Professional Documents

Culture Documents

Kajian IE - WA Bank

Uploaded by

Vasant SriudomOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kajian IE - WA Bank

Uploaded by

Vasant SriudomCopyright:

Available Formats

P 4202 AUDITING IE-WA BANK

Background

IE-WA BANK (IEW) has the headquarters are in Damansara, Selangor and it has banking operations in 35 communities in Negeri Sembilan. It loan portfolio consist primary of agricultural loans, commercial loan, real estate loans to individual. Credit granting authority is headquarters an curtained loan officer have decision authority for small loans in their local area.

Because of IEWs strong control over bank loans, the team place high reliance on controls for example the control risk is assessed as low. Additional detail testing will only be perform if analytical procedure suggest interest income is materially misstated. The 2008 report interest income is RM 35,337,204 and the net income is RM 12,484,000. Misstatement if RM 525,000 is considered material.

To comparing the current year interest income and previous year interest income:-

Average loan volume x Weighted average interest rate

Hak Cipta Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

P 4202 AUDITING

Part A

[1] As part of the year - end audit and using the analytical procedure approach similar to last years audit (average loan volume multiplied by weighted average interest rate ), determine if IEW Banks interest income from loans reported at December 31, 2008 appears fairly stated. Do the result of the analytical procedure indicate that you accept 2008 interest income as reported?

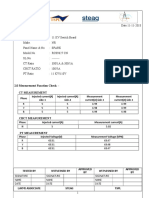

IEWs Loan Interest Analytical Procedure Updated for 2008 Agregate Loan Volume (or balance) as of Dec.31, 2007 Agregate Loan Volume as a December 31, 2008 Average Loan Volume (or volume) for 2008 Multiplied by Weighted Average Annual Interest Rate (2008) Computed 2008 Loan Interest Income 2008 Loan Interest Income per IEW Difference RM388,110,000 RM383,860,000 RM385,985,000 x 9.115% RM35,183,000 RM53,337,000 RM 154,000

Yes, because the difference value is not less then RM 525,000. So, that is not material.

Hak Cipta Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

P 4202 AUDITING [2] Based on the result of the analytical procedure, how likely is it that 2008 interest income is materially misstated?

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Definitely not Misstated

Definitely Misstated

154,000 525,000

X 100 = 29.33%

[3] Please indicate on the scale below your assessment of the strength (quality and sufficiency) of evidence by the interest income analytical procedure:

1 2 Extremely Weak/ Useless Evidence

6 7 Extremely Strong/ Removes all doubt

(525,000 - 154,000) X 7 = 4.95 525,000

Hak Cipta Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

P 4202 AUDITING

Part B

[1] Given the additional information provided in Part B ( i.e. quarterly information by loan type) , please determine if IEW Banks interest income from loans reported at December 31, 2008 appears fairly stated. Can you accept 2008 interest income as reported? For the Year 2008 First Quarter Average Loan Volume X Weight Average Interest Rate Expected Interest Income, First Quarter Second Quarter Average Loan Volume X Weight Average Interest Rate Expected Interest Income, Second Quarter Third Quarter Average Loan Volume X Weight Average Interest Rate Expected Interest Income, Third Quarter Fourth Quarter Average Loan Volume X Weight Average Interest Rate Expected Interest Income, Fourth Quarter Commercial and Agricultural Loans RM 267, 003,000 2.15% 5,741,000 Real Estate Loans RM 99,998,000 2.40% 2,400,000

RM 263,868,000 2.08% 5,488,000

RM101,200 2.35% 2,378,000

RM 264, 400,000 2.13% 5,632,000

RM 95, 608 2.35% 2,247,000

RM 266, 510,000 2.17% 5,783,000

RM 96,200 2.43% 2,338,000

Annual Expected Interest income by Loan Type Based on Quarterly Data RM 22,644,000 RM9,363,000 RM2,515,000 RM34,522,000

Computed Total Interest Income per Audit (RM22,644,000 + RM9,363,000 + RM2,515,000)

2008 Loan Interest Income per IEW Difference

RM 35,337,000 RM815,000

No, because the difference value more then RM525,000. So, that is material.

Hak Cipta Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

P 4202 AUDITING [2]Based on the result of the analytical procedure preformed in Part B, how likely do you think it is that 2008 interest income is materially misstated?

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Definitely not Misstated

Definitely Misstated

815,000 X 100 = 525,000

155%

[3] Please indicate on the scale below your assessment of the strength (quality and sufficiency) of evidence provided by the interest income analytical procedure:

1 2 Extremely Weak/ Useless Evidence

6 7 Extremely Strong/ Removes all Doubt

(525,000 + 815,000) 525,000

-3.87

Hak Cipta Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

P 4202 AUDITING

[4]Now reevaluate the first analytical procedure you performed (i.e. based only on average aggregate loan and interest averages). Using hindsight, please indicate on the scale below your assessment of the strength (quality and sufficiency) of evidence provided by that high level interest income analytical procedure:

6.46

Extremely Weak/ Useless Evidence

Extremely Strong/ Removes all Doubt

154,000 + 810,000 2 525,000 X 7 = 6.46

Conclusion : IEWs Loan Interest Analytical Procedure Updated for 2008, in Part A is not material because the difference value is less then RM525, 000. And Part B is material because the difference value is more then RM525,000.

Hak Cipta Sant Sahabat dan Kawan-Kawan. Dibenar untuk tujuan pembelajaran sahaja

You might also like

- Global Marketing MKT 4703Document2 pagesGlobal Marketing MKT 4703Farhan IsraqNo ratings yet

- Mrketing Assignment 2 - Netflix - 5!6!920190412180106Document6 pagesMrketing Assignment 2 - Netflix - 5!6!920190412180106DrMayank Ranjan SrivastavaNo ratings yet

- Chapter 5 AnswersDocument3 pagesChapter 5 Answersapi-4798026050% (1)

- Case StudiesDocument2 pagesCase StudiesKarishma Kiran100% (2)

- FranchisingDocument2 pagesFranchisingJoel Christian MascariñaNo ratings yet

- Supply Chain Answer KeyDocument7 pagesSupply Chain Answer KeyJoey Zahary GintingNo ratings yet

- 434 HW 2 SolDocument5 pages434 HW 2 SolAnhTuan NguyenHuuNo ratings yet

- Midterm Practice 2: Machining On A Machining On B Machining On CDocument3 pagesMidterm Practice 2: Machining On A Machining On B Machining On CraymondNo ratings yet

- Case Study 01Document1 pageCase Study 01Jonar Villaruel SiudadNo ratings yet

- HopDocument2 pagesHopMindy KennedyNo ratings yet

- Self-Assessment CHP 3Document2 pagesSelf-Assessment CHP 3Evi DamayantiNo ratings yet

- 09 Intro ERP Using GBI Slides HCM en v2.01Document19 pages09 Intro ERP Using GBI Slides HCM en v2.01Mahmoud HabeebNo ratings yet

- Employment Law - Test ReviewDocument27 pagesEmployment Law - Test ReviewN DNo ratings yet

- Case Study For HdbmsDocument5 pagesCase Study For HdbmsMohammed ABDO ALBAOMNo ratings yet

- Case 1 WalmartDocument2 pagesCase 1 Walmartijustateanapple100% (2)

- SCM Med TecDocument4 pagesSCM Med Tecsitinurzahrah100% (2)

- Chapter 5 NotesDocument4 pagesChapter 5 NotesAgithaNo ratings yet

- Answering Question Five Steps of A Typical OBDocument8 pagesAnswering Question Five Steps of A Typical OBapi-19846552No ratings yet

- Case Study Aplikasi E-CommerceDocument9 pagesCase Study Aplikasi E-Commercesukmariyah 93No ratings yet

- IM Ch05 Advanced Data Modeling Ed9Document20 pagesIM Ch05 Advanced Data Modeling Ed9msalmohaya33% (12)

- Week 3 Assignment 233Document1 pageWeek 3 Assignment 233Bắp RangNo ratings yet

- Answers by GRPDocument22 pagesAnswers by GRPAmiraNo ratings yet

- 1 What Did Arthur Andersen Contribute To The Enron DisasterDocument1 page1 What Did Arthur Andersen Contribute To The Enron DisasterAmit PandeyNo ratings yet

- Explain Particular Features of Organizational Behaviour Raised by This Case StudyDocument4 pagesExplain Particular Features of Organizational Behaviour Raised by This Case StudyAllisha Bowen100% (1)

- Muffler MagicDocument2 pagesMuffler MagicSodium Light100% (2)

- Session 6 AssignmentDocument2 pagesSession 6 Assignmentmarkcitiel0% (1)

- The Answer of 2nd Assignment Eco 104-EditDocument12 pagesThe Answer of 2nd Assignment Eco 104-EditWery Astuti100% (1)

- Assignment Three - Summer 2020Document5 pagesAssignment Three - Summer 2020Neeraj Kumar SinhaNo ratings yet

- Prestige Institute of Management and Research, Indore: AssignmentDocument6 pagesPrestige Institute of Management and Research, Indore: AssignmentPooja PandeyNo ratings yet

- Answers To Chapter 27 and 28 CasesDocument4 pagesAnswers To Chapter 27 and 28 CasesVic RabayaNo ratings yet

- Nestle-Organizational Behaviour With Refrence To 17 PointsDocument9 pagesNestle-Organizational Behaviour With Refrence To 17 PointsKhaWaja HamMadNo ratings yet

- Cis270 Chapter8 Inclass QuestionDocument1 pageCis270 Chapter8 Inclass QuestionLeon CaoNo ratings yet

- CaseDocument6 pagesCaseumarzNo ratings yet

- 10 Decision Areas of Operations Management: Google 'S Human Resource ManagementDocument2 pages10 Decision Areas of Operations Management: Google 'S Human Resource ManagementMian RehmanNo ratings yet

- Case Study - Week 6Document1 pageCase Study - Week 6Alexander Hernandez100% (1)

- Reinventing The Wheel at Apex Door CompanyDocument11 pagesReinventing The Wheel at Apex Door Companyjuzzy52100% (1)

- Chapter1 SolutionsDBDocument3 pagesChapter1 SolutionsDBapi-374334580% (5)

- Chapter 3Document4 pagesChapter 3titanchengNo ratings yet

- OHSU, Sony, Novartis, and OthersDocument8 pagesOHSU, Sony, Novartis, and OthersuppasnaNo ratings yet

- Johns 10e Irm ch09Document42 pagesJohns 10e Irm ch09Jacob WeiseNo ratings yet

- External Reconstruction DefinitionDocument3 pagesExternal Reconstruction DefinitionTushar All Rounder67% (3)

- CH 017Document19 pagesCH 017Andrea RobinsonNo ratings yet

- Chapter 1 & 2 OperationsDocument4 pagesChapter 1 & 2 OperationsQasim Mughal0% (1)

- Human Resources Strategy and Analysis - Case 2 - Carter Cleaning Company - The High-Performance Work SystemDocument1 pageHuman Resources Strategy and Analysis - Case 2 - Carter Cleaning Company - The High-Performance Work SystemSole NavarreteNo ratings yet

- Computerized Decision Making KevinDocument7 pagesComputerized Decision Making KevinKevinDennison100% (4)

- Question 4 OsDocument1 pageQuestion 4 OsfarahNo ratings yet

- 4th Sem HRM - 403. Employee SeparationDocument14 pages4th Sem HRM - 403. Employee SeparationRoshan Jha0% (1)

- Performance Management System at Attock Refinery Limited: Group 4 Team PlasterDocument15 pagesPerformance Management System at Attock Refinery Limited: Group 4 Team PlasterMaryum KasbatiNo ratings yet

- Carters Case Extra Credit HomeworkDocument2 pagesCarters Case Extra Credit HomeworkAnh MusicNo ratings yet

- Exercises Unit 14 Qam A1Document7 pagesExercises Unit 14 Qam A1Luis QuinonesNo ratings yet

- Case StudyDocument2 pagesCase StudyasadNo ratings yet

- Skills For Big DataDocument4 pagesSkills For Big DataErfanNo ratings yet

- Chapter 2 - Operation StrategyDocument10 pagesChapter 2 - Operation Strategyrajeevseth100% (1)

- Unit 6 Leverages PDFDocument21 pagesUnit 6 Leverages PDFreliableplacement67% (3)

- Sample Catherine Confectionary Write UpDocument3 pagesSample Catherine Confectionary Write Uparslan0989No ratings yet

- Chapter 2: Operations Strategy and CompetitivenessDocument3 pagesChapter 2: Operations Strategy and CompetitivenessMarie GonzalesNo ratings yet

- 190 - Purpose1Document3 pages190 - Purpose1Asma Durrani0% (1)

- L3 ACC 2008 S2 (M) (New)Document17 pagesL3 ACC 2008 S2 (M) (New)Fung Hui YingNo ratings yet

- FIN619 - Internship ReportDocument27 pagesFIN619 - Internship Reportmalik_saleem_akbarNo ratings yet

- Bod Suad 3Document1 pageBod Suad 3Vasant SriudomNo ratings yet

- Bod Suad 1Document17 pagesBod Suad 1Vasant SriudomNo ratings yet

- Bod Suad 4Document4 pagesBod Suad 4Vasant Sriudom0% (1)

- FA 4 Chapter 3 - Q3Document2 pagesFA 4 Chapter 3 - Q3Vasant SriudomNo ratings yet

- Notes Chapter 1 FA 3Document5 pagesNotes Chapter 1 FA 3Vasant SriudomNo ratings yet

- FA 4 Chapter 3 - Q1Document3 pagesFA 4 Chapter 3 - Q1Vasant SriudomNo ratings yet

- FA 4 Chapter 3 - Q4Document4 pagesFA 4 Chapter 3 - Q4Vasant SriudomNo ratings yet

- FA 4 Chapter 3 - Q2Document3 pagesFA 4 Chapter 3 - Q2Vasant SriudomNo ratings yet

- FA 4 Chapter 3 - Q3Document2 pagesFA 4 Chapter 3 - Q3Vasant SriudomNo ratings yet

- FA 4 Chapter 3 - Q2Document3 pagesFA 4 Chapter 3 - Q2Vasant SriudomNo ratings yet

- FA 4 Chapter 4 - Q2Document5 pagesFA 4 Chapter 4 - Q2Vasant SriudomNo ratings yet

- FA 4 Chapter 3 - Q1Document3 pagesFA 4 Chapter 3 - Q1Vasant SriudomNo ratings yet

- Notes Chapter 1 FA 3Document5 pagesNotes Chapter 1 FA 3Vasant SriudomNo ratings yet

- Soalan Assignment Tax Bab 7 Sem 6Document9 pagesSoalan Assignment Tax Bab 7 Sem 6Vasant SriudomNo ratings yet

- FA 4 Chapter 2 - Q3Document5 pagesFA 4 Chapter 2 - Q3Vasant SriudomNo ratings yet

- FA 4 Chapter 2 - Q4Document5 pagesFA 4 Chapter 2 - Q4Vasant SriudomNo ratings yet

- FA 4 Chapter 1 - AllDocument5 pagesFA 4 Chapter 1 - AllVasant SriudomNo ratings yet

- Full Assignment Tax RPGTDocument19 pagesFull Assignment Tax RPGTVasant SriudomNo ratings yet

- Introduction of Resume: 1 © Hak Milik Sant Sahabat Dan Kawan-Kawan. Dibenarkan Untuk Tujuan Pembelajaran SahajaDocument18 pagesIntroduction of Resume: 1 © Hak Milik Sant Sahabat Dan Kawan-Kawan. Dibenarkan Untuk Tujuan Pembelajaran SahajaVasant SriudomNo ratings yet

- Presentation Audit - Legal LiabilityDocument29 pagesPresentation Audit - Legal LiabilityVasant Sriudom100% (1)

- Soalan Presentation FA 3Document12 pagesSoalan Presentation FA 3Vasant SriudomNo ratings yet

- Investigation Report 1Document3 pagesInvestigation Report 1Vasant SriudomNo ratings yet

- Proceedings IndexDocument3 pagesProceedings IndexHumberto FerreiraNo ratings yet

- Lithium Dongjin 48v100ahDocument5 pagesLithium Dongjin 48v100ahmk7718100% (1)

- Design Report of STOL Transport AircraftDocument64 pagesDesign Report of STOL Transport Aircrafthassan wastiNo ratings yet

- Generic NdaDocument2 pagesGeneric NdalataminvestmentsNo ratings yet

- Stock Trak AssignmentDocument4 pagesStock Trak AssignmentPat ParisiNo ratings yet

- Aggregate Turf PavementDocument6 pagesAggregate Turf PavementDevrim GürselNo ratings yet

- Mil Tos (1ST Quarter)Document3 pagesMil Tos (1ST Quarter)Rhea Carillo100% (14)

- VtmsDocument2 pagesVtmsLorenz YatcoNo ratings yet

- Matter and Materials (Grade 6 English)Document80 pagesMatter and Materials (Grade 6 English)Primary Science Programme100% (5)

- SPR, RCS-9627CN, NoDocument5 pagesSPR, RCS-9627CN, NoAmaresh NayakNo ratings yet

- Visco GraphDocument4 pagesVisco GraphwamlinaNo ratings yet

- Request Please Only Students Who Are Willing To Join in Haryana in Any District Are Requested To Apply For JobDocument2 pagesRequest Please Only Students Who Are Willing To Join in Haryana in Any District Are Requested To Apply For JobUdayan KarnatakNo ratings yet

- Four Quartets: T.S. EliotDocument32 pagesFour Quartets: T.S. Eliotschwarzgerat00000100% (1)

- PESTEL AnalysisDocument2 pagesPESTEL AnalysisSayantan NandyNo ratings yet

- 17 Samss 518Document20 pages17 Samss 518Mohamed H. ShedidNo ratings yet

- AC Hipots 15-200kVDocument4 pagesAC Hipots 15-200kVfelipe.aounNo ratings yet

- 2018-2021 VUMC Nursing Strategic Plan: Vision Core ValuesDocument1 page2018-2021 VUMC Nursing Strategic Plan: Vision Core ValuesAmeng GosimNo ratings yet

- Entrance 2021: Indira Gandhi Rashtriya Uran AkademiDocument2 pagesEntrance 2021: Indira Gandhi Rashtriya Uran Akademird meshramNo ratings yet

- Dual Nature and RadiationDocument39 pagesDual Nature and RadiationWedger RealmeNo ratings yet

- 2015.15009.fundamental Principles of Physical Chemistry - Text PDFDocument782 pages2015.15009.fundamental Principles of Physical Chemistry - Text PDFAnoif Naputo Aidnam100% (1)

- Cognitive InfocommunicationsDocument229 pagesCognitive Infocommunicationsradhakodirekka8732No ratings yet

- Introduction To Plant Physiology!!!!Document112 pagesIntroduction To Plant Physiology!!!!Bio SciencesNo ratings yet

- Deviation Control MethodsDocument4 pagesDeviation Control MethodsLazuardhy Vozicha FuturNo ratings yet

- Relativity Space-Time and Cosmology - WudkaDocument219 pagesRelativity Space-Time and Cosmology - WudkaAlan CalderónNo ratings yet

- Ekoplastik PPR Catalogue of ProductsDocument36 pagesEkoplastik PPR Catalogue of ProductsFlorin Maria ChirilaNo ratings yet

- Computer ArchitectureDocument46 pagesComputer Architecturejaime_parada3097100% (2)

- Beg 2018 XXDocument42 pagesBeg 2018 XXFranz Gustavo Vargas MamaniNo ratings yet

- InflibnetDocument3 pagesInflibnetSuhotra GuptaNo ratings yet

- Revised Implementing Rules and Regulations Ra 10575Document79 pagesRevised Implementing Rules and Regulations Ra 10575Rodel D. LuyaoNo ratings yet

- Book2Chapter10 and 11 EvaluationDocument55 pagesBook2Chapter10 and 11 EvaluationEmmanuel larbiNo ratings yet