect) PKFahad0% (1)

- Architecture of DeceitDocument7 pagesArchitecture of DeceitLudwig Gericke100% (1)

- Computer Applications in ArchitectureDocument21 pagesComputer Applications in ArchitecturePramod M ChauguleNo ratings yet

- OSCA-AOS Transition Plan - V2Document11 pagesOSCA-AOS Transition Plan - V2Alok KhuntiaNo ratings yet

- COVERDocument70 pagesCOVERkandy saidNo ratings yet

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4.5 out of 5 stars4.5/5 (3)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthFrom EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthRating: 4.5 out of 5 stars4.5/5 (1027)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (90)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Having It All: Achieving Your Life's Goals and DreamsFrom EverandHaving It All: Achieving Your Life's Goals and DreamsRating: 4.5 out of 5 stars4.5/5 (65)

- Every Tool's a Hammer: Life Is What You Make ItFrom EverandEvery Tool's a Hammer: Life Is What You Make ItRating: 4.5 out of 5 stars4.5/5 (249)

- Entrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveFrom EverandEntrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveRating: 4.5 out of 5 stars4.5/5 (89)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizFrom EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizRating: 4.5 out of 5 stars4.5/5 (112)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- Summary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoFrom EverandSummary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoRating: 4 out of 5 stars4/5 (1)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachFrom EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachRating: 3.5 out of 5 stars3.5/5 (6)

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberFrom EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberRating: 5 out of 5 stars5/5 (39)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyFrom EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyRating: 5 out of 5 stars5/5 (22)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (802)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderFrom EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderRating: 4.5 out of 5 stars4.5/5 (60)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (26)

- Built to Serve: Find Your Purpose and Become the Leader You Were Born to BeFrom EverandBuilt to Serve: Find Your Purpose and Become the Leader You Were Born to BeRating: 5 out of 5 stars5/5 (25)

- The Bitcoin Standard: The Decentralized Alternative to Central BankingFrom EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingRating: 4.5 out of 5 stars4.5/5 (41)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (58)

- Be Fearless: 5 Principles for a Life of Breakthroughs and PurposeFrom EverandBe Fearless: 5 Principles for a Life of Breakthroughs and PurposeRating: 4 out of 5 stars4/5 (49)