Professional Documents

Culture Documents

Correction - Multiple Choice Questions On Micro Finance

Uploaded by

sushmanthqrewrerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Correction - Multiple Choice Questions On Micro Finance

Uploaded by

sushmanthqrewrerCopyright:

Available Formats

Multiple Choice Questions on microfinance

What is NOT an innovation likely to explain the high repayment rates of microcredit

programs?

(a) Promising larger and larger loans for borrowers in good standing

(b) Public repayments

(c) Strong competition between numerous microcredit programs to reduce interest rates

(d) Starting repayments before investments are likely to have borne fruit

Answer: c

What is NOT a potential limit of group lending?

(a) Monitoring group members can be costly for borrowers

(b) Group lending uses social sanctions instead of collateral foreclosure

(c) Group lending brings added risks for borrowers, those of others members’ default.

(d) Exclusion of all group members after one of them default is too harsh a punishment.

Answer: b

What is TRUE of group lending clause?

(a) Dealing with groups instead of individuals reduces transaction costs for the bank

(b) Group arrangements teach the bank a great deal about who is safe and who is risky

(c) Group lending reduces inequality between borrowers: all benefit from the same interest

rate

(d) Group loans are always cheaper than individual loans

Answer: d

What is NOT a source of difficulty in the estimation of the impact of microfinance projects?

(a) we do not observe what would have happened in absence of the microfinance project

(b) participants systematically differ from non participants in their propensity to benefit from

micro-loans

(c) microfinance programs are not located randomly, they are often located in disfavored

areas

(d) microfinance programs are often targeted to women

Answer: d

What is NOT a mechanism that contributes to the success of micro-credits?

(a) dynamic incentives

(b) peer monitoring

(c) regular repayment schedules

(d) collaterals

Answer: d

What does the microfinance model NOT predict:

(a) a decrease in interest rates when repayment is regular and in time

(b) homogenous risk groups

(c) self-selection of the best borrowers

(d) none of the above

Answer: c

What can be said of microfinance?

(a) The secret to the high repayment rates on loans is tied closely to the use of the group-

lending contracts

(b) Microfinance has a clear record of social impacts and has been shown to be a major tool

for poverty reduction

(c) Microfinance has brought solutions to credit market failures that stem from poor

information and high transactions costs

(d) all of the above

Answer: c

What can NOT be said of group lending?

(a) most microfinance programs rely on group lending contracts

(b) group lending induces peer monitoring

(c) group lending is believed to reduce the incidence of default

(d) group lending is more costly for borrowers than individual lending

Answer: a

What is NOT a feature that seems to explain the microfinance’s high repayment rates?

(a) provision of non financial services (education, health…)

(b) regular repayment schedule

(c) increase in the loan size upon satisfactory repayment

(d) unique and low interest rate for all borrowers

Answer: a

You might also like

- SBA Loans GuideDocument5 pagesSBA Loans GuideHotmansam EvonyNo ratings yet

- Micro Finance PPT FinalDocument37 pagesMicro Finance PPT FinalVaibhav Alawa100% (2)

- Question Bank On Central Banks MCQsDocument20 pagesQuestion Bank On Central Banks MCQsabhilash k.b88% (8)

- MCQS ON FOREIGN EXCHANGE CONCEPTSDocument37 pagesMCQS ON FOREIGN EXCHANGE CONCEPTSPadyala Sriram67% (6)

- Unit III Risk and Return MCQDocument4 pagesUnit III Risk and Return MCQsvpranav8018100% (8)

- MCQ On International BankingDocument7 pagesMCQ On International Bankingparthasarathi_in100% (3)

- Venture Capital Firms, Finance Companies, and Financial Conglomerates ExplainedDocument8 pagesVenture Capital Firms, Finance Companies, and Financial Conglomerates ExplainedShuvro Rahman75% (12)

- Retail BankingDocument10 pagesRetail BankingPayal hazra100% (1)

- Financial Markets and Institutions MCQsDocument1 pageFinancial Markets and Institutions MCQsishtiaqlodhran82% (11)

- Financial Management & Int Finance Study Text P-12Document744 pagesFinancial Management & Int Finance Study Text P-12Saleem Ahmed100% (4)

- CH 10 Case StudiesDocument14 pagesCH 10 Case Studiesravideva84No ratings yet

- Objective Questions and Answers of Financial ManagementDocument52 pagesObjective Questions and Answers of Financial ManagementManohar Reddy81% (95)

- Case Study QuestionsDocument4 pagesCase Study QuestionsVarun Singh ChandelNo ratings yet

- Objective Type Questions in BankingDocument27 pagesObjective Type Questions in Bankingmidhungbabu81% (31)

- Readiness of The Beneficiaries To Engage in Sustainable Livelihood Program (SLP) As Basis For InterventionDocument16 pagesReadiness of The Beneficiaries To Engage in Sustainable Livelihood Program (SLP) As Basis For InterventionIJELS Research JournalNo ratings yet

- International Financial Management MCQDocument5 pagesInternational Financial Management MCQAshish Patel100% (2)

- MCQ of LEVERAGE PDFDocument4 pagesMCQ of LEVERAGE PDFMD Shuhel Ahmed75% (4)

- Muhammad Yunus - Creating A World Without Poverty PDFDocument297 pagesMuhammad Yunus - Creating A World Without Poverty PDFLeslie Quah80% (5)

- Portfolio Performance Evaluation MCQDocument74 pagesPortfolio Performance Evaluation MCQAssad Javed83% (6)

- CHALLENGE STATUS STAGE I EXAMINATION - SAMPLE PAPERDocument26 pagesCHALLENGE STATUS STAGE I EXAMINATION - SAMPLE PAPERNeelam Jain100% (1)

- Sample Exam QuestionsDocument6 pagesSample Exam QuestionsTôn Nữ Hương Giang100% (1)

- 200 PMP Questions 51-75 With AnswersDocument4 pages200 PMP Questions 51-75 With AnswersHaitham AbouzeidNo ratings yet

- Edsb Chapter 3 MCQDocument13 pagesEdsb Chapter 3 MCQdvpatel6680% (5)

- Questionnaire Fro Micro Finance SurveyDocument3 pagesQuestionnaire Fro Micro Finance SurveyManju Messi100% (2)

- MsmeDocument22 pagesMsmeAbhinandan Golchha100% (1)

- Msme MCQ-1Document4 pagesMsme MCQ-1LrajNo ratings yet

- Management of Financial Services MCQ'SDocument4 pagesManagement of Financial Services MCQ'SGuruKPO96% (23)

- A Short History of Grameen BankDocument38 pagesA Short History of Grameen BankRaman Kumar Jha100% (4)

- Multiple Choice QuestionsDocument6 pagesMultiple Choice QuestionsMani Chawla50% (2)

- MCQ On ExportsDocument13 pagesMCQ On ExportsAvlNarasimhaNo ratings yet

- Questionnaire LIC ProjectDocument5 pagesQuestionnaire LIC ProjectKáúśtúbhÇóól83% (12)

- MCQS InvestmentDocument3 pagesMCQS Investmentaashir chNo ratings yet

- Markowitz MCQDocument11 pagesMarkowitz MCQvarunbhardwaj26100% (6)

- Fill The Blanks PMDocument7 pagesFill The Blanks PMflying_alexutza100% (1)

- Microfinance Survey InsightsDocument26 pagesMicrofinance Survey InsightsAbhishek Singh75% (4)

- Question Bank For The Final ExamDocument2 pagesQuestion Bank For The Final ExamRaktim100% (1)

- List of Engineers Deployed for Municipal Polls in APDocument8 pagesList of Engineers Deployed for Municipal Polls in APsushmanthqrewrerNo ratings yet

- MCQ On Current Trends Cases in FinanceDocument20 pagesMCQ On Current Trends Cases in FinanceSanju Das100% (1)

- Multiple Choice Questions On BANKINGDocument12 pagesMultiple Choice Questions On BANKINGIndu GuptaNo ratings yet

- Customer and Banker Relationship MCQDocument13 pagesCustomer and Banker Relationship MCQsn n100% (3)

- Risk Final Exam QuestionsDocument6 pagesRisk Final Exam Questionsnathnael75% (4)

- Questionnaire On Pradhan Mantri JanDocument2 pagesQuestionnaire On Pradhan Mantri JanBikash Kumar Nayak80% (10)

- Financial Management MCQsDocument11 pagesFinancial Management MCQsmadihaadnan150% (2)

- Financial Institution & Investment Management - Final ExamDocument5 pagesFinancial Institution & Investment Management - Final Exambereket nigussie100% (4)

- 142 Mcqs Good - Financial ManagementDocument26 pages142 Mcqs Good - Financial ManagementMuhammad Arslan Usman71% (7)

- Objective Type Questions SAPMDocument15 pagesObjective Type Questions SAPMSaravananSrvn77% (31)

- Data Analysis and InterpretationDocument10 pagesData Analysis and InterpretationHarshil BabariaNo ratings yet

- Management of Cash MCQDocument2 pagesManagement of Cash MCQKimberly Milante100% (1)

- Multiple Choice QuestionsDocument33 pagesMultiple Choice QuestionsSunil Kumar Gadwal100% (1)

- LEASE ACC - MCQ - FY B Com-converted-F10022vo3rON9mO0DtNs-COU20200917082041uFV-1810Document8 pagesLEASE ACC - MCQ - FY B Com-converted-F10022vo3rON9mO0DtNs-COU20200917082041uFV-1810Vineet KrNo ratings yet

- International Finance MCQ With Answers PDFDocument5 pagesInternational Finance MCQ With Answers PDFMijanur Rahman0% (1)

- Final Questionnaire 2Document1 pageFinal Questionnaire 2Debasis Adhikary100% (1)

- Financial Management Wealth Maximisation MCQDocument3 pagesFinancial Management Wealth Maximisation MCQLakshmi NarasaiahNo ratings yet

- Questionnaire For BankDocument5 pagesQuestionnaire For BankRajendra Patidar100% (1)

- Question Paper Review - Financial Services - Cpc6aDocument7 pagesQuestion Paper Review - Financial Services - Cpc6ajeganrajrajNo ratings yet

- MCQ Re-InsuranceDocument1 pageMCQ Re-InsuranceAMIT BHATIA100% (2)

- Xii Mcqs CH - 14 Comparative & Common Size StatementsDocument4 pagesXii Mcqs CH - 14 Comparative & Common Size StatementsJoanna Garcia100% (1)

- Multiple Choice QuestionsDocument4 pagesMultiple Choice QuestionsSatish Varma50% (2)

- Mutual Fund QuestionnaireDocument3 pagesMutual Fund QuestionnaireJayesh Sherasiya100% (2)

- EkonomiMoneter 1 Practice Exam Key ConceptsDocument8 pagesEkonomiMoneter 1 Practice Exam Key ConceptsFachrul AzizNo ratings yet

- Microfinance SheetDocument3 pagesMicrofinance SheetMohamed AzmyNo ratings yet

- MB - Tutorial 5ISADocument4 pagesMB - Tutorial 5ISANouran MohamedNo ratings yet

- Tutorial 5Document4 pagesTutorial 5malak aymanNo ratings yet

- Micro InsuranceDocument5 pagesMicro Insuranceakm.mhs20No ratings yet

- c2 Financial Markets and Institutions يطDocument6 pagesc2 Financial Markets and Institutions يطfeedbackalone feedbackNo ratings yet

- Reading 4 Credit Risk Transfer MechanismsDocument2 pagesReading 4 Credit Risk Transfer MechanismsPriyadarshini SealNo ratings yet

- Sa MPL e Coe Ffici Ent of Cor Rela Tion: WrongDocument10 pagesSa MPL e Coe Ffici Ent of Cor Rela Tion: WrongsushmanthqrewrerNo ratings yet

- Teaching BrochureDocument26 pagesTeaching Brochuresushmanthqrewrer100% (1)

- Ryqwerwerew Rwe Rwerwer We Rwe R We Rwe R We Rwe R We R We T Y Trtwe Rwe Trt5e E 3 5) 46 34 3Document3 pagesRyqwerwerew Rwe Rwerwer We Rwe R We Rwe R We Rwe R We R We T Y Trtwe Rwe Trt5e E 3 5) 46 34 3sushmanthqrewrerNo ratings yet

- Age Cross Tab AnalysisDocument53 pagesAge Cross Tab AnalysissushmanthqrewrerNo ratings yet

- HownDocument1 pageHownsushmanthqrewrerNo ratings yet

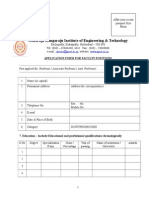

- Appl - Form Faculty PositionsDocument4 pagesAppl - Form Faculty PositionssushmanthqrewrerNo ratings yet

- FMDocument7 pagesFMsushmanthqrewrerNo ratings yet

- Comparitive Study On Mutual Fund: Master of Business AdministrationDocument7 pagesComparitive Study On Mutual Fund: Master of Business AdministrationsushmanthqrewrerNo ratings yet

- Dndnfdsfnsdaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa AaaaaaaaaaaaaDocument2 pagesDndnfdsfnsdaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa Aaaaaaaaaaaaa AaaaaaaaaaaaasushmanthqrewrerNo ratings yet

- HownDocument1 pageHownsushmanthqrewrerNo ratings yet

- Dig v27 n4 171Document3 pagesDig v27 n4 171sushmanthqrewrerNo ratings yet

- Go 179Document2 pagesGo 179sushmanthqrewrerNo ratings yet

- Indian Economy 2012-13 Handbook of Statistics by RBIDocument426 pagesIndian Economy 2012-13 Handbook of Statistics by RBIJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- Indian Economy 2012-13 Handbook of Statistics by RBIDocument426 pagesIndian Economy 2012-13 Handbook of Statistics by RBIJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- ATL Report Draft Version As On June 23rd 2013Document28 pagesATL Report Draft Version As On June 23rd 2013sushmanthqrewrerNo ratings yet

- (By Order and in The Name of The Governor of Andhra Pradesh) Dr. S.K Joshi Principal Secretary To GovernmentDocument1 page(By Order and in The Name of The Governor of Andhra Pradesh) Dr. S.K Joshi Principal Secretary To GovernmentsushmanthqrewrerNo ratings yet

- Panchayat Secretary NotificatonDocument18 pagesPanchayat Secretary NotificatonTelugu VaahiniNo ratings yet

- 2014-15 PanchangamDocument161 pages2014-15 PanchangamsushmanthqrewrerNo ratings yet

- RBI LIABILITIES AND ASSETSDocument102 pagesRBI LIABILITIES AND ASSETSsushmanthqrewrerNo ratings yet

- How Do You Rate Your Organization's Performance Appraisal System?)Document3 pagesHow Do You Rate Your Organization's Performance Appraisal System?)sushmanthqrewrerNo ratings yet

- Accounts ManualDocument521 pagesAccounts Manualabeed517No ratings yet

- ADVT Qualification CWS-1Document3 pagesADVT Qualification CWS-1sushmanthqrewrerNo ratings yet

- Group 1 Syllabus and PatternDocument7 pagesGroup 1 Syllabus and Patternsai198No ratings yet

- Seminar ReportDocument24 pagesSeminar ReportAnup BorseNo ratings yet

- Application Guguloth GaneshDocument2 pagesApplication Guguloth GaneshsushmanthqrewrerNo ratings yet

- MBA R13 Coursestructure and SyllabusDocument80 pagesMBA R13 Coursestructure and Syllabusraghu_iictNo ratings yet

- Scince&TechnologyDocument11 pagesScince&TechnologyKranthi Kumar MarojuNo ratings yet

- Ministerial Rules CorrectedDocument68 pagesMinisterial Rules CorrectedsushmanthqrewrerNo ratings yet

- Financial Inclusion As Tool For Combating Poverty: Governor, Bangladesh Bank EmailDocument8 pagesFinancial Inclusion As Tool For Combating Poverty: Governor, Bangladesh Bank EmailMakame Mahmud DiptaNo ratings yet

- By Gedam MandefroDocument57 pagesBy Gedam MandefroJustin VincentNo ratings yet

- Full ThesisDocument68 pagesFull ThesisVenkat SNo ratings yet

- "Issues and Success Factors in Micro Financing": Project Report OnDocument39 pages"Issues and Success Factors in Micro Financing": Project Report Onansh.shri90% (10)

- IS-15 MicrofinanceDocument349 pagesIS-15 MicrofinancePururaja AjsNo ratings yet

- Information Systems To Support - Door-Step Banking - Enabling ScalDocument23 pagesInformation Systems To Support - Door-Step Banking - Enabling ScalPratik PatilNo ratings yet

- 2017 IRR MicrofinanceNGOSActDocument23 pages2017 IRR MicrofinanceNGOSActErika delos SantosNo ratings yet

- The State Bank of IndiaDocument4 pagesThe State Bank of IndiaHimanshu JainNo ratings yet

- Audit of PovertyDocument36 pagesAudit of Povertykunal100% (2)

- Chapters 1-5Document65 pagesChapters 1-5Ricky ArroyoNo ratings yet

- BACKGROUNDDocument14 pagesBACKGROUNDBige UrbaNo ratings yet

- Academic Research and WritingDocument9 pagesAcademic Research and Writingmd. sharshahNo ratings yet

- 7.P Syamala DeviDocument4 pages7.P Syamala DeviSachin SahooNo ratings yet

- Unit 3 MoneyDocument3 pagesUnit 3 MoneyAlexanderVillacrés0% (1)

- Seminar On PoortyDocument24 pagesSeminar On PoortyAnanthuSibyNo ratings yet

- Governing Development Neoliberalism - Microcredit - and Rational Economic WomanDocument20 pagesGoverning Development Neoliberalism - Microcredit - and Rational Economic WomanSrijana ThapaNo ratings yet

- A Project Report: On Study of Microfinance (Self-Help Groups)Document7 pagesA Project Report: On Study of Microfinance (Self-Help Groups)Rupal Rohan DalalNo ratings yet

- 1-NIRMAAN BHARATI MICRO - CREDIT IN INDIA MICROFINANCE AS A POWERFUL POVERTY FIGHTING TOOL 99pDocument7 pages1-NIRMAAN BHARATI MICRO - CREDIT IN INDIA MICROFINANCE AS A POWERFUL POVERTY FIGHTING TOOL 99parun_kum1No ratings yet

- Jurnal Aquaponik Jada BahrinDocument36 pagesJurnal Aquaponik Jada BahrinbrentozNo ratings yet

- Role of MFI's A Case Study of Cashpor Micro Crdit in Mirzapur.Document53 pagesRole of MFI's A Case Study of Cashpor Micro Crdit in Mirzapur.Kumar Pradeep100% (1)

- 1327 Journal of MicrofinanceDocument177 pages1327 Journal of MicrofinanceAnonymous qAegy6GNo ratings yet

- Micro Finance and Micro Credit SHGsDocument33 pagesMicro Finance and Micro Credit SHGsGanesh SamalNo ratings yet

- Dissertation Mika Jonathan MakanjaDocument83 pagesDissertation Mika Jonathan MakanjaJames AugustinoNo ratings yet

- Micro Finance - Case StudyDocument2 pagesMicro Finance - Case StudyAmrin ChaudharyNo ratings yet

- Greater Tortue Ahmeyim (GTA) ProjectDocument10 pagesGreater Tortue Ahmeyim (GTA) ProjectAnonymous PibYPghNo ratings yet

- Annual-Report-FY2019-20 - Bandhan Bank PDFDocument188 pagesAnnual-Report-FY2019-20 - Bandhan Bank PDFVAIBHAV WADHWANo ratings yet