Professional Documents

Culture Documents

A Variance Is The Difference Between An Actual Result and An Expected Result

Uploaded by

Ridwan Haque DolonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Variance Is The Difference Between An Actual Result and An Expected Result

Uploaded by

Ridwan Haque DolonCopyright:

Available Formats

• A variance is the difference between an actual result and an expected result.

• Variance analysis is the process by which the total difference between standard and actual results is analysed.

• When actual results are better than expected results, we have a favourable variance (F). If actual results are worse

than expected results, we have an adverse variance (A).

• The selling price variance measures the effect on expected profit of a selling price different to the standard selling

price. It is calculated as the difference between what the sales revenue should have been for the actual quantity

sold, and what it was.

• The sales volume variance measures the increase or decrease in expected profit as a result of the sales volume

being higher or lower than budgeted. It is calculated as the difference between the budgeted sales volume and the

actual sales volume multiplied by the standard profit per unit.

• The material total variance is the difference between what the output actually cost and what it should have cost,

in terms of material. It can be divided into the following two sub-variances.

• The material price variance is the difference between what the material did cost and what it should have cost.

• The material usage variance is the difference between the standard cost of the material that should have been

used and the standard cost of the material that was used.

• The labour total variance is the difference between what the output should have cost and what it did cost, in

terms of labour. It can be divided into two sub-variances.

• The labour rate variance is the difference between what the labour did cost and what it should have cost.

• The labour efficiency variance is the difference between the standard cost of the hours that should have been

worked and the standard cost of the hours that were worked.

• The variable production overhead total variance is the difference between what the output should have cost and

what it did cost, in terms of variable production overhead. It can be divided into two sub-variances.

• The variable production overhead expenditure variance is the difference between the amount of variable

production overhead that should have been incurred in the actual hours actively worked, and the actual amount of

variable production overhead incurred.

• The variable production overhead efficiency variance is the difference between the standard cost of the hours

that should have been worked for the number of units actually produced, and the standard cost of the actual

number of hours worked.

• Fixed production overhead total variance is the difference between fixed production overhead incurred and fixed

production overhead absorbed. In other words, it is the under– or over absorbed fixed production overhead.

• Fixed production overhead expenditure variance is the difference between the budgeted fixed production

overhead expenditure and actual fixed production overhead expenditure.

• Fixed production overhead volume variance is the difference between actual and budgeted production/volume

multiplied by the standard absorption rate per unit.

• Fixed production overhead volume efficiency variance is the difference between the number of hours that actual

production should have taken, and the number of hours actually taken (that is, worked) multiplied by the standard

absorption rate per hour.

• Fixed production overhead volume capacity variance is the difference between budgeted hours of work and the

actual hours worked, multiplied by the standard absorption rate per hour.

The reasons for variances

Variance Favourable Adverse Calculation

Material Unforeseen discounts Price increase Price $

received Careless purchasing Based on actual purchases

price Greater care in purchasing Change in material What should it have cost? X

Change in material standard What did it cost? (X)

standard External factors X

External factors (inflation, (inflation, exchange

exchange rates etc) rates etc)

Higher quality material

Prepared by: Dolon Page 1

Material Material used of higher Defective material Usage Kgs

quality than standard Excessive waste Based on actual production

usage More effective use made Theft What should have been used? X

of material Stricter quality control What was used? (X)

Errors in allocating Errors in allocating X

material to jobs material to jobs Difference valued at $X

standard cost per kg

Labour rate Use of workers at a rate of Wage rate increase Rate $

pay lower than standard Wage inflation Based on actual hours paid

Wrong budgeting Higher skilled What should it have cost? X

Lower skilled employees employees What did it cost? (X)

X

Labour Output produced more Lost time in excess of Efficiency Hrs

quickly than expected, standard allowed. Based on actual production

efficiency because of work Output lower than How long should it have taken? X

motivation. standard set because How long did it take? (X)

Better quality of of lack of training, sub- X

equipment or materials. standard material etc. Difference valued at $X

Better learning rate. Errors in allocating standard rate per hour

Errors in allocating time to time to jobs.

jobs Lower skilled

Higher skilled employees employees

Idle time Possible if idle time has Machine breakdown. Idle time Hrs

been built into the budget Non-availability of Hours worked X

material. Hours paid (X)

Illness or injury to X

worker. Difference valued at $X

standard rate per hour

**Overhead Savings in costs Increase in cost of Based on actual hours

incurred services worked $

expenditure More economical use Excessive use of What should it have cost? X

of services services What did it cost? (X)

Change in type of X

services

used

Overhead Production or level of Production or level of Budgeted units X

activity greater than activity less than Actual units (X)

volume budgeted. budgeted X

Difference valued at $X

OAR per unit

Fixed Production or level of Production or level of Budgeted hrs worked X

activity greater than activity less than Actual hrs worked (X)

overhead budgeted budgeted X

capacity Difference valued at X OAR per hour

Selling price Unplanned price increase Unplanned price For the quantity sold

reduction What revenue should have been

generated X

Actual revenue (X)

X

Sales volume Additional demand Unexpected fall in Units

demand Budgeted sales X

Production difficulties Actual sales (X)

X

Difference valued at standard

profit per unit X

Prepared by: Dolon Page 2

Operating statements in an absorption cost environment:

Particulars $ $ $

Budgeted profit XXX

Sales variances: price XXX

volume XXX XXX

Actual sales minus the XXX

standard cost of sales

Cost variances:

(F) (A)

XXX XXX

Material price XXX XXX

Material usage XXX XXX

Labour rate XXX XXX

Labour efficiency XXX XXX

Labour idle time XXX XXX

Variable overhead expenditure XXX XXX

Variable overhead efficiency XXX XXX

Fixed overhead expenditure XXX XXX

Fixed overhead volume XXX XXX

XXX (XXX) XXX/(XXX)

Actual profit XXX

Operating statements in a marginal cost environment:

Particulars $ $ $

Budgeted profit XXX

Budgeted fixed production costs XXX

Budgeted contribution XXX

Sales variances: price XXX

volume XXX XXX

Actual sales minus the standard XXX

variable cost of sales

Cost variances:

(F) (A)

Material price XXX XXX

Material usage XXX XXX

Labour rate XXX XXX

Labour efficiency XXX XXX

Labour idle time XXX XXX

Variable overhead expenditure XXX XXX

Variable overhead efficiency XXX XXX

XXX (XXX) XXX/(XXX)

Actual contribution XXX

Budgeted fixed production costs XXX

Expenditure variance XXX

Actual fixed production XXX

overhead XXX

Actual profit

Prepared by: Dolon Page 3

You might also like

- Internationaltrade Group7 130702031215 Phpapp01 2Document51 pagesInternationaltrade Group7 130702031215 Phpapp01 2Nagarjuna ReddyNo ratings yet

- ReportDocument15 pagesReportJaylord AgpuldoNo ratings yet

- A Narrative Report in OnDocument28 pagesA Narrative Report in OnlefordfoxNo ratings yet

- Arena Blanca Waterpark Resort Final PresentationDocument43 pagesArena Blanca Waterpark Resort Final PresentationChristine Anne Alemania0% (1)

- Chapter II FOOD INNOVATIONDocument7 pagesChapter II FOOD INNOVATIONStella Joan Lita100% (1)

- FinalpdndDocument32 pagesFinalpdndPulkit Garg100% (1)

- SDG 3 Good Health and Well-BeingDocument10 pagesSDG 3 Good Health and Well-BeingStephen BarnettNo ratings yet

- Feasibility StudyDocument4 pagesFeasibility StudyJohn M MachariaNo ratings yet

- Acknowledgement of ThesisDocument1 pageAcknowledgement of ThesisImran Hasan KibriaNo ratings yet

- Executive SummaryDocument5 pagesExecutive SummaryVladimir MarquezNo ratings yet

- Korean BBQ PDFDocument88 pagesKorean BBQ PDFAlex VictorNo ratings yet

- ResearchQuestionnareThe Impact of Technology To The Health and Learning Performance of The StudentsDocument5 pagesResearchQuestionnareThe Impact of Technology To The Health and Learning Performance of The StudentsSHATERLAN ALVIAR. TACBOBONo ratings yet

- 00 Table of Contents Ojt Report 2018Document2 pages00 Table of Contents Ojt Report 2018ronatabbuNo ratings yet

- Research Proposal ODDocument6 pagesResearch Proposal ODAnis Zaman100% (1)

- Ojt Culmination RationaleDocument1 pageOjt Culmination RationaleRyan Arinzol OlaybalNo ratings yet

- Bed MakingDocument9 pagesBed Makingسانو روديلNo ratings yet

- Business ProposalDocument7 pagesBusiness ProposalROCHELLE VERGANIONo ratings yet

- Chapter1 To 3Document26 pagesChapter1 To 3Gerard Adrian Bautista AnonuevoNo ratings yet

- Pineapple Waste Instant TeaDocument19 pagesPineapple Waste Instant TeaArjie GongonNo ratings yet

- Greenwich SWOT AnalysisDocument1 pageGreenwich SWOT AnalysisConackry GuineaNo ratings yet

- Organizational Structure and Management of Facile Tote BagsDocument15 pagesOrganizational Structure and Management of Facile Tote Bags버니 모지코No ratings yet

- Biliran Province State University: Brilliance Innovation Progress Service UnityDocument56 pagesBiliran Province State University: Brilliance Innovation Progress Service UnityDGDelfin100% (1)

- Environmental Impacts of Hotel and Restaurant Establishments in Cabanatuan City A Case StudyDocument3 pagesEnvironmental Impacts of Hotel and Restaurant Establishments in Cabanatuan City A Case StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Finalmidterm Exam in ErgonomicsDocument6 pagesFinalmidterm Exam in ErgonomicsNorma Barrientos Muyot100% (1)

- Project ProposalDocument3 pagesProject Proposalapi-544898097No ratings yet

- OJT FormsDocument17 pagesOJT FormsShaina Delos SantosNo ratings yet

- True Care Spa feasibility studyDocument6 pagesTrue Care Spa feasibility studyIbrahim RegachoNo ratings yet

- Affidavit of ConsentDocument22 pagesAffidavit of ConsentJohnSeth ViosNo ratings yet

- SLU Accounting Internship Survey (38Document2 pagesSLU Accounting Internship Survey (38Jarby Vann CapitoNo ratings yet

- Technical AspectDocument16 pagesTechnical Aspectjulie anne mae mendozaNo ratings yet

- Introductory Pages - Narrative ReportDocument5 pagesIntroductory Pages - Narrative ReportRafael Santiago100% (1)

- Sample of Reflection On My ReportDocument1 pageSample of Reflection On My Reportalestrella sanchez100% (1)

- Gymnastics As A SportDocument2 pagesGymnastics As A SportJohane Grei WallNo ratings yet

- Capstone ProposalDocument8 pagesCapstone Proposalapi-253857430No ratings yet

- Mary Joy Tampo SDocument26 pagesMary Joy Tampo SMhaye CendanaNo ratings yet

- PMLS Narrative Report PDFDocument14 pagesPMLS Narrative Report PDFGilmar ManzanoNo ratings yet

- Reflection Paper - Community Exposure WebinarDocument2 pagesReflection Paper - Community Exposure WebinarElijah Joaquin Payumo BaylonNo ratings yet

- Bakery Financial ReportDocument7 pagesBakery Financial ReportTrisha MaeNo ratings yet

- Financial AssumptionsDocument4 pagesFinancial AssumptionsMary Ann AntenorNo ratings yet

- Indigenous Cheese MakingDocument12 pagesIndigenous Cheese MakingAnsherina SantosNo ratings yet

- Tanza National Trade School: Senior High School - Academic TrackDocument35 pagesTanza National Trade School: Senior High School - Academic TrackMackyNo ratings yet

- Positive Comments From Student EvaluationsDocument5 pagesPositive Comments From Student Evaluationsapi-329560184100% (1)

- Functional Resume Samantha LineDocument3 pagesFunctional Resume Samantha Lineapi-314985523No ratings yet

- Paradigm ShiftsDocument1 pageParadigm ShiftsLove MarieshNo ratings yet

- Narrative Report of On-The-Job Training at The University of Science and Technology of Southern Philippines (Ustp) Student Instructional UnitsDocument10 pagesNarrative Report of On-The-Job Training at The University of Science and Technology of Southern Philippines (Ustp) Student Instructional UnitsPlaymakərNo ratings yet

- Body-Page-Pcc-Teams (Final)Document41 pagesBody-Page-Pcc-Teams (Final)Reymart DablioNo ratings yet

- Computer Lab Rules and RegulationsDocument6 pagesComputer Lab Rules and Regulationshafizah755726No ratings yet

- Activity1 Deleon Bsit3g Itec100Document1 pageActivity1 Deleon Bsit3g Itec100Rodnie Cyrus De LeonNo ratings yet

- Sample Resume and Application LetterDocument3 pagesSample Resume and Application LetterCarl WinnerNo ratings yet

- Final 1-6 PDFDocument80 pagesFinal 1-6 PDFNikKiCasiñoNo ratings yet

- ACKNOWLEDGEMENTDocument17 pagesACKNOWLEDGEMENTapi-2657097980% (5)

- NSTPDocument5 pagesNSTPMagister AryelNo ratings yet

- Waste SegregationDocument22 pagesWaste SegregationTOt's VinNo ratings yet

- SWOT AnalysisDocument8 pagesSWOT AnalysisZairie TarbiyyahmanNo ratings yet

- Allan Baccay Mae Irene Bautistazales Sarah Marie Ibay Hayden Gonzales Farry James Macarilay Esperanza Zablan Severo WashingtonDocument10 pagesAllan Baccay Mae Irene Bautistazales Sarah Marie Ibay Hayden Gonzales Farry James Macarilay Esperanza Zablan Severo WashingtonBrent Glenn Datu RoseteNo ratings yet

- Customers' Preference Among Fast Food Chain Establishment in Tacurong CityDocument33 pagesCustomers' Preference Among Fast Food Chain Establishment in Tacurong CityJaysan SacbibitNo ratings yet

- Chapter 1Document9 pagesChapter 1Jhoy Vien BenavidezNo ratings yet

- Business Plan Buss SimulationDocument20 pagesBusiness Plan Buss SimulationJhanin BuenavistaNo ratings yet

- Standard Costing ExplainedDocument8 pagesStandard Costing ExplainedsajedulNo ratings yet

- 13 VariancesDocument7 pages13 VariancesJack PayneNo ratings yet

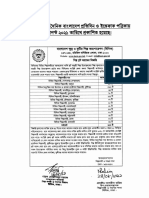

- BSCIC PlotDocument4 pagesBSCIC PlotRidwan Haque DolonNo ratings yet

- Air Finned HeaterDocument1 pageAir Finned HeaterRidwan Haque DolonNo ratings yet

- Quality Awarness & Understanding - S46Document95 pagesQuality Awarness & Understanding - S46Ridwan Haque DolonNo ratings yet

- Artofselling 161219045501Document41 pagesArtofselling 161219045501Ridwan Haque DolonNo ratings yet

- Flange Immersion Heater: FeaturesDocument1 pageFlange Immersion Heater: FeaturesRidwan Haque DolonNo ratings yet

- Prescribed Adhoc IRC FormDocument3 pagesPrescribed Adhoc IRC FormRidwan Haque DolonNo ratings yet

- Screw Plug Immersion HeaterDocument2 pagesScrew Plug Immersion HeaterRidwan Haque DolonNo ratings yet

- General Member List (2019-2020) - Bangladesh Tanners Association (BTA)Document23 pagesGeneral Member List (2019-2020) - Bangladesh Tanners Association (BTA)Ridwan Haque Dolon100% (1)

- 6 Mindsets for Effective Problem SolvingDocument9 pages6 Mindsets for Effective Problem SolvingRidwan Haque DolonNo ratings yet

- Acknowledgement Receipt - A4Document1 pageAcknowledgement Receipt - A4Ridwan Haque DolonNo ratings yet

- Bida SRCP 20181217 FDocument61 pagesBida SRCP 20181217 FRidwan Haque DolonNo ratings yet

- Prescribed Adhoc IRC FormDocument3 pagesPrescribed Adhoc IRC FormRidwan Haque DolonNo ratings yet

- WaterHeaterGuide e PDFDocument50 pagesWaterHeaterGuide e PDFRidwan Haque DolonNo ratings yet

- Domestic Gyser User NoticeDocument1 pageDomestic Gyser User NoticeRidwan Haque DolonNo ratings yet

- 634545536696201250Document17 pages634545536696201250Ridwan Haque DolonNo ratings yet

- 63880Document51 pages63880Ridwan Haque DolonNo ratings yet

- Beioa New MemDocument3 pagesBeioa New MemRidwan Haque DolonNo ratings yet

- Leaflet BackDocument1 pageLeaflet BackRidwan Haque DolonNo ratings yet

- Income Tax Ordinance 1984Document370 pagesIncome Tax Ordinance 1984Md. Mamunur RashidNo ratings yet

- Leaflet Front PDFDocument1 pageLeaflet Front PDFRidwan Haque DolonNo ratings yet

- Water Heater Test Report 111413Document30 pagesWater Heater Test Report 111413thanh_79No ratings yet

- Canada Residential Electric Upright m2 Iomanual 44422 PDFDocument20 pagesCanada Residential Electric Upright m2 Iomanual 44422 PDFRidwan Haque DolonNo ratings yet

- Equity and Entrepreneurship Fund (EEF)Document24 pagesEquity and Entrepreneurship Fund (EEF)Ridwan Haque DolonNo ratings yet

- ICB Yearly - Acc - 2013 - 14Document12 pagesICB Yearly - Acc - 2013 - 14Ridwan Haque DolonNo ratings yet

- Opportunities of Initial Public Offering (IPO)Document29 pagesOpportunities of Initial Public Offering (IPO)Ridwan Haque DolonNo ratings yet

- Statistical L1Document1 pageStatistical L1Ridwan Haque DolonNo ratings yet

- Cash Receipt: Tongwei Feed Mill Bangladesh Limited. The Amount of TK - From BillDocument1 pageCash Receipt: Tongwei Feed Mill Bangladesh Limited. The Amount of TK - From BillRidwan Haque DolonNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisRidwan Haque DolonNo ratings yet

- Marine Cargo Insurance ExplainedDocument2 pagesMarine Cargo Insurance ExplainedRidwan Haque DolonNo ratings yet

- Form of return of withholding tax under Income-tax Ordinance 1984Document4 pagesForm of return of withholding tax under Income-tax Ordinance 1984Ridwan Haque DolonNo ratings yet

- 10 Marketing Truths Revealed by the PandemicDocument7 pages10 Marketing Truths Revealed by the PandemicMuhammad TahaNo ratings yet

- Chapter 15 Designing and Managing Integrated Marketing ChannelsDocument26 pagesChapter 15 Designing and Managing Integrated Marketing ChannelsrioNo ratings yet

- Case StudyDocument30 pagesCase StudyAnh LeNo ratings yet

- Victor Group Internship ProgramDocument32 pagesVictor Group Internship Programleslie33100% (1)

- SC Performance and Achieving Strategic Fit 2Document63 pagesSC Performance and Achieving Strategic Fit 2Srinivasan MastiNo ratings yet

- 2nd Quarter Module Business MathematicsDocument49 pages2nd Quarter Module Business MathematicsNiejay Arcullo Llagas88% (16)

- Experienced Counter Sales ProfessionalDocument4 pagesExperienced Counter Sales Professionalversova onlineNo ratings yet

- Unit One Process CostingDocument9 pagesUnit One Process CostingDzukanji SimfukweNo ratings yet

- Inventory 1-2Document8 pagesInventory 1-2Adym AymdNo ratings yet

- Sales Manager Showroom Interior Design in NYC NY Resume Jaynie BerkeDocument2 pagesSales Manager Showroom Interior Design in NYC NY Resume Jaynie BerkeJaynieBerkeNo ratings yet

- Deed of Sale for Motor VehiclesDocument1 pageDeed of Sale for Motor VehiclesEllen Glae DaquipilNo ratings yet

- New Product LaunchDocument61 pagesNew Product LaunchRabia100% (5)

- Sybba ProjectsDocument72 pagesSybba Projectsproject guide100% (1)

- Mr.M.John Paul/ Management Studies /sathyabama University/ ChennaiDocument53 pagesMr.M.John Paul/ Management Studies /sathyabama University/ Chennaivinothkumararaja8249No ratings yet

- Brand ManagementDocument6 pagesBrand ManagementAnubhov JobairNo ratings yet

- Chapter 6 - Product and Service StrategiesDocument32 pagesChapter 6 - Product and Service StrategiesralphalonzoNo ratings yet

- Mayur Athle - 11-01-2019Document2 pagesMayur Athle - 11-01-2019Bhaskar D.No ratings yet

- Marketing Management 707 v1Document517 pagesMarketing Management 707 v1Shashi BhushanNo ratings yet

- TEAM 4 Case Study StarbucksDocument11 pagesTEAM 4 Case Study StarbucksCharmae Booc67% (3)

- 504 17 Personal Communications-1Document27 pages504 17 Personal Communications-1djgavli11210No ratings yet

- Dakota Office Products Activity-Based Costing Case StudyDocument5 pagesDakota Office Products Activity-Based Costing Case StudyAriyo Roberto Carlos BanureaNo ratings yet

- Marketing Implementation and ControlDocument43 pagesMarketing Implementation and Controlsougata79No ratings yet

- World - Classic - Sale 2017 - Catalog FINAL PDFDocument62 pagesWorld - Classic - Sale 2017 - Catalog FINAL PDFHolstein PlazaNo ratings yet

- The Ultimate Guide To LinkedIn SummariesDocument98 pagesThe Ultimate Guide To LinkedIn Summarieskaren.viviana.guerrero.leonNo ratings yet

- Admk Notes 1Document287 pagesAdmk Notes 1Mohammed NizamuddinNo ratings yet

- Assignment 1 - Julie (Scribd)Document23 pagesAssignment 1 - Julie (Scribd)Julie PhamNo ratings yet

- North Country Auto Profit CentersDocument9 pagesNorth Country Auto Profit CentersSamu BorgesNo ratings yet

- Strategic Management and Value Chain Analysis of ITCDocument30 pagesStrategic Management and Value Chain Analysis of ITCakshay chothe100% (1)

- Role of Advertising in the Promotional MixDocument7 pagesRole of Advertising in the Promotional MixShaik Khwaja Nawaz SharifNo ratings yet