Professional Documents

Culture Documents

Export Finance Facility May 07

Uploaded by

Suren Tambe0 ratings0% found this document useful (0 votes)

30 views1 pageExporters of eligible products can obtain short-term credit from the commercial banks and Fiji Development Bank at a concessional rate of interest. The Reserve Bank of Fiji (RBF) in 1983, introduced the Export Finance Facility (EFF) scheme. Eligible exports must have at least 50 percent domestic content from SPARTECA or Cotonou countries, and 40 percent local (fijian) value added.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentExporters of eligible products can obtain short-term credit from the commercial banks and Fiji Development Bank at a concessional rate of interest. The Reserve Bank of Fiji (RBF) in 1983, introduced the Export Finance Facility (EFF) scheme. Eligible exports must have at least 50 percent domestic content from SPARTECA or Cotonou countries, and 40 percent local (fijian) value added.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views1 pageExport Finance Facility May 07

Uploaded by

Suren TambeExporters of eligible products can obtain short-term credit from the commercial banks and Fiji Development Bank at a concessional rate of interest. The Reserve Bank of Fiji (RBF) in 1983, introduced the Export Finance Facility (EFF) scheme. Eligible exports must have at least 50 percent domestic content from SPARTECA or Cotonou countries, and 40 percent local (fijian) value added.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

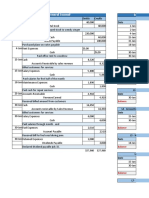

EXPORT FINANCE FACILITY

Objective banks and FDB. The RBF provides finance to

these lenders, if needed. Commercial banks and

The export sector contributes significantly to Fiji’s FDB have been delegated to approve funding

economic growth. While there are some under this scheme. The Reserve Bank' s approval is

established exports, there are many small and new only needed if funds are advanced from the RBF.

exporters that may need financial support before Apart from the EFF eligibility rules and value

and after they sell their exports. For instance, an added criteria, exporters also need to meet the

exporter may wait for three months before the commercial banks/FDB’s lending criteria.

export proceeds are received, and may need money

during that period. Similarly, a small exporter may Eligibility Rules

obtain a large export order, but need additional

finance to be able to export the products. In order All exports, except for exports of sugar, molasses

to assist these small and developing exporters, the and gold, qualify provided they satisfy the value

Reserve Bank of Fiji (RBF) in 1983, introduced added rules. The EFF is also available for the

the Export Finance Facility (EFF) scheme. The construction of up-market hotels and exports of

scheme enables exporters of eligible products to certain professional services such as architectural,

obtain short-term credit from the commercial engineering and maritime services.

banks and Fiji Development Bank (FDB) at a

concessional rate of interest. Value Added Rules

Types All exports (except those excluded under the

There are two types of finance available under the eligibility criteria) under the SPARTECA or

EFF. These are as follows: Cotonou Agreements (known as LOME agreement

prior to February 2000) automatically qualify for

• Pre-shipment finance allows an eligible the EFF. The item exported must have at least 50

exporter to obtain credit from lending banks for percent domestic content from SPARTECA or

the period prior to the shipment of the goods, Cotonou countries. Exports to other destination

to facilitate the production of eligible goods for must have at least 40 percent local (Fiji) value

exports. There are two types of pre-shipment added.

finance available: a 90 day Facility and a

Lump Sum Facility. The 90 day facility is Interest Rates

where exports take place on firm export orders

and an exporter may borrow up to the full Under the EFF, the maximum interest rate charged

amount of the export order subject to the to customers by their commercial banks/FDB is set

drawdown rules. Under the Lump Sum by the RBF from time to time. Currently, finance

Facility, the exporter will be entitled to borrow to exporters under the EFF is available from the

up to 20 percent of the total value of exports. commercial banks and FDB at an interest rate of 6

An eligible exporter is permitted to use only percent per annum. The RBF refinances the

one of the facilities at a time. commercial banks/FDB at 2 percent per annum.

• Post shipment finance allows exporters to Further information

discount export bills with banks at

concessional rates. This facility is available for For more information on the use of the Export

a maximum period of 180 days. Finance Facility, please contact your commercial

bank, FDB or RBF’s Financial Markets Group 322

How the Scheme Operates 3378/322 3351. You may also visit the RBF’s

The scheme is available through the commercial website on www.reservebank.gov.fj.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Analysis of Indian Debt MarketDocument45 pagesAnalysis of Indian Debt Marketmichelle_susan_dsa100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- TransactionSummary 300921104840Document2 pagesTransactionSummary 300921104840punit mishraNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Notice: Casualty and Nonperformance Certificates: Landmark Freight, Inc., Et Al.Document2 pagesNotice: Casualty and Nonperformance Certificates: Landmark Freight, Inc., Et Al.Justia.comNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- RBI Lender of Last ResortDocument18 pagesRBI Lender of Last ResortHemantVermaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- This Study Resource Was: No. Account Title Debit CreditDocument7 pagesThis Study Resource Was: No. Account Title Debit CreditLoiz Santos Trinidad100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- New India All Risks Insurance Claim FormDocument2 pagesNew India All Risks Insurance Claim FormALOK BHARTINo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Sbfs-Dcs Corpus To NpsDocument4 pagesSbfs-Dcs Corpus To NpsMahesh VeNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Consumer Client Manual CitibankDocument32 pagesConsumer Client Manual CitibankGuillermo CarranzaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Cycle Test Ii AnswerDocument46 pagesCycle Test Ii Answersumitha ganesanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Jordan ASCA IAASB GlossaryDocument15 pagesJordan ASCA IAASB GlossaryFACTURE TUNISIENo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Internet BankingDocument67 pagesInternet BankingRaj Kumar0% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- World's Largest Banks in 2008 10Document5 pagesWorld's Largest Banks in 2008 10fatmaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Comparative Study Between Two BanksDocument26 pagesComparative Study Between Two BanksAnupam SinghNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- FINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationDocument17 pagesFINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationAiron Keith Along100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Assignment 3 - AccountingDocument5 pagesAssignment 3 - AccountingGulzar JamalNo ratings yet

- Financial Analysis NestleDocument3 pagesFinancial Analysis NestleArjun AnandNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Data Sheet TTK PRESTIGEDocument4 pagesData Sheet TTK PRESTIGEpriyanshu guptaNo ratings yet

- Govt. Securities Market in India: Presentation OnDocument19 pagesGovt. Securities Market in India: Presentation OnHitesh PandeyNo ratings yet

- What Is Equity AccountingDocument2 pagesWhat Is Equity AccountingDarlene SarcinoNo ratings yet

- Total Current Liabilities: Balance Sheet of Pidilite Industries - in Rs. Cr.Document4 pagesTotal Current Liabilities: Balance Sheet of Pidilite Industries - in Rs. Cr.Vishal GargNo ratings yet

- Chapter 02 MOOCDocument30 pagesChapter 02 MOOCNur JulianieNo ratings yet

- Hedge Fund BackersDocument6 pagesHedge Fund Backers1c796e65b8a4c8No ratings yet

- mt541 MT543Document39 pagesmt541 MT543DR. OMID R TabrizianNo ratings yet

- Operating Segment 2 PDFDocument1 pageOperating Segment 2 PDFGlen JavellanaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- GUMABON V. PNB (2016) Doctrine:: ContentionsDocument3 pagesGUMABON V. PNB (2016) Doctrine:: ContentionsLorie Jean UdarbeNo ratings yet

- Ayala Corp Reflection PaperDocument4 pagesAyala Corp Reflection PaperAaron HuangNo ratings yet

- Financial Statement Analysis of Suzuki MotorsDocument21 pagesFinancial Statement Analysis of Suzuki MotorsMuhammad AliNo ratings yet

- Tutorial Questions FinDocument16 pagesTutorial Questions FinNhu Nguyen HoangNo ratings yet

- CFNetworkDownload IEGF5s.tmp - ListDocument4 pagesCFNetworkDownload IEGF5s.tmp - ListCHRISTINE REYESNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)