Professional Documents

Culture Documents

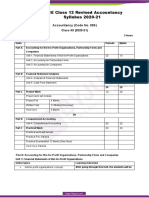

Accounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)

Uploaded by

singhankit2570 ratings0% found this document useful (0 votes)

24 views2 pagesPart (Periods 124) accounting for not-for-profit organisation: meaning and examples. Receipts and payments: meaning and concept of fund based accounting. Unit 2: accounting for Partnership firms: Fixed vs Fluctuating Capital, Division of Profit among partners, Profit and Loss Appropriation Account. Unit 3: Reconstitution of Partnership: Changes in Profit Sharing ratio among the existing partners-Sacrificing ratio and Gaining Rati

Original Description:

Original Title

New Microsoft Word Document

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPart (Periods 124) accounting for not-for-profit organisation: meaning and examples. Receipts and payments: meaning and concept of fund based accounting. Unit 2: accounting for Partnership firms: Fixed vs Fluctuating Capital, Division of Profit among partners, Profit and Loss Appropriation Account. Unit 3: Reconstitution of Partnership: Changes in Profit Sharing ratio among the existing partners-Sacrificing ratio and Gaining Rati

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views2 pagesAccounting For Not-For-Profit Organisations, Partnership, Firms and Companies. (Periods 124)

Uploaded by

singhankit257Part (Periods 124) accounting for not-for-profit organisation: meaning and examples. Receipts and payments: meaning and concept of fund based accounting. Unit 2: accounting for Partnership firms: Fixed vs Fluctuating Capital, Division of Profit among partners, Profit and Loss Appropriation Account. Unit 3: Reconstitution of Partnership: Changes in Profit Sharing ratio among the existing partners-Sacrificing ratio and Gaining Rati

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Part A:

Accounting for Not-For-Profit Organisations, Partnership, Firms and Companies.

(Periods 124)

Unit 1: Accounting for Not-For-profit Organisations (Periods 22)

Not for profit organisation: Meaning and examples.

Receipts and payments: Meaning and concept of fund based accounting.

Preparation of Income and Expenditure Account and Balance Sheet from Receipt and Payment

Account with additional information.

Unit 2: Accounting for Partnership firms (Periods 14)

Nature of Partnership firm: Partnership Deed-meaning, importance.

Final Accounts of Partnership: Fixed vs Fluctuating Capital, Division of Profit among partners,

Profit and Loss Appropriation Account.

Unit 3: Reconstitution of Partnership (Periods 34)

Changes in Profit Sharing Ratio among the existing partners-Sacrificing Ratio and Gaining

Ratio.

Accounting for Revaluation of Assets and Liabilities and distribution of reserves and

Accumulated Profits.

Goodwill: Nature, Factors affecting and methods of valuation: Average profit, Super profit and

Capitalisation methods.

Admission of a Partner: Effect of Admission of Partner, Change in Profit Sharing Ratio,

Accounting Treatment for Goodwill, Revaluation of Assets and Liabilities, Reserves

(accumulated Profits) and Adjustment of Capitals.

Retirement/Death of a Partner: Change in Profit Sharing ratio, accounting treatment of

Goodwill, Revaluation of Assets and Liabilities, Adjustment of accumulated Profits (Reserves)

and capitals.

Unit 4: Accounting for Share Capital and Debenture (Periods 54)

Share Capital: Meaning, Nature and Types.

Accounting for share capital: Issue and Allotment of Equity and Preference Shares; Private

placement of shares, meaning of employee stock option plan, public subscription of shares;

over subscription and under subscription; issue at par, premium and at discount; calls in

advance, calls in arrears, issue of shares for consideration other than cash.

Forfeiture of shares: accounting treatment, re-issue of forfeited shares.

Presentation of Share Capital and Debenture in companyfs Balance Sheet.

Issue of debenture-at par and premium; issue of debenture for consideration other than cash.

Redemption of debenture.

Out of proceeds of fresh issue, accumulated profits and sinking fund.

Part B: Financial Statement Analysis

Unit 5: Analysis of Financial Statements (Periods 33)

Financial Statements of a Company: preparation of simple balance sheet of a company in the

prescribed form with major headings only.

Financial Statement Analysis: meaning, significance and purpose, limitations,

Tools for Financial Statement Analysis: Comparative Statements, Common Size Statements,

Accounting Ratios: meaning and objectives, types of ratios:

Liquidity Ratios: Current Ratio, Liquidity Ratio

Solvency Ratios: Debt to Equity, Total Assets to Debt, Proprietary Ratio

Activity Ratios: Inventory Turnover, Debtors Turnover, Payables Turnover, Working Capital

Turnover, Fixed Assets Turnover, Current Assets Turnover

Profitability Ratio: Gross Profit, Operating Ratio, Net Profit Ratio, Return on Investment,

Earning Per Share, Dividend per Share, Profit Earning Ratio

Unit 6: Cash Flow Statement (Periods 33)

Cash Flow Statement: Meaning and objectives, preparation, adjustments related to

depreciation, dividend and tax, sale and purchase of non-current assets (as per revised

standard issued by ICAI)

Unit 7: Project Work in Accounting (Periods 18)

OR

Part C: Computerised Accounting (Periods 84)

Unit 5: Overview of Computerized Accounting System (Periods 12)

Concept and types of Computerised Accounting System (CAS)

Features of a Computerized Accounting System

Structure of a Computerised Accounting System

Unit 6: Accounting using Database Management System (DBMS) (Periods 26)

Concept of DBMS Objects in DBMS: Tables, Queries, Forms, Reports

Creating data tables for accounting

Using queries, forms and reports for generating accounting information. Applications of DBMS

in generating accounting information such as shareholdersf records, sales reports, customersf

profile, suppliersf profile, payroll, employeesf profile, petty cash register.

Unit 7: Accounting Applications of Electronic Spreadsheet (Periods 24)

Concept of an Electronic Spreadsheet (ES)

Features offered by Electronic Spreadsheet

Applications of Electronic Spreadsheet in generating accounting information, preparing

depreciation schedule, loan repayment schedule, payroll accouning and other such

applications.

Unit 8: Practical Work in Computerised Accounting (Periods 22)

Note: Students can opt any one from Part-B or Part-C. Part-A is compulsory.

You might also like

- Advacc 2 Chapter 1 ProblemsDocument5 pagesAdvacc 2 Chapter 1 ProblemsClint-Daniel Abenoja100% (1)

- IFRS Guidebook - 2019 Edition (2018, AccountingTools, Inc.) Steven M. BraggDocument508 pagesIFRS Guidebook - 2019 Edition (2018, AccountingTools, Inc.) Steven M. Braggal chemiste100% (7)

- Accountancy For Dummies PDFDocument6 pagesAccountancy For Dummies PDFsritesh00% (1)

- A-Level Accounting PDFDocument11 pagesA-Level Accounting PDFTawanda B MatsokotereNo ratings yet

- Instructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseDocument14 pagesInstructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseShefali GoyalNo ratings yet

- Account PaperDocument8 pagesAccount PaperAhmad SiddiquiNo ratings yet

- Final Accountancy 12 March 2023Document5 pagesFinal Accountancy 12 March 2023happilyakshitaNo ratings yet

- 301 AccountancyDocument4 pages301 AccountancyAlkaNo ratings yet

- 2013 Syllabus 12 AccountancyDocument4 pages2013 Syllabus 12 Accountancybhargavareddy007No ratings yet

- Final Chapter 3.pmdDocument4 pagesFinal Chapter 3.pmdMANISH SINGHNo ratings yet

- Higher Secondary Accounts Syllabus NewDocument10 pagesHigher Secondary Accounts Syllabus NewBIKASH166No ratings yet

- Accountancy - XII Cbse 2013Document35 pagesAccountancy - XII Cbse 2013Zeus GhoshNo ratings yet

- CBSE 2015 Syllabus 12 Accountancy NewDocument5 pagesCBSE 2015 Syllabus 12 Accountancy NewAdil AliNo ratings yet

- All Subject Syllabus Class 12 CBSE 2020-21Document51 pagesAll Subject Syllabus Class 12 CBSE 2020-21Bear BraceNo ratings yet

- Prachi CUET-UG AccountancyDocument22 pagesPrachi CUET-UG AccountancySmriti Saxena100% (1)

- Cbse Accountancy - SrSec - 2022-23Document8 pagesCbse Accountancy - SrSec - 2022-23Sneha DubeNo ratings yet

- Cbse Accountancy Class XIi Sample Paper PDFDocument27 pagesCbse Accountancy Class XIi Sample Paper PDFFirdosh Khan100% (2)

- Bba Amity AccountsDocument1 pageBba Amity AccountsDeepak BatraNo ratings yet

- Cbse Class 12 Accountancy SyllabusDocument8 pagesCbse Class 12 Accountancy SyllabusKunj PatelNo ratings yet

- Term Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Document5 pagesTerm Wise Syllabus (Session 2019-20) Class-XII Subject-Accountancy (Code No. 055)Ashutosh GargNo ratings yet

- Part A:Financial Accounting-I: One Paper 90 Marks 3 Hours Units Periods MarksDocument4 pagesPart A:Financial Accounting-I: One Paper 90 Marks 3 Hours Units Periods Marksapi-243565143No ratings yet

- H.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyDocument2 pagesH.S. 2nd Year Syllabus For Pre-Final Examination, 2021-22: AccountancyAnurag DeyNo ratings yet

- ACCOUNTANCYDocument176 pagesACCOUNTANCYSUDHA GADADNo ratings yet

- 2014 Syllabus 11 AccountancyDocument4 pages2014 Syllabus 11 Accountancyapi-248768984No ratings yet

- Higher Secondary AccountancyDocument8 pagesHigher Secondary Accountancysgangwar2005sgNo ratings yet

- Cbse Board Accountancy SyllabusDocument4 pagesCbse Board Accountancy Syllabusapi-139761950No ratings yet

- 15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionDocument1 page15% Weightage: Accounting For Partnership Firms - Reconstitution and DissolutionKhushiNo ratings yet

- Accountancy XIIDocument30 pagesAccountancy XIIrajNo ratings yet

- 12 Accountancy Eng 2023 24Document5 pages12 Accountancy Eng 2023 24Gaurav KumarNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2022 23Document8 pagesCBSE Class 12 Accountancy Syllabus 2022 23SanakhanNo ratings yet

- Financing ActivitiesDocument41 pagesFinancing ActivitiesZahoor Ul HaqNo ratings yet

- Grade 12 AccountancyDocument8 pagesGrade 12 AccountancyPeeyush VarshneyNo ratings yet

- 24 2015 Syllabus 11 Accountancy NewDocument4 pages24 2015 Syllabus 11 Accountancy Newirfan685No ratings yet

- Financial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32Document77 pagesFinancial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32gazmeerNo ratings yet

- Accountancy (Code No. 055) : Class-XII (2019-20)Document6 pagesAccountancy (Code No. 055) : Class-XII (2019-20)naveenaNo ratings yet

- Account Sylabus Pu 2Document7 pagesAccount Sylabus Pu 2bhasunagaNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument10 pagesACCOUNTANCY (Code No. 055) : RationaleAshish GangwalNo ratings yet

- 12 Revised Accountancy 21Document10 pages12 Revised Accountancy 21sarvodayaeducationalgroupNo ratings yet

- 2 Syllabus 1 CHSE O FinalDocument22 pages2 Syllabus 1 CHSE O FinalChandrika DasNo ratings yet

- Xii AccountancyDocument214 pagesXii AccountancyNeetu Sharma100% (1)

- ACC 201: Financial Accounting: BIM 3rd SemesterDocument3 pagesACC 201: Financial Accounting: BIM 3rd SemesterWave WoNo ratings yet

- 2022 23 Accountancy 12-MinDocument8 pages2022 23 Accountancy 12-MinShajila AnvarNo ratings yet

- CBSE Class 12 Accountancy SyllabusDocument6 pagesCBSE Class 12 Accountancy Syllabusrkmobile58627No ratings yet

- Part A:Financial Accounting-I: One Paper 90 Marks 3 Hours Units Periods MarksDocument4 pagesPart A:Financial Accounting-I: One Paper 90 Marks 3 Hours Units Periods MarkscerlaNo ratings yet

- Accountancy Class 11 SyllabusDocument4 pagesAccountancy Class 11 SyllabuspddNo ratings yet

- AccountancyDocument7 pagesAccountancyRubesh PanneerselvamNo ratings yet

- Final Question Bank Xii Accoutancy-2022-23Document206 pagesFinal Question Bank Xii Accoutancy-2022-23Khushi Sharma100% (1)

- Acct XIDocument41 pagesAcct XIsainimanish170gmailcNo ratings yet

- What Are Incomplete RecordsDocument8 pagesWhat Are Incomplete Recordssatish ThamizharNo ratings yet

- 2012 Syllabus 11 AccountancyDocument4 pages2012 Syllabus 11 AccountancyYadira TerryNo ratings yet

- Class: XI: Financial AccountingDocument15 pagesClass: XI: Financial AccountingRavi DuttaNo ratings yet

- AccountancyDocument4 pagesAccountancyiftikhar hussainNo ratings yet

- Corporate Financial ReportingDocument6 pagesCorporate Financial ReportingAsadvirkNo ratings yet

- CBSE Class 12 Revised Accountancy Syllabus 2020-21Document8 pagesCBSE Class 12 Revised Accountancy Syllabus 2020-21Harry AryanNo ratings yet

- 11 2011 Syllabus AccountancyDocument3 pages11 2011 Syllabus AccountancycerlaNo ratings yet

- CBSE Class 12 Accountancy Syllabus 2023 24Document8 pagesCBSE Class 12 Accountancy Syllabus 2023 24kankariya1424No ratings yet

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocument380 pages1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNo ratings yet

- Class 11 Accounts Syllabus Session 2015-16Document7 pagesClass 11 Accounts Syllabus Session 2015-16Nikhil MalhotraNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument13 pagesACCOUNTANCY (Code No. 055) : Rationalepiraisudi013341No ratings yet

- Comm1140 NotesDocument43 pagesComm1140 Notesa45247788989No ratings yet

- Accounting 12Document140 pagesAccounting 12sainimanish170gmailc0% (2)

- ICGFM Compilation Guide To Financial Reporting by GovernmentsDocument58 pagesICGFM Compilation Guide To Financial Reporting by GovernmentsAndy Wynne100% (1)

- Conceptual Frame Work-CAP IIDocument9 pagesConceptual Frame Work-CAP IIbinuNo ratings yet

- Goodwill QuestionsDocument7 pagesGoodwill QuestionsTanisha JainNo ratings yet

- Ch1 4e - Acc in Action 2021Document50 pagesCh1 4e - Acc in Action 2021K59 Vu Thi Thu HienNo ratings yet

- Measurement: ©2018 John Wiley & Sons Australia LTDDocument50 pagesMeasurement: ©2018 John Wiley & Sons Australia LTDdickzcaNo ratings yet

- Part 1 Financial Statement Types Presentation Limitation Users - Qs 07 Aug 2021Document17 pagesPart 1 Financial Statement Types Presentation Limitation Users - Qs 07 Aug 2021Le Blanc0% (1)

- Problem 1: Journal EntryDocument11 pagesProblem 1: Journal EntrySarah Nelle PasaoNo ratings yet

- 62c39f2609022 Ferrell 12e PPT ch14Document51 pages62c39f2609022 Ferrell 12e PPT ch14fayyasin99No ratings yet

- Book Value of Old Asset Cash Payment Cost of New AssetDocument2 pagesBook Value of Old Asset Cash Payment Cost of New AssetPasaoa Clarice V.No ratings yet

- PARTNERSHIPDocument153 pagesPARTNERSHIPJoen SinamagNo ratings yet

- Beiträge Zur Völkerkunde BrasiliensDocument105 pagesBeiträge Zur Völkerkunde BrasiliensFernanda PittaNo ratings yet

- Grameenphone Accounts 2020Document62 pagesGrameenphone Accounts 2020JUNAYED AHMED RAFINNo ratings yet

- List of Standard Reports in Oracle EBSDocument17 pagesList of Standard Reports in Oracle EBSJilani Shaik100% (1)

- Plumbing Arithmetic - QuestionnaireDocument7 pagesPlumbing Arithmetic - QuestionnaireAngelico ParasNo ratings yet

- Ch1 All Ex StudentDocument27 pagesCh1 All Ex StudentBttpNo ratings yet

- Quizzer #8 PPEDocument13 pagesQuizzer #8 PPEAseya CaloNo ratings yet

- Business Valuations: Exam GuideDocument17 pagesBusiness Valuations: Exam GuideAjay Kumar TakiarNo ratings yet

- CFAS Module Week 3-4Document13 pagesCFAS Module Week 3-4Yamit, Angel Marie A.No ratings yet

- Day1 IAS-16Document44 pagesDay1 IAS-16tariq hassaNo ratings yet

- Mcs PPT FinalDocument38 pagesMcs PPT FinalSandip KadamNo ratings yet

- Ratio Analysis Project ReportDocument80 pagesRatio Analysis Project Reportpriya,eNo ratings yet

- DAYAG Advac SolutionChapter6Document18 pagesDAYAG Advac SolutionChapter6Lawrence Lamban100% (5)

- Big 'J'S Supermarket Income Statement 2022Document2 pagesBig 'J'S Supermarket Income Statement 2022Stephen Francis100% (1)

- CTBN LK TW I 2019Document120 pagesCTBN LK TW I 2019Kiki NikeNo ratings yet

- Chapter 4 Governmental AccountingDocument8 pagesChapter 4 Governmental Accountingmohamad ali osmanNo ratings yet

- Comprehensive Problem On Financial Statement PositionDocument2 pagesComprehensive Problem On Financial Statement PositionLesa RobinsonNo ratings yet

- Assignment-ACF: Standalone Balance Sheet Hero MotocorpDocument11 pagesAssignment-ACF: Standalone Balance Sheet Hero MotocorpAryaman jaiswalNo ratings yet

- Assets Magazine Sept 2011 - The Meaning of Life Cycle by John Woodhouse Website PDFDocument3 pagesAssets Magazine Sept 2011 - The Meaning of Life Cycle by John Woodhouse Website PDFOscar OsorioNo ratings yet