Professional Documents

Culture Documents

B95) of Insurance Contract

Uploaded by

karina gayosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B95) of Insurance Contract

Uploaded by

karina gayosCopyright:

Available Formats

Gayos, Karina K.

A4A-ACCSPIN

-SCOPE OF IFRS 17-

The video discussed the scope of IFRS 17, definition of an insurance contract, IFRS 17

current measurement model, exclusions, reinsurance contracts, measurement and changes to

the balance sheet and performance.

The scope of IFRS 17 is (a) insurance contracts, including reinsurance contracts, it

issues; (b) reinsurance contracts it holds; and (c) investment contracts with discretionary

participation features it issues, provided the entity also issues insurance contracts.

However, IFRS 17 shall not apply to: (a) warranties provided by a manufacturer, dealer

or retailer in connection with the sale of its goods or services to a customer (b) employers’

assets and liabilities from employee benefit plans and retirement benefit obligations reported by

defined benefit retirement plans (c) contractual rights or contractual obligations contingent on

the futures of, or the right to use, a non-financial item (d) residual value guarantees provided by

a manufacturer, dealer or retailer and a lessee’s residual value guarantees when they are

embedded in lease (e) financial guarantee contracts, unless the issuer has previously asserted

explicitly that it regards such contracts as insurance contracts and has used accounting

applicable to insurance contracts (f) contingent consideration payable or receivable in a

business combination and (g) insurance contracts in which the entity is the policyholder, unless

those contracts are reinsurance contracts held (see paragraph 3(b).

Appendix A of IFRS 17 defines insurance contract as a contract under which one party

(the issuer) accepts significant insurance risk from another party (the policyholder) by

agreeing to compensate the policyholder if a specified uncertain future event (the insured

event) adversely affects the policyholder.

Appendix A of IFRS 17 defines reinsurance contract as an insurance contract issued by

one entity (the reinsurer) to compensate another entity for claims arising from one or more

insurance contracts issued by that other entity (underlying contracts).

The measurement for initial recognition (paragraphsB36–B95) of insurance contract

liabilities was also elaborated in the video. Moreover, the components of the liability were

introduced such as the future cash flows (FCF), risk adjustment, and contractual service margin

(CSM). That on initial recognition, the entity shall measure the insurance liabilities on the total of

FCF and CSM.

The subsequent measurement shall be the sum of the liability for remaining coverage

and the liability for incurred claims. Liability for remaining coverage shall comprise of the

fulfillment cash flows related to future service allocated and the contractual service margin of the

group at that date. Moreover, the liability for incurred claims shall comprise of fulfillment cash

flows related to past service allocated to the group at that date.

An entity shall present separately in the statement of financial position the carrying

amount of group of: insurance and reinsurance contracts that are assets, and insurance and

reinsurance contracts issued that are liabilities.

Recognition and presentation in the statement(s) of financial performance (paragraphs

B120–B136) says that the entity is not required to disaggregate the change in the risk

adjustment for non-financial risk between the insurance service result and insurance finance

income or expense. However, is he does not, it shall include the entire change in the risk

adjustment for non-financial risk as part of the insurance service result.

You might also like

- IFRS 17 OverviewDocument14 pagesIFRS 17 OverviewDM BuenconsejoNo ratings yet

- IFRS 17 Reinsurance GuideDocument15 pagesIFRS 17 Reinsurance GuideDiane LorenzoNo ratings yet

- IFRS 17 - Insurance Contacts Technical Summary of IFRS 17: ObjectiveDocument8 pagesIFRS 17 - Insurance Contacts Technical Summary of IFRS 17: ObjectiveAhmadi SemahNo ratings yet

- IFRS17 Replaces IFRS4Document10 pagesIFRS17 Replaces IFRS4Micaella DanoNo ratings yet

- PFRS 17 Insurance ContractsDocument13 pagesPFRS 17 Insurance ContractsAlex OngNo ratings yet

- Ifrs 4 - Insurance Contract: Presented by - Harshal Thombare 27Document10 pagesIfrs 4 - Insurance Contract: Presented by - Harshal Thombare 27hthombare25No ratings yet

- PFRS 17 - Insurance ContractsDocument28 pagesPFRS 17 - Insurance ContractsHannah TaduranNo ratings yet

- Summary of Ifrs 17Document7 pagesSummary of Ifrs 17Abegail Kaye BiadoNo ratings yet

- Ifrs4 PDFDocument18 pagesIfrs4 PDFLorraine TomasNo ratings yet

- SummaryDocument3 pagesSummaryMaitet CarandangNo ratings yet

- Insurance Contracts - 104: Ms Pooja D, Mcom NET Assistant Professor - Brindavan CollegeDocument13 pagesInsurance Contracts - 104: Ms Pooja D, Mcom NET Assistant Professor - Brindavan CollegePooja D AcharyaNo ratings yet

- PFRS 17 Insurance Contracts SummaryDocument2 pagesPFRS 17 Insurance Contracts SummaryAnnie JuliaNo ratings yet

- Insurance Contracts: Indian Accounting Standard (Ind AS) 104Document33 pagesInsurance Contracts: Indian Accounting Standard (Ind AS) 104Bhargav BhatNo ratings yet

- Insurance Contracts (IFRS 17Document6 pagesInsurance Contracts (IFRS 17Dere Guranda100% (1)

- Pfrs 17 Insurance ContractsDocument3 pagesPfrs 17 Insurance ContractsR.A.No ratings yet

- IFRS 17 Insurance Contracts - SummaryDocument8 pagesIFRS 17 Insurance Contracts - SummaryEltonNo ratings yet

- Ifrs 17 Project SummaryDocument16 pagesIfrs 17 Project Summarymarhadi100% (1)

- Summary of Ifrs 4Document3 pagesSummary of Ifrs 4Woodliness McMahon100% (2)

- 4IndAS104 2016Document30 pages4IndAS104 2016rshetty066No ratings yet

- IFRS 17 Multiple Choice QuestionsDocument5 pagesIFRS 17 Multiple Choice QuestionsRalph Adian TolentinoNo ratings yet

- Enmienda IFRS 17 IFRS2020 PDFDocument140 pagesEnmienda IFRS 17 IFRS2020 PDFOmarNo ratings yet

- New or Revised Financial Reporting Standards Part 2.: Intended Learning Outcomes (Ilos)Document6 pagesNew or Revised Financial Reporting Standards Part 2.: Intended Learning Outcomes (Ilos)Mon RamNo ratings yet

- IFRS 4 Insurance ContractsDocument27 pagesIFRS 4 Insurance ContractsAdam CuencaNo ratings yet

- Insurance Contracts: International Financial Reporting Standard 4Document18 pagesInsurance Contracts: International Financial Reporting Standard 4xxx101xxxNo ratings yet

- 4 Ind AS 104 Insurance ContractsDocument35 pages4 Ind AS 104 Insurance ContractsravikanthcaNo ratings yet

- In The Spotlight: IFRS 17 Affects More Than Just Insurance CompaniesDocument14 pagesIn The Spotlight: IFRS 17 Affects More Than Just Insurance Companiesgir botNo ratings yet

- Ind AS 104 Insurance ContractsDocument33 pagesInd AS 104 Insurance Contractsshalu salamNo ratings yet

- Ap06 Recovery of Insurance Acquisition Cash FlowsDocument33 pagesAp06 Recovery of Insurance Acquisition Cash FlowsStella M Yoan NaryndraNo ratings yet

- Exposure Draft Amendments To Ind AS 117 Insurance Contracts: Last Date For The Comments: January 24, 2021Document51 pagesExposure Draft Amendments To Ind AS 117 Insurance Contracts: Last Date For The Comments: January 24, 2021Wubneh AlemuNo ratings yet

- Ifrs 4Document2 pagesIfrs 4Foititika.netNo ratings yet

- AFAR-21 (Insurance Contracts - Service Concession Arrangements)Document8 pagesAFAR-21 (Insurance Contracts - Service Concession Arrangements)Flores Renato Jr. S.No ratings yet

- PFRS 17 Insurance ContractsDocument23 pagesPFRS 17 Insurance ContractsCharles MateoNo ratings yet

- Pugosa Final 581-600 Audtg. 1 Adv Part 2 BookDocument20 pagesPugosa Final 581-600 Audtg. 1 Adv Part 2 BookPorferia PugosaNo ratings yet

- IFRS 17 Insurance Contracts OverviewDocument7 pagesIFRS 17 Insurance Contracts OverviewIrishLove Alonzo BalladaresNo ratings yet

- Accounting For Insurance Contracts (CH-4)Document38 pagesAccounting For Insurance Contracts (CH-4)yesuqal tesfayeNo ratings yet

- Chapter 22Document51 pagesChapter 22Sia DLSLNo ratings yet

- Modification and De-Recognition ModificationDocument8 pagesModification and De-Recognition Modificationdwi davisNo ratings yet

- Coverage Period and CSM Release For Deferred AnnuitiesDocument5 pagesCoverage Period and CSM Release For Deferred AnnuitiesWubneh AlemuNo ratings yet

- Ifrs 4 - 2005Document89 pagesIfrs 4 - 2005jon_cpaNo ratings yet

- Ifrs at A GlanceDocument8 pagesIfrs at A GlanceRafael Renz DayaoNo ratings yet

- HKFRS 17 - 2023Document309 pagesHKFRS 17 - 2023sashahe95No ratings yet

- Chapter Four: Insurance ContractsDocument14 pagesChapter Four: Insurance ContractstalilaNo ratings yet

- Insurance ContractsDocument2 pagesInsurance ContractsRomel Kiwang0% (1)

- Schedule Q - Standard Contracts Rev 070815 PL Required PDFDocument4 pagesSchedule Q - Standard Contracts Rev 070815 PL Required PDFRecordTrac - City of OaklandNo ratings yet

- Afar.3416 Insurance ContractsDocument3 pagesAfar.3416 Insurance ContractsBennett GiftNo ratings yet

- Knowledge Base Care Ifrs 17 (LRC)Document33 pagesKnowledge Base Care Ifrs 17 (LRC)grace sijabatNo ratings yet

- Ifrs 1 7 & IF RIC 12: Insur Ance Cont Ract S& Servi Ce Co Ncess ION Arra Ngem EntsDocument78 pagesIfrs 1 7 & IF RIC 12: Insur Ance Cont Ract S& Servi Ce Co Ncess ION Arra Ngem EntsGeneva OnsatNo ratings yet

- Contractual Liability Insurance and Your VendorsDocument2 pagesContractual Liability Insurance and Your VendorsAmir KhosravaniNo ratings yet

- SSAP 62 - ReinsuranceDocument33 pagesSSAP 62 - ReinsurancepedroemedinaNo ratings yet

- InsuranceDocument6 pagesInsuranceElla MyrrNo ratings yet

- Module 11 - PFRS 17 Insurance ContractsDocument8 pagesModule 11 - PFRS 17 Insurance ContractsAKIO HIROKINo ratings yet

- Prac 1 Insurance ContractsDocument5 pagesPrac 1 Insurance ContractsKc SevillaNo ratings yet

- Advanced Financial ch2Document10 pagesAdvanced Financial ch2bikilahussenNo ratings yet

- As 29Document13 pagesAs 29Mansi NigadeNo ratings yet

- PFRS 17Document19 pagesPFRS 17Princess Jullyn ClaudioNo ratings yet

- Us 2018 20 Long Duration Contracts Asu 2018 12 PDFDocument110 pagesUs 2018 20 Long Duration Contracts Asu 2018 12 PDFfsdNo ratings yet

- Us 2018 20 Long Duration Contracts Asu 2018 12Document110 pagesUs 2018 20 Long Duration Contracts Asu 2018 12fsdNo ratings yet

- Grace-AST Module 9Document2 pagesGrace-AST Module 9Devine Grace A. MaghinayNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Proposal DefenseDocument16 pagesProposal Defensekarina gayosNo ratings yet

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- I. Time Value of MoneyDocument9 pagesI. Time Value of Moneykarina gayosNo ratings yet

- ASS1Document2 pagesASS1karina gayosNo ratings yet

- Activity 1 - Galvanic CellsDocument13 pagesActivity 1 - Galvanic Cellskarina gayosNo ratings yet

- Process Selection Written ReportDocument11 pagesProcess Selection Written Reportkarina gayosNo ratings yet

- CoWorld Essay On GlobalizationDocument1 pageCoWorld Essay On Globalizationkarina gayosNo ratings yet

- ASS2Document1 pageASS2karina gayosNo ratings yet

- ASS1Document2 pagesASS1karina gayosNo ratings yet

- CPA MOCK BOARD EXAM - PRACTICAL ACCOUNTING TWODocument18 pagesCPA MOCK BOARD EXAM - PRACTICAL ACCOUNTING TWOkarina gayosNo ratings yet

- Title of The Proposed StudyDocument1 pageTitle of The Proposed Studykarina gayosNo ratings yet

- Title of The Proposed StudyDocument1 pageTitle of The Proposed Studykarina gayosNo ratings yet

- ForecastDocument1 pageForecastkarina gayosNo ratings yet

- Quiz in Finman2Document3 pagesQuiz in Finman2karina gayosNo ratings yet

- Seatwork - GenbiolDocument4 pagesSeatwork - Genbiolkarina gayosNo ratings yet

- How To Invest The Beginners Guide v2Document30 pagesHow To Invest The Beginners Guide v2Edwin NtjanaNo ratings yet

- Kings College Jan2020Document75 pagesKings College Jan2020qwsx098No ratings yet

- 15923389512005ftYV5b44KcpSWjG PDFDocument2 pages15923389512005ftYV5b44KcpSWjG PDFAkshayJhaNo ratings yet

- IAS 30 Disclosures in The Financial Statements of Banks and Similar Financial InstitutionsDocument8 pagesIAS 30 Disclosures in The Financial Statements of Banks and Similar Financial InstitutionsZienab Mosabbeh100% (1)

- Review Session 3 Conceptual FrameworkDocument16 pagesReview Session 3 Conceptual Frameworkalyanna alanoNo ratings yet

- Assignment 1 WorksheetDocument1 pageAssignment 1 Worksheetgolemwitch01No ratings yet

- Estimation of Project Cash Flows: RequiredDocument4 pagesEstimation of Project Cash Flows: Requiredjjayakumar_vjNo ratings yet

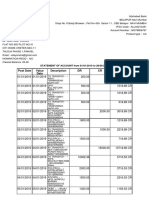

- Statements 2862Document4 pagesStatements 2862Jeffery Haack75% (4)

- Financial Statement AnalysisDocument32 pagesFinancial Statement AnalysisNaimish BodarNo ratings yet

- Cy BANKDocument3 pagesCy BANKapi-3720975No ratings yet

- Ir & PD Course Registration Form 2018 0% SST PDFDocument1 pageIr & PD Course Registration Form 2018 0% SST PDFPais SaedinNo ratings yet

- Reserve Bank of Fiji exchange control loan repayment applicationDocument3 pagesReserve Bank of Fiji exchange control loan repayment applicationroybendengNo ratings yet

- Effect of Non-Payment and Partial Payment of Insurance PremiumsDocument1 pageEffect of Non-Payment and Partial Payment of Insurance PremiumsAthena SantosNo ratings yet

- TransNum Jun 28 100629Document24 pagesTransNum Jun 28 100629Udayraj VarmaNo ratings yet

- Depository System in India Needs and ProgressDocument17 pagesDepository System in India Needs and ProgressGaurav PandeyNo ratings yet

- Brokerage Structure - ABSL Multi Asset Allocation Fund NFODocument1 pageBrokerage Structure - ABSL Multi Asset Allocation Fund NFOSanjay GuptaNo ratings yet

- Morgan Stanley CEO On Asian Market DifferentiationDocument2 pagesMorgan Stanley CEO On Asian Market DifferentiationWorldwide finance newsNo ratings yet

- Business Report - 2 (GODIGIT Bank)Document10 pagesBusiness Report - 2 (GODIGIT Bank)Rahul100% (1)

- Accounting MergedDocument63 pagesAccounting MergedAnnika TrishaNo ratings yet

- 431 FinalDocument6 pages431 FinalfNo ratings yet

- Managerical Economics Web VersionDocument229 pagesManagerical Economics Web VersionBHUVANA SUNDARNo ratings yet

- Accounting and The Financial Management Process: © 2013 Delmar/Cengage Learning. All Rights ReservedDocument13 pagesAccounting and The Financial Management Process: © 2013 Delmar/Cengage Learning. All Rights Reservedpooja natarajanNo ratings yet

- FIN 308-Chapter 3 (With Notes)Document59 pagesFIN 308-Chapter 3 (With Notes)rNo ratings yet

- Table Key: How To Use This Document?Document28 pagesTable Key: How To Use This Document?subsmagicNo ratings yet

- Prelim Exam Personal FinanceDocument3 pagesPrelim Exam Personal FinanceMarjonNo ratings yet

- HCG Manavata Oncology LLPDocument19 pagesHCG Manavata Oncology LLPBhushan ToraskarNo ratings yet

- Bida-Tech Company Chart of Accounts Account Naccount NameDocument66 pagesBida-Tech Company Chart of Accounts Account Naccount NameTrisha Mae Mendoza MacalinoNo ratings yet

- Statement-2020-08-11 4Document1 pageStatement-2020-08-11 4BrendaNo ratings yet

- Assignment 9Document17 pagesAssignment 9Beenish JafriNo ratings yet

- Liquidity and Profitability Financial Ratios ExplainedDocument7 pagesLiquidity and Profitability Financial Ratios Explainedy tNo ratings yet