Professional Documents

Culture Documents

RMC No. 35-2012 On Taxability of Clubs

Uploaded by

Pilyang SweetOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC No. 35-2012 On Taxability of Clubs

Uploaded by

Pilyang SweetCopyright:

Available Formats

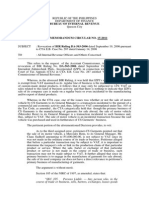

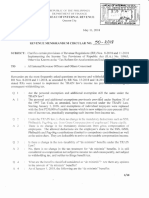

6. RMC No. 35-2012 on taxability of clubs operated exclusively for pleasure, recreation and other non-profit purposes.

Income Tax

Clubs which are organized and operated exclusively for pleasure, recreation, and other non-profit purposes are subject to income tax

under the National Internal Revenue Code of 1997, as amended. According to the doctrine of casus omissus pro omisso habendus est, a person

object or thing omitted from an enumeration must be held to have been omitted intentionally. The provision in the National Internal Revenue

Code of 1977 which granted income tax exemption to such recreational clubs was omitted in the current list of tax exempt corporations under

National Internal Revenue Code of 1997, as amended. Hence, the income of recreational clubs from whatever source, including but not limited to

membership fees, assessment dues, rental income, and service fees are subject to income tax.

THE BUREAU of Internal Revenue (BIR) has clarified in separate circulars issued

earlier this month that recreational clubs and construction receipts are not

exempted from taxes.

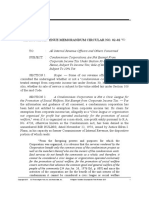

"Clubs organized and operated exclusively for pleasure, recreation and other non-profit purposes" are

subject to income and value-added taxes (VAT), read Revenue Memorandum Circular No. 35-2012,

dated Aug. 6.

While recreational clubs were exempted from taxes under the 1977 National Internal Revenue Code

(NIRC), this provision was deleted in the 1997 version, the circular explained. "…[A] person or thing

omitted from an enumeration must be held to have been omitted intentionally. The provision in the

NIRC of 1977…was omitted in the current list of tax-exempt corporations under the NIRC of 1997, as

amended," it said.

Thus, income of recreational clubs from membership fees, assessment dues, rental income, service

fees and the like are subject to income tax, the circular said.

They are likewise subject to VAT for the sale of goods and services, even as a non-stock, non-profit

organization. The BIR cited the NIRC of 1997, which states that the VAT is imposed on all transactions

"in the course of trade or business." This, the bureau said, refers to the "regular conduct or pursuit of

a commercial or an economic activity…by an person, regardless of whether or not the person

engaged therein is a nonstock, non-profit private organization."

The VAT is also imposed regardless of whether the goods and services are rendered exclusively to

affiliates on a "reimbursement-on-cost basis only," it added, noting a Supreme Court decision penned

in March 2000. "As long as the entity provides service for a fee, renumeration or consideration, then

the service rendered is subject to VAT," the decision read.

BIR Commissioner Kim S. Jacinto-Henares said in an interview that all rulings contrary to RMC 35-

2012 "should no longer be followed." "We are just aligning ourselves with the letter of the law."

Meanwhile, RMC 36-2012, issued last Aug. 3, clarified that construction receipts are subject to

documentary stamp tax (DST).

"Only instruments, documents and papers of transactions expressly enumerated in [the NIRC of 1997]

are exempt from the DST. Consequently, certificates and other necessary documents issued by the

Construction Industry Authority of the Philippines… are not among those mentioned…" the circular

read, citing certificates of registration and renewal or registration of overseas contractors;

contractor’s license; certificate of whether a contractor is licensed; certified true copies of license

certificates; certified true copies of documents; certificate of accreditation of arbitrators; and case

documents.

You might also like

- Request For ReinvestigationDocument9 pagesRequest For Reinvestigationjoel raz93% (15)

- Tan Chong Vs Secretary of LaborDocument3 pagesTan Chong Vs Secretary of Laborrm28030% (2)

- 12 Guerrero V VillamorDocument3 pages12 Guerrero V VillamorJudy Ann ShengNo ratings yet

- McKee v. Intermediate Appellate Court ruling overturnedDocument2 pagesMcKee v. Intermediate Appellate Court ruling overturnedErika-Anne Therese100% (5)

- RMC 35-2012Document0 pagesRMC 35-2012Peggy SalazarNo ratings yet

- Casus Omissus Pro Omisso Habendus Est - A Person, Object, or Thing Omitted FromDocument3 pagesCasus Omissus Pro Omisso Habendus Est - A Person, Object, or Thing Omitted FromCP LugoNo ratings yet

- 11.-Commissioner of Internal Revenue V.20210424-14-4bunewDocument10 pages11.-Commissioner of Internal Revenue V.20210424-14-4bunewMarj BaquialNo ratings yet

- BIR Circular on Taxing Non-Profit Clubs Ruled InvalidDocument2 pagesBIR Circular on Taxing Non-Profit Clubs Ruled InvalidEllenNo ratings yet

- ANPC vs. BIRDocument2 pagesANPC vs. BIRAnneNo ratings yet

- BIR Revokes Tax Exemption for Philippine Canine ClubDocument0 pagesBIR Revokes Tax Exemption for Philippine Canine ClubRheneir MoraNo ratings yet

- ANPC v. BIR rules membership fees non-taxableDocument2 pagesANPC v. BIR rules membership fees non-taxableDerek C. Egalla100% (2)

- Bir VS First e Bank Condominium CorporationDocument3 pagesBir VS First e Bank Condominium CorporationluckyNo ratings yet

- Cases Income Tax VsDocument10 pagesCases Income Tax VsWreath An GuevarraNo ratings yet

- Facts:: Anpc (Vs BirDocument2 pagesFacts:: Anpc (Vs BirDNAANo ratings yet

- BIR V First E-Bank-fullDocument17 pagesBIR V First E-Bank-fullLucky JavellanaNo ratings yet

- Condo dues tax circular summaryDocument3 pagesCondo dues tax circular summarySpecforcNo ratings yet

- Supreme Court Rules Recreational Club Fees Not Subject to Income Tax, VATDocument4 pagesSupreme Court Rules Recreational Club Fees Not Subject to Income Tax, VATJoshua John EspirituNo ratings yet

- DST On Policy Holders Registered With PEZADocument5 pagesDST On Policy Holders Registered With PEZACkey ArNo ratings yet

- 2013 Tax-Exemption Guidelines For Non-Stock, Nonprofit Corporations FDM 8.1.13Document2 pages2013 Tax-Exemption Guidelines For Non-Stock, Nonprofit Corporations FDM 8.1.13cyrilNo ratings yet

- Declaratory Relief On The Validity of BIR RMC No. 65-2012Document25 pagesDeclaratory Relief On The Validity of BIR RMC No. 65-2012CJNo ratings yet

- Dayagbil, Escano, Sabdullah, Villablanca EH 406 TAX 1 December 16, 2017Document4 pagesDayagbil, Escano, Sabdullah, Villablanca EH 406 TAX 1 December 16, 2017Vanda Charissa Tibon DayagbilNo ratings yet

- RMC No 65-2012 PDFDocument3 pagesRMC No 65-2012 PDFGhreighz GalinatoNo ratings yet

- Basic ElementsDocument82 pagesBasic Elementskristel jane caldozaNo ratings yet

- Revokes Ruling on VAT for Car SalesDocument3 pagesRevokes Ruling on VAT for Car SalesEric DykimchingNo ratings yet

- (11 Sections) : 3 Types of Activities: Sale of Goods and PropertiesDocument12 pages(11 Sections) : 3 Types of Activities: Sale of Goods and PropertiesInna Marie CaylaoNo ratings yet

- Dayagbil, Escano, Sabdullah, Villablanca EH 406 TAX 1 December 16, 2017 Perino, Benuya, Go, SalvacionDocument5 pagesDayagbil, Escano, Sabdullah, Villablanca EH 406 TAX 1 December 16, 2017 Perino, Benuya, Go, SalvacionVanda Charissa Tibon DayagbilNo ratings yet

- 16 Bureau of Internal Revenue v. First E-Bank Tower Condominium CorpDocument18 pages16 Bureau of Internal Revenue v. First E-Bank Tower Condominium CorpChristian Edward CoronadoNo ratings yet

- Clarifying the Tax Liability of Non-Profit Recreational ClubsDocument13 pagesClarifying the Tax Liability of Non-Profit Recreational ClubsYusef KirikoNo ratings yet

- Let's Talk TaxDocument4 pagesLet's Talk TaxFiel Aldous EvidenteNo ratings yet

- Taxation - Direct and IndirectDocument10 pagesTaxation - Direct and IndirectcpaatuldwivediNo ratings yet

- Commissioner of Internal Revenue, Petitioner, vs. Court of Appeals and Commonwealth Management and Services CORPORATION, RespondentsDocument6 pagesCommissioner of Internal Revenue, Petitioner, vs. Court of Appeals and Commonwealth Management and Services CORPORATION, RespondentsMary Joy NavajaNo ratings yet

- Basic Overview of Corporate Income Taxation in the PhilippinesDocument7 pagesBasic Overview of Corporate Income Taxation in the PhilippinesMae Katherine Grande Lumbria100% (1)

- Types of Organizations Revised Corporation CodeDocument11 pagesTypes of Organizations Revised Corporation CodeNadie LrdNo ratings yet

- Faqs Withholding TaxDocument50 pagesFaqs Withholding TaxHarryNo ratings yet

- Tax Ruling on VAT Invoice RequirementsDocument8 pagesTax Ruling on VAT Invoice RequirementsturtlesareawesomexxNo ratings yet

- VatDocument4 pagesVatColeenNo ratings yet

- GST On TrustDocument4 pagesGST On TruststeveNo ratings yet

- Legal opinion on taxability of awards and TINDocument3 pagesLegal opinion on taxability of awards and TINSiimaemanuelNo ratings yet

- Cir V CA ComasercoDocument2 pagesCir V CA ComasercoJoel G. AyonNo ratings yet

- Dof Order No. 17-04Document10 pagesDof Order No. 17-04matinikkiNo ratings yet

- 2014 Tax Updates and Common Errors To AvoidDocument110 pages2014 Tax Updates and Common Errors To AvoidMcrislbNo ratings yet

- 1-ANPC v. BIR, G.R. 228539, June 26, 2019Document3 pages1-ANPC v. BIR, G.R. 228539, June 26, 2019evreynosoNo ratings yet

- Taxation (Income Tax) - Pp41-60Document37 pagesTaxation (Income Tax) - Pp41-60Iya PadernaNo ratings yet

- 03 Chap 03 05 Mamalateo 2019 Tax BookDocument151 pages03 Chap 03 05 Mamalateo 2019 Tax BookZachary Siayngco100% (1)

- RMC 33-2013Document4 pagesRMC 33-2013Ephraim TuganoNo ratings yet

- A Guide For An Individual Who Obtains A Business Certificate (Abridged Version)Document8 pagesA Guide For An Individual Who Obtains A Business Certificate (Abridged Version)Anastasia EremeevaNo ratings yet

- Tax Planning in Business Bangladesh Perspective - by Swapan Kumar Bala - SSRN-id991329Document21 pagesTax Planning in Business Bangladesh Perspective - by Swapan Kumar Bala - SSRN-id991329Rahmat UllahNo ratings yet

- RR No. 07-12Document53 pagesRR No. 07-12Nash Ortiz LuisNo ratings yet

- ProtestLetter TICIDocument4 pagesProtestLetter TICIdbircs100% (4)

- 71 - Association of Non-Profit Club, Inc. v. BIRDocument2 pages71 - Association of Non-Profit Club, Inc. v. BIRJoshua BorresNo ratings yet

- SSRN Id2566587 PDFDocument37 pagesSSRN Id2566587 PDFAnonymous b0FSKVRALUNo ratings yet

- RRMC 2002Document8 pagesRRMC 2002Maisie Rose VilladolidNo ratings yet

- By Rowena Altura: Volume 9 No.12Document6 pagesBy Rowena Altura: Volume 9 No.12arnelmapzNo ratings yet

- Uae Corporate Tax Law SummaryDocument37 pagesUae Corporate Tax Law SummarypankajNo ratings yet

- Revenue Memorandum Circular No. 065-12 Clarifying The Taxability of Association DuesDocument3 pagesRevenue Memorandum Circular No. 065-12 Clarifying The Taxability of Association DuesMary Cris O. ServinasNo ratings yet

- Ing V Cir FinalDocument6 pagesIng V Cir FinalTrem GallenteNo ratings yet

- 360 Supreme Court Reports Annotated: ING Bank N.V. vs. Commissioner of Internal RevenueDocument44 pages360 Supreme Court Reports Annotated: ING Bank N.V. vs. Commissioner of Internal RevenueFrancis ManuelNo ratings yet

- Circular On Taxation of NGOsDocument7 pagesCircular On Taxation of NGOsAdina MarcuNo ratings yet

- Bureau of Internal Revenue: March 25, 2013 Concerning The Recovery of Unutilized Creditable Input TaxesDocument3 pagesBureau of Internal Revenue: March 25, 2013 Concerning The Recovery of Unutilized Creditable Input TaxesSammy AsanNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- The AntecedentsDocument7 pagesThe AntecedentsPilyang SweetNo ratings yet

- Corporate Income Tax Part 2Document8 pagesCorporate Income Tax Part 2Pilyang SweetNo ratings yet

- Corporate Income Tax Part 1Document4 pagesCorporate Income Tax Part 1Pilyang SweetNo ratings yet

- DeductionsDocument3 pagesDeductionsPilyang SweetNo ratings yet

- Whether LGU can impose business tax on condo corpDocument2 pagesWhether LGU can impose business tax on condo corpPilyang SweetNo ratings yet

- Date: Name OIC/Owner Company DearDocument1 pageDate: Name OIC/Owner Company DearPilyang SweetNo ratings yet

- Lim, Sr. vs. Court of Appeals, 190 SCRA 616, G.R. Nos. 48134-37. October 18, 1990Document4 pagesLim, Sr. vs. Court of Appeals, 190 SCRA 616, G.R. Nos. 48134-37. October 18, 1990Pilyang SweetNo ratings yet

- Cebu City Tax on Matches Sold Outside CityDocument1 pageCebu City Tax on Matches Sold Outside CityPilyang SweetNo ratings yet

- Whether LGU can impose business tax on condo corpDocument2 pagesWhether LGU can impose business tax on condo corpPilyang SweetNo ratings yet

- Smart Communications Vs City of DavaoDocument1 pageSmart Communications Vs City of DavaoPilyang SweetNo ratings yet

- DeductionsDocument3 pagesDeductionsPilyang SweetNo ratings yet

- Deductions From Gross Income 2Document3 pagesDeductions From Gross Income 2Pilyang SweetNo ratings yet

- Insurance Outline As of Jan. 17 2017Document10 pagesInsurance Outline As of Jan. 17 2017Judy GojarNo ratings yet

- Date: Name OIC/Owner Company DearDocument1 pageDate: Name OIC/Owner Company DearPilyang SweetNo ratings yet

- RMC No 50-2018Document18 pagesRMC No 50-2018JajajaNo ratings yet

- RMC No 50-2018Document18 pagesRMC No 50-2018JajajaNo ratings yet

- Industries-Heritage Hotel Manila Supervisors Chapter (Nuwhrain-HHMSC) G.R. No. 178296, January 12, 2011Document2 pagesIndustries-Heritage Hotel Manila Supervisors Chapter (Nuwhrain-HHMSC) G.R. No. 178296, January 12, 2011Pilyang SweetNo ratings yet

- 17abad Vs BiasonDocument2 pages17abad Vs BiasonmarbienNo ratings yet

- Coronel v. CA Full CaseDocument12 pagesCoronel v. CA Full CasePilyang SweetNo ratings yet

- Faith Hill Lyrics There You'Ll BeDocument1 pageFaith Hill Lyrics There You'Ll BePilyang SweetNo ratings yet

- On The Wings of Love LyricsDocument2 pagesOn The Wings of Love LyricsPilyang SweetNo ratings yet

- Atty Jimenez Did Not Violate Ethics Code in Estate CaseDocument1 pageAtty Jimenez Did Not Violate Ethics Code in Estate CasePilyang Sweet50% (2)

- Pelaez V Auditor General - LasamDocument2 pagesPelaez V Auditor General - LasamPilyang SweetNo ratings yet

- Disini Jr. vs. Secretary of JusticeDocument16 pagesDisini Jr. vs. Secretary of JusticePilyang SweetNo ratings yet

- Bisig NG Manggagawa Sa Concrete Aggregates v. NLRCDocument2 pagesBisig NG Manggagawa Sa Concrete Aggregates v. NLRCtemporiariNo ratings yet

- Johnson Vs McIntoshDocument2 pagesJohnson Vs McIntoshPilyang SweetNo ratings yet

- LTD Cases 1-9Document199 pagesLTD Cases 1-9Pilyang SweetNo ratings yet

- Kilusang Mayo Uno Labor Center VsDocument1 pageKilusang Mayo Uno Labor Center VsPilyang SweetNo ratings yet

- Barcelon Vs BakerDocument1 pageBarcelon Vs BakerPilyang SweetNo ratings yet

- Legal Aspects PrelimsDocument12 pagesLegal Aspects Prelimsdumpacc.skyyyNo ratings yet

- Security Dowans High Court LondonDocument3 pagesSecurity Dowans High Court LondonSarah HermitageNo ratings yet

- TaserspeechDocument2 pagesTaserspeechapi-226374961No ratings yet

- Claim in A NutshellDocument11 pagesClaim in A NutshellRebel X100% (3)

- List of Lawyers + Legal AidDocument1 pageList of Lawyers + Legal AiddeeNo ratings yet

- Furnco Constr. Corp. v. Waters, 438 U.S. 567 (1978)Document15 pagesFurnco Constr. Corp. v. Waters, 438 U.S. 567 (1978)Scribd Government DocsNo ratings yet

- Mizoram Driver Group B and C Post Recruitment Rules 2018Document5 pagesMizoram Driver Group B and C Post Recruitment Rules 2018Ngcha PachuauNo ratings yet

- Final PPT Motor TP Insurance & ClaimsDocument57 pagesFinal PPT Motor TP Insurance & ClaimsPRAKASH100% (1)

- GST Certificate S S IndDocument3 pagesGST Certificate S S IndPiyu VaiNo ratings yet

- Francisco V MT DigestDocument4 pagesFrancisco V MT DigestMariel Shing100% (1)

- Asdfasdfasdfasdfasdfa Wwerwersasfasdfd As Fdas Dfa SDF AsdfDocument5 pagesAsdfasdfasdfasdfasdfa Wwerwersasfasdfd As Fdas Dfa SDF AsdfbalajithrillerNo ratings yet

- Gan V CaDocument1 pageGan V CaTricia SibalNo ratings yet

- Final Harrington v. Purdue Pharma Side A BriefDocument58 pagesFinal Harrington v. Purdue Pharma Side A BriefRed Voice NewsNo ratings yet

- Labor Standards Part 1 by Atty. Anselmo S. Rodiel IVDocument18 pagesLabor Standards Part 1 by Atty. Anselmo S. Rodiel IVAnselmo Rodiel IVNo ratings yet

- BARBA Vs Liceo - PhilRadiant Vs Metrobank Case DigestsDocument6 pagesBARBA Vs Liceo - PhilRadiant Vs Metrobank Case DigestsKaren RefilNo ratings yet

- Contract Import ShablonDocument4 pagesContract Import ShablonAljona GeraščenkoNo ratings yet

- Pale Canon 15Document11 pagesPale Canon 15Yannie BarcelonaNo ratings yet

- The Crash of Valuejet Flight 592 and the Hurricane Katrina CaseDocument2 pagesThe Crash of Valuejet Flight 592 and the Hurricane Katrina Caseblack_hole34No ratings yet

- HOUSE CONTRACT AGREEMENT SUMMARYDocument6 pagesHOUSE CONTRACT AGREEMENT SUMMARYRachmat FaizalNo ratings yet

- Flawed Models Implementation of International Standards in Thailand's Model' Prisons For WomenDocument36 pagesFlawed Models Implementation of International Standards in Thailand's Model' Prisons For WomenRazi MahriNo ratings yet

- Republic of The Philippines Regional Trial Court Tarlac City Branch - Roberto Sentry R. ReynaldoDocument4 pagesRepublic of The Philippines Regional Trial Court Tarlac City Branch - Roberto Sentry R. ReynaldoIngrid Frances CalmaNo ratings yet

- Constitutional Law II (Bar Q & A 2008)Document6 pagesConstitutional Law II (Bar Q & A 2008)Jun Rex SaloNo ratings yet

- UnpublishedDocument6 pagesUnpublishedScribd Government DocsNo ratings yet

- Cancel at Ion of Sale DeedDocument61 pagesCancel at Ion of Sale DeedKooraju Raju100% (1)

- MBA 101 - Internal & External Institution and Influences of Corp. GovDocument2 pagesMBA 101 - Internal & External Institution and Influences of Corp. GovLouiene Morisey AcedilloNo ratings yet

- ObliCon Online Activity 3 (Rommel A. Cabalhin) PDFDocument3 pagesObliCon Online Activity 3 (Rommel A. Cabalhin) PDFRommel CabalhinNo ratings yet

- United States v. Sixty Acres in Etowah County, Evelyn Charlene Ellis, 930 F.2d 857, 11th Cir. (1991)Document7 pagesUnited States v. Sixty Acres in Etowah County, Evelyn Charlene Ellis, 930 F.2d 857, 11th Cir. (1991)Scribd Government DocsNo ratings yet