Professional Documents

Culture Documents

Creed Market Report

Uploaded by

angkorriceOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Creed Market Report

Uploaded by

angkorriceCopyright:

Available Formats

Market Report

March 23, 2011

U.S.D.A. World Market

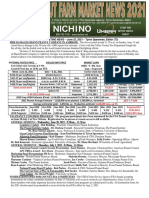

World Market Price This week Last week 1 Year Ago 2010 Loan WMP and Loan Rates

LDP

Value Factors 03/23/10 03/16/10 03/24/10 Factors ‘10 crop L/G M/G

Long Grain To be 19.22 16.52 00.00 9.91 Yield 52.78/14.31 61.03/8.69

Medium Grain issued 18.89 16.23 00.00 9.65 WMP 12.09 12.71

Short Grain Mar. 23 18.89 16.23 00.00 9.65 Loan 6.23 6.50

Brokens 8:30am 13.60 11.37 - 7.01 Difference (5.76) (6.21)

Posting: (March/April/May Shipment)

Southern U.S. - Long Grain Abbreviation Quote Basis

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $23.00 per cwt. sacked, F.A.S. U.S. Gulf

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $23.00 per cwt, BULK, FOB Vessel US Gulf

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $23.50 per cwt. containerized FOB US Gulf

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $560.00 per mt sacked delivered Laredo TX

U.S. #2 Long Grain, max. 4% Broken, Hard Milled #2/4% $24.50 per cwt sacked delivered Miami FL

U.S. #3 Long Grain, max. 15% Broken, Hard Milled #3/15 $22.00 per cwt. sacked, F.A.S. U.S. Gulf

U.S. #3 Long Grain, max. 15% Broken, Hard Milled #3/15 $550.00 per mt sacked delivered Laredo TX

U.S. #2 Long Grain Brown, max. 4% Broken, 75% yield #2/4/75 no quote per mt bulk FOB vessel NOLA

U.S. #1 Parboiled L/G Brown, max. 4% Broken, 88% yield #1/4/88 no quote per mt bulk FOB vessel NOLA

U.S. #1 Parboiled L/G MILLED, max. 4% Broken (except 0.8% damage) #1/4 Parb no quote per mt sacked FOB vessel NOLA

U.S. #1 Parboiled L/G MILLED, max. 4% Broken #1/4 Parb $625.00 per mt bulk FOB vessel NOLA

U.S. #2 Long Grain Paddy, 55/70 yield #2 55/70 $290.00 per mt bulk F.O.B. vessel NOLA

Long Grain, max. 20% broken, Hard milled (Ghana specs) #4/20/hm $21.00 per cwt. sacked, F.A.S. U.S. Gulf

U.S. #5 L/G, max. 20% broken, WELL MILLED #5/20/wm $20.50 per cwt. sacked, F.A.S. U.S. Gulf

Southern U.S. - Medium Grain

U.S. #2 Medium Grain, max. 4% broken, Hard Milled #2/4% no quote per mt bulk FOB vessel NOLA

U.S. #2 Medium Grain Paddy, 58/69 yield #2 58/69 no quote per mt bulk FOB vessel NOLA

Southern U.S. - Package Quality

Package Quality Parboiled L/G, max. 4% broken (0.8% damage) Pkg. Parb. $28.00 per cwt. bulk F.O.B. mill

Package Quality Long Grain Milled, max. 4% broken Pkg. L/G $22.00 per cwt. bulk F.O.B. mill

Package Quality Long Grain Brown Rice, max. 4% broken Pkg. Br. $31.00 per cwt. bulk F.O.B. mill

Package Quality Medium Grain Milled, max. 4% broken Pkg. M/G $35.00 per cwt. bulk F.O.B. mill

California - Medium Grain

U.S. #1 Medium Grain, max. 4% Broken #1/4 $835.00 per mt sacked containerized FOB Mill

U.S. #1 Medium Grain, max. 4% Broken #1/4 $875.00 per mt sacked containerized Oakland

U.S. #1 Medium Grain milled rice, except max. 7% Broken (Japan Specs) #1/7% $875.00 per mt sacked in 30kg bags FOB vessel

U.S. #3 Medium Grain Brown rice, max. 8% broken (Korea Specs) #3 Brown $810.00 per mt in totes containerized Oakland

U.S. #1 Medium Grain Paddy, 58/69 yield #1 58/69 $550.00 per mt bulk ex-spout Sacramento CA

California - Package Quality

Package Rice for Industrial Use and Repackers #1/4% $37-$38 per cwt. bulk F.O.B. Mill

U.S. South Brokens:

Flour Quality brokens Flour Qlty $15.00 per cwt. bulk, F.O.B. rail

Pet Food Quality / #4 Brewers (milled) contracts M/A $13.00 per cwt. bulk, F.O.B. rail

U.S. California Brokens:

Flour Quality brokens Flour Qlty $19.00 per cwt. bulk, F.O.B. mill

Pet Food Quality / #4 Brewers contracts M/A $14.00 per cwt. bulk, F.O.B. mill

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

March 23, 2011 - Page 1 of 4

Far East Report

some recent print media reports that show as little as 860,000 mt, of

SOUTHEAST ASIAN MARKETS which 600,000 mt will be licensed out to privates March 23. Also,

In Thailand, the market is relatively quiet with the they have wisely been patient, by waiting on the main season harvest

main focus on short covering against the three most recent to fully complete in Vietnam, Indonesia get out of the way, and allow

tender awards with Iraq, totaling 320,000 mt since the first for the Thai second crop to come into play. We think it is “game

of the calendar year. Those FOB sales prices ranged $505- on” before too much longer...in all likelihood within the next week

490 per mt, and the market is now openly quoted at $480- or so. Furthermore, I find it difficult to see the privates capable of

485 and slightly biddable. competing with Vinafood, given the state owned agency pays no

Also, of particular note, is the recent renewed interest, import duty. I do see two exceptions whereby that comes to play...

albeit somewhat limited, in parboil out of Nigeria, following a bit of either waive the duty, or somehow allow the privates to compete for

a drought on that biz. We offer up two reasons the Nigerians were political purposes...we shall see.

absent the market for a while: Thailand Exports

1- They viewed the market as soft in anticipation of lower prices, Jan. 1 - Mar. 3, 2011: 2,014,643 mt

which has come true Jan. 1 - Mar. 3, 2010: 1,505,409 mt

2- And, they opted for cheaper and what some consider Jan. 1 - Mar. 6, 2009: 1,440,116 mt

better quality parboil out of Brazil.

The last of the Indonesian shipments are finishing as INDIA, PAKISTAN, AND BANGLADESH

those were for March guaranteed arrival, slightly short of In India, The Hindu newspaper reported on Monday

the original sales (300-320,000 vs. 380,000 mt). that the Director General of Foreign Trade, which falls

With Thai second crop just right around the corner, we under the auspices of the Ministry of Commerce and Trade has issue

look for further declines in the market. a release that allows for certain conditional exceptions for the export

In Vietnam, Vinafood II has been loading a multitude of non-Basmati rice. The varieties listed were “Matta”, “Sona Masuri”,

of vessels against old BULOG contracts (most recently a and “Ponni”. The rice must be shipped between now and September

sale of 400,000 mt) in an effort to finish their shipments 30, 2011 and should be in 10 kg packages. The total quantity listed

which need to arrive in March as well. We estimate their total in the article was 150,000 mt, which is by historical

shipments dating back to the third quarter of 2010 to be around 1.5 Indian export standards inconsequential. However, one

MMT, bringing total Indonesian purchases close to 1.9 MMT, almost has to wonder if this may lead to additional exceptions,

double their original forecast. This should provide them with more i.e. like the ones previously allowed for core markets like

than adequate buffer stocks for the foreseeable future. This will likely Bangladesh, Sri Lanka, and Nepal...most interesting to

take them out of the market for the next six months, or new crop for say the least...market changer longer term...that remains

Thailand. to be seen.

Now the market focus is keenly on The Philippines, Also, of particular note is the Bangladesh retender

as it has been. I must say, the NFA, in sharp contrast of package 4 and 5. This consists of 50,000 mt of non-

to the previous administration, is playing the market Basmati parboil. The $64,000 question is ...will the Indians

in a much more disciplined and shrewd manner versus participate here?...or will it go to Thailand? Pakistan is not

the corrupt reckless policy of their predecessors...”a bit of a cat and a likely option as their parboil prices are surprisingly high.

mouse game”, if you will...and rather cleaver I might add. Many In Pakistan, not much new to report here as prices are

industry experts, yours truly included, believe the press releases up slightly softer on the white coarse rice but uncompetitively

to this point sighting reduced imports are understated. Whereas in high on parboil. IRRI-6 25% is quoted at $415 per mt FOB

no way will they come close to equaling last year’s imprudent and Karachi, and around $470-475 for 5%. Parboil 5% ranges $530-540.

excessive purchases, I do believe they will likely buy more than they Stay tuned, as this area may become very interesting on both the

are currently indicating. I think it will be closer to 1.4 MMT versus supply and demand side of the equation.

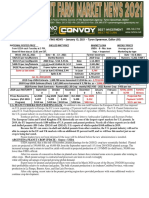

OFFSHORE QUOTES

Thailand Vietnam India Pakistan Uru. Arg. Brazil

100%B $500.00 5% $450.00 Export ban, MEP $900

5% $480.00 5% N/A 5% $470.00 $525.00 $525.00

10% $475.00 10% $440.00 10% N/A 10% no quote $515.00 $515.00

15% $470.00 15% $430.00 15% N/A 15% no quote no quote no quote

25% $450.00 25% $415.00 25% N/A 25% $415.00

Parb. 5% N/A Parb 5% $520.00 $505.00

Brokens $395.00 Brokens $390.00 Var. 1121 $1350 Parb 15%* $490.00

Parb. 100B sorted $505.00 MEP-5% $490.00 Basmati Brokens $385.00 Paddy

Thai Hom Mali $935.00 MEP-25% $470.00 Traditional $1800 Basmati $330.00

Frag. Brokens $410.00 Pusa $1300 S. Kernal $1325.00

All prices basis U.S. dollars per metric ton, F.O.B. vessel, corresponding home port *Bangladesh Specs.

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

March 23, 2011 - Page 2 of 4

CBOT Rough Rice Futures (03/21/11 Volume: 1,311 Open Interest: 24,605)

Contract Tuesday’s Close Net Change From Prices

Month Price Monday Last Report One Year Ago 03/23/10

‘11 May $13.855 UP 0.020 UP 0.980 ‘10 May $12.745

‘11 Jul $14.160 UP 0.020 UP 0.995 ‘10 Jul $13.040

‘11 Sep $14.810 UP 0.020 UP 0.940 ‘10 Sep $12.720

‘11 Nov $15.085 UP 0.020 UP 0.930 ‘10 Nov $12.890

‘12 Jan $15.330 UP 0.020 UP 0.910 ‘11 Jan $13.195

‘12 Mar $15.590 UP 0.020 UP 0.865 ‘11 Mar $13.505

U.S. Paddy Market Report California - 2010 Calrose M/G is bid at $14.00 with last trades $14.55 per cwt

over loan. 2011 new crop is bid at $13.00 with last trades at $13.00 - $13.50

Texas - Buyers’ price ideas are lower this week ranging $4.00 - $5.00 per cwt per cwt over loan.

over loan. Planting of new crop continues.

Louisiana - Long grain bids are $11.25 - $11.50 per cwt FOB farm with a Reflective Prices (all basis per cwt FOB country, 2010 Crop)

small amount of trading reported. Medium grain new crop is still bid at Texas Louisianna Mid-South California

$14.50 per cwt FOB farm. Planting of new crop continues. Long grain 10.50-11.50 11.50 $10.25b/10.75a *

Mid South - Bids for long grain are softer at $11.25 per cwt delivered mill/ Med Grain * 14.50b new crop $17.25 $21.05

river for May shipment while sellers’ price ideas are $11.75 per cwt loaded L/G is #2 55/70, M/G is #2 58/69 (California #1)

barge. Planting is just beginning. * - These areas do not have sufficient supplies of this type to quote.

U.S. Report their imports, but will lose valuable farmland due to salt intrusion.

Neither will prove to be true in our view. Granted, there will be

U.S. GULF & FUTURES MARKETS relief shipments of rice, but not an inordinate import campaign.

I am going to try and do my very best to be less negative within As regards our neighbors to the South, our latest numbers

the confounds of what these market conditions will afford me. reflect crops as follows:

First of all, thanks to two successive USDA Public Law 480 tenders 1- Brazil -- 13 MMT +

(totaling approximately 35,000 mt), the mills in Louisiana are back 2- ARG. -- 1.7 MMT

up and running through the balance of March and well into April. 3- URU. -- 1.5 MMT

I’m sorry to say, that’s about where the good news starts and stops. That adds up to be a lot of exportable surplus of premium

As for the balance of this crop, we face a very challenging task quality with which to contend.

to market what is for the most part the worse crop in over 50 years. And on that note, that sums up my report for this segment.

Now, one should bear in mind that the bulk of the rice and the

majority of the yield and quality issues reside in the mid South

(N. La., Ark., Miss., and MO.), whereas the crops in Texas and

S.W. did not suffer near the damage or loss of yield....mind you, CALIFORNIA, AUSTRALIA, JAPAN & THE “MED”

they were not excellent crops, more like average, or thereabouts. First of all, let me extend, on behalf of the entire

However, most of that rice is spoken for, for the most part by the rice industry and all Americans our heartfelt grief

mills, or soon will be. for our Japanese friends...help is coming, and we will

The $64,000 question everyone is asking is how large will the do more than our part, rest assured of that.

reduction in acreage be for long grain in the South, due to better On the business side of the equation, there is no

opportunities with other soft commodities. My guess is around change in the California market in general, as mills continue

25-30%, and maybe larger in parts of the mid South where flex deliveries to the port against old MA business for Japan, as well

acreage will come into play and cotton and other crops will be as commercial sales to Libya. At present, we have no reason

planted. But, if one figures a normal yielding crop, better quality, to believe either business will be impaired by the inordinate

and a large carryover (almost 2 MMT according to USDA’s latest), situation at those destinations...let us pray!

then production and stocks will not likely decrease significantly... I think I will leave it with a couple of brief comments about

maybe 5-10%, if that. There will be no shortage, in our view. the market as mills are very busy, prices remain firm, and no

Following the collapse of the previous few weeks, futures rallied new cash paddy trades reported.

almost $1.00 on fears that Japan will not only have to increase With that, I now close my comments

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

March 23, 2011 - Page 3 of 4

Upcoming Tenders: USDA Export Sales Highlights

(March 4 - 10, 2011)

Mar. 27 Bangladesh retender for package 4 & 5 to buy 50,000mt of

non-basmati parboiled rice. Sales

Net sales of 62,200 MT were down 15 percent from the

previous week and 13 percent from the prior 4-week average.

Tenders Results: Increases were reported for:

Mexico (23,500 MT)

Mar. 16 KCCO MR-22 Inv. 031 bought: Liberia (11,900 MT)

5000mt #2/7, Parboiled at $678.35 per mt FAS Lake Charles Belgium (4,000 MT)

Nicaragua (3,700 MT)

4370mt #3/15, L/G at $451.50-452.60 per mt FAS Lake Charles Jamaica (3,600 MT)

830mt #2/7, L/G at $476.41 per mt FAS Lake Charles

580mt #5/20, at $441.80 per mt FAS Lake Charles

Exports

Exports of 56,600 MT were down 17 percent from the

previous week and 32 percent from the prior 4-week average.

The primary destinations were :

Mexico (25,000 MT)

Turkey (7,000 MT)

Saudi Arabia (4,700 MT)

Canada (4,300 MT)

Liberia (4,100 MT)

Source: USDA

Upcoming Events:

Mar. 28-30, 2011 Rice Trade Outlook 2011 conference

for more info: www.ricetrade.agraevents.com

June 7-9, 2011 TRT Americas Conference 2011

Hotel Riu Plaza Panama, Panama City, Panama

For more info go to: http://trtamericas.com/

June 26-30, 2011 USA Rice Millers’ Association Convention

Rice Co-Products - Spot market prices basis $ per short ton bulk, FOB mill (virtually no spot supply available for sale in South, except hulls)

Texas Louisiana Arkansas California

Bran: Not Available ($105) Not Available ($105) Not Available ($110) 100

Mill Feed: Not Available ($40) Not Available ($40) Not Available ($40)

Ground Hulls: 5-7 2-5 15

Unground Hulls: 5-7 2-5 12 10 - 13

Creed Rice Co. Inc. 800 Wilcrest Suite 200 Houston, Texas 77042 USA

Ph 1.713.782.3260 Fax 1.713.782.4671 www.creedrice.com email: ricecreed@aol.com & creedinc@swbell.net

Brokers • Consultants • Market Reports • Arbitrators

Copyright © 2011 Creed Rice. Co., Inc. All Rights reserved www.creedrice.com

March 23, 2011 - Page 4 of 4

You might also like

- Split-Top Roubo WorkbenchDocument29 pagesSplit-Top Roubo WorkbenchamelieNo ratings yet

- We Northern CheyenneDocument188 pagesWe Northern CheyenneAnonymous j8LfkG2No ratings yet

- Detox 7 Day DietDocument194 pagesDetox 7 Day DietSundar PrabhuNo ratings yet

- Chillies of IndiaDocument5 pagesChillies of IndiaSriram SridaranNo ratings yet

- The First Settlements in America-AUgustDocument50 pagesThe First Settlements in America-AUgustIvana AgueroNo ratings yet

- Belarus 1822.3Document358 pagesBelarus 1822.3paky1111No ratings yet

- Health Food Study: Is Healthy Food More Expensive?Document50 pagesHealth Food Study: Is Healthy Food More Expensive?Palisadian PostNo ratings yet

- HACCP Palm OilDocument5 pagesHACCP Palm OilLaura Arango Rojas100% (1)

- Get Your #Project - Proposal - On - Coffee - PlantationsDocument2 pagesGet Your #Project - Proposal - On - Coffee - PlantationsSuleman100% (2)

- Regan's Product HandbookDocument131 pagesRegan's Product Handbookjomz100% (7)

- Creed Rice Market ReportDocument4 pagesCreed Rice Market ReportnsopheaNo ratings yet

- Creed Rice Market Report.Document4 pagesCreed Rice Market Report.nsopheaNo ratings yet

- Creed Market ReportDocument4 pagesCreed Market ReportnsopheaNo ratings yet

- Creed Rice Market ReportDocument4 pagesCreed Rice Market ReportnsopheaNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Document1 pageShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeNo ratings yet

- Container and Substrate Production of Raspberries HansonDocument20 pagesContainer and Substrate Production of Raspberries HansonYana SamirNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBMorgan IngramNo ratings yet

- PricesDocument2 pagesPricessoftbreezeNo ratings yet

- PEANUT MARKETING NEWS - May 13, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 13, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly PricesDocument1 pageShelled MKT Price Market Loan Weekly PricesMorgan IngramNo ratings yet

- NC Organic Blackberry Budget ProgramDocument25 pagesNC Organic Blackberry Budget ProgramgonzomapsNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - December 9, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 9, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - November 13, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - November 13, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Case Study T Table A and BDocument3 pagesCase Study T Table A and BBhuwanNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Composite Fish Farming - 8870851Document5 pagesComposite Fish Farming - 8870851Telugu kabbilli SirishaNo ratings yet

- Vist Our Yard at 5637 Davidson Road, Just Off Motherlode DRDocument1 pageVist Our Yard at 5637 Davidson Road, Just Off Motherlode DRrrr44No ratings yet

- PEANUT MARKETING NEWS - April 2, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 2, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- 4 40 20 PDFDocument1 page4 40 20 PDFBrittany EtheridgeNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportBrittany EtheridgeNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- Commodity Price TableDocument4 pagesCommodity Price TableAishatu Musa AbbaNo ratings yet

- Agricultural Land Use and Wetland ManagementDocument1 pageAgricultural Land Use and Wetland ManagementGengjiaqi CHANGNo ratings yet

- 9 1 10 SpecialsDocument1 page9 1 10 SpecialsTalcove ExoticwoodsNo ratings yet

- Cmu170420 3Document4 pagesCmu170420 3jenNo ratings yet

- CT Ag RPT Dec 11 2013Document4 pagesCT Ag RPT Dec 11 2013Patricia DillonNo ratings yet

- BPO FormDocument1 pageBPO Formrealestate6199No ratings yet

- PEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - April 16, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 16, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Available Commodities Listing - July & Aug - Kingdom Trade Group LLC, UsaDocument18 pagesAvailable Commodities Listing - July & Aug - Kingdom Trade Group LLC, UsaSaniya ShaikhNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Weekly Canadian cattle market and feed pricesDocument4 pagesWeekly Canadian cattle market and feed pricesjenNo ratings yet

- Indoor Mushroom Cultivation EconomicsDocument20 pagesIndoor Mushroom Cultivation EconomicsEmir KarabegovićNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Requirements & TermsDocument4 pagesRequirements & TermsmasariieNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau, and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument1 pageCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau, and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualBrittany EtheridgeNo ratings yet

- Gaithersburg Condos Sold in 20878 For June 2010Document1 pageGaithersburg Condos Sold in 20878 For June 2010Bob MyersNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Rice Growth and DevelopmentDocument14 pagesRice Growth and DevelopmentErika MatiasNo ratings yet

- Prairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideFrom EverandPrairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideNo ratings yet

- Hemp Hurds as Paper-Making Material United States Department of Agriculture, Bulletin No. 404From EverandHemp Hurds as Paper-Making Material United States Department of Agriculture, Bulletin No. 404No ratings yet

- Jackson Son & Co - LRI - Sep 30, 2011Document9 pagesJackson Son & Co - LRI - Sep 30, 2011angkorriceNo ratings yet

- Jackson Son & Co - LRI - Sep 16, 2011Document9 pagesJackson Son & Co - LRI - Sep 16, 2011angkorriceNo ratings yet

- Jackson Son & Co - LRI - Aug 26, 2011Document9 pagesJackson Son & Co - LRI - Aug 26, 2011angkorriceNo ratings yet

- Jackson Son & Co - LRI - Jun 03, 2011Document9 pagesJackson Son & Co - LRI - Jun 03, 2011angkorriceNo ratings yet

- Lri 20110527Document9 pagesLri 20110527angkorriceNo ratings yet

- Creed Rice Market Report.Document4 pagesCreed Rice Market Report.nsopheaNo ratings yet

- Lri 20110520Document9 pagesLri 20110520angkorriceNo ratings yet

- Creed Market ReportDocument4 pagesCreed Market ReportangkorriceNo ratings yet

- International Rice StandardsDocument9 pagesInternational Rice Standardsangkorrice67% (3)

- Creed Market ReportDocument4 pagesCreed Market ReportangkorriceNo ratings yet

- HikmaDocument4 pagesHikmaHikmah khanza PutriNo ratings yet

- DH Lawrence Introduction To A Study of Thomas HardyDocument8 pagesDH Lawrence Introduction To A Study of Thomas HardyNistor OanaNo ratings yet

- History: Rasam, Chaaru, Saaru or Kabir Is ADocument2 pagesHistory: Rasam, Chaaru, Saaru or Kabir Is Aalay2986No ratings yet

- Pastoralists in The Modern WorldDocument5 pagesPastoralists in The Modern WorldAdvay GuglianiNo ratings yet

- Group3 Philippine Literature FINAL DRAFT!Document68 pagesGroup3 Philippine Literature FINAL DRAFT!Maria Katrina Bello100% (1)

- Native Forest in Salta - Seghezzo, Volante, Paruelo, Somma Et Al - JED 2011Document27 pagesNative Forest in Salta - Seghezzo, Volante, Paruelo, Somma Et Al - JED 2011Daniel SommaNo ratings yet

- From Bharaut To IndiaDocument26 pagesFrom Bharaut To Indiaramgohra_854545280No ratings yet

- How To Win An Argument With A MeatDocument1 pageHow To Win An Argument With A MeatrocosanaNo ratings yet

- Máquina Pão PanasonicDocument24 pagesMáquina Pão Panasonicsilveira_manuelNo ratings yet

- Chapter 15-Writing3 (Thesis Sentence)Document7 pagesChapter 15-Writing3 (Thesis Sentence)Dehan Rakka GusthiraNo ratings yet

- Food Shortage: Supply VS DemandDocument19 pagesFood Shortage: Supply VS DemandMaria ZakirNo ratings yet

- Sheanut RepDocument77 pagesSheanut RepBalogun AhmedNo ratings yet

- Karnataka Horti Produce - Rabo BankDocument72 pagesKarnataka Horti Produce - Rabo BankAnonymous EAineTiz100% (1)

- Chapter 7 - Farming Systems: Nabard Grade A (Agriculture)Document13 pagesChapter 7 - Farming Systems: Nabard Grade A (Agriculture)gaurav singhNo ratings yet

- Old Testament PDFDocument772 pagesOld Testament PDFkinyNo ratings yet

- Rates for roads, bridge and culvert works 2013-14Document130 pagesRates for roads, bridge and culvert works 2013-14Bilal A BarbhuiyaNo ratings yet

- Khuma 8: A High-Yielding Variety With Good Cooking Quality For The Mid-Hill Areas of NepalDocument2 pagesKhuma 8: A High-Yielding Variety With Good Cooking Quality For The Mid-Hill Areas of NepalIRRI_resourcesNo ratings yet

- Pioneer Review, October 18, 2012Document14 pagesPioneer Review, October 18, 2012surfnewmediaNo ratings yet

- Farm Mechanization Impact on Ag LaborDocument10 pagesFarm Mechanization Impact on Ag LaborMohana KrishnanNo ratings yet

- Cocoa of IndonesiaDocument6 pagesCocoa of Indonesiamajid_baigNo ratings yet

- The Environmental Impact of Poultry Production: January 2011Document8 pagesThe Environmental Impact of Poultry Production: January 2011Amrit PatnaikNo ratings yet

- Dairy Farming Project ReportDocument16 pagesDairy Farming Project ReportGOVIND ROYNo ratings yet