Professional Documents

Culture Documents

Annual Data

Uploaded by

Jess BautistaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Data

Uploaded by

Jess BautistaCopyright:

Available Formats

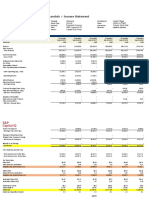

INCOME STATEMENT

12 months 12 months 12 months 12 months

In Millions of USD (except for per

ending 2010-12- ending 2009-12- ending 2008-12- ending 2007-12-

share items)

31 31 31 31

Revenue 24,074.60 22,744.70 23,522.40 22,786.60

Other Revenue, Total - - - -

Total Revenue 24,074.60 22,744.70 23,522.40 22,786.60

Cost of Revenue, Total 14,437.30 13,952.90 14,883.20 14,881.40

Gross Profit 9,637.30 8,791.80 8,639.20 7,905.20

Selling/General/Admin. Expenses,

2,333.30 2,234.20 2,355.50 2,367.00

Total

Research & Development - - - -

Depreciation/Amortization - - - -

Interest Expense(Income) - Net

- - - -

Operating

Unusual Expense (Income) -4.80 -115.60 -48.50 1,774.80

Other Operating Expenses, Total - - - -

Total Operating Expense 16,601.50 15,903.70 17,079.50 18,907.60

Operating Income 7,473.10 6,841.00 6,442.90 3,879.00

Interest Income(Expense), Net Non-

- - - -

Operating

Gain (Loss) on Sale of Assets - - - -

Other, Net -44.20 -26.60 -12.10 -19.80

Income Before Tax 7,000.30 6,487.00 6,158.00 3,572.10

Income After Tax 4,946.30 4,551.00 4,313.20 2,335.00

Minority Interest - - - -

Equity In Affiliates - - - -

Net Income Before Extra. Items 4,946.30 4,551.00 4,313.20 2,335.00

Accounting Change - - - -

Discontinued Operations - - - -

Extraordinary Item - - - -

Net Income 4,946.30 4,551.00 4,313.20 2,395.10

Preferred Dividends - - - -

Income Available to Common

4,946.30 4,551.00 4,313.20 2,335.00

Excl. Extra Items

12 months 12 months 12 months 12 months

In Millions of USD (except for per

ending 2010-12- ending 2009-12- ending 2008-12- ending 2007-12-

share items)

31 31 31 31

Income Available to Common Incl.

4,946.30 4,551.00 4,313.20 2,395.10

Extra Items

Basic Weighted Average Shares - - - -

Basic EPS Excluding

- - - -

Extraordinary Items

Basic EPS Including

- - - -

Extraordinary Items

Dilution Adjustment - - - 0.00

Diluted Weighted Average Shares 1,080.30 1,107.40 1,146.00 1,211.80

Diluted EPS Excluding

4.58 4.11 3.76 1.93

Extraordinary Items

Diluted EPS Including

- - - -

Extraordinary Items

Dividends per Share - Common

2.26 2.05 1.62 1.50

Stock Primary Issue

Gross Dividends - Common Stock - - - -

Net Income after Stock Based Comp.

- - - -

Expense

Basic EPS after Stock Based Comp.

- - - -

Expense

Diluted EPS after Stock Based

- - - -

Comp. Expense

Depreciation, Supplemental - - - -

Total Special Items - - - -

Normalized Income Before Taxes - - - -

Effect of Special Items on Income

- - - -

Taxes

Income Taxes Ex. Impact of Special

- - - -

Items

Normalized Income After Taxes - - - -

Normalized Income Avail to

- - - -

Common

Basic Normalized EPS - - - -

Diluted Normalized EPS 4.58 4.04 3.73 2.88

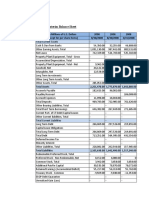

BALANCE SHEET

In Millions of USD (except for per share As of 2009-12- As of 2008-12- As of 2007-12- As of 2006-12-

items) 31 31 31 31

Cash & Equivalents 1,796.00 2,063.40 1,981.30 2,128.10

Short Term Investments - - - -

Cash and Short Term Investments 1,796.00 2,063.40 1,981.30 2,128.10

Accounts Receivable - Trade, Net 1,060.40 931.20 1,053.80 806.90

Receivables - Other - - - -

Total Receivables, Net 1,060.40 931.20 1,053.80 806.90

Total Inventory 106.20 111.50 125.30 112.40

Prepaid Expenses 453.70 411.50 421.50 318.60

Other Current Assets, Total - - 0.00 1,826.20

Total Current Assets 3,416.30 3,517.60 3,581.90 5,192.20

Property/Plant/Equipment, Total - Gross 33,440.50 31,152.40 32,203.70 29,722.90

Accumulated Depreciation, Total -11,909.00 -10,897.90 -11,219.00 -10,284.80

Goodwill, Net 2,425.20 2,237.40 2,301.30 2,073.60

Intangibles, Net - - - -

Long Term Investments 1,212.70 1,222.30 1,156.40 1,035.40

Other Long Term Assets, Total 1,639.20 1,229.70 1,367.40 1,235.20

Total Assets 30,224.90 28,461.50 29,391.70 28,974.50

Accounts Payable 636.00 620.40 624.10 668.70

Accrued Expenses 1,854.80 1,633.00 1,635.30 1,459.50

Notes Payable/Short Term Debt 0.00 0.00 1,126.60 0.00

Current Port. of LT Debt/Capital Leases 18.10 31.80 864.50 17.70

Other Current liabilities, Total 479.80 252.70 248.00 805.70

Total Current Liabilities 2,988.70 2,537.90 4,498.50 2,951.60

Long Term Debt 10,560.30 10,186.00 7,310.00 8,389.90

Capital Lease Obligations - - - -

Total Long Term Debt 10,560.30 10,186.00 7,310.00 8,389.90

Total Debt 10,578.40 10,217.80 9,301.10 8,407.60

Deferred Income Tax 1,278.90 944.90 960.90 1,076.30

Minority Interest - - - -

Other Liabilities, Total 1,363.10 1,410.10 1,342.50 1,098.40

Total Liabilities 16,191.00 15,078.90 14,111.90 13,516.20

Redeemable Preferred Stock, Total - - - -

Preferred Stock - Non Redeemable, Net - - - -

Common Stock, Total 16.60 16.60 16.60 16.60

Additional Paid-In Capital 4,853.90 4,600.20 4,226.70 3,445.00

In Millions of USD (except for per share As of 2009-12- As of 2008-12- As of 2007-12- As of 2006-12-

items) 31 31 31 31

Retained Earnings (Accumulated Deficit) 31,270.80 28,953.90 26,461.50 25,845.60

Treasury Stock - Common -22,854.80 -20,289.40 -16,762.40 -13,552.20

Other Equity, Total 882.00 199.40 1,375.10 -296.70

Total Equity 14,033.90 13,382.60 15,279.80 15,458.30

Total Liabilities & Shareholders' Equity 30,224.90 28,461.50 29,391.70 28,974.50

Shares Outs - Common Stock Primary Issue - - - -

Total Common Shares Outstanding 1,076.70 1,115.30 1,165.30 1,203.70

CASH FLOW

In Millions of USD (except for 12 months ending 12 months ending 12 months ending 12 months ending

per share items) 2009-12-31 2008-12-31 2007-12-31 2006-12-31

Net Income/Starting Line 4,551.00 4,313.20 2,395.10 3,544.20

Depreciation/Depletion 1,216.20 1,207.80 1,214.10 1,249.90

Amortization - - - -

Deferred Taxes 203.00 101.50 -39.10 33.40

Non-Cash Items -390.20 48.90 1,342.40 -322.80

Changes in Working Capital 171.00 245.80 -36.20 -163.20

Cash from Operating Activities 5,751.00 5,917.20 4,876.30 4,341.50

Capital Expenditures -1,952.10 -2,135.70 -1,946.60 -1,741.90

Other Investing Cash Flow Items,

296.80 511.00 796.50 467.80

Total

Cash from Investing Activities -1,655.30 -1,624.70 -1,150.10 -1,274.10

Financing Cash Flow Items 60.50 34.30 2.10 5.00

Total Cash Dividends Paid -2,235.50 -1,823.40 -1,765.60 -1,216.50

Issuance (Retirement) of Stock,

-2,465.30 -3,371.10 -2,805.40 -1,983.70

Net

Issuance (Retirement) of Debt, Net 219.30 1,045.70 572.60 -2,264.70

Cash from Financing Activities -4,421.00 -4,114.50 -3,996.30 -5,459.90

Foreign Exchange Effects 57.90 -95.90 123.30 267.60

Net Change in Cash -267.40 82.10 -146.80 -2,124.90

Cash Interest Paid, Supplemental 468.70 507.80 392.70 430.30

Cash Taxes Paid, Supplemental 1,683.50 1,294.70 1,436.20 1,528.50

You might also like

- ESTADOS fINANCIEROS SUPERMERCADOS DIADocument42 pagesESTADOS fINANCIEROS SUPERMERCADOS DIARichard NavarroNo ratings yet

- Infosys LTD (INFO IN) - AdjustedDocument12 pagesInfosys LTD (INFO IN) - AdjustedAswini Kumar BhuyanNo ratings yet

- $serb Bursa: 5279 Reuters: SERB - KL Category: Energy (Oil & Gas Related Equipment and Services)Document8 pages$serb Bursa: 5279 Reuters: SERB - KL Category: Energy (Oil & Gas Related Equipment and Services)Sokri YussoffNo ratings yet

- FinanzasDocument12 pagesFinanzasYamilet Maria InquillaNo ratings yet

- Valoracion EcopetrolDocument66 pagesValoracion EcopetrolNicolas SarmientoNo ratings yet

- Coca Cola FsDocument5 pagesCoca Cola FsDanah Jane GarciaNo ratings yet

- UMS Income StatementDocument20 pagesUMS Income StatementNour FaizahNo ratings yet

- Tesco PLC LSE TSCO Financials Income StatementDocument6 pagesTesco PLC LSE TSCO Financials Income StatementYA JiaoNo ratings yet

- Taller Indices TecnologíaDocument196 pagesTaller Indices Tecnologíaluisa hernandezNo ratings yet

- Income StatementDocument75 pagesIncome StatementAmitNo ratings yet

- Apple Valuation Exercise - AAPL Financials (Annual) July 31 2020Document44 pagesApple Valuation Exercise - AAPL Financials (Annual) July 31 2020/jncjdncjdnNo ratings yet

- Year 2009 2008: Johnson & Johnson Balance Sheet (In Millions of USD)Document14 pagesYear 2009 2008: Johnson & Johnson Balance Sheet (In Millions of USD)ujjwal26No ratings yet

- Company Information: Financial Results (All Figures in Lakhs)Document2 pagesCompany Information: Financial Results (All Figures in Lakhs)ChellapandiNo ratings yet

- Flujo de Caja AaplDocument9 pagesFlujo de Caja AaplPablo Alejandro JaldinNo ratings yet

- Morgan Stanley (MS US) - AdjustedDocument24 pagesMorgan Stanley (MS US) - AdjustedAswini Kumar BhuyanNo ratings yet

- Coca Cola 18.11.22Document99 pagesCoca Cola 18.11.22Arturo Del RealNo ratings yet

- Final FA ProjectDocument28 pagesFinal FA Projectapi-19592137No ratings yet

- In Millions of Euro (Except For Per Share Items) 2008 2008-12-31Document5 pagesIn Millions of Euro (Except For Per Share Items) 2008 2008-12-31William LongNo ratings yet

- Intel Corp (INTC US) - AdjustedDocument10 pagesIntel Corp (INTC US) - AdjustedAswini Kumar BhuyanNo ratings yet

- DG Cement Financial Ratios: LiquidyDocument11 pagesDG Cement Financial Ratios: Liquidyhijab zaidiNo ratings yet

- Income StatementDocument2 pagesIncome StatementelninothekidNo ratings yet

- CSB Task 2Document21 pagesCSB Task 2Saumya SarkarNo ratings yet

- Company Info - Print Financials 1Document2 pagesCompany Info - Print Financials 1rjaman9981No ratings yet

- Pepsico Inc: Financial Statement: Business Type: IndustryDocument3 pagesPepsico Inc: Financial Statement: Business Type: Industrychandel100No ratings yet

- 4 Years of Financial Data - v4Document25 pages4 Years of Financial Data - v4khusus downloadNo ratings yet

- Forward Industries Inc (FORD US) - AdjustedDocument14 pagesForward Industries Inc (FORD US) - AdjustedAswini Kumar BhuyanNo ratings yet

- Cash FlowDocument2 pagesCash FlowGaurang PujaraNo ratings yet

- Alphabet-Goog Lacv 2Document258 pagesAlphabet-Goog Lacv 2Daisy MartinezNo ratings yet

- FS NvidiaDocument22 pagesFS NvidiaReza FachrizalNo ratings yet

- Infosys: Balance SheetDocument6 pagesInfosys: Balance SheetchiragNo ratings yet

- Reformulated Comprehensive Income StatementDocument5 pagesReformulated Comprehensive Income StatementXyzNo ratings yet

- Boeing Co/The (BA US) - AdjustedDocument15 pagesBoeing Co/The (BA US) - AdjustedAswini Kumar BhuyanNo ratings yet

- Income Statement PSODocument4 pagesIncome Statement PSOMaaz HanifNo ratings yet

- CEAT TyresDocument14 pagesCEAT Tyresashirwad singhNo ratings yet

- Brown ForDocument10 pagesBrown ForLina XuNo ratings yet

- Viney FM ProjectDocument7 pagesViney FM ProjectMADHUSMITA PANINo ratings yet

- Session8 FMD Mdim 2021Document20 pagesSession8 FMD Mdim 2021MOHAMMED ARBAZ ABBASNo ratings yet

- AkzoDocument2 pagesAkzoABHAY KUMAR SINGHNo ratings yet

- Reformulation of Financial StatementsDocument30 pagesReformulation of Financial StatementsKatty MothaNo ratings yet

- NCZ Stock Target $0.38: Period EndingDocument2 pagesNCZ Stock Target $0.38: Period EndingmohsineprrNo ratings yet

- Go Digit General Insurance Limited Financials Income StatementDocument3 pagesGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNo ratings yet

- Balance Sheet: Annual DataDocument4 pagesBalance Sheet: Annual DataJulie RayanNo ratings yet

- CF Export 26 02 2024Document56 pagesCF Export 26 02 2024v4d4f8hkc2No ratings yet

- Income StatementDocument3 pagesIncome StatementneetsasneetuNo ratings yet

- Income StatementDocument3 pagesIncome StatementneetsasneetuNo ratings yet

- Potential of The Automobile IndustryDocument21 pagesPotential of The Automobile IndustrySteevan SwamiNo ratings yet

- 5 Year Financial PlanDocument20 pages5 Year Financial PlanNKITDOSHI100% (1)

- Bharti Airtel LTD (BHARTI IN) - AdjustedDocument4 pagesBharti Airtel LTD (BHARTI IN) - AdjustedDebarnob SarkarNo ratings yet

- CMA DataDocument36 pagesCMA DataPramod GuptaNo ratings yet

- Tarea Razones RentabilidadDocument12 pagesTarea Razones RentabilidadEmilio BazaNo ratings yet

- Larsen & Toubro Infotech LTD - Income Statement - Thomson Reuters Eikon 10-Aug-2019 01:04Document140 pagesLarsen & Toubro Infotech LTD - Income Statement - Thomson Reuters Eikon 10-Aug-2019 01:04Nishant SharmaNo ratings yet

- Advanced Info Service PCL (ADVANC TB) - AdjustedDocument12 pagesAdvanced Info Service PCL (ADVANC TB) - AdjustedYounG TerKNo ratings yet

- Vertical and HorizontalDocument25 pagesVertical and HorizontalJunaid MalikNo ratings yet

- Bharat Forge LTD (BHFC IN) - AdjustedDocument4 pagesBharat Forge LTD (BHFC IN) - AdjustedAswini Kumar BhuyanNo ratings yet

- TCS Profit and Loss StatementsDocument2 pagesTCS Profit and Loss StatementsRuchita MoreNo ratings yet

- Money ControlDocument2 pagesMoney ControlSudhir KumarNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsAakash AakashNo ratings yet

- Income Statement (In MLN.) : Roic - Ai - AfiDocument11 pagesIncome Statement (In MLN.) : Roic - Ai - AfiJoshua LeeNo ratings yet

- Hindustanprofit LossDocument2 pagesHindustanprofit LossPradeep WaghNo ratings yet

- Question Bank 1. A and B Are Partners Sharing Profits in The Ratio of 3: 2 With Capitals of Rs. 50,000 and Rs. 30,000Document2 pagesQuestion Bank 1. A and B Are Partners Sharing Profits in The Ratio of 3: 2 With Capitals of Rs. 50,000 and Rs. 30,000navin_raghuNo ratings yet

- MSC Finance and Strategy Online BrochureDocument12 pagesMSC Finance and Strategy Online BrochureSiphoKhosaNo ratings yet

- Commerzbank AG: Issuer Rating ReportDocument12 pagesCommerzbank AG: Issuer Rating ReportvaishnaviNo ratings yet

- Tr3ndy Jon's Trading StrategiesDocument3 pagesTr3ndy Jon's Trading Strategieshotdog10No ratings yet

- UntitledDocument3 pagesUntitledapi-234474152No ratings yet

- Topic 1 DQ 1: Course?: The Tension Between Conservative Corporate Law Theory and Citizens UnitedDocument4 pagesTopic 1 DQ 1: Course?: The Tension Between Conservative Corporate Law Theory and Citizens Unitedlmills3333No ratings yet

- 11 Actividad #4 Crucigrama Contabilidad VDocument3 pages11 Actividad #4 Crucigrama Contabilidad VMaria F OrtizNo ratings yet

- Fin Ca2 FinalDocument6 pagesFin Ca2 FinalVaishali SonareNo ratings yet

- MBA (E) 2021-23, 3rd Semester All Subjects SyllabusDocument40 pagesMBA (E) 2021-23, 3rd Semester All Subjects SyllabusANISHA DUTTANo ratings yet

- The - Faber.report CNBSDocument154 pagesThe - Faber.report CNBSWilly Pérez-Barreto MaturanaNo ratings yet

- Northern Arc Capital Raises $25 Million Debt From FMODocument10 pagesNorthern Arc Capital Raises $25 Million Debt From FMOBSA3Tagum MariletNo ratings yet

- Fees & ExpensesDocument3 pagesFees & ExpensesJames JenkinsNo ratings yet

- Eliminating Emotions With Candlestick Signals: by Stephen W. Bigalow The Candlestick ForumDocument122 pagesEliminating Emotions With Candlestick Signals: by Stephen W. Bigalow The Candlestick Forumbruce1976@hotmail.comNo ratings yet

- Chapter 4 Accounts Receivable Learning Objectives: Receivables."Document4 pagesChapter 4 Accounts Receivable Learning Objectives: Receivables."Misiah Paradillo JangaoNo ratings yet

- Learnings From DJ SirDocument94 pagesLearnings From DJ SirHare KrishnaNo ratings yet

- Online Application Form JAT Holdings Limited 32Document2 pagesOnline Application Form JAT Holdings Limited 32cpasl123No ratings yet

- IBT MCQ and Essay QuestionsDocument9 pagesIBT MCQ and Essay QuestionsCristine BilocuraNo ratings yet

- CLS Gathers Momentum, Rao, CCILDocument6 pagesCLS Gathers Momentum, Rao, CCILShrishailamalikarjunNo ratings yet

- Desirable Corporate Governance: A CodeDocument16 pagesDesirable Corporate Governance: A CodesiddharthanandNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument156 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFJamille Rose PagulayanNo ratings yet

- Week 1 MSTA Notes PDFDocument93 pagesWeek 1 MSTA Notes PDFMohd Najmi HuzaiNo ratings yet

- 7 - Yex Marine (SBL Specimen 2 Sept 3023 Preseen) ) - Answer by Sir Hasan Dossani (Full Drafting)Document13 pages7 - Yex Marine (SBL Specimen 2 Sept 3023 Preseen) ) - Answer by Sir Hasan Dossani (Full Drafting)nnabilahloveNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancefriendztoall4351No ratings yet

- Research Paper - MN559990 - Batch35 - PDFDocument17 pagesResearch Paper - MN559990 - Batch35 - PDFkhushboo sharmaNo ratings yet

- Transfer Pricing II: Rajan Baa 3257Document15 pagesTransfer Pricing II: Rajan Baa 3257Rajan BaaNo ratings yet

- FX MrktsDocument46 pagesFX MrktsSoe Group 1No ratings yet

- Accounting/Series 3 2004 (Code3001)Document20 pagesAccounting/Series 3 2004 (Code3001)Hein Linn Kyaw100% (1)

- Kumkum YadavDocument51 pagesKumkum YadavHarshit KashyapNo ratings yet

- Geojit BNP Paribas Report of Saurabh PrithwaniDocument62 pagesGeojit BNP Paribas Report of Saurabh PrithwaniSaurabh Prithwani100% (3)

- SOP: Sales Invoices: Stage I: Recording A Sales InvoiceDocument2 pagesSOP: Sales Invoices: Stage I: Recording A Sales InvoiceSuresh KattamuriNo ratings yet