Professional Documents

Culture Documents

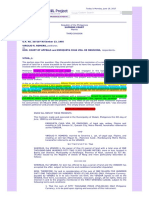

US Internal Revenue Service: P536supp - 2001

Uploaded by

IRS0 ratings0% found this document useful (0 votes)

24 views1 pageUnder new law, if you have an NOL for a tax year ending during 2001 or 2002, you must generally carry back the entire amount of the NOL to the 5 tax years before the NOL year. You can still choose to carry back an NOL to 2 (or 3, if applicable) years before the year. Any remaining NOL can be carried forward for up to 20 years.

Original Description:

Original Title

US Internal Revenue Service: p536supp--2001

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUnder new law, if you have an NOL for a tax year ending during 2001 or 2002, you must generally carry back the entire amount of the NOL to the 5 tax years before the NOL year. You can still choose to carry back an NOL to 2 (or 3, if applicable) years before the year. Any remaining NOL can be carried forward for up to 20 years.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views1 pageUS Internal Revenue Service: P536supp - 2001

Uploaded by

IRSUnder new law, if you have an NOL for a tax year ending during 2001 or 2002, you must generally carry back the entire amount of the NOL to the 5 tax years before the NOL year. You can still choose to carry back an NOL to 2 (or 3, if applicable) years before the year. Any remaining NOL can be carried forward for up to 20 years.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Userid: ________ Leading adjust: -20% ❏ Draft ❏ Ok to Print

PAGER/SGML Fileid: P536SUPP.sgm (29-May-2002) (Init. & date)

Page 1 of 1 of Publication 536 13:58 - 29-MAY-2002

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Introduction

After Publication 536 was printed, legislation was enacted

to temporarily extend the carryback period for a net operat-

ing loss (NOL).

Publication 536

Cat. No. 33968N

New 5-Year NOL Carryback

Supplement to Carryback period. Under new law, if you have an NOL for

Publication a tax year ending during 2001 or 2002, you must generally

carry back the entire amount of the NOL to the 5 tax years

before the NOL year (the carryback period). However, you

536 can still choose to carry back an NOL to the 2 (or 3, if

applicable) years before the NOL year. Any remaining

NOL can be carried forward for up to 20 years. You can

also choose not to carry back an NOL and only carry it

Net Operating Losses forward.

(NOLs) for Individuals, Return already filed. If you already filed your return for a

tax year ending during 2001 or 2002 and did not apply the

Estates, and Trusts new 5-year carryback for an NOL, you have a limited

opportunity to do so.

If you elected to forgo the carryback period. Individ-

For use in preparing uals who elected to forgo the carryback period but now

want to apply the 5-year carryback period can do so by

2001 Returns filing either Form 1045, Application for Tentative Refund,

or Form 1040X, Amended U.S. Individual Income Tax

Return. Estates and trusts file Form 1045 or amended

Form 1041, U.S. Income Tax Return for Estates and

Trusts. Type or print across the top of the form “Revocation

of NOL carryback waiver pursuant to Rev. Proc.

2002 –40.”

If you elected to forgo the carryback period and still want

to forgo a carryback, do nothing. Your previous election

applies to forgo the 5-year carryback period.

If you applied a 2 (or 3)-year carryback period. Indi-

viduals who applied a 2 (or 3)-year carryback period but

now want to apply the 5-year carryback period can do so

by filing either Form 1045 or Form 1040X. Estates and

trusts file Form 1045 or amended Form 1041. Type or print

across the top of the form “Amended refund claim pursuant

to Rev. Proc. 2002 –40.”

If you applied a 2 (or 3)-year carryback period and still

want to use that period, do nothing. You will be considered

to have made an election to forgo the 5-year carryback

period in favor of the 2 (or 3)-year carryback period.

If you neither elected to forgo the carryback period

nor applied the 2 (or 3)-year carryback period. Individ-

uals who neither elected to forgo the carryback period nor

applied a 2 (or 3)-year period but now want to forgo the

5-year period and apply a 2 (or 3)-year period can do so by

filing either Form 1045 or Form 1040X. Estates and trusts

file Form 1045 or amended Form 1041. If you do not

choose the 2 (or 3)-year period, the 5-year period will

apply.

When to file. File the appropriate form by October 31,

2002.

You might also like

- US Internal Revenue Service: I4972 - 1992Document4 pagesUS Internal Revenue Service: I4972 - 1992IRSNo ratings yet

- Exceptions To The Early Distribution Penalty: Synergy Financial GroupDocument4 pagesExceptions To The Early Distribution Penalty: Synergy Financial GroupgvandykeNo ratings yet

- US Internal Revenue Service: I4972 - 1995Document4 pagesUS Internal Revenue Service: I4972 - 1995IRSNo ratings yet

- NZ Student - From 01 October 2017Document16 pagesNZ Student - From 01 October 2017ivanNo ratings yet

- Budget 2021Document2,120 pagesBudget 2021Pawan Kumar100% (1)

- US Internal Revenue Service: I4972 - 1993Document4 pagesUS Internal Revenue Service: I4972 - 1993IRSNo ratings yet

- Fair Work ContractsDocument3 pagesFair Work Contractstempestbringer777No ratings yet

- US Internal Revenue Service: I4972 - 1994Document4 pagesUS Internal Revenue Service: I4972 - 1994IRSNo ratings yet

- US Internal Revenue Service: I3903f - 1992Document2 pagesUS Internal Revenue Service: I3903f - 1992IRSNo ratings yet

- US Internal Revenue Service: I4972 - 1996Document4 pagesUS Internal Revenue Service: I4972 - 1996IRSNo ratings yet

- US Internal Revenue Service: f3903 - 1995Document2 pagesUS Internal Revenue Service: f3903 - 1995IRSNo ratings yet

- Costco Canada TV Extended Warranty - Excellence Plus+ 3 Year TV WarrantyDocument2 pagesCostco Canada TV Extended Warranty - Excellence Plus+ 3 Year TV WarrantyAnonymous SamTjzvNo ratings yet

- DMCC Employment FAQs-V3Document35 pagesDMCC Employment FAQs-V3Amir AnwarNo ratings yet

- Priti Docs.Document4 pagesPriti Docs.naseemNo ratings yet

- Cascading Clauses Example:: 1. Restraint of TradeDocument1 pageCascading Clauses Example:: 1. Restraint of TradeKaylah NewcombeNo ratings yet

- Adobe Scan Oct 19, 2023Document6 pagesAdobe Scan Oct 19, 2023A. Karkuvel RajaNo ratings yet

- OPCF 116revisedDocument1 pageOPCF 116revisedGarry sharmaNo ratings yet

- Form of Grant Acceptance Agreement Relating To Stock Option GrantsDocument5 pagesForm of Grant Acceptance Agreement Relating To Stock Option GrantsaratanjalaineNo ratings yet

- US Internal Revenue Service: I1045 - 1993Document4 pagesUS Internal Revenue Service: I1045 - 1993IRSNo ratings yet

- 29 PDFDocument58 pages29 PDFAradhna BhasinNo ratings yet

- US Internal Revenue Service: I3903f - 1993Document2 pagesUS Internal Revenue Service: I3903f - 1993IRSNo ratings yet

- US Internal Revenue Service: I5329 - 1994Document5 pagesUS Internal Revenue Service: I5329 - 1994IRSNo ratings yet

- Moving Expenses: Before You BeginDocument4 pagesMoving Expenses: Before You BeginEloy RodriguezNo ratings yet

- Bill Shorten - Maternity Leave Is Unpaid LeaveDocument43 pagesBill Shorten - Maternity Leave Is Unpaid LeaveMichael SmithNo ratings yet

- A Person Has Not Filed ReturnDocument1 pageA Person Has Not Filed ReturnMalik Mansoor AhmedNo ratings yet

- Long Form NoticeDocument13 pagesLong Form NoticeDaniel GarciaNo ratings yet

- The Law of Limitation Act 1963Document10 pagesThe Law of Limitation Act 1963mahiNo ratings yet

- US Internal Revenue Service: I5500ez - 1995Document6 pagesUS Internal Revenue Service: I5500ez - 1995IRSNo ratings yet

- GPCL 1 FormDocument8 pagesGPCL 1 FormNicky LimNo ratings yet

- Labour Law PowerPointDocument16 pagesLabour Law PowerPointAnjali NairNo ratings yet

- Guide To Employment Labour and Equality Law 18Document82 pagesGuide To Employment Labour and Equality Law 18Mihai VoicuNo ratings yet

- ENGLISH One Pager Sanchay Plus Long Term Income Retail FinalDocument2 pagesENGLISH One Pager Sanchay Plus Long Term Income Retail FinalAbhisek BrahmaNo ratings yet

- US Internal Revenue Service: I3468 - 1996Document3 pagesUS Internal Revenue Service: I3468 - 1996IRSNo ratings yet

- Media 327439 SMXXDocument5 pagesMedia 327439 SMXXCheena Vitug LabasanNo ratings yet

- Group BenefitsDocument2 pagesGroup BenefitsredcolNo ratings yet

- US Internal Revenue Service: f3903f - 1997Document2 pagesUS Internal Revenue Service: f3903f - 1997IRSNo ratings yet

- MLE#4Document6 pagesMLE#4Angela FaithNo ratings yet

- SUMMARY of Goverment Regulation No 35 - 2021Document5 pagesSUMMARY of Goverment Regulation No 35 - 2021De Aris DerismanNo ratings yet

- STONZ V NZRDA MECA Comparison - July 2021Document6 pagesSTONZ V NZRDA MECA Comparison - July 2021hlouis8No ratings yet

- Chambers Global Practice Guide Employment 2019Document11 pagesChambers Global Practice Guide Employment 2019bradNo ratings yet

- Termination of Unionized Contracts in Singapore Caa 08012014 Time 1413pmDocument5 pagesTermination of Unionized Contracts in Singapore Caa 08012014 Time 1413pmgeraldtanjiaminNo ratings yet

- Does Not Work. They May, But There Is No NeedDocument3 pagesDoes Not Work. They May, But There Is No NeedGhee MoralesNo ratings yet

- Does Not Work. They May, But There Is No NeedDocument3 pagesDoes Not Work. They May, But There Is No NeedGhee MoralesNo ratings yet

- Amendments To The CIL Executive Leave Rules 2010 26072017Document2 pagesAmendments To The CIL Executive Leave Rules 2010 26072017balakrishna eNo ratings yet

- Saudi Arabia Employment Labour LawDocument7 pagesSaudi Arabia Employment Labour LawheruNo ratings yet

- US Internal Revenue Service: f3903 - 2001Document2 pagesUS Internal Revenue Service: f3903 - 2001IRSNo ratings yet

- US Internal Revenue Service: f4563 - 1991Document2 pagesUS Internal Revenue Service: f4563 - 1991IRSNo ratings yet

- Publication 721, Tax Guide To U.S. Civil Service Retirement Benefits (2021)Document33 pagesPublication 721, Tax Guide To U.S. Civil Service Retirement Benefits (2021)Dianna VenezianoNo ratings yet

- Temporary Appointment LetterDocument5 pagesTemporary Appointment LetterMichael van StadenNo ratings yet

- PHILIPPINE FEDERATION OF PETROLEUM WORKERS V CIRDocument2 pagesPHILIPPINE FEDERATION OF PETROLEUM WORKERS V CIROne TwoNo ratings yet

- Instructions For Form 1120S: U.S. Income Tax Return For An S CorporationDocument19 pagesInstructions For Form 1120S: U.S. Income Tax Return For An S CorporationIRSNo ratings yet

- Lending RelendingDocument12 pagesLending RelendingLone TravellerNo ratings yet

- Retirement Law + CasesDocument23 pagesRetirement Law + CasesJica GulaNo ratings yet

- Debates BM 2019-21Document7 pagesDebates BM 2019-21harisankar sureshNo ratings yet

- Payment of Termination Benefits, Indemnity in Lieu of Notice and Payment in Lieu of Unutilised Annual Leave by EmployerDocument7 pagesPayment of Termination Benefits, Indemnity in Lieu of Notice and Payment in Lieu of Unutilised Annual Leave by EmployerJenson ElectricalNo ratings yet

- Management Position 10-03-2023Document1 pageManagement Position 10-03-2023Vinnie KittyNo ratings yet

- 2011 Equity Incentive Plan Notice of GrantDocument6 pages2011 Equity Incentive Plan Notice of Grantdscalisi1No ratings yet

- FIDIC Quick Reference Guide - Yellow Book 2017Document2 pagesFIDIC Quick Reference Guide - Yellow Book 2017Magloire HiolNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Statcon Part VDocument28 pagesStatcon Part VApr Celestial100% (2)

- Tsai v. Court of Appeals, G.R. Nos. 120098 and 120109, October 2, 2001Document1 pageTsai v. Court of Appeals, G.R. Nos. 120098 and 120109, October 2, 2001Jube Kathreen ObidoNo ratings yet

- Airbus A319 A321 DLH Training Manual Ata 29 Hydraulic Power Line Amp Base Maintenance Level 3Document139 pagesAirbus A319 A321 DLH Training Manual Ata 29 Hydraulic Power Line Amp Base Maintenance Level 3viney1130No ratings yet

- Labor Standards CasesDocument72 pagesLabor Standards CasesCarmel LouiseNo ratings yet

- Certificate of Inventory: Republic of The Philippines Philippine National PoliceDocument1 pageCertificate of Inventory: Republic of The Philippines Philippine National PoliceNobrien HernandezNo ratings yet

- Hollywood HaremsDocument5 pagesHollywood HaremsAnonymous mIBVSENo ratings yet

- Direct To Indirect (157 Solved Sentences)Document9 pagesDirect To Indirect (157 Solved Sentences)HAZIQNo ratings yet

- Case Study 2.internal Control-CashDocument3 pagesCase Study 2.internal Control-CashAlvian CBNo ratings yet

- Romero v. Court of Appeals 250 SCRA 223Document5 pagesRomero v. Court of Appeals 250 SCRA 223Krisleen Abrenica0% (1)

- Queen Elizabeth IIDocument14 pagesQueen Elizabeth IIbrunostivalNo ratings yet

- Pride Prejudice SummaryDocument22 pagesPride Prejudice SummaryMarita Bayandorian100% (1)

- NCERT Class 7 Geography PDFDocument81 pagesNCERT Class 7 Geography PDFJayant OjhaNo ratings yet

- 3 G's Objectives of Spanish Colonization: Taxes During Spanish ControlDocument3 pages3 G's Objectives of Spanish Colonization: Taxes During Spanish ControlMegan ForestNo ratings yet

- V. Liabilities of Parties A. Liability of MakerDocument4 pagesV. Liabilities of Parties A. Liability of MakerRalph Christian Lusanta FuentesNo ratings yet

- Stories From Schöneberg and SurroundingsDocument86 pagesStories From Schöneberg and SurroundingsLiviu BuleaNo ratings yet

- Bioethics Unit 1 and 2Document6 pagesBioethics Unit 1 and 2marykNo ratings yet

- Unit 1 Indian Contract Act 1872Document48 pagesUnit 1 Indian Contract Act 1872DeborahNo ratings yet

- History of Arnis EssayDocument2 pagesHistory of Arnis EssayNatss VillanuevaNo ratings yet

- Grady Wallace - WikipediaDocument7 pagesGrady Wallace - WikipediabNo ratings yet

- Star Wars Canon Timeline MythBankDocument43 pagesStar Wars Canon Timeline MythBankJonathan CarsonNo ratings yet

- Llses: Federal Register! Vol. 64, No. 231/ Thursday, December 2, 1999/ Notices 67585Document1 pageLlses: Federal Register! Vol. 64, No. 231/ Thursday, December 2, 1999/ Notices 67585H.I.M Dr. Lawiy Zodok100% (2)

- Company Liquidation Process and ProcedureDocument2 pagesCompany Liquidation Process and ProcedureandrewNo ratings yet

- Arnis Week-8Document15 pagesArnis Week-8Koolecarla BernardoNo ratings yet

- Asynchronous Activity 2 (A) DigestsDocument10 pagesAsynchronous Activity 2 (A) DigestsGeralice GalangNo ratings yet

- United States v. Antonio Clifford McMillan, 19 F.3d 1430, 4th Cir. (1994)Document9 pagesUnited States v. Antonio Clifford McMillan, 19 F.3d 1430, 4th Cir. (1994)Scribd Government DocsNo ratings yet

- Nazi Police StateDocument16 pagesNazi Police StateTheo ChingombeNo ratings yet

- TCP Syn Flood Attack Detection and PreventionDocument6 pagesTCP Syn Flood Attack Detection and PreventionseventhsensegroupNo ratings yet

- AJD2Document19 pagesAJD2HollyRustonNo ratings yet

- Bpop Plan - DanahaoDocument3 pagesBpop Plan - DanahaoJessica CindyNo ratings yet

- Dap An Mon En16Document42 pagesDap An Mon En16Thu Hà LêNo ratings yet

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- Modern Warriors: Real Stories from Real HeroesFrom EverandModern Warriors: Real Stories from Real HeroesRating: 3.5 out of 5 stars3.5/5 (3)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- Crimes and Cover-ups in American Politics: 1776-1963From EverandCrimes and Cover-ups in American Politics: 1776-1963Rating: 4.5 out of 5 stars4.5/5 (26)

- The Red and the Blue: The 1990s and the Birth of Political TribalismFrom EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismRating: 4 out of 5 stars4/5 (29)

- The Next Civil War: Dispatches from the American FutureFrom EverandThe Next Civil War: Dispatches from the American FutureRating: 3.5 out of 5 stars3.5/5 (50)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorFrom EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNo ratings yet

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaFrom EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaRating: 4.5 out of 5 stars4.5/5 (4)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (98)

- The Lemon Tree: An Arab, a Jew, and the Heart of the Middle EastFrom EverandThe Lemon Tree: An Arab, a Jew, and the Heart of the Middle EastRating: 4.5 out of 5 stars4.5/5 (43)

- A Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyFrom EverandA Short History of the United States: From the Arrival of Native American Tribes to the Obama PresidencyRating: 3.5 out of 5 stars3.5/5 (19)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicFrom EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNo ratings yet

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismFrom EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismRating: 4.5 out of 5 stars4.5/5 (42)

- The Science of Liberty: Democracy, Reason, and the Laws of NatureFrom EverandThe Science of Liberty: Democracy, Reason, and the Laws of NatureNo ratings yet

- To Make Men Free: A History of the Republican PartyFrom EverandTo Make Men Free: A History of the Republican PartyRating: 4.5 out of 5 stars4.5/5 (21)

- Slouching Towards Gomorrah: Modern Liberalism and American DeclineFrom EverandSlouching Towards Gomorrah: Modern Liberalism and American DeclineRating: 4 out of 5 stars4/5 (59)

- Corruptible: Who Gets Power and How It Changes UsFrom EverandCorruptible: Who Gets Power and How It Changes UsRating: 4.5 out of 5 stars4.5/5 (45)

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryFrom EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryRating: 4 out of 5 stars4/5 (6)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- The Invisible Bridge: The Fall of Nixon and the Rise of ReaganFrom EverandThe Invisible Bridge: The Fall of Nixon and the Rise of ReaganRating: 4.5 out of 5 stars4.5/5 (32)

- U.S. Constitution for Dummies: 2nd EditionFrom EverandU.S. Constitution for Dummies: 2nd EditionRating: 3.5 out of 5 stars3.5/5 (8)

- UFO: The Inside Story of the US Government's Search for Alien Life Here—and Out ThereFrom EverandUFO: The Inside Story of the US Government's Search for Alien Life Here—and Out ThereRating: 4.5 out of 5 stars4.5/5 (16)