Professional Documents

Culture Documents

Super Leverage Addendum

Uploaded by

Nishant M SharmaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Super Leverage Addendum

Uploaded by

Nishant M SharmaCopyright:

Available Formats

To, Prabhudas Lilladher Pvt. Ltd. Dear Sir, 1.

I/We have gone through the details of your product / scheme S u p e r L e v e r a g e and wish to subscribe to the same and the terms & conditions for the same mentioned below are accepted by me. 2. I/We understand and agree that the terms and conditions are in addition to and not in substitution of my/our Member Client Agreements and addendums / authorisations there under. I/We agree that in case of any conflict in the terms and conditions, the terms and conditions of Member Client Agreement and addendum(s) / authorization(s) accepted / issued by me shall prevail over the terms and conditions herein. I/We agree to place order /create / initiate position in Super Leverage product/ scheme for intraday trading purpose only and will close all open positions before predefined time communicated on website. However, if I/we fail to do so, PLPL at its discretion, may attempt to close all my/our open positions. I/We agree that this discretion is not an obligation / duty / responsibility upon PLPL to square off open positions and all or any losses whether on account of Square off or non square off by PLPL shall be borne by me/us. I/we agree to take responsibility of monitoring positions / margins & losses; PLPL shall not be required to make margin call / email / alert if my/our margin positions fall below required margin levels. I/We agree to pay / update / provide proper / additional margin required for any open / carry forward position(s) if I/we/ PLPL fail to square off open position(s) on any trading day; loss, if any, due to such failure will be borne by me/us. In case of excessive volatility exposure can be reduced/ margin per contract can be increased during day, I/We agree to pay additional margin required in such case to safe guard open positions failing which my/our open positions can be considered for square off & pending order(s) cancelled by PLPL on account of insufficient margin / MTM loss in my account. I/we agree that PLPL has a right but not an obligation / duty/ responsibility to liquidate any or all of my /our open positions in its absolute discretion without prior notice if Mark to Market # percentage as per PLPL is greater than or equal to defined / required % #. I/We agree that Mark to Market shall be derived as per the following formula: Mark to Market = [{Notional loss} / {Leger Balance + Collateral Value after Haircut + Transferred funds Booked Loss}]*100 i. Where Collateral Value after Haircut shall be = value of securities / stock / shares kept by client in PLPLs Margin # Account & valued after applying haircut as defined by PLPLs Risk management guidelines & procedure adopted from time-to- time. Permitted securities & Haircut are subject to change which may be without notice. Booked loss shall be = total loss booked in all segments during the day Notional loss shall be = total losses calculated as difference of all open / unsettled positions buying / selling / carry forward / open price with last traded price. Terms & conditions#

#

3.

4. 5.

6.

7.

ii. iii.

A.

Higher intraday exposure upto 2 times, at the sole discretion of PLPL, against credit in ledger account + valuation of permitted scrips placed by client with PLPL. Exposure multiple shall vary from scrip to scrip depending upon categorization by PLPL. B. Higher intraday exposure in futures contracts in derivatives segment by paying only initial / span margin under Super Leverage product / scheme. C. Open positions cannot be converted to other products to carry forward. D. All open positions created need to be closed / squared off within same trading day before predefined square off time. E. All Open positions will be attempted to close / liquidate on predefined square off time# or mark to market % reaches or # crosses 50 whichever is earlier. F. PLPL reserves the right to choose / decide the future contracts# in derivatives segment permitted for trading under Super Leverage. G. Predefined square-off time will be available to clients at the online trading web-site of PLPL.

# Liable to change from time to time as per managements discretion without any prior notice

You might also like

- Alice Blue RMS PolicyDocument2 pagesAlice Blue RMS Policyrajamp74No ratings yet

- Risk Management PolicyDocument8 pagesRisk Management PolicyNidhi NitnawareNo ratings yet

- Additional Rights & Obligations (Voluntary)Document18 pagesAdditional Rights & Obligations (Voluntary)RuchikaGosainNo ratings yet

- Additional Rights & Obligations (Voluntary)Document17 pagesAdditional Rights & Obligations (Voluntary)BALACHITRANo ratings yet

- Terms and Conditions (Bracket Order) : Mis+ T&CDocument1 pageTerms and Conditions (Bracket Order) : Mis+ T&Cpinakin medhatNo ratings yet

- Additional Rights & Obligations (Voluntary)Document17 pagesAdditional Rights & Obligations (Voluntary)Shankar RajNo ratings yet

- Policies & Procedure: A) Policy For Penny StockDocument5 pagesPolicies & Procedure: A) Policy For Penny StockAparna AppuNo ratings yet

- Cftraders: Power of Attorney For IndividualsDocument5 pagesCftraders: Power of Attorney For IndividualsThiago CruzNo ratings yet

- Regulations for trading operations guideDocument9 pagesRegulations for trading operations guideMarcela CastillaNo ratings yet

- Consent for Margin Trading FundingDocument11 pagesConsent for Margin Trading FundingGemini PatelNo ratings yet

- PDA Repair FormDocument2 pagesPDA Repair FormVincent TonNo ratings yet

- Contrato ZsystemDocument5 pagesContrato ZsystemAlex GarzónNo ratings yet

- 20230930134842-Utc - Signed-20230930-Funding Pips Evaluation - Customer Agreement - Ivan Akwasi OwusuDocument6 pages20230930134842-Utc - Signed-20230930-Funding Pips Evaluation - Customer Agreement - Ivan Akwasi OwusuIvan OwusuNo ratings yet

- Role and Function of Brokerage FirmDocument29 pagesRole and Function of Brokerage FirmSrinibash BehuraNo ratings yet

- DealCancellation Terms Bvi Int enDocument4 pagesDealCancellation Terms Bvi Int enSiroNo ratings yet

- Manage risks and maximize returns with a collateralized trading accountDocument1 pageManage risks and maximize returns with a collateralized trading accountDaniel WigginsNo ratings yet

- Margin FAQDocument39 pagesMargin FAQamitthemalNo ratings yet

- Terms of Business: For Ecn Types of Accounts (Ecn/Stp, Pamm Ecn/Stp)Document8 pagesTerms of Business: For Ecn Types of Accounts (Ecn/Stp, Pamm Ecn/Stp)consultasporinternetNo ratings yet

- Terms of Business: For Market Maker Types of Accounts (Standard, Micro, Pamm Standard)Document8 pagesTerms of Business: For Market Maker Types of Accounts (Standard, Micro, Pamm Standard)Badril AminNo ratings yet

- Trading AgreementDocument17 pagesTrading AgreementANo ratings yet

- Natural Trading Contract TermsDocument5 pagesNatural Trading Contract TermsAndre IsmaelNo ratings yet

- Funds and TransfersDocument12 pagesFunds and TransfersPassionate Chidochashe JinjikaNo ratings yet

- Policies & Procedures: 1. Refusal of Orders For Penny / Illiquid StockDocument6 pagesPolicies & Procedures: 1. Refusal of Orders For Penny / Illiquid StockKetan SuriNo ratings yet

- Novafunding Trading Evaluation: Terms of Use - Micro TraderDocument9 pagesNovafunding Trading Evaluation: Terms of Use - Micro TraderProuserNo ratings yet

- REDEEM-SWITCHDocument2 pagesREDEEM-SWITCHarshadjafri123No ratings yet

- Funds and TransfersDocument11 pagesFunds and Transferskoketso fortunatteNo ratings yet

- Bulenox ContractDocument9 pagesBulenox Contractjorge.omcrNo ratings yet

- Condiciones para Operar CFD's/ForexDocument11 pagesCondiciones para Operar CFD's/ForexLucas ToralessNo ratings yet

- To BMA Wealth Creators LTD 29/5A, DR, Ambedkar Sarani, Vishwakarma Building, Tower-II, Topsia Road Kolkata 700046Document1 pageTo BMA Wealth Creators LTD 29/5A, DR, Ambedkar Sarani, Vishwakarma Building, Tower-II, Topsia Road Kolkata 700046Sourav SenguptaNo ratings yet

- VPTCDocument3 pagesVPTCkd17209No ratings yet

- Peers2Win: Power of Attorney For IndividualsDocument5 pagesPeers2Win: Power of Attorney For IndividualsDilanNo ratings yet

- Other DocumentsDocument5 pagesOther DocumentsDavi LopesNo ratings yet

- Share Wealth Risk Management PolicyDocument7 pagesShare Wealth Risk Management PolicySuman ChakrvartyNo ratings yet

- Apache Corporation: Shareowner Services Plus PlanDocument23 pagesApache Corporation: Shareowner Services Plus PlanTheNourEldenNo ratings yet

- Risk - Warning - Plus500Document4 pagesRisk - Warning - Plus500Nikos VlachosNo ratings yet

- Intermediate Accounting 8th Edition Spiceland Solutions Manual 1Document36 pagesIntermediate Accounting 8th Edition Spiceland Solutions Manual 1waynerichardsonoafkzpincs100% (23)

- UntitledDocument11 pagesUntitledAbdulmalik DikkoNo ratings yet

- 3149e - Sign-Disclaimer Grow Tech It SolutionsDocument2 pages3149e - Sign-Disclaimer Grow Tech It SolutionsSMS JobNo ratings yet

- Terms and conditions for funds, transfers, refunds and Deriv P2PDocument9 pagesTerms and conditions for funds, transfers, refunds and Deriv P2PWarren ChingovoNo ratings yet

- Manage Scholar ContractDocument5 pagesManage Scholar ContractEvangeline GulisaoNo ratings yet

- DocuSign Mirror-Trading AuthorizationDocument3 pagesDocuSign Mirror-Trading AuthorizationErika T AcostaNo ratings yet

- Terms and Conditions for Solar DealershipDocument2 pagesTerms and Conditions for Solar DealershipConsultancy GurukulNo ratings yet

- Forex Management AgreementDocument5 pagesForex Management Agreementapi-34208217883% (6)

- Trading and SettlementDocument12 pagesTrading and SettlementLakhan KodiyatarNo ratings yet

- Risk Disclosure Notice: Plus500CY LTDDocument8 pagesRisk Disclosure Notice: Plus500CY LTDandres torresNo ratings yet

- S 57Document18 pagesS 57blah123123123No ratings yet

- LKP's RMS User Manual:: 1) ObjectiveDocument4 pagesLKP's RMS User Manual:: 1) ObjectiveAnilkotNo ratings yet

- Forward ContractsDocument23 pagesForward Contractsnikhil tiwariNo ratings yet

- LpoaDocument5 pagesLpoajmalfavonNo ratings yet

- POWER OF ATTORNEY TO CIL SECURITIESDocument3 pagesPOWER OF ATTORNEY TO CIL SECURITIESsrikanthgodin9No ratings yet

- Information On Risk Management PolicyDocument7 pagesInformation On Risk Management Policysamho0No ratings yet

- Margin Trading FAQ 11 Feb 2020Document13 pagesMargin Trading FAQ 11 Feb 2020Damodar GaliNo ratings yet

- SCB Order Execution Policy ROW PDFDocument13 pagesSCB Order Execution Policy ROW PDFAbdulqayum SattigeriNo ratings yet

- Risk Disclosure Statement: For Market Maker Types of Accounts (Standard and Micro)Document3 pagesRisk Disclosure Statement: For Market Maker Types of Accounts (Standard and Micro)AlanAlejandroCastellanosMejiaNo ratings yet

- Order Execution PolicyDocument21 pagesOrder Execution PolicyKazuko ArishimaNo ratings yet

- FL Facility LetterDocument1 pageFL Facility LetterAlayas ArtemasNo ratings yet

- Novafunding Trading Evaluation: Terms of Use - Micro TraderDocument9 pagesNovafunding Trading Evaluation: Terms of Use - Micro Trader4955k465cwNo ratings yet

- Trading Bonus Terms and ConditionsDocument5 pagesTrading Bonus Terms and ConditionsVotikaNo ratings yet

- Uploaded 1Document4 pagesUploaded 1NAGESH PORWALNo ratings yet

- Performance Evaluation of HSBC BankDocument38 pagesPerformance Evaluation of HSBC BankTahia Nawar Deya50% (2)

- The Great Crash 1929Document4 pagesThe Great Crash 1929alphius17No ratings yet

- Credit Management in BanksDocument10 pagesCredit Management in BanksmarufNo ratings yet

- Overview of Dupont Analysis: Net Profit - Net Sales - Net Profit MarginDocument4 pagesOverview of Dupont Analysis: Net Profit - Net Sales - Net Profit Margin0asdf4No ratings yet

- CMNPDocument2 pagesCMNPIsni AmeliaNo ratings yet

- Early Settlement Rebates-Further AnalysisDocument33 pagesEarly Settlement Rebates-Further AnalysisBan Dee MeeNo ratings yet

- Principles of Credit ManagementDocument26 pagesPrinciples of Credit ManagementPALLAVI KAMBLENo ratings yet

- Agri Business Products & Schemes GuideDocument258 pagesAgri Business Products & Schemes GuideAmit KkalyanNo ratings yet

- Potential Red Flags and Detection TechniquesDocument12 pagesPotential Red Flags and Detection TechniqueslusyNo ratings yet

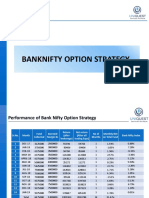

- Banknifty Option StrategyDocument14 pagesBanknifty Option StrategyMaviz SyedNo ratings yet

- Priority Sector Lending PDFDocument11 pagesPriority Sector Lending PDFJitendra Singh Meena100% (1)

- Ratio Analysis. Corporate FinanceDocument46 pagesRatio Analysis. Corporate FinanceRadwa MohammedNo ratings yet

- Withdrawal of Restriction On Short SalesDocument1 pageWithdrawal of Restriction On Short SalesKhushiNo ratings yet

- CaterpillarDocument21 pagesCaterpillarZerohedge100% (1)

- WashingtonDocument10 pagesWashingtonAshley BaslNo ratings yet

- Chapter 03 - How Securities Are TradedDocument8 pagesChapter 03 - How Securities Are TradedSarahNo ratings yet

- Energy DerivativesDocument126 pagesEnergy DerivativesSachin RawatNo ratings yet

- Share Market and Mutual Fund " For: "A Study of Performance and Investors Opinion AboutDocument73 pagesShare Market and Mutual Fund " For: "A Study of Performance and Investors Opinion AboutakshayNo ratings yet

- PT Argo Pantes Tbk. financial analysisDocument4 pagesPT Argo Pantes Tbk. financial analysisIshidaUryuuNo ratings yet

- PROJECT REPORT On Indian Derivative MarketDocument40 pagesPROJECT REPORT On Indian Derivative MarketRavi VermaNo ratings yet

- Maintaining Condition Records in SAPDocument6 pagesMaintaining Condition Records in SAPcyberabadNo ratings yet

- Presentation SharekhanDocument29 pagesPresentation Sharekhanombhasker05No ratings yet

- Pre and Post-Merger Impact On Financial Performance: A Case Study of Jordan Ahli BankDocument8 pagesPre and Post-Merger Impact On Financial Performance: A Case Study of Jordan Ahli Bankjahnvi shahNo ratings yet

- Secondary Market Risk Management and RegulationsDocument20 pagesSecondary Market Risk Management and Regulationsmayank0963No ratings yet

- CH 4 The Dawn of A New Order in Commodity TradingDocument7 pagesCH 4 The Dawn of A New Order in Commodity TradingDevang BharaniaNo ratings yet

- Arbitrage Trade Analysis of Top 10 Public Sector Banks of Indian Economy Listed in Bse and NseDocument112 pagesArbitrage Trade Analysis of Top 10 Public Sector Banks of Indian Economy Listed in Bse and NsekeerthiNo ratings yet

- Sonali Bank Profile: Bangladesh's Leading Commercial BankDocument24 pagesSonali Bank Profile: Bangladesh's Leading Commercial BankRahi RebaNo ratings yet

- Coach Case 4Document37 pagesCoach Case 4R K100% (3)

- 2013 Isda Best Practices For The Otc Derivatives Collateral Process FinalDocument26 pages2013 Isda Best Practices For The Otc Derivatives Collateral Process Finaldeepikap0013375No ratings yet

- Understanding Financial Instruments and Mutual Funds (Jay Taparia)Document85 pagesUnderstanding Financial Instruments and Mutual Funds (Jay Taparia)National Press FoundationNo ratings yet