Professional Documents

Culture Documents

Management of Leakages

Uploaded by

sidranazkiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Management of Leakages

Uploaded by

sidranazkiCopyright:

Available Formats

MANAGEMENT OF LEAKAGES AND FRAUDS IN GENERAL INSURANCE CLAIMS

R.Qaiser Faculty Member, NIA, Pune In the emerging Insurance scenario in India, pricing and claim servicing will decide where an Insurance Company stands. In fact, in the days to come, claim cost will have a direct bearing on the pricing. Leakages and frauds on account of claim / underwriting will adversely affect the claim experience which in turn will affect the pricing. Because of the misdeeds of a few and because of the lack of effective control by the insurance company, the genuine customers who constitute the majority will have to pay higher prices for insurance products than is actually warranted. In an open market with lot many option available the consequence are very obvious. Not only because of higher prices it will deter new customer to come even existing client base will start dwindling. It is therefore essential for their own survival that insurance companies formulate a claim management philosophy where concern on account of leakages & frauds are taken care of properly. A transparent claims management policy in fact can be a good market strategy also. As long as there has been insurance, there have been insurance frauds. Lets accept the fact that the leakages and frauds can not be eliminated altogether. But lets also accept the fact that they can be managed, controlled and kept within a limit. In common parlance fraud is associated with dishonesty, breach of trust, criminal deception, misappropriation, etc. However, fraud is not defined in I.P.C. But we can say that Whenever there is intention to deceive and by means of deceit to obtain an advantage there is fraud. If we extend this concept to insurance, then any act aimed at making profit from an insurance contract constitute Page 1 of 1

Insurance fraud. intention of

e.g. Non-disclosure of material fact with the

Getting reduced insurance premium - rate Getting claim settled which otherwise would not have been possible.

Of late there have been spurt in insurance related frauds and this can not be viewed in isolation as this also reflects on the shortcomings in the society we live in and partly explains the spurt. Economic disparity, unemployment falling moral values, materialism, etc. in their own way give rise to white collar crime in society. other reasons are High reward low risk proposition: There is no penal provision in IPC to deal effectively with insurance related frauds / leakages and hence it is very difficult to book a culprit. This being the position and there being no strong, effective deterrent, unscrupulous persons see nothing risky in taking a chance. They have nothing to loose but everything to gain. Public attitude Victimless crime : Insurance fraud / leakages generally do not in any way directly affect the public at large. The common perception is that Insurance Companies have deep pockets. Hence the society and / or individuals do not react to the insurance fraud / leakages in the same way as they do on matter that are of concern to them. Low law enforcement priority: The law enforcement agencies are too pre-occupied with other more pressing and urgent matters to pay attention to frauds / leakages in insurance. the bottom. In their priority list such matters are always at The

Page 2 of 2

Inadequate enforcement of system and procedures in Insurance Companies : Although there are adequate well defined systems and procedures relating to underwriting & claims, the same are not followed in letter and spirit. These need to be strictly followed and those found guilty of violating them should be dealt with firmly.

Slow pace at which DCA (conduct, discipline & appeal) cases proceed and the culprits not getting punishment : While the no. of CDA related cases in Insurance Companies are increasing, the disposal of these cases are very slow. Proper cases are not made out against dishonest people and they go scot free in the absence of evidence / witness. Quick disposal with appropriate punishment will act as a deterrent for other.

Human desire to get something for nothing: The human desire to make fast buck-right or wrong at times finds congenial atmosphere to make hay while the sun shines.

If we examine the leakages and frauds, we can broadly classify them in two groups viz. Those committed by the insiders e.g. companys personnel / Agents either on their own as in collusion with the client Those committed by the outsiders e.g. claimants, service providers, surveyors, advocates, etc. Under the first category would come the leakages and frauds like antedating of cover note, collusion with the claimant to help him get inflated claim, granting cover but not depositing the premium etc.

Page 3 of 3

Under the second category would come the leakages and frauds like staged accident / injury / arson/ theft, etc.; scuttling of ship, charter party frauds, documentary frauds, in marine insurance; wrong billing by service provider with / without the collusion of the insured etc. Before we discuss the remedies and the strategy to combat leakages and frauds, lets examine some fraud indicators. The alarm bell should sound whenever we come across such indicators and this calls for being more careful and vigilant in handling these cases. Motor cover note issued in Friday evening Claims made shortly after the policy inception Serious underwriting lapses observed while processing a claim Insured overtly aggressive in pursuit of a quick settlement Willing to accept small settlement rather than document all losses. Documents of doubtful nature. Insured behind in loan repayment Accident un-witnessed and not promptly reported. Invisible injury High value leakage claim without any known casualty.

These are but some of the indicators. Being always vigilant is the only insurance to plug the leakages and frauds. Some studies made in USA a couple of years back reveal that in USA, insurer lose $120 billion annually is fraudulent claims and about 90% of this relates to health insurance. This obviously does not include cases not detected. The study further revealed that if insurance fraud was a business it would rank 56th among the top companies in USA. A very disturbing trend that was noticed was that

Page 4 of 4

most of the young respondents covered by the study did not see any wrong if the claims are exaggerated to cover insurance premium / policies, excess, etc. The position is not that alarming in India. However MACT and heath segment claims are posing serious threats. In fact in India no study has been made to assess the extent of frauds / leakages and what percentage it constitute of the total claims paid. Any such study in reference to MACT and health will bring out startling revelation The following remedies are suggested For internal frauds: Strict adherence to system and procedure relating to underwriting and claims. Internal check and balances to be strengthened and strictly enforced. Severe punishment to guilty persons and speedy disposal of CDA cases. Apart from their traditional role and functions, IAD having whole heap of records. Developing culture of work place ethics / integrity in the organization. People in insurance company should be educated that their indifference towards the leakages and malpractices in their offices has serious implications for them also apart from the organization. For external frauds: Pursuits of civil litigation against these involved in fraud. Close cooperation with law enforcing agency. Seek the help of public spirited people / NGOs. and Vigilance should prepare system of prevention rather than

Page 5 of 5

It should be understood that unless the unscrupulous person from the Insurance Co., the insured and the surveyor / advocate / investigator join hands it is very difficult for any leakage / fraud to take place. Surveyor / advocates / investigators are independent professionals and they have to abide by professional code of ethics. The surveyors in particular have to abide by IRDA guidelines also. The performance of surveyors / advocates / investigators needs to be constantly monitored vis--vis their integrity. Competence, jobknowledge, work-quality, timely submission of report, etc. Based on the appraisal, action as deemed necessary and wherever warranted should be initiated. This will not only help in plugging the leakages but will also help in better overall claims management. Lets develop a culture where it becomes difficult to commit fraud / leakages and get away with it. This is in the best interest of insuring public at large, the insurance companies as also the society. Claims settlement being a key service parameter, and therefore, while every effort should be made for speedy settlement of claims, a balance has to be maintained to ensure claims of doubtful nature are properly examined and looked into before they are passed.

*****

Page 6 of 6

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Simple Present Story 4 PDFDocument7 pagesSimple Present Story 4 PDFjasnas75No ratings yet

- Michel Foucault: From Discipline and Punish: The Birth of PrisonDocument12 pagesMichel Foucault: From Discipline and Punish: The Birth of PrisonShoNo ratings yet

- Corporal PunishmentDocument18 pagesCorporal Punishmentmalama123No ratings yet

- The Mossad Marc E Vargo (1476619662) PDFDocument292 pagesThe Mossad Marc E Vargo (1476619662) PDFgabytrexNo ratings yet

- Admin Law 2Document80 pagesAdmin Law 2liboaninoNo ratings yet

- Harden v. Benguet Mining DigestDocument3 pagesHarden v. Benguet Mining Digestkjhenyo218502No ratings yet

- Criminal Misappropriation and Criminal Breach of TrustDocument13 pagesCriminal Misappropriation and Criminal Breach of Trustbilal khanNo ratings yet

- Carlito Bondoc Vs SandiganbayanDocument2 pagesCarlito Bondoc Vs SandiganbayanMyra Mae J. Duglas100% (1)

- Angeles University Foundation Angeles City School of LawDocument40 pagesAngeles University Foundation Angeles City School of LawDianne Rosales50% (2)

- Caning EssayDocument2 pagesCaning EssayIylia AnisNo ratings yet

- Memorial (Repaired)Document20 pagesMemorial (Repaired)Yug Pratap Singh33% (12)

- Chapter Nine: The Trial and Execution of Dr. Jose Rizal: 3 CommentsDocument4 pagesChapter Nine: The Trial and Execution of Dr. Jose Rizal: 3 CommentsMark Angelo Hasal DuanaNo ratings yet

- Reintegration and Recidivism A Phenomeno PDFDocument133 pagesReintegration and Recidivism A Phenomeno PDFJared John MendozaNo ratings yet

- Private-Prisons US StudentDocument5 pagesPrivate-Prisons US StudentMauricio Gil Bonilla100% (1)

- People v. Yu 80 SCRA 382Document8 pagesPeople v. Yu 80 SCRA 382iya mpNo ratings yet

- "Juvenile Death Sentence Lives On ... Even After Roper v. Simmons" by Akin AdepojuDocument41 pages"Juvenile Death Sentence Lives On ... Even After Roper v. Simmons" by Akin AdepojuTlecoz Huitzil100% (2)

- Criminal Attempt A Comparitive Analysis of India, Uk and Us Chapter - 1Document52 pagesCriminal Attempt A Comparitive Analysis of India, Uk and Us Chapter - 1Antika DudejaNo ratings yet

- GR No. 183577 PP v. Hilario EscotonDocument12 pagesGR No. 183577 PP v. Hilario EscotonNnelg Soalrub OnaicragNo ratings yet

- Compilation of Elements Title OneDocument5 pagesCompilation of Elements Title OneEzekiel T. MostieroNo ratings yet

- Disciplinary ActionDocument3 pagesDisciplinary ActionJahnob KonwarNo ratings yet

- Module 3Document16 pagesModule 3Jhon Carlo CanchelaNo ratings yet

- Interview With Jarvis Jay Masters, Author of THAT BIRD HAS MY WINGSDocument1 pageInterview With Jarvis Jay Masters, Author of THAT BIRD HAS MY WINGSHarperOne (an imprint of HarperCollins)No ratings yet

- 2018029,,, Corporate Law Research PaperDocument14 pages2018029,,, Corporate Law Research PaperG V MANISH KumarNo ratings yet

- Sornarajah (1994) The Definition of Murder Under The Penal Code PDFDocument28 pagesSornarajah (1994) The Definition of Murder Under The Penal Code PDFAnonymous P5WQfWNo ratings yet

- Reaction PaperDocument2 pagesReaction PaperKriz tyNo ratings yet

- Death Penalty - Opening StatementDocument2 pagesDeath Penalty - Opening Statementapi-250545038100% (4)

- Half Moon Bay Orchids Agrees To Pollution Penalty: Heat Nba ChampsDocument32 pagesHalf Moon Bay Orchids Agrees To Pollution Penalty: Heat Nba ChampsSan Mateo Daily JournalNo ratings yet

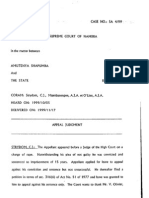

- Shapumba V The StateDocument12 pagesShapumba V The StateAndré Le RouxNo ratings yet

- ReferenceDocument14 pagesReferencePj TignimanNo ratings yet

- CRIM2001 Lectures 1 & 2 CH 2018 PDFDocument28 pagesCRIM2001 Lectures 1 & 2 CH 2018 PDFIzabela Ingrid PrecupNo ratings yet