Professional Documents

Culture Documents

Exerpt From June 11 2009 Commission Meeting Gomez Explaining 2008 Financials and Illegal Transfers

Uploaded by

investigatemiamiblogOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exerpt From June 11 2009 Commission Meeting Gomez Explaining 2008 Financials and Illegal Transfers

Uploaded by

investigatemiamiblogCopyright:

Available Formats

From the June 11, 2009 Miami Commission Meeting discussion of the 2008 Financial Statements. Ms.

. Gomez: Diana Gomez, Finance director. This is a discussion item in accordance with the financial integrity principles. I'll be presenting the comprehensive annual financial report for the year ended September 30, 2008, which was issued on March 30, 2009. The focus of this presentation is on the results of operation for fiscal year 2008, and this presentation will be limited to those actual results. The integrity ordinance also requires that the single audit and management letter be presented by the City's external auditors. The City's auditors are here and will answer any questions you have regarding the findings and recommendations. Okay. When we look at the financial statements, the City received an unqualified opinion or clean opinion for the fiscal year 2008 audit. The opinion -- this opinion is the highest level of assurance that the financial statements are free from material misstatement. The financial statements were issued - this year, the financial statements were issued on time. You recall in the previous several years we had been late in issuing the financial statements. However -- and that was due to a lack ofadequate personnel, as well as the financial systems implementation that we were dealing with. This year, though, we did -- we were able to issue timely because we were granted additional positions, as well as the system is operational. We have submitted our financial reports to the GFOA's (Government Finance Officers Association) Excellence in Reporting certificate program, and we are anticipating to receive that honor again this year. The unqualified opinion and the timely issuance of the financial statements assisted the City with maintaining its bond rating. We recently hosted all three agencies -- rating agencies, and they reaffirmed the City's bond ratings. All three noted -- all three of their aiding agencies noted strong financial management practices as a basis for maintaining the current rating. Additionally, we were able to sell the last series of the Homeland Defense bonds last -- a few weeks ago, and those bonds sold without insurance. That represented a -- an immediate cash savings of $670,000 to the City, and the interest rate was at 5.096. Okay. When looking -- when reviewing the financial statements -- we start at the fund level financial statements. Page 17 shows the statement of revenues, expenditures, and changes in fund balance. The focus for the purpose of this presentation is on the general fund only, as of September 30, 2008. For September 30, revenues totaled $472 million, which is down slightly from the prior year. Expenditures totaled 525 million; again, down slightly from the prior year. And transfers -other financing sources, transfers, in and out, total of 46 million, which was increased from the prior year. Fund balance decreased for fiscal year 2008 by 6.9 million. This decrease in fund balance was due primarily to expenditures in excess of original budgets. Decrease was offset by increasing transfers into the general fund from capital project funds, unused general fund contributions, public services tax, special revenue fund, and recovery of indirect costs from other special revenue funds and capital project funds. The ending fund balance for the general fund at September 30, 2008 was $93,577,448. When we look at the balance sheet, on page 15 of the CAFR (Certificate of Achievement in Excellence for Financial Reporting), again, the focus is on the general fund. Assets for the year total $162 million, which is decreased from the prior year mainly due to reduction in actual cash on hand at year end. Liabilities for the year totaled 68.4 million, which decreased from prior year mainly due to the reduction of accounts payable on hand at 9/30. The fund balance -- when you look at the fund balance, fund balance includes three sections, reserve fund balance, unreserved designated fund balance, and unreserved undesignated fund balance. Reserve fund balance includes amounts reserved for prepaid expenses and a Building Department reservation in the current year. This amount represents amounts collected in excess of expenditures which must be reserved and used for the Building Department operations in subsequent years. Unreserved undesignated fund balance total 44.6 million, which is available to meet future needs of the City. This amount also meets the financial integrity requirement, which is the 10 percent of the average three years of revenue set aside in unreserved undesignated fund balance. In unreserved designated fund balance, this amount includes also amounts that are available for subsequent years, and this -- I'm sorry.

You might also like

- Detailed Consolidated Financial Report for Oakland Municipality FY 2003Document2 pagesDetailed Consolidated Financial Report for Oakland Municipality FY 2003shajiNo ratings yet

- Cash Budget - A Short-Term Forecasting ToolDocument6 pagesCash Budget - A Short-Term Forecasting ToolAndoNo ratings yet

- Module 6 Ratio Analysis and InterpretationDocument9 pagesModule 6 Ratio Analysis and InterpretationHeart MacedaNo ratings yet

- An Overview of National Budget in BangladeshDocument4 pagesAn Overview of National Budget in BangladeshAnikaNo ratings yet

- Statement of Cash Flows ExplainedDocument10 pagesStatement of Cash Flows ExplainedStacy Anne LucidoNo ratings yet

- Kitsap Budget MemoDocument18 pagesKitsap Budget MemopaulbalcerakNo ratings yet

- Acc423 in 2015 Better City Received 5000000 of BondDocument8 pagesAcc423 in 2015 Better City Received 5000000 of BondDoreenNo ratings yet

- Security Bank Audited Financial Statements 2017Document141 pagesSecurity Bank Audited Financial Statements 2017crystal01heartNo ratings yet

- 2020 - PFRS For SEs NotesDocument16 pages2020 - PFRS For SEs NotesRodelLaborNo ratings yet

- Annual Audit Fy07-08 RiversideDocument65 pagesAnnual Audit Fy07-08 Riversideapi-126378091No ratings yet

- Management Assignment........... 1Document38 pagesManagement Assignment........... 1Muhammad MubashirNo ratings yet

- Day 1 PM - SEC Rules Updates and Common SEC Findings PDFDocument144 pagesDay 1 PM - SEC Rules Updates and Common SEC Findings PDFNelson GarciaNo ratings yet

- Assignment 1 Outline and Guideline UpdateDocument4 pagesAssignment 1 Outline and Guideline UpdateĐan Nguyễn PhươngNo ratings yet

- WEEK 1 Discussion ProblemsDocument9 pagesWEEK 1 Discussion ProblemsJemNo ratings yet

- Sen Finance Sen Finance Sen Finance Sen Finance: CFA® Level IDocument31 pagesSen Finance Sen Finance Sen Finance Sen Finance: CFA® Level IPavel LahaNo ratings yet

- Financial Analysis of PNB Met LifeDocument92 pagesFinancial Analysis of PNB Met LifeKomal chawlaNo ratings yet

- Principles of Managerial FinanceDocument37 pagesPrinciples of Managerial FinanceAngela VeronikaNo ratings yet

- Home Depot Financial Statement Analysis ReportDocument6 pagesHome Depot Financial Statement Analysis Reportapi-301173024No ratings yet

- ACCT567 W2 CaseStudyDocument6 pagesACCT567 W2 CaseStudyPetra0% (1)

- August 18 2011 FD MemoDocument8 pagesAugust 18 2011 FD MemoMy-Acts Of-SeditionNo ratings yet

- Amaysim Australia LimitedDocument9 pagesAmaysim Australia LimitedMahnoor NooriNo ratings yet

- Financial Accounting and Reporting BasicsDocument14 pagesFinancial Accounting and Reporting BasicsMohammed Abdul MajeedNo ratings yet

- Financial Accounting - Review: HUL Q4 Misses Estimates, Profit Dips 1% To Rs 1,519 Crore, Volume Shrinks 7%Document10 pagesFinancial Accounting - Review: HUL Q4 Misses Estimates, Profit Dips 1% To Rs 1,519 Crore, Volume Shrinks 7%anishjoseph007No ratings yet

- Fundamentals of Accounting Questions With AnswersDocument13 pagesFundamentals of Accounting Questions With Answersdhabekarsharvari07No ratings yet

- City of St. Louis Office of Treasurer: Susan Montee, CPADocument33 pagesCity of St. Louis Office of Treasurer: Susan Montee, CPARaymondWattsNo ratings yet

- Audit Report Southeast BankDocument6 pagesAudit Report Southeast BankSohel MahmudNo ratings yet

- Chapter - 36: Financial Management in Government CompaniesDocument34 pagesChapter - 36: Financial Management in Government CompaniesViz PrezNo ratings yet

- Financial Ratios GSKDocument17 pagesFinancial Ratios GSKUnzillah AzharNo ratings yet

- Governmental Entities: Other Governmental Funds and Account GroupDocument31 pagesGovernmental Entities: Other Governmental Funds and Account GroupabmyonisNo ratings yet

- Hyundai Motor Company 2019 Financial StatementsDocument95 pagesHyundai Motor Company 2019 Financial StatementsmNo ratings yet

- Review of FY 2013 Mid-Year Budget Monitoring ReportDocument22 pagesReview of FY 2013 Mid-Year Budget Monitoring Reportapi-27500850No ratings yet

- Financial Statements Ara 2021Document100 pagesFinancial Statements Ara 2021Krishna HarshitaNo ratings yet

- The City of Manor, Texas Annual Financial Report and Independent Auditors' Report Year Ended September 30, 2009Document44 pagesThe City of Manor, Texas Annual Financial Report and Independent Auditors' Report Year Ended September 30, 2009cityofmanorNo ratings yet

- Unit 5 Financial Reports and Financial StatementDocument2 pagesUnit 5 Financial Reports and Financial StatementNate WorkNo ratings yet

- MD - Siful Malak Srijon 1Document5 pagesMD - Siful Malak Srijon 1Sohel MahmudNo ratings yet

- Lesson 1Document8 pagesLesson 1Amangeldi SalimzhanovNo ratings yet

- Chp-3 General Fund PGDocument16 pagesChp-3 General Fund PGkasimNo ratings yet

- Financial Spreading Draft - 1Document12 pagesFinancial Spreading Draft - 1Chandan Kumar ShawNo ratings yet

- Conceptual Framework and Accounting Standards 2Document74 pagesConceptual Framework and Accounting Standards 2Alex Grace DiagbelNo ratings yet

- Past Exam QuestionDocument95 pagesPast Exam Questionabsankey770No ratings yet

- Finanancial Statements NotesDocument10 pagesFinanancial Statements Notespetco95No ratings yet

- Taxation Management AssignmentDocument11 pagesTaxation Management AssignmentniraliNo ratings yet

- 2019 CBC Audited Financial StatementsDocument143 pages2019 CBC Audited Financial StatementsElsa MendozaNo ratings yet

- BudgetDocument3 pagesBudgetGBHS NARBALNo ratings yet

- Understanding Financial Statement FM 1Document5 pagesUnderstanding Financial Statement FM 1ashleyNo ratings yet

- ACCT 221 Chapter 1Document26 pagesACCT 221 Chapter 1Shane Hundley100% (1)

- Financial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Document22 pagesFinancial Statement Analysis - by P.balasubramaniyam - Xmba5 - 9Pasupuleti Balasubramaniyam100% (1)

- Introduction To Final AccountsDocument38 pagesIntroduction To Final AccountsCA Deepak Ehn88% (8)

- CK 2010 Audited FinancialsDocument39 pagesCK 2010 Audited FinancialskrobinetNo ratings yet

- Assignment 2Document7 pagesAssignment 2Dawna Lee BerryNo ratings yet

- Mahindra Annual Report SummaryDocument3 pagesMahindra Annual Report Summaryvishakha AGRAWALNo ratings yet

- Balance Sheet and RatioDocument52 pagesBalance Sheet and RatioVPLAN INFOTECH100% (1)

- LESSON7Document9 pagesLESSON7Ira Charisse BurlaosNo ratings yet

- Financial PlanningDocument25 pagesFinancial Planningmaryloumarylou0% (1)

- FIRR Financial Rate of Return ProjectDocument11 pagesFIRR Financial Rate of Return ProjectdanisbyNo ratings yet

- Name of Municipality: Consolidated Financial Statements For The Year Ended December 31, 2009Document37 pagesName of Municipality: Consolidated Financial Statements For The Year Ended December 31, 2009nandiampuanNo ratings yet

- Understanding Financial StatementsDocument5 pagesUnderstanding Financial StatementsMark Russel Sean LealNo ratings yet

- 2011 Transit AuditDocument10 pages2011 Transit AuditgreensudburyNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Miami Over 100 KDocument15 pagesMiami Over 100 KinvestigatemiamiblogNo ratings yet

- Release of Regalado Tax LiensDocument5 pagesRelease of Regalado Tax LiensinvestigatemiamiblogNo ratings yet

- DDA Coordinating Get Out The Vote For Sarnoff With His Staffer Plans en CIADocument2 pagesDDA Coordinating Get Out The Vote For Sarnoff With His Staffer Plans en CIAinvestigatemiamiblogNo ratings yet

- Sarnoff Trying To Distance Himself From The Fire ContractDocument2 pagesSarnoff Trying To Distance Himself From The Fire ContractinvestigatemiamiblogNo ratings yet

- 2011-12 Miami Budget LegislationDocument6 pages2011-12 Miami Budget LegislationinvestigatemiamiblogNo ratings yet

- 8 Miami Officers Suspended in Fatal Beating of A Suspect - New York TimesDocument1 page8 Miami Officers Suspended in Fatal Beating of A Suspect - New York TimesinvestigatemiamiblogNo ratings yet

- Comparison of Miami 2011 and 2012 BudgetDocument1 pageComparison of Miami 2011 and 2012 BudgetinvestigatemiamiblogNo ratings yet

- Regalado Tax LiensDocument6 pagesRegalado Tax LiensinvestigatemiamiblogNo ratings yet

- Miami Herald Salary Chart2Document1 pageMiami Herald Salary Chart2investigatemiamiblogNo ratings yet

- Kate Callahan Release Announcing Opposition To BillboardsDocument2 pagesKate Callahan Release Announcing Opposition To BillboardsinvestigatemiamiblogNo ratings yet

- Hard-Brass - Chargi S Ing Unit Tsnoth Held To Accoun Ntbypo OliceDocument6 pagesHard-Brass - Chargi S Ing Unit Tsnoth Held To Accoun Ntbypo OliceinvestigatemiamiblogNo ratings yet

- 6 Miami Officers Indicted in '88 Death of Drug Dealer _ Law Enforcement_ the New Charges Claim a Police Cover-up in the Fatal Beating. Earlier Acquittals Had Sparked Violence in Puerto Rican CommunityDocument1 page6 Miami Officers Indicted in '88 Death of Drug Dealer _ Law Enforcement_ the New Charges Claim a Police Cover-up in the Fatal Beating. Earlier Acquittals Had Sparked Violence in Puerto Rican CommunityinvestigatemiamiblogNo ratings yet

- Regalado Campaign Report Showing Illegal Foreign ContributionsDocument5 pagesRegalado Campaign Report Showing Illegal Foreign ContributionsinvestigatemiamiblogNo ratings yet

- Carollo Discussion Items For July 11 Word FormatDocument2 pagesCarollo Discussion Items For July 11 Word FormatinvestigatemiamiblogNo ratings yet

- Fitch Ratings - Press ReleaseDocument4 pagesFitch Ratings - Press ReleaseinvestigatemiamiblogNo ratings yet

- Summary of Original Close Campaign Termination ReportDocument1 pageSummary of Original Close Campaign Termination ReportinvestigatemiamiblogNo ratings yet

- MPA June 24 Board Minutes - Simpson Interim CFO DiscussionDocument3 pagesMPA June 24 Board Minutes - Simpson Interim CFO DiscussioninvestigatemiamiblogNo ratings yet

- Summary of Original Close Campaign Termination ReportDocument1 pageSummary of Original Close Campaign Termination ReportinvestigatemiamiblogNo ratings yet

- 1998 Sun Sentinel Article About Carollo and Garcia PedrosaDocument2 pages1998 Sun Sentinel Article About Carollo and Garcia PedrosainvestigatemiamiblogNo ratings yet

- Summary of Amended Termination Report For Regalado CampaignDocument1 pageSummary of Amended Termination Report For Regalado CampaigninvestigatemiamiblogNo ratings yet

- Democratic Exec Committee Report Oct - Dec 2006Document6 pagesDemocratic Exec Committee Report Oct - Dec 2006investigatemiamiblogNo ratings yet

- Blanche Park Master Plan ImprovementsDocument6 pagesBlanche Park Master Plan ImprovementsinvestigatemiamiblogNo ratings yet

- Expedited Captial Projects OrdinanceDocument8 pagesExpedited Captial Projects OrdinanceinvestigatemiamiblogNo ratings yet

- Original ECP Ordinance Project ListDocument2 pagesOriginal ECP Ordinance Project ListinvestigatemiamiblogNo ratings yet

- Current ECP Ordinance Project ListDocument1 pageCurrent ECP Ordinance Project ListinvestigatemiamiblogNo ratings yet

- Larry Spring and Diana Gomez RecommendationsDocument2 pagesLarry Spring and Diana Gomez RecommendationsinvestigatemiamiblogNo ratings yet

- Summary Form Showing Due Date and No Fiscal ImpactDocument1 pageSummary Form Showing Due Date and No Fiscal ImpactinvestigatemiamiblogNo ratings yet

- 2010 Tax Certificate Sales Advertised For Sarnoff's Grove PropertiesDocument2 pages2010 Tax Certificate Sales Advertised For Sarnoff's Grove PropertiesinvestigatemiamiblogNo ratings yet

- CCSG Formed For Purposes of The ContractDocument1 pageCCSG Formed For Purposes of The ContractinvestigatemiamiblogNo ratings yet

- Form GST Mov-02 Order For Physical VerificationDocument1 pageForm GST Mov-02 Order For Physical VerificationShruti SantoshNo ratings yet

- Advert-Manager-Operational Risk and ComplianceDocument4 pagesAdvert-Manager-Operational Risk and ComplianceRashid BumarwaNo ratings yet

- Absorption Vs VariableDocument10 pagesAbsorption Vs VariableRonie Macasabuang CardosaNo ratings yet

- Luxasia Pte. Ltd. and Its Subsidiaries Directors' Statement and Financial Statements Year Ended December 31, 2018Document73 pagesLuxasia Pte. Ltd. and Its Subsidiaries Directors' Statement and Financial Statements Year Ended December 31, 2018Joyce ChongNo ratings yet

- Effective Capital Project Execution Mining and MetalsDocument10 pagesEffective Capital Project Execution Mining and MetalsAmit AgarwalNo ratings yet

- Meghana Resume UpdatedDocument2 pagesMeghana Resume UpdatedTAX DESTINATION100% (1)

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- Guidelines For The Esdm SchemeDocument5 pagesGuidelines For The Esdm Schemevivek raj ChauhanNo ratings yet

- (M2S2-POWERPOINT) Control Self-Assessment (CSA) and Evaluating The Internal Audit ActivityDocument18 pages(M2S2-POWERPOINT) Control Self-Assessment (CSA) and Evaluating The Internal Audit ActivityJayson J. ManlangitNo ratings yet

- Financial Accounting Syllabus KNEC DiplomaDocument4 pagesFinancial Accounting Syllabus KNEC DiplomaEsther SaisiNo ratings yet

- General Purpose Cost StatementDocument36 pagesGeneral Purpose Cost StatementShatrughna SamalNo ratings yet

- Sop 0024Document6 pagesSop 0024samirneseemNo ratings yet

- Declaration and Table of ContentDocument6 pagesDeclaration and Table of Contentsamuel debebeNo ratings yet

- Nwaire Chima Sunday: Profile & Career SummaryDocument4 pagesNwaire Chima Sunday: Profile & Career SummaryAnam Rana100% (1)

- Quantity Surveyors Role in Project DeliveryDocument21 pagesQuantity Surveyors Role in Project DeliveryIdayat abdulrazaqNo ratings yet

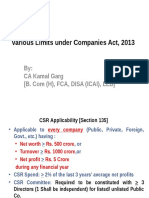

- Various Limits Under Companies Act, 2013 (CA Final)Document61 pagesVarious Limits Under Companies Act, 2013 (CA Final)Asim JavedNo ratings yet

- The Enhancement Program Handouts - Far PDFDocument36 pagesThe Enhancement Program Handouts - Far PDFRica Jane Lloren0% (1)

- Break-Even Analysis: (Company Name)Document8 pagesBreak-Even Analysis: (Company Name)AMINNo ratings yet

- Establish Mobile Money Transfer AgencyDocument22 pagesEstablish Mobile Money Transfer AgencySabrina Abdurahman100% (2)

- Goodwill PDFDocument14 pagesGoodwill PDFShaileshNo ratings yet

- Analysis of Employee's Satisfaction and Customer Service Management of Mercantile Bank LimitedDocument68 pagesAnalysis of Employee's Satisfaction and Customer Service Management of Mercantile Bank LimitedPratikBhowmickNo ratings yet

- Legal Validity of Notices Us 148 Post 1st April, 2021Document59 pagesLegal Validity of Notices Us 148 Post 1st April, 2021Kairav BhotiNo ratings yet

- 6business Transactions and Their Analysis-For Observation4Document38 pages6business Transactions and Their Analysis-For Observation4Marilyn Nelmida TamayoNo ratings yet

- Casifmas: Trainers Methodology Level I Bookkeeping Nciii Document No. Issued By: Ntta Page - ofDocument7 pagesCasifmas: Trainers Methodology Level I Bookkeeping Nciii Document No. Issued By: Ntta Page - ofarnold mamanoNo ratings yet

- IACM For The Public SectorDocument147 pagesIACM For The Public SectorNur Asyiah100% (2)

- Statistical Process ContriolDocument4 pagesStatistical Process ContriolVon Gary RasNo ratings yet

- Guidelines For Renovation Activity 24.9.22Document10 pagesGuidelines For Renovation Activity 24.9.22Syed Naeem NaqviNo ratings yet

- Advanced-Audit-&-Assurance - PDF - Studocu: People Also AskDocument8 pagesAdvanced-Audit-&-Assurance - PDF - Studocu: People Also AskPatricia Nicole BarriosNo ratings yet

- Executive Agencies Act, Cap 245Document10 pagesExecutive Agencies Act, Cap 245Jeremia MtobesyaNo ratings yet

- Lecture 1: Introduction: MGT-131: Financial AccountingDocument20 pagesLecture 1: Introduction: MGT-131: Financial AccountingMubashir NawazNo ratings yet