Professional Documents

Culture Documents

Purcahsing Power Parity

Uploaded by

Asim NajamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Purcahsing Power Parity

Uploaded by

Asim NajamCopyright:

Available Formats

December 12, 2005

Vikram Sharma

Note on Purchasing Power Parity

When someone from a developed country is considering taking a job in a developing country, she may have to consider a number of factors and salary is one of them. Let us assume that the given person has two job offers, one in the United States with an annual salary of $60,000 and another in India with everything else the same but with an annual salary of Rs. 2000,000 (approximately equivalent1 to $43,375 based on nominal exchange rate). Let us assume, everything else which is important for the person is exactly the same in both jobs and the person intends to spend all the salary on lifestyle goods2. On a pure dollar face value comparison the job in the US is more attractive because the salary is roughly 40% higher. Will this comparison change if someone told the person that she can buy much higher quantities of lifestyle goods in India with $43,375 than $60,000 would buy in the United States? Or simply saying the purchasing power of equivalent amount of Indian rupees3 is higher than the purchasing power of a US Dollar, which may mean that $43,375 in India is worth more than $60,000 in the United States. The fact is, in order to compare two currencies the nominal exchange rate is not adequate, but one has to use a different exchange rate which takes into consideration the buying power of the local currency. The exchange rate which equalizes the purchasing power of different currencies, given the prices of goods and services in the countries concerned, is referred to as Purchasing Power Parity (PPP). The application of PPP is not limited to simply comparing the buying power of different currencies but has a number of other applications, for example it is used to compare the standard of living of two or more countries. It is a necessary tool for such comparison because comparing the GDP per capita using market exchange rates does not accurately measure differences in income and consumption. Market exchange rates fluctuate widely, and the purchasing power parity hypothesis suggests that in the long run the market exchange rates and PPP rates should converge4. This note provides a primer on PPP and is divided into three sections. The first section describes and compares different methods for PPP exchange rate estimation. The second section discusses the drivers for the difference in the nominal and PPP rates. The third and final section provides some applications and examples of PPP. _______________________

1 2

Based on an exchange ratio of US$ 1 = 46.11, access from www.x-rates.com on December 11, 2005 Lifestyle goods here includes living expenses, food, beverages and entertainment 3 As determined by nominal US Dollar/Indian Rupee exchange rate 4 Lawrence H. Officer, Purchasing Power Parity and Exchange rates: Therory, Evidence and Relevance, Jai Press Inc. 1986

Note on Purchasing Power Parity

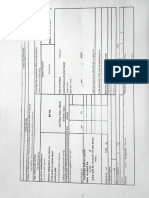

I. Calculating Purchasing Power Parity (PPP) exchange rates The theory of PPP has been around for centuries but it remains controversial and economists still argue the assumptions behind its calculations and its validity in different applications. There are two commonly used approaches for calculating the PPP exchange rates, the absolute approach and the relative approach. Absolute approach to PPP Let us start with a simple illustration of prices of a few items of daily use in the United States and in India (Table -1). Column A shows the prices in the United States of some common items of daily use and Column B shows their prices in India in Indian Rupees. Column C converts the price in India from Rupees to US Dollars using nominal exchange rates. We observe that the equivalent prices of these items in India are very low compared to their prices in the United States. Table 1 - List of prices for common items in India and the United States Price in India in Rupees B 10 12 12 35000 Rupees converted to US$ using market exchange rate of 0.022* C 46.11 0.22 0.26 0.26 759 Implied PPP Exchange rate D = C/A 0.18 0.20 0.17 0.36

Item A 12oz cup of coffee A one Lb loaf of bread Price of 1 litre Bottled water "Dasani" Rent per month for a two Bedroom apartment*

Price in the US in $ A 1.2 1.29 1.5 2100

Note: These are some sample prices at similar locations based on authors experience and not collected through a published source * Based on a 1US Dollar = 46.11 Indian Rupees, source www.x-rates.com, 12/11/2005 ** Apartments considered in Boston for US and Mumbai in India, 1000 sq. ft. size

Dividing the price in column C with price in column A gives an exchange rate which is shown in column D. This value is the PPP exchange rate, using this to convert Indian Rupees into US Dollars would result in equivalent buying power for the two currencies. However as column D indicates we have different values for PPP based on what sample item we use. In order to counter this problem economists use a basket of goods and services, this is also not easy, since purchasing patterns and even the goods available to purchase differ across countries. Additional statistical difficulties arise with multilateral comparisons when (as is usually the case) more than two countries are to be compared. This approach of PPP exchange rate estimation is called the absolute method for PPP estimation.

Note on Purchasing Power Parity

A simple example of a measure of absolute PPP is the Big Mac index popularised by The Economist, which looks at the prices of a Big Mac burger in McDonald's restaurants in different countries. If a Big Mac costs USD 4 in the US and GBP 3 in Britain, the PPP exchange rate would be 3 for $4. In the same way, if a Big Mac or any basket of goods costs $4 in the US, the PPP exchange rate is always GBP3 for $4. The Economist does not attach any special significance to the Big Mac, beyond it being a well-known good whose price is easily tracked in many countries5.

Relative approach to PPP Another method of PPP exchange rate estimation is the relative approach. This method was first employed after World War 1. Professor Gustav Cassel in his 1918 paper, Abnormal Deviations in International Exchanges," argued that the rates of exchange between two currencies should be expected to deviate from their old parity in proportion to the inflation of each country. This method6 estimates the new exchange rate by multiplying the original exchange rate with the relative movement of price levels (inflation). [Correct rate] = [Old rate] x [Price increase in country A] / [Price increase in country B] or EPPP(t) = E(0) x [Pa(t)/Pa(0)] / [Pb(t)/Pb(0)] (assuming that EPPP(0) = E(0)) Where: EPPP(t) is the PPP exchange rate at time t. E(0) is the nominal exchange rate during the base year, and Pa(t) and Pb(t) are the prices in countries A and B respectively at time t. The argument follows the following approach: 1. Let us assume that in year 2000, the prices between country A and country B were equalized i.e., the nominal and PPP exchange rates were the same. 2. After 2000, the inflation in country A was higher than inflation in country B, and the cumulative difference was 10%. 3. Thus, the new correct rate should be the one in which the country A currency is 10% more depreciated vis-a-vis country B, relative to year 2000. This method6 became very popular because it is very easy. Even today, many people use this method to calculate the "correct" exchange rate. When the IMF advises currency devaluation, it is often based on this kind of calculation. The major issue with this method is the base year, since we are making an implicit assumption that the prices had equalized in the base year (year 2000 in the example above). Since price data are expressed as an index with some arbitrary base year (say, 100 in the year 2000), it contains movement information but not level information (for example, by how much _______________________

5

Source: Wikipedia, http://en.wikipedia.org/wiki/Purchasing_power_parity, accessed December 2005. Details articles on Burgernomics can be accessed from The Economist through, www.economist.com 6 Lectures on International Economics by Prof. Kenichi Ohno, through http://www.grips.ac.jp/teacher/oono/hp/lecture_F/lec05.htm, accessed December 2005 3

Note on Purchasing Power Parity

were country A prices higher than country B prices in 2000). If we calculate PPP with 2000 as the base year, this is equivalent to assuming that absolute PPP held in 2000 (or the absolute PPP was the same as nominal exchange rate). The validity of this assumption needs to be proven first. Any such PPP estimate will have an unspecified error which is equal to the difference between the nominal exchange rate and PPP rates in 2000.

II. Drivers of PPP and what causes it to fail The law of one price The law of one price says that identical commodities bought and sold in different markets should bear the same price. Otherwise, there will be a profit opportunity in buying the commodity in one market and selling it in another where the price is higher (arbitrage opportunity). In an integrated and properly functioning market, arbitrage will surely continue until the law of one price is established, eliminating any further opportunity for excess profit until the two markets are really one7. The theory of PPP is founded under this law of one price. However not all commodities are tradable and sold across different markets. Most goods we buy are composite goods i.e., composed of tradable and non-tradable goods. The Big Mac used by The Economist to track PPP of different countries is composed of several ingredients8 (ground beef, bread, lettuce, labor cost, rent, etc.). Within this ground beef and bread may be considered tradable between different countries but lettuce or labor or rent may not be. That may help explain why the prices for the Big Mac have not converged across countries since The Economist began tracking them.

Reasons for why PPP does not always hold There are several reasons for the PPP theory to not hold or why the law of one price is not always valid. The main reasons are: Restrictions on international trade: Trade barriers such as import and export tariffs, duties etc. can erode much of the difference in price which may exist between two countries. For example if there is a 100% tariff on import of steel into India, the domestic prices of steel(which is a tradable good) in India will continue to be higher than the country of comparison, and any arbitrage is impractical. Transportation and logistics costs: If it is very expensive to transport goods from one market to another, we would expect to see a difference in prices in the two markets. This even happens in places that use the same currency; for instance the price of certain commodities (e.g., corn) is cheaper in cities such as Chicago when compared to Alaska. _______________________

7 8

ibid David C. Parsley et al., A Prism into the PPP Puzzles: The Micro-foundations of Big Mac Real Exchange Rates, NBER Working papers, August 2003.

Note on Purchasing Power Parity

This effect maybe more pronounced when there are huge economies of scale in production and there tend to be few centers of production. Shelf life: It may be physically impossible to transfer goods from one market to another. The lettuce which is used in the Big Mac may be cheaper in the United States but it does not help in reducing the price of Lettuce in Dubai, because by the time the American lettuce reaches Dubai, it may have turned brown. Location: The monthly rent to lease a location for McDonalds may be cheaper in Bangalore, India when compared with certain cities in United States, but one cannot buy a piece of land in India and move it to the United States. Wage rates: Labor costs in India or Mexico (which is much closer to the Unites States) are much lower than the labor costs in the Unites States, but one cannot bring Mexican or Indian employees in the United States and pay them lower than market wages. Skills gap and transferability: Some country may have abundant highly skilled people engaged in a certain task which may reduce the price of the goods they produce in their home country due to their lower wage rates. However it may not be possible for another country to develop a pool of individuals skilled in those tasks in a short period of time. So while purchasing power parity theory helps us understand exchange rate differentials, exchange rates do not always converge in the short term. It is empirically known that PPP does not hold (actual and PPP rates are different) within a day, a week, a month, a year, and even within a few years. But it is often observed that PPP is more firmly established as a long-term tendency9. Whether or not PPP holds in the long run is a prominent question in international macroeconomics. A wide variety of hypotheses about exchange rate movements hold that in the short run the exchange rate deviates from its long-run equilibrium value, but converges eventually to that equilibrium value. But, there is disagreement over what constitutes the equilibrium value. Some argue it is the PPP level, while others argue that there is a complex set of factors determining the long-run value, including such things as the relative labor productivities at home and abroad10.

III. Application of PPP and some examples The example in the introduction of this note explained how PPP exchange rates can help in comparing the value of salaries in different countries when one is trying to estimate the buying potential. There are in fact many other applications of PPP. _______________________

9 10

Reference from Lectures on International Economics by Prof. Kenichi Ohno Charles Engel, Long run PPP may not hold after all, NBER working papers, July 1996. For further details about relative labor productivity and its effect study the Balassa-Samuelson Effect, for Perspectives on PPP and long-run real exchange rates, Froot and Rogoff, NBER working paper series.

Note on Purchasing Power Parity

Measuring income and output of different countries: Let us say the value of currency of country A falls by 25% compared to the US dollar, its Gross Domestic Product measured in dollars will also reduce by 25%. However, this exchange rate results from international trade and financial markets. It does not necessarily mean that the output of country A reduced by 25% or its citizens became poorer by 25%; if incomes and prices measured in country As currency stay the same, its citizens would be no worse off assuming that imported goods are not essential to the quality of life of citizens of country A. Measuring income and outputs of different countries using PPP exchange rates helps to avoid this problem. The differences between PPP and real exchange rates can be significant. For example, the nominal exchange rate for Indian Rupee in terms of US Dollar is 0.0217, whereas the PPP exchange rate is 0.11411. Similarly GDP per capita in India is about US$622, while on a PPP basis, it is US$3,080. At the other extreme, Japan's nominal GDP per capita is US$37,600, but its PPP figure is only US$31,40012. World Bank and IMF maintain a list of countries ranked by their GDP both in nominal terms (based on market exchange rates) and GDP in PPP terms. To highlight the impact of PPP on the view of world economy consider the example of India and China. Based on Nominal GDP numbers India and China are ranked as number seven and ten in the world respectively, however in PPP terms they are at number two and four respectively13. Exchange rate determination: PPP can also explain why the actual exchange rate moves in a certain way. Typically, high inflation countries have depreciating currencies and low inflation countries have appreciating currencies. Determining the correct exchange rate: When there are large deviations in nominal exchange rate, PPP can help in indicating the right level. The monetary authority may try to narrow the gap between the actual and the desirable rate, either by devaluation or domestic adjustment (macroeconomic policy). When the government wishes to stabilize the exchange rate, PPP can provide the appropriate target level. PPP exchange rates are especially useful when official exchange rates are artificially manipulated by governments. Countries with strong government control of the economy sometimes enforce official exchange rates that make their own currency artificially strong. By contrast, the currency's black market exchange rate is artificially weak. In such cases a PPP exchange rate is likely the most realistic basis for economic comparison14. Indicator of competitiveness: the real exchange rate is frequently used as an indicator of international price competitiveness. When real exchange rate rises (domestic currency depreciates in real terms), the home country gains competitiveness because domestic prices become relatively lower (undervaluation). By contrast, when RER falls, the home country loses competitiveness because domestic prices are relatively higher (overvaluation)15. _______________________

International Monetary Fund, World Economic Outlook Database, September 2005 Wikipedia 13 World Bank, July 2005, data accessed through Wikipedia, December 2005 14 Source : McKinnon, Ronald I., and Kenichi Ohno, Dollar and Yen: Resolving Economic Conflict between the United States and Japan, MIT Press, 1997 15 ibid 6

12 11

Note on Purchasing Power Parity

Standard of living comparison: besides comparison of incomes in international locations, PPP exchange rates are also used to compare standard of living across different countries. International organizations like IMF or World Bank may need these comparison for determining aid packages or for making policy decisions.

In conclusion PPP is a very useful yet controversial concept and it continues to remain as one of the major puzzles16 in the field of economics.

_______________________

16

Maurice Obstfeld and Kenneth Rogoff, "The Six Major Puzzles in International Finance: Is There a Common Cause?", NBER Macroeconomics Annual 15, 2000

Note on Purchasing Power Parity

Bibliography

Cassel, Gustav, "Abnormal Deviations in International Exchanges," Economic Journal, December 1918 Ohno, Kenichi. Lectures on International Economics, http://www.grips.ac.jp/teacher/oono/hp/lecture_F/lec05.htm; http://internationalecon.com/v1.0/Finance/ch30/30c030.html accessed through

Parsley, David C. A Prism into the PPP Puzzles: The Micro-foundations of Big Mac Real Exchange Rates. NBER working papers series. Rogoff, Kenneth S. The Purchasing Power Parity Puzzle, Journal of Economic Literature 34, June 1996, 647-68. Wikipedia, Purchasing Power Parity http://en.wikipedia.org/wiki/Purchasing_power_parity List of countries by nominal GDP http://en.wikipedia.org/wiki/List_of_countries_by_GDP_%28nominal%29/update The World Bank http://www.worldbank.org/ National Graduate Institute of Policy Studies , Japan. Lectures by Prof. Kenichi Ohno http://www.grips.ac.jp/teacher/oono/hp/lec_F.htm

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Annex Consolidated SpaDocument2 pagesAnnex Consolidated Spamcjeff32No ratings yet

- Segregation of DutiesDocument1 pageSegregation of DutiesjadfarranNo ratings yet

- Certificate of Increase of Capital Stock BlankDocument10 pagesCertificate of Increase of Capital Stock BlankHBENo ratings yet

- 2021 JCI Philippines Awards ManualDocument42 pages2021 JCI Philippines Awards ManualKing Erlano100% (1)

- Chapter 5 - Multiple Choice ProblemsDocument22 pagesChapter 5 - Multiple Choice Problemssol lunaNo ratings yet

- ATRAM Phil Equity Smart Index Fund Fact Sheet Apr 2020Document2 pagesATRAM Phil Equity Smart Index Fund Fact Sheet Apr 2020anton clementeNo ratings yet

- CH 010Document24 pagesCH 010melodie03No ratings yet

- Contract of LeaseDocument4 pagesContract of LeaseKim GarridNo ratings yet

- Ife761 Final AssessmentDocument12 pagesIfe761 Final AssessmentElySya SyaNo ratings yet

- IILM Graduate School of ManagementDocument15 pagesIILM Graduate School of ManagementMd. Shad AnwarNo ratings yet

- A Study On Awareness About Mobile Banking Services Provided by BanksDocument20 pagesA Study On Awareness About Mobile Banking Services Provided by BanksakhyatiNo ratings yet

- Average Daily FloatDocument4 pagesAverage Daily FloatAn DoNo ratings yet

- Ringkasan Kinerja Perusahaan TercatatDocument3 pagesRingkasan Kinerja Perusahaan TercatatDian PrasetyoNo ratings yet

- Assessing The Effect of Financial Literacy On SavingDocument7 pagesAssessing The Effect of Financial Literacy On SavingMarinette Valencia MedranoNo ratings yet

- Anggo Toyota Application FormDocument1 pageAnggo Toyota Application FormTempwell company Naga BranchNo ratings yet

- BellonDocument7 pagesBellonValeria Rendon NoyolaNo ratings yet

- Digital Lending: KenyaDocument31 pagesDigital Lending: KenyaRick OdomNo ratings yet

- ACCOUNTING PRINCIPLES AND PARALLEL Accounting ConfigurationDocument9 pagesACCOUNTING PRINCIPLES AND PARALLEL Accounting ConfigurationRaju Raj RajNo ratings yet

- NPO StandardsDocument9 pagesNPO Standardsbngo01No ratings yet

- Income Statement and Statement of Financial Position Prepared byDocument7 pagesIncome Statement and Statement of Financial Position Prepared byFakhrul IslamNo ratings yet

- Khali Tin ChallanDocument2 pagesKhali Tin ChallanNimeshNo ratings yet

- Credit Risk PlusDocument14 pagesCredit Risk PlusAliceNo ratings yet

- COOPERATIVEDocument15 pagesCOOPERATIVEGiann Lorrenze Famisan RagatNo ratings yet

- Accounting II BBA 3rdDocument9 pagesAccounting II BBA 3rdTalha GillNo ratings yet

- Annual Report 2022 en Final WebsiteDocument76 pagesAnnual Report 2022 en Final WebsiteSin SeutNo ratings yet

- Resume - Aansh DesaiDocument2 pagesResume - Aansh Desaisiddhant jainNo ratings yet

- Twin Deficits HypothesisDocument3 pagesTwin Deficits HypothesisinnovatorinnovatorNo ratings yet

- Why Use LINK in Selling Your Business by Matt Maypa Business BrokerDocument4 pagesWhy Use LINK in Selling Your Business by Matt Maypa Business BrokerMatt MaypaNo ratings yet

- ICQDocument12 pagesICQAndrew LamNo ratings yet

- Annexa Prime Trading CoursesDocument11 pagesAnnexa Prime Trading CoursesFatima FX100% (1)