Professional Documents

Culture Documents

Case 1 SwanDavis

Uploaded by

silly_rabbitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 1 SwanDavis

Uploaded by

silly_rabbitCopyright:

Available Formats

CASE 72M STUDENT MODEL 9/28/96

SWAN-DAVIS, INC.

Bond and Stock Valuation

The model-generated portion oI this Iile can actually be divided into 4 separate parts:

cost oI debt and bond valuation, cost oI preIerred stock, cost oI equity/common stock

valuation, and convertible bond valuation. The model uses inputs provided in the input

data section to calculate the yields to maturity and call on the 10-yr. SDI bond, and the

yield to call and the bond price on the 23-yr. SDI bond. In addition, the cost oI SDI's

preIerred stock is calculated as well as the aIter-tax returns to both an individual and a

corporation investing in SDI's preIerred stock. The corporation's cost oI equity is

calculated using three diIIerent methodologies: DCF (using Tony Biddle's dividend and

price proiections), nonconstant DCF, and bond-yield-plus-risk-premium. ERRs that

appear in student models are due to blank cells.

The Iollowing cells have been blanked out:

C94, C124, B135, C185, E205, C213, G259, C32, F120, C125, B152, E161, E164, and C182.

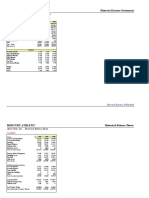

INPUT DATA: OUTPUT DATA:

Bonds: Bonds:

Par value, both bonds $1,000.00 YTM, 10-yr SDI bond 8.61

A (10-yr) bond price $1,092.00 YTC, 10-yr SDI bond 0.00

A (10-yr) bond coupon 10.00

A (10-yr) call price $1,040.00 23-yr SDI bond price $2,587.00

B (23-yr) bond coupon 6.90 YTC, 23-yr SDI bond -6.21

B (23-yr) call price $1,100.00

B (23-yr) k(d)

PreIerred Stock: PreIerred Stock:

PreIerred dividend $8.25 k(ps) SDI 8.51

PreI. stock price $97.00 AT return to indiv. 0.00

Individual tax rate 39.60 AT return to corp. 0.00

Corporate tax rate 40.00

Corp. div. exclusion 70.00

Common Stock: Common Stock:

1996 EOY stock price $15.00 kM (Ior reIerence) 0.00

Supernrmal g in div. 20.00

D(0) (Table 2) $0.52 ks Calculations:

EPS (0) (Table 2) $1.07 Nonconstant DCF 0.00

D(1): 1997 (Table 5) $0.20 CAPM, LT kRF -2.44

D(2): 1998 " $0.24 CAPM, ST kRF 5.20

D(3): 1999 " $0.29 CAPM, Ibbotson 16.60

D(4): 2000 " $0.35 kd RP (Ibbotson) 6.40

D(5): 2001 " $0.41 Text: kdRP (Low) 2.00

P(5): 2000 " $30.20 Text: kdRP (High) 6.00

Constant g, g(N) 14.90

Avg. stock's div. yld. 2.40 (Irom Value Line)

Avg. stk's 4-yr gain 55.00 "

Risk premium, ks - kd 6.40 (Irom Ibbotson)

Risk prem, kM - k(RF) 7.50 (Irom Ibbotson)

Risk-Iree rate, L-T: 6.10 Given in case

Risk-Iree rate, S-T: 5.20 Given in case

Convertibles: Convertibles:

Par value: $1,000.00 kC, beIore-tax -6.01

Coupon rate: 7.00 kC, aIter-tax 0.00

Years to maturity: 15

Shares received: 40

Call price: $1,050.00

Years to call: 10

Premium to call: 30.00

MODEL-GENERATED DATA: Cost oI Debt and Bond Valuation

A (10-yr.) bond: B (23-yr.) bond:

6-month CF iI CF 6-month CF iI not CF

period not called iI called period called iI called

------------------- ----------------- ------------------- ----------------- ----------------- -----------------

0 (1,092.00) (1,092.00) 0 0.00 (2,587.00)

1 50.00 50.00 1 34.50 34.50

2 50.00 50.00 2 34.50 34.50

3 50.00 50.00 3 34.50 34.50

4 50.00 1,090.00 4 34.50 34.50

5 50.00 5 34.50 34.50

6 50.00 6 34.50 34.50

7 50.00 7 34.50 34.50

8 50.00 8 34.50 34.50

9 50.00 9 34.50 34.50

10 50.00 10 34.50 1,134.50

11 50.00 11 34.50

12 50.00 12 34.50

13 50.00 13 34.50

14 50.00 14 34.50

15 50.00 15 34.50

16 50.00 16 34.50

17 50.00 17 34.50

18 50.00 18 34.50

19 50.00 19 34.50

20 1,050.00 20 34.50

YTM 8.61 21 34.50

YTC 22 34.50

23 34.50

24 34.50

25 34.50

26 34.50

27 34.50

28 34.50

29 34.50

30 34.50

31 34.50

32 34.50

33 34.50

34 34.50

35 34.50

36 34.50

37 34.50

38 34.50

39 34.50

40 34.50

41 34.50

42 34.50

43 34.50

44 34.50

45 34.50

46 1,034.50

NPV $2,587.00

YTC -6.21

PREFERRED STOCK:

Cost oI preI. stock 8.51

AT return to indiv.

AT return to corp.

COMMON STOCK:

Calculate ks using DCF Method and Tony Biddle's cash Ilow proiections:

Time Line: 1996 1997 1998 1999 2000 2001

Dividend 0.52 0.20 0.24 0.29 0.35 0.41

Price -15.00 30.20

----- ---- ---- ---- ---- -----

Cash Flow -15.00 0.20 0.24 0.29 0.35 30.61

DCF ks

NON-CONSTANT DCF MODEL:

The non-constant DCF model is used as Iollows: Insert a "reasonable"

estimate oI the non-constant DCF cost oI equity in the cell Ior "Non-C

DCFk"; you must change this value later. Then the model Iorecasts

dividends in column C below, Iinds the PV oI the dividends discounted

at the rate you inputted Ior "Non-C DCFk," Iinds the stock price at the

end oI the non-constant growth period as D6/(k-g), Iinds the PV oI that

price, sums the PVs oI the dividends during the non-constant growth

period, and adds to this sum the PV oI the terminal stock price, P5, to

obtain the "Calculated price." The initial calculated price will not

equal the actual current price except by luck. You must change the

value in the DCF k cell until the calculated price is approximately

equal to the actual price to get the expected rate oI return.

MANUAL NON-CONSTANT DCF K MODEL: (plus/minus 5 cents is close enough!)

Non-C DCFk: Calculated price: $1.07

(increase value iI Actual price: $15.00

calc price ~ act. price) EOY Stock

Growth rate: Dividends: PV oI DIVS: Price:

0 $0.520 $15.00

1 0.200 $0.2000 1.29

2 20.0 0.240 0.2400 1.05

3 20.0 0.288 0.2880 0.76

4 20.0 0.346 0.3456 0.41

5 20.0 0.415 0.00

6 14.9 0.477 -----------------

Sum oI PV oI divs, 1-5: $1.0736

P(5) sum PV oI DIVS beyond Yr 5:

PV oI P(5) $0.0000

-----------------

Calculated price PV div PV P(5) $1.0736

Note: Since Tony Biddle's estimates are used as inputs Ior this model,

the estimate obtained should be the same as that derived using the

time line approach and Excel's IRR Iunction.

CAPM APPROACH:

k(RF), L-T: 6.10

k(RF), S-T: 5.20

k(M) Calculation:

N 4 Value Line's Iorecast period.

PV $1.00 Beginning index oI average stock.

FV $1.55 Ending index iI 55 appreciation.

I Avg. stock's g Rate that gets $1 to $1.55 in 4 years.

Avg. stock's div. yld. 2.40 Given in Value Line Report.

-------------------

k(M)

BETA CALCULATION: Year SDI Market

Regression Output: 1 25.64 30.50

Constant 0.055668915 2 10.34 7.70

Std Err oI Y Est 0.404605947 3 46.97 10.00

R Squared 0.001647618 4 -34.96 2.00

No. oI Observations 5 5 -28.35 35.60

Degrees oI Freedom 3

X CoeIIicient(s) -0.095506498 calculated beta coeIIicient versus

Std Err oI CoeI. 1.357331569 1.1 to 1.3 industry average.

Beta based on industry average range oI 1.1 to 1.3: 1.4

CAPM ks ESTIMATES:

ks: calc b, LT kRF: 6.10 0.58 6.68

ks: indus b, LT kRF: 6.10 -8.54 -2.44

ks: calc b, ST kRF: 5.20 0.50 5.70

ks: indus b, ST kRF: 5.20 5.20

ks: indus b, Ibbotson: 6.10 10.50 16.60

Note: The negative beta CAPM estimates are nonsense. The reasonable

CAPM estimates range Irom 16.60 to 17.49.

RISK PREMIUM METHOD:

Calculate ks using kd RP:

SDI's bond yld, kd: Based on analysis in case.

Ibbotson RP: 6.40 Ibbotson.

------

ks kd RP 6.40

2.00 low end oI ks range.

6.00 upper end oI ks range.

CONVERTIBLE BOND ANALYSIS

This model Iinds the rate oI return an investor would expect to earn

on convertible bonds. First, it Iinds the value oI the bonds as

straight debt over time. Next, it Iinds the value oI the bonds iI they

were converted at each point in time. The conversion value is a

Iunction oI the stock price, which is expected to grow. The stock

prices over time could be estimated in various ways; we used the

inIormation derived in the nonconstant growth section oI the model

above, then increased stock price at 14.9 aIter Year 5.

An investor would have to pay $1,000, then would receive interest

until the bonds were called, and then would get the conversion

value. The IRR oI this cash Ilow stream is the expected rate oI return

to the investor and the beIore-tax cost to the company. II the terms

oI the convertible change enough to cause a change in the year

conversion occurs, then it would be necessary to modiIy the IRR range

manually.

SDI's

Cost II SDI's

Beginning Bond CF to Straight Value iI Converted AIter-tax

oI Year Maturity debt value Convert Year 10 Cost

0 (1,000) 2,050.00 600.00 (1,000.00) (1,000.00)

1 70 1,980.00 51.53 70.00 42.00

2 70 1,910.00 41.93 70.00 42.00

3 70 1,840.00 30.41 70.00 42.00

4 70 1,770.00 16.59 70.00 42.00

5 70 1,700.00 0.00 70.00 42.00

6 70 1,630.00 0.00 70.00 42.00

7 70 1,560.00 0.00 70.00 42.00

8 70 1,490.00 0.00 70.00 42.00

9 70 1,420.00 0.00 70.00 42.00

10 70 1,350.00 0.00 70.00 42.00

11 70 1,280.00 0.00

12 70 1,210.00 0.00

13 70 1,140.00 0.00

14 70 1,070.00 0.00

15 1,070 1,000.00 0.00

IRR Cost Rate -6.01

The convertible provides relatively certain interest payments plus

relatively risky capital gains. Straight bonds provide all relatively

sure cash Ilows, and common stock provides more risky cash Ilows. So,

a convertible's risk is between a straight bond and common stock, so the

rate oI return on a convertible should be between that on straight

bonds and common stock. ThereIore, the convertible seems reasonably

priced.

We also determine the convertible's aIter-tax cost by reducing

each interest payment by (1-T), but leaving the conversion value

alone, and Iinding the IRR, which is the aIter tax-cost cost oI the

convertibles. That value could be used to Iind a new WACC, iI we had

adequate inIormation.

END

You might also like

- O&G Services - Jason Saw DMG PartnersDocument18 pagesO&G Services - Jason Saw DMG Partnerscybermen35No ratings yet

- Financial Management CalculationsDocument35 pagesFinancial Management CalculationsfossacecaNo ratings yet

- Heavy Equipment Rental in The US Industry Report 53241Document53 pagesHeavy Equipment Rental in The US Industry Report 53241paozinNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- Capital Budgeting by Group 1 PDFDocument54 pagesCapital Budgeting by Group 1 PDFSXCEcon PostGrad 2021-23No ratings yet

- Loan Amortization Calculator BestDocument11 pagesLoan Amortization Calculator BestHenok mekuriaNo ratings yet

- Capital Budgeting: Long-Term Investment Planning and EvaluationDocument40 pagesCapital Budgeting: Long-Term Investment Planning and EvaluationMrvive JiNo ratings yet

- Advance Corporate FinanceDocument53 pagesAdvance Corporate FinanceIdham Idham IdhamNo ratings yet

- Loan Modification CalculatorDocument4 pagesLoan Modification CalculatorElizabeth ThomasNo ratings yet

- Retained Customer Rates Over TimeDocument13 pagesRetained Customer Rates Over TimeDiego SinayNo ratings yet

- Property Reality - Bond Statement TemplateDocument21 pagesProperty Reality - Bond Statement TemplateOwenNo ratings yet

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationDocument24 pagesWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668No ratings yet

- Evaluation Chapter 11 LBO M&ADocument32 pagesEvaluation Chapter 11 LBO M&AShan KumarNo ratings yet

- Merger Model PP Allocation BeforeDocument100 pagesMerger Model PP Allocation BeforePaulo NascimentoNo ratings yet

- Law Firms in The US: Due ProcessDocument35 pagesLaw Firms in The US: Due ProcessCraigNo ratings yet

- Debt DesignDocument37 pagesDebt DesignShankey GuptaNo ratings yet

- Blu Containers Worksheet - IntermediateDocument13 pagesBlu Containers Worksheet - Intermediateahmedmostafaibrahim22No ratings yet

- Bval 1Document26 pagesBval 1anon_298077070No ratings yet

- Sample Model Training | 25.8% IRRDocument282 pagesSample Model Training | 25.8% IRRKumar SinghNo ratings yet

- Shareholder structure and financial modeling insightsDocument20 pagesShareholder structure and financial modeling insightsabdul5721No ratings yet

- Comparative Financials SampleDocument19 pagesComparative Financials SampleNadia.ishaqNo ratings yet

- Small Bank Pro Forma Model: Balance Sheets Thousand $Document5 pagesSmall Bank Pro Forma Model: Balance Sheets Thousand $jam7ak3275No ratings yet

- LBO Model Cash Flow AnalysisDocument38 pagesLBO Model Cash Flow AnalysisBobbyNicholsNo ratings yet

- ProjectDocument24 pagesProjectAayat R. AL KhlafNo ratings yet

- Excel Skills - Loan Calculation & Analysis TemplateDocument57 pagesExcel Skills - Loan Calculation & Analysis TemplateCyprienNo ratings yet

- Excel Amortization Schedule With Irregular Payments v.2Document75 pagesExcel Amortization Schedule With Irregular Payments v.2azertyytrezaNo ratings yet

- Precedent Transaction Template - NewDocument5 pagesPrecedent Transaction Template - NewAmay SinghNo ratings yet

- SBDC Valuation Analysis ProgramDocument8 pagesSBDC Valuation Analysis ProgramshanNo ratings yet

- 3 Statement Model: Strictly ConfidentialDocument9 pages3 Statement Model: Strictly ConfidentialAshokNo ratings yet

- Private Companies (Very Small Businesses) Key Financial DifferencesDocument50 pagesPrivate Companies (Very Small Businesses) Key Financial DifferencesFarhan ShafiqueNo ratings yet

- M&a - Retail StoresDocument186 pagesM&a - Retail Storesvaibhavsinha101No ratings yet

- Merger Analysis APV MethodDocument22 pagesMerger Analysis APV MethodPrashantKNo ratings yet

- 72 11 NAV Part 4 Share Prices AfterDocument75 pages72 11 NAV Part 4 Share Prices Aftercfang_2005No ratings yet

- Factset Data Sheet Financial Statements and AnalysisDocument22 pagesFactset Data Sheet Financial Statements and Analysischandan.hegdeNo ratings yet

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- Worldwide Paper DCFDocument16 pagesWorldwide Paper DCFLaila SchaferNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- Mercury Athletic Historical Income StatementsDocument18 pagesMercury Athletic Historical Income StatementskarthikawarrierNo ratings yet

- Apple Inc. Financial Statements and Valuation AnalysisDocument67 pagesApple Inc. Financial Statements and Valuation AnalysisPrashantKNo ratings yet

- Verizon Communications Inc.: Horizontal AnalysisDocument42 pagesVerizon Communications Inc.: Horizontal Analysisjm gonzalezNo ratings yet

- Tata Steel - Financial Model - 2016-2025Document95 pagesTata Steel - Financial Model - 2016-2025Prabhdeep DadyalNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- Ballerina Tech Assumptions & SummaryDocument48 pagesBallerina Tech Assumptions & Summaryapi-25978665No ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookkamranNo ratings yet

- Model #14 M - A Model (Mergers and Acquisitions)Document11 pagesModel #14 M - A Model (Mergers and Acquisitions)Rahul GopanNo ratings yet

- Valuation Cash Flow A Teaching NoteDocument5 pagesValuation Cash Flow A Teaching NotesarahmohanNo ratings yet

- Term Structure JP Morgan Model (Feb04)Document7 pagesTerm Structure JP Morgan Model (Feb04)api-3763138No ratings yet

- ModelDocument103 pagesModelMatheus Augusto Campos PiresNo ratings yet

- Alibaba IPO Financial Model WallstreetMojoDocument52 pagesAlibaba IPO Financial Model WallstreetMojoJulian HutabaratNo ratings yet

- Box IPO Financial ModelDocument42 pagesBox IPO Financial ModelVinNo ratings yet

- 06 06 Football Field Walmart Model Valuation BeforeDocument47 pages06 06 Football Field Walmart Model Valuation BeforeIndrama Purba0% (1)

- Merger ModelDocument8 pagesMerger Modelneelie777No ratings yet

- NYSF Practice TemplateDocument22 pagesNYSF Practice TemplaterapsjadeNo ratings yet

- Exercises and Answers Chapter 5Document8 pagesExercises and Answers Chapter 5MerleNo ratings yet

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument21 pagesChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesJITIN ARORANo ratings yet

- Multicolor Free Professional PestelPEST Analysis GraphDocument1 pageMulticolor Free Professional PestelPEST Analysis GraphCécile ContriNo ratings yet

- Capital Budgeting Decision Criteria ExplainedDocument53 pagesCapital Budgeting Decision Criteria ExplainedSaahil LedwaniNo ratings yet

- Unit III Capital Budgeting Decision CriteriaDocument55 pagesUnit III Capital Budgeting Decision CriteriaVivek ValiantNo ratings yet