Professional Documents

Culture Documents

Internal Rate of Return

Uploaded by

harish chandraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal Rate of Return

Uploaded by

harish chandraCopyright:

Available Formats

Internal Rate of Return

What is 'Internal Rate of Return - IRR'

Internal Rate of Return (IRR) is a metric used in capital budgeting to estimate the profitability of potential

investments. Internal rate of return is a discount rate that makes the net present value (NPV) of all cash

flows from a particular project equal to zero. IRR calculations rely on the same formula as NPV does.

The following is the formula for calculating NPV:

The formula for calculating Net Present Value (NPV).

Where:

Ct = net cash inflow during the period t

Co= total initial investment costs

r = discount rate, and

t = number of time periods

To calculate IRR using the formula, one would set NPV equal to zero and solve for the discount rate r,

which is here the IRR. Because of the nature of the formula, however, IRR cannot be calculated

analytically, and must instead be calculated either through trial-and-error or using software programmed

to calculate IRR.

Generally speaking, the higher a project's internal rate of return, the more desirable it is to undertake.

IRR is uniform for investments of varying types and, as such, IRR can be used to rank multiple prospective

projects a firm is considering on a relatively even basis. Assuming the costs of investment are equal

among the various projects, the project with the highest IRR would probably be considered the best and

undertaken first.

IRR is sometimes referred to as "economic rate of return" (ERR) or "discounted cash flow rate of return

(DCFROR)." The use of "Internal" refers to the omission of external factors, such as the cost of capital or

inflation, from the calculation.

You might also like

- What Is Internal Rate of Return (IRR) ?Document10 pagesWhat Is Internal Rate of Return (IRR) ?anayochukwuNo ratings yet

- Significance of Capital Budgeting: Discounted Cash Flow MethodDocument8 pagesSignificance of Capital Budgeting: Discounted Cash Flow MethodSarwat AfreenNo ratings yet

- Internal Rate of ReturnDocument6 pagesInternal Rate of ReturnDagnachew Amare DagnachewNo ratings yet

- FM Mid Term TestDocument14 pagesFM Mid Term TestAnkita SinghNo ratings yet

- Weighted Average Cost of CapitalDocument6 pagesWeighted Average Cost of CapitalStoryKingNo ratings yet

- Internal Rate of ReturnDocument4 pagesInternal Rate of ReturnMaria Ali ZulfiqarNo ratings yet

- Internal Rate of ReturnDocument7 pagesInternal Rate of ReturnChinta PadmavathiNo ratings yet

- Capital Investment AppraisalDocument3 pagesCapital Investment AppraisalGeorge Ayesa Sembereka Jr.No ratings yet

- Internal Rate of Return - WikipediaDocument6 pagesInternal Rate of Return - Wikipediapuput075No ratings yet

- IRR vs CAGR - Understanding Internal Rate of Return and Compound Annual Growth RateDocument10 pagesIRR vs CAGR - Understanding Internal Rate of Return and Compound Annual Growth Rateblue_sea_00No ratings yet

- Corporate Finance: NPV and IRR AnalysisDocument8 pagesCorporate Finance: NPV and IRR Analysiszubair attariNo ratings yet

- Internal Rate of ReturnDocument6 pagesInternal Rate of ReturnNeeraj DhariaNo ratings yet

- EVALUATION OF INVESTMENT PROPOSALS LectDocument6 pagesEVALUATION OF INVESTMENT PROPOSALS LectSimranjeet SinghNo ratings yet

- CB 1Document3 pagesCB 1Shreyas KothiNo ratings yet

- What is IRRDocument1 pageWhat is IRRshivam vatsNo ratings yet

- Project Valuation Methods for Financial AnalysisDocument16 pagesProject Valuation Methods for Financial Analysisknowledge informationNo ratings yet

- Capital Budgeting Techniques ExplainedDocument15 pagesCapital Budgeting Techniques ExplainedIrfana MubarakNo ratings yet

- IRR vs WACC - Understanding key capital return metricsDocument2 pagesIRR vs WACC - Understanding key capital return metricsAlexandraNo ratings yet

- Understanding IRR and How it Equates Cash FlowsDocument13 pagesUnderstanding IRR and How it Equates Cash FlowsBhavana PedadaNo ratings yet

- Internal Rate of ReturnDocument18 pagesInternal Rate of ReturnRiaz javedNo ratings yet

- Internal Rate of ReturnDocument6 pagesInternal Rate of ReturnJim KatNo ratings yet

- 2 Maximizing-Profitability-An-In-Depth-Exploration-Of-Net-Present-Value-And-Its-Practical-Application-20231007094738r408Document7 pages2 Maximizing-Profitability-An-In-Depth-Exploration-Of-Net-Present-Value-And-Its-Practical-Application-20231007094738r408Aani RashNo ratings yet

- Calculate IRR in ExcelDocument2 pagesCalculate IRR in Excelrahulchutia100% (1)

- Payback PeriodDocument1 pagePayback Periodaznairah.malicNo ratings yet

- Profitability Analysis Method PresentationDocument16 pagesProfitability Analysis Method PresentationArnab DasNo ratings yet

- Net Present Value vs. Internal Rate of ReturnDocument15 pagesNet Present Value vs. Internal Rate of ReturnSumaira BilalNo ratings yet

- Internal Rate of Return (IRR)Document1 pageInternal Rate of Return (IRR)LJBernardoNo ratings yet

- Net Present ValueDocument12 pagesNet Present ValueRamya SubramanianNo ratings yet

- Discounted Cash Flow Method:: NPV PVB - PVC Where, PVB Present Value of BenefitsDocument3 pagesDiscounted Cash Flow Method:: NPV PVB - PVC Where, PVB Present Value of BenefitsReven BalazonNo ratings yet

- Project Management Chapter 8 Investment Criteria Question AnswersDocument6 pagesProject Management Chapter 8 Investment Criteria Question AnswersAkm EngidaNo ratings yet

- NPV Recommended for Investment Appraisal Due to Consideration of Time Value and All Cash FlowsDocument3 pagesNPV Recommended for Investment Appraisal Due to Consideration of Time Value and All Cash FlowsWasi Nafijur RahmanNo ratings yet

- Profitability IndexDocument3 pagesProfitability IndexSaira Ishfaq 84-FMS/PHDFIN/F16No ratings yet

- Project Management - Chapter 8 - Investment Criteria - Question/AnswersDocument6 pagesProject Management - Chapter 8 - Investment Criteria - Question/AnswersMostafa Kamal83% (6)

- Internal Rate of ReturnDocument4 pagesInternal Rate of Returnram_babu_59No ratings yet

- Internal Rate of Return - Wikipedia, The Free EncyclopediaDocument8 pagesInternal Rate of Return - Wikipedia, The Free EncyclopediaOluwafemi Samuel AdesanmiNo ratings yet

- Internal Rate of Return (IRR) Advantages and Disadvantages ExplainedDocument4 pagesInternal Rate of Return (IRR) Advantages and Disadvantages ExplainedCyrus SantosNo ratings yet

- FM Group - 5 Section - ADocument9 pagesFM Group - 5 Section - AAnand PramanikNo ratings yet

- Irr FormulaDocument2 pagesIrr FormulaWaqar EnterprisesNo ratings yet

- Net Present ValueDocument10 pagesNet Present ValueGuneet SawhneyNo ratings yet

- Lecture 6 - IRR (N)Document24 pagesLecture 6 - IRR (N)amjadullahNo ratings yet

- NPV is Superior to IRR for Capital Budgeting DecisionsDocument9 pagesNPV is Superior to IRR for Capital Budgeting DecisionsAhmad Syuaib Ahmad RazaliNo ratings yet

- Internal Rate of Return IRR Calculation - Example - Decision RuleDocument2 pagesInternal Rate of Return IRR Calculation - Example - Decision Ruleakram1978No ratings yet

- Internal Rate of ReturnDocument16 pagesInternal Rate of ReturnAnnalie Alsado BustilloNo ratings yet

- Irr, NPV, Mirr, Project AppraisalDocument12 pagesIrr, NPV, Mirr, Project Appraisalart galleryNo ratings yet

- Financial Management Assignment 1Document4 pagesFinancial Management Assignment 1Humaira ShafiqNo ratings yet

- Main Project Capital Budgeting MbaDocument110 pagesMain Project Capital Budgeting MbaRaviKiran Avula65% (34)

- Calculate Project Profitability with IRR, MIRR, ARR & NPVDocument2 pagesCalculate Project Profitability with IRR, MIRR, ARR & NPVsagarramakaNo ratings yet

- Definition of IrrDocument3 pagesDefinition of IrrRajesh ShresthaNo ratings yet

- Finance & Economic ExerciseDocument2 pagesFinance & Economic ExerciseShahmala PerabuNo ratings yet

- NPV Calculation Explained - How to Evaluate Project Cash FlowsTITLEUsing NPV and IRR to Make Capital Budgeting Investment DecisionsDocument11 pagesNPV Calculation Explained - How to Evaluate Project Cash FlowsTITLEUsing NPV and IRR to Make Capital Budgeting Investment DecisionsAndrew LeeNo ratings yet

- Irr and NPVDocument6 pagesIrr and NPVyesid camacho torresNo ratings yet

- FinanceDocument2 pagesFinanceRaj KishoreNo ratings yet

- D. NPV & Capt. Budg. DecisionsDocument2 pagesD. NPV & Capt. Budg. DecisionsSweeti JaiswalNo ratings yet

- Project Investment Summary AnalysisDocument11 pagesProject Investment Summary AnalysisMatthew AdeyinkaNo ratings yet

- Chapter 14Document2 pagesChapter 14jhouvanNo ratings yet

- Internal Rate of ReturnDocument1 pageInternal Rate of ReturnpilotNo ratings yet

- Capital Budgeting Techniques and MethodsDocument7 pagesCapital Budgeting Techniques and Methodsbhagat103No ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingRajatNo ratings yet

- BFD Basic Investment AppraisalDocument7 pagesBFD Basic Investment AppraisalAbdul RaufNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Organization Design and DevelopmentDocument3 pagesOrganization Design and Developmentharish chandraNo ratings yet

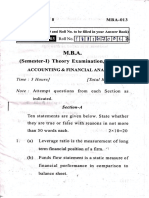

- MBA Accounting and Financial Analysis Practice ExamDocument8 pagesMBA Accounting and Financial Analysis Practice Examharish chandraNo ratings yet

- Project Report On Employees SatisfactionDocument64 pagesProject Report On Employees Satisfactionharish chandra0% (2)

- Financial Risk and ReturnDocument3 pagesFinancial Risk and Returnharish chandraNo ratings yet

- Managerial Position To Fulfill Some Specific Managerial Activities or Tasks. ThisDocument2 pagesManagerial Position To Fulfill Some Specific Managerial Activities or Tasks. Thisharish chandraNo ratings yet

- Business LetterDocument17 pagesBusiness Letterharish chandraNo ratings yet

- Calculate NPV with this formulaDocument2 pagesCalculate NPV with this formulaharish chandraNo ratings yet

- Corporate Ch02Document40 pagesCorporate Ch02LeiNo ratings yet

- Internal Rate of ReturnDocument1 pageInternal Rate of Returnharish chandraNo ratings yet

- Consumer BehaviourDocument1 pageConsumer Behaviourharish chandraNo ratings yet

- Trial BalanceDocument21 pagesTrial BalanceRiza JauferNo ratings yet

- Kiss PrincipleDocument4 pagesKiss Principleharish chandraNo ratings yet

- A Research Project Report: ON Human Resource Management SystemDocument78 pagesA Research Project Report: ON Human Resource Management Systemharish chandraNo ratings yet

- Environment in Human Resource ManagementDocument2 pagesEnvironment in Human Resource Managementharish chandraNo ratings yet

- Business LetterDocument17 pagesBusiness Letterharish chandraNo ratings yet

- Organization DesignDocument5 pagesOrganization Designharish chandraNo ratings yet

- Industrial Disputes: Causes, Types and Resolution TacticsDocument9 pagesIndustrial Disputes: Causes, Types and Resolution Tacticsharish chandraNo ratings yet

- IR scope relations trade unions objectives functionsDocument6 pagesIR scope relations trade unions objectives functionsharish chandraNo ratings yet

- Business LetterDocument2 pagesBusiness Letterharish chandraNo ratings yet

- Business LetterDocument2 pagesBusiness Letterharish chandraNo ratings yet

- Sandeep Kumar SharmaDocument2 pagesSandeep Kumar Sharmaharish chandraNo ratings yet

- MCA Notes 1 UnitDocument5 pagesMCA Notes 1 Unitharish chandraNo ratings yet

- Financial Mathematics Unit III: Capital Structure and LeverageDocument4 pagesFinancial Mathematics Unit III: Capital Structure and Leverageharish chandraNo ratings yet

- Financial Derivatives 260214Document347 pagesFinancial Derivatives 260214akshay mourya100% (1)

- Unit 2: Bussiness CommunicationDocument15 pagesUnit 2: Bussiness Communicationharish chandraNo ratings yet

- IBM Cloud Computing Leader With Over 100 Years HistoryDocument15 pagesIBM Cloud Computing Leader With Over 100 Years Historyharish chandraNo ratings yet

- Wipro History and Services in 35 CharactersDocument12 pagesWipro History and Services in 35 Charactersharish chandraNo ratings yet

- Accounting TerminologyDocument8 pagesAccounting Terminologyharish chandraNo ratings yet

- Salary Structure-Ctr 856Document5 pagesSalary Structure-Ctr 856Manish BoliaNo ratings yet