Professional Documents

Culture Documents

ICICIdirect ExpectedHighDividendYieldStocks

Uploaded by

Ramesh RajagopalanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICICIdirect ExpectedHighDividendYieldStocks

Uploaded by

Ramesh RajagopalanCopyright:

Available Formats

ICICI Securities Limited

Expected Dividend Yield

March 8, 2011

High dividend yield stocks offer a safe haven to investors where safety has greater priority compared to high returns.

Hence, even if the market remains volatile, going ahead, an investor can still get a decent return on investment, thanks to

good dividend yielding stocks. The dividends are paid no matter what direction the stocks move and can provide a higher

yield on investment in a weak market.

We have short-listed companies that would provide a decent dividend yield in the near future. For this purpose, we have

filtered companies that have had at least 75% of FY10 profits in the nine months ended December 2010 and assumed that

the companies would maintain their FY10 dividend payout ratio. We have forecasted the FY11E PAT by taking the actual

PAT of nine months ended December 2010 and assumed Q4FY11 as an average of last three quarters net profit. Based on

the FY11E net profit and FY10 payout ratio, we have calculated the dividend percent for FY11E. Finally, we have deducted

the interim dividends already paid in FY11 to arrive at the expected final dividend and dividend yield.

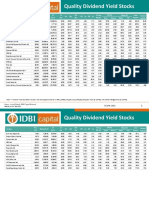

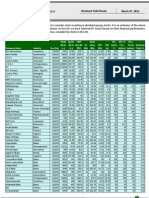

Exhibit 1: High dividend yield stocks

PAT

(| Cr) 9

month Dividend Total Final

Dividend ended PAT (| Amt Face Dividend % FY11 interim Dividend % Expected

Idirect PAT (| Payout Dividend December Cr) FY11E Equity Value CMP expected dividend % expected Dividend

Company Name code Cr) FY10 (%) FY10 % FY10 2010 FY11E (| Cr) (| Cr) (| ) (| Cr) for FY11E already paid for FY11 Yield %

SCI SCI 376.9 62.0 50.0 565.2 753.6 466.8 465.8 10 106.0 100 30 70 6.63

Indiabulls Fin. INDBUL 264.2 73.1 250.0 449.9 599.8 438.5 62.2 2 147.5 705 250 455 6.18

T N Newsprint TAMNEW 126.1 25.8 45.0 129.4 172.6 44.5 69.2 10 122.6 64 0 64 5.24

Edelweiss Cap. EDECAP 34.2 271.1 200.0 45.1 60.1 163.0 75.2 1 37.3 217 25 192 5.14

GNFC GNFC 123.8 43.8 32.5 129.6 172.9 75.6 155.4 10 99.8 49 0 49 4.88

Delta Corp ARRWEB 13.6 38.6 25.0 130.2 173.5 67.0 20.2 1 68.8 332 0 332 4.83

SRF SRF 309.4 28.7 140.0 347.4 463.1 133.0 60.5 10 321.2 220 70 150 4.66

SJVN SJVLIM 972.7 35.8 8.0 801.9 1069.1 382.2 4136.6 10 20.4 9 0 9 4.53

Vijaya Bank VIJBAN 507.3 23.9 25.0 469.6 626.1 149.5 433.5 10 77.4 34 0 34 4.46

Balmer Lawrie BALLAW 117.3 33.7 230.0 86.8 115.7 39.0 16.3 10 547.0 240 0 240 4.38

Jagran Prakashan JAGPRA 175.9 66.7 175.0 163.8 218.3 145.7 60.2 2 115.9 242 0 242 4.18

SREI Infra. Fin. SREINT 111.5 12.8 12.0 118.1 157.4 20.1 116.3 10 43.3 17 0 17 3.99

Chambal Fert. CHAFER 249.1 33.5 19.0 257.5 343.3 115.1 416.2 10 70.2 28 0 28 3.94

J & K Bank JAMKAS 512.4 21.6 220.0 476.5 635.3 137.1 48.5 10 752.6 283 0 283 3.76

Jindal Poly Film JINPOL 208.4 11.3 100.0 484.3 645.8 72.6 46.0 10 420.4 158 0 158 3.75

Mcleod Russel MCLRUS 240.3 18.8 80.0 355.2 473.6 88.9 54.7 5 222.0 162 0 162 3.66

GSFC GSFC 254.5 14.4 45.0 544.2 725.6 104.7 79.7 10 363.9 131 0 131 3.61

Nag. Fert & Chem NAGFER 66.4 34.1 5.0 88.9 118.5 40.4 428.2 10 27.2 9 0 9 3.47

Brigade Enterpr. BRIENT 46.2 30.7 12.0 92.0 122.7 37.6 112.3 10 97.3 34 0 34 3.44

Indian Metals INDMFA 41.0 33.9 50.0 141.0 187.9 63.8 26.3 10 564.8 242 50 192 3.40

Sasken Comm.Tec. SASCOM 76.0 22.2 60.0 71.2 94.9 21.1 27.6 10 152.2 77 25 52 3.38

Gateway Distr. GATDIS 77.2 53.3 35.0 58.5 78.0 41.6 108.0 10 113.9 38 0 38 3.38

Guj NRE Coke GUJNRE 51.9 129.6 10.0 51.0 68.0 88.1 558.0 10 47.4 16 0 16 3.33

Rolta India ROLIND 360.5 14.9 32.5 395.1 526.8 78.4 161.3 10 147.7 49 0 49 3.29

Guj Inds. Power GUJIP 106.8 37.6 25.0 81.7 109.0 41.0 151.3 10 88.6 27 0 27 3.06

Deepak Fert. DEEFER 172.1 23.8 45.0 133.9 178.5 42.4 88.2 10 159.1 48 0 48 3.02

Tata Chemicals TATCHE 434.8 55.0 90.0 334.7 446.2 245.2 254.8 10 330.6 96 0 96 2.91

Opto Circuits OPTCIR 147.0 61.4 40.0 164.3 219.1 134.5 183.3 10 258.1 73 0 73 2.84

BASF India BASF 96.8 35.7 80.0 118.2 157.6 56.2 40.8 10 493.4 138 0 138 2.80

Ackruti City AKRNIR 173.8 21.7 50.0 150.7 200.9 43.6 72.7 10 217.3 60 0 60 2.76

Polaris Soft. POLSOF 130.6 27.8 70.0 136.0 181.3 50.3 49.6 5 184.9 101 0 101 2.74

GMDC GUJMI 279.9 29.9 125.0 262.1 349.4 104.3 63.6 2 123.5 164 0 164 2.66

TVS Motor Co. TVSSUZ 88.0 34.1 120.0 150.9 201.2 68.6 47.5 1 55.0 144 0 144 2.63

Bajaj Fin. BAJAF 89.4 25.6 60.0 175.9 234.6 60.1 36.6 10 637.2 164 0 164 2.57

ONGC ONGC 16767.6 45.2 330.0 16133.1 21510.9 9729.4 2138.9 5 268.6 455 320 135 2.51

BGR Energy Sys. BGRENE 201.0 26.2 70.0 225.9 301.1 78.9 72.1 10 441.4 109 0 109 2.48

Dena Bank DENBAN 511.3 11.4 20.0 454.6 606.2 69.3 286.8 10 98.1 24 0 24 2.47

City Union Bank CITUNI 152.8 20.3 75.0 163.7 218.2 44.3 40.4 1 45.1 110 0 110 2.43

Bank of India BANIND 1741.1 21.9 70.0 1995.1 2660.1 582.8 525.9 10 460.3 111 0 111 2.41

IDBI Bank IDBI 1031.1 21.8 30.0 1134.1 1512.1 328.9 984.5 10 139.6 33 0 33 2.39

Bajaj Auto BAAUTO 1702.7 36.0 400.0 1939.3 2585.8 931.4 289.4 10 1377.7 322 0 322 2.34

Akzo Nobel ICIIND 159.3 39.4 160.0 118.8 158.4 62.4 36.8 10 729.0 169 0 169 2.33

Punjab Natl.Bank PUNBAN 3905.4 18.3 220.0 3232.6 4310.1 789.2 315.3 10 1080.6 250 0 250 2.32

South Ind.Bank SOUIN0 233.8 20.0 40.0 210.8 281.1 56.2 113.0 1 21.6 50 0 50 2.30

Vardhman Textile MAHSPI 213.8 8.2 30.0 330.2 440.3 36.2 63.7 10 258.1 57 0 57 2.20

Source: Capitaline, ICICIdirect.com Research

ICICIdirect.com | Equity Research

ICICI Securities Limited

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

7th Floor, Akruti Centre Point,

MIDC Main Road, Marol Naka

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

Disclaimer

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of

ICICI Securities Ltd (I-Sec). The author of the report does not hold any investment in any of the companies mentioned in this report. I-Sec may be

holding a small number of shares/position in the above-referred companies as on date of release of this report. This report is based on information

obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness

guaranteed. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or

solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal,

accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities

discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their

own investment objectives, financial positions and needs of specific recipient. This report may not be taken in substitution for the exercise of

independent judgment by any recipient. The recipient should independently evaluate the investment risks. I-Sec and affiliates accept no liabilities for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Actual results may

differ materially from those set forth in projections. I-Sec may have issued other reports that are inconsistent with and reach different conclusion from

the information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or

resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law,

regulation or which would subject I-Sec and affiliates to any registration or licensing requirement within such jurisdiction. The securities described

herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come

are required to inform themselves of and to observe such restriction.

ICICIdirect.com | Equity Research

Page 2

You might also like

- Drilling Fluids Processing HandbookFrom EverandDrilling Fluids Processing HandbookRating: 4.5 out of 5 stars4.5/5 (4)

- Dividend Yield Stocks 210922Document3 pagesDividend Yield Stocks 210922Aaron KaleesNo ratings yet

- Dividend Yield Stocks: Retail ResearchDocument3 pagesDividend Yield Stocks: Retail ResearchAmeerHamsaNo ratings yet

- Dividend Yield StocksDocument3 pagesDividend Yield StocksSushilNo ratings yet

- Dividend Yield Stocks 200619-201906201641102022239Document2 pagesDividend Yield Stocks 200619-201906201641102022239Pushkaraj SherkarNo ratings yet

- Dividend Yield StocksDocument3 pagesDividend Yield StocksDilip KumarNo ratings yet

- Dividend Yield StocksDocument2 pagesDividend Yield Stocksunu_uncNo ratings yet

- Quality Dividend Yield Stocks - 301216Document5 pagesQuality Dividend Yield Stocks - 301216sumit guptaNo ratings yet

- Gitanjali Gems Shilpi CableDocument15 pagesGitanjali Gems Shilpi CablestrignentNo ratings yet

- Dividend Yield Stocks 300410Document1 pageDividend Yield Stocks 300410kunalprasherNo ratings yet

- Stock DetailsDocument2 pagesStock DetailsNilesh DhandeNo ratings yet

- Quality Dividend Yield Stocks Jan 22 03 January 2022 478756522Document4 pagesQuality Dividend Yield Stocks Jan 22 03 January 2022 478756522Jaikanth MuthukumaraswamyNo ratings yet

- Trending Value Portfolio Implementation-GoodDocument260 pagesTrending Value Portfolio Implementation-Gooddheeraj nautiyalNo ratings yet

- Depriciation Function ADocument6 pagesDepriciation Function ADeep BusaNo ratings yet

- 2012 2013 2014 2015 Assumptions: INR MN %p.a. Years #Document6 pages2012 2013 2014 2015 Assumptions: INR MN %p.a. Years #Shirish BaisaneNo ratings yet

- DIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564Document5 pagesDIVIDEND YIELD REPORT - JUNE 2023-05-June-2023-1938561564uma AgrawalNo ratings yet

- Div Yield 10Document2 pagesDiv Yield 10Hardik SompuraNo ratings yet

- MarketInsightUploads DividendYieldStocks8MarDocument2 pagesMarketInsightUploads DividendYieldStocks8MarsanakdasNo ratings yet

- CLSA Valuation Matrix 20131127Document3 pagesCLSA Valuation Matrix 20131127mkmanish1No ratings yet

- FIB Research - NSE Financial StatsDocument16 pagesFIB Research - NSE Financial StatslexmuiruriNo ratings yet

- Dividend Yield Stocks 6 JanDocument2 pagesDividend Yield Stocks 6 JanIndrayani NimbalkarNo ratings yet

- Dividend Yield Stocks - HDFC Sec - 26 09 09Document1 pageDividend Yield Stocks - HDFC Sec - 26 09 09vishalknoxNo ratings yet

- CA Pre-Open CHNG Prev. CloseDocument8 pagesCA Pre-Open CHNG Prev. Closeanant_sahu_1No ratings yet

- NO Kode Emiten HARGA SAHAM ROE (Bigger Better) DER (Less Better)Document17 pagesNO Kode Emiten HARGA SAHAM ROE (Bigger Better) DER (Less Better)Renggana Dimas Prayogi WiranataNo ratings yet

- Dividend Stocks ListDocument4 pagesDividend Stocks ListAnjaiah PittalaNo ratings yet

- AmcDocument19 pagesAmcTimothy RenardusNo ratings yet

- SCBS Investment Recommendations: Underperform UnderperformDocument4 pagesSCBS Investment Recommendations: Underperform UnderperformHappybabyNo ratings yet

- Valuation Snapshot: 17 March 2023 18Document1 pageValuation Snapshot: 17 March 2023 18Hari BhaskarNo ratings yet

- Fundata Screener DataDocument8 pagesFundata Screener DataKrishna MoorthyNo ratings yet

- KSL BL 11-02-2022 Chennai EPaper Stocks 01Document1 pageKSL BL 11-02-2022 Chennai EPaper Stocks 01CH BLESSINANo ratings yet

- StockTracker Rev2 OrigDocument149 pagesStockTracker Rev2 OrigPuneet100% (2)

- Stocks ShortlistDocument24 pagesStocks Shortlistallly100% (1)

- StocksDocument5 pagesStockstemp raoNo ratings yet

- FinolexCablesFSA Final DRAFTDocument14 pagesFinolexCablesFSA Final DRAFTAbhisek MohantyNo ratings yet

- Sheet1 F2:F51 Contains 1 Sheet1 G2:G51 Contains 2 Sheet1 F2:F51 Contains 1 Sheet1 G2:G51 Contains 2Document9 pagesSheet1 F2:F51 Contains 1 Sheet1 G2:G51 Contains 2 Sheet1 F2:F51 Contains 1 Sheet1 G2:G51 Contains 2techkasambaNo ratings yet

- Rising Net Cash Flow and Cash From Operating Activity Aug 10Document3 pagesRising Net Cash Flow and Cash From Operating Activity Aug 10KabirNo ratings yet

- NIFTYCALCULATOROctober2018www - Nooreshtech.co .InDocument13 pagesNIFTYCALCULATOROctober2018www - Nooreshtech.co .InbrijsingNo ratings yet

- Tabla de Equivalencias de Valores DCP Vrs CBRDocument1 pageTabla de Equivalencias de Valores DCP Vrs CBRJulesNo ratings yet

- Latihan MDP (Ekivalen Beban)Document2 pagesLatihan MDP (Ekivalen Beban)bela yusdiantikaNo ratings yet

- Projections & ValuationDocument109 pagesProjections & ValuationPulokesh GhoshNo ratings yet

- Quality Control Monthly Report Kernel Crushing Plant 750 MT: Pt. Eup - Tanjung PuraDocument16 pagesQuality Control Monthly Report Kernel Crushing Plant 750 MT: Pt. Eup - Tanjung Puramuhammad fitrah nasutionNo ratings yet

- Stock Screener203557Document6 pagesStock Screener203557Sde BdrNo ratings yet

- Name of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Document15 pagesName of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Adarsh JainNo ratings yet

- Tables: Table 1 Annual Growth Rate of Meat Production in India: 1975-2000Document6 pagesTables: Table 1 Annual Growth Rate of Meat Production in India: 1975-2000Sanket Kumar DeshmukhNo ratings yet

- Long Term SIP Picks Jan 23Document15 pagesLong Term SIP Picks Jan 23sbvaNo ratings yet

- KSL BL 22-04-2022 Chennai EPaper Stocks 01Document1 pageKSL BL 22-04-2022 Chennai EPaper Stocks 01Prasad ChakkrapaniNo ratings yet

- Stock Screener172818Document6 pagesStock Screener172818Rafiq ShaikhNo ratings yet

- Identifier Company Name (Millions, INR) Millions) (Millions, INR) (FY0)Document7 pagesIdentifier Company Name (Millions, INR) Millions) (Millions, INR) (FY0)Puneet GeraNo ratings yet

- Allocation Release and Expenditure Pulse Polio ImmunizationDocument2 pagesAllocation Release and Expenditure Pulse Polio ImmunizationVidya GuptaNo ratings yet

- UntitledDocument3 pagesUntitledSankalp MishraNo ratings yet

- Gula PasirDocument5 pagesGula PasirbambangijoNo ratings yet

- An Investment Analysis Case Study: Home DepotDocument6 pagesAn Investment Analysis Case Study: Home DepotMúbâshēr ÃlìNo ratings yet

- Recommended Input Sizes For RollingDocument7 pagesRecommended Input Sizes For RollingTushar PachlangiaNo ratings yet

- 07 Findings and ConclusionDocument7 pages07 Findings and ConclusionAmish SoniNo ratings yet

- Project FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFDocument102 pagesProject FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFRekha Rajaram74% (19)

- GDP 8th PlanDocument1 pageGDP 8th PlanDavid WykhamNo ratings yet

- High Devidend StockDocument8 pagesHigh Devidend StockAshishKumar RavalNo ratings yet

- Stock Symbol 4/24 Price Current Spread 52 Week Low 52 Week High 52 Week SpreadDocument3 pagesStock Symbol 4/24 Price Current Spread 52 Week Low 52 Week High 52 Week SpreadJohn MonroseNo ratings yet

- Return Loss Vs VSWRDocument1 pageReturn Loss Vs VSWRcolinNo ratings yet

- Return Loss-Vswr TableDocument1 pageReturn Loss-Vswr TableEbrahimNo ratings yet

- News Bulletin Jan 15 PDFDocument33 pagesNews Bulletin Jan 15 PDFRamesh RajagopalanNo ratings yet

- Answers - MADRAS DAY 2021 ONLINE QUIZDocument7 pagesAnswers - MADRAS DAY 2021 ONLINE QUIZRamesh RajagopalanNo ratings yet

- Guru CharanamDocument5 pagesGuru CharanamRamesh RajagopalanNo ratings yet

- 1100ec713636fa27fd0d636fe46abab8Document25 pages1100ec713636fa27fd0d636fe46abab8Ramesh RajagopalanNo ratings yet

- Tantric Texts Series 02 Shatchakranirupanam and Padukapanchakam - Arthur Avalon 1913Document157 pagesTantric Texts Series 02 Shatchakranirupanam and Padukapanchakam - Arthur Avalon 1913Calyan KumarNo ratings yet

- E-Verification User ManualDocument9 pagesE-Verification User ManualRamesh RajagopalanNo ratings yet

- The Habit of Eating HealthyDocument1 pageThe Habit of Eating HealthyRamesh RajagopalanNo ratings yet

- OnlineecDocument379 pagesOnlineecRamesh RajagopalanNo ratings yet

- Conservation Works of Thirumalai Nayakkar Part 001Document52 pagesConservation Works of Thirumalai Nayakkar Part 001Ramesh RajagopalanNo ratings yet

- Chocolates and ChildrenDocument1 pageChocolates and ChildrenRamesh RajagopalanNo ratings yet

- SaltDocument2 pagesSaltRamesh RajagopalanNo ratings yet

- A American Sex SurveyDocument27 pagesA American Sex SurveyRamesh RajagopalanNo ratings yet

- Articolo Singh Su Geografia - Sacred Geography of The Goddesses in Kashi, IndiaDocument13 pagesArticolo Singh Su Geografia - Sacred Geography of The Goddesses in Kashi, IndiapervincarumNo ratings yet

- A American Sex SurveyDocument27 pagesA American Sex SurveyRamesh RajagopalanNo ratings yet

- PDFGENEO18Document45 pagesPDFGENEO18Ramesh RajagopalanNo ratings yet

- Financial Management Bcoc 132Document6 pagesFinancial Management Bcoc 132RahulNo ratings yet

- Dissolution of A CorporationDocument8 pagesDissolution of A Corporationggsteph100% (1)

- Sbi Mutual Funds: Presented by Isha Kartik Priyam Saurabh TofiqueDocument21 pagesSbi Mutual Funds: Presented by Isha Kartik Priyam Saurabh Tofiquetoff1410No ratings yet

- A Mutual Fund Is A Trust That Pools The Savings of A Number of Investors Who Share A Common Financial GoalDocument10 pagesA Mutual Fund Is A Trust That Pools The Savings of A Number of Investors Who Share A Common Financial GoalMonika MonaNo ratings yet

- Franklin Templeton Global Total Return Fund - I (Acc) EURDocument52 pagesFranklin Templeton Global Total Return Fund - I (Acc) EURgiorginoNo ratings yet

- Reviewer On InvestmentDocument16 pagesReviewer On Investmentcriszel4sobejanaNo ratings yet

- Securities Market StructureDocument69 pagesSecurities Market StructureGajjala Swetha Gajjala SwethaNo ratings yet

- JP Morgan Interview QuestionsDocument13 pagesJP Morgan Interview QuestionsdianwenNo ratings yet

- Chapter 2 Christopher Viney Peter PhillipsDocument20 pagesChapter 2 Christopher Viney Peter PhillipsNguyen Nhat VyNo ratings yet

- Synopsis For Project On Gold ETFDocument9 pagesSynopsis For Project On Gold ETFArun PramajanNo ratings yet

- Timeshare Realty V LaoDocument6 pagesTimeshare Realty V LaoEstelle Rojas TanNo ratings yet

- Dwnload Full Contemporary Financial Intermediation 3rd Edition Greenbaum Solutions Manual PDFDocument36 pagesDwnload Full Contemporary Financial Intermediation 3rd Edition Greenbaum Solutions Manual PDFquachhaitpit100% (14)

- Stock MarketDocument12 pagesStock MarketMuhammad Saleem SattarNo ratings yet

- Varma Committee Report: IndexDocument29 pagesVarma Committee Report: Indexsantu8800No ratings yet

- Business LawDocument160 pagesBusiness Lawincrediblekashif7916No ratings yet

- Chapter 1Document12 pagesChapter 1phan hàNo ratings yet

- Preparation of Financial Statements 081112 RevisedDocument89 pagesPreparation of Financial Statements 081112 RevisedNorhian AlmeronNo ratings yet

- Summary of Agreements For Schwab One International Account ApplicationDocument1 pageSummary of Agreements For Schwab One International Account ApplicationAshutosh GuptaNo ratings yet

- The Companies Act of NepalDocument166 pagesThe Companies Act of NepalJames Singh100% (1)

- Financial Sector Liberalisation in JamaicaDocument97 pagesFinancial Sector Liberalisation in JamaicaAdrian KeysNo ratings yet

- Internship Report On Departments and Subsidiaries Branches of ICBDocument37 pagesInternship Report On Departments and Subsidiaries Branches of ICBNafiz FahimNo ratings yet

- Financial Regulatory Bodies of IndiaDocument22 pagesFinancial Regulatory Bodies of IndiaAli WarsiNo ratings yet

- Tata Chemicals by KotakDocument9 pagesTata Chemicals by KotakAshish KudalNo ratings yet

- Punjab National BankDocument51 pagesPunjab National BankLeslie Sequeira100% (2)

- General Power of AttorneyDocument5 pagesGeneral Power of AttorneyRocketLawyer100% (9)

- Investment Environment & Management ProcessDocument10 pagesInvestment Environment & Management ProcessMd Shahbub Alam SonyNo ratings yet

- Semantic DraftDocument409 pagesSemantic DraftGaneshNo ratings yet

- Sources of Intermediate and Long-Term Financing: Debt and EquityDocument4 pagesSources of Intermediate and Long-Term Financing: Debt and EquityborgszxcNo ratings yet

- From PLI's Course Handbook: Conducting Due DiligenceDocument16 pagesFrom PLI's Course Handbook: Conducting Due DiligencedaucNo ratings yet

- AR19 DKSH Internet enDocument120 pagesAR19 DKSH Internet enChi NguyenNo ratings yet