Professional Documents

Culture Documents

Chapter 2

Uploaded by

Julie Neay AfableOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2

Uploaded by

Julie Neay AfableCopyright:

Available Formats

11

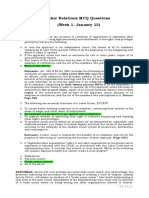

CHAPTER 2: CORPORATE LIQUIDATION

Part 1: Theory of Accounts

1. It refers to the extinguishment of the juridical personality of a corporation for

causes expressly provided by law.

a. Corporate liquidation

b. Corporate dissolution

c. Corporate rehabilitation

d. Corporate termination

2. It refers to the process of winding up the affairs of the corporation by settling its

corporate debts and distribution the remainder to the stockholders.

a. Corporate liquidation

b. Corporate dissolution

c. Corporate rehabilitation

d. Corporate termination

3. After the date of corporate dissolution, what is the maximum period allowed by

law to dissolve corporation to complete its liquidation process?

a. 1 year

b. 2 years

c. 3 years

d. 4 years

4. What is the term used when the total stockholders’ equity has debit balance?

a. Deficit

b. Deficiency

c. Delinquency

d. Default

5. Which of the following unsecured debts with priority shall be paid first during

corporate liquidation?

a. Corporate liabilities to employees

b. Obligations arising from corporate crime

c. Corporate liabilities arising from taxes to government

d. Obligations arising from corporate tort or quasi-delict

6. Which of the following creditors can always fully recover its claim from a

dissolved corporation during corporate liquidation?

a. Fully secured creditors

b. Partially secured creditors

c. Unsecured creditors with priority

d. Unsecured creditors without priority

7. Which of the following items is not being considered in the computation of

recovery percentage of unsecured creditors without priority?

a. Assets reserved for fully secured credits

b. Assets reserved for partially secured credits

c. Unsecured portion of partially secured liabilities

d. Assets not used as collateral for any liability

12

Part II. Problem Solving

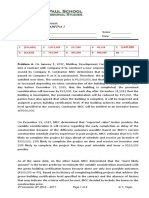

1. The following balances were ascertained in No Money Corp. which is

experiencing insolvency;

Cash 8,000 Accounts payable 80,000

Notes receivable 120,000 Accrued expenses 30,000

Inventories 80,000 Salaries payable 15,000

Prepaid expenses 10,000 Mortgage payable 155,000

Equipment, net 150,000 Ordinary shares 100,000

Deficit (12,000)

Additional information:

Estimated net realizable value of the notes receivable was P 105,000 and

was pledged to the mortgage payable.

80% of the book value of the inventories can be sold at P 45,000 and was

pledged to 60% of the accounts payable.

The remaining book value of the inventories has an estimated fair value

of P 20,000.

80% of the remaining unpaid accounts payable were secured by the

equipment having an estimated fair value of P 60,000.

Prepaid expense has no estimated fair value.

Liquidation and administration expenses were estimated in the amount

of P 8,000.

Income tax payable had been accrued in the amount of P 2,000 (the

accountant recorded it using the accrued expense account).

Interest on the notes receivable and mortgage payable has not been

accrued in the amount of P 10,000 and P 15,000 respectively.

1.1. How much is the estimated deficiency?

a. 61,400 b. 40,000 c. 55,000 d. 46,400

1.2. How much are the net free assets?

a. 52,400 b. 37,400 c. 31,000 d. 46,000

1.3. How much is the estimated payment to the mortgage payable?

a. 137,264 b. 146,191 c. 133,453 d. 142,379

1.4. How much is the estimated recovery percentage to the partially secured

accounts payable?

a. 97.29% b. 95.85% c. 96.28% d. 96.86%

2. Cagayan Co. is experiencing financial problems which resulted to ultimate

bankruptcy. The statement of financial position of the entity before liquidation

is presented below:

Cash 100,000 Income tax payable 200,000

Inventory 300,000 Salaries payable 300,000

Land 200,000 Note payable 800,000

Mortgage payable 100,000

Accounts payable 400,000

Contributed capital 500,000

13

Deficit (1,700,000)

The note payable is secured by the inventory with net realizable value of

P 250,000.

The mortgage payable is secured by the land with fair value of P 120,000.

2.1. What is the amount received by the holder of the note payable at the end

of corporate liquidation?

a. 320,000 b. 300,000 c. 250,000 d. 260,000

2.2. What is the amount received by the holder of the mortgage payable at the

end of corporate liquidation?

a. 120,000 b. 200,000 c. 150,000 d. 100,000

2.3. What is the amount received by the employees at the end of corporate

liquidation concerning their salaries?

a. 100,000 b. 120,000 c. 72,000 d. 300,000

3. Liberty Corp. provided the following balances in July 1, 2018:

Cash 5,500 Accounts payable 59,500

Accounts receivable 35,000 Wages payable 25,000

Inventories 60,000 Tax payable 35,000

Notes receivable 78,000 Note payable 65,000

Equipment 256,000 Mortgage payable 175,000

Share capital 120,000

Deficit (45,000)

In the statement of realization and liquidation the following data are ascertained

for the month of July:

The note payable and mortgage payable together with their respective

interest are paid.

Only 7/8 is collected from the existing accounts receivable at the

beginning of the month.

Half of the inventories were sold for P 45,000.

Only P 68,500 of the notes receivable is collected.

Equipment is sold for P 225,000.

Administrative expenses of P 13,800 are paid.

Additional credit sales amounting to P 10,500 are made for the remaining

inventories

Interests not accrued for the month are note receivable P 1,500, note

payable P 5,500 and mortgage payable P 10,500.

All existing noncash assets at the beginning of the month are sold or

collected during the month.

3.1. How much is the profit or loss in the statement of realization and

liquidation?

a. (42,475) b. 27,975 c. (77,675) d. 75,175

3.2. How much is the estate equity at July 31, 2018?

a. (102,975) b. 32,525 c. 150,175 d. (2,675)

14

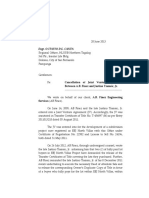

4. Finish Corp. has been undergoing liquidation since January 1. Its condensed

statement of realization and liquidation for the month of June is presented

below:

Interest received in cash on investment 10,500

Purchases on account 105,000

Liabilities liquidated 2,450,000

Assets realized 2,100,000

Payment of expenses of trustee 525,000

Liabilities to be liquidated 4,574,500

Sales on account 50,000

Assets to be realized 2,940,000

Liabilities not liquidated 2,229,500

Sales for cash 1,750,000

Assets not realized 6,650,000

What is the net gain (loss) on realization and liquidation?

a. 1,225,000 b. (479,500) c. (1,225,000) d. 479,500

You might also like

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- Management Accounting Multiple Choice ExamDocument12 pagesManagement Accounting Multiple Choice ExamMark Lord Morales Bumagat100% (1)

- Acct. 162 - EPS, BVPS, DividendsDocument5 pagesAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueNo ratings yet

- GonzalesDocument2 pagesGonzalesPrecious Gonzales100% (1)

- Jpia Cup p1Document65 pagesJpia Cup p1RonieOlarte100% (1)

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- Final Exam in Advanced Financial Accounting IDocument6 pagesFinal Exam in Advanced Financial Accounting IYander Marl BautistaNo ratings yet

- Chapter 03Document30 pagesChapter 03ajbalcitaNo ratings yet

- Chapter 8 - Investment Property, Other Non-current AssetsDocument7 pagesChapter 8 - Investment Property, Other Non-current AssetsPamela Cruz100% (1)

- Quiz 1 ConsulDocument4 pagesQuiz 1 ConsulJenelyn Pontiveros40% (5)

- Auditing Problems AP 007 to 010 SolutionsDocument6 pagesAuditing Problems AP 007 to 010 SolutionsSerena Van der WoodsenNo ratings yet

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Document10 pagesCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADNo ratings yet

- Vdocuments - MX - Advanced Financial Accounting 1Document11 pagesVdocuments - MX - Advanced Financial Accounting 1Sweet EmmeNo ratings yet

- Sol Man Sec 6 SQ1 PDFDocument4 pagesSol Man Sec 6 SQ1 PDFHope Trinity EnriquezNo ratings yet

- LiquiDocument3 pagesLiquiPremium Netflix0% (1)

- NFJPIA Mockboard 2011 P2Document13 pagesNFJPIA Mockboard 2011 P2Regie Sharry Alutang PanisNo ratings yet

- Competency Appraisal UM Digos (PARTNERSHIP)Document10 pagesCompetency Appraisal UM Digos (PARTNERSHIP)Diana Faye CaduadaNo ratings yet

- Problem 44Document2 pagesProblem 44Arian AmuraoNo ratings yet

- FAR-04 Share Based PaymentsDocument3 pagesFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Chapter 27 Earnings and Book Value Per ShareDocument19 pagesChapter 27 Earnings and Book Value Per ShareNhel AlvaroNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsJayr BVNo ratings yet

- Corporation LiquidationDocument1 pageCorporation LiquidationMelisa DomingoNo ratings yet

- Partnership FormationDocument2 pagesPartnership Formationlouise carinoNo ratings yet

- AUDIT OF INVESTMENTS GAINS AND LOSSESDocument6 pagesAUDIT OF INVESTMENTS GAINS AND LOSSESZyrelle DelgadoNo ratings yet

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- Quiz On Cap BudgDocument3 pagesQuiz On Cap BudgjjjjjjjjNo ratings yet

- Seatwork - Advacc1Document2 pagesSeatwork - Advacc1David DavidNo ratings yet

- I. Concept Notes Joint CostsDocument9 pagesI. Concept Notes Joint CostsDanica Christele AlfaroNo ratings yet

- ICPA PH - Substatantive Testing & Audit EvidenceDocument7 pagesICPA PH - Substatantive Testing & Audit EvidenceErika delos SantosNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Use The Fact Pattern Below For The Next Three Independent CasesDocument5 pagesUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- F3Document2 pagesF3Kimberly PadlanNo ratings yet

- P2Document18 pagesP2Robert Jayson UyNo ratings yet

- Set ADocument9 pagesSet AGladys Mae CorpuzNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- SW - NpoDocument1 pageSW - NpoGwy HipolitoNo ratings yet

- Activity - Chapter 4Document2 pagesActivity - Chapter 4Greta DuqueNo ratings yet

- Ac3a Qe Oct2014 (TQ)Document15 pagesAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Auditing Appplications PrelimsDocument5 pagesAuditing Appplications Prelimsnicole bancoroNo ratings yet

- AainvtyDocument4 pagesAainvtyRodolfo SayangNo ratings yet

- Suzette Washington CaseDocument30 pagesSuzette Washington CaseMary Queen Ramos-Umoquit100% (1)

- TX 1102 Deductions from Gross Income Itemized and Special DeductionsDocument10 pagesTX 1102 Deductions from Gross Income Itemized and Special DeductionsJulz0% (1)

- Business CombinationDocument8 pagesBusiness CombinationCharla SuanNo ratings yet

- Audit of Intangible Assets TitleDocument2 pagesAudit of Intangible Assets TitleJaycee FabriagNo ratings yet

- PartnershipDocument10 pagesPartnershipJasmine Marie Ng Cheong50% (2)

- Acctg 2 QuizDocument4 pagesAcctg 2 QuizAshNor RandyNo ratings yet

- Home Office and Branch Accounting PDFDocument3 pagesHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Cash BasisDocument4 pagesCash BasisMark DiezNo ratings yet

- Case 1 - Computations of GW or IFADocument3 pagesCase 1 - Computations of GW or IFAJem Valmonte0% (1)

- AtcpDocument2 pagesAtcpnavie VNo ratings yet

- MGT Adv Serv 09.2019Document11 pagesMGT Adv Serv 09.2019Weddie Mae VillarizaNo ratings yet

- Practical Accounting 2 4Document13 pagesPractical Accounting 2 4AB CloydNo ratings yet

- DocxDocument12 pagesDocxNothingNo ratings yet

- Department of Accountancy: Page - 1Document16 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- Corporate liquidation quizDocument9 pagesCorporate liquidation quizKyla de SilvaNo ratings yet

- 9405 - Corporate LiquidationDocument4 pages9405 - Corporate LiquidationKenneth Anthony BalitayoNo ratings yet

- Afar 02: Corporate Liquidation: I. True or False - Theory of AccountsDocument5 pagesAfar 02: Corporate Liquidation: I. True or False - Theory of AccountsRoxell CaibogNo ratings yet

- 9005 - Corporate LiquidationDocument5 pages9005 - Corporate LiquidationAjmerick AgupeNo ratings yet

- 9105 - Corporate LiquidationDocument4 pages9105 - Corporate LiquidationGo FarNo ratings yet

- Table of Specifications May 2019Document25 pagesTable of Specifications May 2019Justine Joyce Gabia90% (10)

- Not MineDocument4 pagesNot MineJulie Neay AfableNo ratings yet

- Solution - Shareholders EquityDocument37 pagesSolution - Shareholders EquityJulie Neay AfableNo ratings yet

- 1701q PDFDocument6 pages1701q PDFJulie Neay AfableNo ratings yet

- 2010-2015 Tax Bar Based On The 2015 Bar Syllabus PDFDocument124 pages2010-2015 Tax Bar Based On The 2015 Bar Syllabus PDFNin BANo ratings yet

- RR No. 8-2018Document27 pagesRR No. 8-2018deltsen100% (1)

- TRAIN PresentationDocument17 pagesTRAIN PresentationApril Mae Niego MaputeNo ratings yet

- TAX Session 1Document75 pagesTAX Session 1MaeNeth GullanNo ratings yet

- Ey Applying Conceptual Framework April2018 PDFDocument11 pagesEy Applying Conceptual Framework April2018 PDFYoooNo ratings yet

- QuizDocument2 pagesQuizJulie Neay AfableNo ratings yet

- Ey Applying Conceptual Framework April2018 PDFDocument11 pagesEy Applying Conceptual Framework April2018 PDFYoooNo ratings yet

- 2020 Study Plan StrategyDocument28 pages2020 Study Plan StrategyYeyebonlNo ratings yet

- 5 6266956484341399676Document65 pages5 6266956484341399676Julie Neay AfableNo ratings yet

- DHL Express Rate Transit Guide PH enDocument25 pagesDHL Express Rate Transit Guide PH enJulie Neay AfableNo ratings yet

- QuizDocument12 pagesQuizJulie Neay AfableNo ratings yet

- Ap 59 PW - 5 06 PDFDocument18 pagesAp 59 PW - 5 06 PDFJasmin NgNo ratings yet

- Dr. Ferrer's First Preboard Review '85 SolutionsDocument4 pagesDr. Ferrer's First Preboard Review '85 SolutionsJulie Neay AfableNo ratings yet

- Barter of Reviewers For Accountancy Vocation - Organization (PH)Document24 pagesBarter of Reviewers For Accountancy Vocation - Organization (PH)Ashdeeyah AyishaNo ratings yet

- CORPORATION LAW PRINCIPLESDocument20 pagesCORPORATION LAW PRINCIPLESStephanie Valentine100% (10)

- Chapter 3Document5 pagesChapter 3Julie Neay AfableNo ratings yet

- Law & Tax QuizzerDocument10 pagesLaw & Tax QuizzerJulie Neay AfableNo ratings yet

- Oblicon LawDocument5 pagesOblicon LawJulie Neay AfableNo ratings yet

- QuizDocument2 pagesQuizJulie Neay AfableNo ratings yet

- 2012 BPI Vs LeeDocument2 pages2012 BPI Vs LeeMa Gabriellen Quijada-TabuñagNo ratings yet

- Statement of Realization and LiquidationDocument5 pagesStatement of Realization and LiquidationPj ConcioNo ratings yet

- RCC Reviewer Part IIDocument17 pagesRCC Reviewer Part IIjoventiladorNo ratings yet

- Deed of Undertaking Real EstateDocument62 pagesDeed of Undertaking Real EstatePcl Nueva VizcayaNo ratings yet

- Bankruptcy Judge Approves Oakfabco's Amended Plan and Asbestos TrustDocument3 pagesBankruptcy Judge Approves Oakfabco's Amended Plan and Asbestos TrustKirk HartleyNo ratings yet

- Presentation On Rights of ShareholdersDocument12 pagesPresentation On Rights of ShareholdersHemasri ChinnuNo ratings yet

- Consolidated Bank Vs CADocument17 pagesConsolidated Bank Vs CAAriza YogiNo ratings yet

- 0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFDocument9 pages0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFIan RanilopaNo ratings yet

- Company LawDocument42 pagesCompany Lawdirector_iitdNo ratings yet

- Chapter - I: PreliminaryDocument32 pagesChapter - I: Preliminarykasha pullappaNo ratings yet

- Partnership Liquidation - SeatworkDocument1 pagePartnership Liquidation - SeatworkReymilyn SanchezNo ratings yet

- Insolvency Law Study Guide 2014 - UNISADocument219 pagesInsolvency Law Study Guide 2014 - UNISADawn McGowan100% (1)

- Law 3 Test Banks PDFDocument42 pagesLaw 3 Test Banks PDFCheramie Encabo QuezolNo ratings yet

- Dissolution and winding up of partnership between Serra and MotaDocument3 pagesDissolution and winding up of partnership between Serra and MotaNLainie OmarNo ratings yet

- LAW438 Topic 8Document34 pagesLAW438 Topic 8Nureen Izzaty Bt YusryNo ratings yet

- Letter To HLURB III Re Cancellation of JV AnnotationDocument5 pagesLetter To HLURB III Re Cancellation of JV AnnotationPending_nameNo ratings yet

- Company Law - TRIPATHI ABHISHEK AMARNATH ANJANADocument10 pagesCompany Law - TRIPATHI ABHISHEK AMARNATH ANJANAabhirocxNo ratings yet

- Labor Relations MCQ QuestionsDocument23 pagesLabor Relations MCQ QuestionsChaNo ratings yet

- Philippine Supreme Court rules on dismissal of corporate rehabilitation petitionDocument27 pagesPhilippine Supreme Court rules on dismissal of corporate rehabilitation petitionMarissaNo ratings yet

- Liquidation Regulations (Upto September 16, 2022)Document75 pagesLiquidation Regulations (Upto September 16, 2022)Umang ShirodariyaNo ratings yet

- Tocao vs. CADocument6 pagesTocao vs. CAckqashNo ratings yet

- MK LawDocument4 pagesMK LawShibin JayaprasadNo ratings yet

- Format For Course Curriculum: Annexure CD-01'Document4 pagesFormat For Course Curriculum: Annexure CD-01'farazNo ratings yet

- Tan Tiong Bio vs. CIR, G.R. No. L-15778, April 23, 1962Document1 pageTan Tiong Bio vs. CIR, G.R. No. L-15778, April 23, 1962Lizzy WayNo ratings yet

- Draft Copy - 2 MW PV Project PDFDocument142 pagesDraft Copy - 2 MW PV Project PDFMahendra Asawale100% (1)

- SEC Bangladesh OverviewDocument37 pagesSEC Bangladesh Overviewtazim07100% (1)

- GR. No. 97212Document5 pagesGR. No. 97212Zainne Sarip BandingNo ratings yet

- Step For Winding Up LLPDocument3 pagesStep For Winding Up LLPCHUAN YONG TANNo ratings yet

- New Era of Corporate AdjudicationDocument45 pagesNew Era of Corporate AdjudicationsklljNo ratings yet

- Rules and winding up of government companiesDocument4 pagesRules and winding up of government companiesSakibul Islam SifatNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)