Professional Documents

Culture Documents

CAMPOFRIO RATIOSv1

Uploaded by

Nacho Marijuan0 ratings0% found this document useful (0 votes)

28 views15 pagesExport Turnover Material Costs Costs of Employees Depreciation Interest Paid Research and Development expenses Cash Flow Added Value EBITDA Operating Revenue / Turnover Sales (NET) Costs of Goods Sold Gross Profit Other Operating Expenses Operating P / L [=EBIT]

Original Description:

Original Title

CAMPOFRIO RATIOSv1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentExport Turnover Material Costs Costs of Employees Depreciation Interest Paid Research and Development expenses Cash Flow Added Value EBITDA Operating Revenue / Turnover Sales (NET) Costs of Goods Sold Gross Profit Other Operating Expenses Operating P / L [=EBIT]

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views15 pagesCAMPOFRIO RATIOSv1

Uploaded by

Nacho MarijuanExport Turnover Material Costs Costs of Employees Depreciation Interest Paid Research and Development expenses Cash Flow Added Value EBITDA Operating Revenue / Turnover Sales (NET) Costs of Goods Sold Gross Profit Other Operating Expenses Operating P / L [=EBIT]

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 15

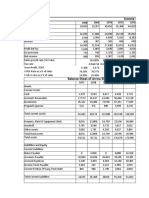

P & L ACCOUNT

12/31/2009 12/31/2008 12/31/2007 12/31/2006 12/31/2005

th EUR th EUR th EUR th EUR th EUR

IFRS IFRS IFRS IFRS IFRS

Operating Revenue/Turnover 1,857,129 928,839 988,960 875,239 920,349

Sales (NET) 1,845,655 921,829 968,455 864,554 911,056

Costs of Goods Sold 959,652 469,456 478,317 438,284 455,921

Gross Profit 897,477 459,383 510,643 436,955 464,428

Other Operating Expenses 816,396 412,845 439,838 379,592 411,103

Operating P/L [=EBIT] 81,081 46,538 70,805 57,363 53,325

Financial Revenue 4,422 7,042 6,455 7,541 3,545

Financial Expenses 66,502 27,323 28,637 10,890 15,829

Financial P/L -62,080 -20,281 -22,182 -3,349 -12,284

P/L before Tax & Extr. Items 19,001 26,257 48,623 54,014 41,041

Taxation 2,293 12,848 15,468 22,480 15,405

P/L after Tax 16,708 13,409 33,155 31,534 25,636

Extr. and Other P/L -2,743 -19,258 -1,002 -1,441 -283

P/L for Period [= Net Income] 13,965 -5,849 32,153 30,093 25,353

Memo lines

Export Turnover n.a. n.a. n.a. n.a. n.a.

Material Costs n.a. n.a. n.a. n.a. n.a.

Costs of Employees 351,117 155,328 161,262 141,386 147,777

Depreciation 56,877 27,851 31,942 28,971 29,586

Interest Paid 38,518 23,021 24,632 23,773 19,595

Research & Development n.a. n.a. n.a. n.a. n.a.

expenses

Cash Flow 70,842 22,002 64,095 59,064 54,939

Added Value 458,184 187,503 234,521 201,743 206,906

EBITDA 137,958 74,389 102,747 86,334 82,911

NT

12/31/2004 12/31/2003 12/31/2002 12/31/2001 12/31/2000

th EUR th EUR th EUR th EUR th EUR

IFRS Local GAAP Local GAAP Local GAAP Local GAAP

991,861 1,085,397 1,412,624 1,520,247 1,286,569 12/31/2009 12/31/2008

982,728 1,076,860 1,410,918 1,512,658 1,270,998 100.00% 100.00%

512,309 572,137 846,570 990,536 817,646 52.00% 50.93%

479,552 513,260 566,054 529,711 468,923 48.63% 49.83%

431,164 452,769 519,083 478,452 428,230 44.23% 44.79%

48,388 60,491 46,971 51,259 40,693 4.39% 5.05%

4,607 3,618 3,107 1,420 1,597 0.24% 0.76%

-4,703 44,402 47,172 23,664 6,533 3.60% 2.96%

9,310 -40,784 -44,065 -22,244 -4,936 -3.36% -2.20%

57,698 19,707 2,906 29,015 35,757 1.03% 2.85%

17,451 6,787 -24,449 -1,369 2,006 0.12% 1.39%

40,247 12,920 27,355 30,384 33,751 0.91% 1.45%

-592 -896 -4,887 -4,660 -3,125 -0.15% -2.09%

39,655 12,024 22,468 25,724 30,626 0.76% -0.63%

n.a. n.a. n.a. n.a. n.a.

n.a. n.a. n.a. n.a. n.a.

162,261 164,211 199,381 207,156 175,040

39,396 43,192 47,625 53,783 45,687

16,911 21,137 23,785 27,098 19,462

n.a. n.a. n.a. n.a. n.a.

79,051 55,216 70,093 79,507 76,313

240,772 233,777 317,708 315,130 268,809

87,784 103,683 94,596 105,042 86,380

ANALISIS VERTICAL

12/31/2007 12/31/2006 12/31/2005 12/31/2004 12/31/2003 12/31/2002 12/31/2001 12/31/2000

100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

49.39% 50.69% 50.04% 52.13% 53.13% 60.00% 65.48% 64.33%

52.73% 50.54% 50.98% 48.80% 47.66% 40.12% 35.02% 36.89%

45.42% 43.91% 45.12% 43.87% 42.05% 36.79% 31.63% 33.69%

7.31% 6.63% 5.85% 4.92% 5.62% 3.33% 3.39% 3.20%

0.67% 0.87% 0.39% 0.47% 0.34% 0.22% 0.09% 0.13%

2.96% 1.26% 1.74% -0.48% 4.12% 3.34% 1.56% 0.51%

-2.29% -0.39% -1.35% 0.95% -3.79% -3.12% -1.47% -0.39%

5.02% 6.25% 4.50% 5.87% 1.83% 0.21% 1.92% 2.81%

1.60% 2.60% 1.69% 1.78% 0.63% -1.73% -0.09% 0.16%

3.42% 3.65% 2.81% 4.10% 1.20% 1.94% 2.01% 2.66%

-0.10% -0.17% -0.03% -0.06% -0.08% -0.35% -0.31% -0.25%

3.32% 3.48% 2.78% 4.04% 1.12% 1.59% 1.70% 2.41%

ANALISIS HORIZONTAL

12/31/2009 12/31/2008 12/31/2007 12/31/2006 12/31/2005 12/31/2004 12/31/2003

100.22% -4.81% 12.02% -5.10% -7.29% -8.74% -23.68%

104.42% -1.85% 9.13% -3.87% -11.01% -10.46% -32.42%

95.37% -10.04% 16.86% -5.92% -3.15% -6.57% -9.33%

97.75% -6.14% 15.87% -7.66% -4.65% -4.77% -12.78%

74.23% -34.27% 23.43% 7.57% 10.20% -20.01% 28.78%

-37.21% 9.09% -14.40% 112.72% -23.05% 27.34% 16.45%

143.39% -4.59% 162.97% -31.20% -436.57% -110.59% -5.87%

206.10% -8.57% 562.35% -72.74% -231.94% -122.83% -7.45%

-27.63% -46.00% -9.98% 31.61% -28.87% 192.78% 578.15%

-82.15% -16.94% -31.19% 45.93% -11.72% 157.12% -127.76%

24.60% -59.56% 5.14% 23.01% -36.30% 211.51% -52.77%

-85.76% 1821.96% -30.46% 409.19% -52.20% -33.93% -81.67%

-338.76% -118.19% 6.85% 18.70% -36.07% 229.80% -46.48%

12/31/2002 12/31/2001 12/31/2009 12/31/2008 12/31/2007 12/31/2006 12/31/2005

-6.73% 19.01%

-14.53% 21.14%

6.86% 12.96%

8.49% 11.73%

-8.37% 25.97%

118.80% -11.08%

99.34% 262.22%

98.10% 350.65%

-89.98% -18.86%

1685.90% -168.25%

-9.97% -9.98%

4.87% 49.12%

-12.66% -16.01%

12/31/2004 12/31/2003 12/31/2002 12/31/2001 12/31/2001

BALANCE SHEET

12/31/2009 12/31/2008 12/31/2007 12/31/2006 12/31/2005 12/31/2004

12 months 12 months 12 months 12 months 12 months 12 months

Unaudited Unqual Unqual Unqual Unqual Unqual

th EUR th EUR th EUR th EUR th EUR th EUR

IFRS IFRS IFRS IFRS IFRS IFRS

AR AR AR AR AR AR

Fixed Assets 1,243,371 1,250,140 504,365 594,340 510,209 494,164

Intangible Fixed Assets 602,575 571,524 146,640 148,005 151,674 152,035

Tangible Fixed Assets 566,241 609,770 329,127 333,549 270,052 247,661

Other Fixed Assets 74,555 68,846 28,598 112,786 88,483 94,468

Current Assets 670,877 711,201 542,648 513,320 546,495 525,037

Stocks 273,900 318,698 209,364 202,556 220,628 228,889

Debtors 180,453 187,147 69,398 64,322 64,609 39,561

Other Current Assets 216,524 205,356 263,886 246,442 261,258 256,587

Cash & Cash Equivalent 160,159 120,958 224,467 208,944 214,470 205,884

Total Assets 1,914,248 1,961,341 1,047,013 1,107,660 1,056,704 1,019,201

Shareholders Funds 616,017 608,293 314,049 286,002 299,512 322,940

Capital 102,221 102,221 52,644 52,644 52,644 52,644

Other Shareholders Funds 513,796 506,072 261,405 233,358 246,868 270,296

Non Current Liabilities 764,573 655,800 386,261 430,037 421,437 381,704

Long Term Debt 555,897 447,868 308,374 331,004 338,807 302,394

Other Non-Current Liabilities 208,676 207,932 77,887 99,033 82,630 79,310

Provisions 51,312 39,115 13,576 32,677 22,516 21,424

Current Liabilities 533,658 697,248 346,703 391,621 335,755 314,557

Loans 0 4,250 536 51,784 1,217 1,953

Creditors 405,656 410,504 269,090 232,629 263,636 257,805

Other Current Liabilities 128,002 282,494 77,077 107,208 70,902 54,799

Total Shareh. Funds & Liab. 1,914,248 1,961,341 1,047,013 1,107,660 1,056,704 1,019,201

Memo lines

Working Capital 48,697 95,341 9,672 34,249 21,601 10,645

Net Current Assets 137,219 13,953 195,945 121,699 210,740 210,480

Enterprise Value 1,090,072 807,434 609,567 955,885 848,724 723,563

Employees 9,326 5,187 5,198 5,687 5,712 6,327

AC 35% 36% 52% 46% 52% 52%

PC 28% 36% 33% 35% 32% 31%

AF 65% 64% 48% 54% 48% 48%

P LP 40% 33% 37% 39% 40% 37%

RP 32% 31% 30% 26% 28% 32%

12/31/2003 12/31/2002 12/31/2001 12/31/2000

12 months 12 months 12 months 12 months

Unqual Unqual Unqual Qualif n.a.

th EUR th EUR th EUR th EUR

Local GAAP Local GAAP Local GAAP Local GAAP

AR AR AR ANALISIS HORIZONTAL

12/31/2009 12/31/2008 12/31/2007 12/31/2006

473,800 498,194 552,008 579,485 -0.54% 147.86% -15.14% 16.49%

184,830 190,777 200,752 204,110 5.43% 289.75% -0.92% -2.42%

222,258 284,464 333,152 341,563 -7.14% 85.27% -1.33% 23.51%

66,712 22,953 18,104 33,812 8.29% 140.74% -74.64% 27.47%

525,459 584,162 580,938 577,905 -5.67% 31.06% 5.71% -6.07%

222,309 234,904 261,087 251,573 -14.06% 52.22% 3.36% -8.19%

50,306 78,363 203,066 210,309 -3.58% 169.67% 7.89% -0.44%

252,844 270,895 116,785 116,023 5.44% -22.18% 7.08% -5.67%

143,595 169,845 20,195 52,157 32.41% -46.11% 7.43% -2.58%

999,259 1,082,356 1,132,946 1,157,390 -2.40% 87.33% -5.48% 4.82%

338,071 351,407 254,869 286,087 1.27% 93.69% 9.81% -4.51%

52,644 52,644 39,483 39,483 0.00% 94.17% 0.00% 0.00%

285,427 298,763 215,386 246,604 1.53% 93.60% 12.02% -5.47%

322,875 376,044 365,573 422,052 16.59% 69.78% -10.18% 2.04%

283,271 313,636 299,924 342,683 24.12% 45.24% -6.84% -2.30%

39,604 62,408 65,649 79,369 0.36% 166.97% -21.35% 19.85%

11,998 6,656 2,637 3,227 31.18% 188.12% -58.45% 45.13%

338,313 354,905 512,504 449,251 -23.46% 101.11% -11.47% 16.64%

0 0 0 0 -100.00% 692.91% -98.96% 4155.05%

180,945 262,907 286,608 294,488 -1.18% 52.55% 15.67% -11.76%

157,368 91,998 225,896 154,763 -54.69% 266.51% -28.11% 51.21%

999,259 1,082,356 1,132,946 1,157,390 -2.40% 87.33% -5.48% 4.82%

91,670 50,360 177,545 167,394

187,146 229,257 68,434 128,654

666,314 n.a. n.a. n.a.

7,551 8,691 9,280 8,964

53% 54% 51% 50%

34% 33% 45% 39%

47% 46% 49% 50%

32% 35% 32% 36%

34% 32% 22% 25%

ANALISIS HORIZONTAL

12/31/2005 12/31/2004 12/31/2003 12/31/2002 12/31/2001

3.25% 4.30% -4.90% -9.75% -4.74%

-0.24% -17.74% -3.12% -4.97% -1.65%

9.04% 11.43% -21.87% -14.61% -2.46%

-6.34% 41.61% 190.65% 26.78% -46.46%

4.09% -0.08% -10.05% 0.55% 0.52%

-3.61% 2.96% -5.36% -10.03% 3.78%

63.31% -21.36% -35.80% -61.41% -3.44%

1.82% 1.48% -6.66% 131.96% 0.66%

4.17% 43.38% -15.46% 741.03% -61.28%

3.68% 2.00% -7.68% -4.47% -2.11%

-7.25% -4.48% -3.80% 37.88% -10.91%

0.00% 0.00% 0.00% 33.33% 0.00%

-8.67% -5.30% -4.46% 38.71% -12.66%

10.41% 18.22% -14.14% 2.86% -13.38%

12.04% 6.75% -9.68% 4.57% -12.48%

4.19% 100.26% -36.54% -4.94% -17.29%

5.10% 78.56% 80.26% 152.41% -18.28%

6.74% -7.02% -4.68% -30.75% 14.08%

-37.69% #DIV/0! #DIV/0! #DIV/0! #DIV/0!

2.26% 42.48% -31.18% -8.27% -2.68%

29.39% -65.18% 71.06% -59.27% 45.96%

3.68% 2.00% -7.68% -4.47% -2.11%

12/31/2009 12/31/2008 12/31/2007 12/31/2006 12/31/2005 12/31/2004

Ratios de Liquidez

AC/PC 1.26 1.02 1.57 1.31 1.63 1.67

Prueba Acida 0.74 0.56 0.96 0.79 0.97 0.94

Ratio de Solvencia

FP/PT 0.47 0.45 0.43 0.35 0.40 0.46

AT/FP 3.11 3.22 3.33 3.87 3.53 3.16

(AT-FP)/AT 0.68 0.69 0.70 0.74 0.72 0.68

Ratios de Rentabilidad

ROE 0.027 0.022 0.106 0.110 0.086 0.125

Margen 0.9% 1.5% 3.4% 3.6% 2.8% 4.1%

Rotación 96.4% 47.0% 92.5% 78.1% 86.2% 96.4%

Apalancamiento 310.7% 322.4% 333.4% 387.3% 352.8% 315.6%

ROA 0.01 0.01 0.03 0.03 0.02 0.04

Margen 0.01 0.01 0.03 0.04 0.03 0.04

Rotación 0.96 0.47 0.92 0.78 0.86 0.96

Margen EBITDA 0.49 0.50 0.53 0.51 0.51 0.49

Margen EBIT 0.04 0.05 0.07 0.07 0.06 0.05

Rotación

Rotación Stock 104.18 247.79 159.76 168.69 176.63 163.07

Rotación clientes 35.69 74.10 26.16 27.16 25.88 14.69

Rotación Proveedores 154.29 319.17 205.34 193.73 211.06 183.68

14.43 -2.72 19.42 -2.11 8.55 5.91

FM 137,219 € 13,953 € 195,945 € 121,699 € 210,740 € 210,480 €

NOF -5,915 € 4,775 € 5,233 € 30,928 € 16,940 € 3,543 €

* Hay partidas con n.a

Other Short Term 13,543 82,499 49,225 50,820 38,802 21,803

Debt

Prepaid Expenses & 26,074 53,819 13,914 14,908 20,757 15,881

Advances

Deferred Charges 0 0 0 0 0 0

Income Tax Payable 42,983 52,745 9,821 11,324 16,774 14,754

Social Expenditure 37,703 44,490 8,532 6,905 8,644 8,229

Payable

Dividends Payable n.a. 47,150 n.a. n.a. n.a. n.a.

80,686 144,385 18,353 18,229 25,418 22,983

12/31/2003 12/31/2002 12/31/2001 12/31/2000

1.55 1.65 1.13 1.29

0.90 0.98 0.62 0.73

0.51 0.48 0.29 0.33

2.96 3.08 4.45 4.05

0.66 0.68 0.78 0.75

0.038 0.078 0.119 0.118

1.2% 1.9% 2.0% 2.7%

107.8% 130.4% 133.5% 109.8%

295.6% 308.0% 444.5% 404.6%

0.01 0.03 0.03 0.03

0.01 0.02 0.02 0.03

1.08 1.30 1.34 1.10

0.48 0.40 0.35 0.37

0.06 0.03 0.03 0.03

141.82 101.28 96.21 112.30

17.05 20.27 49.00 60.40

115.44 113.35 105.61 131.46

-43.44 -8.20 -39.60 -41.24

187,146 € 229,257 € 68,434 € 128,654 €

126,569 € 102,211 € 162,709 € 149,983 €

14,941 47,778 99,364 52,052

57,354 74,763 1,442 1,458

1,238 733 0 0

15,241 13,986 12,045 14,063

8,452 9,659 4,233 4,806

n.a. n.a. n.a. n.a.

23,693 23,645 16,278 18,869

You might also like

- Vertical Analysis of Income Statement 0F Blessed TextileDocument208 pagesVertical Analysis of Income Statement 0F Blessed TextileB SNo ratings yet

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- BMP Bav ReportDocument79 pagesBMP Bav ReportThu ThuNo ratings yet

- BMP Bav Report FinalDocument93 pagesBMP Bav Report FinalThu ThuNo ratings yet

- FSP Tuka CheckDocument25 pagesFSP Tuka CheckAlina Binte EjazNo ratings yet

- AFDMDocument6 pagesAFDMAhsan IqbalNo ratings yet

- 2013 Assets Current AssetsDocument18 pages2013 Assets Current AssetsrosieNo ratings yet

- Homeritz Corporation BerhadDocument12 pagesHomeritz Corporation BerhadAfiq KhidhirNo ratings yet

- Assets Current AssetsDocument11 pagesAssets Current AssetsJohnrey FeguroNo ratings yet

- Bahan Prediksi Closing April 2019-1Document12 pagesBahan Prediksi Closing April 2019-1NazarNo ratings yet

- Income Statement-2014Quarterly - in MillionsDocument6 pagesIncome Statement-2014Quarterly - in MillionsHKS TKSNo ratings yet

- 2021 Vs 2020 BudgetsDocument2 pages2021 Vs 2020 BudgetsRappler100% (1)

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- Probation SupervisionDocument2 pagesProbation SupervisionLesson Plan ni Teacher GNo ratings yet

- 唯品会估值模型Document21 pages唯品会估值模型Yiang QinNo ratings yet

- MSFTDocument83 pagesMSFTJohn wickNo ratings yet

- Baru Baru - PT X - Study Case 5Document98 pagesBaru Baru - PT X - Study Case 5Kojiro FuumaNo ratings yet

- Aklan 2,679,336,133.00 1,929,885,856.69 72.03% 10Document7 pagesAklan 2,679,336,133.00 1,929,885,856.69 72.03% 10jean estomataNo ratings yet

- Invesment LabDocument16 pagesInvesment Labtapasya khanijouNo ratings yet

- US$ Millions, Except Number of Shares Which Are Reflected in Thousands and Per Share Amounts Consolidated Statement of OperationsDocument31 pagesUS$ Millions, Except Number of Shares Which Are Reflected in Thousands and Per Share Amounts Consolidated Statement of OperationsT CNo ratings yet

- Income Statement of Arrow Electronics: ItemsDocument78 pagesIncome Statement of Arrow Electronics: Itemsasifabdullah khanNo ratings yet

- Lala Historical Results v5 UploadDocument20 pagesLala Historical Results v5 UploadRayados PittNo ratings yet

- Atlas Battery Limted Balance Sheet As at June 30 2004Document84 pagesAtlas Battery Limted Balance Sheet As at June 30 2004loverboy_q_sNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Laporan Par Dan NPL Bulan September 2018Document2 pagesLaporan Par Dan NPL Bulan September 2018kencanaNo ratings yet

- ST BK of IndiaDocument10 pagesST BK of IndiangbopNo ratings yet

- Equity Valuation On Square Pharmaceuticals Limited - Excel FileDocument34 pagesEquity Valuation On Square Pharmaceuticals Limited - Excel FileShadman SakibNo ratings yet

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaNo ratings yet

- Pro Forma 9pm RealDocument11 pagesPro Forma 9pm Realapi-3710417No ratings yet

- Date Adj Close CCR CCR Adj Close CCR CCR CCRDocument17 pagesDate Adj Close CCR CCR Adj Close CCR CCR CCRRanjith KumarNo ratings yet

- Pak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Document14 pagesPak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Abdul RehmanNo ratings yet

- Finance 2Document208 pagesFinance 2B SNo ratings yet

- Sales CV Divisi 1 MTD & Ytd Until 02 May, Mds Mandau 258Document1 pageSales CV Divisi 1 MTD & Ytd Until 02 May, Mds Mandau 258julio prathama nugrahaNo ratings yet

- NMDC AnalysisDocument59 pagesNMDC Analysisshivani guptaNo ratings yet

- Commetrce StudyDocument2 pagesCommetrce StudyPB electronicsNo ratings yet

- Statement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Document35 pagesStatement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Tinatini BakashviliNo ratings yet

- Lap. Crosseling February 2022Document59 pagesLap. Crosseling February 2022Fatimah RizkiNo ratings yet

- New Pro Forma Use MeDocument8 pagesNew Pro Forma Use Meapi-3710417No ratings yet

- OT Assignment Subham 2Document19 pagesOT Assignment Subham 2S SubhamNo ratings yet

- Disney (Long) - Valuation - AAMDocument115 pagesDisney (Long) - Valuation - AAMJaime Vara De ReyNo ratings yet

- Excel Bav Vinamilk C A 3 Chúng TaDocument47 pagesExcel Bav Vinamilk C A 3 Chúng TaThu ThuNo ratings yet

- Veritrade Summary Mishellegonzales3799@Gmail - Com PE I 20220520000628Document4 pagesVeritrade Summary Mishellegonzales3799@Gmail - Com PE I 20220520000628Mishelle Gonzales AcuñaNo ratings yet

- HDFC BankDocument13 pagesHDFC BankAnkit KejriwalNo ratings yet

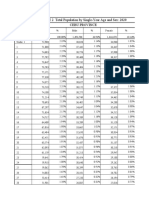

- TABLE 2 Total Population by Single-Year Age and Sex: 2020 Cebu ProvinceDocument21 pagesTABLE 2 Total Population by Single-Year Age and Sex: 2020 Cebu ProvinceDatus AlonsoNo ratings yet

- Narration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst Casekukrejanikhil70No ratings yet

- ABDM oDocument70 pagesABDM oMunish RanaNo ratings yet

- ABDMDocument75 pagesABDMMunish RanaNo ratings yet

- Public Sector Banks Comparative Analysis 3QFY24Document10 pagesPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaNo ratings yet

- Hindustan Zinc Ltd. Shivam VermaDocument37 pagesHindustan Zinc Ltd. Shivam Vermashivam vermaNo ratings yet

- SR No. Year Face Value No. of Shares Dividend Per Share EPSDocument10 pagesSR No. Year Face Value No. of Shares Dividend Per Share EPSPraharsha ChowdaryNo ratings yet

- FPC 20Document15 pagesFPC 20zugaboysuperNo ratings yet

- Income Statement of Unilever: Jan Feb Mar Apr MayDocument6 pagesIncome Statement of Unilever: Jan Feb Mar Apr MayHossain PieasNo ratings yet

- JSW Energy: Horizontal Analysis Vertical AnalysisDocument15 pagesJSW Energy: Horizontal Analysis Vertical Analysissuyash gargNo ratings yet

- MG 2021 BudgetDocument8 pagesMG 2021 BudgetJerryJoshuaDiazNo ratings yet

- NTP - Group 6 Assignment ACCDocument24 pagesNTP - Group 6 Assignment ACCChâu Nguyễn Ngọc MinhNo ratings yet

- Pt. Belfoods Indonesia Laporan Evaluasi Forecast Terhadap Aktual Sales PERIODE 2022Document422 pagesPt. Belfoods Indonesia Laporan Evaluasi Forecast Terhadap Aktual Sales PERIODE 2022pandu dinataNo ratings yet

- Particulars: Operating Profit - 560 89.11% - 1,059 - 40.23%Document16 pagesParticulars: Operating Profit - 560 89.11% - 1,059 - 40.23%Viral MehtaNo ratings yet

- A Proposed Bpo Hub in Arca SouthDocument22 pagesA Proposed Bpo Hub in Arca SouthKent Francisco0% (1)

- Application For Employment: Evadel Home Care LLCDocument6 pagesApplication For Employment: Evadel Home Care LLCAdel Carmen WaiderNo ratings yet

- BL-COMP-6103-LEC-1933T CURRENT Trends and IssuesDocument6 pagesBL-COMP-6103-LEC-1933T CURRENT Trends and Issuesaudrey mae faeldoniaNo ratings yet

- Dragon Magazine #059 PDFDocument84 pagesDragon Magazine #059 PDFasx100% (5)

- DMCDocument5 pagesDMCAmarpal YadavNo ratings yet

- NIT PMA NagalandDocument15 pagesNIT PMA NagalandBasantNo ratings yet

- MCS in Service OrganizationDocument7 pagesMCS in Service OrganizationNEON29100% (1)

- Week 2 Handout 2 - Swakarya Dry and CleanDocument11 pagesWeek 2 Handout 2 - Swakarya Dry and CleantazkiaNo ratings yet

- 17 SDDDocument6 pages17 SDDioi123No ratings yet

- Top 10 Forex Trading RulesDocument3 pagesTop 10 Forex Trading Rulescool_cyrusNo ratings yet

- BesorDocument3 pagesBesorPaul Jures DulfoNo ratings yet

- Economic Base TheoryDocument5 pagesEconomic Base TheoryBagus AndriantoNo ratings yet

- Tata Aig Booklet BackcoverDocument9 pagesTata Aig Booklet Backcoversushant pathakNo ratings yet

- Handover NoteDocument3 pagesHandover NoteEmmNo ratings yet

- Accounting For Oracle ReceivablesDocument13 pagesAccounting For Oracle ReceivablesAshokNo ratings yet

- Brief Overview of APPLDocument2 pagesBrief Overview of APPLRashedul Islam BappyNo ratings yet

- Session 4-11.8.18 PDFDocument102 pagesSession 4-11.8.18 PDFTim Dias100% (1)

- ITIL Test PaperDocument9 pagesITIL Test PaperNitinNo ratings yet

- Marketing Management NotesDocument57 pagesMarketing Management NotesKanchana Krishna KaushikNo ratings yet

- Excel Exam 01Document4 pagesExcel Exam 01redouane50% (2)

- IRDA Agent Licensing PortalDocument48 pagesIRDA Agent Licensing PortalLibin Raj100% (1)

- Counter-Brand and Alter-Brand Communities: The Impact of Web 2.0 On Tribal Marketing ApproachesDocument16 pagesCounter-Brand and Alter-Brand Communities: The Impact of Web 2.0 On Tribal Marketing ApproachesJosefBaldacchinoNo ratings yet

- Health and Safety Policy DocumentDocument4 pagesHealth and Safety Policy DocumentbnmqweNo ratings yet

- CB Consumer MovementDocument11 pagesCB Consumer Movementbhavani33% (3)

- TATA - STEEL - Group 5Document7 pagesTATA - STEEL - Group 5Sidhant NayakNo ratings yet

- Lessons From "The Founder" FilmDocument2 pagesLessons From "The Founder" FilmK ez MotoNo ratings yet

- Natalie ResumeDocument1 pageNatalie Resumeapi-430414382No ratings yet

- Hall Mark ScamDocument4 pagesHall Mark ScamSharika NahidNo ratings yet

- Graduate School BrochureDocument2 pagesGraduate School BrochureSuraj TaleleNo ratings yet

- Chapter 4 Risks and Materiality: Learning ObjectivesDocument11 pagesChapter 4 Risks and Materiality: Learning ObjectivesMohsin BasheerNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (14)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 4.5 out of 5 stars4.5/5 (14)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityFrom EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)