Professional Documents

Culture Documents

East African Breweries Ltd. (EABL) - A Business & Financial Analysis

Uploaded by

Patrick Kiragu Mwangi BA, BSc., MA, ACSIOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

East African Breweries Ltd. (EABL) - A Business & Financial Analysis

Uploaded by

Patrick Kiragu Mwangi BA, BSc., MA, ACSICopyright:

1. Introduction.

1.1 Brief company overview

Established in 1922 and with its headquarters in Nairobi- Kenya, East African Breweries Ltd. (EABL) is a

leading branded alcohol manufacturing company in the East African region engaged in the marketing,

brewing and selling of alcoholic and non- alcoholic drinks as well as the manufacturing of glass containers.

Majority owned by Diageo, it consists of a number of subsidiaries.1

1.2. Research rationale.

Compared to their counterparts in the developed world, little research has been carried out on organizations

that operate in African countries as these are seen as lacking the management capacity or financial resources

either to compete with larger organizations in the developed world or to interest international investors.

However the events of the last two years, which have seen investors lose millions of dollars in their

investments due to the collapse of the international financial markets, have increased the need for

international investors to diversify their portfolios into regions hitherto considered unimportant. By carrying

out a critical business and financial evaluation of the performance of a typical large African organization, this

report attempts to highlight the missed opportunities that may remain untapped in emerging markets.

With annual revenues of KES 21 billion (US$ 285 million), KES 26 billion (US$ 367 million) and KES 32

1

The subsidiaries include Kenya Breweries Ltd., Uganda Breweries Ltd., Kenya Maltings, UDV Kenya and Central

Glass Industries. The company also holds a 20% stake in Tanzania Breweries Ltd. (EABL, 2008a p.85)

-1- © 2009 PK Mwangi Global Consulting

billion (US$ 479 million)2 in FY06, FY07 and FY08 respectively and an adherence to international

accounting and audit standards i.e. IFRSs and ISAs respectively, this

company3 may represent a well managed company with growing profitability and investment potential. This

report attempts to establish this by analyzing its business and financial performance over a three year period.

To assist in the analysis of EABL’s performance the average exchange rate prevalent in the three years under

study are as follows:

Table 1: Foreign exchange rates.

Average annual exchange rate

Calendar Year US Dollars (USD) Kenya Shillings (KES)

2006 1 73.73870

2007 1 70.80733

2008 1 66.83044

Source: Oanda (2009)

1.3. Research objective and question.

This research delves into both the business and financial performance of EABL with an aim to identify the

major business elements that are key to its performance. It goes further to look at how these business factors

have impacted on the financial performance of the company.

It is difficult to separate the financial performance of a company from its wider business environment and

hence the business and financial performance of a company are closely interlinked. Decisions made at the

corporate and/ or business level impact directly on company’s financial performance. Where corporate

strategy aims to grow the company through acquisition of competitor firms, this will have a direct impact on

profitability and profitability indicators. Increased sales in new markets will lead to bigger profits and

margins where costs are well managed.

1.4. Research approach.

Drawing primarily on secondary sources of information (accounting books, annual reports, academic

journals, newspaper articles, etc) this research sought to analyze both quantitative data and qualitative

2

These figures are converted from KES to USD based on average exchange rates for the relevant years as shown in

Table 1.

3

Although EABL is a group of companies, it has been referred to as a company throughout this report for ease of

reference.

-2- © 2009 PK Mwangi Global Consulting

information with a view to using this to critically evaluate the performance of a real life organization- EABL.

Quantitative data was drawn mainly from the company’s financial statements while the qualitative

information was drawn primarily from academic and practitioner journals.

The business models and accounting techniques were applied to gathered qualitative and quantitative

information and used to evaluate and critically analyze the company, identifying areas of strengths and

weaknesses. (ACCA 2009).

In addition, limited data on key business and financial variables was collected on the company’s key

competitors as well as industry-wide statistics in order to benchmark the performance of EABL against these

other factors. This offered, in addition to the inter-temporal analysis of the company, a further avenue of

analysis thereby enabling a more comprehensive business and financial analysis of company performance.

Section One is an introduction to the research project providing a brief company overview as well as briefly

explaining the research rationale, objectives and research approach. Section Two explains in more detail the

research methodology undertaken and also the limitations associated with this research methodology. It also

identifies and describes the business models and accounting techniques used in the research project. Section

Three looks at the sources of data, presents the data collected and looks at the limitations in gathering the

data. Section Four applies the business models and accounting techniques to the company environment and

on the basis of this goes on to evaluate and critically analyze EABL’s business and financial performance

over a three year period. Section Five then presents conclusions reached on the basis of the research

undertaken as well as providing a number of recommendations.

[OMMITTED]

-3- © 2009 PK Mwangi Global Consulting

4.2. Financial performance analysis

4.2.1. Ratio analysis

Table 7: Financial ratios of EABL for the period FY06 to FY08.

Ratio Analysis

% change 2006 % change 2007 % change 2008

Profitability

Percentage increase in sales revenue 8.97 23.74 25.58

Return on capital employed (ROCE) 0.64 31.28 5.10 32.87 14.55 37.66

Return on equity (ROE) 4.10 45.28 15.35 52.23 13.34 59.20

Net asset turnover -1.18 1.02 10.72 1.13 17.93 1.33

Gross profit margin -7.37 62.23 -11.43 55.12 -2.97 53.48

Operating profit margin -2.88 37.94 -3.49 36.62 -8.52 33.50

Financial stability.

Equity to assets ratio -2.67 57.12 -18.88 46.34 0.67 46.65

Debt to equity ratio (gearing ratio) 0.00 0.00 0.00

Current ratio 2.91 3.23 -31.76 2.21 -10.39 1.98

Liquidity (quick) ratio -1.17 2.29 -32.60 1.54 -15.25 1.31

Management efficiency.

Closing inventory holding period -3.22 187.12 -8.62 170.99 -16.19 143.31

Trade receivables collection period -1.46 41.13 51.85 62.46 -26.03 46.20

Trade payables payment period -9.22 190.31 20.26 228.87 -13.44 198.11

Investment

Debt-holder Interest cover 0.00 0.00 0.00

Interest yield 0.00 0.00 0.00

Shareholder Market share price as at 30 June -7.02 139.00 10.79 154.00 29.22 199.00

Dividend per share 30.93 4.91 49.49 7.34 9.67 8.05

Dividend cover 1.44 -12.96 1.26 -6.40 1.18

Dividend yield 40.82 3.53 34.93 4.77 -15.13 4.05

Earnings per share (EPS) 13.10 6.82 13.78 7.76 23.07 9.55

Price earnings ratio (P/E ratio) -17.79 20.38 -2.63 19.85 5.00 20.84

Net asset value per share 18.34 133.71 1.25 135.39 -17.91 111.15

Total Shareholder Return (TSR) -3.74 -529.83 16.07 114.34 34.45

Source: EABL, 2005; EABL, 2006a; EABL, 2007a; EABL, 2008a

-4- © 2009 PK Mwangi Global Consulting

Profitability

Figure 7: EABL profitability indicators between FY06 and FY08.

35000

32486

30000

25871

25000

KES 20907

Millions

20000

Net sales value

15000

12,316

10,884 Operating

10,636

9,474 profit

10000 8,577

7,933

Profit before

tax

5000

0

2006 2007 2008

Year

Source: EABL, 2007b p. 28

Both ROCE and ROE rose year-on-year between FY06 and FY08 due to heavy capital investments4 that

have yielded increased productivity. The year-on-year increase in sales revenue and ROCE with increased

capital investments and upward revaluations of PPE suggests that revenue has increased proportionately

higher than the increased capital investments and revaluations – an indication of better capacity utilization

and productivity.

Despite a bonus issue in FY085, ROE continued to rise showing an increasing return to a larger shareholder

base. However gross profit margins fell between FY06 and FY08 due to cost of sales increasing

proportionately more than the increase in sales revenue. Cost of sales was driven up by increasing

productions costs caused by a shortage of barley, rising fuel costs and constant power outages. (EABL,

2007b p. 28)

Operating profit margin also declined in the period. A combination of rising marketing expenses6 and

4

Capital expenditure on state-of-the-art equipment grew during this period from KES 2 billion to just over KES 3 billion

(see Figure 14)

5

Assuming post-tax profits remained constant, an increase in the number of shares on issue would lead to a fall in

ROE. That ROE in the three years has continued to rise is an indication of an increasing return for each share in issue

i.e. the growth in post-tax profits has outpaced the growth in equity capital.

6

These rose by 27%, 19% and 37% in FY06, FY07 and FY08 respectively. (see Appendix)

-5- © 2009 PK Mwangi Global Consulting

distribution costs7 (due to increased activity in newer markets) contributed to this decline. (Gosman, 2009 p.

46)

Net asset turnover8 rose in line with sales revenue and ROCE indicating EABL’s efficiency in the use of its

net assets in line with increasing ROCE.EABL has no finance leases but rather makes rental payments on

leased PPE. These costs, as a percentage of the value of the related PPE, may be less than the ROCE figures

thereby contributing to the rising ROCE9.

Financial stability.

EABL’s equity to assets ratio dropped in FY06 and FY07 but remained stable in FY08. The drop showed a

decrease in the importance of equity to the financing of total assets. However the company has had nil

gearing throughout the same period following a policy of zero borrowing.

The company’s current ratio dropped in FY07 and FY08. The relatively high ratios, however, reveal

excessive cover of current liabilities. The falling current ratios were in line with falling inventory periods in

FY07 and FY08 while payables payment period rose, albeit falling marginally in FY08. The relatively high

current ratios are also indicative of a large cash base which has helped service increased capital expenditure.

The company’s liquidity ratios also fell in FY06 to FY08. These still represent high levels of cover in line

with company policy of minimal borrowings.

However the trend has been declining current and liquidity ratios due to increasing deferred income tax

liabilities. This led to additional tax charges of KES 222 million and KES 217 million10 in FY07 and FY08

respectively.

Management efficiency.

Inventory holding period decreased in FY06 to FY08. This was down to the increase in cost of sales

outpacing that of closing inventory. Despite increasing productivity and sales, closing inventory continued to

rise, an indication of the company’s need to maintain high inventory levels to accommodate expansion into

newer markets.

Both trade receivables collection period and trade payables payment period decreased in FY06 and FY08 but

7

Fuel costs alone increased by 82% in the 12 months leading to FY-end 2008 (EABL, 2008b p.8)

8

This measures the amount of sales made by the company per KES 1 invested in net assets. A turnover of more than

1 time reflects a more than proportionate return to investment and hence efficiency in the use of PPE.

9

A further indication of EABL’s superior ROCE is the fact that PPE is held at current values (note the existence of a

revaluation surplus account) meaning that were PPE to held at historical cost, ROCE figures would show an even

more impressive return.

10

This is because total deferred tax liabilities on the balance sheet rose from KES 1.8 billion to KES 2 billion between

FY06 and FY07 and from KES 2 billion to KES 2.3 billion between FY07 and FY08. (see Table 3)

-6- © 2009 PK Mwangi Global Consulting

increased in FY07. The relatively short receivables collection periods and long payables payment periods are

evidence not only of the company’s effective credit control but also of the weak bargaining positions of both

buyers and suppliers. The strength of the company’s credit control is also evidenced by the larger number of

receivables in the 0-30 days receivables band as opposed to those in the 31- 120 days band (see Appendix).

Despite a rise in sales volumes throughout the period, receivables and receivables collection period dropped

in FY08 due possibly to better credit control. It would be a cause of concern had sales volumes dropped in

line with decreasing receivables as this would have indicated falling demand or capacity inefficiencies given

that capital expenditure in FY08 alone was up 5%. That this was not the case is evidenced by a 14% increase

in ROCE in FY08.

Investor activity.

DPS and dividend cover.

Figure 8: EPS and DPS values between FY04 and FY08.

10

9.55

9

8.05

8 7.76

7.34

7 6.82

6.03

KES 6

5 4.89 4.91

EPS

4 3.75

DPS

3 2.89

0

2004 2005 2006 2007 2008

Year

Source: EABL, 2008a p.5

DPS has grown year-on-year showing a healthy dividend policy by the company. This has helped improve

the company’s share price performance These dividend payouts have been made out of current year profits

and hence future profitability is not endangered by paying out current dividends from prior year earnings.

Dividend cover fell in FY07 and FY08 due to increases in dividend payments outstripping those in post-tax

-7- © 2009 PK Mwangi Global Consulting

profits11.

Earnings per share (EPS)

EPS grew during the period in line with increases in post-tax profits. Despite a bonus issue in FY08 (which

should have seen a fall in EPS due to an increase in the number of shares on issue), EPS continued to climb-

a clear indication of the growing profitability of the company.

Price-earnings ratio.

The PE ratio has remained fairly stable falling marginally in FY07 and then rising marginally in FY08. PE

ratio marginally fell in FY07 as the rise in EPS narrowly outpaced the rise in EABL’s share price. This

pattern was reversed in FY08.The slower growth in EPS in FY08 was down to the bonus issue which saw an

increase in the number of shares in issue.

This relatively stable PE ratio shows that investors are fairly confident in the company’s future performance.

Net asset value (NAV) per share.

NAV per share relates to the book value of a company’s share. EABL’s NAV per share rose marginally in

FY07 and then dipped substantially in FY08 falling by 18%. The initial rise was due to the increase in net

assets in FY07 while equity capital remained constant. However, following the bonus issue in FY08, NAV

per share fell substantially.

Differences between NAV per share and EABL’s market share price indicate that EABL shares are selling at

a premium. This is in line with the high PE ratios averaging 20 times for the three year period. (Pontiff and

Schall, 1998, p. 142)

4.2.2. Benchmarking EABL .

EABL outperforms its major competitor- SABMiller in all profitability and financial stability ratios. (see

Appendix)12. Both ROCE and operating profit margin are much higher than the respective SABMiller

figures- an indication of better capacity utilization and cost management13.

11

While dividend payments grew by 28% and 25% in FY07 and FY08 respectively, post-tax profits grew by 17% and

22% for the same periods. (EABL, 2007b p. 31; EABL, 2008 p. 42)

12

A word of caution here is that the figures for SABMiller are derived from its worldwide operations while those of

EABL are based solely on its East African operations. However SABMiller prepares no financial statements for its

African operations and the financial statements prepared on the basis of its global operations provide the best avenue

for comparison. These ratios can be assumed to be broadly similar for its East African operations.

13

It may well be that EABL operates in a fast growing market indicated by the higher net asset turnover figures. The

contribution to turnover by each unit of PPE is higher than at SABMiller which may be operating in near saturated

markets.

-8- © 2009 PK Mwangi Global Consulting

Although EABL has a much superior cover of its current liabilities, both companies have either nil or low

gearing and hence face little danger to their going concern status. EABL’s longer payables collection periods

indicates its superior bargaining position against suppliers in the region while SABMiller may not enjoy such

luxury in global markets where competition is stiffer.

SABMiller’s shorter receivables collection period may also be indicative of its need for quicker working

capital movements to finance its debt obligations. However, SABMiller has a superior dividend cover due to

its lower payout ratio14 while both companies enjoy high PE ratios and hence continued investor confidence

in their future performances.

4.2.3. Segment Analysis.

Segmental analysis of EABL in the region involved exploring the different rates of profitability and different

opportunities for growth presented by each geographic segment15. (FTC Ltd., 2005 p.193)

Profitability

Figure 9: Contribution to operating profit by geographic segment.

10,000 9,690

9,000

8,387

8,000

6,957 Kenya

KES 7,000

Millions

6,000

Uganda

5,000

4,000

3,000 Tanzani

a

2,000

1,087 1,194

976

1,000

0

2006 2007 2008

Year

Source: EABL, 2007 p. 59; EABL, 2008 p. 73

14

These stood at 45% and 43% for FY07 and FY08 respectively. (SABMiller, 2007 p.1; SABMiller, 2008 p.1)

15

Segment information is presented on the basis of the group’s geographical segments, which is the primary format

based on the countries of operations. No distinguishable business segments exist (EABL, 2007a p. 57-8)

-9- © 2009 PK Mwangi Global Consulting

Figure 10: Contribution to net profit by geographic segment.

8,000

7,566

7,000

6,032

KES 6,000 Kenya

millions

4,990

5,000

Uganda

4,000

3,000 Tanzania

2,000

1,000 763 762 735 810 808

657

0

2006 2007 2008

Year

Source: EABL, 2007 p. 59; EABL, 2008 p. 73

Kenya has provided the greatest contribution to both group operating profit and net profit during the three

year period averaging 89% for operating profit and 80% for net profit respectively (see Appendix).

Kenyan operations showed a higher percentage increase in revenue in FY08 than the Uganda operations but a

lesser percentage increase in revenue in FY07. In line with higher operating profits and net profits, the Kenya

operations showed superior operating profit margins and net profit margins. This reveals better PPE

(capacity) utilization at the Kenya plants. This may be due to the higher capital investment in the Kenya

operations as opposed to the Uganda operations16. This is evidenced by the increase in depreciation charge in

FY08 in the Kenyan operations which rose from KES 588 million to KES I billion, up 84%.

EABL has a minority stake in the Tanzania operations and hence profit margins here are nil except for

EABL’s share of associate profits.

16

2005 saw a KES 600 million investment in a brew house in Kenya which led to a 35% improvement in energy usage

as well as a further KES 425 million investment in a keg-line. (EABL, 2005, p. 22)

- 10 - © 2009 PK Mwangi Global Consulting

Growth

Figure 11: Volume growth rates by geographic segment.

30

27 27 27 27

25

20

20

18 18

%

Kenya

15

Uganda

Tanzania

10

5

5

2

0

2006 2007 2008

Year

Source: EABL, 2007b; EABL, 2008b

Despite its low contribution to overall sales and profits, the Tanzania operations have seen tremendous

growth in FY07 and FY08 at 27% and 18% respectively. This is down to EABL increased focus on

improving its market share here.

- 11 - © 2009 PK Mwangi Global Consulting

Figure 12: Sales revenue growth rates by geographic segment.

35

31

29

30

25 Kenya

25

20 Uganda

% 16

15

Tanzania

10

0

2007 2008

Year

Source: EABL, 2007b; EABL, 2008b

Fig. 13: Segment share of group volume and units exported (FY08).

80

71

70

60 Share of group

volume (%)

50

40

Exported units

30 (millions)

20 18

10 5.7 6

1.4 0.5

0

Kenya Uganda Tanzania

Country

Source: EABL, 2008b p. 17-18

- 12 - © 2009 PK Mwangi Global Consulting

4.2.4. Finance risk analysis

Table 8: Finance risk analysis matrix.

EABL RISK ANALYSIS

On a scale of 1 to 5

1 - very low risk

2 - low risk

3 - moderate risk

4 - high risk

5 - very high risk

Rating assigned Weight assigned(%) Weighed Value of Factor(%)

Financial risk factors

liquidity risk 1 30% 0.3

foreign exchange risk 4 10% 0.4

interest rate risk 3 20% 0.6

contagion risk 4 10% 0.4

credit risk 2 20% 0.4

falling equity prices 4 10% 0.4

Total weights 100% 2.5 Financial risk factor

Liquidity risk has received the highest weight assigned (30%) due to its implications on the

company’s going concern status. Loan default could lead to liquidation and a cessation of

business.

Interest rate risk also received a high weight (20%) due to the impact a hike in interest rates

would have on a business’ ability to raise finance17. Credit risk also received a high weighting

(20%) due to the implications of counter-party risk where business parties are unable to meet

their contractual obligations18.

Foreign exchange risk, contagion risk and the risk of falling equity prices have received

weightings of 10% due to their relatively lower impact. Foreign exchange risk is a factor

where a company has substantial offshore trading. Contagion risk and falling equity prices are

17

Where a business has borrowed close to its limits and is struggling to meet its lender obligations, a minor hike in

interest rates may have grave implications for its going concern status. Conversely, for a company with substantial

term deposits as opposed to borrowings, a decline in interest rates will mean a fall in interest income. (EABL, 2008 p.

71-2)

18

On the supply side this has an impact on the ability of the company to continue in operation unless alternative supply

sourcing is identified. On the demand side, inability of receivables to make payments impacts on cash flow and

possibly the going concern status.

- 13 - © 2009 PK Mwangi Global Consulting

particularly relevant in recessionary periods. (Crouhy et al., 2000 p. 72)

However, despite their lower weightings foreign exchange risk19, contagion risk and the risk of

falling equity prices all received high risk ratings due to the specific impact they have on

EABL’s profitability. EABL’s heavy dependence on equity funding also means that contagion

risk and consequent falling equity prices directly impact the company’s ability to raise equity

finance20.

On the other hand, however, liquidity risk and interest rate risk received low to moderate risk

ratings due to the company’s strong cash and nil gearing positions. There is no risk of loan

default by the company and although a hike in interest rates would have little impact on the

company’s financial position, a fall in interest rates would affect interest income due to

EABL’s substantial term deposits. Credit risk received a low risk rating due to the company’s

strict vetting of its trade partners.

4.2.5. Capital investment.

Figure 14: EABL capital expenditure between FY02 and FY08.

Source: EABL (2008b p.11)

A high proportion of net cash generated from operations is paid out as dividends, exceeding that used in the

19

Transactional foreign exchange losses totalled KES 72 million in FY07 and KES 53 million in FY08. (see Appendix )

20

Falling equity prices mean that a rights issue would raise less funding than otherwise since investors would be

reluctant to invest where equity prices are on the decline.

- 14 - © 2009 PK Mwangi Global Consulting

purchase of PPE21. Although this sends a positive message to investors and has a positive impact on EABL

shares, this high payout ratio seems unjustifiable in a market where competition is increasing.

In FY06 massive asset disposals worth KES 289 million were made. Profits of KES 106 million were

received from these disposals suggesting that these assets were sold well before they had exhausted their

economic useful lives. This is further evidenced by the relatively high proportion of carrying amount relative

to cost showing that PPE is not near the end of its economic useful life22. Thus replacement of PPE is

motivated by other factors other than an aging of existing assets. One plausible reason is a desire to boost

productivity to stay ahead in an increasingly competitive environment. (Mautz and Angell, 2009 p. 16-17)

4.2.6. Investor relations.

4.2.6.1. Business valuation.

The PE method can be used here to give a business valuation of EABL. Based on this

method the value of a company is given as:

Value of company = total earnings ×PE ratio.

EABL’s total earnings (PAT) as at 30 June 2008 were KES 9,184 million (see Table 2)

The PE ratio at this date was 16.13 (see Table 7)

Value of EABL as at 30 June 2008 was KES 9,184 million × 16.13

= KES 148 billion

(FTC Kaplan Ltd., 2007 pg. 509-24)

21

In FY08, for example, of the net cash from operations of KES 9.3 billion, KES 3 billion was used for capital

expenditure while a massive KES 7.7 billion was paid out to shareholders.

22

As at June 30th 2008, the proportion of the carrying amount of PPE to its cost was 65%. (EABL, 2008 p. 79)

- 15 - © 2009 PK Mwangi Global Consulting

4.2.6.2. Share price performance.

Figure 15: Share price chart for the period October 2006 to October 2009.

Source: myStocks! (2009)

EABL’s share price held relatively steady in FY06 and FY07 in line with stable profits. In October 2007

following the bonus issue the share price registered about a 20% rise before falling again to its pre-bonus

issue price.

The share price however peaked in June 2008 in line with a record DPS of KES 8.05 and a record payout of

84%23. This and the year-on-year increase in DPS have helped fuel its relatively strong stock performance.

23

EABL’s high payout is evidenced in Figure 8 by dividing the annual DPS values with respective the EPS values.

- 16 - © 2009 PK Mwangi Global Consulting

You might also like

- Unmasking Blockchain FinanceDocument11 pagesUnmasking Blockchain FinancePatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Accounting and Financial Management Study NotesDocument72 pagesAccounting and Financial Management Study NotesShani BitonNo ratings yet

- Research Proposal: Financial Analysis of Hospitality Sector in UKDocument13 pagesResearch Proposal: Financial Analysis of Hospitality Sector in UKRama Kedia100% (1)

- Moment Generating FunctionDocument10 pagesMoment Generating FunctionRajesh DwivediNo ratings yet

- Everelite Technology Financial AnalysisDocument15 pagesEverelite Technology Financial AnalysisNelly Yulinda50% (2)

- Introduction To Economic AnalysisDocument18 pagesIntroduction To Economic AnalysiskrishnaNo ratings yet

- Kathmandu University School of Management EMBA End-Term Examination (Spring 2020)Document2 pagesKathmandu University School of Management EMBA End-Term Examination (Spring 2020)Sailesh Dahal100% (1)

- Decentralised Finance (De-Fi) : Is This The Future of Finance?Document26 pagesDecentralised Finance (De-Fi) : Is This The Future of Finance?Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Alina NedelcuDocument27 pagesAlina NedelcuasdasddddNo ratings yet

- MA5616 V800R311C01 Configuration Guide 02Document741 pagesMA5616 V800R311C01 Configuration Guide 02Mário Sapucaia NetoNo ratings yet

- Civil Boq AiiapDocument170 pagesCivil Boq AiiapMuhammad ArslanNo ratings yet

- Rental Volatility in UK Commercial Market - Assignment (REE) - 2010-FinalDocument11 pagesRental Volatility in UK Commercial Market - Assignment (REE) - 2010-Finaldhruvjjani100% (1)

- Managerial Economics: Class: Mba 3.5 Semester V Instructor: Ms. Saira MajeedDocument102 pagesManagerial Economics: Class: Mba 3.5 Semester V Instructor: Ms. Saira MajeedFatima KhalidNo ratings yet

- A New World of Endless PossibilitiesDocument75 pagesA New World of Endless PossibilitiesKristi Duran100% (1)

- Attock Petroleum Financial Report 2010Document6 pagesAttock Petroleum Financial Report 2010Naveed JavedNo ratings yet

- Conceptually-Based Financial Reporting Quality Assessment. An Empirical Analysis On Quality Differences Between UK Annual Reports and US 10-K ReportsDocument35 pagesConceptually-Based Financial Reporting Quality Assessment. An Empirical Analysis On Quality Differences Between UK Annual Reports and US 10-K ReportsAbdulAzeemNo ratings yet

- 14th CRITICAL THINKING PROCESSES OF JUNIOR HIGH SCHOOL STUDENTS PDFDocument188 pages14th CRITICAL THINKING PROCESSES OF JUNIOR HIGH SCHOOL STUDENTS PDFWidhie CaemNo ratings yet

- Acca Thesis For BSC Applied AccountancyDocument32 pagesAcca Thesis For BSC Applied AccountancyJehanzeb KhanNo ratings yet

- 81645-Article Text-194899-1-10-20120927 PDFDocument32 pages81645-Article Text-194899-1-10-20120927 PDFNaod MekonnenNo ratings yet

- Assignment 3 - Financial Case StudyDocument1 pageAssignment 3 - Financial Case StudySenura SeneviratneNo ratings yet

- Consumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithDocument28 pagesConsumption Function: "Consumption Is The Sole End and Purpose of All Production." Adam SmithPooja SheoranNo ratings yet

- IS-LM Model ExplainedDocument28 pagesIS-LM Model ExplainedVikku AgarwalNo ratings yet

- Analysis AssignmentDocument3 pagesAnalysis AssignmentmadyanoshieNo ratings yet

- RAP 20 ChobeDocument34 pagesRAP 20 ChobeSusan GomezNo ratings yet

- Level 5 Assessment Specification: Appendix Ga36BDocument10 pagesLevel 5 Assessment Specification: Appendix Ga36BcsolutionNo ratings yet

- ACCT3583 - 2011 - Topic 01 - SeminarDocument8 pagesACCT3583 - 2011 - Topic 01 - Seminarreflecti0nNo ratings yet

- Lecture+4+Investment+Appraisal+Mehtods+11 12Document25 pagesLecture+4+Investment+Appraisal+Mehtods+11 12Mahajan AjayNo ratings yet

- Corporate Finance ProjectDocument13 pagesCorporate Finance Projectsaniya_umbreenNo ratings yet

- Mendel OwDocument3 pagesMendel OwRamshanUrdog123No ratings yet

- Financial Analysis of BUXLY PAINTSDocument36 pagesFinancial Analysis of BUXLY PAINTSAmberpmNo ratings yet

- Steps - Oral Case AnalysisDocument3 pagesSteps - Oral Case AnalysisRodolfo Mapada Jr.No ratings yet

- Consolidated financial statements of Zena GroupDocument27 pagesConsolidated financial statements of Zena Groupbcnxv100% (1)

- Coursework 1-Corporate FinanceDocument3 pagesCoursework 1-Corporate Financeyitong zhangNo ratings yet

- Pestle AnalysisDocument11 pagesPestle Analysislippslips_22No ratings yet

- Financial Analysis For ToshibaDocument13 pagesFinancial Analysis For ToshibaNoname Nonamesky100% (2)

- IUBAT - International University of Business Agriculture and TechnologyDocument4 pagesIUBAT - International University of Business Agriculture and Technologycreative dudeNo ratings yet

- Management AccountingDocument21 pagesManagement AccountingbelladoNo ratings yet

- Dividend Policy of Nepal TelecomDocument9 pagesDividend Policy of Nepal TelecomGwacheeNo ratings yet

- OBU BSC RAP-Business ModelsDocument4 pagesOBU BSC RAP-Business ModelsTanim Misbahul MNo ratings yet

- Math662TB 09SDocument712 pagesMath662TB 09SGadhoumiWalid100% (1)

- Commented Proposal by DR AbiyDocument60 pagesCommented Proposal by DR AbiyGirmaAbu Oromo OromiaNo ratings yet

- Trade and Theories: Critical Questions: Mercantilism Is A Bankrupt Theory That Has No Place in The Modern World. DiscussDocument15 pagesTrade and Theories: Critical Questions: Mercantilism Is A Bankrupt Theory That Has No Place in The Modern World. DiscussMishal FatimaNo ratings yet

- PEST AnalysisDocument1 pagePEST AnalysisTrey Poppi CausleyNo ratings yet

- RMS (40931) Final Exam PaperDocument5 pagesRMS (40931) Final Exam PaperAbdurehman Ullah khanNo ratings yet

- Esearch Roject: A. Files To Be UploadedDocument4 pagesEsearch Roject: A. Files To Be Uploadedasfandkamal12345No ratings yet

- Creative Accounting Ethical Issues of Micro and Macro Manipulation PDFDocument11 pagesCreative Accounting Ethical Issues of Micro and Macro Manipulation PDFAđńaŋ NèeþuNo ratings yet

- ECON 4301 Midterm Solutions PDFDocument8 pagesECON 4301 Midterm Solutions PDFHumam HassanNo ratings yet

- Article Review AssignmentDocument2 pagesArticle Review AssignmentAndualem GetuNo ratings yet

- Profitability Ratio Analysis of Fertilizer CompaniesDocument49 pagesProfitability Ratio Analysis of Fertilizer CompaniesSaifullah JunejoNo ratings yet

- Square and Renata Ratio Analysis and ValuationDocument47 pagesSquare and Renata Ratio Analysis and ValuationRawkill 2000No ratings yet

- Big Data and Changes in Audit Technology - Contemplating A Research AgendaDocument26 pagesBig Data and Changes in Audit Technology - Contemplating A Research AgendaMuh.shahib100% (1)

- Management - Ch06 - Forecasting and PremisingDocument9 pagesManagement - Ch06 - Forecasting and PremisingRameshKumarMurali0% (1)

- PPM 542 - Shimelis Tessema - GSR-2453-13Document4 pagesPPM 542 - Shimelis Tessema - GSR-2453-13Shimelis TesemaNo ratings yet

- Instructor's Manual To Accompany Managerial EconomicsDocument2 pagesInstructor's Manual To Accompany Managerial Economicssambalikadzilla6052100% (1)

- Operations Research Analysts A Complete Guide - 2019 EditionFrom EverandOperations Research Analysts A Complete Guide - 2019 EditionNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Financial Statement Analysis Ratios ExplainedDocument20 pagesFinancial Statement Analysis Ratios ExplainedRoxieNo ratings yet

- Financial Analysis of Nestle India and ACC LtdDocument20 pagesFinancial Analysis of Nestle India and ACC Ltdrahil0786No ratings yet

- Financial Decision Making: AssignmentDocument19 pagesFinancial Decision Making: AssignmentMutasem AmrNo ratings yet

- Ratio - Tesco AssignmentDocument11 pagesRatio - Tesco AssignmentaXnIkaran100% (1)

- Financial Reporting and Analysis PDFDocument2 pagesFinancial Reporting and Analysis PDFTushar VatsNo ratings yet

- Financial Analysis of Next Plc Reveals Profitability and Liquidity StrengthsDocument11 pagesFinancial Analysis of Next Plc Reveals Profitability and Liquidity StrengthsHamza AminNo ratings yet

- Regulation of Cryptocurrency in Key JurisdictionsDocument11 pagesRegulation of Cryptocurrency in Key Jurisdictionscryptic kenyaNo ratings yet

- Bitcoin Hashrate and Bitcoin Price: Is Price Prediction Possible?Document11 pagesBitcoin Hashrate and Bitcoin Price: Is Price Prediction Possible?Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Cryptocurrency - Taming The Volatility Through Fund-InvestingDocument14 pagesCryptocurrency - Taming The Volatility Through Fund-InvestingPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Bitcoin - A SWOT AnalysisDocument6 pagesBitcoin - A SWOT AnalysisPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Identifying Corporate FailureDocument4 pagesIdentifying Corporate FailurePatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Global Investment Opportunities - A Low-Cost Passive 'Buy-And-Hold' StrategyDocument34 pagesGlobal Investment Opportunities - A Low-Cost Passive 'Buy-And-Hold' StrategyPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Africa Multinational Corporations - Navigating Currency RiskDocument9 pagesAfrica Multinational Corporations - Navigating Currency RiskPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Corporate Recovery - The SemanticsDocument6 pagesCorporate Recovery - The SemanticsPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Corporate Governance 'Unplugged'Document7 pagesCorporate Governance 'Unplugged'Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Project Not Feasible - Not So Fast - A Black-Scholes PerspectiveDocument5 pagesProject Not Feasible - Not So Fast - A Black-Scholes PerspectivePatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Easy Pickings On The Nairobi Securities Exchange (NSE)Document5 pagesEasy Pickings On The Nairobi Securities Exchange (NSE)Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Nairobi Stock Exchange (NSE) Sector and Benchmark Index Performance (2010)Document18 pagesNairobi Stock Exchange (NSE) Sector and Benchmark Index Performance (2010)Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Assembling A Client Portfolio - A Simplified Theoretical PerspectiveDocument8 pagesAssembling A Client Portfolio - A Simplified Theoretical PerspectivePatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Nairobi Securities Exchange Sector and Benchmark Index Performance (2011)Document20 pagesNairobi Securities Exchange Sector and Benchmark Index Performance (2011)Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- The Nairobi Stock Exchange (NSE) - The Case For A Buy-And-hold Strategy For Equity InvestorsDocument18 pagesThe Nairobi Stock Exchange (NSE) - The Case For A Buy-And-hold Strategy For Equity InvestorsPatrick Kiragu Mwangi BA, BSc., MA, ACSI100% (1)

- Dividend Yield or Capital Growth On The Nairobi Stock Exchange (NSE)Document19 pagesDividend Yield or Capital Growth On The Nairobi Stock Exchange (NSE)Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Nairobi Stock Exchange Sector and Benchmark Index Performance (2008)Document6 pagesNairobi Stock Exchange Sector and Benchmark Index Performance (2008)Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Why Africa Should Form A Key Part of Your Investment PortfolioDocument3 pagesWhy Africa Should Form A Key Part of Your Investment PortfolioPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Nairobi Stock Exchange Sector and Benchmark Index Performance (2009)Document17 pagesNairobi Stock Exchange Sector and Benchmark Index Performance (2009)Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- Do African Stock Markets Provide A Window of Opportunity To The International Investor ?Document3 pagesDo African Stock Markets Provide A Window of Opportunity To The International Investor ?Patrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- The Nairobi Stock Exchange (NSE) Sectors ReconfiguredDocument5 pagesThe Nairobi Stock Exchange (NSE) Sectors ReconfiguredPatrick Kiragu Mwangi BA, BSc., MA, ACSINo ratings yet

- My Con Pds Sikafloor 161 HCDocument5 pagesMy Con Pds Sikafloor 161 HClaurenjiaNo ratings yet

- CIGB B164 Erosion InterneDocument163 pagesCIGB B164 Erosion InterneJonathan ColeNo ratings yet

- Caf 8 Aud Spring 2022Document3 pagesCaf 8 Aud Spring 2022Huma BashirNo ratings yet

- Ts 391 IltDocument5 pagesTs 391 IltFunnypoumNo ratings yet

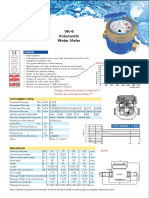

- Baylan: VK-6 Volumetric Water MeterDocument1 pageBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNo ratings yet

- Jurisdiction of The Supreme CourtDocument1 pageJurisdiction of The Supreme CourtAnshul Yadav100% (1)

- Critical Aspects in Simulating Cold Working Processes For Screws and BoltsDocument4 pagesCritical Aspects in Simulating Cold Working Processes For Screws and BoltsstefanomazzalaiNo ratings yet

- MatrikonOPC Server For Simulation Quick Start Guide PDFDocument2 pagesMatrikonOPC Server For Simulation Quick Start Guide PDFJorge Perez CastañedaNo ratings yet

- GeM Bidding 2568310Document9 pagesGeM Bidding 2568310SICURO INDIANo ratings yet

- Zellner Bayesian AnalysisDocument4 pagesZellner Bayesian AnalysisfoopeeNo ratings yet

- Merging - Scaled - 1D - & - Trying - Different - CLassification - ML - Models - .Ipynb - ColaboratoryDocument16 pagesMerging - Scaled - 1D - & - Trying - Different - CLassification - ML - Models - .Ipynb - Colaboratorygirishcherry12100% (1)

- 2012 NAPTIN DocumentDocument48 pages2012 NAPTIN DocumentbenaikodonNo ratings yet

- How To Generate Your First 20,000 Followers On InstagramDocument44 pagesHow To Generate Your First 20,000 Followers On InstagramAdrian Pratama100% (1)

- Igbt Irg 4p254sDocument9 pagesIgbt Irg 4p254sMilagros Mendieta VegaNo ratings yet

- Grid Xtreme VR Data Sheet enDocument3 pagesGrid Xtreme VR Data Sheet enlong bạchNo ratings yet

- Machine Problem 6 Securing Cloud Services in The IoTDocument4 pagesMachine Problem 6 Securing Cloud Services in The IoTJohn Karlo KinkitoNo ratings yet

- RAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefDocument26 pagesRAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefMardiana MardianaNo ratings yet

- Lessee Information StatementDocument1 pageLessee Information Statementmja.carilloNo ratings yet

- Solved Problems: EEE 241 Computer ProgrammingDocument11 pagesSolved Problems: EEE 241 Computer ProgrammingŞemsettin karakuşNo ratings yet

- Find The Minimal Sum of Products For The Boolean Expression F Using Quine-Mccluskey MethodDocument15 pagesFind The Minimal Sum of Products For The Boolean Expression F Using Quine-Mccluskey MethodSaira RasulNo ratings yet

- UE Capability Information (UL-DCCH) - Part2Document51 pagesUE Capability Information (UL-DCCH) - Part2AhmedNo ratings yet

- Identifying Community Health ProblemsDocument4 pagesIdentifying Community Health ProblemsEmvie Loyd Pagunsan-ItableNo ratings yet

- AGCC Response of Performance Completed Projects Letter of recommendAGCC SS PDFDocument54 pagesAGCC Response of Performance Completed Projects Letter of recommendAGCC SS PDFAnonymous rIKejWPuS100% (1)

- 1Z0-062 Exam Dumps With PDF and VCE Download (1-30)Document6 pages1Z0-062 Exam Dumps With PDF and VCE Download (1-30)Humberto Cordova GallegosNo ratings yet

- Applied Econometrics ModuleDocument142 pagesApplied Econometrics ModuleNeway Alem100% (1)

- SAPGLDocument130 pagesSAPGL2414566No ratings yet

- Naoh Storage Tank Design Description:: Calculations For Tank VolumeDocument6 pagesNaoh Storage Tank Design Description:: Calculations For Tank VolumeMaria Eloisa Angelie ArellanoNo ratings yet