Professional Documents

Culture Documents

Capital Budgeting (Case Study Camel)

Uploaded by

Amit SainiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting (Case Study Camel)

Uploaded by

Amit SainiCopyright:

Available Formats

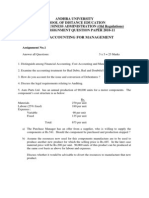

CASE STUDY CAPITAL BUDGETING

The below mentioned case study will be discussed on Friday, March 18th 2011- All students are requested to mail the ppts, group wise before Friday 9:00 a.m.

Camel Corporation Ltd. is a manufacturing concern that produces and sells a wide range of products. The company not only produces a number of products and equipment components but also is capable of producing special purpose manufacturing equipment as per customer requirements. The firm is considering adding a new stapler to one of its product lines. More equipment will be required to produce the new stapler. There are three different ways to acquire the needed equipment 1) purchase general purpose equipment, 2) Lease general purpose equipment, 3) Build special purpose equipment. A fourth alternative Purchase of special purpose equipment has been ruled out because it would be prohibitively expensive. The general purpose equipment can be purchased for Rs 12,50,000 and has an estimated salvage value of Rs 4 lakhs at the end of 5 years. Alternatively, the general purpose equipment can be acquired by a 5 year lease for Rs 4 lakhs annual rent. The lessor will assume all responsibility for taxes, insurance and maintenance. Special purpose equipment can be constructed by the contract equipment department of the company. While the department is operating at a level that is normal for the time of the year, it is below full capacity. The department could produce the equipment without interfering with its regular production activities. The estimated departmental costs for the construction of the special purpose equipment are: Material and spare parts Direct Labour Variable overheads(50% of DLC) Total Rs 7,50,000 6,00,000 3,00,000 16,50,000

Engineering and management studies provide the following revenue and cost estimates (excluding lease payments and depreciation) for producing the new stapler depending upon the equipment used: General Purpose Self Constructed Equipment Equipment Lease Purchase (Rs) (Rs) (Rs) 50.00 50.00 50.00 18.00 16.50 34.50 15.50 40,000 6,20,0 00 1,60,0 00 18.00 16.50 34.50 15.50 40,000 6,20,000 1,60,000 30,000 30,000 2,20,000 17.00 14.00 31.00 19 40,000 7,60,000 1,80,000 50,000 20,000 2,50,000

Unit Selling price Unit Production Costs: Materials Conversion costs Total unit production costs Unit Contribution margin Estimated Volume Estimated Total contribution Other costs: Supervision Taxes and insurance Maintenance

1,60,0 00

This type of equipment is subject to 5 years depreciation on straight line basis. At the end of 5 years, the special purpose machine can be sold for Rs 3,00,000. The company uses an after tax cost of capital of 10%. Its marginal tax rate is 40%. You have to advise the company on which proposal should the company use and why. You can use NPV method for evaluation of all the three alternatives.

You might also like

- Review Handout For Exam 3Document3 pagesReview Handout For Exam 3manmanman124No ratings yet

- 7894 Final GR 2 Paper 5 Cost Managementyear 2005Document60 pages7894 Final GR 2 Paper 5 Cost Managementyear 2005Tlm BhopalNo ratings yet

- Question - Allegro Technologies Co (ATC)Document6 pagesQuestion - Allegro Technologies Co (ATC)Chanda MusondaNo ratings yet

- Organizational ResearchDocument31 pagesOrganizational ResearchsiddharthsharmazNo ratings yet

- D10-CAC Spring 2013Document4 pagesD10-CAC Spring 2013Mudassir HaiderNo ratings yet

- Tutorial AccountingDocument5 pagesTutorial AccountingMevika MerchantNo ratings yet

- ISBM Financial & Cost AccountingDocument3 pagesISBM Financial & Cost AccountingMadhumohan543No ratings yet

- Topic 6 Capital AllowanceDocument33 pagesTopic 6 Capital AllowanceBaby KhorNo ratings yet

- Financial Analysis Bajaj Auto LTDDocument45 pagesFinancial Analysis Bajaj Auto LTDRajat Gulati83% (6)

- Managerial Cases 5&6Document2 pagesManagerial Cases 5&6Anna Fermina MendozaNo ratings yet

- AssigmentDocument8 pagesAssigmentnonolashari0% (1)

- Case 1 Prod HartDocument5 pagesCase 1 Prod Harteldo0% (1)

- Acc101 Probset4Document7 pagesAcc101 Probset4Megan LoNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Project Profile On Leather ShoesDocument5 pagesProject Profile On Leather ShoesSadrul Jamil100% (1)

- Procurement Guideline For ATL SchoolsDocument4 pagesProcurement Guideline For ATL SchoolsManKapNo ratings yet

- # VIT PM HA PR 3043 Q Bank PDFDocument29 pages# VIT PM HA PR 3043 Q Bank PDFCHAITANYA GHARAPURKARNo ratings yet

- Question BankDocument29 pagesQuestion BankCHAITANYA GHARAPURKARNo ratings yet

- IILM Institute For Higher Education: Assignment For All SectionsDocument4 pagesIILM Institute For Higher Education: Assignment For All SectionsRahul DuaNo ratings yet

- Marginal Costing ApplicationsDocument2 pagesMarginal Costing ApplicationsRatan GohelNo ratings yet

- Shree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementDocument6 pagesShree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementVeerraju RyaliNo ratings yet

- Standard Cost (RS.)Document13 pagesStandard Cost (RS.)Anushree GuptaNo ratings yet

- Rev PB SheetDocument10 pagesRev PB SheetPatriqKaruriKimbo100% (1)

- Advanced Management Accounting PDFDocument4 pagesAdvanced Management Accounting PDFSmag SmagNo ratings yet

- 59 IpcccostingDocument5 pages59 Ipcccostingapi-206947225No ratings yet

- Management Accounting AssignmentDocument8 pagesManagement Accounting AssignmentAjay VatsavaiNo ratings yet

- Project Report For Manufacturing Fastner 3Document2 pagesProject Report For Manufacturing Fastner 3RaviNo ratings yet

- Rubberband Manufacturing PROJECT REPORTSDocument20 pagesRubberband Manufacturing PROJECT REPORTSbinod1234No ratings yet

- F-17 MacDocument4 pagesF-17 MacNadeem HanifNo ratings yet

- Problems - PPE & DepnDocument5 pagesProblems - PPE & DepnSaurabh SinghNo ratings yet

- Problems On Transfer PricingDocument4 pagesProblems On Transfer Pricingdjgavli11210No ratings yet

- Indian Electricals Limited (Complete) 1Document8 pagesIndian Electricals Limited (Complete) 1Prashant BarsingNo ratings yet

- 3014accounting For ManagementDocument2 pages3014accounting For ManagementSatyanarayana AmarapinniNo ratings yet

- 13 Marginal CostingDocument5 pages13 Marginal CostingPriyanka ShewaleNo ratings yet

- (2015 Onwards) : M.Sc. Software Systems Degree Examin Tions, April 2018Document6 pages(2015 Onwards) : M.Sc. Software Systems Degree Examin Tions, April 2018Aravind KumarNo ratings yet

- Design Handbook MAchine DesignDocument5 pagesDesign Handbook MAchine DesignsouravNo ratings yet

- Finance Cap 2Document19 pagesFinance Cap 2Dj babuNo ratings yet

- F 9Document32 pagesF 9billyryan1100% (2)

- 7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFDocument32 pages7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFPrasanna SharmaNo ratings yet

- Tax Management and Make - Buy DecisionsDocument12 pagesTax Management and Make - Buy DecisionsYash MittalNo ratings yet

- Acca QNSDocument10 pagesAcca QNSIshmael OneyaNo ratings yet

- Strategic Cost Mngt. May 18Document33 pagesStrategic Cost Mngt. May 18Bijay AgrawalNo ratings yet

- Ca Final Costing Questions and SolutionsDocument33 pagesCa Final Costing Questions and SolutionsJashn KhandelwalNo ratings yet

- Relevant CostDocument22 pagesRelevant Costkhawajafzal100% (2)

- QWDocument1 pageQWJPNo ratings yet

- QWDocument1 pageQWJPNo ratings yet

- ZXDocument2 pagesZXJPNo ratings yet

- AsDocument1 pageAsJPNo ratings yet

- ZXDocument2 pagesZXJPNo ratings yet

- AsDocument1 pageAsJPNo ratings yet

- AsDocument1 pageAsJPNo ratings yet

- ZXDocument2 pagesZXJPNo ratings yet

- QWDocument1 pageQWJPNo ratings yet

- 0126financial and Corporate ReportingDocument6 pages0126financial and Corporate ReportingSmag SmagNo ratings yet

- Make Versus BuyDocument1 pageMake Versus BuyManish KhandelwalNo ratings yet

- ACCT 434 Midterm Exam (Updated)Document4 pagesACCT 434 Midterm Exam (Updated)DeVryHelpNo ratings yet

- M 2012 June PDFDocument21 pagesM 2012 June PDFMoses LukNo ratings yet

- General-Purpose Industrial Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral-Purpose Industrial Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Training Facility Norms and Standard Equipment Lists: Volume 1---Precision Engineering or MachiningFrom EverandTraining Facility Norms and Standard Equipment Lists: Volume 1---Precision Engineering or MachiningNo ratings yet

- Wasting AssetsDocument4 pagesWasting AssetsjomelNo ratings yet

- Engineering Economy: Replacement Analysis - Chapter 9Document50 pagesEngineering Economy: Replacement Analysis - Chapter 9ismailNo ratings yet

- Water Resources Systems Planning and Management - LectureDocument30 pagesWater Resources Systems Planning and Management - LectureTejaswiniNo ratings yet

- WorksheetDocument3 pagesWorksheetabhii10282% (38)

- Accountant Interview Questions and AnswersDocument36 pagesAccountant Interview Questions and Answersheehan6No ratings yet

- TP 24 PappadamDocument27 pagesTP 24 PappadamImasha SewwandiNo ratings yet

- Case 4 (1-6) GabungDocument12 pagesCase 4 (1-6) GabungFadhila HanifNo ratings yet

- Vouching & Verification: Ms. Fleur Dsouza Asst. Prof., BMS SIES CollegeDocument44 pagesVouching & Verification: Ms. Fleur Dsouza Asst. Prof., BMS SIES Collegesagar kasalkarNo ratings yet

- Assignment HBDocument3 pagesAssignment HBJhay Sy LynNo ratings yet

- FA TableDocument8 pagesFA TableVy Duong TrieuNo ratings yet

- ZMT R Fi Asset Register FormDocument14 pagesZMT R Fi Asset Register FormCharan Kumar PentakotaNo ratings yet

- Ppe Cpale Reviewer Ppe Ap 11234Document3 pagesPpe Cpale Reviewer Ppe Ap 11234Sharon CarilloNo ratings yet

- Entrepreneurship - Post Test 2018Document3 pagesEntrepreneurship - Post Test 2018Gina Marmol100% (1)

- Vadilal ValuationDocument77 pagesVadilal Valuationsid lahoriNo ratings yet

- Acc 15 ADocument9 pagesAcc 15 Akim545No ratings yet

- t1 - Introduction of School Financial ManagementDocument15 pagest1 - Introduction of School Financial ManagementSARIPAH BINTI ABDUL HAMID MoeNo ratings yet

- Accounting: Cambridge International Examinations International General Certificate of Secondary EducationDocument12 pagesAccounting: Cambridge International Examinations International General Certificate of Secondary Educationlie chingNo ratings yet

- Chapter 7 Financial Aspect ScheduleDocument13 pagesChapter 7 Financial Aspect ScheduleAleelNo ratings yet

- Common Finance Interview QuestionsDocument3 pagesCommon Finance Interview QuestionsIndu Gupta100% (1)

- Module 6 Cost of Capital and Capital Investment Decisions PDFDocument14 pagesModule 6 Cost of Capital and Capital Investment Decisions PDFDaisy ContinenteNo ratings yet

- BF R. Kit As at 25 April 2006Document255 pagesBF R. Kit As at 25 April 2006Winny Shiru Machira100% (2)

- This Study Resource WasDocument2 pagesThis Study Resource WasGONZALES CamilleNo ratings yet

- Full Assignment Tax RPGTDocument19 pagesFull Assignment Tax RPGTVasant SriudomNo ratings yet

- Form 2106Document2 pagesForm 2106Weiming LinNo ratings yet

- As 01Document9 pagesAs 01Dipak UgaleNo ratings yet

- Level I of CFA Program 6 Mock Exam December 2020 Revision 1Document43 pagesLevel I of CFA Program 6 Mock Exam December 2020 Revision 1JasonNo ratings yet

- First Benchmark PublishingDocument17 pagesFirst Benchmark PublishingChan Mark AyapanaNo ratings yet

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- Case 2 Adjusting Entries F 18Document6 pagesCase 2 Adjusting Entries F 18rcbcsk csk0% (1)

- Final Exam f02Document13 pagesFinal Exam f02Omar Ahmed ElkhalilNo ratings yet