Professional Documents

Culture Documents

Equity Formula PDF

Uploaded by

shirishaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Formula PDF

Uploaded by

shirishaCopyright:

Available Formats

[ 18 ] Financial Markets

Tea m Pr oject 1. - Equity Analy sis

EXECUTIVE SUMMARY - (LESS THAN 1 PAGE -5 POINTS)

The executive summary is designed for someone who reads only the first page of the report. It

should present your principal findings and recommendations in a straightforward and easy-to-

read summary.

INTRODUCTION - (2 PAGES -5 POINTS)

You should provide the name and principal characteristics of the company and the environment

in which it operates; its relative size, market share, asset value, and importance in the industry,

principal difficulties it must overcome and opportunities it might seize over the next year or so.

Remember to cite your sources whenever necessary in the text or your report and provide a

complete list of references.

BETA CALCULATION - (2 PAGES - 10 POINTS)

Characteristic Line

Calculate the β coefficient (systematic risk) of the company. The calculation should rely on at

least 36 monthly returns on your company's stock and you should justify your choice of the

market proxy you use. The report should provide a high-low-close graph, a regression analysis, the

derived equation, a graph of the characteristic line, and a brief explanation and interpretation of

the results. Remember to include the R2 of your regression.

You should compare the β you calculate to the published β for your company and explain why

there might be a discrepancy.

The appendices should include the prices, dividends, and monthly returns you used to calculate

β and a complete list of references.

Security Market Line

The results of your calculations should be presented as a Security Market line. Explain how you

chose the proxy for the risk free rate and market return, and how you calculated your company's

expected return.

DIVERSIFICATION - (1 PAGE - 10 POINTS)

In this section you should propose an investment which might be used to diversify a portfolio

which has a significant position in your company; we are looking for a company who's returns

would be expected to correlate negatively with your company's returns.

To illustrate the effect of diversifying a portfolio as you recommend set up a hypothetical

portfolio which invests exclusively in your company's stock and calculate its average return (µ ),

risk (σ), beta (β), and R2 of the beta over the last three years. Set up a similar portfolio which

invests 50% in your company's stock and 50% in your recommended diversifying stock and

Projects [ 19 ]

examine the same statistics.

You should explain your rationale for choosing this stock as a diversifying investment and justify

your position using the portfolio statistics you calculated.

The appendices should include the prices, dividends, and monthly returns you used in calculating

the correlation between the two stocks.

CONCLUSION - (1 PAGE 5 POINTS)

Evaluate the systematic risk involved in the investment you analyze and make a recommendation

(sell, hold, buy, buy only for aggressive investors) for the stock you analyze. How representative

of future expectations is the data you analyzed.

SAMPLE RATE OF RETURN CALCULATIONs

Intel (INTC) pays quarterly dividends which must be incorporated into the rate of return

calculation.

Intel (INTC)

Month Closing Price Div Ex-date Return Explanation

Dec-95 56 3/4

Jan-96 55 15/64 0.040 30-Jan-96 -2.600%

Feb-96 58 13/16 6.478%

Mar-96 56 7/8 -3.294%

Apr-96 76 3/4 0.040 29-Apr-96 35.015% (76.75 + 0.04) / 56.875 = 1.35015

May-96 75 1/2 -1.629% (75.50) / 76.75 = 0.98371

Jun-96 73 7/16 -2.732%

Jul-96 75 1/8 0.050 30-Jul-96 2.366%

Aug-96 79 13/16 6.240%

Sep-96 95 7/16 19.577%

Oct-96 109 7/8 0.050 30-Oct-96 15.180%

Nov-96 126 7/8 15.472%

Dec-96 130 15/16 3.202%

Microsoft split 2:1 December 9, 1996

Microsoft (MSFT)

Month Closing Price Return Explanation

Sep-96 131 7/8 7.653%

Oct-96 137 1/4 4.076%

Nov-96 156 7/8 14.299% 156.875 / 137.25 = 1.14299

Dec-96 82 5/8 5.339% (2 * 82.625) / 156.875 = 1.05339

Jan-97 83 3/16 0.681% 83.1875 / 82.625 = 1.00681

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- EpsDocument11 pagesEpsshirishaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Accounting ConceptsDocument7 pagesAccounting ConceptsshirishaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- How To Calculate AAGR - 0Document2 pagesHow To Calculate AAGR - 0shirishaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Accounting ConceptsDocument7 pagesAccounting ConceptsshirishaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Financial Formulas - Ratios (Sheet)Document3 pagesFinancial Formulas - Ratios (Sheet)carmo-netoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Financial Formulas - Ratios (Sheet)Document3 pagesFinancial Formulas - Ratios (Sheet)carmo-netoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Tea M PR Oject 1. - Equity Analy Sis: Xecutive Ummary Less Than PointsDocument2 pagesTea M PR Oject 1. - Equity Analy Sis: Xecutive Ummary Less Than PointsshirishaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Product & Services: Project Report OnDocument100 pagesProduct & Services: Project Report OnshirishaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Tea M PR Oject 1. - Equity Analy Sis: Xecutive Ummary Less Than PointsDocument2 pagesTea M PR Oject 1. - Equity Analy Sis: Xecutive Ummary Less Than PointsshirishaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Cashflow AnalysisDocument60 pagesCashflow Analysisshirisha100% (1)

- Project On Online Trading at Sharekhan LTDDocument134 pagesProject On Online Trading at Sharekhan LTDMithun Kumar Patnaik73% (26)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Pakistan Economic Survey 06-07Document388 pagesPakistan Economic Survey 06-07Ali RazaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Q1 2023 US VC Valuations ReportDocument25 pagesQ1 2023 US VC Valuations ReportToni WilliamNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- RBI and Functions of Central BankDocument21 pagesRBI and Functions of Central BanktusharNo ratings yet

- FRADocument8 pagesFRArajashreekini13No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Bodie Essentials of Investments 12e Chapter 09 PPT AccessibleDocument33 pagesBodie Essentials of Investments 12e Chapter 09 PPT AccessibleEdna DelantarNo ratings yet

- Role of MNC's in Transfering TechnologyDocument42 pagesRole of MNC's in Transfering TechnologyOsman Gani100% (3)

- David Elliot MIT MAP.1.2Document59 pagesDavid Elliot MIT MAP.1.2tacamp da100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Unit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToDocument56 pagesUnit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToAudit MarathonNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Chap 010Document66 pagesChap 010MohitNo ratings yet

- Briefing About Annual Report of InfosysDocument3 pagesBriefing About Annual Report of InfosysRonak SingodiaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- International Finance - MG760-144 Week 4 - Chapter 5 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolDocument5 pagesInternational Finance - MG760-144 Week 4 - Chapter 5 Nazifa Antara Prome Homework Assignment Monroe College King Graduate SchoolKiran100% (1)

- Sample of Fixed Asset ScheduleDocument1 pageSample of Fixed Asset ScheduleAnnie ChewNo ratings yet

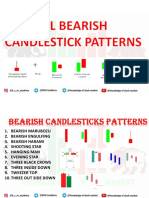

- All Bearish Candle Stick PatternsDocument18 pagesAll Bearish Candle Stick PatternsxhghdghNo ratings yet

- New Century Loan Pools - List of Securities TrustsDocument11 pagesNew Century Loan Pools - List of Securities Trusts83jjmack100% (1)

- Babajide A. A. and Adetiloye K.ADocument29 pagesBabajide A. A. and Adetiloye K.ATosin JohnsonNo ratings yet

- How To Trade A News BreakoutDocument4 pagesHow To Trade A News BreakoutJason2Kool100% (2)

- Letter From James PallottaDocument2 pagesLetter From James PallottaDealBook100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- PR Manager Conversations Scott Ramsey 0667-NLD-031313Document4 pagesPR Manager Conversations Scott Ramsey 0667-NLD-031313spritch1No ratings yet

- © The Mcgraw-Hill Companies, Inc., 2008 E11.14Document141 pages© The Mcgraw-Hill Companies, Inc., 2008 E11.14Haris Storage1No ratings yet

- Chapter 17: Bonds: Bond Price MovementDocument2 pagesChapter 17: Bonds: Bond Price MovementsaanmitNo ratings yet

- MK 5BDocument3 pagesMK 5BFaqih NuriandaNo ratings yet

- Hutchison Whampoa Case ReportDocument6 pagesHutchison Whampoa Case ReporttsjakabNo ratings yet

- ACCA P4 Revision 2019Document8 pagesACCA P4 Revision 2019Manoj SolankiNo ratings yet

- Chapter 6 - Questions AccDocument8 pagesChapter 6 - Questions Accmasud.mily06No ratings yet

- MBA - Chapter 7Document2 pagesMBA - Chapter 7GauravNo ratings yet

- Foreign Institutional InvestorDocument14 pagesForeign Institutional InvestorDaniel Raj RichardNo ratings yet

- Indian Railways Annual Report Accounts 2019 20 EnglishDocument179 pagesIndian Railways Annual Report Accounts 2019 20 EnglishRakesh KumarNo ratings yet

- FIN310 Module 3 Excel AssignmentDocument27 pagesFIN310 Module 3 Excel AssignmentJonathan BurgosNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Anchoria Fixed Income FundDocument33 pagesAnchoria Fixed Income FundTijani OladipupoNo ratings yet

- The Capital Budgeting Decision: Mcgraw-Hill/IrwinDocument48 pagesThe Capital Budgeting Decision: Mcgraw-Hill/IrwinkonyatanNo ratings yet