Professional Documents

Culture Documents

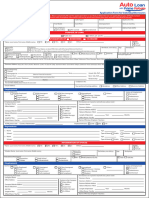

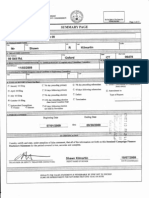

Application Form for Corporate Auto Loan

Uploaded by

Rymnd OtimajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application Form for Corporate Auto Loan

Uploaded by

Rymnd OtimajCopyright:

Available Formats

Application Form for Corporate Borrowers

Thank you for taking interest in PSBank’s Auto Loan. Please completely fill out this application form or put N/A on fields that are not applicable to you. All fields marked with asterisk

(*) should be answered completely to ensure validity of entry. Application with incomplete information will not be processed. Please print your answers using BLACK ink only.

Date of Application Dealer Sales Agent Branch Application No.

Brand Year Model Cash Price Downpayment Term (in months)

Model Type of Vehicle Amount Financed Add-on Rate (AOR)

Brand New Used Reconditioned

PURPOSE OF LOAN

Personal Business Public Use Others, pls. specify

INFORMATION OF PARTNERSHIP / CORPORATION

*Name of Firm

Date Established *Tax Identification No. SSS / GSIS No.

*Head / Main Office Address (House No./ Floor/ Unit No./ Block No./ Lot No./ P.O. Box No./ Bldg./ Apartment Name/ Street Name/ Village/ Subdivision/ Phase/ Barangay/ Barrio/ Municipality/ Province/ City/ Zip Code/ Country)

Firm Premise Ownership: Owned Leased Rented Mortgaged Used Free

Length of Stay Years Months

Size of Firm Business Type Scope of Operation

No. of Employees Corporation Partnership Sole Proprietorship Others Nationwide International

*Office Phone Number/s (For non-Metro Manila, please indicate the area code) Local No. Office Fax Number (For non-Metro Manila, please indicate the area code)

1.

2. E-mail Address

3.

Factory / Branch / Store

*Factory / Branch Office / Store Address (House No./ Floor/ Unit No./ Block No./ Lot No./ P.O. Box No./ Bldg./ Apartment Name/ Street Name/ Village/ Subdivision/ Phase/ Barangay/ Barrio/ Municipality/ Province/ City/ Zip Code/ Country)

*Office Phone Number/s (For non-Metro Manila, please indicate the area code) Local No.

Firm Premise Ownership: Owned Leased Rented Mortgaged Used Free

1.

2.

Length of Stay Years Months

3.

Type of Business (Nature of Operation) Years in Operation Stock Amount Capital Stock Retained Earnings

MANAGEMENT / DIRECTORS / STOCKHOLDERS / PARTNERS

Name (Last name, First name, Middle name) Nationality Birthday Position Number of Shares % Address

FINANCIALS

Date Annual Sales Net Income Equity

As of PhP PhP PhP

Current Assests Total Assets Current Liabilities Total Liabilities

PhP PhP PhP PhP

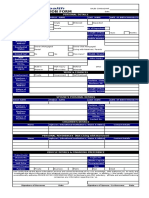

CORPORATION: BENEFICIAL OWNER / BENEFICIARY (if applicable)

Name Date of Birth Place of Birth

Present Address (House No./ Floor/ Unit No./ Block No./ Lot No./ P.O. Box No./ Bldg./ Apartment Name/ Street Name/ Nature of Work Source of Fund

Village/ Subdivision/ Phase/ Barangay/ Barrio/ Municipality/ Province/ City/ Zip Code/ Country)

CREDIT / BANK REFERENCES

Bank Type Account No. Monthly Amortization Outstanding Balance Maturity Date

TRADE REFERENCES (SUPPLIER / BUYER)

Name Address Contact Number/s

SOURCE OF PRODUCT INFORMATION DO YOU HAVE A RELATIVE WORKING IN PSBANK?

How did you learn about PSBank Auto Loan? Yes No

TV / Radio Website Direct Mail Flyer / Poster / Streamer Newspaper / Magazine

If yes, please state:

PSBank Personnel Name

Others, pls. Specify: Name

PSBank Client Name

Agency Name Relation

HIGHLIGHTS OF TERMS AND CONDITIONS

FEES AND CHARGES

Product Features - PSBank Auto Loan with Prime Rebate is a Term Loan facility.

A.) BOOKING FEES AND CHARGES:

Loan Range: Minimum of PhP100,000 for brand new cars / Minimum of

CHATTEL MORTGAGE FEES + INSURANCE + OTHER CHARGES (RD

PhP300,000 for 2nd hand units.

Registration (out of town) fee + LTO Encumbrance (out of town) fee)

Terms: 12 to 60 months for brand new units

48 months for second hand units

B.) POST-BOOKING FEES AND CHARGES:

Interest Rate: Based on prevailing interest rate at time of loan booking.

Prime Rebate Feature: Allows clients to get a “discount” on his/her loan when DUE DATE EXTENSION FEE Due date extension fee is computed as:

(accrued interest from old Outstanding Balance x Rate x number of days /

he/she makes advance or excess payments on his/her monthly due.

due date to new due date) 360

Examples: SERVICE FEE FOR CERTIFICATE A certification fee of PhP50 shall be charged

Advance Payment - When client pays five days before his/her loan’s monthly due OF ENCUMBRANCE FOR LTO plus a notary fee of PhP300 if Certificate of

date, he/she earns a rebate on a daily basis from the day his/her payment was REGISTRATION Encumbrance for LTO registration is notarized.

posted to the day before his/her loan’s due date.

- PhP5,000 shall be charged for amendments

PROCESSING FEES FOR CHANGE

Excess Payment - When a client pays in excess of the amount required on his/her or change of collateral.

IN COLLATERAL AND

- PhP10,000 shall be charged for conversion of

due date, he/she will earn a rebate on a daily basis from the date of posting. CONVERSION OF UNIT TO PUV

unit to PUV.

Events of Default – Each or any of the following shall constitute an event of LATE SUBMISSION FEE ON PhP1,500 shall be collected if insurance policy

default. INSURANCE POLICY RENEWAL is not submitted from 31st to 180th day after

a.) Client fails to pay the amortization amount and interest due; expiry.

b.) Client violates any of the T&C of the agreement; NON SUBMISSION FEE ON PhP2,500 shall be collected if insurance policy

c.) Client refuses to deliver the foreclosed property to the Bank; INSURANCE POLICY RENEWAL is not submitted from 181st day onwards after

d.) Client fails to register the motor vehicle with the LTO; expiry.

e.) Lost, destroyed, damaged or change in form and use of mortgaged A collection fee amounting to 3% of the

property. The property/ies mortgaged shall be deemed lost if Client COLLECTION FEE IN CASE OF monthly installment or amount due shall also

fails to give additional security (in lieu of the damages, etc. on the DEFAULT be charged in case of default.

property/ies) to the Bank. 5% per month or a fraction thereof shall be

LATE PAYMENT PENALTY FEE added on each unpaid installment from its due

Consequences of Default – In case of default, the Bank may, without need of date until fully paid.

notice or demand, exercise any or all of the following remedies. In case of default and no legal action is filed,

a.) Cancellation of the Contract of Sale; borrower shall pay an additional sum equal to

b.) The whole amount remaining unpaid including (interest, fees and 10% of the amount due as attorney’s fees. In

charges) shall immediately become due and payable; ATTORNEY'S FEES AND case of litigation, borrower shall pay an

c.) Extrajudicial /Judicial foreclosure; LIQUIDATED DAMAGES additional sum equal to 25% of all amount

d.) Exercise the right to offset and/or legal compensation; outstanding as attorney’s fees and the further

e.) Deliver the mortgaged property to the Bank, at Client’s own sum of 20% as liquidated damages, in addition

to cost and other expenses of litigation.

expense;

f.) In case of breach of the Terms & Conditions client expressly waives NOTARY FEE FOR RELEASE OF A notary fee of PhP300 shall be charged for the

the term of 30 days as the period which must elapse before the Bank CHATTEL MORTGAGE release of Chattel Mortgage.

shall foreclose the mortgage.

PRE-TERMINATION CHARGES / FREE OF CHARGE

EARLY SETTLEMENT FEE

Customer Complaints, Concerns and Other Queries - In case of complaints,

concerns and other queries regarding PSBank Auto Loan with Prime Rebate, the Note: All aforesaid fees and charges will take effect immediately and may be

Client may contact the Bank's 24/7 Customer Experience Hotline at (02)845-8888; cancelled or modified anytime at the Bank’s sole discretion without any prior

text (63)998-8458888; or e-mail at customerexperience@psbank.com.ph. The notice.

Client can also get in touch with the Bank via the PSBank LiveChat by visiting

www.psbank.com.ph.

CORRECTNESS, WAIVER OF CONFIDENTIALITY OF PERSONAL AND FINANCIAL INFORMATION, AND TERMS AND CONDITIONS OF LOAN APPROVAL

1. The undersigned loan applicant/borrower (hereinafter the “Borrower” 4. The Borrower understands that the approval of his loan

regardless of number) understands that the personal and financial application shall be at the sole discretion of the Bank, subject to:

information (hereinafter “Information”) supplied by him in the Auto Loan

Application Form for Corporate on the reverse side of this page, and a) The Bank’s existing credit policies and procedures on its Auto

those which may be obtained from his income tax returns, financial Loan Facility for Corporate;

statements, credit transactions and all other documents submitted to b) Existing rules and regulations of the Bangko Sentral ng

the Bank in support of his loan application (“Supporting Documents”) Pilipinas;

shall be used by Philippine Savings Bank (the “Bank”) as basis for the c) Payment by the Borrower of all fees and charges relative to

approval of his said loan application. the processing of his loan application;

d) Submission by the Borrower of all documentary requirements

2. In connection with the above, the Borrower: and compliance with all other conditions imposed by the

Bank for the approval of his loan application as prescribed

a) Certifies the correctness of all his Information; under existing Bank credit policies or those that may be

b) Authorizes the Bank to verify his Information and Supporting prescribed by the Bank’s Legal Department;

Documents with the pertinent government or private e) Agreement by the Borrower to all terms and conditions of the

institutions; Loan.

c) Waives all provisions of Republic Act 1405 ( Law on Secrecy of

Deposits), Republic Act 6426 ( The Foreign Currency Deposit Act), In case of disapproval of the Borrower’s loan application, the Bank

Republic Act 8791(General Banking Law of 2000), Republic Act shall not be obliged to disclose the reason/s for such disapproval.

10173 ( Data Privacy Act of 2012), their amendatory laws if any,

and all other laws now existing or may hereafter exist protecting 5. The Borrower authorizes the Bank to send updates about the

the confidentiality of the Borrower’s Information. Borrower’s loan application via SMS/text, email, mail or other

d) Acknowledges that pursuant to Republic Act 9510, the Bank is means of communication.

required to regularly submit and disclose the Borrower’s basic

credit data (as defined under Republic Act No. 9510 and its 6. The Borrower‘s loan application may be withdrawn or cancelled

Implementing Rules and Regulations) to the Credit Information at any time prior to booking, without incurring additional charges.

Corporation (CIC) as well as any updates or corrections thereof; The Borrower shall course all complaints or concerns, if any, at the

and to share the Borrower’s said basic credit data with other Bank’s Customer Experience Division or Indirect Auto Loan Channel

lenders authorized by the CIC, and credit reporting agencies duly Department.

accredited by the CIC.

7. The Loan Application Form and all Supporting Documents shall

3. The Borrower understands that the Bank may disapprove his loan remain the Bank’s property and the same may be used at the Bank’s

application, revoke prior loan approvals, or terminate existing loan discretion whether the loan is granted or not.

availments on the ground of misrepresentation and/or concealment of

the Borrower’s Information, whether intended or not, without prejudice

to any other legal remedies that the Bank may take.

Name and Signature of Authorized Signatory/ies Date Automatic Debit Arrangement Account Number

Signature Verified, Authenticated, Approved by:

You might also like

- PSBank Auto Loan With Prime Rebate FormDocument2 pagesPSBank Auto Loan With Prime Rebate FormMark Anthony Carreon Malate100% (1)

- Homeplus Loan Application CorpDocument2 pagesHomeplus Loan Application CorpPascual D Monsanto JrNo ratings yet

- Buss Loan Detailed Editable Appli FormDocument6 pagesBuss Loan Detailed Editable Appli FormArun ChaudharyNo ratings yet

- Application Form Bplo Latest LegalDocument1 pageApplication Form Bplo Latest LegalEvan Fontamillas DeocadesNo ratings yet

- BPLS Unified Form ApplicationDocument1 pageBPLS Unified Form ApplicationEvan Fontamillas DeocadesNo ratings yet

- Unified 2024 NewDocument2 pagesUnified 2024 NewabmbookkeepingofficeNo ratings yet

- Account Opening Form PDFDocument5 pagesAccount Opening Form PDFWildan FrianaNo ratings yet

- Application Form For Business PermitDocument2 pagesApplication Form For Business PermitJoyce Leeann Manansala0% (1)

- New Auto-Loan-Application-Form - IndividualDocument2 pagesNew Auto-Loan-Application-Form - IndividualRheneir MoraNo ratings yet

- Psbank Auto Loan With Prime Rebate Application Form 2019Document2 pagesPsbank Auto Loan With Prime Rebate Application Form 2019jim poblete0% (1)

- Purpose of Loan Information of Borrower Co-MakerDocument2 pagesPurpose of Loan Information of Borrower Co-MakerSophia GonzalesNo ratings yet

- Bplo Unified Form PDFDocument2 pagesBplo Unified Form PDFTristan Lindsey Kaamiño AresNo ratings yet

- Unifiedform DavaoDocument2 pagesUnifiedform DavaoTristan Lindsey Kaamiño Ares100% (1)

- Auto Loan Application Form - IndividualDocument2 pagesAuto Loan Application Form - IndividualKlarise EspinosaNo ratings yet

- SVCL Application WB FundDocument16 pagesSVCL Application WB FundSurajPandeyNo ratings yet

- Operator Application Form 2.0Document6 pagesOperator Application Form 2.0IanNo ratings yet

- Customer Application FormDocument4 pagesCustomer Application Formoeruel bautistaNo ratings yet

- Phoenix Petroleum Customer FormDocument4 pagesPhoenix Petroleum Customer FormJf LarongNo ratings yet

- No. of Years: For Individuals and Sole ProprietorshipsDocument2 pagesNo. of Years: For Individuals and Sole Proprietorshipsjunil rejanoNo ratings yet

- Ally Aaos Cover Letter Credit AppDocument5 pagesAlly Aaos Cover Letter Credit AppNitin GNo ratings yet

- Applicationform New Grey ScaleDocument2 pagesApplicationform New Grey ScaleStanley ValencianaNo ratings yet

- Business Permit Application Form PDFDocument1 pageBusiness Permit Application Form PDFKimberly ParalejasNo ratings yet

- Auto Loan Application Form Motorcycle Loan Application Form: A Commercial Bank A Commercial BankDocument3 pagesAuto Loan Application Form Motorcycle Loan Application Form: A Commercial Bank A Commercial BankChristine GuyalaNo ratings yet

- ACCOUNTABILITYDocument3 pagesACCOUNTABILITYJaniceNo ratings yet

- Revolt Dealership Application Form 17 Dec 2020Document8 pagesRevolt Dealership Application Form 17 Dec 2020abhishekNo ratings yet

- Credit Application Form HyundaiDocument1 pageCredit Application Form HyundaiPing GuerreroNo ratings yet

- PSBank Auto Loan Application Form - IndividualDocument2 pagesPSBank Auto Loan Application Form - IndividualJp Dela CruzNo ratings yet

- Barangay Sari-Sari Store Business Permit PDFDocument2 pagesBarangay Sari-Sari Store Business Permit PDFBenecio ManliguezNo ratings yet

- Application Form For Business Permit Tax Year 2017 Municipality of GAMUDocument1 pageApplication Form For Business Permit Tax Year 2017 Municipality of GAMUGamu DILGNo ratings yet

- Application Form For Business Permit (2014)Document1 pageApplication Form For Business Permit (2014)Bplo CaloocanNo ratings yet

- Vendor Master File FormDocument3 pagesVendor Master File FormVince Dones SagarapNo ratings yet

- Revised Reservation FormDocument2 pagesRevised Reservation FormTed anadiloNo ratings yet

- 3-5 Dec, 2022Document34 pages3-5 Dec, 2022Faiq MurtazaNo ratings yet

- Application Form: Hyundai Authorised Service CenterDocument5 pagesApplication Form: Hyundai Authorised Service CenterArshaan AliNo ratings yet

- Tenant Application Form: Step 1 Step 2Document1 pageTenant Application Form: Step 1 Step 2F&L CapturesNo ratings yet

- BPLD - AF - 001 - REV.003 - NOV 2021 Business Application FormDocument1 pageBPLD - AF - 001 - REV.003 - NOV 2021 Business Application FormWORKBUDDY BOOKKEEPING SERVICESNo ratings yet

- Taguig City Business Permit Application Form 2019Document1 pageTaguig City Business Permit Application Form 2019Binkee VillaramaNo ratings yet

- Unioil Dealership Application FormDocument5 pagesUnioil Dealership Application FormCarlos BauzaNo ratings yet

- Apply - For - Dealership - Application Form PDFDocument15 pagesApply - For - Dealership - Application Form PDFabhishekNo ratings yet

- Customer Application FormDocument2 pagesCustomer Application FormErica AquinoNo ratings yet

- SME Vendor Detail FormDocument1 pageSME Vendor Detail FormAJNo ratings yet

- Cover Sheet: Amended Articles of IncorporationDocument1 pageCover Sheet: Amended Articles of IncorporationAjean Tuazon-CruzNo ratings yet

- Online Application UserguideDocument10 pagesOnline Application UserguideFat'hurrahman JasmiNo ratings yet

- MSME Loan Application FinalDocument12 pagesMSME Loan Application Finalnambi2rajanNo ratings yet

- Kia India Dealership Application FormDocument9 pagesKia India Dealership Application FormfalconsnordNo ratings yet

- Business Banking Credit Application Form (Conventional) - Version 9 4Document12 pagesBusiness Banking Credit Application Form (Conventional) - Version 9 4affuriezNo ratings yet

- Businee Permit Application FormDocument1 pageBusinee Permit Application FormMk TatumNo ratings yet

- Application For Registration: (To Be Filled Up by BIR) DLNDocument2 pagesApplication For Registration: (To Be Filled Up by BIR) DLNRhu BurauenNo ratings yet

- HDFC Application Form Working CapitalDocument6 pagesHDFC Application Form Working CapitalHimanshu SharmaNo ratings yet

- Form 2019-20Document54 pagesForm 2019-20Brajmohan RayNo ratings yet

- GCash Merchant Application Form v2Document2 pagesGCash Merchant Application Form v2Erwil Angelo Bangco Sanico100% (1)

- SEC Cover Sheet For AFS 1Document2 pagesSEC Cover Sheet For AFS 1janex92No ratings yet

- Audited Financial Statements Cover SheetDocument1 pageAudited Financial Statements Cover SheetLorenz Samuel GomezNo ratings yet

- Audited Financial Statements Cover SheetDocument2 pagesAudited Financial Statements Cover SheetMarie Jade Ebol Araneta75% (4)

- Auto Loan Application Form For Individual and Sole PropietorshipsDocument1 pageAuto Loan Application Form For Individual and Sole PropietorshipsChristianNo ratings yet

- 2011 App Forms StandardDocument14 pages2011 App Forms StandardgreatgeniusNo ratings yet

- Application For Registration: Republic of The Philippines BIR Form No. Department of Finance Bureau of Internal RevenueDocument5 pagesApplication For Registration: Republic of The Philippines BIR Form No. Department of Finance Bureau of Internal RevenueSJC ITRNo ratings yet

- Sample Vendor FormDocument2 pagesSample Vendor Formarjunav41No ratings yet

- The Film and TV Actor's Pocketlawyer: Legal Basics Every Actor Should KnowFrom EverandThe Film and TV Actor's Pocketlawyer: Legal Basics Every Actor Should KnowRating: 5 out of 5 stars5/5 (1)

- BSBFIM601 - Assessment 2 ProjectDocument8 pagesBSBFIM601 - Assessment 2 ProjectSaanjit KcNo ratings yet

- Assign - Trial Balance Answer SheetDocument9 pagesAssign - Trial Balance Answer SheetDing CostaNo ratings yet

- BANKING AWARENESS WITH MULTIPLE CHOICE QUESTIONSDocument458 pagesBANKING AWARENESS WITH MULTIPLE CHOICE QUESTIONSAbhi Saha100% (2)

- MOD 1 - Introduction On Cost AccountingDocument10 pagesMOD 1 - Introduction On Cost Accountingzach thomasNo ratings yet

- Select City Walk (Tarun)Document15 pagesSelect City Walk (Tarun)Tarun BatraNo ratings yet

- Santiago V Sps GarciaDocument2 pagesSantiago V Sps GarciaEmerjhon HernandezNo ratings yet

- Annual Report AnalysisDocument257 pagesAnnual Report AnalysisvinaymathewNo ratings yet

- BFI Topic 1 2 3Document17 pagesBFI Topic 1 2 3Arnold LuayonNo ratings yet

- For Each of The Following SituationsDocument2 pagesFor Each of The Following Situationslo jaNo ratings yet

- Presentation On Inflation: Presented By: Darwin Balabbo ManaguelodDocument13 pagesPresentation On Inflation: Presented By: Darwin Balabbo ManaguelodJulius MacaballugNo ratings yet

- Defi Flash LoanDocument25 pagesDefi Flash LoanKarim OubelkacemNo ratings yet

- Cryptocurrency: An Analysis of Growth of Bitcoin and Its FutureDocument4 pagesCryptocurrency: An Analysis of Growth of Bitcoin and Its FutureAnonymous izrFWiQ100% (1)

- HUDEX Power Monthly Report January 2020Document6 pagesHUDEX Power Monthly Report January 2020Kovács IstvánNo ratings yet

- Seec F'orm 20Document23 pagesSeec F'orm 20The Valley IndyNo ratings yet

- Amazon Company ReportDocument9 pagesAmazon Company ReportjonsnowedNo ratings yet

- Alberta Residential LeaseDocument8 pagesAlberta Residential LeaseHoa BachNo ratings yet

- Outreach Networks Case StudyDocument9 pagesOutreach Networks Case Studymothermonk100% (3)

- Test Bank For Financial Accounting An Integrated Approach 5th Edition TrotmanDocument24 pagesTest Bank For Financial Accounting An Integrated Approach 5th Edition Trotmanaudreycollinsnstjaxwkrd100% (48)

- Final Accounts PPT APTDocument36 pagesFinal Accounts PPT APTGaurav gusai100% (1)

- Letter of Interest TemplatesDocument9 pagesLetter of Interest TemplatesMelissa BritoNo ratings yet

- Investing Strategy: Paul Tudor Jones Shares 7 Timeless Trading Rules - Business InsiderDocument1 pageInvesting Strategy: Paul Tudor Jones Shares 7 Timeless Trading Rules - Business InsiderCosimo Dell'OrtoNo ratings yet

- 4) TaxationDocument25 pages4) TaxationvgbhNo ratings yet

- Full Download Foundations of Financial Management Canadian 11th Edition Block Solutions ManualDocument36 pagesFull Download Foundations of Financial Management Canadian 11th Edition Block Solutions Manualyoreoakling.9vtk0y100% (25)

- Request For Electronic Policy Payout: Policy Number Name of Policy Holder Aadhaar Number PAN Mobile NumberDocument1 pageRequest For Electronic Policy Payout: Policy Number Name of Policy Holder Aadhaar Number PAN Mobile Numberrovensingh007No ratings yet

- Chapter 15: Maintaining Integrity, Objectivity and IndependenceDocument11 pagesChapter 15: Maintaining Integrity, Objectivity and IndependenceMh AfNo ratings yet

- Annual Report KIJA 2015 56 - 63Document210 pagesAnnual Report KIJA 2015 56 - 63David Susilo NugrohoNo ratings yet

- Top 40 Property Management CompaniesDocument9 pagesTop 40 Property Management Companiessudeeksha dhandhaniaNo ratings yet

- Accounting CycleDocument10 pagesAccounting CycleJane VillanuevaNo ratings yet

- (9781800375949 - FinTech) Chapter 1 - INTRODUCTION - WHAT IS FINTECHDocument21 pages(9781800375949 - FinTech) Chapter 1 - INTRODUCTION - WHAT IS FINTECHMonica VeressNo ratings yet

- Master Budgeting For Bhelpuri - 2019 & 2020: Spring 2021Document12 pagesMaster Budgeting For Bhelpuri - 2019 & 2020: Spring 2021Amira KarimNo ratings yet