Professional Documents

Culture Documents

Sched H

Uploaded by

Zach EdwardsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sched H

Uploaded by

Zach EdwardsCopyright:

Available Formats

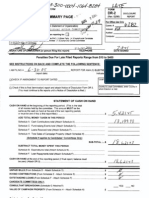

FOR INSTRUCTIONS, SEE BACK OF FORM

SCHEDULE

RESET

H CAMPAIGN

THIS FORM IS USED BY CANDIDATES’ COMMITTEES ONLY (Rev. 02/08) PROPERTY

ATTACH SCHEDULE H TO

COMMITTEE NAME (Must be same as on Statement of Organization) EACH REPORT, MAKING

CHANGES AS REQUIRED.

CHECK THIS BOX IF

AMENDING FORM

PART I - ONGOING INVENTORY OF CAMPAIGN PROPERTY

Date Purchased

(Schedule B) Purchase Price or Est. Value Current Value at Fair Market

or Date Received Description of Property When Acquired* This Report

(Schedule E)

(MM/DD/YR)

TOTAL VALUE CAMPAIGN PROPERTY THIS REPORT (TRANSFER TO SUMMARY PAGE) $

* If estimated, show est. beside figure.

PART II - SALES OR TRANSFERS OF CAMPAIGN PROPERTY **

Date Name and Address of Purchaser/Donee Description of Property Sold? Sale Price Value of

(MM/DD/YR) Y/N Donation

TOTALS $ $

** PROPERTY SALES & TRANSFERS TOTAL (TRANSFER TO SUMMARY PAGE) $

(Attach Additional Schedules if Needed)

Page ________ of ________ Pages

(For Schedule H)

SCHEDULE H

INVENTORY AND SALE OR TRANSFER OF CAMPAIGN PROPERTY

THIS FORM IS TO BE USED BY CANDIDATES’ COMMITTEES ONLY!

Iowa Code §68A.304 states that equipment, supplies, or other materials purchased with

campaign funds or received in kind are campaign property. Campaign property belongs to the

candidate’s committee and not to the candidate.

Campaign property with a value of five hundred dollars ($500) or more when acquired by the

committee should be listed on the inventory section (Part I) of Schedule H. The property is to be listed on

each report until it is disposed of by the committee or its residual value falls below one hundred dollars

($100). (EXCEPTION: Consumable campaign property, such as stationery, yard signs and other

campaign materials imprinted to be specific to a candidate or election, is NOT required to be

reported as committee inventory, regardless of the initial value of the campaign property.)

When the committee dissolves, this schedule must be filed showing the disposal of any remaining

campaign property (with a residual value of $100 or more, excluding consumable campaign property), by

one of the following means: (1) Sale at fair market value, with the proceeds treated the same as other

campaign funds, or (2) donation of the property itself to one of the recipients permitted to receive

campaign funds.

1. List the candidate’s committee name at the top of each Schedule page. If you are amending the

form, check the box to indicate this in the top right-hand corner.

2. List the original date (month, day, year) of purchase of the campaign property in the first column

of Part I. If the property is received in kind, list the date it was received.

3. Describe the property.

4. List the purchase price of the property (from Schedule B). If the property was received in kind,

show the value when acquired (from Schedule E). If the value is estimated, show “est.” beside the

figure.

5. List the current value of the property, i.e., its value with depreciation considered, or the amount

you believe the property could be marketed for.

6. When the property value is less than $100 and that has been reported, it should be deleted from

inventory.

7. If you sell an item of campaign property, report this transaction on Schedule H, Part II, to indicate

that the committee no longer owns the campaign property. Make the appropriate notation (such as “sold

to Johnson for Sheriff”), along with the date and sale price at fair market value. Show total sales on

summary page.

8. If campaign property is donated to a political party committee or charitable organization, show the

item in Part II of Schedule H and provide the recipient committee with a signed statement of your

donation, including the fair market value of the item, so that the recipient committee can report the item as

an in kind contribution (if applicable).

9. Sub-total or total the page.

10. Number the page.

You might also like

- This Form Is Used by Candidates' Committees Only HDocument8 pagesThis Form Is Used by Candidates' Committees Only HZach EdwardsNo ratings yet

- Disclosure F ' Mmary Page 3 ° Dr-2 5: Kil SF'PR - Ftir J P Y Important: You 1 2 5 7 ofDocument6 pagesDisclosure F ' Mmary Page 3 ° Dr-2 5: Kil SF'PR - Ftir J P Y Important: You 1 2 5 7 ofZach EdwardsNo ratings yet

- Iowa Federation of Animal Owners - 9724 - ScannedDocument4 pagesIowa Federation of Animal Owners - 9724 - ScannedZach EdwardsNo ratings yet

- Winnebago Republican Women - 9640 - ScannedDocument3 pagesWinnebago Republican Women - 9640 - ScannedZach EdwardsNo ratings yet

- Greimann Jane - 1204 - ScannedDocument5 pagesGreimann Jane - 1204 - ScannedZach EdwardsNo ratings yet

- FORM DR-2: Disclosure Summary PageDocument7 pagesFORM DR-2: Disclosure Summary PageZach EdwardsNo ratings yet

- Par - Aus : Disclosure Summary Page DR-2Document7 pagesPar - Aus : Disclosure Summary Page DR-2Zach EdwardsNo ratings yet

- Peterson Judith - 1538 - ScannedDocument13 pagesPeterson Judith - 1538 - ScannedZach EdwardsNo ratings yet

- Rodriguez Joseph - 1262 - ScannedDocument5 pagesRodriguez Joseph - 1262 - ScannedZach EdwardsNo ratings yet

- Sched GDocument2 pagesSched GZach EdwardsNo ratings yet

- Hy-Vee Inc Employees PAC - 6282 - ScannedDocument24 pagesHy-Vee Inc Employees PAC - 6282 - ScannedZach EdwardsNo ratings yet

- Disclosure Summary Page DR-2: Penalties Due For Late Filed Reports Range From $10 To $400Document24 pagesDisclosure Summary Page DR-2: Penalties Due For Late Filed Reports Range From $10 To $400Zach EdwardsNo ratings yet

- 2007-07-19 DR2 SummaryDocument8 pages2007-07-19 DR2 SummaryZach EdwardsNo ratings yet

- Thomas Roger - 1046 - ScannedDocument2 pagesThomas Roger - 1046 - ScannedZach EdwardsNo ratings yet

- Coppock Allen - 1311 - ScannedDocument2 pagesCoppock Allen - 1311 - ScannedZach EdwardsNo ratings yet

- 2002-10-19 DR2 Summary AmendedDocument2 pages2002-10-19 DR2 Summary AmendedZach EdwardsNo ratings yet

- McLaren Derryl - 616 - ScannedDocument3 pagesMcLaren Derryl - 616 - ScannedZach EdwardsNo ratings yet

- 2004 12 16 - DR3Document3 pages2004 12 16 - DR3Zach EdwardsNo ratings yet

- 2004-12-16 DR2 SummaryDocument2 pages2004-12-16 DR2 SummaryZach EdwardsNo ratings yet

- Disclosur Summary Page Be Same As On Statement of Organization) JUN 1 0 $ OQ Repor?Document10 pagesDisclosur Summary Page Be Same As On Statement of Organization) JUN 1 0 $ OQ Repor?Zach EdwardsNo ratings yet

- Disclosure Summary Page DR-2: For Instructions, See Aack of Form BeDocument10 pagesDisclosure Summary Page DR-2: For Instructions, See Aack of Form BeZach EdwardsNo ratings yet

- 2005-09-21 DR2 SummaryDocument4 pages2005-09-21 DR2 SummaryZach EdwardsNo ratings yet

- Disclosure Summary Page: For Instructions, See Back of FormDocument2 pagesDisclosure Summary Page: For Instructions, See Back of FormZach EdwardsNo ratings yet

- Disclosure Summary Page DR-2: For Instructions, See Back of FormDocument6 pagesDisclosure Summary Page DR-2: For Instructions, See Back of FormZach EdwardsNo ratings yet

- Disclosure Summary Pa DR-2Document8 pagesDisclosure Summary Pa DR-2Zach EdwardsNo ratings yet

- Cohoon Dennis - 376 - ScannedDocument3 pagesCohoon Dennis - 376 - ScannedZach EdwardsNo ratings yet

- Heck Steven - 1543 - ScannedDocument8 pagesHeck Steven - 1543 - ScannedZach EdwardsNo ratings yet

- Phoenix John - 1315 - ScannedDocument2 pagesPhoenix John - 1315 - ScannedZach EdwardsNo ratings yet

- Cataldo Michael - 754 - ScannedDocument2 pagesCataldo Michael - 754 - ScannedZach EdwardsNo ratings yet

- Disclosure Summary Page Elect Niay 6 2o02 DR-2: Routine Penalties Due For Late Filed Reports Range From $20 To $800Document7 pagesDisclosure Summary Page Elect Niay 6 2o02 DR-2: Routine Penalties Due For Late Filed Reports Range From $20 To $800Zach EdwardsNo ratings yet

- Disclosure Summary Pag DR-2 I: Use - Only 7Document4 pagesDisclosure Summary Pag DR-2 I: Use - Only 7Zach EdwardsNo ratings yet

- Polk County Republican Womens Club - 9628 - ScannedDocument13 pagesPolk County Republican Womens Club - 9628 - ScannedZach EdwardsNo ratings yet

- Henry County Republican Women 9536 ScannedDocument3 pagesHenry County Republican Women 9536 ScannedZach EdwardsNo ratings yet

- Disclosure Summary Page DR-2: Statement of Cash On HandDocument7 pagesDisclosure Summary Page DR-2: Statement of Cash On HandZach EdwardsNo ratings yet

- Iron Workers Local 67 PAC - 6148 - ScannedDocument3 pagesIron Workers Local 67 PAC - 6148 - ScannedZach EdwardsNo ratings yet

- Disclosure Summary Page DR-2: Torr) 1 Ec Rrow NDocument5 pagesDisclosure Summary Page DR-2: Torr) 1 Ec Rrow NZach EdwardsNo ratings yet

- Vitamvas Sally 1566 ScannedDocument3 pagesVitamvas Sally 1566 ScannedZach EdwardsNo ratings yet

- May Dennis - 339 - ScannedDocument5 pagesMay Dennis - 339 - ScannedZach EdwardsNo ratings yet

- Disclosure Summary Page: Routine Penalties Due For Late Filed Reports Range From $20 To $800Document5 pagesDisclosure Summary Page: Routine Penalties Due For Late Filed Reports Range From $20 To $800Zach EdwardsNo ratings yet

- Borlaug Allen - 610 - ScannedDocument2 pagesBorlaug Allen - 610 - ScannedZach EdwardsNo ratings yet

- Disclosure Summary Pag Jan 2 2002 1-22 DR-2Document4 pagesDisclosure Summary Pag Jan 2 2002 1-22 DR-2Zach EdwardsNo ratings yet

- Klemme Ralph - 711 - ScannedDocument6 pagesKlemme Ralph - 711 - ScannedZach EdwardsNo ratings yet

- Home Builders Assoc of Greater Cedar Rapids PAC - 6234 - ScannedDocument1 pageHome Builders Assoc of Greater Cedar Rapids PAC - 6234 - ScannedZach EdwardsNo ratings yet

- Home Builders Assoc of Greater Des Moines - 6207 - ScannedDocument3 pagesHome Builders Assoc of Greater Des Moines - 6207 - ScannedZach EdwardsNo ratings yet

- Home Builders Assoc of Greater Cedar Rapids - 6324 - ScannedDocument2 pagesHome Builders Assoc of Greater Cedar Rapids - 6324 - ScannedZach EdwardsNo ratings yet

- 2002-10-19 DR2 SummaryDocument3 pages2002-10-19 DR2 SummaryZach EdwardsNo ratings yet

- Seng Joe - 1282 - ScannedDocument12 pagesSeng Joe - 1282 - ScannedZach EdwardsNo ratings yet

- McKean Andy - 83 - ScannedDocument4 pagesMcKean Andy - 83 - ScannedZach EdwardsNo ratings yet

- Disclosure Summary Page DR-2: Foh Instructions, See Back of FormDocument6 pagesDisclosure Summary Page DR-2: Foh Instructions, See Back of FormZach EdwardsNo ratings yet

- Walter Douglas - 1273 - ScannedDocument3 pagesWalter Douglas - 1273 - ScannedZach EdwardsNo ratings yet

- Verizon Iowa State Good Government Club - 6038 - ScannedDocument97 pagesVerizon Iowa State Good Government Club - 6038 - ScannedZach EdwardsNo ratings yet

- Disclosure Summary Page DR-2: - C:: ?&W-I/vt, e SignatureDocument6 pagesDisclosure Summary Page DR-2: - C:: ?&W-I/vt, e SignatureZach EdwardsNo ratings yet

- Disclosure Summary Page ®R-2: Routine Penalties Due For Late Filed Reports Range From $20 To $800Document3 pagesDisclosure Summary Page ®R-2: Routine Penalties Due For Late Filed Reports Range From $20 To $800Zach EdwardsNo ratings yet

- Disclosure Summary Page DR-2: (Must Be Same As On Statement of Organization)Document3 pagesDisclosure Summary Page DR-2: (Must Be Same As On Statement of Organization)Zach EdwardsNo ratings yet

- Disclosure Summary Page Dr-2: - E'Le'Ct Ffte - E9Astjr1?Iffa-7) M16A) C 2., # / AyDocument7 pagesDisclosure Summary Page Dr-2: - E'Le'Ct Ffte - E9Astjr1?Iffa-7) M16A) C 2., # / AyZach EdwardsNo ratings yet

- Routine Penalties Due For Late Filed Reports Range From $20 To $800Document12 pagesRoutine Penalties Due For Late Filed Reports Range From $20 To $800Zach EdwardsNo ratings yet

- Disclosure Summary Page DR-2: Penalties Due For Late Filed Reports Range From $10 I $400Document5 pagesDisclosure Summary Page DR-2: Penalties Due For Late Filed Reports Range From $10 I $400Zach EdwardsNo ratings yet

- Cormack Michael - 891 - ScannedDocument2 pagesCormack Michael - 891 - ScannedZach EdwardsNo ratings yet

- Third Quarterly ReportDocument3 pagesThird Quarterly ReportZach EdwardsNo ratings yet

- PACEG Committee (Political Action Comm. For Effect. Govt) - 6112 - EDocument1 pagePACEG Committee (Political Action Comm. For Effect. Govt) - 6112 - EZach EdwardsNo ratings yet

- Second Quarterly ReportDocument3 pagesSecond Quarterly ReportZach EdwardsNo ratings yet

- Year-End ReportDocument12 pagesYear-End ReportZach EdwardsNo ratings yet

- PACEG Committee (Political Action Comm. For Effect. Govt) - 6112 - EDocument1 pagePACEG Committee (Political Action Comm. For Effect. Govt) - 6112 - EZach EdwardsNo ratings yet

- Olson, Steve - Steve Olson For State Representative - 1387 - A - ContributionsDocument2 pagesOlson, Steve - Steve Olson For State Representative - 1387 - A - ContributionsZach EdwardsNo ratings yet

- Second Quarterly ReportDocument3 pagesSecond Quarterly ReportZach EdwardsNo ratings yet

- Third Quarterly ReportDocument3 pagesThird Quarterly ReportZach EdwardsNo ratings yet

- Third Quarterly ReportDocument3 pagesThird Quarterly ReportZach EdwardsNo ratings yet

- Olson, Rick - Committee To Elect Rick Olson To House of Representatives - 1560 - DR1Document2 pagesOlson, Rick - Committee To Elect Rick Olson To House of Representatives - 1560 - DR1Zach EdwardsNo ratings yet

- Olson, Steve - Steve Olson For State Representative - 1387 - DR1Document2 pagesOlson, Steve - Steve Olson For State Representative - 1387 - DR1Zach EdwardsNo ratings yet

- Iowa Laborers Political Action Committee - 6449 - B - ExpendituresDocument3 pagesIowa Laborers Political Action Committee - 6449 - B - ExpendituresZach EdwardsNo ratings yet

- Olson, Steve - Steve Olson For State Representative - 1387 - DR2 - SummaryDocument1 pageOlson, Steve - Steve Olson For State Representative - 1387 - DR2 - SummaryZach EdwardsNo ratings yet

- Olson, Steve - Steve Olson For State Representative - 1387 - B - ExpendituresDocument1 pageOlson, Steve - Steve Olson For State Representative - 1387 - B - ExpendituresZach EdwardsNo ratings yet

- Olson, Rick - Committee To Elect Rick Olson To House of Representatives - 1560 - DR1Document2 pagesOlson, Rick - Committee To Elect Rick Olson To House of Representatives - 1560 - DR1Zach EdwardsNo ratings yet

- Wipperman, Citizens For Wipperman - 1670 - DR2 - SummaryDocument1 pageWipperman, Citizens For Wipperman - 1670 - DR2 - SummaryZach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR2 - SummaryDocument1 pageOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR2 - SummaryZach EdwardsNo ratings yet

- Wipperman, Citizens For Wipperman - 1670 - DR2 - SummaryDocument1 pageWipperman, Citizens For Wipperman - 1670 - DR2 - SummaryZach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR1Document2 pagesOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR1Zach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - E - in - KindDocument1 pageOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - E - in - KindZach EdwardsNo ratings yet

- Olson, Olson For State Representative Committee, Donovan Olson, Can - 1392 - A - ContributionsDocument9 pagesOlson, Olson For State Representative Committee, Donovan Olson, Can - 1392 - A - ContributionsZach EdwardsNo ratings yet

- Reynolds, Committee To Re-Elect Representative Reynolds - 1052 - BDocument1 pageReynolds, Committee To Re-Elect Representative Reynolds - 1052 - BZach EdwardsNo ratings yet

- Olson, Olson For State Representative Committee, Donovan Olson, Can - 1392 - ADocument7 pagesOlson, Olson For State Representative Committee, Donovan Olson, Can - 1392 - AZach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR1Document2 pagesOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR1Zach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - A - ContributionsDocument1 pageOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - A - ContributionsZach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - B - ExpendituresDocument1 pageOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - B - ExpendituresZach EdwardsNo ratings yet

- Olson, Dennis - Dennis Olson For Representative - 1920 - DR2 - SummaryDocument1 pageOlson, Dennis - Dennis Olson For Representative - 1920 - DR2 - SummaryZach EdwardsNo ratings yet

- Olson, Dennis - Dennis Olson For Representative - 1920 - D - DebtsDocument1 pageOlson, Dennis - Dennis Olson For Representative - 1920 - D - DebtsZach EdwardsNo ratings yet

- Olson, Dennis - Dennis Olson For Representative - 1920 - E - in - KindDocument1 pageOlson, Dennis - Dennis Olson For Representative - 1920 - E - in - KindZach EdwardsNo ratings yet

- Olson, Dennis - Dennis Olson For Representative - 1920 - DR1 - 04-26-2010Document2 pagesOlson, Dennis - Dennis Olson For Representative - 1920 - DR1 - 04-26-2010Zach EdwardsNo ratings yet

- Finance - Cost of Capital TheoryDocument30 pagesFinance - Cost of Capital TheoryShafkat RezaNo ratings yet

- Wilcon Depot Quarterly Earnings, Revenue, EPS and Forecast SummaryDocument9 pagesWilcon Depot Quarterly Earnings, Revenue, EPS and Forecast SummaryAleli BaluyoNo ratings yet

- Government of Ghana MLGRD A Operational Manual For Dpat 2016 A 1st CycleDocument84 pagesGovernment of Ghana MLGRD A Operational Manual For Dpat 2016 A 1st CycleGifty BaidooNo ratings yet

- FI BankDocument34 pagesFI BankoptymNo ratings yet

- Presentation Made To Analyst/Institutional Investors at Motilal Oswal Investor ConferenceDocument32 pagesPresentation Made To Analyst/Institutional Investors at Motilal Oswal Investor ConferenceShyam SunderNo ratings yet

- Liberty Secure Future Connect Group Policy Enrollment FormDocument2 pagesLiberty Secure Future Connect Group Policy Enrollment FormAbcNo ratings yet

- Arbitrage Pricing Theory ExplainedDocument41 pagesArbitrage Pricing Theory ExplainedPablo DiegoNo ratings yet

- Mitigating Control: 1. General InformationDocument2 pagesMitigating Control: 1. General InformationRavi KumarNo ratings yet

- 1240 - Dela Cruz v. ConcepcionDocument6 pages1240 - Dela Cruz v. ConcepcionRica Andrea OrtizoNo ratings yet

- Appendix 10D - Instructions - RBUDCODocument1 pageAppendix 10D - Instructions - RBUDCOdinvNo ratings yet

- Viva Ruchi MamDocument9 pagesViva Ruchi Mam21358 NDIMNo ratings yet

- Residual Income Model ExplainedDocument12 pagesResidual Income Model ExplainedKanav GuptaNo ratings yet

- DavisIM PDFDocument36 pagesDavisIM PDFRizwanNo ratings yet

- Clarifies On News Item (Company Update)Document3 pagesClarifies On News Item (Company Update)Shyam SunderNo ratings yet

- Calculating Transaction Price for New ProductDocument3 pagesCalculating Transaction Price for New Productjefferson sarmientoNo ratings yet

- Profitability Analysis - Product Wise/ Segment Wise/ Customer WiseDocument10 pagesProfitability Analysis - Product Wise/ Segment Wise/ Customer WisecasarokarNo ratings yet

- FINMAN 4 - Instructional Material 1Document25 pagesFINMAN 4 - Instructional Material 1Justine NeronaNo ratings yet

- DLF Cost Sheet PlotsDocument6 pagesDLF Cost Sheet PlotsTobaNo ratings yet

- International Capital MarketDocument2 pagesInternational Capital MarketPhuc LeNo ratings yet

- Case Study: Buffett Invests in Nebraska Furniture MartDocument8 pagesCase Study: Buffett Invests in Nebraska Furniture MartceojiNo ratings yet

- Global Financial Crisis and Key Risks: Impact On India and AsiaDocument24 pagesGlobal Financial Crisis and Key Risks: Impact On India and AsiaGauravNo ratings yet

- Group 3 CostingDocument68 pagesGroup 3 CostingPY SorianoNo ratings yet

- Types of Assessment and Tax ProceduresDocument9 pagesTypes of Assessment and Tax ProceduresRasel AshrafulNo ratings yet

- Daro Nacar Vs Gallery Frames DigestDocument4 pagesDaro Nacar Vs Gallery Frames DigestMyra MyraNo ratings yet

- Risk Management in Bse and NseDocument52 pagesRisk Management in Bse and NseAvtaar SinghNo ratings yet

- Skripsi Tanpa PembahasanDocument99 pagesSkripsi Tanpa PembahasanJohanes ProNo ratings yet

- Csc-Roii-Acic and Lddap of Payment For Online TrainingDocument4 pagesCsc-Roii-Acic and Lddap of Payment For Online TrainingJale Ann A. EspañolNo ratings yet

- Professional Legal Services and Attorneys in ArmeniaDocument17 pagesProfessional Legal Services and Attorneys in ArmeniaAMLawFirmNo ratings yet

- Capital Market Regulatory Insight - P.S.rao & AssociatesDocument43 pagesCapital Market Regulatory Insight - P.S.rao & AssociatesSharath Srinivas Budugunte100% (1)

- Project GuideDocument22 pagesProject GuideMr DamphaNo ratings yet