Professional Documents

Culture Documents

Travelling Rights

Uploaded by

rmaqOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Travelling Rights

Uploaded by

rmaqCopyright:

Available Formats

Right To Travel Without A License

https://www.youtube.com/watch?v=nVHCq0qZOfI

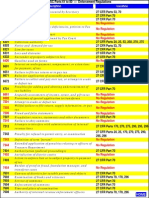

CVC Section 21052 The provisions of this code applicable to the drivers of vehicles upon the highways

apply to the drivers of all vehicles while engaged in the course of employment by this State, any political

subdivision thereof, any municipal corporation, or any district, including authorized emergency vehicles

subject to those exemptions granted such authorized emergency vehicles in this code. CVC 260. (a) A

"commercial vehicle" is a motor vehicle of a type required to be registered under this code used or

maintained for the transportation of persons for hire, compensation, or profit or designed, used, or

maintained primarily for the transportation of property. (b) Passenger vehicles and house cars that are not

used for the transportation of persons for hire, compensation, or profit are not commercial vehicles. This

subdivision shall not apply to Chapter 4 (commencing with Section 6700) of Division 3. CVC 17460 The

acceptance or retention by a resident of this state of a driver's license issued pursuant to the provisions of

this code, shall constitute the consent of the person that service of summons may be made upon him

within or without this state, whether or not he is then a resident of this state, in any action brought in the

courts of this state upon a cause of action arising in this state out of his operation of a motor vehicle

anywhere within this state. CVC 17459 The acceptance by a resident of this state of a certificate of

ownership or a certificate of registration of any motor vehicle or any renewal thereof, issued under the

provisions of this code, shall constitute the consent by the person that service of summons may be made

upon him within or without this state, whether or not he is then a resident of this state, in any action

brought in the courts of this state upon a cause of action arising in this state out of the ownership or

operation of the vehicle. Definitions by corporate Federal "State" for "in the state", "in this state", "in the

state", "within this state" and "this state" CALIFORNIA (CCA) located in: Aircraft assessment and taxation,

Revenue and Taxation Code §5304 Beverage containers, Health and Safety Code §113200 Cigarette tax,

Revenue and Taxation Code §30013 Corporate Securities Law of 1968, Corporations Code §25008

Diesel fuel tax, Revenue and Taxation Code §60017 Emergency Telephone Users Surcharge Law,

Revenue and Taxation Code §41005 Energy resources surcharge, Revenue and Taxation Code §40006

Fractional interests, local agency obligations, Government Code §5950 Hazardous Substances Tax Law,

Revenue and Taxation Code §43009 Integrated waste management fees, Revenue and Taxation Code

§45008 Motor vehicle fuel license tax, Revenue and Taxation Code §7309 Private railroad car tax,

Revenue and Taxation Code §11205 Residential mortgage lenders, Finance Code §50003 Sales and use

tax, Revenue and Taxation Code §6017 Taxation, Revenue and Taxation Code §130(f) Use fuel tax,

Revenue and Taxation Code §8609 Revenue and Taxation §130(f) "In this state" means within the exterior

limits of the State of California, and includes all territory within these limits owned by, or ceded to, the

United States of America. Revenue and Taxation §6017. "In this State" or "in the State" means within the

exterior limits of the State of California and includes all territory within these limits owned by or ceded to

the United States of America. CASE MENTIONED: 7 Cal.App.2d 395, 46 P.2d 234 JOHN J. O'NEIL,

Appellant, v. DEPARTMENT OF PROFESSIONAL AND VOCATIONAL STANDARDS et al, Respondents.

Civ. No. 10276. District Court of Appeal, Second District, Division 2, California. June 5, 1935. Message 1

of 12181 Interview and uploaded from Minivan Jack https://www.youtube.com/watch?v=eQ6mq...

You might also like

- Sign Name Without LiabiltyDocument4 pagesSign Name Without Liabiltyrmaq100% (4)

- Bankers Notice of Accept PrestmDocument13 pagesBankers Notice of Accept PrestmNova91% (11)

- Strawman The Untold StoryDocument6 pagesStrawman The Untold StoryMike Williams100% (2)

- Cestui Que Vie TrustDocument7 pagesCestui Que Vie TrustHelen Walker Private Person100% (9)

- Consent Required Y or NDocument277 pagesConsent Required Y or Nrmaq100% (1)

- Doctrine of DiscoveryDocument4 pagesDoctrine of Discoveryrmaq0% (1)

- Constitutional Criminal Complaint Book 1 4 121 PDFDocument119 pagesConstitutional Criminal Complaint Book 1 4 121 PDFJohn Kronnick100% (5)

- A4V Processes and ProceduresDocument4 pagesA4V Processes and Proceduresrmaq100% (4)

- Counterclaim ProcessesDocument4 pagesCounterclaim Processesrmaq100% (1)

- Counterclaim ProcessesDocument4 pagesCounterclaim Processesrmaq100% (1)

- The Right To TravelDocument167 pagesThe Right To TravelBJSSRS50% (2)

- Why Capital Letter NAMES MatterDocument2 pagesWhy Capital Letter NAMES MatterrmaqNo ratings yet

- Natural Law & ScripturesDocument6 pagesNatural Law & ScripturesrmaqNo ratings yet

- Notes-Executors and EstatesDocument15 pagesNotes-Executors and EstatesrmaqNo ratings yet

- Surrendering Birth CertificateDocument3 pagesSurrendering Birth Certificatermaq100% (8)

- UN Report On US Treatment of Native AmericansDocument50 pagesUN Report On US Treatment of Native AmericansCEInquiry100% (1)

- Laws of EquityDocument3 pagesLaws of Equityrmaq100% (1)

- Law of ContractsDocument1 pageLaw of ContractsrmaqNo ratings yet

- From Freedom To Serfdom Rev - 19Document498 pagesFrom Freedom To Serfdom Rev - 19ronwestNo ratings yet

- Common Law & EquityDocument5 pagesCommon Law & EquityrmaqNo ratings yet

- Common Law & EquityDocument5 pagesCommon Law & EquityrmaqNo ratings yet

- Common Law & EquityDocument5 pagesCommon Law & EquityrmaqNo ratings yet

- DUNSNOSDocument1 pageDUNSNOSCarla DiCapriNo ratings yet

- Reviewer - Chan (2017)Document145 pagesReviewer - Chan (2017)Ginn Est100% (3)

- Concessions To The Pope (1213)Document2 pagesConcessions To The Pope (1213)Yaw Mensah Amun Ra100% (1)

- I 843Document6 pagesI 843ayi imaduddinNo ratings yet

- Bailbond 2Document5 pagesBailbond 2romnickNo ratings yet

- Using The Doctirne of Ex Debito Justitiae in CourtDocument2 pagesUsing The Doctirne of Ex Debito Justitiae in Courtrmaq100% (2)

- Last Will and TestamentDocument3 pagesLast Will and TestamentLetlhogonolo Molokomme MokhuseNo ratings yet

- Income Tax Law 1297 Holds The KeyDocument8 pagesIncome Tax Law 1297 Holds The KeyrmaqNo ratings yet

- Bond SetDocument56 pagesBond SetrmaqNo ratings yet

- The Stamp Act 1899Document47 pagesThe Stamp Act 1899bakhtiarahmed7362No ratings yet

- California DMV REQUIRED by CALIFORNIA LAW To Issue CA EXEMPT License Plates To Non Commercial Automobile Users PDFDocument5 pagesCalifornia DMV REQUIRED by CALIFORNIA LAW To Issue CA EXEMPT License Plates To Non Commercial Automobile Users PDFaplawNo ratings yet

- Expert Witness ReportDocument3 pagesExpert Witness Reportcitizeninv1100% (2)

- Attorney License Fraud Attorney'S License??? Ain'T No Such Thing!!!Document14 pagesAttorney License Fraud Attorney'S License??? Ain'T No Such Thing!!!Julio VargasNo ratings yet

- Courts Lack Jurisdiction Over The Living ManDocument1 pageCourts Lack Jurisdiction Over The Living Manrmaq100% (1)

- ExecutorDocument1 pageExecutorjulie gonzalesNo ratings yet

- Record of AssessmentDocument9 pagesRecord of AssessmentNihil Inultum RemanebitNo ratings yet

- Introduction To Trusts PDFDocument34 pagesIntroduction To Trusts PDFrmaq100% (1)

- EQUITY & Te TureDocument4 pagesEQUITY & Te TurermaqNo ratings yet

- Domestic Violence in The United StatesDocument82 pagesDomestic Violence in The United Statesnick kharshiladzeNo ratings yet

- EXHIBIT 013 - Without United StatesDocument4 pagesEXHIBIT 013 - Without United StatesJesse Garcia100% (2)

- Trespass Exclusion NoticeDocument1 pageTrespass Exclusion NoticebperkyNo ratings yet

- Magna Carta and NZ ConstitutionDocument22 pagesMagna Carta and NZ ConstitutionSimon KaiwaiNo ratings yet

- Ex Debitojustitiae: House of Lords Case Law.Document7 pagesEx Debitojustitiae: House of Lords Case Law.rmaq100% (1)

- P5 Cma Inter LawDocument512 pagesP5 Cma Inter Lawraju100% (1)

- 11 - Republic Vs Marlon MedidaDocument2 pages11 - Republic Vs Marlon MedidaJan Kristelle BarlaanNo ratings yet

- Bill Yackle Embezzlement Case PDFDocument16 pagesBill Yackle Embezzlement Case PDFFritz CarrNo ratings yet

- 22 USC 288a - Privileges, Exemptions, and Immunities of International Organizations - Title 22 - Foreign Relations and Intercourse - U.SDocument3 pages22 USC 288a - Privileges, Exemptions, and Immunities of International Organizations - Title 22 - Foreign Relations and Intercourse - U.SNicole LebrasseurNo ratings yet

- Unicameral V Bicameral Pros and Con PDFDocument64 pagesUnicameral V Bicameral Pros and Con PDFRidhwan XivNo ratings yet

- Citizens Committee To Save Elysian Park - Newsletter Number 109 - January 27, 1994Document2 pagesCitizens Committee To Save Elysian Park - Newsletter Number 109 - January 27, 1994Citizens Committee to Save Elysian ParkNo ratings yet

- Invoice To Federation of State, County, Municipal EmployeesDocument2 pagesInvoice To Federation of State, County, Municipal EmployeesrodclassteamNo ratings yet

- 5.TN Treasury Code Vol1 77-150Document74 pages5.TN Treasury Code Vol1 77-150Porkodi SengodanNo ratings yet

- Household Balance Sheet Q2 2009Document6 pagesHousehold Balance Sheet Q2 2009DvNetNo ratings yet

- Republic Act No. 7Document2 pagesRepublic Act No. 7ulonggwapoNo ratings yet

- Winslow Township - Commerical Lien - Affidavit of ObligationDocument1 pageWinslow Township - Commerical Lien - Affidavit of ObligationJ. F. El - All Rights ReservedNo ratings yet

- RAP Offical Press Release - Republic Restored!Document1 pageRAP Offical Press Release - Republic Restored!Dennis-JospehNo ratings yet

- Legal Department NoticeDocument1 pageLegal Department Noticescribddotcom111No ratings yet

- ArrestDocument11 pagesArrestNehru Valdenarro ValeraNo ratings yet

- ABH-012012-VPQB Verification of PaymentDocument2 pagesABH-012012-VPQB Verification of PaymentAllen-nelson of the Boisjoli familyNo ratings yet

- MCS 150 Page 1Document2 pagesMCS 150 Page 1Galina NovahovaNo ratings yet

- Extracts Tax Acts IncomeDocument25 pagesExtracts Tax Acts IncomeFAQMD2No ratings yet

- 3 Ae 6 B 4 F 68Document7 pages3 Ae 6 B 4 F 68MohammadAhmadNo ratings yet

- Private Car Package PolicyDocument16 pagesPrivate Car Package PolicyAwadhesh YadavNo ratings yet

- Stan Preckel Workshops Curriculumtermsandconditions October14 1Document5 pagesStan Preckel Workshops Curriculumtermsandconditions October14 1joerocketmanNo ratings yet

- Bill of ExchangeDocument3 pagesBill of ExchangeAlbert PadillaNo ratings yet

- Alabama Press ReleaseDocument1 pageAlabama Press ReleaseDonald BoxleyNo ratings yet

- VTR 275Document2 pagesVTR 275Konan SnowdenNo ratings yet

- 14 08 04 Letter FiledDocument7 pages14 08 04 Letter FiledwarriorsevenNo ratings yet

- YOUR Right To Remain SilentDocument5 pagesYOUR Right To Remain SilentkelzbernaNo ratings yet

- Lawsuit Against Harrisburg Police Dauphin CountyDocument58 pagesLawsuit Against Harrisburg Police Dauphin CountyChristine VendelNo ratings yet

- Responsibility. I Think Not.Document6 pagesResponsibility. I Think Not.Benne JamesNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document6 pagesAttention:: WWW - Irs.gov/form1099jengNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument4 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- PDF 20200812 131130 142277012701921Document4 pagesPDF 20200812 131130 142277012701921Lee LienNo ratings yet

- Arrest Is False InformationDocument1 pageArrest Is False InformationbperkyNo ratings yet

- CFRxref PDFDocument4 pagesCFRxref PDFiamnumber8No ratings yet

- 39 Stat 951, An Act To Provide A Civil Government For Puerto Rico (2 March 1917), HR 6333, PL 368Document18 pages39 Stat 951, An Act To Provide A Civil Government For Puerto Rico (2 March 1917), HR 6333, PL 368nolu chan100% (1)

- Diplomatic ImmunityDocument1 pageDiplomatic ImmunityAsim MahatoNo ratings yet

- Treasury Secretary Steve Mnuchin Asks Congress To Raise Debt LimitDocument1 pageTreasury Secretary Steve Mnuchin Asks Congress To Raise Debt LimitCNBC.comNo ratings yet

- Regn. No.: The Employees' Deposit Linked Insurance Scheme 1976Document2 pagesRegn. No.: The Employees' Deposit Linked Insurance Scheme 1976Tilak RajNo ratings yet

- 3.25.11 IRS Case Appeal Notice Filed DCDocument8 pages3.25.11 IRS Case Appeal Notice Filed DCKonan SnowdenNo ratings yet

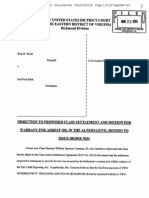

- SunTrust Litigation 3:13-cv-662-JRSDocument15 pagesSunTrust Litigation 3:13-cv-662-JRSsconneratNo ratings yet

- The Treaty of Hopewell: 1785Document5 pagesThe Treaty of Hopewell: 1785TRAVIS MISHOE SUDLER I100% (4)

- LetterRogatory ServiceFormDocument1 pageLetterRogatory ServiceFormPETENo ratings yet

- Christopher Proe Criminal ComplaintDocument7 pagesChristopher Proe Criminal ComplaintWXYZ-TV Channel 7 DetroitNo ratings yet

- Drury Lane FilingDocument3 pagesDrury Lane FilingExecutive VP Kansas CureNo ratings yet

- Bankers' AcceptanceDocument4 pagesBankers' AcceptanceSatyabrota DasNo ratings yet

- ZIP Codes Are Applicable To Federal Territories and Enclaves Located Within The 50 States of The Union PDFDocument2 pagesZIP Codes Are Applicable To Federal Territories and Enclaves Located Within The 50 States of The Union PDFnujahm1639100% (1)

- Print & Cut Along Dotted LineDocument1 pagePrint & Cut Along Dotted LineKonan SnowdenNo ratings yet

- Scope of Interest Taken: Citizens Bank & Trust v. Gibson Lumber Co., Page 97Document11 pagesScope of Interest Taken: Citizens Bank & Trust v. Gibson Lumber Co., Page 97agothermailNo ratings yet

- You Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryFrom EverandYou Are My Servant and I Have Chosen You: What It Means to Be Called, Chosen, Prepared and Ordained by God for MinistryNo ratings yet

- MTN Buy Out ProcedureDocument1 pageMTN Buy Out ProcedurermaqNo ratings yet

- Legitimate Expectation, Doctrine ofDocument1 pageLegitimate Expectation, Doctrine ofrmaqNo ratings yet

- MTN Buy Out Procedures 02Document1 pageMTN Buy Out Procedures 02rmaqNo ratings yet

- Sovereign Man: Nobel Prize-Winning Economist Joseph Stiglitz Says We Shouldn't Worry About America's Prodigious DebtDocument3 pagesSovereign Man: Nobel Prize-Winning Economist Joseph Stiglitz Says We Shouldn't Worry About America's Prodigious DebtrmaqNo ratings yet

- Tax CasesDocument33 pagesTax CasesPat P. MonteNo ratings yet

- History Research PaperDocument14 pagesHistory Research Paperlucifer morningstarNo ratings yet

- Article 348 of The ConstitutionDocument2 pagesArticle 348 of The ConstitutionLatest Laws TeamNo ratings yet

- Constitutional Law Project One India One ElectionDocument18 pagesConstitutional Law Project One India One ElectionKushal KediaNo ratings yet

- Political Law Q 2003Document5 pagesPolitical Law Q 2003Mackoy WillchurchNo ratings yet

- Alwin E. Hopfmann v. Michael Joseph Connolly, 746 F.2d 97, 1st Cir. (1984)Document9 pagesAlwin E. Hopfmann v. Michael Joseph Connolly, 746 F.2d 97, 1st Cir. (1984)Scribd Government DocsNo ratings yet

- "'Words Fitly Spoken': Thomas Jefferson, Slavery, and Sally HemingsDocument14 pages"'Words Fitly Spoken': Thomas Jefferson, Slavery, and Sally HemingsDavid PostNo ratings yet

- Revisiting The Controversies On The Jurisdiction of National Industrial Court of Nigeria Over Labour-Related Human Rights MattersDocument18 pagesRevisiting The Controversies On The Jurisdiction of National Industrial Court of Nigeria Over Labour-Related Human Rights MattersMichael T. A DamiariNo ratings yet

- SSS All InformationDocument47 pagesSSS All InformationdaudinhanNo ratings yet

- 2013 NADA Data 102113Document21 pages2013 NADA Data 102113NakedLimeNo ratings yet

- Roy II vs. Herbosa, G.R. No. 207946, November 22, 2016Document20 pagesRoy II vs. Herbosa, G.R. No. 207946, November 22, 2016Rina OlandoNo ratings yet

- Fourth Corner Credit Union v. Federal Reserve Bank of Kansas City - Dismissal OrderDocument9 pagesFourth Corner Credit Union v. Federal Reserve Bank of Kansas City - Dismissal OrderBen AdlinNo ratings yet

- Divya A. Jain: Name of AuthorDocument11 pagesDivya A. Jain: Name of AuthorkomalNo ratings yet

- Jammu and Kashmir Reorganisation Bill, 2019Document58 pagesJammu and Kashmir Reorganisation Bill, 2019PGurusNo ratings yet

- Official GazetteDocument18 pagesOfficial GazetteSuhas SahakariNo ratings yet

- Concurrent Power of Legislation Under List III of The Indian ConstitutionDocument11 pagesConcurrent Power of Legislation Under List III of The Indian ConstitutionAhmed SiddiquiNo ratings yet

- Senate Hearing, 109TH Congress - Puerto RicoDocument159 pagesSenate Hearing, 109TH Congress - Puerto RicoScribd Government DocsNo ratings yet

- Macariola v. Asuncion, 114 SCRA 77 (1982)Document9 pagesMacariola v. Asuncion, 114 SCRA 77 (1982)John OrdanezaNo ratings yet

- Public Officer and Election Laws Related CasesDocument225 pagesPublic Officer and Election Laws Related CasesLei Bataller BautistaNo ratings yet

- Austin Sullivan - Complaint For DamagesDocument19 pagesAustin Sullivan - Complaint For DamagesshreveporttimesNo ratings yet

- 294 The Story of A Pioneer Pastor Paul Gerhardt Tonsing ADocument43 pages294 The Story of A Pioneer Pastor Paul Gerhardt Tonsing ARichard Tonsing100% (2)