Professional Documents

Culture Documents

Kukil Das

Uploaded by

Rajib Das0 ratings0% found this document useful (0 votes)

133 views1 pageThe above prices are current ex-showroom prices. Buyers will have to pay prices prevailing at the time of delivery. Optionals, accessories, insurance, registration, taxes, octroi, other levies etc. Will be charged extra as applicable. All disputes arising between the parties hereto shall be referred to arbitration according to the arbitration laws of the country. The company shall not be liable due to any prevention, hindrance, or delay in manufacture, delivery of vehicles or accessories /

Original Description:

Original Title

KUKIL DAS

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe above prices are current ex-showroom prices. Buyers will have to pay prices prevailing at the time of delivery. Optionals, accessories, insurance, registration, taxes, octroi, other levies etc. Will be charged extra as applicable. All disputes arising between the parties hereto shall be referred to arbitration according to the arbitration laws of the country. The company shall not be liable due to any prevention, hindrance, or delay in manufacture, delivery of vehicles or accessories /

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

133 views1 pageKukil Das

Uploaded by

Rajib DasThe above prices are current ex-showroom prices. Buyers will have to pay prices prevailing at the time of delivery. Optionals, accessories, insurance, registration, taxes, octroi, other levies etc. Will be charged extra as applicable. All disputes arising between the parties hereto shall be referred to arbitration according to the arbitration laws of the country. The company shall not be liable due to any prevention, hindrance, or delay in manufacture, delivery of vehicles or accessories /

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

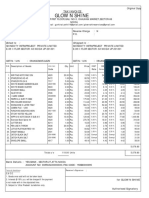

TAX INVOICE

To, Date : 30/03/2011 09:01:46 PM

Mr. KUKIL DAS

VILL & P/O- MOHMORIA, CRN : CR01-11-111550967211

, Invoice no : GhosBr-1011-01680

NAGAON NAGAON Customer P.O. No - Date :

Assam, India. Transaction no : KUKIL DAS # 1

Pin - 782002 Order No : SO-GhosBr-1011-01928

Customer TIN No: Delivery at : NAGAON SHOWROOM

A/C Code : 1-5B15BCB HP / HPA / LEASE / SELF LEASE

Hypothecation : TATA MOTORS FINANCE LTD

TIN No.- 18190014833 CST No.-18329911027

PAN No.- AABCG7254Q

TIN NO.18190014833

Particulars Qty Unit Price (Rs.) Amount (Rs.)

Product Code (28340720AFXR) - TATA NANO 273 MPFI PETROL 1 131,700.44 131,700.44

ENGINE (BHARAT STAGE III),4 SPEED TRANSAXLE, 5

NOSWHEEL RIMS, 3 NOS.135/70/R12 ( & ) 2 NOS.155/65/R12

TYRES, 2230 MMW.B.,SEATING CAPACITY 3+ DRIVER, COLOUR :

RACING RED

Total tax : 17,779.55

Gross Total : 149,479.99

Adjustment Amount : 0.01

Grand Total : 149,480.00

Rupees One Lakh Fourty Nine Thousand Four Hundred Eighty Only

Color : RACING_RED Chassis no : MAT612201AKP30814 Engine No : 273MPFI01PZYK39051

Name Tax Rate % Tax Amount

VAT 13.50 17,698.37

Terms and Condition E. & O. E.

1) Above prices are current ex-showroom prices. Buyers will have to pay prices prevailing at the time of delivery.

2) Optionals, accessories, insurance, registration, taxes, octroi, other levies etc. will be charged extra as applicable.

3) Prices are for current specifications and are subject to change without notice.

4) Prices and additional charges as above will have to be paid completely, to conclude the sales.

5) Payments by Cheques /Demand Drafts may be in favor of GHOSH BROTHERS AUTOMOBILES payable at GUWAHATI

6) Acceptance of advance / deposits by the seller is merely an indication of an intention to sell and does not result into a contract of sale.

7) All disputes arising between the parties hereto shall be referred to arbitration according to the arbitration laws of the country.

8) Only the courts of GUWAHATI shall have jurisdiction in any proceedings relating to this contract.

9) The company shall not be liable due to any prevention, hindrance, or delay in manufacture, delivery of vehicles or accessories/optional due to shortage

of material, strike, riot, civil commotion, accident, machinery breakdown, government policies, acts of god and nature and all events beyond the

control of the company.

10) The seller shall have a general lien on the goods for all moneys due to the seller from the buyer on account of this, or other transaction.

11) Taxes as applicable.

12) I/we hereby certify that my/our Registration Certificate under the Assam State Value Added Tax Act, 2002 is in force on the date on which the sale

of the goods specified in this ""tax invoice"" is made by me/us and that the transaction of sale covered by this ""tax invoice"" has been effected by

me/us and it shall be accounted for in the turnover of sales while filing of return and the due tax, if any, payable on the sale has been paid or shall be

paid.

L.S.T. Act 1959

For GHOSH BROTHERS AUTOMOBILES

____________________ ______________________

Customer's Signature Authorized signatory

You might also like

- Ramesh Verma PDFDocument2 pagesRamesh Verma PDFPankajNo ratings yet

- Customer ReprintDocument1 pageCustomer ReprintInderjeet singhNo ratings yet

- Chi 1Document2 pagesChi 1Syam JamiNo ratings yet

- Bill P2 872Document3 pagesBill P2 872DATTANA INTERNATIONALNo ratings yet

- Usha Quartz Room HeaterDocument1 pageUsha Quartz Room HeaterArunNo ratings yet

- Book Flight OnlineDocument1 pageBook Flight OnlineMaharshi DattaNo ratings yet

- Srinivas InvoiceDocument1 pageSrinivas InvoiceKanchanapalli SrinivasNo ratings yet

- MAYUR GAS SERVICE tax invoice details for LPG cylinder refill orderDocument2 pagesMAYUR GAS SERVICE tax invoice details for LPG cylinder refill ordervimal rajNo ratings yet

- Stationary Invoice-5080 PaidDocument2 pagesStationary Invoice-5080 PaidAnkur Agarwal100% (1)

- Mega Sales Sale - Cr1186Document6 pagesMega Sales Sale - Cr1186Spitfire llNo ratings yet

- ForwardInvoice ORD358711360Document2 pagesForwardInvoice ORD358711360Chinmoy Tamuli0% (1)

- HPVCZ683Document1 pageHPVCZ683Ankit SinghNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SibasishPattnaik100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mûkêsh Kàñnâñ AJNo ratings yet

- CHAUDHARY CAR SERVICE CENTRE JOB CARDDocument3 pagesCHAUDHARY CAR SERVICE CENTRE JOB CARDwm. mfcskhairNo ratings yet

- Tax Invoice: Duplicate For BuyerDocument1 pageTax Invoice: Duplicate For BuyerakhlaquemdNo ratings yet

- OD115563023203880000Document2 pagesOD115563023203880000rajasekhar1babu1swarNo ratings yet

- Vision Invoice INV556Document1 pageVision Invoice INV556Rahul MagareNo ratings yet

- Tax invoice receipt FUP25Mbps package renewalDocument1 pageTax invoice receipt FUP25Mbps package renewalDipam HalderNo ratings yet

- Keyboard InvoiceDocument1 pageKeyboard InvoiceMohit SharmaNo ratings yet

- Washing Machine InvoiceDocument1 pageWashing Machine InvoiceAmeet ParekhNo ratings yet

- Coban Performa Invoice - Discount To - Luis Javier 2Document1 pageCoban Performa Invoice - Discount To - Luis Javier 2javierpmejia100% (1)

- FTA HSRP SoDocument1 pageFTA HSRP SoAnkit RupaparaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Devan ShahNo ratings yet

- 60009TG220033816Document3 pages60009TG220033816Swathi PriyaNo ratings yet

- Proforma Invoice - Calibration VesselsDocument1 pageProforma Invoice - Calibration VesselsDibyojyoti BanerjeeNo ratings yet

- InvoiceDocument1 pageInvoiceAkhil Patel BandariNo ratings yet

- PO No. 91578 KohinoorDocument2 pagesPO No. 91578 KohinoorVipul RathodNo ratings yet

- Vestige Marketing Invoice SummaryDocument2 pagesVestige Marketing Invoice SummaryshubhNo ratings yet

- AVARI CrdownloadDocument1 pageAVARI Crdownloadfalosay704No ratings yet

- Oneplus 108Cm (43 Inch) Full HD Led Smart Android TV: Grand Total 22499.00Document2 pagesOneplus 108Cm (43 Inch) Full HD Led Smart Android TV: Grand Total 22499.00Ravi PrajapatiNo ratings yet

- Invoice Nokia 6.1plusDocument1 pageInvoice Nokia 6.1plusArisha NusratNo ratings yet

- HMSI Motorcycle Sale ReceiptDocument3 pagesHMSI Motorcycle Sale ReceiptKishore ChakrabortyNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Srinath YadavNo ratings yet

- Tax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Document2 pagesTax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Rinku Singh RinkuNo ratings yet

- Tax Invoice (Original For RecipentDocument3 pagesTax Invoice (Original For RecipentVss PradeepNo ratings yet

- Tax Invoice: Billed To: Invoice DetailsDocument1 pageTax Invoice: Billed To: Invoice DetailsVINAY BANSAL100% (1)

- Invoice PDFDocument1 pageInvoice PDFAkhilesh B.MNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)huzefa slatewalaNo ratings yet

- 107 181 1548850925963 InvoiceDocument1 page107 181 1548850925963 InvoiceRupesh SinghNo ratings yet

- Oneblade Invoice PDFDocument1 pageOneblade Invoice PDFSuman DharaNo ratings yet

- 2208238392Document1 page2208238392NEW GENERATIONSNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sahil YadavNo ratings yet

- Invoice FormatDocument1 pageInvoice Formatshreyash nakhawaNo ratings yet

- Tax Invoice: Coraplast IndustriesDocument1 pageTax Invoice: Coraplast IndustriesParesh GanganiNo ratings yet

- Gst-Challan Creation FormatDocument2 pagesGst-Challan Creation FormatMANAS KUMAR SAHU100% (1)

- Sales 32 2023 24Document1 pageSales 32 2023 24Bharat AutomobileNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFAnil KumarNo ratings yet

- Cost Estimate: Datum TechnologiesDocument1 pageCost Estimate: Datum Technologiesraj rajNo ratings yet

- GST 1056 2019 20. Ckecp Mohali P&M and IrDocument1 pageGST 1056 2019 20. Ckecp Mohali P&M and IrEntertainment AbhiNo ratings yet

- Invoice and packing list for food exportsDocument2 pagesInvoice and packing list for food exportsThant ZinNo ratings yet

- Test 3Document2 pagesTest 3rafaelNo ratings yet

- Metronaut Men Light Blue Trousers: Grand Total 5800.00Document7 pagesMetronaut Men Light Blue Trousers: Grand Total 5800.00prince GoriaNo ratings yet

- Invoice 7538177918Document1 pageInvoice 7538177918Venu Gopal ReddyNo ratings yet

- Patanjali DN 33Document1 pagePatanjali DN 33Jai SoniNo ratings yet

- InvoiceDocument1 pageInvoiceAmazon CompaniesNo ratings yet

- Tax Invoice for AC PurchaseDocument1 pageTax Invoice for AC PurchaseraviNo ratings yet

- Details of Receiver (Billed To) Details of Consignee (Shipped To)Document1 pageDetails of Receiver (Billed To) Details of Consignee (Shipped To)VESTIGE JVRATNAMNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ronaldo CristonzaNo ratings yet

- Life Motors: Shantanu BLDG, Shop No8/9, Pawar Nagar, Thane (West), Thane:400601Document2 pagesLife Motors: Shantanu BLDG, Shop No8/9, Pawar Nagar, Thane (West), Thane:400601abhishek pandeyNo ratings yet

- Sartorius YDP20-0CE PrinterDocument116 pagesSartorius YDP20-0CE Printerblockhead135399No ratings yet

- Project Requisition Format - Graduation Project - PEOPLE 3Document2 pagesProject Requisition Format - Graduation Project - PEOPLE 3Jashid HameedNo ratings yet

- Apela - Learners - Handbook - L3-L7 - 120721Document34 pagesApela - Learners - Handbook - L3-L7 - 120721shahrol effendy rodziNo ratings yet

- 100 Song ChallengeDocument3 pages100 Song ChallengeChristina KnightsNo ratings yet

- S4 Aceiteka 2017 AccountsDocument7 pagesS4 Aceiteka 2017 AccountsEremu ThomasNo ratings yet

- Mufon Ufo Journal - May 1985Document20 pagesMufon Ufo Journal - May 1985Carlos RodriguezNo ratings yet

- Engineer's ResumeDocument3 pagesEngineer's ResumeAri RosyadiNo ratings yet

- Evangeline Henry Wadsworth Longfellow PDFDocument2 pagesEvangeline Henry Wadsworth Longfellow PDFPatrickNo ratings yet

- CHM1 Qualitative ChemistryDocument216 pagesCHM1 Qualitative ChemistryHakim AbbasNo ratings yet

- 5.17 ETextbook 1Document1,177 pages5.17 ETextbook 1HAFSAHNo ratings yet

- Hilti Data Sheet-HstDocument1 pageHilti Data Sheet-HstAnujay Singh NegiNo ratings yet

- CHAPTER 1 Group 2 Clinical Risk ManagementDocument21 pagesCHAPTER 1 Group 2 Clinical Risk ManagementKyla LotaNo ratings yet

- Heat Transport Systems: S. Clement Ravi Chandar Indira Gandhi Centre For Atomic Research, Kalpakkam-603 102, INDIADocument41 pagesHeat Transport Systems: S. Clement Ravi Chandar Indira Gandhi Centre For Atomic Research, Kalpakkam-603 102, INDIAR Krishna KumarNo ratings yet

- Vizio User ManualDocument76 pagesVizio User ManualcastleNo ratings yet

- Ultrasonic CleaningDocument9 pagesUltrasonic Cleaningfgdgrte gdfsgdNo ratings yet

- What You Need To Know About Association Dues: Trusted Real Estate DeveloperDocument10 pagesWhat You Need To Know About Association Dues: Trusted Real Estate Developerced100% (1)

- BSBPMG635 Task 1Document6 pagesBSBPMG635 Task 1Aroosa MirzaNo ratings yet

- At-Home Edition!: Darryl'S HP (Happy Parent) Restoring Tonic Recipe Glenn Asks: What Is A Lock, Really?Document9 pagesAt-Home Edition!: Darryl'S HP (Happy Parent) Restoring Tonic Recipe Glenn Asks: What Is A Lock, Really?Howdy Magic RodeoNo ratings yet

- WHO WAS THE DIRECTOR-GENERAL OF WHO DURING COVID-19Document1,670 pagesWHO WAS THE DIRECTOR-GENERAL OF WHO DURING COVID-19Edson Rovillos0% (1)

- Sarmasoftwareservices-Hyderabad. Mobile:9949210713. MM Process FlowDocument4 pagesSarmasoftwareservices-Hyderabad. Mobile:9949210713. MM Process FlowSARMANo ratings yet

- Electrophilic and Free Radical Benzene Toluene Nitrating: Nitration of and With Various AgentsDocument5 pagesElectrophilic and Free Radical Benzene Toluene Nitrating: Nitration of and With Various Agentsmutia rizki anandaNo ratings yet

- VAT Return - 9.1 - May-2023 - Sumiya TradeDocument63 pagesVAT Return - 9.1 - May-2023 - Sumiya TradeMD shohelNo ratings yet

- Storage Tanks Basic TrainingDocument97 pagesStorage Tanks Basic Traininganouar82100% (8)

- Abhilesh SipDocument42 pagesAbhilesh SiprahadipayanNo ratings yet

- 1 IE6700 Syllabus Fall 2021 - 01Document5 pages1 IE6700 Syllabus Fall 2021 - 01Ashok ThiruvengadamNo ratings yet

- Run CommandDocument20 pagesRun CommandedinNo ratings yet

- Myocarditis and PericarditisDocument28 pagesMyocarditis and PericarditisMahesh RathnayakeNo ratings yet

- 2009 - Moreira - Ten Reasons To Exclude Viruses From The Tree of Life PDFDocument6 pages2009 - Moreira - Ten Reasons To Exclude Viruses From The Tree of Life PDFJames Roi BerroyaNo ratings yet

- Sustainability Relative To The Performance of Buildings: Standard Terminology ForDocument5 pagesSustainability Relative To The Performance of Buildings: Standard Terminology ForEdmundo Jaita CuellarNo ratings yet

- Hunter Quayle - MHD - Annotated BibliographyDocument8 pagesHunter Quayle - MHD - Annotated Bibliographyapi-654030470No ratings yet