Professional Documents

Culture Documents

Property Quotient - MPI Monthly Report June 2011

Uploaded by

Russell ChaiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Quotient - MPI Monthly Report June 2011

Uploaded by

Russell ChaiCopyright:

Available Formats

FACILITAT ING & PROMOT I N G I N VE ST M E N T F O R M A LAY S I A N R E A L E S TAT E | www.malaysiapropertyinc.

com

June 2011 issue 13

INVESTOR PREFERENCES The China Report POLICY Its All a Question of Intention IN A NUTSHELL Growing Retirement Savings Through Property GRAPHICALLY SPEAKING Landed Property Price in 1Q2011p Compared with 1Q2010

COVER STORY A Vertical City SPOTLIGHT Southern Prosperity SPECIAL REPORT Poised for Growth

A VERTICAL CITY

The transformation of what was once plantation land into one of Kuala Lumpurs premier high-rise residential enclaves offers a development model worthy of emulation Who would have thought that what was previously part of a rubber plantation would one day become a sought-after high-rise residential address? The tale of Mont Kiaras evolution is one worthy of note, not just because its a true blue Malaysian real estate success story, but also because of the lessons it offers both developers and property investors alike. In a period of just 15 years, Kuala L u m p u r s M o n t K i a r a e n c l a v e has garnered the respect not just of Malaysians, but also of the international community in Malaysia, many of whom make a bee-line to there to find a place to live. Attracted by the concept of community living and the developers focus on quality of life, their presence has helped turn it into a vibrant, desirable place to live and this has increasingly drawn Malaysians to high-rise living in the area. Today, Mont Kiara has turned into a suburban township complete with amenities and lifestyle outlets. It is the only suburban township that constitutes primarily high-rise developments in Kuala Lumpur. Its reputation has grown in tandem with its size and it is now considered by many to be the Damansara Heights of highrise living (Damansara Heights is one of Malaysias premier landed residential property enclaves). by Afiq Syarifuddin Figure 1: Map of MontKiara

(continued next page)

Source: Ho Chin Soon Research

COVER STORY

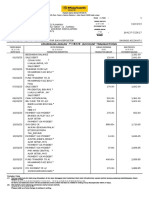

Figure 2: Existing Condominium Developments in Mont Kiara Project Name Amarin Kiara Kiaramas Sutera Hijauan Kiara Verve Suites Casa Kiara I Flora Murni Laman Suria Mont Kiara Meridin Mont Kiara Damai Mont Kiara Bayu La Grande Kiara

Source: MPI Research

Developer Amarin Group Asia Quest Holding Bukit Kiara Properties Bukit Kiara Properties Dijaya / Sunway Tian Gloval Sunrise Bhd Sunrise Bhd Sunrise Bhd Sunrise Bhd Nikmat Kuasa

Gross Floor Area (sq.ft) 4,073-6,141 1,347-4,100 2,090-3,732 633-1,213 1,235-4,573 1,615-5,490 931-2,147 1,787-4,487 2,272-11,000 798-2,300 1,961-7,335

Subsale Price (RM/sq.ft) 600 400 600-800 800 430 455 520 650 590 500 456

Asking Rental (RM/sq.ft) 2.89 3.00 3.20 6.00 2.50 2.62 2.50 2.50 3.00 3.00 3.04

Rental Completion Yield (%) Date 5.78 9.00 6.40 9.00 6.98 6.91 5.77 4.62 6.10 7.20 8.00 Jan-08 2004 Mar-08 Ongoing Apr-06 2006 Jan-04 Jan-09 Jul-04 Oct-02 2005

School, Mont Kiara International School, Australian International School M o n t K i a ra c o m p r i s e s m o s t l y and Lyce Franais de Kuala Lumpur condominium developments, with which offer British, American and and a some supporting retail and office French curricula. components. The residents are, interestingly, made up of 30 different Due to its desirable location and nationalities, of which Japanese good accessibility, Mont Kiara and Koreans constitute a majority. has experienced healthy capital Mont Kiara also hosts a multitude of appreciation over the years. Prices here businesses located in the office space hover in the region of RM500 to 750 and shoplots located around the per square foot and have been rising steadily due constant demand. The township. average rental and yield is RM2.86 psf The main business hub is known as Plaza and 6.89% respectively. Mont Kiara, where many established multi-national companies have taken T h e r e a r e c u r r e n t l y 1 4 2 , 0 5 9 up office space. Other commercial condominium units in the market, hotspots are Seni Mont Kiara, Solaris reported by the National Property Mont Kiara and Solaris Dutamas. A Information Centre (NAPIC) in the notable foreign investment in Mont Property Market Report 2010. Of note Kiara is Cheung Kong Groups foray into is the fact that 17,922 units are coming the area with ARA Asia Dragon Fund into the market, further increasing the through One Mont Kiara. This retail- supply in Kuala Lumpur alone. office development is valued at RM321 million. Although there are concerns of oversupply in the market, this is a broadThe competitive edge that Mont Kiara based phenomenon and occurs only in has is its location which is 8km away specific pockets in Kuala Lumpur City from the bustling city centre of Kuala Centre where branding, positioning and Lumpur and proximity to exciting planning are ambiguous. In this respect, townships with various amenities. MontKiara has been way ahead of the Accessibility to Mont Kiara from rest right from its inception, thanks Petaling Jaya and Bangsar is convenient to the smart strategies employed by through the SPRINT Expressway and Sunrise Berhad, the developer that was the North-South Expressways Jalan instrumental for first carving a vertical Duta exit.The area also boasts excellent city out of plantation land. infrastructure and easy access to the recreational facilities of nearby Bukit It is little wonder why investors are attracted to Mont Kiara. Key factors Kiara. for a successful property market can International schools have also found be determined through the saleability their way into this township to serve and offer price. However, once the initial and cater for the educational needs of developer price has reached a certain the residents children. For instance, threshold, the asking price would then only attract the upper-tier market and Mont Kiara has Garden International

(from previous page)

no longer be affordable to the masses. Therefore it is pertinent that the proposed new developments pricing is in tandem with the supply and demand situation. On top of strategic location and accessibilities, developers also need to put extra weight on the building design, facilities and amenities that will improve the overall residents quality of life. The environment also has to be designed to include amenities such as schools, shopping complexes and parks, as these are necessary to create a self-sustaining enclave that offers a convenient and vibrant lifestyle. Once the hardware is in place the developer of such an enclave would need to put in the software, which is the services, activities and other offerings that will give residents a lifestyle experience unlike any other. In Mont Kiara, for example, even residents transportation needs are taken care of through a shuttle service that takes them to major shopping areas in the vicinity. Exciting activities in the form of a weekend bazaar offer the opportunity for community shopping and family outings, while the nearby commercial precincts hold out the taste of vibrant entertainment and dining out experiences. MontKiara appears to have avoided being marred by oversupply and slow take-up, a fact that developers of highrise enclaves would want to take note of. Its secret lies in ensuring a winning formula right from the start and in sustaining the formula for the long term.

SPOTLIGHT

SOUTHERN PROSPERITY

depend on individual qua (energy areas), and there are altogether nine quas. PQ: How does Feng Shui affect property values? Prof. Choo: We can see over time how some properties or areas thrive while others stagnate.Human factors undoubtedly play a role, but Feng Shui also has influence in enhancing harmony and value of the property. For instance, auction properties are often shied away from as they are associated with bad energy. People are looking at all these factors and more when purchasing properties these days. There are many factors that contribute to the value of property such as location, design and developer. Feng Shui is just one part of it and not the sole contributing factor. PQ: From a Feng Shui perspective, what are the upcoming areas in Greater Kuala Lumpur? Prof. Choo: The Seri Kembangan area in the south of the Klang Valley. According to the qua, south is good for the next two years and this area will see positive growth for the next two years. Capitaland and YTL have gone into Seri Kembangan. The Klang Valley is prosperous because it is intertwined by the Gombak and Klang rivers. The KLCC area will continue to be robust as it is positioned at the concave of the rivers. According to Feng Shui principles, if the river embraces the land (concave), the energy will be collected. On the opposite side (convex), the energy is dispersed. We can see the effects on the fertility of the soil. The vegetation on the concave side is greener and lusher compared to the convex side. PQ: What are the basic Feng Shui principles to consider when purchasing properties? Prof. Choo: The Flow of the river. Properties that are positioned on the concave of the river will prosper. When purchasing residential property the back portion of the house needs to be higher than the entrance. This will ensure the prosperity of the unit does not flow out of the property. The position of the entrance depends on the individual qua. The qua is determined by the date of birth of the individuals. The position of the main entrance follows the qua of the man of the house and the master bedroom and kitchen

by S.Sulocana Professor Joe Choo is not what you expect of a feng shui expert. The first thing that startles you upon making Prof Choos acquaintance is the fact that this feng shui master is in fact a feng shui mistress. And a petite, pretty one to boot. All thoughts of greying, bearded sages ruling the feng shui world fly out of the window the minute she begins to speak. She is witty, charming and chatty, and very modern in her outlook to life. She has the ability to make one feel totally at ease in her company within minutes of meeting her. The diminutive President of the Malaysian Institute of Geomancy Sciences was recently awarded a Professorship by the Shanghai Jiao Tong University in China. She works with some notable listed companies in Malaysia and acts as consultant to various development projects. She also contributes articles on Real Estate Feng Shui for a number of publications in Malaysia.

follows the wifes qua. Feng Shui is all about finding the equilibrium of the Yin and Yang. In this case, Yang is the male and Ying is the female. Male attracts the energy, while female contains the energy. PQ: How do developers in Malaysia incorporate Feng Shui into their developments? Prof. Choo: It depends on how intensely they want to adhere to the principles. The principles are best incorporated from inception to completion. This includes the design and structure of the building, drainage, energy substation, water tank, sewerage pond, landscaping features and flow of the road. One of the residential projects that has fully incorporated the principles is Mitrajaya Berhads C180 condominium project in Cheras. I worked with the architects to draw up plans for the project. . PQ: What is the property outlook for year 2011? Prof. Choo: The southern part of Malaysia, which is Johor will be doing well. Property prices in Johor, especially the high-end and commercial properties, will see a consistent and steady growth. In the northern part of Malaysia, Penang will see rapid growth and prices are moving upwards parallel to the Klang Valley. In the Klang Valley, the areas that will see an increase in activity and growth are those in the southern part such as Sri Kembangan, Sungai Besi and Balakong.

Property Quotient (PQ) caught up with her recently to learn about how feng shui has begun to influence real estate practices in Malaysia.

PQ: What is Feng Shui and why do people place great emphasis in adhering to its principles? Prof. Choo: Feng Shui literally means wind and water. The whole idea of Feng Shui revolves around conserving Live Qi (Energy), using the understanding of its behaviour and response to wind and water. There are four aspects to Feng Shui, namely Harmony, Money, Health and Advancement. These aspects impact a persons needs at various times of their life. More and more people now have an understanding on Feng Shui and its disconnect from religion. They are more receptive to incorporating Feng Shui principles as a means to enrich and enhance their lives. Feng Shui principles

If you would like to know more about Feng Shui, kindly contact Prof. Joe Choo: joechoo@divine-element.com

SPECIAL REPORT

POISED FOR GROWTH

The Malaysian hospitality industry is growing on the back of increasing tourism and MICE activities

Figure 3: Tourist Arrivals and Receipts to Malaysia, 2001-2010

Receipts (RM million) 60,000 50,000 40,000 30,000 20,000 10,000 Tourist Arrivals (in million) 30 25 20 15 10 5 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

by S.Sulocana Malaysias Hospitality Industry is flourishing thanks to the Malaysia Truly Asia campaigns carried out around the globe by Tourism Malaysia. The industry is experiencing additions in the form of hotels and hospitality-related services to cater for an increasing number of business travelers, as well as the tourism and Meeting-Incentives- ConventionsExhibitions (MICE) industry segments. Tourism Malaysia is also actively promoting the MICE segment to mark Malaysia as the preferred destination to hold such events. Malaysias unique selling proposition is its strategic location as the hub of the Asia Pacific region, its sophisticated facilities and the lower cost compared with the rest of the region. The hospitality industry appears to be flourishing in Kuala Lumpur, Johor Baru, Penang, Kota Kinabalu and Langkawi. A total of 24.6 million tourists entered Malaysia in 2010, marking an increase of 4.2% year-on-year compared with 23.6 million in 2009.

Legend:

Receipts (LHS)

Arrivals (RHS)

Source: Tourism Malaysia

The tourism industry in Malaysia continues to show resilience despite the global economic crisis. The total receipts in 2010 increased to RM56.50 billion compared with RM53.37 billion in 2009. Total receipts have been experiencing a steady 10-year compounded annual growth rate of 13%. Tourism Malaysia figures show there were 2,367 hotels and 168,497 rooms in the country as at the end of 2010. As at March 2011 there were 215 fourstar and five-star hotels in Malaysia, of which 60 hotels offering 23,129 rooms are located in the Klang Valley area. The average hotel occupancy rate in 2010 was fairly stable, standing at 60% in 2010. The average room rate for three, four and five-star and budget hotels hovered around RM160, RM224, RM365 and RM100 respectively.

Several big names entered the hospitality industry last year. DoubleTree by Hilton made its mark by opening a 540-room hotel in the Kuala Lumpur city centre and Banjaran Hotsprings resort by local hotel operator Sunway City Berhad opened 25 luxury villas. Notable brands that will be coming on stream are The Regent, Hyatt and St Regis. The Regent will be entering the market in 2011 with a 250-room hotel complemented by 102 luxury residential apartments in Kuala Lumpur city centre. Hyatt Hotels & Resorts, which currently operates two hotels in Malaysia, will be growing its brand to have bigger representation in popular tourist cities in Malaysia namely Penang, Malacca, Langkawi and Johor Bahru. Hyatt currently manages the 330-room Hyatt Regency Kuantan in Pahang and the 288-room Hyatt Regency Kinabalu in Sabah. The hotel chain owners are also anticipating the opening of Grand Hyatt hotel located in the Golden Triangle in 2013. The hotel will offer 412 rooms, bringing the total inventory of Hyatt to 1,030 rooms. St. Regis by Starwood Hotels and Resort Group will be entering the industry in 2014, setting a new benchmark in terms of room rates. Located in KL Sentral, the primary transportation hub in Kuala Lumpur, hotel rates are expected to hover around RM1,000. The development will include a 208-room hotel and 160 units of apartments.

Figure 4: Number of Hotels and Rooms Supply in Malaysia, 2001-2010

No. of rooms (in 000) 180 150 120 90 60 30 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 No. of hotels (in 000) 2.6 2.4 2.2 2.0 1.8 1.6 1.4 1.2 1.0

Legend:

Supply of Rooms (LHS)

Supply of Hotels (RHS)

(continued next page)

Source: Tourism Malaysia

SPECIAL REPORT

Figure 5: Recently Opened Establishment, 2010 Opening in 2010 Banjaran Hotsprings G City Club Hotel Shah Alam Convention Centre Fraser Place (Serviced Apartment) The Philea Resort & Spa DoubleTree by Hilton Hotel Rating 6 5 n/a 5 6 5 No. of Rooms/ Facilities 25 units 180 rooms 208,000 sq.ft 215 units 201 units 540 rooms, 20,000 sq.ft (meeting space) 720 rooms / 441 units Location Perak Kuala Lumpur Selangor KLCC Malacca Kuala Lumpur Completion Date Jan-10 Mar-10 Apr-10 May-10 May-10 Aug-10

TOTAL

Source: MyCEB

(from previous page)

The need for branded budget hotels in Malaysia has also increased over the years, due to cheap travel offered by low cost carriers (LCC), Air Asia and FireFly. The rapid expansion of local and international routes has also contributed to the growth of budget travelers and even business travellers looking for economical fares. The LCCs have become a transit mode to other destinations. Air Asia has expanded its routes to 78 destinations around the world, including the recent additions of Seoul, Paris and Christchurch. Firefly, on the other hand, flies to 18 destinations and will

be expanding its routes in the coming years. Currently, Tune Hotels and Grand Paradise Hotels are the only two branded budget hotel chains in Malaysia. The chains operate nine and two hotels respectively in various states in Malaysia. Malaysias hospitality industry has a long term growth potential, judging by its resilience despite the global economic turmoil and global pandemic outbreaks. An important point to note is that the hospitality industry is investor-friendly, with no restrictions on foreigners owning any type of hospitality asset. At present, 58% of four and five-star hotels in Kuala Lumpur are owned by foreign entities.

DoubleTree by Hilton

Figure 6: Incoming Supply of Rooms/ Facilities until 2016 New Development The Regent The Regent Residence Allson Capital Hotel Pullman Impiana Hotel (extension) Fraser Residence Traders Hotel Grand Hyatt St. Regis Hotel MATRADE Convention Centre W Hotel TOTAL

Source: MyCEB, MPI Research

Hotel Rating 5 5 4 5 4 n/a 4 5 6 n/a 5

No. of Rooms/ Facilities 236 rooms 115 units 236 rooms 515 units 180 rooms (existing 335 rooms) n/a 286 rooms 450 rooms 200 rooms, 32,300 sq.ft (meeting space) 1 million sq.ft 150 rooms 1,765 rooms / 115 units

Location KLCC KLCC Kuala Lumpur Kuala Lumpur KLCC Kuala Lumpur Johor Bahru KLCC Kuala Lumpur Kuala Lumpur Kuala Lumpur

Expected Completion Date 2011 2011 2011 2011 2011 2012 2012 2013 2014 2014 2016

INVESTOR PREFERENCES

THE CHINA REPORT

Malaysia-China diplomatic and trade relations are on a strengthening momentum with a timely visit from Premier Wen Jiabao to Kuala Lumpur, April this year Tianjin Beijing Bohai Rim

Chengdu

Shanghai

Chongqing Guangzhou by Chan Tze Wee In terms of bilateral transactions, China is Malaysias largest trading partner, second largest export destination and largest source of import in 2010. Malaysia has also been Chinas largest trading partner in ASEAN for three consecutive years since 2008. Despite the global economic crisis, Malaysias export to China registered double digit growth of 14.5% valued at RM80.60 billion in 2010. During Premier Wens visit on 29th April, a total of eight agreements and MoUs were signed between Malaysia and China. The list includes: Pearl River Delta

Source: www.chinasuccessstories.com

Yangtze Delta

real estate sector? The obvious beneficiary is increased investments in corporate real estate. Using Huawei Technologies presence in Malaysia as a case study, Huawei is the countrys largest Chinese investor since entering the Malaysian market in April 2001, as tracked by the Malaysian Investment Development Authority (MIDA). The MoU signed on assistance to help Malaysia train 10,000 telecom professionals in the next five years, Agreement on Expanding and making Malaysia one of the few global Deepening Economic and Trade human resource centers for Huawei. Cooperation between Malaysia and This would be followed by plans to China develop a Malaysian training centre to Agreement between Malaysia and fulfill the training initiative. Currently, China on Framework Agreement Huawei has 645 employees in Malaysia, to Facilitate Mutual Recognition where close to 10% are Chinese nationals in Academic Higher Education Taken from a wider view, this is but one Qualifications. of 120 companies with Chinese interest Joint-Venture Agreement between across various industries operating in Smelter Asia Sdn Bhd and Aluminium Malaysia as of 2011. Suffice to say, the Corporation of China Limited expanding presence of international (CHALCO) MoU between Beijing Foreign Studies Malaysia is the Country of University and Universiti Malaya on Jointly Establishing Chinese Studies Honour in the upcoming Centre 8th China-ASEAN Expo held MoU Resolving Traffic Congestion in annually in Nanning, Guangxi. Penang between the state Industry clusters to be featured government and Beijing Urban Construction Group Co. Ltd in the Malaysia Pavilion include MoU on MSC Malaysia Human Property Development, Food & Capital Development Programme Beverages, Health & Wellness, in ICT Industry between Multimedia Building Materials and a Corporation Sdn Bhd (Mdec) and Dream Catcher Consulting Sdn Bhd strong representation from with Huawei Technologies (M) Sdn all government offices with a Bhd

companies in Malaysia will bring along an increased demand for housing, amenities and other services associated with serving the business community. Malaysian real estate potential to the Chinese investor With one of the worlds fastest growing insurance markets, Chinas insurance premium totaled RMB 1,452.8 billion and this market is expected to become the worlds fourth largest insurance market by 2018. By February 2011, Chinese insurers have total assets under management (AUM) of RMB5.2 trillion. The China Insurance Regulatory Commission (CIRC) issued a September 2010 circular (CIRC Circular 79) that explicitly permits Chinas insurance companies to invest their assets in private equity. The allowed investments may be either direct or indirect, making Chinas insurance companies potential equity investors in onshore companies as well as limited partners in onshore private equity funds or RMB funds. The aggregate investment in any one private equity fund may not exceed 20% of the funds total offering size. With this, up to 10% of the RMB5.2 trillion assets are allowed to invest in real estate. For some context, real estate investment by Chinese insurers stood at RMB40 billion at end 2009, less than 10% of the RMB520 billion permitted as at February 2011.

presence in China.

How does this bode for the Malaysian

(continued next page)

INVESTOR PREFERENCES

Malaysia 6,187,400

6,000,000 3,000,000 1,000,000 500,000 200,000

Figure 7: Chinese Diaspora

Source: WSJ Research, The Shao Center at Ohio University, CIA World Factbook

(from previous page)

With the Chinese insurance markets widening investment horizon as an example of further liberal steps by the Chinese government, Malaysian players targeting inbound investments must continue positioning and lobbying for Chinas attention and beyond. Aside from the immediate advantage o f g e o g ra p h i c a l p r ox i m i t y a n d benefits conferred by being part of the China-ASEAN Free Trade Agreement, enhancing the current government-togovernment relations between Malaysia and China is crucial to continue creating buy-in from Chinese conglomerates and investors alike. Over the course of 2011, the Malaysia-China engagement looks to solidify with further official visits such as the minister of industry and trades return visit to Shanghai in December, following the Deputy Prime Ministers visit in March. On the homebuyer level, increasing enquiries on Malaysian real estate opportunities have been recorded from Q2 2011. Some attribute this to Premier Wens recent visit as recognition of Chinas closer ties with Malaysia. Various forms of enquiries have emerged. Chinese real estate agents are testing the viability of promoting prime Malaysian properties to their local clients in 1st tier cities. Similar to the requirements of most foreign real estate buyers in Malaysia, the sought after formats are condominiums within the range of 500 2,000sq.ft. An additional criteria more

Factbox

The many angles of potential Chinese interest into Malaysian real estate: Shanghais high concentration of Malaysians offers the opportunity of tapping into an accessible database as well leveraging on Shanghais extensive business networks Hong Kongs corporate community includes China mainland companies that have larger exposure to foreign markets by virtue of being listed in Hong Kong The Pearl River Delta Region is made up of Chinas southern coastal cities and provinces. Familiarity with Malaysia is highest in this part of China. Malaysia is the 4th largest population within the Chinese diaspora around the world (Wall Street Journal, July 2010).

unique to the Chinese target market is higher enquiries for themed properties such as golf villas and beachfront properties. Kuala Lumpur, Penang and Kota Kinabalu are the immediate areas of interest. On the construction and development front, Chinese companies are enquiring on the prospects of development or equity joint ventures with credible Malaysian parties. At this stage of infancy, most investor questions are still focused on supplementing their initial market research stages understanding Malaysias real estate outlook, growth prospects and clarification of government regulations. In the long run, Malaysias favourable position within the ASEAN countries and its outward looking policies will need to remain highly competitive against the

promising growth prospects of other South East Asian countries. Perhaps a larger aspiration would be to fit into a China + 1 strategy where Malaysia features as the complementary regional office to China for global investors expanding into Asia Pacific.

Upcoming MPI China Market Events are open for participation from Malaysian developers and real estate companies. Please contact MPI for further information. September 2011: Malaysia Property Showcase, Shanghai October 2011: China-ASEAN Expo, Malaysia Pavilion, Nanning

POLICY

ITS ALL A QUESTION OF INTENTION

S. Saravana Kumar discusses the distinction between income tax and real property gains tax

In property transactions, profits derived upon disposal of a property by a taxpayer are subject to income tax or real property gains tax. This distinction depends on the taxpayers intention to hold the parcel of property either as a trading stock or as an investment. It is important to identify this intention as the tax treatment between the two types of property is different and disputes can occur between the taxman and taxpayer about the nature of the profits derived upon disposal of the property.

Any profits arising from disposal of a trading stock are subject to income tax at the rate of 25%. Meanwhile, any gains arising from the realisation of an investment are subject to real property gains tax (RPGT) at the rate of 5%, if it was owned for a period of less than 5 years. If the investment was owned for a period of more than 5 years, it is not subject to RPGT. On the other hand, trading requires an intention to trade. The question to be So how does one distinguish between asked is whether that intention existed a property held as trading stock or at the time of the acquisition of the investment? The Malaysian Courts have property. Was the property acquired decided in a number of recent cases that with the intention of disposing of it at a the distinction simply depends on the profit, or was it acquired as a permanent intention of the taxpayer. investment? The Courts have held that the mere realisation of investment is not income under the ordinary concepts and usages of mankind. However, profits arising from the sale of any property acquired for the purpose of trading are subject to income tax.In these circumstances, the focal point of enquiry by the Courts is the dominant purpose for which the particular property was originally acquired. It is encouraging that the Courts have commented that the mere presence of an intention to sell property at a profit at some future date is not of itself, sufficient to cause the profit to be taxable if the dominant motive in pur-

chasing the property was not the In one case [1], the Courts held that the gains arising from the disposal of expectation of profit by sale. the land were subject to RPGT. It was So how does one distinguish between commented that the evidence showed a property held as trading stock or that the property was the only property investment? The Malaysian Courts have bought and kept by the taxpayer for decided in a number of recent cases that investment. There was no evidence the distinction simply depends on the to show that the taxpayer had been intention of the taxpayer. dealing in land before they acquired the property. In fact, there was no evidence The Courts have held that the mere to show that the taxpayer had other realisation of investment is not income transactions in property before. There under the ordinary concepts and usages was also no evidence to show that the of mankind. However, profits arising taxpayer was a developer before the from the sale of any property acquired transaction. The purchase of the said for the purpose of trading are subject property was the only transaction to income tax. In these circumstances, carried out by the taxpayer. In those the focal point of enquiry by the Courts circumstances, the Courts held that is the dominant purpose for which it could not be said that dealing in the particular property was originally land was the principal activity of the acquired.It is encouraging that the taxpayer. Courts have commented that the mere presence of an intention to sell property Similarly, the Courts had also held that at a profit at some future date is not of where a taxpayer takes no serious effort itself, sufficient to cause the profit to to obtain a loan facility from a financial be taxable if the dominant motive in institution and has no capabilities to purchasing the property was not the develop land [2], such land is held to be expectation of profit by sale. the taxpayers investment. The gains are then subjected to RPGT.The mere fact The Courts are guided by the badges of that a taxpayer made a gain because trade as the criteria for distinguishing the land was near the main road or a between profits subject to income tax good location does not automatically and those subject to RPGT. The main make the gain liable to income tax. In badges of trade are the dominant another interesting case [3], it was held purpose of acquiring the property, that the taxpayer had invested in the subject matter of transactions, property by reason of its proximity to a period of ownership, frequency of nearby town. The value of the taxpayers transactions, circumstances for sale, land merely appreciated in the course motive or intention of taxpayer and of time due to the development of the methods of sale. surrounding areas. The factors highlighted above were not seen by the Courts as factors alluding to trading but rather investment. In this regard, it is crucial that a taxpayer is aware of the potential tax implication in managing his tax affairs prudently.

[1] ALF Properties Sdn Bhd v Ketua Pengarah Hasil

Often, it is necessary to ask further [2] Au How Cheong Sdn Bhd v Ketua Pengarah Hasil questions: an investment may be sold Dalam Negeri (No.R(3)(1)-14-02-2006 in order to acquire another investment [3] E v Comptroller-General of Inland Revenue (1950thought to be more satisfactory and 1985) MSTC 106 that does not involve an operation of trade notwithstanding whether the Next issue: What are the factors that first investment is sold at a profit or at allude to trading? a loss. The Courts have held that a purpose so qualified and suspended does not amount to an intention to trade. At best, it is a mere contemplation until the materials necessary to a decision on the commercial merits are available and have resulted in such a decision.

S. Saravana Kumar is a tax lawyer with Lee Hishammuddin Allen & Gledhill. He holds a Master of Laws in Taxation from the London School of Economics. He appears regularly in court for various tax and customs disputes. Saravana also advises on tax advisory & planning, tax audit & investigation, transfer pricing and international tax aspects.

Dalam Negeri [2005] 3 CLJ 936

IN THE NUTSHELL

GROWING RETIREMENT SAVINGS THROUGH PROPERTY

Asian pension funds are becoming incresingly enamoured of real estate as a long term investment option

Figure 8: Total Assets in US$ trillion and Annualised Growth in Asset of Top 20 Funds, 2010 (Split by Fund Domicile)

Total Asset (US$ trillion) 1.6 1.4 1.2 1.0 0.8 0.6 0.4 0.2 0 Netherlands Singapore Denmark Malaysia S. Africa Annualised Growth (%) 50

40.6

40 30 20 10 0

11.7 3.5 3.6 5.0 6.3

11.8

12.8

14.0

14.7

Canada

Korea

by Hazrul Izwan & A.Lalitha A pension fund is generally the biggest player in the investment world, ahead of mutual funds, insurance companies, currency reserves, sovereign wealth funds, hedge funds, or private equity. Over the past decade, the total assets of pension funds globally have increased more than 75%, from US$17 trillion in 2001 to over US$30 trillion in 2010.

Legend:

Total Assets in USD trillion (LHS) Annualised Growth Rate (RHS)

Source: Towers Watson

asset growth of 12.4%. Chinas National Social Security Fund has shown tremendous growth of 40.6%, followed by Denmark (14.7%), Singapore (14.0%), Canada (12.8%), Malaysia (11.8%) and Korea (11.7%). In many countries, particularly the developed nations of the West, the real estate sector has generally been considered to be an attractive asset class for long term investment. In the

Towers Watson estimates that the Top 20 pension funds worldwide contributed more than 13% to the market. From 2004 to 2009, this sector has undergone an average annualised

Figure 9: Top 20 Pension Funds Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Fund

Country Japan Norway Netherlands Korea USA USA Japan USA USA Netherlands Singapore Canada USA China Japan Denmark USA South Africa Malaysia USA

Total Asset (US$ million) 1,315,071 475,859 299,873 234,946 234,404 198,765 164,510 130,461 125,692 123,390 122,497 122,067 114,663 113,716 113,364 111,887 111,669 110,976 109,002 99,200

Major demographic changes in Asia will see Asian pension funds reassessing their current conservative asset allocations. Increased levels of real estate in their portfolios offer an important asset class for Asian pension funds to achieve portfolio diversification and meet their significantly increasing future liabilities in an effective riskadjusted manner

Professor Graeme Newell, University of Western Sydney early 70s, pension funds began investing in real estate, predominantly in the office, retail and industrial sectors. Over the last 40 years, more than a hundred billion dollars have been injected into the property market through a number of investment modes such as direct acquisition, real estate investment trust (REITs), unlisted real estate funds and joint-ventures. In Asia, however, real estate has not traditionally made up a significant level in most portfolios. Asian pension funds focus mainly on domestic low-yield assets, particularly fixed income and equities.

Government Pension Investment Government Pension Fund-Global ABP National Pension Federal Retirement Thrift California Public Employees Local Government Officials California State Teachers New York State Common PFWZ Central Provident Fund Canada Pension Florida State Board National Social Security Pension Fund Association ATP New York City Retirement GEPF Employees Provident Fund General Motors

Source: Towers Watson

(continued next page)

China

Japan

USA

IN THE NUTSHELL

10

(from previous page)

The exposure level in Asian pension funds is typically lower than in US, Canada, UK and Australia. Japan, which has the worlds largest pension fund, allocates less than 2% to real estate investments.

in an effective risk-adjusted manner, he explained in a report on the significance of real estate in Asian pension funds.

Colliers International (HK) Ltd regional director David Faulkner said, With greater institutional involvement in direct real estate investment in Asia, more income producing properties are This scenario appears to be changing, now being traded. however, as more and more Asian pension funds look for new asset Recent years have witnessed intense David Faulkner, classes in a search of good and stable reform efforts in pension funds around Colliers International (HK) Ltd yields. Real estate is increasingly being the globe. Malaysias largest pension considered as one such asset class that fund, the Employee Provident Fund Recently, EPF and Singapores offers safe diversification with stable (EPF) has also stepped up to increase Guocoland entered into 20-80 jointyield. the asset allocation for real estate. venture agreement to develop a US$2.6 billion mixed-use development which is Figure 10: EPFs Gross Investment Income in 2010 expected to be completed in 2015. Money Market Instrument 2.9% Since early last year, EPF has been Property & revealing its top equity investments Equities 45.5% Miscellaneous in Bursa Malaysia on a quarterly basis. Income 0.5% This is to promote greater transparency and to reassure its members that the investments are being undertaken in the interest of growing their retirement savings and in accordance with Malaysian investment and corporate governance Government best practices. Securities 22.1% EPF has shares in property development and property-related companies such Loans & Bonds 29.2% as Malaysian Building Society Berhad Source: Employees Provident Fund (EPF) (67.25%), Malaysian Resources University of Western Sydney professor Currently, the pension fund has less Corporation Berhad (41.78%), WCT of property investment Graeme Newell than 2% of its total accumulated funds Berhad (21.33%), Sime Darby Berhad said major demographic changes in Asia [amounting to US$ 140 billion] invested (15.29%), SP Setia Berhad (14.86%) and will see Asian pension funds reassessing in properties. However, it has a IJM Corporation Berhad (14.67%). their current conservative asset strategic asset allocation target of 5% allocations. for properties, said EPF deputy chief In order to create a vibrant domestic executive officer for investment Shahril property market, EPF has pledged to Increased levels of real estate in their Ridza Ridzuan. continuously increase its real estate portfolios offer an important asset exposure. Although EPFs fund size is class for Asian pension funds to achieve Local properties owned by the EPF smaller compared with pension funds portfolio diversification and meet their include Sogo Shopping Complex, Wisma in Europe and US, it is more proactive in significantly increasing future liabilities KFC, MAS Academy, Block A (Plaza implementing its real estate strategy. Sentral) and Gurney Resort Hotel. EPF is also involved in a mixed development EPF reported that its property and greenfield project at the 3,000-acre miscellaneous income last year rose Rubber Research Institute Malaysia 17% to USD34.4 million in 2010 from Currently, the pension land in Sungai Buloh which it acquired US$29.3 million in the preceding year. As for close to US$1 billion. such, total gross investment income in fund has less than 2% of its 2010 reached US$8.02 billion compared total accumulated funds While aggressively exploring the with US$5.74 billion in 2009. invested in properties. domestic market, the EPF is also However, it has a strategic increasing its exposure overseas and is Moving forward, Malaysian pension actively seeking investable properties funds can adapt to increase their asset allocation target of 5% in Singapore, Australia and the United exposure and stimulate the property for properties Kingdom. market by establishing clear real estate risk management procedures, Shahril Ridza Ridzuan, Its international investment strategy particularly in terms of a risk-sharing Employees Provident Fund (EPF) includes the acquisition of London strategy that includes joint-ventures properties The Fleet Street, One and co-investment with other major Sheldon Square and Portman Square for pension funds, sovereign wealth funds US$789 million in August 2010. and real estate investors.

With greater institutional involvement in direct real estate investment in Asia, more income producing properties are now being traded

US$ 8.02 billion

GRAPHICALLY SPEAKING

11

LANDED PROPERTY PRICE IN 1Q2011p COMPARED TO 1Q2010

PENANG Island: +5% Seberang Perai: +3%

KUALA LUMPUR Central: +7% North: +9% South: +17%

SELANGOR Petaling: +12% Kelang: +5% Gombak: +8% Hulu Langat: +12%

JOHOR Johor Bahru: -4% Batu Pahat: +5% Muar: +1% Kluang: -4% Segamat: +11%

CAPITAL APPRECIATION FOR VARIOUS HOTSPOTS IN KLANG VALLEY, PENANG AND JOHOR

KLANG VALLEY Bandar Utama +23.3% Bandar Sri Damansara +21.8% Bangsar +12.9% PENANG Greenlane Sungai Dua Pulau Tikus +12.3% +11.6% +10.7% JOHOR Bdr. Baru Permas Jaya Taman Daya Taman Perling +9.5% +8.8% +8.3%

Source: NAPIC, CBRE, Raine & Horne, KGV-LSH, MPI Research Note: All analysis is based on

Capital appreciation as at 1Q 2011p compared with 1Q 2010 Selected housing schemes p = Preliminary data

12

ABOUT US

Malaysia Property Incorporated is a Government initiative set up under the Economic Planning Unit to drive investments in real estate into Malaysia. As the first port-of-call for real estate investment queries, Malaysia Property Inc. connects interested parties through an extensive network of government agencies, private sector companies, real estate firms, business councils and real estaterelated associations. MPI has two core objectives; to create international awareness and to establish connections between foreign interests and Malaysian real estate industry players, ultimately contributing to real estate investments into the country.

For further information and up-to-date tracking of Malaysian real estate data, visit: www.malaysiapropertyinc.com For further enquiry, write to: info@malaysiapropertyinc.com

Disclamer: This report contains information that is publicly-available and has been relied on by Malaysia Property Incorporated on the basis that it is accurate and complete. MPI is not liable if the case proves to be otherwise. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and the same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed.

You might also like

- The Economics of the Modernisation of Direct Real Estate and the National Estate - a Singapore PerspectiveFrom EverandThe Economics of the Modernisation of Direct Real Estate and the National Estate - a Singapore PerspectiveNo ratings yet

- Property Investment: Needs, Long Term Investment, Social StatusDocument58 pagesProperty Investment: Needs, Long Term Investment, Social StatusjayNo ratings yet

- Mag Issue137 PDFDocument141 pagesMag Issue137 PDFShafiq Nezat100% (1)

- Focus On Negri Sembilan - 14 September 2014Document24 pagesFocus On Negri Sembilan - 14 September 2014Times MediaNo ratings yet

- Final Project Report RajDocument30 pagesFinal Project Report RajkaranchandelNo ratings yet

- P Kuala-lumpur-urban-DevelopmentsDocument154 pagesP Kuala-lumpur-urban-Developmentsgks6043No ratings yet

- Malaysia Top Property Developer 2012/2013Document173 pagesMalaysia Top Property Developer 2012/2013IProperty Malaysia75% (4)

- Forest Woods Sales KitDocument23 pagesForest Woods Sales KitWilliam ChuiNo ratings yet

- EP 1995 Lowres LockedDocument8 pagesEP 1995 Lowres LockedRamani KrishnamoorthyNo ratings yet

- Highly Integrated Firms or Real Estate Developers in The Philippines:Housing Delivery Process in The PhilippinesDocument35 pagesHighly Integrated Firms or Real Estate Developers in The Philippines:Housing Delivery Process in The PhilippinesEditha BaniquedNo ratings yet

- Real Estate Highlights 2H2012 - MalaysiaDocument16 pagesReal Estate Highlights 2H2012 - MalaysiaOtto LpNo ratings yet

- Hidden Treasures in The Nigerian Real Estate Sector by Dr. MKO BalogunDocument29 pagesHidden Treasures in The Nigerian Real Estate Sector by Dr. MKO BalogunVictor KingBuilderNo ratings yet

- North BangaloreDocument4 pagesNorth BangaloreGhanshyam YadavNo ratings yet

- Premium EquityDocument2 pagesPremium EquityrifapuspaNo ratings yet

- Sri Lanka Real Estate Market Brief Jan 2012 (Softcopy)Document10 pagesSri Lanka Real Estate Market Brief Jan 2012 (Softcopy)nerox87No ratings yet

- Supplementary ResearchDocument16 pagesSupplementary Researchregina macalongNo ratings yet

- Proposal-5 COTELDocument2 pagesProposal-5 COTELMarvin LacdaoNo ratings yet

- Chapter 4 Project ProfileDocument22 pagesChapter 4 Project ProfilePow JohnNo ratings yet

- Macaraeg-Arc150 (RSW No.1)Document20 pagesMacaraeg-Arc150 (RSW No.1)Kathleen Denise Doria MacaraegNo ratings yet

- Sahara City Homes PVTDocument41 pagesSahara City Homes PVTnishanth_nishanthNo ratings yet

- Business and Marketing Analysis and Suggestions To A Newly Proposed Apartment Project in Sri LankaDocument14 pagesBusiness and Marketing Analysis and Suggestions To A Newly Proposed Apartment Project in Sri LankaSithari RanawakaNo ratings yet

- Knight Frank H 206Document12 pagesKnight Frank H 206Telemetric SightNo ratings yet

- Sansiri Redefines Modern Living With Prime PropertiesDocument1 pageSansiri Redefines Modern Living With Prime PropertiesKingston LaiNo ratings yet

- Impression City, MalaccaDocument24 pagesImpression City, Malaccalyd roslyNo ratings yet

- Smart CitiesDocument36 pagesSmart CitiesTiong MarcusNo ratings yet

- Background of The Building - Part HafizDocument12 pagesBackground of The Building - Part HafizMuhammad HafizNo ratings yet

- Bahria Town Project Edited With Macro EnvironmentDocument32 pagesBahria Town Project Edited With Macro EnvironmentRaja KhurramNo ratings yet

- Southern PropertyDocument24 pagesSouthern PropertyTimes MediaNo ratings yet

- Age of Information TechnologyDocument4 pagesAge of Information TechnologyKenneth MarcosNo ratings yet

- Competitor Analysis - Revised As of Jan22Document16 pagesCompetitor Analysis - Revised As of Jan22HNicdaoNo ratings yet

- FNG Guidelines PDFDocument18 pagesFNG Guidelines PDFSamuel TolentinoNo ratings yet

- TRX Development - Brochure PDFDocument12 pagesTRX Development - Brochure PDFCheng FrankNo ratings yet

- CNN DocumentaryDocument4 pagesCNN DocumentaryLe MontblancNo ratings yet

- Malaysia's Top Developers 2011 / 2012Document134 pagesMalaysia's Top Developers 2011 / 2012ipropertymalaysiaNo ratings yet

- C31 Oiakl3o7ni7wwvz1.1Document3 pagesC31 Oiakl3o7ni7wwvz1.1M Ilyas KurniawanNo ratings yet

- Invest Malaysia - 28 June 2016Document12 pagesInvest Malaysia - 28 June 2016Times MediaNo ratings yet

- 10 Points For North Bangalore Development StoryDocument3 pages10 Points For North Bangalore Development StoryGhanshyam YadavNo ratings yet

- Listed Property Companies in Malaysia: A Comparative Performance AnalysisDocument17 pagesListed Property Companies in Malaysia: A Comparative Performance AnalysisCassandra LimNo ratings yet

- 10 Reasons To Buy LakecityDocument11 pages10 Reasons To Buy LakecityLim Pep LeadNo ratings yet

- Ep 2317 Lowres LockedDocument24 pagesEp 2317 Lowres LockedJkonNo ratings yet

- Sky Vue: Media ReleaseDocument3 pagesSky Vue: Media ReleaseSG PropTalkNo ratings yet

- Mixed UseDocument8 pagesMixed UsemdtaahNo ratings yet

- Anantya IM (M) - EditedDocument43 pagesAnantya IM (M) - EditedSandeep BorseNo ratings yet

- M/S Champalal K .Vardhan & Co Executive Summary: ProfileDocument21 pagesM/S Champalal K .Vardhan & Co Executive Summary: ProfileVishmita Vanage100% (1)

- PHINMA - University of Pangasinan: Astadan, Ira Mae NDocument13 pagesPHINMA - University of Pangasinan: Astadan, Ira Mae NIra Mae AstadanNo ratings yet

- Township DevelopmentDocument7 pagesTownship DevelopmentYamTengkuNo ratings yet

- SMDC Ar2010Document60 pagesSMDC Ar2010Aimee Fallorina PatricioNo ratings yet

- Philippines: Polar CenterDocument6 pagesPhilippines: Polar CenterLuningning CariosNo ratings yet

- Boulevard 51 250516 Sales Kit 2016Document54 pagesBoulevard 51 250516 Sales Kit 2016api-340431954No ratings yet

- Johor Property - 17 October 2015Document24 pagesJohor Property - 17 October 2015Times MediaNo ratings yet

- B. Industry and Competitor Analysis B.1 Industry AnalysisDocument42 pagesB. Industry and Competitor Analysis B.1 Industry AnalysisAngelica Sanchez de VeraNo ratings yet

- ASIAPAC - Annual Report 2016aDocument167 pagesASIAPAC - Annual Report 2016adanNo ratings yet

- Feasibility Study Final Paper (Chu)Document23 pagesFeasibility Study Final Paper (Chu)John ChuNo ratings yet

- Colombocitydevelopment TksDocument35 pagesColombocitydevelopment TksRandora LkNo ratings yet

- Edge DU SpecialDocument13 pagesEdge DU SpecialthinkoracleNo ratings yet

- Cidb News June 2014Document20 pagesCidb News June 2014Suhaila NamakuNo ratings yet

- ADP Detailed Design and ReportDocument13 pagesADP Detailed Design and ReportYuan MingNo ratings yet

- Why Invest in Singapore (BASIC) PDFDocument12 pagesWhy Invest in Singapore (BASIC) PDFShadow_Warrior88No ratings yet

- An Asian Direct and Indirect Real Estate Investment AnalysisFrom EverandAn Asian Direct and Indirect Real Estate Investment AnalysisNo ratings yet

- What Is Valuation?Document1 pageWhat Is Valuation?Russell ChaiNo ratings yet

- AceScube HomeDocument1 pageAceScube HomeRussell ChaiNo ratings yet

- Location Map - Mutiaraville Cybejaya A2-1Document1 pageLocation Map - Mutiaraville Cybejaya A2-1Russell ChaiNo ratings yet

- Market ValueDocument1 pageMarket ValueRussell ChaiNo ratings yet

- Should I Appoint One or More Agents To Sell My Home?Document2 pagesShould I Appoint One or More Agents To Sell My Home?Russell ChaiNo ratings yet

- Mutiara Ville Cyberjaya ProjectDocument5 pagesMutiara Ville Cyberjaya ProjectRussell ChaiNo ratings yet

- Buying A New Home GuideDocument4 pagesBuying A New Home GuideRussell ChaiNo ratings yet

- Malaysia My 2nd Home Programme-FAQDocument3 pagesMalaysia My 2nd Home Programme-FAQRussell ChaiNo ratings yet

- Malaysia My 2nd Home Programme-Application Through An AgentDocument2 pagesMalaysia My 2nd Home Programme-Application Through An AgentRussell ChaiNo ratings yet

- Malaysia My 2nd Home Programme-Direct ApplicationDocument2 pagesMalaysia My 2nd Home Programme-Direct ApplicationRussell ChaiNo ratings yet

- Malaysia My 2nd Home Programme-House PurchaseDocument1 pageMalaysia My 2nd Home Programme-House PurchaseRussell ChaiNo ratings yet

- Malaysia My 2nd Home Programme-New ApplicationDocument3 pagesMalaysia My 2nd Home Programme-New ApplicationRussell ChaiNo ratings yet

- Malaysia My 2nd Home Programme-Terms & ConditionsDocument2 pagesMalaysia My 2nd Home Programme-Terms & ConditionsRussell ChaiNo ratings yet

- The Essential Guide For Malaysia My Second Home (Mm2h) VisaDocument14 pagesThe Essential Guide For Malaysia My Second Home (Mm2h) VisaRussell ChaiNo ratings yet

- Mid 2018 2019 512a 93eaafe3a2Document419 pagesMid 2018 2019 512a 93eaafe3a2J&A Partners JANNo ratings yet

- Gadang HoldingsDocument9 pagesGadang HoldingsPauHua LimNo ratings yet

- Shell Recruitment Day: Graduate Briefing Pack - Damansara Heights, Kuala LumpurDocument25 pagesShell Recruitment Day: Graduate Briefing Pack - Damansara Heights, Kuala Lumpurchow_hui_3No ratings yet

- Saloma Bistro - An Authentic Ramadhan BuffetDocument6 pagesSaloma Bistro - An Authentic Ramadhan BuffetMiaa MeorNo ratings yet

- Margma 2020Document42 pagesMargma 2020Kai Yuan TeoNo ratings yet

- Capital Prominent - Co Profile 2022 V3 Copy-1Document25 pagesCapital Prominent - Co Profile 2022 V3 Copy-1Rosnisa SahmatNo ratings yet

- PPC ProfileDocument39 pagesPPC ProfileHusnina FakhiraNo ratings yet

- Micare Panel GP List For Aia December 2016Document97 pagesMicare Panel GP List For Aia December 2016Ethan ExpressivoNo ratings yet

- InTra Supervisor List 2017-2018!1!290917Document115 pagesInTra Supervisor List 2017-2018!1!290917Faiz IshakNo ratings yet

- List of CollegesDocument11 pagesList of CollegesEkaa VoxcleraNo ratings yet

- Previu KL DCP 2008Document45 pagesPreviu KL DCP 2008AlexNo ratings yet

- CRJGR-WMSB-DCR-SYS-S5.SKB-COM-CTV-00001 (4) (2) - Part2Document30 pagesCRJGR-WMSB-DCR-SYS-S5.SKB-COM-CTV-00001 (4) (2) - Part2hidayahNo ratings yet

- Senarai Ahli Panel Syarian Unit Amanah IslamDocument6 pagesSenarai Ahli Panel Syarian Unit Amanah IslamazmanasmaNo ratings yet

- 2918 Merdeka pnb118 Case Study Adding Value To The Growing City PDFDocument11 pages2918 Merdeka pnb118 Case Study Adding Value To The Growing City PDFTan Kean Tiong50% (2)

- Asian Championship 2024 (Malaysia)Document13 pagesAsian Championship 2024 (Malaysia)yhx2333333No ratings yet

- Bank MuamalatDocument286 pagesBank MuamalatMuhammad FadhilNo ratings yet

- Site Analysis PresentationDocument119 pagesSite Analysis PresentationEvon LowNo ratings yet

- Hab Pasar Seni Uitm Seksyen 2, Shah Alam: 750 Bus Time Schedule & Line MapDocument5 pagesHab Pasar Seni Uitm Seksyen 2, Shah Alam: 750 Bus Time Schedule & Line MapShaheer Ahmed KhanNo ratings yet

- Company Profile: Colweld Piling SDN BHD Colweld Geotech SDN BHDDocument13 pagesCompany Profile: Colweld Piling SDN BHD Colweld Geotech SDN BHDAdam LimNo ratings yet

- Rajakamil Updated ResumeDocument5 pagesRajakamil Updated ResumeRrajakamil X KableNo ratings yet

- Group AssignmentDocument28 pagesGroup AssignmentLe NhiNo ratings yet

- LATTTESTDocument13 pagesLATTTESTAmal SNo ratings yet

- RESUME Norly 123Document3 pagesRESUME Norly 123Norfadzlina EderisNo ratings yet

- Ibs TMN Midah, KL 1 31/03/23Document5 pagesIbs TMN Midah, KL 1 31/03/23Nor SharizaNo ratings yet

- 1.1 Executive Summary: Bahulu Hujan Panas Is One of The Most Popular Bahulu at Our Company. BAHULU'S HOUSE WithDocument3 pages1.1 Executive Summary: Bahulu Hujan Panas Is One of The Most Popular Bahulu at Our Company. BAHULU'S HOUSE WithJoyful StarNo ratings yet

- Pudu Jail Conservation StatementDocument34 pagesPudu Jail Conservation Statementmariana isa100% (3)

- D+A Magazine Issue 085, 2015Document116 pagesD+A Magazine Issue 085, 2015Bùi ThắngNo ratings yet

- Rujukan GamelanDocument6 pagesRujukan GamelanNOR ASRINA BINTI JAMALUDDINNo ratings yet

- List of Recommended Companies 2019Document6 pagesList of Recommended Companies 2019IT man100% (1)

- Publications Related To Malaysian MusicDocument6 pagesPublications Related To Malaysian MusicAriputhiran NarayananNo ratings yet