Professional Documents

Culture Documents

US Internal Revenue Service: f2441 - 1995

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: f2441 - 1995

Uploaded by

IRSCopyright:

Available Formats

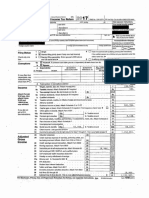

2441

OMB No. 1545-0068

Child and Dependent Care Expenses

Form

© Attach to Form 1040.

Department of the Treasury Attachment

Internal Revenue Service (99) © See separate instructions. Sequence No. 21

Name(s) shown on Form 1040 Your social security number

You need to understand the following terms to complete this form:

Qualifying Person(s), Dependent Care Benefits, Qualified

Expenses, and Earned Income. See Important Terms on page 1

of the Form 2441 instructions.

Persons or Organizations Who Provided the Care—You must complete this part.

Part I

(If you need more space, use the bottom of page 2.)

(a) Care provider’s (b) Address (c) Identifying number (d) Amount paid

1

name (number, street, apt. no., city, state, and ZIP code) (SSN or EIN) (see instructions)

2 Add the amounts in column (d) of line 1 2

3 Enter the number of qualifying persons cared for in 1995 ©

NO © Complete only Part II below.

Did you receive

dependent care benefits? YES © Complete Part III on the back now.

Part II Credit for Child and Dependent Care Expenses

4 Enter the amount of qualified expenses you incurred and paid in

1995. DO NOT enter more than $2,400 for one qualifying person

or $4,800 for two or more persons. If you completed Part III, enter

the amount from line 25 4

5 Enter YOUR earned income 5

6 If married filing a joint return, enter YOUR SPOUSE’S earned

income (if student or disabled, see the instructions); all others,

enter the amount from line 5 6

7 Enter the smallest of line 4, 5, or 6 7

8 Enter the amount from Form 1040, line 32 8

9 Enter on line 9 the decimal amount shown below that applies to the amount on line 8

If line 8 is— Decimal If line 8 is— Decimal

But not amount But not amount

Over over is Over over is

$0—10,000 .30 $20,000—22,000 .24

10,000—12,000 .29 22,000—24,000 .23

12,000—14,000 .28 24,000—26,000 .22 9 3.

14,000—16,000 .27 26,000—28,000 .21

16,000—18,000 .26 28,000—No limit .20

18,000—20,000 .25

10 Multiply line 7 by the decimal amount on line 9. Enter the result. Then, see the instructions for

the amount of credit to enter on Form 1040, line 41 10

Caution: If you paid a person who worked in your home, you may have to pay employment taxes. See the instructions for

Form 1040, line 53, on page 26.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11862M Form 2441 (1995)

Form 2441 (1995) Page 2

Part III Dependent Care Benefits—Complete this part only if you received these benefits.

11 Enter the total amount of dependent care benefits you received for 1995. This amount should

be shown in box 10 of your W-2 form(s). DO NOT include amounts that were reported to you

as wages in box 1 of Form(s) W-2 11

12 Enter the amount forfeited, if any. See the instructions 12

13 Subtract line 12 from line 11 13

14 Enter the total amount of qualified expenses incurred in 1995

for the care of the qualifying person(s) 14

15 Enter the smaller of line 13 or 14 15

16 Enter YOUR earned income 16

17 If married filing a joint return, enter YOUR SPOUSE’S earned

income (if student or disabled, see the line 6 instructions); if

married filing a separate return, see the instructions for the

amount to enter; all others, enter the amount from line 16 17

18 Enter the smallest of line 15, 16, or 17 18

19 Excluded benefits. Enter here the smaller of the following:

%

● The amount from line 18, or

● $5,000 ($2,500 if married filing a separate return 19

and you were required to enter your spouse’s

earned income on line 17).

20 Taxable benefits. Subtract line 19 from line 13. Also, include this amount on Form 1040,

line 7. On the dotted line next to line 7, write “DCB” 20

To claim the child and dependent care credit, complete

lines 21–25 below, and lines 4–10 on the front of this form.

21 Enter the amount of qualified expenses you incurred and paid in 1995. DO NOT include on

this line any excluded benefits shown on line 19 21

22 Enter $2,400 ($4,800 if two or more qualifying persons) 22

23 Enter the amount from line 19 23

24 Subtract line 23 from line 22. If zero or less, STOP. You cannot take the credit. Exception. If

you paid 1994 expenses in 1995, see the line 10 instructions 24

25 Enter the smaller of line 21 or 24 here and on line 4 on the front of this form 25

Printed on recycled paper

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Isba ChecklistDocument1 pageIsba ChecklistAnonymous zNjWCxV9dNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- IllinoisState Fy 2020Document79 pagesIllinoisState Fy 2020Matt BrownNo ratings yet

- Path To FreedomDocument132 pagesPath To FreedomMelinda Owens100% (3)

- Adriano Alessandro Averzano 2019 Tax ReturnDocument21 pagesAdriano Alessandro Averzano 2019 Tax ReturnMucho FacerapeNo ratings yet

- FWD - Us Education Fund-Form 990, 2019 (Public Disclosure)Document57 pagesFWD - Us Education Fund-Form 990, 2019 (Public Disclosure)Breitbart NewsNo ratings yet

- Notice: Sanctions, blocked persons, specially-designated nationals, terrorists, narcotics traffickers, and foreign terrorist organizations: Foreign Narcotics Kingpin Designation Act; additional designations; listDocument3 pagesNotice: Sanctions, blocked persons, specially-designated nationals, terrorists, narcotics traffickers, and foreign terrorist organizations: Foreign Narcotics Kingpin Designation Act; additional designations; listJustia.comNo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- CorporationsDocument68 pagesCorporationsPaoNo ratings yet

- Request Taxpayer ID and Certification FormDocument6 pagesRequest Taxpayer ID and Certification FormMuhammad Husnain Ijaz0% (1)

- W-8 Attachment: Citizenship, Form #04.219Document50 pagesW-8 Attachment: Citizenship, Form #04.219Sovereignty Education and Defense Ministry (SEDM)No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Schedule D Capital Gains and Losses Tax FormDocument1 pageSchedule D Capital Gains and Losses Tax Formkushaal subramonyNo ratings yet

- Concessionaire Contract FormatDocument5 pagesConcessionaire Contract FormatAnonymous Lu6MrQmNo ratings yet

- Schedule-C (Contract Price and Payment Provisions)Document84 pagesSchedule-C (Contract Price and Payment Provisions)Ahmed BoraeyNo ratings yet

- South Dakota FRSDocument79 pagesSouth Dakota FRSMatt BrownNo ratings yet

- US Internal Revenue Service: Irb05-44Document82 pagesUS Internal Revenue Service: Irb05-44IRSNo ratings yet

- IRS Publication 535Document56 pagesIRS Publication 535private completelyNo ratings yet

- Sanders IRS Filing 2017Document21 pagesSanders IRS Filing 2017Stephanie Dube DwilsonNo ratings yet

- Barbara Etzel - Webster's Finance and Investment Dictionary-Wiley (2003)Document388 pagesBarbara Etzel - Webster's Finance and Investment Dictionary-Wiley (2003)wayawid760No ratings yet

- Lesson 1Document12 pagesLesson 1Met MalayoNo ratings yet

- Investigative Report: Case#EI-14-0126-IR#13Document2 pagesInvestigative Report: Case#EI-14-0126-IR#13The Florida Times-UnionNo ratings yet

- IRS Form W-8 ReceivedDocument2 pagesIRS Form W-8 ReceivedManishDikshitNo ratings yet

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- Ui#menu W2Document1 pageUi#menu W2lisa rugeNo ratings yet

- The Income Tax ChallengeDocument49 pagesThe Income Tax Challengeaafft100% (1)

- Wage and Tax Statement: Last Name SuffDocument1 pageWage and Tax Statement: Last Name SuffDavid RadNo ratings yet

- Form 1099Document6 pagesForm 1099Joe LongNo ratings yet

- Liberty University's 990 Income Tax FormDocument111 pagesLiberty University's 990 Income Tax FormWSETNo ratings yet

- Updated Information On Use of Form W-8Eci (Revision Date February 2006) Before January 1, 2015Document2 pagesUpdated Information On Use of Form W-8Eci (Revision Date February 2006) Before January 1, 2015Criss RojasNo ratings yet

- Tax Filing Basics For Stock Plan TransactionsDocument8 pagesTax Filing Basics For Stock Plan Transactionshananahmad114No ratings yet

- Instructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceDocument13 pagesInstructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceChristian RiveraNo ratings yet