Professional Documents

Culture Documents

New Microsoft Office Word Document

Uploaded by

farrukhbashirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Microsoft Office Word Document

Uploaded by

farrukhbashirCopyright:

Available Formats

acknowledgement All gratitude and thanks to almighty ALLAH the gracious, the most merciful and beneficent who

gave me courage to undertake and complete this task. I am very much obliged to my ever caring and loving parents whose prayers have enabled to reach this stage. I am grateful to almighty ALLAH who made me able to complete the work presented in this report. It is due to HIS unending mercy that this work moved towards success. I am highly indebted to my course instructor Mr. Mudassar Awan for providing me an opportunity to learn about the Banking system of Bank Al-Falah" which is vital ingredient of MBA program. I am very great full to my teacher Mr. Mudassar Awan for providing me guideline for the completion of this report. I feel great pride and pleasure on the accomplishment of this report. EXECUTIVE SUMMARY

The banking structure in Pakistan comprises of the following types, State Bank of Pakistan, Commercial Bank of Pakistan; Exchange Banks, Saving banks, Cooperative banks, specialized credit institutions. The state bank of Pakistan is the Central bank of the country and was established on July 01, 1948. The network of bank branches now covers a very large segment of national economy. The State Bank of Pakistan issues the shares of these periodically. Bank employees and other common peoples can also purchase these shares and earn profit. To open an account the customer has to meet the general banking manager with an introducer. The procedure begins with the punching of account opening form to the customer file i.e. customers master file. Before closing any account, bank send letter to the account hold for informing him that his account is going to be closed. There is need an approval form higher authority to close any account. Current deposits are those which are payable to bank whenever demanded by the customer. Bank does not pay any profit on current deposits. The following are the financial products/services of PLS Account, Saving Account, Term deposit and Foreign currency accounts. In remittance department like any other BANK AL-FALAH also have instruments for transferring of money, Telegraphic Transfer, Mail Transfer. In cash department both deposits and withdrawals go side by side. This department works under the CD In charge and deals with cash deposits and payments. This department maintains the following sheets, books, and ledger of account cash received voucher sheet. Cash paid voucher sheet, Paying-in-slip, Cheque Book, Cash balance book. The clearing in Karachi at BANK AL-FALAH or other banks is being done through NIFT (National Institute of Facilitation Technology). Bank provides this facility to the people who need advance money to meet their requirement. Party dealing with other banks financial condition of borrower business and as a first step credit proposal is being made. BANK AL-FALAH provides advances, which are two types. Secured Advances, Unsecured Advances. BANK AL-FALAH usually classified advances in to following types Commercial Advances, Corporate/SMEs Advances, Agricultural Advances. Commercial Advances are of following types Demand Finance, Cash Finance, Export Refinance Part I (Pre

Shipment) & others. Banks Agriculture division deals with the agriculture advances. Bank provides the Agriculture Advances in order to enhance and support the agriculture sector of the country. Farm Credit & Non Farm Credit. In foreign exchange, BANK AL-FALAH is dealing Foreign Currency Accounts, Foreign Remittances, and Foreign Bills for Collection, Imports & Exports Foreign currency accounts & the foreign currency department deals with the following types of accounts, Current account, Saving bank account, Term deposit. Foreign accounts are convertible on floating rate available to the bank. Letter Of Credit facility is being provided by BANK ALFALAH in foreign exchange. The Board The list of Board of Directors of Bank Alfalah Limited is as under: y H.H. Sheikh Nahayan Mabarak Al-Nahayan. y Mr. Abdulla Naseer Hawalled Al-Mansoori. y Mr. Abdulla Khalil Al-Mutawa. y Mr. Omar Z. Al-Askari. y Mr. Naeem Iqbal Sheikh. y Mr. Ikram-ul-Majeed Sehgal. y Mr. Muhammad Saleem Akhtar.

conclusion If I have to express my experience of internship in Bank Al-Falah Limited Urdu Bazaar Branch Lahore I would briefly say: Bank Al-Falah is a good Organization in the way that anybody can join it for his/ her long-term career. Overall working environment is comfortable. Management of branch cares a lot of its employees and considers them as the Asset of bank. Behavior of senior executive of bank is very polite and they are caring about the individuals career and their growth. However management is very demanding about the targets but good reward at the achievement of assigned targets is awarded. Employees at Bank Al-Falah are quite efficient. As Urdu Bazaar Branch is a new one, its employees have to bring their bank among the list of good banks. Therefore, they work more than their working hours and it is all according to their will. It also shows their loyalty, commitment to organization. Employees are given the benefits like bonus, gratuity funds, loans, increments, and medical.

All the customers are entertained individually. Same kind of behavior and attention is given to all the customers. Getting ideas for improvement from customer side is a new idea and that is working very well in Bank Al-Falah Ltd. All the customers are asked to fill a suggestion form and the standards of the bank are improved through them. Prioritizing its product portfolio in line with its corporate and consumer needs and wants the bank is committed to develop products that give more value to its customers in both the sectors. In bank, all the work is done on computers. All the entries are made in computer. Balance are fed into the computer. This increases efficiency of the bank. During my internship training I gathered information regarding how a successful bank operational aspect decorticated with the practical. I found my internship training at Bank Al-Falah Limited Urdu Bazaar Branch Lahore to be a very rewarding experience. The training was beneficial because it helpful me to aware a real life working environment. So far my learning is concerned; all the employees at branch were quite cooperative. They helped me to understand the activities of a bank to possible extent. Their good attitude gave me more confidence to learn more and to ask if I have any query in my mind. Besides their ever going activities they never get irritant by my questioning. I had made an honest efferent to present the working & operation of Bank Al-Falah Limited Urdu Bazaar Branch Lahore in simplest way. I feel pleasure that I have really gained a lot during 6 weeks & enjoyed working with experienced cooperative & intelligent staff. RECOMMENDATIONS It was an interested experience to do internship in Bank Alfalah Limited. The staff was highly cooperated and due to their help I learned big deal about modern banking.

I suggest that such an internship program highly integrative for the students of commerce education so that the students should be enquired with the knowledge of practice world .I do summarize that it would be a great help to me in selection of job or future field of work. Here I am putting some suggestions, which will enable the bank to compete with other banks more effectively & efficiently. It is observed that the employees were overburdened so they have to stay at branch till late at night. In this way their efficiency is affected and hiring more employees can reduce their work. The employees should be signed jobs for specific period and than they should shifted to other department so that they gain knowledge of other jobs. Bank Alfalah Limited should properly advertise and Communicate to public about the services provided by it, so that more customers will be attracted. The banks management should give more incentives and pay scale of officers should be revised & improved. System and operations should be more defined and organized. IT draw backs should be improved. Administration drawbacks should be improved by the strict control of general issues. Audit should be held internally. Rather there should be an Audit Department in the branch to make audit on daily basis. This can become so helpful as different banks are having this department of their own. Lockers, ATM, all these facilities should be provided to attract more customers. Expenditures must be control, which are very high.

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- There Are 4 Way Is The Factor AnalysisDocument8 pagesThere Are 4 Way Is The Factor Analysisapi-279431750No ratings yet

- 23 Napocor vs. CbaaDocument23 pages23 Napocor vs. CbaaAnonymous 12BvdWEWyNo ratings yet

- A Walk On The (Asian) Wild Side: James Chanos Kynikos AssociatesDocument24 pagesA Walk On The (Asian) Wild Side: James Chanos Kynikos AssociatessubflacherNo ratings yet

- Hills Cement FinalDocument204 pagesHills Cement FinalAniruddha DasNo ratings yet

- ETR BusinessDocument24 pagesETR BusinessAmirNo ratings yet

- Chapter 3.3 Break-Even AnalysisDocument5 pagesChapter 3.3 Break-Even AnalysislojainNo ratings yet

- Usiness Aluation: DigestDocument28 pagesUsiness Aluation: Digestgioro_miNo ratings yet

- WIWA Airless Spray GunsDocument52 pagesWIWA Airless Spray Gunsosvaldo lopezNo ratings yet

- MACFOS Investors-PresentationDocument29 pagesMACFOS Investors-PresentationIDEasNo ratings yet

- Advanced Control System by N.D.prasadDocument26 pagesAdvanced Control System by N.D.prasadAshish IndarapuNo ratings yet

- National Food Safety Standard - General Safety Requirements On Food Contact Materials and ArticlesDocument4 pagesNational Food Safety Standard - General Safety Requirements On Food Contact Materials and ArticlesShariq HaiderNo ratings yet

- Oil and Gas Dessertation TopicsDocument8 pagesOil and Gas Dessertation TopicsNitin SharmaNo ratings yet

- Research Work08072021 01Document41 pagesResearch Work08072021 01Mohammad AliNo ratings yet

- Omni Flow Computer 3000-6000Document2 pagesOmni Flow Computer 3000-6000syed jeelani ahmedNo ratings yet

- Fullsummary PDFDocument118 pagesFullsummary PDFEsa SulyNo ratings yet

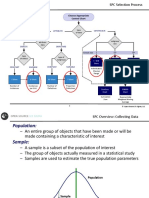

- Control - Statistical Process Control SPCDocument22 pagesControl - Statistical Process Control SPCHalimNo ratings yet

- University of Caloocan City: (Week 12)Document8 pagesUniversity of Caloocan City: (Week 12)Gilyn NaputoNo ratings yet

- Performance of Coffee Farmers Marketing Cooperatives in Yiragcheffe and Wonago Woredas, SNNPRS, Ethiopia PDFDocument166 pagesPerformance of Coffee Farmers Marketing Cooperatives in Yiragcheffe and Wonago Woredas, SNNPRS, Ethiopia PDFesulawyer2001No ratings yet

- Te 2013 PDFDocument298 pagesTe 2013 PDFadu joshiNo ratings yet

- Tc-2060 Instruction Manual v0.09Document93 pagesTc-2060 Instruction Manual v0.09Herry SusiloNo ratings yet

- Easy Soft Education Loans For SRM StudentsDocument13 pagesEasy Soft Education Loans For SRM StudentsSankarNo ratings yet

- Big Changes For RPG in IBM I 7.1Document5 pagesBig Changes For RPG in IBM I 7.1pmeenakNo ratings yet

- Facebook Addiction Chapter1Document22 pagesFacebook Addiction Chapter1Catherine BenbanNo ratings yet

- BSP M-2022-024 s2022 - Rural Bank Strengthening Program) PDFDocument5 pagesBSP M-2022-024 s2022 - Rural Bank Strengthening Program) PDFVictor GalangNo ratings yet

- 203 - The Poky Little Puppy - See, Hear, ReadDocument28 pages203 - The Poky Little Puppy - See, Hear, ReadAndrew Rukin100% (2)

- HSE Program 2017 - FinalDocument12 pagesHSE Program 2017 - FinalAbdul Hamid Tasra100% (2)

- TDS - 2 Pack PU Clear Sealer - Exterior (F92N0ECS)Document2 pagesTDS - 2 Pack PU Clear Sealer - Exterior (F92N0ECS)Krishna Vacha100% (1)

- What Is HR ConsultingDocument2 pagesWhat Is HR ConsultingRustashNo ratings yet

- Statement of The ProblemDocument2 pagesStatement of The ProblemchimikoxdNo ratings yet

- 8 Form Reading The Stronger ManDocument8 pages8 Form Reading The Stronger Manмаксим соловейNo ratings yet