Professional Documents

Culture Documents

Ddce - Probable Questions

Uploaded by

Suvasmita Biswal0 ratings0% found this document useful (0 votes)

11 views8 pagesDdce

Original Title

Ddce- Probable Questions

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDdce

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views8 pagesDdce - Probable Questions

Uploaded by

Suvasmita BiswalDdce

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

PROBABLE QUESTIONS / TYPE OF QUESTIONS THAT

YOU CAN EXPECT-

Sub:- CTL

Note of Caution :- This is only a MODEL

QUESTION. There is no guarantee or surety that the

questions in exam will be of similar nature. The objective

of this model question is just to give an idea about the

type of questions that may come in the exam. Hence to

avoid any risk and surprises , please cover your syllabus

thoroughly and completely, without concentrating on just

the model questions.

A-12 marks question type –

1) What is a “Private Company” and what are it’s

privileges and limitations?

2) What are MOA & AOA and what are the

differences between these two documents ?

3) Who is a “director” and how a director can be

appointed ?

4) Who is a “director” and how a director can be

removed from his office ?

5) What is “winding up” of a company , and how a

company can be wound up ?

6) What are the expenditures allowed to be deducted

while computing income from business or

profession ? Explain with examples.

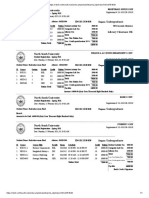

7) Compute the Taxable income of Sri Ravi from his

Salaries, who is working in Bhubaneswar for the

Assessment Year 2019-20.

SALARY PARTICULARS for the Financial Year 2018- Rs.

19

Basic Salary 6,00,000

DA (Forming part of the Salary) 3,00,000

HRA 3,00,000

Transport Allowance 9,600

Medical Allowance 19,200

Educational Allowance For 2 Children 4,800

Hostel Allowance- For 2 Children 7,200

Professional Pursuit-Reimbursement 24,000

Special Allowance 49,400

Additional Information-

a) Sri Ravi was staying in a rented house at Cuttack and

was paying a monthly rent of Rs. 25,000/= .

b) Sri Ravi had one child for whose school fees was

6,000/= p.a and hostel fees was 12,000/= p.a.

c) Sri Ravi had his personal car for his family , the

remuneration of the driver was being paid to the

tune of Rs.1,20,000/= p.a by the office.

(Answer- Income from Salaries- Rs.11,54,200/=)

B- 8 marks question type –

a)U/S 2(51) of Companies Act-2013, who are Key

Managerial Personnel and which companies are

mandatorily required to appoint KMP ?

8) What is a “Small Company” and what are it’s

advantages ?

9) What is a “Meeting” and what are the requisites of a

valid meeting ?

10) What is – Authorised Capital, Issued Capital

Subscribed Capital & Reserve Capital ?

11) What is “Tax Avoidance” and how does it

differ from “Tax Planning” ?

12) What are the methods of “Tax Planning” ,give

examples ?

13) What is Tax Planning and how an employee

can do his planning ?

14) In spite of stringent laws, why there is rampant

Tax Evasion in India ? In your opinion what can be

done to stop Tax Evasion by various tax payers in

India ?

15) Compute Sri Jaga’s Income from House

Property-

Information- He had three houses, one was self

occupied, 2nd one was not let out and the 3rd one

was let out. Rental income for the 3rd house per

month was Rs.10,000/=. Fair rent in the locality

for 2nd house and 3rd house was Rs.1,50,000/=

and Rs.1,44,000/= respectively p.a. When Sri

Jaga had paid Municipality tax for the self

occupied house to the tune of Rs.10,000/= and

for 2nd house Rs.12,000/= p.a, he couldn’t pay

municipality tax for the third house which was

Rs.18,000/=. For constructing the 3rd house Jaga

had taken a loan from his friend, to whom he

was repaying Rs.2,50,000/= towards principal

and Rs.2,00,000/= as interest every year.

(Answer- 1st House-Self Occupied- NIL

2nd House- Deemed to be let out- Rs.96,600/=

3rd House-Let out-Loss Rs.99,200/=. Loss from

House Property- Rs.2,600/=)

16) What are the Central & State Taxes that have

been subsumed in GST and as on date which taxes

are not subsumed within GST ambit ?

17) Compute the taxable income from business or

profession of Mr X, the proprietor for the Financial

year 2018-19.

a) Gross revenue from trading business-Rs.85,00,000/=

b) Gross revenue from gambling business – Rs.2,00,000/=

c) Gross revenue from his audit firm- Rs.12,00,000/=

d) Mr X incurred following expenses during the Financial

year for his business & profession.

i. Rent for his office- Rs.1,20,000/=

ii. Rent for his house-Rs.1,80,000/=

iii. Remuneration to employees-Rs.8,00,000/=

iv. Various expenses for conducting gambling-

Rs.4,00,000/=

v. Purchased one air conditioner for office –

Rs.50,000/=

vi. There was a cash shortage of Rs.25,000/=

during the year

vii. Fines & Penalty imposed by Govt. for

violating certain provisions-Rs.30,000/=

viii. Foreign travel for official purpose-

Rs.3,00,000/=

ix. Marriage expenses of his daughter-

Rs.1,50,000/=

(Ans- Income from business or profession- Rs.86,55,000/=)

C- 5 marks question type –

1)What is a Prospectus and how many types of

Prospectus are there ?

2)What is a “minutes of meeting” ?

3) What are the businesses that are generally

conducted in an Annual General Meeting ?

4) What do you mean by Corporate Social

Responsibilities ?

5) What is “Tax Input Credit” under GST regime and

what are the conditions to avail it ?

6) What are the methods of Corporate tax planning ?

7) Compute the Output Tax under GST for B, who

purchased material from A and sold to various end

consumers. It can be presumed that both A & B

have fulfilled all the conditions to avail Input Tax

Credit and Selling price includes all costs & their

profit.

As per Invoice A (Trader) B (Trader)

Selling Price of Rs.1,000/= Rs.1,500/=

the Item

GST 12% Rs.120/= Rs.180/=

Invoice Value Rs.1,120/= Rs.1,680/=

(Answer – Output Tax of B is Rs.60/=)

8)How much TDS you will deduct in following

cases, presuming the receivers of payment has

provided his PAN.

i) You have to pay Rs.1,00,000/= to Mr X

towards winning from Horse Race.

ii) Bonus & commission payable to agents or

sellers of lottery tickets to the tune of Rs.5,00,000/=

iii) Payment of Rs.1,25,000/= to a contractor

who is an individual.

iv) Payment of Rs.2,00,000/= to your auditor

v) Rent payment of Rs.1,00,000/= during the

year.

9)Under what circumstances, Tax need not be deducted

at source ?

10) What is a “Loss Return” and what are the

consequences if Income Tax return is not filled in case

of “Loss” ?

11)What are the advantages of GST and as on date how

many tax rates are applicable under GST?

12) What is “CIN” in case of companies ? What the

number signifies ?

13) What is Reverse Charge Mechanism (RCM) in GST

? Explain with some examples.

14) Who need to be registered under GST ?

15) How having a subsidiary company helps in tax

planning ?

16) How amalgamation and merges of companies helps

in tax planning ?

17) How MOA & AOA can be altered ?

18) What are the requisites of a “valid meeting” ?

19) What are the differences between Tax Planning &

Tax Management ?

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Venture Capital Firms MCQDocument8 pagesVenture Capital Firms MCQShuvro Rahman75% (12)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Equity Bank StatementDocument2 pagesEquity Bank StatementJayke80% (10)

- Íq2F %$Q%# W (Ywhî Ìç ! Î: Total Due R 857.57Document4 pagesÍq2F %$Q%# W (Ywhî Ìç ! Î: Total Due R 857.57Mindrys100% (2)

- Anderson Tax SaleDocument1 pageAnderson Tax SaleSarah Nelson0% (3)

- (Digest) Chavez v. OngpinDocument1 page(Digest) Chavez v. OngpinHomer SimpsonNo ratings yet

- Detail Study of HDFC Mutual FundDocument77 pagesDetail Study of HDFC Mutual FundNabeel Mohammed89% (28)

- CIR Vs Soriano TAX DigestDocument3 pagesCIR Vs Soriano TAX DigestGeorge PandaNo ratings yet

- Travel Claim - Appendix A, B Etc - DotolloDocument6 pagesTravel Claim - Appendix A, B Etc - DotolloHanzelkris CubianNo ratings yet

- FLIGHT Billing 2Document2 pagesFLIGHT Billing 2Baby AnnNo ratings yet

- Technical AnalysisDocument43 pagesTechnical AnalysisSuvasmita BiswalNo ratings yet

- Venture Capital Firms MCQDocument8 pagesVenture Capital Firms MCQSuvasmita BiswalNo ratings yet

- Chapter 01 - Introductory To Mergers and AcquisitionsDocument10 pagesChapter 01 - Introductory To Mergers and AcquisitionsSom DasNo ratings yet

- Merrl: Factories Act 1948Document65 pagesMerrl: Factories Act 1948Suvasmita BiswalNo ratings yet

- Training: Training Is Teaching, or Developing in Oneself or Others, Any Skills and Knowledge or Fitness That Relate ToDocument80 pagesTraining: Training Is Teaching, or Developing in Oneself or Others, Any Skills and Knowledge or Fitness That Relate ToSuvasmita BiswalNo ratings yet

- What Is An HRIS?Document57 pagesWhat Is An HRIS?Suvasmita BiswalNo ratings yet

- MBFSDocument62 pagesMBFSSuvasmita BiswalNo ratings yet

- 15 - Chapter 6 PDFDocument33 pages15 - Chapter 6 PDFTejasNo ratings yet

- Performance Analysis of Reliance Mutual FundDocument89 pagesPerformance Analysis of Reliance Mutual FundSuvasmita BiswalNo ratings yet

- Self Declaration For Tuition FeesDocument1 pageSelf Declaration For Tuition FeesSudha SNo ratings yet

- Biotechusa KFT Beu21159378Document1 pageBiotechusa KFT Beu21159378Paško RunjićNo ratings yet

- Advanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsDocument12 pagesAdvanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsKiyong TanNo ratings yet

- Business Mathematics Worksheet Week 4Document6 pagesBusiness Mathematics Worksheet Week 4300980 Pitombayog NHSNo ratings yet

- General Ledger (Summary) 8/1/1974 To 9/30/1974Document1 pageGeneral Ledger (Summary) 8/1/1974 To 9/30/1974Andre TuukNo ratings yet

- Confirmation1Document2 pagesConfirmation1Ignas Getsema Agasi SuryaNo ratings yet

- Auxilo EIL Schedule of ChargesDocument2 pagesAuxilo EIL Schedule of ChargesArun KumarNo ratings yet

- Goods and Service Tax (GST) and Its Impact: Jaspreet KaurDocument3 pagesGoods and Service Tax (GST) and Its Impact: Jaspreet KaurSreekutty KNo ratings yet

- Australian Company Number (Acn) Australian Registered Body Number (Arbn)Document8 pagesAustralian Company Number (Acn) Australian Registered Body Number (Arbn)liamNo ratings yet

- CFR Tax Booklet - Eng 2022Document48 pagesCFR Tax Booklet - Eng 2022Justin CamilleriNo ratings yet

- Forest Flooring SDN BHD: ReceiptDocument2 pagesForest Flooring SDN BHD: ReceiptRobin JonesNo ratings yet

- Invoices of GTG ClientsDocument18 pagesInvoices of GTG ClientsJasanmeet SinghNo ratings yet

- North South University: ID# 181 1530 030 DegreeDocument1 pageNorth South University: ID# 181 1530 030 DegreeRashaduzzaman RiadNo ratings yet

- Mgxls MYOB Chart of AccountsDocument1 pageMgxls MYOB Chart of AccountsFloe RgerNo ratings yet

- IncomeTax MaterialDocument91 pagesIncomeTax MaterialSandeep JaiswalNo ratings yet

- Booking: VoucherDocument1 pageBooking: Vouchermichelle obrianNo ratings yet

- Withholding Tax (Eng)Document10 pagesWithholding Tax (Eng)WN TV programsNo ratings yet

- SRReport 1500301211137 PDFDocument2 pagesSRReport 1500301211137 PDFShahid Ali LodhiNo ratings yet

- TAX-5.0 - Individual Income TaxDocument65 pagesTAX-5.0 - Individual Income TaxCharmaine RosalesNo ratings yet

- Accounting - UCO Bank - Assignment4Document1 pageAccounting - UCO Bank - Assignment4KummNo ratings yet

- Corporate Tax Planning: Tax Evasion and AvoidanceDocument8 pagesCorporate Tax Planning: Tax Evasion and AvoidanceShainaNo ratings yet

- CIR Vs Fortune TobaccoDocument6 pagesCIR Vs Fortune TobaccoJohnde MartinezNo ratings yet

- Invoice No. 7372858 Bill ToDocument2 pagesInvoice No. 7372858 Bill Tothuyen anhNo ratings yet