Professional Documents

Culture Documents

Republic v. Caguioa

Uploaded by

victoria100%(1)100% found this document useful (1 vote)

1K views3 pagescase digest

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcase digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

1K views3 pagesRepublic v. Caguioa

Uploaded by

victoriacase digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

employment opportunities in and around the zone and to attract and

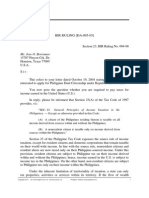

Republic of the Philippines v. Caguioa (Vi)

promote productive foreign investments."

October 15, 2007| Carpio-Morales, J. | Non-impairment 2. Section 12 of the law provided that “(b) The Subic Special

PETITIONER: Republic of the Philippines represented by Secretary of Economic Zone shall be operated and managed as a separate

Finance, Commissioner of BIR, Commissioner of Customs, and the customs territory ensuring free flow or movement of goods and

Collector of Customs of the Port of Subic capital within, into and exported out of the Subic Special

RESPONDENTS: Indigo Distribution Corporation, W Star Trading and Economic Zone, as well as provide incentives such as tax and

Warehousing Corporation, Freedom Brands Philippines Corporation, duty-free importations of raw materials, capital and equipment.

Branded Warehouse, Inc., Altasia, Inc., Tainan Trade (Taiwan) Inc., Subic However, exportation or removal of goods from the territory of

Park 'N Shop, Incorporated, Trading Gateways International Philippines, the Subic Special Economic Zone to the other parts of the

Inc., Duty Free Superstore (DFS) Inc., Chijmes Trading, Inc., Premier Philippine territory shall be subject to customs duties and taxes

Freeport, Inc., Future Trade Subic Freeport, Inc., Grand Comtrade Int'l., under the Customs and Tariff Code and other relevant tax laws

Corp., and First Platinum International, Inc., of the Philippines;” and “(c) The provisions of existing laws,

SUMMARY: Congress enacted RA 7227 that provides that no taxes shall rules and regulations to the contrary notwithstanding, no taxes,

be imposed within the Subic Special Freeport and Economic Zone. The local and national, shall be imposed within the Subic Special

companies listed as respondents applied for certificates of exemption which Economic Zone.”

were granted. RA 9334 was subsequently passed which provided that all 3. Indigo Distribution Corporation, W Star Trading and Warehousing

taxes, duties, charges, including excise taxes shall be applied to cigars and Corporation, Freedom Brands Philippines Corporation, Branded

cigarettes, distilled spirits, fermented liquors and wines brought to the Warehouse, Inc., Altasia, Inc., Tainan Trade (Taiwan) Inc., Subic

freeports of Subic Economic Freeport Zone. Indigo, et. al. sought for Park 'N Shop, Incorporated, Trading Gateways International

reconsideration but were denied. They filed a petition for declaratory relief Philipines, Inc., Duty Free Superstore (DFS) Inc., Chijmes Trading,

with RTC Olongapo and Judge Caguioa granted it as well as the injunction Inc., Premier Freeport, Inc., Future Trade Subic Freeport, Inc.,

bond of P1M. The issue is whether the tax exemption is contractual in nature Grand Comtrade Int'l., Corp., and First Platinum International, Inc.,

and the right to non-impairment of contracts may be invoked. While the which are all domestic corporations doing business at the SBF,

tax exemption contained in the Certificates of Registration of private applied for and were granted Certificates of Registration and Tax

respondents may have been part of the inducement for carrying on Exemption 6 by the SBMA. This allowed them to trade, retail,

their businesses in the SBF, this exemption, nevertheless, is far from wholesale, import, export, etc. and uniformly granted them tax

being contractual in nature in the sense that the non-impairment clause exemptions for such importations according to the certificates that

of the Constitution can rightly be invoked. “The Company shall be entitled to tax and duty-free

DOCTRINE: Certificates of Tax Exemption are not absolute and is far importation of raw materials, capital equipment, and household

from being contractual in nature in the sense that the non-impairment and personal items for use solely within the Subic Bay Freeport

clause of the Constitution can rightly be invoked. Zone”.

4. Congress subsequently passed R.A. No. 9334 which amended the

NIRC and said that articles brought into the Philippines tax-free

FACTS: subsequently sold to non-exempt persons, the purchasers shall be

1. In 1992, Congress enacted Republic Act (R.A) No. 7227 or the liable for the duty and internal revenue tax and the provision of any

BASES CONVERSION AND DEVELOPMENT ACT OF 1992 special or general law to the contrary notwithstanding, the

which created the Subic Special Economic and Freeport Zone (SBF) importation of cigars and cigarettes, distilled spirits, fermented

and the Subic Bay Metropolitan Authority (SBMA). R.A. No. 7227 liquors and wines into the Philippines, even if destined for tax

envisioned the SBF to be developed into a "self-sustaining, and duty free shops, shall be subject to all applicable taxes,

industrial, commercial, financial and investment center to generate

duties, charges, including excise taxes due thereon. This shall the operations, file warehousing entries, and not compelling them to

apply to cigars and cigarettes, distilled spirits, fermented liquors pay the taxes. An injunction bond of P1M was approved.

and wines brought directly into the duly chartered or legislated

freeports of the Subic Economic Freeport Zone, created under ISSUE:

Republic Act No. 7227; 1. Whether the writ of preliminary injunction was properly issued - NO

5. Based on Sec. 6 of R.A. No. 9334, SBMA issued a Memorandum 2. Whether the certificates of tax exemption may be used to invoke the

declaring that all importations of cigars, cigarettes, distilled spirits, non-impairment of contracts - NO

fermented liquors and wines into the SBF, including those intended

to be transshipped to other free ports in the Philippines, shall be RATIO:

treated as ordinary importations subject to all applicable taxes, 1. For a writ of preliminary injunction to issue, the plaintiff must be

duties and charges, including excise taxes. able to establish that (1) there is a clear and unmistakable right to be

6. Meanwhile, former BIR Commissioner Guillermo L. Parayno, Jr. protected, (2) the invasion of the right sought to be protected is

requested then Customs Commissioner George M. Jereos to material and substantial, and (3) there is an urgent and paramount

immediately collect the excise tax due on imported alcohol and necessity for the writ to prevent serious damage.

tobacco products brought to the Duty Free Philippines (DFP) and 2. R.A. No. 7227 granted private respondents exemption from local

Freeport zones. The Collector of Customs of the port of Subic and national taxes, including excise taxes, on their importations of

directed the SBMA Administrator to require payment of all general merchandise, for which reason they enjoyed tax-exempt

appropriate duties and taxes on all importations of cigars and status until the effectivity of R.A. No. 9334. However, by

cigarettes, etc. subsequently enacting R.A. No. 9334, however, Congress expressed

7. SBMA issued a Memorandum directing the departments concerned its intention to withdraw private respondents' tax exemption

to require locators/importers in the SBF to pay the corresponding privilege on their importations of cigars, cigarettes, distilled spirits,

duties and taxes on their importations of cigars, cigarettes, etc. fermented liquors and wines.

3. The old Section 131 of the NIRC expressly provided that all taxes,

8. Private respondents wrote the offices of respondent Collector of

duties, charges, including excise taxes shall not apply to

Customs and the SBMA Administrator requesting for a importations of cigars, cigarettes, fermented spirits and wines

reconsideration of the directives on the imposition of duties and brought directly into the duly chartered or legislated freeports of the

taxes, particularly excise taxes on their cigarettes, etc. Despite these, SBF but Section 131, as amended by R.A. No. 9334, now provides

they were not allowed to file any warehousing entry for their that such taxes shall apply.

shipments. Thus, they filed a petition for declaratory relief to have 4. The Court stated basic principles:

certain provisions of RA 9334 declared as unconstitutional. a. Every presumption must be indulged in favor of the

9. Indigo, et. al. claimed that repeals by implication are not favored, a constitutionality of a statute. The burden of proving the

general law cannot amend a special law, and that it violates the one- unconstitutionality of a law rests on the party assailing the

bill-one-subject rule as well as the constitutional proscription law.

against the impairment of the obligation of contracts. They also b. There is no vested right in a tax exemption. The power to

prayed for the issuance of a writ of preliminary injunction and/or impose taxes is one so unlimited in force and so searching

TRO. in extent, it is subject only to restrictions which rest on the

10. The trial court granted these and issued a Writ of Preliminary discretion of the authority exercising it.

Injunction directing petitioners and the SBMA Administrator as c. Generally, tax exemptions are construed strictly against the

well as all persons assisting or acting for and in their behalf to allow taxpayer and liberally in favor of the taxing authority. The

burden of proof is with the one claiming exemption.

d. A tax exemption cannot be grounded upon the continued businesses cannot possibly outweigh the dire consequences

existence of a statute which precludes its change or repeal that the non-collection of taxes, not to mention the

because no law is irrepealable. unabated smuggling inside the SBF, would wreak on the

e. . The rights granted under the Certificates of Registration government.

and Tax Exemption of private respondents are not

absolute and unconditional as to constitute rights in esse 5. The possibility of irreparable damage without proof of an actual

existing right would not justify an injunctive relief. Besides, private

— those clearly founded on or granted by law or is

respondents are not altogether lacking an appropriate relief under

enforceable as a matter of law.

the law. As petitioners point out in their Petition before this Court,

These certificates granting private respondents a they may avail themselves of a tax refund or tax credit should R.A.

"permit to operate" their respective businesses are in No. 9334 be finally declared invalid.

the nature of licenses, which the bulk of jurisprudence 6. Indeed, Sections 204 and 229 of the NIRC provide for the recovery

considers as neither a property nor a property right. of erroneously or illegally collected taxes which would be the nature

The licensee takes his license subject to such conditions of the excise taxes paid by private respondents should Section 6 of

as the grantor sees fit to impose, including its revocation R.A. No. 9334 be declared unconstitutional or invalid.

at pleasure. A license can thus be revoked at any time 7. Any injunction that restrains the collection of taxes, which is the

since it does not confer an absolute right. inevitable result of the suspension of the implementation of the

While the tax exemption contained in the Certificates of assailed Section 6 of R.A. No. 9334, is a limitation upon the right of

Registration of private respondents may have been part the government to its lifeline and wherewithal. The power to tax

of the inducement for carrying on their businesses in emanates from necessity; without taxes, government cannot fulfill

the SBF, this exemption, nevertheless, is far from being its mandate of promoting the general welfare and well-being of the

contractual in nature in the sense that the non- people. That the enforcement of tax laws and the collection of taxes

impairment clause of the Constitution can rightly be are of paramount importance for the sustenance of government has

invoked. been repeatedly observed. Taxes being the lifeblood of the

f. Whatever right may have been acquired on the basis of government that should be collected without unnecessary hindrance,

the Certificates of Registration and Tax Exemption must 60 every precaution must be taken not to unduly suppress it.

yield to the State's valid exercise of police power. 8. WHEREFORE, the Petition is PARTLY GRANTED. The writ

g. As a rule, courts should avoid issuing a writ of preliminary of certiorari to nullify and set aside the Order of May 4, 2005

injunction which would in effect dispose of the main case as well as the Writ of Preliminary Injunction issued by

without trial. respondent Judge Caguioa on May 11, 2005 is GRANTED. The

h. A court may issue a writ of preliminary injunction only assailed Order and Writ of Preliminary Injunction are hereby

when the petitioner assailing a statute has made out a case declared NULL AND VOID and accordingly SET ASIDE. The

of unconstitutionality or invalidity strong enough to writ of prohibition prayed for is, however, DENIED.

overcome the presumption of validity, in addition to a

showing of a clear legal right to the remedy sought.

i. The feared injurious effects of the imposition of duties,

charges and taxes on imported cigars, cigarettes, distilled

spirits, fermented liquors and wines on private respondents'

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- J. Carpio-Morales: Surveillance If Such Importations Are Delivered Immediately and For Use Solely Within The SubicDocument3 pagesJ. Carpio-Morales: Surveillance If Such Importations Are Delivered Immediately and For Use Solely Within The SubicTippy Dos SantosNo ratings yet

- Republic of The Philippines Vs CAGUIOADocument14 pagesRepublic of The Philippines Vs CAGUIOAAnonymous NWnRYIWNo ratings yet

- Request of Atty. ZialcitaDocument2 pagesRequest of Atty. ZialcitaAngelo Castillo100% (1)

- CIR v. Citytrust Investment Phils., Inc. and Asiabank Corporation v. CIRDocument3 pagesCIR v. Citytrust Investment Phils., Inc. and Asiabank Corporation v. CIRAila Amp100% (1)

- Cir Vs Central Luzon Drug CorporationDocument2 pagesCir Vs Central Luzon Drug CorporationVincent Quiña Piga71% (7)

- Republic Vs Mambulao Lumber - CDDocument1 pageRepublic Vs Mambulao Lumber - CDmenforeverNo ratings yet

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- Manila Tax Ordinance Ruled Invalid for Failing Publication RequirementDocument2 pagesManila Tax Ordinance Ruled Invalid for Failing Publication RequirementRyan Acosta100% (3)

- CIR Vs Fortune Tobacco DigestDocument2 pagesCIR Vs Fortune Tobacco DigestCJ67% (6)

- NAPOCOR Tax Exemption Ruled Invalid by SCDocument1 pageNAPOCOR Tax Exemption Ruled Invalid by SCIsh100% (3)

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- Roxas Building Assessment Ruled Illegal Due to Incomplete ImprovementsDocument3 pagesRoxas Building Assessment Ruled Illegal Due to Incomplete ImprovementsChelle BelenzoNo ratings yet

- CIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Document4 pagesCIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Kath Leen100% (1)

- Paseo Realty & Development Corporation vs. Court of AppealsDocument12 pagesPaseo Realty & Development Corporation vs. Court of AppealsMp CasNo ratings yet

- DOMINGO VS. GARLITOS TAXES COMPENSATEDDocument1 pageDOMINGO VS. GARLITOS TAXES COMPENSATEDAdhara CelerianNo ratings yet

- 3M PhilippinesDocument2 pages3M PhilippinesKarl Vincent Raso100% (1)

- Republic v. Mambulao Lumber Co.Document2 pagesRepublic v. Mambulao Lumber Co.Joni Aquino50% (2)

- City of Manila vs. Coca-ColaDocument3 pagesCity of Manila vs. Coca-ColaAngel Agustine O. Japitan IINo ratings yet

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- Phil Guaranty V CIR DigestDocument2 pagesPhil Guaranty V CIR DigestMaria Reylan Garcia100% (2)

- Case Digest Cir vs. BoacDocument1 pageCase Digest Cir vs. BoacAnn SC100% (4)

- Philippine Power & Development Co. franchise tax caseDocument16 pagesPhilippine Power & Development Co. franchise tax caseLou StellarNo ratings yet

- Domingo v. GarlitosDocument1 pageDomingo v. GarlitosJazz TraceyNo ratings yet

- CTA upholds Fortune Tobacco tax refundDocument1 pageCTA upholds Fortune Tobacco tax refundlenvfNo ratings yet

- CIR Vs CA, CTA, and GCL Retirement Plan TAXDocument2 pagesCIR Vs CA, CTA, and GCL Retirement Plan TAXLemuel Angelo M. Eleccion100% (1)

- ABAKADA GURO PARTY LIST V ERMITA DigestDocument4 pagesABAKADA GURO PARTY LIST V ERMITA DigestAndrea Tiu100% (3)

- 106 Cir Vs Cta GR No 106611 July 21 1994 DigestDocument1 page106 Cir Vs Cta GR No 106611 July 21 1994 Digestjayinthelongrun33% (3)

- CIR vs. Mitsubishi MetalDocument3 pagesCIR vs. Mitsubishi MetalHonorio Bartholomew Chan100% (1)

- PNOC v. CA (G.R. No. 109976. April 26, 2005.)Document2 pagesPNOC v. CA (G.R. No. 109976. April 26, 2005.)Emmanuel Yrreverre100% (1)

- BIR Ruling (DA-287-07) May 8, 2007Document3 pagesBIR Ruling (DA-287-07) May 8, 2007Raiya AngelaNo ratings yet

- Javier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesDocument7 pagesJavier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesRean Raphaelle GonzalesNo ratings yet

- Philippine Acetylene Co. Inc vs. CirDocument2 pagesPhilippine Acetylene Co. Inc vs. Cirbrendamanganaan100% (1)

- Bir Ruling Da 095 05Document2 pagesBir Ruling Da 095 05RB BalanayNo ratings yet

- SC upholds validity of market stall rental increase ordinanceDocument4 pagesSC upholds validity of market stall rental increase ordinanceMhaliNo ratings yet

- Pepsi Cola v. City of Butuan DigestDocument2 pagesPepsi Cola v. City of Butuan DigestAnonymous PbYTL9zzco100% (1)

- Abakada Guro Party List Case DigestDocument2 pagesAbakada Guro Party List Case DigestCarmelito Dante Clabisellas100% (1)

- Case Digest - TIO Vs Videogram Regulatory Board 151 SCRA 208Document2 pagesCase Digest - TIO Vs Videogram Regulatory Board 151 SCRA 208Lu Cas100% (14)

- Fernandez Hermanos Case DigestDocument2 pagesFernandez Hermanos Case DigestLean Robyn Ledesma-Pabon100% (1)

- Casanovas Vs Hord DigestDocument2 pagesCasanovas Vs Hord DigestSaab Abelita100% (3)

- Ericsson Vs City of PasigDocument3 pagesEricsson Vs City of PasigRaymond RoqueNo ratings yet

- Benefits Received Theory in Inheritance TaxationDocument2 pagesBenefits Received Theory in Inheritance TaxationPatrick Anthony Llasus-NafarreteNo ratings yet

- 5 Chavez Vs Ongpin - DigestDocument2 pages5 Chavez Vs Ongpin - DigestGilbert Mendoza100% (5)

- Cir Vs Hawaiian Phil Co - DigestDocument2 pagesCir Vs Hawaiian Phil Co - DigestRona Rosos100% (1)

- Consti2Digest - Juan Luna Subdivisio, Inc. Vs M. Sarmiento, Et Al, GR L-3538, (28 May 1952Document3 pagesConsti2Digest - Juan Luna Subdivisio, Inc. Vs M. Sarmiento, Et Al, GR L-3538, (28 May 1952Lu CasNo ratings yet

- PAGCOR vs. BIR: Tax ExemptionDocument2 pagesPAGCOR vs. BIR: Tax Exemptionpaul carmelo esparagoza100% (1)

- Caltex v. COA - DigestDocument2 pagesCaltex v. COA - DigestChie Z. Villasanta71% (7)

- Philippine Airlines vs. Commissioner of Internal RevenueDocument3 pagesPhilippine Airlines vs. Commissioner of Internal RevenueGenebva Mica NodaloNo ratings yet

- Cir V Fortune Tobacco DigestDocument2 pagesCir V Fortune Tobacco DigestIvy BernardoNo ratings yet

- City of Manila Vs ColetDocument3 pagesCity of Manila Vs ColetErika ColladoNo ratings yet

- Domingo v. Garlitos estate tax offsetDocument1 pageDomingo v. Garlitos estate tax offsetJogie AradaNo ratings yet

- CIR Assessment of Net Worth Increases RejectedDocument2 pagesCIR Assessment of Net Worth Increases RejectedKim Lorenzo CalatravaNo ratings yet

- Manila Wine Merchants v. CIRDocument3 pagesManila Wine Merchants v. CIRPio MathayNo ratings yet

- Progressive Development Corporation v. Quezon CityDocument1 pageProgressive Development Corporation v. Quezon Cityfranzadon100% (1)

- Nursery Care Corporation Vs AcevedoDocument1 pageNursery Care Corporation Vs AcevedoLouana AbadaNo ratings yet

- Madrigal Vs RaffertyDocument2 pagesMadrigal Vs RaffertyKirs Tie100% (1)

- PBCOM Vs CIR - DigestDocument2 pagesPBCOM Vs CIR - DigestAngelie ManingasNo ratings yet

- RTC Order Staying Implementation of RA 9334 Increasing Excise Taxes on Alcohol, TobaccoDocument17 pagesRTC Order Staying Implementation of RA 9334 Increasing Excise Taxes on Alcohol, TobaccoChristine Rose Bonilla LikiganNo ratings yet

- Republic Vs CaguioaDocument6 pagesRepublic Vs CaguioaKim Lorenzo CalatravaNo ratings yet

- Novena Prayer To ST Rita of Cascia: (Mention Your Request)Document2 pagesNovena Prayer To ST Rita of Cascia: (Mention Your Request)victoriaNo ratings yet

- Sample Lorem Ipsum 4Document4 pagesSample Lorem Ipsum 4victoriaNo ratings yet

- Lorem Ipsum 24Document5 pagesLorem Ipsum 24victoriaNo ratings yet

- Lorem Ipsum 23Document5 pagesLorem Ipsum 23victoriaNo ratings yet

- Sample Lorem Ipsum 1Document3 pagesSample Lorem Ipsum 1victoriaNo ratings yet

- Lorem Ipsum 13Document5 pagesLorem Ipsum 13victoriaNo ratings yet

- Ipsum 1Document5 pagesIpsum 1victoriaNo ratings yet

- Ipsum 4Document5 pagesIpsum 4victoriaNo ratings yet

- Ipsum 3Document5 pagesIpsum 3victoriaNo ratings yet

- Lorem Ipsum 12Document5 pagesLorem Ipsum 12victoriaNo ratings yet

- 3331Document10 pages3331Adam WoodNo ratings yet

- Sample Lorem Ipsum 2Document4 pagesSample Lorem Ipsum 2victoriaNo ratings yet

- Ipsum 2Document5 pagesIpsum 2victoriaNo ratings yet

- People v. Gamboa (Vi): Perpenian Liable as Accomplice to KidnappingDocument3 pagesPeople v. Gamboa (Vi): Perpenian Liable as Accomplice to KidnappingvictoriaNo ratings yet

- Lorem Ipsum 10Document5 pagesLorem Ipsum 10victoriaNo ratings yet

- Acuña v. CADocument3 pagesAcuña v. CAvictoriaNo ratings yet

- Rosas v. MontorDocument3 pagesRosas v. MontorvictoriaNo ratings yet

- Sample Lorem Ipsum 5Document4 pagesSample Lorem Ipsum 5victoriaNo ratings yet

- Cyanamid DigestDocument3 pagesCyanamid DigestvictoriaNo ratings yet

- People v. Octa (Vi) kidnapping conspiracy caseDocument3 pagesPeople v. Octa (Vi) kidnapping conspiracy casevictoriaNo ratings yet

- Delsan Transport Lines v. CADocument4 pagesDelsan Transport Lines v. CAvictoriaNo ratings yet

- Sample 7 Lorem IpsumDocument4 pagesSample 7 Lorem IpsumvictoriaNo ratings yet

- Re: Letter of Court of Appeals Justice Vicente S. E. Veloso, Resolution On MR DigestDocument3 pagesRe: Letter of Court of Appeals Justice Vicente S. E. Veloso, Resolution On MR Digestvictoria50% (2)

- Bir 287-07Document3 pagesBir 287-07victoriaNo ratings yet

- FPIB v. CA - ConflictsDocument3 pagesFPIB v. CA - ConflictsvictoriaNo ratings yet

- David v. SETDocument4 pagesDavid v. SETvictoriaNo ratings yet

- In Re RiosaDocument2 pagesIn Re RiosavictoriaNo ratings yet

- Lorem Ipsum SamplesDocument3 pagesLorem Ipsum SamplesvictoriaNo ratings yet

- De Guia Case - TortsDocument4 pagesDe Guia Case - TortsvictoriaNo ratings yet

- Filcar liable as registered owner in car accident caseDocument3 pagesFilcar liable as registered owner in car accident casevictoriaNo ratings yet

- European Financial Markets and Institutions PDFDocument2 pagesEuropean Financial Markets and Institutions PDFVenkatNo ratings yet

- The Problem With Separate Toys For Girls and BoysDocument7 pagesThe Problem With Separate Toys For Girls and BoysNico DavidNo ratings yet

- International Relations Questions For UPSC Mains GS 2Document4 pagesInternational Relations Questions For UPSC Mains GS 2commissioner social welfareNo ratings yet

- FC - FVDocument88 pagesFC - FVandrea higueraNo ratings yet

- Racial and Ethnic Groups 13e - BMDocument51 pagesRacial and Ethnic Groups 13e - BMpsykhoxygen0% (1)

- Ios - 6. Harmonious RuleDocument4 pagesIos - 6. Harmonious RuleSrishti Goel0% (1)

- B.A (Prog) History 4th Semester 2019Document22 pagesB.A (Prog) History 4th Semester 2019lakshyadeep2232004No ratings yet

- Registration Form For Admission To Pre KGDocument3 pagesRegistration Form For Admission To Pre KGM AdnanNo ratings yet

- 1 QQQQQQQQQQQQQQQQQQQQQQDocument8 pages1 QQQQQQQQQQQQQQQQQQQQQQJeremy TatskiNo ratings yet

- Basics of Custom DutyDocument3 pagesBasics of Custom DutyKeshav JhaNo ratings yet

- On Decoloniality Second ThoughtsDocument8 pagesOn Decoloniality Second ThoughtsJulia UNo ratings yet

- Legal BasisDocument3 pagesLegal BasisMaydafe Cherryl Carlos67% (6)

- Mr. Asher Molk 8 Grade Social Studies Gridley Middle School: EmailDocument6 pagesMr. Asher Molk 8 Grade Social Studies Gridley Middle School: Emailapi-202529025No ratings yet

- Sebastián Hurtado de CorcueraDocument1 pageSebastián Hurtado de CorcueraOliver Salvador BersaminaNo ratings yet

- (Advances in Political Science) David M. Olson, Michael L. Mezey - Legislatures in The Policy Process - The Dilemmas of Economic Policy - Cambridge University Press (1991)Document244 pages(Advances in Political Science) David M. Olson, Michael L. Mezey - Legislatures in The Policy Process - The Dilemmas of Economic Policy - Cambridge University Press (1991)Hendix GorrixeNo ratings yet

- Employee Code of Conduct - Islamic SchoolsDocument2 pagesEmployee Code of Conduct - Islamic SchoolsSajjad M ShafiNo ratings yet

- 824 Lake Grove Dr. Little Elm, TX 75068 469-588-7778 4805 Spring Park Circle Suwanee, GA 30024Document29 pages824 Lake Grove Dr. Little Elm, TX 75068 469-588-7778 4805 Spring Park Circle Suwanee, GA 30024kmonclaNo ratings yet

- Ogl 220 Paper 2Document13 pagesOgl 220 Paper 2api-366594193No ratings yet

- Bedan Scholars' Guild: Bringing Smiles To The Dumagat TribeDocument3 pagesBedan Scholars' Guild: Bringing Smiles To The Dumagat TribeShelumiel EmuslanNo ratings yet

- Prepared By: Charry Joy M. Garlet MED-Social ScienceDocument6 pagesPrepared By: Charry Joy M. Garlet MED-Social ScienceDenise DianeNo ratings yet

- Employee Complaint FormDocument4 pagesEmployee Complaint FormShah NidaNo ratings yet

- Presidential Democracy in America Toward The Homogenized RegimeDocument16 pagesPresidential Democracy in America Toward The Homogenized RegimeAndreea PopescuNo ratings yet

- Bayero University Kano: Faculty of Management Science Course Code: Pad3315Document10 pagesBayero University Kano: Faculty of Management Science Course Code: Pad3315adam idrisNo ratings yet

- A Post-Washington ConsensusDocument6 pagesA Post-Washington ConsensuszakariamazumderNo ratings yet

- Subhadra Kumari Chauhan - BiographyDocument3 pagesSubhadra Kumari Chauhan - Biographyamarsingh1001No ratings yet

- Approaching Ottoman HistoryDocument274 pagesApproaching Ottoman HistoryTurcology Tirana100% (4)

- NALANDA INTERNATIONAL PUBLIC SCHOOL ENGLISH CORE TERM I KEY ANSWERS CLASS XIIDocument3 pagesNALANDA INTERNATIONAL PUBLIC SCHOOL ENGLISH CORE TERM I KEY ANSWERS CLASS XIIEmmanuel MariaNo ratings yet

- Memorandum: United States Department of EducationDocument3 pagesMemorandum: United States Department of EducationKevinOhlandtNo ratings yet

- Montebon vs. Commission On Elections, 551 SCRA 50Document4 pagesMontebon vs. Commission On Elections, 551 SCRA 50Liz LorenzoNo ratings yet

- Nine Lessons For NegotiatorsDocument6 pagesNine Lessons For NegotiatorsTabula RasaNo ratings yet