Professional Documents

Culture Documents

Washington Americas MarketBeat Office Q22019

Uploaded by

William HarrisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Washington Americas MarketBeat Office Q22019

Uploaded by

William HarrisCopyright:

Available Formats

MARKETBEAT

Washington, D.C.

Office Q2

Q1 2019

2017

Washington, D.C. OFFICE Economy

Year end 2018 net new job growth in the Washington, DC metropolitan region was revised sharply

downward in the second quarter of 2019, falling from the initial reporting of 54,000 new jobs to 36,000.

Economic Indicators This possibly indicates that the government shutdown of late 2018/early 2019 had a pronounced

12-Month negative impact and does not bode well for a federal sector that is likely to be faced with increasing

Q2 18 Q2 19

Forecast gridlock in advance of the 2020 presidential election. This is reminiscent of the “Tea Party Wave” of

2010 in which a conservative House of Representatives came into the majority that was diametrically

D.C. Metro Employment 3.30M 3.33M opposed to the incumbent executive branch and the friction between the two branches mired the

federal government in shutdowns, budget sequestration and gridlock. While the headline job growth

D.C. Metro Unemployment 3.4% 3.3% statistics in the region have slowed in late 2018/early 2019, the headline economic indicators remain

relatively healthy. The labor markets remain very tight with a regional unemployment rate of 3.3% and

U.S. Unemployment 3.9% 3.6% year-to-date, the DC region has added 20,800 jobs led by gains in Professional and Business

Services, Leisure and Hospitality and Retail (6,500, 5,800 and 3,100 jobs, respectively).

Market Overview

The first deliveries scheduled for 2019 with significant vacancies came online and, as expected, ticked

up the vacancy rate in the District of Columbia in the second quarter of 2019. Just over one million

Market Indicators (Overall, All Classes) square feet (sf) of vacant space was added to the Washington, DC market in the second quarter

resulting in a 13.9% overall vacancy rate, up 60 basis points (bps) from 13.3% in the first quarter but

12-Month down slightly from the 14.0% year-over-year (YOY). In the East End, 655 New York Avenue, NW,

Q2 18 Q2 19

Forecast delivered with approximately 64% of its 756,000 sf of rentable building area (RBA) vacant. The

Advisory Board—which signed an initial prelease for 522,776 sf in 2015, has split into two companies:

Vacancy 14.0% 13.9% United Healthcare Group moved into its 272,149 sf of space upon delivery this quarter. EAB—the

second entity of the Advisory Board, has not yet occupied its 200,589 sf as of the close of the second

YTD Net Absorption (sf) 390k 817k quarter. In NoMa, 150 M Street, NE delivered entirely vacant during the quarter, adding 522,550 sf of

vacant space to the market. The U.S. Department of Justice, however, is consolidating its District of

Under Construction (sf) 3.6M 2.9M Columbia locations into 475,100 sf as part of a phased move-in and should occupy almost the entire

building by the end of 2019 or early 2020. That move will mitigate the impact of this vacant space on

Average Asking Rent* $55.01 $54.61 market fundamentals. Still, for the time being, vacancy rates have been inching upward, closer to their

historical post-recession high of 14.5%, registered in the first quarter of 2010.

United Healthcare Group’s relocation was also the largest move-in of the second quarter of 2019 with

*Rental rates reflect gross asking $psf/year Ankura Consulting’s move and expansion into 91,398 sf at 2000 K Street, NW—following its purchase

of Navigant Consulting—the second largest. Rounding out the District of Columbia’s largest move-ins

and positive net new demand drivers were The Carlyle Group’s expansion into 69,784 sf of new space

Overall Net Absorption/Overall Asking Rent at 1001 Pennsylvania Avenue, NW and Verizon’s 25,684 sf expansion at 1300 Eye Street, NW.

Overall, Washington, DC registered 302,402 sf of net absorption in the second quarter, down from the

4-QTR TRAILING AVERAGE 514,257 sf in the first quarter of the year. Even so, the District of Columbia is on pace to surpass its

10-year historical annual average absorption of approximately 915,000 sf. While demand has

remained steady in Washington, DC, the sheer amount of new construction coming online in the

1,000 $56.00 market continues to spur vacancy rates upward. Another 1.9 million sf is scheduled to come online by

the end of 2019, primarily in Capitol Hill, NoMa and the CBD, with only about half of the space

800 preleased. The question remains if net demand will stay elevated at least enough to offset a significant

$54.00 portion of the new construction and anchor vacancies.

600 On a separate note, Kirkland & Ellis’s relocation and contraction from 655 15th Street, NW into its

187,834 sf of new space and Carlyle’s expansion significantly lowered overall vacancy for trophy

400 $52.00 product in Washington, DC—from 14.2% at the close of the first quarter of 2019 to 10.9% in the

second quarter, well below the market average. While vacancy rates are expected to rise overall, DC

200 $50.00 is historically a “flight to quality” market and that is likely to keep Class A+ and Trophy rates in check

while unrenovated commodity A space softens. Trophy, along with the Capitol Riverfront submarket,

0 are the two tightest subsets in the District, both posting 10.9% overall vacancy rates at the close of the

$48.00 second quarter.

-200 The legal sector was particularly active in the second quarter of 2019 as some law firms continued to

rightsize and others expanded. As mentioned, Kirkland & Ellis shed almost 22% of its footprint in the

-400 $46.00 relocation to Pennsylvania Avenue. King & Spaulding also executed its renewal in the second quarter

2012 2013 2014 2015 2016 2017 2018 YTD at its 1700 and 1730 Pennsylvania Avenue, NW locations. The law firm renewed 147,000 of its

2019 189,843 sf of space and will shrink their footprint by about 23% when the renewal commences.

Meanwhile, Miles & Stockbridge moved into its new 26,051 sf space at 1201 Pennsylvania Avenue,

Net Absorption, Th.SF Asking Rent, $ PSF NW, vacating 1500 K Street, NW, and expanding its footprint by about 42%. Goodwin Procter signed

for a 12,000 sf expansion at its soon-to-be new office at 1900 N Street, NW, still under construction.

This expansion followed an initial relocation and rightsize. Winston & Strawn also expanded at a

property still under construction, 1901 L Street, NW, after the firm’s initial prelease to relocate and

Overall Vacancy downsize. This development could very well be the beginning of a welcomed trend in the legal sector

that these firms initially leaned out too aggressively and are now beginning to take back space.

16% Overall net new leasing activity of 1,099,294 sf in the second quarter of 2019 was down a bit relative

to the first quarter—1,685,058 sf—as well as the 10-year historical quarterly average of 1,353,378 sf.

Even so, 2019 annual new leasing activity is on pace to hit the 10-year historical annual average of

about 5.4 million sf. Coworking group WeWork signed the largest new lease of the quarter, taking

111,273 sf at Capitol Crossing’s 200 Massachusetts Avenue, NW. The coworking sector was

14% particularly active in terms of leasing activity in the second quarter with CommonGrounds, Mixer and

WeWork all signing leases for over 20,000 sf (WeWork having signed two). However, no coworking

firms moved into space during the quarter to help support absorption numbers. It should be noted

eight of the top ten largest leases during the quarter were renewals. These were largely government

12% extensions: 10 of the top 15 leases in the District of Columbia during the second quarter were

renewals, mostly government extensions: i.e. the U.S. Securities and Exchange Commission

Historical Average = 12.7% renewing almost 1.3 million sf across its Station Place I, II, and III locations in NoMa. This led to an

extremely strong gross leasing activity figure of approximately 3.5 million sf, but about average in

10% terms of new leasing totals.

Outlook

With another 1.9 million sf of space set to deliver across Washington, DC, and only about 50% having

been preleased at the close of the second quarter of 2019, we could see another one million sf of

vacant space hit the market by year’s end. However, with about 550,000 sf of coworking space set to

be taken up by the end of 2019 and demand fundamentals remaining steady, this empty space’s

effects on vacancy rates will soften. cushmanwakefield.com

MARKETBEAT

Washington, D.C.

Office Q2 2019

CURRENT QTR YTD YTD OVERALL OVERALL

SUBLET DIRECT OVERALL UNDER

INVENTORY OVERALL NET OVERALL NET LEASING AVERAGE AVERAGE

SUBMARKET VACANT VACANT VACANCY CNSTR

(SF) ABSORPTION ABSORPTION ACTIVITY ASKING RENT ASKING RENT

(SF) (SF) RATE (SF)

(SF) (SF) (SF)** (ALL CLASSES)* (CLASS A)*

Capitol Hill/NoMa 14,605,281 19,320 2,058,475 14.2% -14,986 265,957 299,681 1,287,623 $53.78 $57.38

East End 38,888,297 388,715 5,719,554 15.7% 482,919 527,396 779,496 386,854 $56.98 $62.74

CBD 34,108,947 429,162 3,846,624 12.5% 25,761 145,834 929,263 1,076,770 $55.36 $63.85

West End/Georgetown 4,779,133 82,768 739,798 17.2% -214,152 -347,288 165,430 - $49.10 $53.97

Uptown 3,188,523 61,954 334,969 12.4% 14,836 42,968 122,908 - $42.53 $47.38

Southwest 11,644,799 20,476 1,359,578 11.9% 82,477 270,028 178,533 - $46.50 $49.00

Capitol Riverfront 3,817,062 17,601 400,075 10.9% -74,453 -88,226 309,041 175,000 $53.59 $53.59

WASHINGTON, D.C. TOTALS 111,032,042 1,019,996 14,459,073 13.9% 302,402 816,669 2,784,352 2,926,247 $54.61 $60.56

*Rental rates reflect gross asking $psf/year **Does not include Renewals

CURRENT QTR YTD YTD

SUBLET OVERALL UNDER DIRECT OVERALL

INVENTORY DIRECT VACANT OVERALL NET OVERALL NET LEASING

VACANT VACANCY CNSTR AVERAGE AVERAGE

(SF) (SF) ABSORPTION ABSORPTION ACTIVITY

(SF) RATE (SF) ASKING RENT* ASKING RENT*

(SF) (SF) (SF)

Class A 62,595,246 497,521 8,071,464 13.7% 405,939 1,634,611 1,911,165 2,926,247 $62.65 $60.56

Class B 29,012,534 356,198 3,763,092 14.2% -48,328 -601,740 412,189 - $54.89 $53.19

Class C 19,424,262 166,277 2,624,517 14.4% -55,209 -216,202 460,998 - $47.44 $46.53

Key Lease Transactions Q2 2019

PROPERTY SF TENANT TRANSACTION TYPE SUBMARKET

100 F Street, NE / 600 & 700 2nd Street,

1,276,156 U.S. Securities and Exchange Commission Renewal Capitol Hill/NoMa

NE

1700 & 1730 Pennsylvania Avenue, NW 146,994 King & Spalding Renewal CBD

200 Massachusetts Avenue, NW 111,273 WeWork New Lease Capitol Hill/NoMa

475 School Street, SW 62,254 Richard Wright PCS for Journalism & Media Arts New Lease Southwest

1140 3rd Street, NE 39,137 Pact New Lease Capitol Hill/NoMa

Key Sales Transactions Q2 2019

PROPERTY SF SELLER/BUYER PRICE / $PSF SUBMARKET

1319 F Street, NW & 1612 K Street, NW 122,320 EDG Corporation / Modell Family $48,000,000 / $392 East End / CBD

Jones Foundation / Lincoln Property Company &

1666 Connecticut Avenue, NW 71,764 $30,500,000 / $425 Uptown

ASB Capital

National City Christian Church / Rock Creek Property

1401 Massachusetts Avenue, NW 58,000 $6,000,000 / $103 East End

Group

Cushman & Wakefield For more information, contact: About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional

2101 L Street, NW Ryan McMahon, Research Analyst

value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services

Washington, DC 20037 Tel: +1 202 495 7029 firms with approximately 51,000 employees in 400 offices and 70 countries. In 2018, the firm had revenue of

cushmanwakefield.com Ryan.McMahon@cushwake.com $8.2 billion across core services of property, facilities and project management, leasing, capital markets,

valuation and other services. To learn more, visit www.cushmanwakefield.com or follow @CushWake on

Twitter.

©2019 Cushman & Wakefield. All rights reserved. The information contained within this report is gathered

from multiple sources believed to be reliable. The information may contain errors or omissions and is

presented without any warranty or representations as to its accuracy.

cushmanwakefield.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cyber Nations User Player GuideDocument13 pagesCyber Nations User Player GuideOzread100% (1)

- Maruti Suzuki Strives To Consistently Improve The Environmental Performance of Its Manufacturing OperationsDocument6 pagesMaruti Suzuki Strives To Consistently Improve The Environmental Performance of Its Manufacturing OperationsandljnnjdsNo ratings yet

- 2023 Fast 500 Winners List v1.1Document16 pages2023 Fast 500 Winners List v1.1William HarrisNo ratings yet

- Q1 2023 AcquisitionsDocument28 pagesQ1 2023 AcquisitionsWilliam HarrisNo ratings yet

- Market Report 2023 Q1 Full ReportDocument17 pagesMarket Report 2023 Q1 Full ReportKevin ParkerNo ratings yet

- April 2024 CPRA Board Simoneaux 20240415 CompressedDocument37 pagesApril 2024 CPRA Board Simoneaux 20240415 CompressedWilliam HarrisNo ratings yet

- 2023 ASI Impact ReportDocument43 pages2023 ASI Impact ReportWilliam HarrisNo ratings yet

- QR 3 - FinalDocument20 pagesQR 3 - FinalWilliam HarrisNo ratings yet

- 2022 Abell Foundation Short Form Report 8yrDocument36 pages2022 Abell Foundation Short Form Report 8yrWilliam HarrisNo ratings yet

- FP - CTS Report H1.21Document13 pagesFP - CTS Report H1.21William HarrisNo ratings yet

- Development: Washington, DCDocument96 pagesDevelopment: Washington, DCWilliam HarrisNo ratings yet

- Pebblebrook Update On Recent Operating TrendsDocument10 pagesPebblebrook Update On Recent Operating TrendsWilliam HarrisNo ratings yet

- Industry Update H2 2021 in Review: Fairmount PartnersDocument13 pagesIndustry Update H2 2021 in Review: Fairmount PartnersWilliam HarrisNo ratings yet

- Atlanta 2022 Multifamily Investment Forecast ReportDocument1 pageAtlanta 2022 Multifamily Investment Forecast ReportWilliam HarrisNo ratings yet

- Copt 2021Document44 pagesCopt 2021William HarrisNo ratings yet

- 3Q21 I81 78 Industrial MarketDocument5 pages3Q21 I81 78 Industrial MarketWilliam HarrisNo ratings yet

- DSB Q3Document8 pagesDSB Q3William HarrisNo ratings yet

- FP Pharmaceutical Outsourcing Monitor 08.30.21Document30 pagesFP Pharmaceutical Outsourcing Monitor 08.30.21William HarrisNo ratings yet

- Manhattan RetailDocument9 pagesManhattan RetailWilliam HarrisNo ratings yet

- FP - CTS Report Q3.20Document13 pagesFP - CTS Report Q3.20William HarrisNo ratings yet

- Regional Surveys of Business ActivityDocument2 pagesRegional Surveys of Business ActivityWilliam HarrisNo ratings yet

- For Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentDocument5 pagesFor Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentWilliam HarrisNo ratings yet

- Comms Toolkit For MD Clean Energy Town HallDocument4 pagesComms Toolkit For MD Clean Energy Town HallWilliam HarrisNo ratings yet

- Gun Stocks: Fear Fires Up Investors To Purchase Gun StocksDocument14 pagesGun Stocks: Fear Fires Up Investors To Purchase Gun StocksWilliam HarrisNo ratings yet

- Healthcare Technology Mailer v14Document4 pagesHealthcare Technology Mailer v14William HarrisNo ratings yet

- 2020 Q3 Industrial Houston Report ColliersDocument7 pages2020 Q3 Industrial Houston Report ColliersWilliam HarrisNo ratings yet

- TROW Q3 2020 Earnings ReleaseDocument15 pagesTROW Q3 2020 Earnings ReleaseWilliam HarrisNo ratings yet

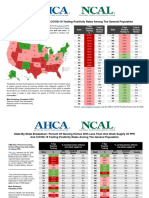

- State-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationDocument2 pagesState-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationWilliam HarrisNo ratings yet

- Richmond Office Performance in DownturnsDocument1 pageRichmond Office Performance in DownturnsWilliam HarrisNo ratings yet

- A Brief Analysis On The Labor Pay of Government Employed Registered Nurses (RN) in The PhilippinesDocument3 pagesA Brief Analysis On The Labor Pay of Government Employed Registered Nurses (RN) in The PhilippinesMary Joy Catherine RicasioNo ratings yet

- Accounting Chapter 9Document89 pagesAccounting Chapter 9api-27283455No ratings yet

- Cir V SLMC DigestDocument3 pagesCir V SLMC DigestYour Public ProfileNo ratings yet

- CIVIL Green BuildingDocument17 pagesCIVIL Green Buildingyagna100% (1)

- Impact of The Construction Waste On The Cost of The Project: Sawant Surendra B., Hedaoo Manoj, Kumthekar MadhavDocument3 pagesImpact of The Construction Waste On The Cost of The Project: Sawant Surendra B., Hedaoo Manoj, Kumthekar MadhavJay ar TenorioNo ratings yet

- Advantages and Disadvantages of Shares and DebentureDocument9 pagesAdvantages and Disadvantages of Shares and Debenturekomal komal100% (1)

- Global Affairs CH - 3 @Document34 pagesGlobal Affairs CH - 3 @Bererket BaliNo ratings yet

- ANX6732AAQDocument1 pageANX6732AAQRathod GunvantrayNo ratings yet

- Partnership Dissolution Lecture NotesDocument7 pagesPartnership Dissolution Lecture NotesGene Marie PotencianoNo ratings yet

- Research On DemonetizationDocument61 pagesResearch On DemonetizationHARSHITA CHAURASIYANo ratings yet

- Bookmakers NightmareDocument50 pagesBookmakers NightmarefabihdroNo ratings yet

- Internal Audit Checklist Sample PDFDocument3 pagesInternal Audit Checklist Sample PDFFernando AguilarNo ratings yet

- Contoh Presentasi PerusahaanDocument20 pagesContoh Presentasi PerusahaanTafrihan Puput SantosaNo ratings yet

- Commissioner of Internal Revenue vs. Primetown Property Group, Inc.Document11 pagesCommissioner of Internal Revenue vs. Primetown Property Group, Inc.Queenie SabladaNo ratings yet

- Chapter 7 - Valuation and Characteristics of Bonds KEOWNDocument9 pagesChapter 7 - Valuation and Characteristics of Bonds KEOWNKeeZan Lim100% (1)

- Ten Principles of UN Global CompactDocument2 pagesTen Principles of UN Global CompactrisefoxNo ratings yet

- FOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherDocument2 pagesFOR Office USE Only: HDFC Life Sb/Ca/Cc/Sb-Nre/Sb-Nro/OtherVIkashNo ratings yet

- Swine Breeder Farms Sbfap November 29 2021Document2 pagesSwine Breeder Farms Sbfap November 29 2021IsaacNo ratings yet

- The Indonesian Economy Trade and Industrial PoliciesDocument315 pagesThe Indonesian Economy Trade and Industrial PoliciesRegine RichardoNo ratings yet

- Certificate of Origin: Issued by The Busan Chamber of Commerce & IndustryDocument11 pagesCertificate of Origin: Issued by The Busan Chamber of Commerce & IndustryVu Thuy LinhNo ratings yet

- 15dec2022102121 ShipperDocument1 page15dec2022102121 ShipperDISPATCH GROUPNo ratings yet

- Attacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep DevkarDocument14 pagesAttacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep Devkarsim4misNo ratings yet

- GLInqueryDocument36 pagesGLInquerynada cintakuNo ratings yet

- The Pioneer 159 EnglishDocument14 pagesThe Pioneer 159 EnglishMuhammad AfzaalNo ratings yet

- Microeconomics - CH9 - Analysis of Competitive MarketsDocument53 pagesMicroeconomics - CH9 - Analysis of Competitive MarketsRuben NijsNo ratings yet

- Credit CreationDocument17 pagesCredit Creationaman100% (1)

- Assertive Populism Od Dravidian PartiesDocument21 pagesAssertive Populism Od Dravidian PartiesVeeramani ManiNo ratings yet

- Fees and ChecklistDocument3 pagesFees and ChecklistAdenuga SantosNo ratings yet