Professional Documents

Culture Documents

Sched D

Uploaded by

Zach EdwardsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sched D

Uploaded by

Zach EdwardsCopyright:

Available Formats

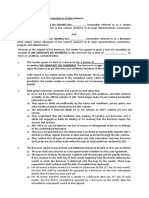

FOR INSTRUCTIONS, SEE BACK OF FORM SCHEDULE

D INCURRED

COMMITTEE NAME (Must be same as on Statement of Organization) (Rev. 08/98) INDEBTEDNESS

CHECK THIS BOX

IF AMENDING

NOTE: Debts previously reported that remain unpaid must be included on this Reset Form FORM

Schedule, as well as any new obligations incurred in this period.

An “incurred debt” is a debt for

DEBTS/OBLIGATIONS REMAINING THIS REPORTING PERIOD goods or services ordered or

(DO NOT INCLUDE LOANS -- SHOW LOANS ON SCHEDULE F) received, but not paid for by the

end of the reporting period.,

regardless of whether an invoice

has been received.

DATE DESCRIPTION OF GOODS OR BALANCE OWED AT

INCURRED NAME AND ADDRESS OF PERSON SERVICES PROVIDED OR CLOSE OF

(MM/DD/YR) TO WHOM DEBT OR OBLIGATION IS OWED PURCHASED REPORTING

PERIOD*

$

SUB-TOTAL $

TOTAL DEBTS OWED BY COMMITTEE AT THE END OF THIS REPORTING PERIOD $

*If actual figure is unknown, show “estimated” beside the figure. Page _________ of ________

(for Schedule D)

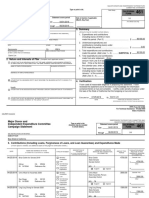

CANDIDATE COMMITTEES NOTE:

*Incurred indebtedness also includes each person/entity with whom the candidate’s committee has entered into a contract during the reporting period for future

or continuing performance. Enter the name of the consultant who provides or procures services for items such as advertising, fund-raising, polling, managing, or

organizing services. Report on Schedule G the nature of performance and the estimated performance reasonably expected of the consultant.

SCHEDULE D

INCURRED INDEBTEDNESS

DEBTS AND OBLIGATIONS

An “incurred debt” is an obligation not paid for by the end of the reporting period.

“Incurred debts” include:

•= Merchandise which may have been received, but not invoiced.

•= Merchandise which may have been ordered, but not received.

•= Merchandise or services which may have been received and invoiced, but remain

unpaid.

An incurred debt should continue to be shown on each report until it has been reported

on Schedule B or Schedule E. Schedule D is to reflect all of the outstanding obligations (except

loans) as of the end of each reporting period.

1. List the name of the committee at the top of each Schedule page. If you are amending

the form, check the box to indicate this in the top right-hand corner.

2. List the exact date the debt was incurred (month, day, year). If an additional debt is

incurred with the same creditor, list that transaction separately. For example, advertisements

ordered on separate dates from the same newspaper need to be listed separately, by date

incurred, not “lumped together”.

3. List the complete name and address of the person or organization to whom the debt is

owed, including street address or box, city, state and zip.

4. Identify product or service provided or purchased.

5. List the amount owed. If the exact amount is not known, show “estimated” beside the

figure.

6. Subtotal and total the page or pages as applicable.

7. Number the page appropriately (i.e., page 1 of 3, 2 of 3, 3 of 3, etc.).

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Top 100 Volume Robocallers April 2021-CombinedDocument6 pagesTop 100 Volume Robocallers April 2021-CombinedAnonymous Pb39klJ0% (1)

- Compendium of PNB Products & ServicesDocument125 pagesCompendium of PNB Products & ServicesRomanshu PorwalNo ratings yet

- Survey Questionnier For Startup BarriersDocument5 pagesSurvey Questionnier For Startup BarriersSarhangTahir100% (4)

- Audit Engagement LetterDocument3 pagesAudit Engagement LetterMakeup Viral StudiosNo ratings yet

- CA Certificate For VisaDocument4 pagesCA Certificate For VisaVamshi Krishna Reddy Pathi0% (1)

- Loan Agreement FINALDocument7 pagesLoan Agreement FINALAbhishek MitraNo ratings yet

- Tuning Up The Turtle StrategyDocument5 pagesTuning Up The Turtle Strategybillthegeek100% (2)

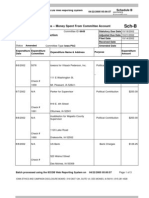

- Blue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementDocument6 pagesBlue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementWAKESHEEP Marie RNNo ratings yet

- Economic Value Added AnalysisDocument14 pagesEconomic Value Added AnalysisBharath Pavanje50% (2)

- Capital BudgetingDocument13 pagesCapital BudgetingBridge VillacuraNo ratings yet

- 5rd Sessiom - Audit of LeaseDocument21 pages5rd Sessiom - Audit of LeaseRyan Victor Morales100% (1)

- Sched GDocument2 pagesSched GZach EdwardsNo ratings yet

- Sched FDocument2 pagesSched FZach EdwardsNo ratings yet

- Financial StatementsDocument30 pagesFinancial StatementsMarcel VelascoNo ratings yet

- Appendix 24 - Qrror - Far 5Document1 pageAppendix 24 - Qrror - Far 5pdmu regionixNo ratings yet

- Appendix 24 - Qrror - Far 5Document1 pageAppendix 24 - Qrror - Far 5gbertNo ratings yet

- Appendix 24 - Qrror - Far 5Document1 pageAppendix 24 - Qrror - Far 5Mark Joseph BajaNo ratings yet

- Appendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSDocument1 pageAppendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSPau PerezNo ratings yet

- Disclosure Summary Page DR-2: Penalties Due For Late Filed Reports Range From $10 To $400Document24 pagesDisclosure Summary Page DR-2: Penalties Due For Late Filed Reports Range From $10 To $400Zach EdwardsNo ratings yet

- SECURITIES AND EXCHANGE COMMISSION FORM 23-BDocument4 pagesSECURITIES AND EXCHANGE COMMISSION FORM 23-BMartin Lewis KoaNo ratings yet

- Name of Company: Work Progress ReportDocument4 pagesName of Company: Work Progress ReportLenin Rey PolonNo ratings yet

- Disclosure Summary Pa DR-2Document8 pagesDisclosure Summary Pa DR-2Zach EdwardsNo ratings yet

- Analyze Financial StatementsDocument38 pagesAnalyze Financial StatementsSamantha OcfemiaNo ratings yet

- Vitamvas Sally 1566 ScannedDocument3 pagesVitamvas Sally 1566 ScannedZach EdwardsNo ratings yet

- Amodia - Notes (SIM 3)Document2 pagesAmodia - Notes (SIM 3)CLUVER AEDRIAN AMODIANo ratings yet

- Associated General Contractors of Iowa - 6004 - ScannedDocument12 pagesAssociated General Contractors of Iowa - 6004 - ScannedZach EdwardsNo ratings yet

- ACCOUNTING Reviewer Chapter 3 4Document4 pagesACCOUNTING Reviewer Chapter 3 4hoxhiiNo ratings yet

- US Internal Revenue Service: f1066 - 1991Document4 pagesUS Internal Revenue Service: f1066 - 1991IRSNo ratings yet

- Settlement ProposalDocument2 pagesSettlement ProposalGeorge Thomas100% (1)

- Greimann Jane - 1204 - ScannedDocument5 pagesGreimann Jane - 1204 - ScannedZach EdwardsNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Pager/SgmlDocument14 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Pager/SgmlIRSNo ratings yet

- Chapter 3 2023Document7 pagesChapter 3 2023Linh DieuNo ratings yet

- Pres Enta Tion ON: PPT Made by - Prasham Makwana Tybfm 132Document16 pagesPres Enta Tion ON: PPT Made by - Prasham Makwana Tybfm 132prasham makwanaNo ratings yet

- Chapter 2 Bus FinDocument19 pagesChapter 2 Bus FinMickaella DukaNo ratings yet

- US Internal Revenue Service: f5500sb - 1999Document8 pagesUS Internal Revenue Service: f5500sb - 1999IRSNo ratings yet

- Disclosure Summary Page La - CK - 5 + DR-2: - Ev/ G. LDocument10 pagesDisclosure Summary Page La - CK - 5 + DR-2: - Ev/ G. LZach EdwardsNo ratings yet

- Disclosur Summary Page Be Same As On Statement of Organization) JUN 1 0 $ OQ Repor?Document10 pagesDisclosur Summary Page Be Same As On Statement of Organization) JUN 1 0 $ OQ Repor?Zach EdwardsNo ratings yet

- Topic 5 Events After Reporting Period 4studentsDocument22 pagesTopic 5 Events After Reporting Period 4studentsputerimanggis11No ratings yet

- US Internal Revenue Service: I5500sb - 2003Document8 pagesUS Internal Revenue Service: I5500sb - 2003IRSNo ratings yet

- FR Prep Session (2) - 1-5Document38 pagesFR Prep Session (2) - 1-5mahachem_hariNo ratings yet

- Resolve 990 Federal Financial Disclosure - 2009Document13 pagesResolve 990 Federal Financial Disclosure - 2009ResolveNo ratings yet

- Shareholder's Instructions For Schedule K-1 (Form 1120S) : Pager/SgmlDocument8 pagesShareholder's Instructions For Schedule K-1 (Form 1120S) : Pager/SgmlIRSNo ratings yet

- 2002-10-19 DR2 Summary AmendedDocument2 pages2002-10-19 DR2 Summary AmendedZach EdwardsNo ratings yet

- Thomas Roger - 1046 - ScannedDocument2 pagesThomas Roger - 1046 - ScannedZach EdwardsNo ratings yet

- 2022 Completion of The Accounting CycleDocument30 pages2022 Completion of The Accounting CycleCharlemagne Jared RobielosNo ratings yet

- US Internal Revenue Service: f5500 - 2001Document4 pagesUS Internal Revenue Service: f5500 - 2001IRSNo ratings yet

- ACCTG 1st Sem Prelim NotesDocument11 pagesACCTG 1st Sem Prelim NoteshjNo ratings yet

- Detailed Instructions: Please SelectDocument7 pagesDetailed Instructions: Please Selectflrpatel81No ratings yet

- NOW Corporation SEC Filing Provides 26.92% Shareholding UpdateDocument5 pagesNOW Corporation SEC Filing Provides 26.92% Shareholding UpdateJulius Mark Carinhay TolitolNo ratings yet

- Liquidation Report: Payee: Dept./UnitDocument2 pagesLiquidation Report: Payee: Dept./UnitClotheshoppe ForhimherNo ratings yet

- Employee Benefit PlanDocument8 pagesEmployee Benefit PlantinydmpNo ratings yet

- Tax.3301-3 Accounting Methods and PeriodsDocument2 pagesTax.3301-3 Accounting Methods and PeriodsDena Heart OrenioNo ratings yet

- Information On Overseas Service Contract/S As of - Quarter ofDocument4 pagesInformation On Overseas Service Contract/S As of - Quarter ofLenin Rey PolonNo ratings yet

- 2008 Instructions For Schedule C Profit or Loss From BusinessDocument11 pages2008 Instructions For Schedule C Profit or Loss From BusinessBrad MotterNo ratings yet

- Form For NPS Salary DeductionDocument3 pagesForm For NPS Salary DeductionRobert ZeetNo ratings yet

- Project Details and Manpower ReportsDocument3 pagesProject Details and Manpower Reportsfegsgsgsh vagdgNo ratings yet

- NullDocument7 pagesNullsarahmahay5609No ratings yet

- Administration and Selling ExpensesDocument14 pagesAdministration and Selling ExpensesAhmed FahmyNo ratings yet

- CFAS Millan CHAPTERS 9-10Document8 pagesCFAS Millan CHAPTERS 9-10Maria Mikaela ReyesNo ratings yet

- US Internal Revenue Service: f1066 - 1997Document4 pagesUS Internal Revenue Service: f1066 - 1997IRSNo ratings yet

- Home Builders Assoc of Greater Des Moines - 6207 - ScannedDocument3 pagesHome Builders Assoc of Greater Des Moines - 6207 - ScannedZach EdwardsNo ratings yet

- Statement of Comprehensive IncomeDocument29 pagesStatement of Comprehensive IncomeMarjorie TacordaNo ratings yet

- Disabled Access Credit: General InstructionsDocument2 pagesDisabled Access Credit: General InstructionsIRSNo ratings yet

- 19h (12-00) Develop The Audit Program - Accrued Liabilities and Deferred IncomeDocument2 pages19h (12-00) Develop The Audit Program - Accrued Liabilities and Deferred IncomeTran AnhNo ratings yet

- Quarterly Contribution Return and Report of Wages: REMINDER: File Your DE 9 and DE 9C TogetherDocument2 pagesQuarterly Contribution Return and Report of Wages: REMINDER: File Your DE 9 and DE 9C TogetherWomen Cup2No ratings yet

- Tyrrell Phil - 133 - ScannedDocument3 pagesTyrrell Phil - 133 - ScannedZach EdwardsNo ratings yet

- 03 Accounting For Budgetary Accounts PT 1Document27 pages03 Accounting For Budgetary Accounts PT 1Peterson ManalacNo ratings yet

- Payroll Report Template 3434Document1 pagePayroll Report Template 3434Shaun AdamsNo ratings yet

- Third Quarterly ReportDocument3 pagesThird Quarterly ReportZach EdwardsNo ratings yet

- Year-End ReportDocument12 pagesYear-End ReportZach EdwardsNo ratings yet

- Third Quarterly ReportDocument3 pagesThird Quarterly ReportZach EdwardsNo ratings yet

- Second Quarterly ReportDocument3 pagesSecond Quarterly ReportZach EdwardsNo ratings yet

- Second Quarterly ReportDocument3 pagesSecond Quarterly ReportZach EdwardsNo ratings yet

- Olson, Rick - Committee To Elect Rick Olson To House of Representatives - 1560 - DR1Document2 pagesOlson, Rick - Committee To Elect Rick Olson To House of Representatives - 1560 - DR1Zach EdwardsNo ratings yet

- Olson, Steve - Steve Olson For State Representative - 1387 - DR1Document2 pagesOlson, Steve - Steve Olson For State Representative - 1387 - DR1Zach EdwardsNo ratings yet

- Olson, Steve - Steve Olson For State Representative - 1387 - DR2 - SummaryDocument1 pageOlson, Steve - Steve Olson For State Representative - 1387 - DR2 - SummaryZach EdwardsNo ratings yet

- Olson, Rick - Committee To Elect Rick Olson To House of Representatives - 1560 - DR1Document2 pagesOlson, Rick - Committee To Elect Rick Olson To House of Representatives - 1560 - DR1Zach EdwardsNo ratings yet

- Third Quarterly ReportDocument3 pagesThird Quarterly ReportZach EdwardsNo ratings yet

- Olson, Steve - Steve Olson For State Representative - 1387 - A - ContributionsDocument2 pagesOlson, Steve - Steve Olson For State Representative - 1387 - A - ContributionsZach EdwardsNo ratings yet

- Olson, Steve - Steve Olson For State Representative - 1387 - B - ExpendituresDocument1 pageOlson, Steve - Steve Olson For State Representative - 1387 - B - ExpendituresZach EdwardsNo ratings yet

- Wipperman, Citizens For Wipperman - 1670 - DR2 - SummaryDocument1 pageWipperman, Citizens For Wipperman - 1670 - DR2 - SummaryZach EdwardsNo ratings yet

- Iowa Laborers Political Action Committee - 6449 - B - ExpendituresDocument3 pagesIowa Laborers Political Action Committee - 6449 - B - ExpendituresZach EdwardsNo ratings yet

- PACEG Committee (Political Action Comm. For Effect. Govt) - 6112 - EDocument1 pagePACEG Committee (Political Action Comm. For Effect. Govt) - 6112 - EZach EdwardsNo ratings yet

- PACEG Committee (Political Action Comm. For Effect. Govt) - 6112 - EDocument1 pagePACEG Committee (Political Action Comm. For Effect. Govt) - 6112 - EZach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - A - ContributionsDocument1 pageOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - A - ContributionsZach EdwardsNo ratings yet

- Wipperman, Citizens For Wipperman - 1670 - DR2 - SummaryDocument1 pageWipperman, Citizens For Wipperman - 1670 - DR2 - SummaryZach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR2 - SummaryDocument1 pageOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR2 - SummaryZach EdwardsNo ratings yet

- Olson, Olson For State Representative Committee, Donovan Olson, Can - 1392 - A - ContributionsDocument9 pagesOlson, Olson For State Representative Committee, Donovan Olson, Can - 1392 - A - ContributionsZach EdwardsNo ratings yet

- Reynolds, Committee To Re-Elect Representative Reynolds - 1052 - BDocument1 pageReynolds, Committee To Re-Elect Representative Reynolds - 1052 - BZach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - B - ExpendituresDocument1 pageOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - B - ExpendituresZach EdwardsNo ratings yet

- Olson, Dennis - Dennis Olson For Representative - 1920 - DR2 - SummaryDocument1 pageOlson, Dennis - Dennis Olson For Representative - 1920 - DR2 - SummaryZach EdwardsNo ratings yet

- Olson, Olson For State Representative Committee, Donovan Olson, Can - 1392 - ADocument7 pagesOlson, Olson For State Representative Committee, Donovan Olson, Can - 1392 - AZach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - E - in - KindDocument1 pageOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - E - in - KindZach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR1Document2 pagesOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR1Zach EdwardsNo ratings yet

- Olson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR1Document2 pagesOlson, Donovan - Olson For State Representative Committee, Donovan Olson, Can - 1392 - DR1Zach EdwardsNo ratings yet

- Olson, Dennis - Dennis Olson For Representative - 1920 - E - in - KindDocument1 pageOlson, Dennis - Dennis Olson For Representative - 1920 - E - in - KindZach EdwardsNo ratings yet

- Olson, Dennis - Dennis Olson For Representative - 1920 - DR1 - 04-26-2010Document2 pagesOlson, Dennis - Dennis Olson For Representative - 1920 - DR1 - 04-26-2010Zach EdwardsNo ratings yet

- Olson, Dennis - Dennis Olson For Representative - 1920 - D - DebtsDocument1 pageOlson, Dennis - Dennis Olson For Representative - 1920 - D - DebtsZach EdwardsNo ratings yet

- Salary Loan/Advance - Application Form: Personal InformationDocument2 pagesSalary Loan/Advance - Application Form: Personal InformationJohn Ray Velasco100% (1)

- JD Analyst RIS 2023-24Document1 pageJD Analyst RIS 2023-24Aishwarya GuptaNo ratings yet

- ct860 Data Dict 20200330Document46 pagesct860 Data Dict 20200330ANKUR PUROHITNo ratings yet

- BopDocument105 pagesBopAleena ShahNo ratings yet

- Delta 9 Deck ApprovedDocument23 pagesDelta 9 Deck ApprovedAnonymous xhcUYpAlNo ratings yet

- Global Depository ReceiptsDocument4 pagesGlobal Depository ReceiptsSaiyam ChaturvediNo ratings yet

- Multi Sports FacilityDocument7 pagesMulti Sports FacilityDivyanshu ShekharNo ratings yet

- Business FinanceDocument2 pagesBusiness FinancejonaNo ratings yet

- Em 504 Financial Management BautistaDocument8 pagesEm 504 Financial Management BautistaPatricia Mae SamaritaNo ratings yet

- Working Capital OverviewDocument8 pagesWorking Capital OvervieweferemNo ratings yet

- Fairchem Organics LimitedDocument16 pagesFairchem Organics Limitedsaipavan999No ratings yet

- Assessing Fraud Risk Factors of Assets Misappropriation: Evidences From Iranian BanksDocument6 pagesAssessing Fraud Risk Factors of Assets Misappropriation: Evidences From Iranian BanksNayda RyiadiNo ratings yet

- Equity Investment 2 - ValuationDocument34 pagesEquity Investment 2 - Valuationnur syahirah bt ab.rahmanNo ratings yet

- HBL Schedule of Bank ChargesDocument25 pagesHBL Schedule of Bank ChargesJohn Wick60% (5)

- Advance Accounting - Dayag 2015. Chapter 7 Problem IIIDocument1 pageAdvance Accounting - Dayag 2015. Chapter 7 Problem IIIJohn Carlos DoringoNo ratings yet

- Valuation of BondsDocument7 pagesValuation of BondsHannah Louise Gutang PortilloNo ratings yet

- CTS ROLES AND TOPICS ON PERCENTAGES, PROFIT AND LOSS, SIMPLE INTEREST, COMPOUND INTERESTDocument12 pagesCTS ROLES AND TOPICS ON PERCENTAGES, PROFIT AND LOSS, SIMPLE INTEREST, COMPOUND INTERESTArunNo ratings yet

- Girnar Insurance Brokers Private Limited: Salary Slip For The Month of November - 2022Document2 pagesGirnar Insurance Brokers Private Limited: Salary Slip For The Month of November - 2022karanmitroo1No ratings yet

- NatureviewFarm Group6 SectionADocument10 pagesNatureviewFarm Group6 SectionAChetali HedauNo ratings yet

- Chapter 4 The Meaning of Interest RatesDocument4 pagesChapter 4 The Meaning of Interest RatesSamanthaHand100% (1)