Professional Documents

Culture Documents

KP2Q2011

Uploaded by

Kelvingrove Partners, LLCOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KP2Q2011

Uploaded by

Kelvingrove Partners, LLCCopyright:

Available Formats

July 28, 2011

Dear Partner, Kelvingrove Fund, L.P. returned 0.30% net of fees for the second quarter of 2011 and is now up 6.48% year to date through June 30, 2011. This compares to a year to date return of 0.75% for the Credit Suisse Tremont Long/Short Equity Index, 1.23% for the BarclayHedge Long/Short Equity Index and 6.02% for the S&P 500. We ended the quarter with gross exposure of 149% and net exposure of 54%. Before we begin, we would like to apologize for the tardiness of this communication, which was completed about a week later than normal. Sometimes writing a quarterly letter can be difficult. The most obvious of those times would be when the funds performance doesnt quite measure up to our expectations. Almost as difficult, but in a different way is when we exceed our objectives. This is not due to some unseen pressure to appear humble or modest, but rather due to the fact that even in the best periods we can always find something we didnt do quite right. This letter was a struggle to produce, but not for either of the reasons listed above. Our performance was good, could have been better, as it always can. The difficulty in putting pen to paper comes from the extraordinary geopolitical events overtaking any micro or stock-specific commentary. We are referring to the ongoing sovereign debt crisis roiling the Eurozone and the debt ceiling brouhaha in Washington. The discussion we have had on these matters and what it might mean for the fund, equities in general, the dollar, the economy, has seemed at times endless and devoid of any productive conclusions. Kabuki Theatre Regarding the debt limit in the US, we are torn between two equally plausible scenarios. The first is the most benign, but is also the most cynical. It basically dismisses all of the posturing and histrionics as just another example of bad political theatre. The crisis is really just a manufactured one. To put a rather fine point on it, the US is an autonomous and monopolistic supplier of its own currency. Its debts are denominated in said currency. There are no constrains in this equation to limit the availability of money. We will only run out of money if we decide to. This does not mean the reckless issuance of currency is without cost; a debased fiat currency will be ravaged by inflation if some restraint is not exercised. But the notion that default is something that could be tripped or imposed upon the nation because of some procedural sin is ludicrous.

825 Third Avenue, 33rd Floor, New York, NY 10022 T: 212 488 1776 F: 212 488 1783 www.kelvingrove.com

So, in keeping with our Kabuki theatre metaphor, the Worlds Greatest Deliberative Body will make a great show of working through the weekend, and announce (in time for the Sunday morning talkies) that we have finally, after great leadership/compromise, arrived at a deal. With that the uncertainty hanging over the market results in an immediate jump in the S&P futures. After that we can go back to contemplating the next brick in the road back from our balance sheet recession. In short, this crisis will prove to be much ado about very little. Or Or, we are witnesses to the final clash of two irreconcilable and ideologically driven factions within our government. The initial casualty, of course, will be the nations credit rating. Forgetting for a moment whether the AAA rating is even justified (how can anything truly worthy of an AAA rating be so in the face of numerous not-so-subtle reminders by the rating agencies that failure to do this or that will result in a possible downgrade? Doesnt the warning in itself undermine the AAA appellation?); a downgrade, should it happen, is a real issue. As one of our old professors used to say, its not the geometry that gets you, its the calculus. Any adjustment to the risk free asset will not occur without significant movement and re-pricing of all other asset classes. To say that the territory beyond this trip wire is uncharted is a not hyperbole. The possibility of events cascading out of control could be quite real. Obviously, for all its distastefulness, we are hopeful of an outcome along the lines of the first scenario. As for the political scorekeeping, we could care less that a grand bargain, however struck, can accrue to the benefit of one party versus the other. In other words, we dont care who wins, we just want an end to the game. We cannot say we are looking forward to seeing one of these well coiffed empty suits on television this Sunday morning mugging for the camera thinking himself the reincarnation of John Adams while an obedient press hails him a statesman but we will take it if it is the price of a deal. About the Quarter We ended with a flat quarter net of fees, somewhat disappointing but still outperforming our benchmarks. Before fees, our long book was flat and our shorts were up close to 1%. While some long positions did well (Electronic Arts, IGT, Symantec), we were hurt by some of the large cap names (Cisco, Google, Adobe, Yahoo) and a few smaller names (Harris Corp., SGI and Mentor Graphics). The flat performance of our longs has not forced any change in our thinking or our major positions. Value investing often means waiting for a change agent to occur, or sometimes waiting for the market to recognize it. Electronic Arts was our best performer in the quarter; we owned the stock for over a year with flat performance, adding more back in January, anticipating a larger focus on its digital revenues. This finally happened the last few months. Ditto for Symantec, still our largest position and as of this writing just reporting another strong quarter. We owned the stock for about a year before it started gaining traction, and has steadily built up credibility over the past 12 months.

825 Third Avenue, 33rd Floor, New York, NY 10022 T: 212 488 1776 F: 212 488 1783 www.kelvingrove.com

We expect job cuts and a focus on its core business to benefit Cisco. And Mentor tailed off at the end of the quarter when the Carl Icahn bid fell off the front pages, but we still expect a transaction to occur in the near future. Sometimes, however, patience can be extraordinarily painful. Our Yahoo investment came under pressure as the companys management was caught seemingly flat footed in trying to explain how the chief executive at one of its investment properties was able to transfer one of the more interesting and valuable assets of that firm to an entity controlled and owned by him. It is a very good question of course, and not the sort of thing you would wish to see being discussed on the tape and comfortably after the fact. This news has been met by promises on the part of Yahoo to arrive at or negotiate an equitable settlement to this fiasco. Regardless of the resolution, this episode is either evidence of poor board oversight, or exhibit A in why joint ventures and investments in China are nothing more than elaborate fictions. Perhaps it is both; a position that, upon reflection, doesnt seem all that outrageous. That we must view these events through this prism is unfortunate. But far from being an incontrovertible signal to exit the position, we see it as moving Yahoo closer to its end-game, which is either a break-up of the business or an outright sale to a strategic buyer. Ms. Bartz will not be able to ignore or dismiss any serious offer, should one materialize, with one of her trademarked vulgarisms. Oftentimes the danger in making this sort of investment (where the assets are valuable but management invents new ways to bleed value) is the absence of anything specific or objectively damning on the part of managements or the Boards stewardship of the enterprise. That particular roadblock has been cleared again and again. On the short side, we were helped by LPS, RIMM, and a few others. Our positions in the mobile computing market continued to work quite well even if we did find occasion to profitably close out Nokia, one of our longer term positions (more on this below). Our aerospace and defense names worked against us in the quarter on both the long and the short side. In the quarter we closed out, at a modest loss, one of our short positions in this space as an activist investor began pressing this company to remedy its operational and structural deficiencies. We found ourselves in complete agreement with this activist, which was the basis of our short position. It was our view that the management team probably sees these deficiencies too, but had demonstrated little concern and even less motivation to undertake any efforts to dramatically improve the situation. With an activist involved that may change. Finally, our investments in the specialty retail sector were a net positive in the quarter. The fact that these positions are exclusively on the short side was also beneficial. The Pain is Inevitable; Suffering Optional From previous communications you know that we have been skeptical of efforts by Nokia and Research in Motion to remain relevant in the markets they defined and dominated until just recently. Over the past few years these have been difficult positions to stake out and defend. They were made all the more harrowing by the paucity of headline worthy evidence that either of these two franchises was struggling.

825 Third Avenue, 33rd Floor, New York, NY 10022 T: 212 488 1776 F: 212 488 1783 www.kelvingrove.com

By the time the halfway point of 2011 was reached, everything had changed. Today the take on both couldnt be more different. In fact, now it is unusual to come upon news items and analysis that do not depict each of them as being in the grip of a deep crisis. Rehashing our respective views on these names is not important now, beyond saying that the roads ahead for each are likely to be more treacherous than those most recently traveled. There is a difference, however, in how we are viewing the possibility of a reversal of fortune for these businesses. To understand this, we will quickly review the recent strategic moves that each has undertaken (or intends to undertake) in the hopes of stabilizing its businesses. Burning Platforms and Other Pleasantries Though Nokias recently-installed CEO Stephen Elop has been roundly criticized over his decision to completely overhaul the prior managements strategy, we think his reasoning was remarkably clear and his actions justified. In fact, over the medium term this strategy (aided with near flawless execution) may prove to have been the right thing to do. Over the short term, however, Nokias business has and will likely continue to suffer mightily for this change. But given what we knew about the strategy he inherited we are hard pressed to say what else he might have done. And while some might take issue with his Burning Platform memo/metaphor we have heard little which holds prior management accountable for the technological dead ends they were willing to bet the future of the company upon. Say what you will about the allusions used to make the argument Nokia was most certainly facing a Hobbesian choice. Of the equally unattractive choices, Nokia chose the one that offered the best chance of survival. Co-Chief Executives and other Absurdities Speaking of suffering, we come again to Research in Motion. In stark contrast to Nokias clean break, RIMM choose an addlepated path towards an increasingly uncertain tomorrow. One that, if we are correct, will deprive it of developers, then carriers and other sponsors, and ultimately users by the time it reaches its destination. RIMM is attempting to hurry all of these ecosystem partners across several generations of incompatible code streams. This will not end well. First, developers will not spend limited resources on platforms destined for the dust heap. This is especially the case when there are two perfectly viable and thriving platforms already at critical mass. And with a third on the horizon championed by a wealthy sponsor (Microsoft) that has repeatedly demonstrated a propensity to fund strategic initiatives indefinitely (see Bing, XBox, etc.), what on earth would a developer find appealing about coding for a platform that RIMM has explicitly declared dead by 2012? Second, what sort of value does the carrier get for continuing to support a dated and aging lineup of electronics with limited appeal to consumers? Even if RIMM were to create a compelling handset, its numerous deficiencies (limited developer attention, weak apps market, etc.) are likely to weigh more heavily in the arithmetic of this important audience (carriers). Finally, the promise of some grand convergence is one of the oldest deceits in technology. Let us put this down clearly, since it took us a few iterations in the real world to finally and truly grasp: code streams do not merge. Ever. The hope that investments by RIMM and its third party developers can be dragged

825 Third Avenue, 33rd Floor, New York, NY 10022 T: 212 488 1776 F: 212 488 1783 www.kelvingrove.com

from the coding ghetto of the soon to be mothballed Blackberry OS and be easily repurposed into QNX is a dangerous delusion. We have traded around our RIMM position in an effort to minimize counter trend volatility in this name. Nonetheless, we remain committed in our belief that RIMM remains a core position in our short portfolio. The contrast here with Nokia is rather stark. Our discussions surrounding Nokia are increasingly focused on a potential point of entry for a long investment. Operationally, Nokia remains on treacherous ground. But we long ago learned that valuable franchises with a smart management teams making the correct strategic moves are not the sort of business you want to make a habit of betting against. Its corporate direction and thinking is clear; its strategy knowable; its path difficult. By comparison, RIMMs executive suite appears to be rife with factionalism and political intrigue. Its top managers increasingly look like courtiers making appeals to whichever Chief Executive shows them favor. Petitions that have gone unheeded have surfaced in the media, a very troubling sign. Despite the turmoil of the last several weeks, we remain comfortable with our exposure and our positions. So far July has been tough, even with most of our portfolio companies having good earnings reports. We are using this period to add to our high conviction names and cover shorts where appropriate. As always, we appreciate your confidence and support. Respectfully,

Joseph Farley

Managing Member

Michael Wallace Managing Member

This letter does not constitute an investment recommendation or an offer to sell or a solicitation of an offer to purchase an interest in any security, including Kelvingrove Fund, LP (the Fund). Any such offer or solicitation shall be made only pursuant to the confidential offering memorandum for the Fund, which describes risks related to an investment therein and which qualifies in its entirety the information set forth herein. The current year returns and other financial information regarding the Fund presented in this letter are unaudited. An individual investors actual performance may differ from the performance presented as a result of characteristics attributable to the specific investment such as the timing of capital contributions and withdrawals, eligibility to participate in new issues profit and losses, and the payment of performance and management fees. Investment performance results are for illustrative purposes only and are not a guarantee of future performance. Results are time-weighted rates of return and reflect reinvestment of interest and other earnings, unless noted otherwise. Other performance calculation methods may produce different results. Past performance is not indicative of future results and may differ for different time periods.

825 Third Avenue, 33rd Floor, New York, NY 10022 T: 212 488 1776 F: 212 488 1783 www.kelvingrove.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Corporate Fraud AnalysisDocument39 pagesCorporate Fraud AnalysisAnonymous u6yR25kiobNo ratings yet

- A New Economic Framework Based On Islamic PrinciplesDocument163 pagesA New Economic Framework Based On Islamic PrinciplesHeidi FreeNo ratings yet

- Co250 F11Document169 pagesCo250 F11Aditya SridharNo ratings yet

- Rethinking The ChainDocument7 pagesRethinking The ChaindjumekenziNo ratings yet

- Section 80 Deduction TableDocument6 pagesSection 80 Deduction TablevineyNo ratings yet

- Saudi Cement Sector - Cementing The Future - 2023 ReportDocument39 pagesSaudi Cement Sector - Cementing The Future - 2023 Reportkhizar.zubairiNo ratings yet

- AREIT to list as Philippines' first REIT, eyes Teleperformance Cebu acquisitionDocument12 pagesAREIT to list as Philippines' first REIT, eyes Teleperformance Cebu acquisitionJajahinaNo ratings yet

- Draft Offer Letter PAS 4Document12 pagesDraft Offer Letter PAS 4binodgstpNo ratings yet

- International Financial ManagementDocument20 pagesInternational Financial ManagementKnt Nallasamy GounderNo ratings yet

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- Financial Statement Analysis ProjectDocument15 pagesFinancial Statement Analysis ProjectAnonymous wcE2ABquENo ratings yet

- The Geopolitics of Mexico - A Mountain Fortress Besieged - StratforDocument13 pagesThe Geopolitics of Mexico - A Mountain Fortress Besieged - StratforAbe Schreier100% (1)

- LendIt PDFDocument4 pagesLendIt PDFLuis GNo ratings yet

- Dokumen - Tips - Standard Settlement Instructions Ssi Ssi Last Version 150617xlsxpdfeuroclearDocument2 pagesDokumen - Tips - Standard Settlement Instructions Ssi Ssi Last Version 150617xlsxpdfeuroclearZou CongjunNo ratings yet

- AAVE (EthLend) WhitepaperDocument56 pagesAAVE (EthLend) WhitepaperSwitchainNo ratings yet

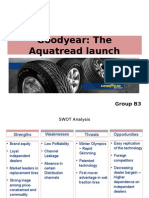

- GoodyearDocument10 pagesGoodyearMiteshwar SinghNo ratings yet

- VI SEM TPA-Unit IV-Law Relating To Transfer of Intangible Properties PDFDocument10 pagesVI SEM TPA-Unit IV-Law Relating To Transfer of Intangible Properties PDFSakshi MehraNo ratings yet

- Sfac 6Document91 pagesSfac 6Raymond Parmonangan Hutahaean100% (1)

- The Complete Guide To Trading PDFDocument116 pagesThe Complete Guide To Trading PDFvkverma352No ratings yet

- PitchBook For Corporate Development - EbookDocument20 pagesPitchBook For Corporate Development - EbookHun Yao ChongNo ratings yet

- How To Assess Nonprofit Financial PeformanceDocument84 pagesHow To Assess Nonprofit Financial PeformanceRay Brooks100% (1)

- Chapter 3: Management of Working Capital 3.0 Current Asset ManagementDocument15 pagesChapter 3: Management of Working Capital 3.0 Current Asset Managementraqib ayubNo ratings yet

- Analyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachDocument6 pagesAnalyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachAshebirNo ratings yet

- RENAISSANCERE HOLDINGS LTD 10-K (Annual Reports) 2009-02-20Document207 pagesRENAISSANCERE HOLDINGS LTD 10-K (Annual Reports) 2009-02-20http://secwatch.comNo ratings yet

- Wellness Report by PWCDocument64 pagesWellness Report by PWCPranav Santurkar100% (1)

- Fidelity Overview of Factor InvestingDocument8 pagesFidelity Overview of Factor InvestingAndrew LeeNo ratings yet

- QA-05 Ratio-2 - QDocument31 pagesQA-05 Ratio-2 - Qlalit kumawatNo ratings yet

- PP Descriptives-FACRDocument11 pagesPP Descriptives-FACRMisbah IlyasNo ratings yet

- Examination About Investment 6Document2 pagesExamination About Investment 6BLACKPINKLisaRoseJisooJennieNo ratings yet

- Internship Report On: Financial Analysis of KDS Accessories LimitedDocument50 pagesInternship Report On: Financial Analysis of KDS Accessories Limitedshohagh kumar ghoshNo ratings yet