Professional Documents

Culture Documents

Non Banking Finance

Uploaded by

Tanvir KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Non Banking Finance

Uploaded by

Tanvir KhanCopyright:

Available Formats

Non-Banking Finance Companies in India’s Financial Landscape article

Non-Banking Finance Companies find the non-banking entities convenient due to their

quicker decision-making ability, prompt provision of

in India’s Financial Landscape* services and expertise in niche segments. Apart from

widening the ambit of and access to financial services,

Non-Banking Finance Companies (NBFCs) have they also enhance the resilience of the financial

played an important role in the Indian financial system system by acting as backup institutions when banks

by complementing and competing with banks, and come under stress.

by bringing in efficiency and diversity into financial

Given the nature of their operations, NBFCs

intermediation. NBFCs have evolved considerably in

also carry inherent risks including, excess leverage,

terms of operations, heterogeneity, asset quality and

amplification of procyclicality and over-reliance on

profitability, and regulatory architecture. Going forward,

wholesale funding (Ghosh, et al, 2012). Given their

the growing systemic importance and interconnectedness

exposure to niche segments, they may also suffer from

of this sector calls for regulatory vigil.

concentration of risks. They are often not allowed the

Section 1: Introduction benefit from the central bank as lender of last resort

The world over, non-banking financial entities and from deposits insurance institutions.

complement the mainstream banking system in The shadow banking sector in India primarily

the process of financial intermediation. Regarded as includes NBFCs and collective investment vehicles

shadow banks by the Financial Stability Board (FSB) such as money market funds, fixed income funds,

–“entities and activities (fully or partially) outside the mixed funds, real estate funds, and securitisation-

regular banking system”1 (FSB, 2017), these specialised based credit intermediation like securitisation vehicles

intermediaries leverage on lower transaction costs, and structured finance vehicles. NBFCs are, however,

financial innovations and regulatory arbitrage. In distinctly different from shadow banking entities in

emerging economies, they often play an important role other countries. They are regulated by the Reserve

because of their ability to (a) reach out to inaccessible Bank of India (RBI) with priority being assigned to

areas; and (b) act as not just complements but also calibrating regulations to harmonise them with

substitutes to banks when the banks are confronted those of the banking sector regulations to minimise

with stricter regulatory constraints. Customers tend to the scope of regulatory arbitrage. NBFCs are gaining

increasing importance in the Indian financial system,

*

This article is prepared by Smt. K.M. Neelima and Shri Anand Kumar

under the guidance of Dr. Pallavi Chavan and Dr. Jai Chander in the Division

accounting for about 9 per cent of the total assets of

of Non-Bank Financial Studies of the Department of Economic and Policy the financial sector – the third largest segment after

Research, Reserve Bank of India. The valuable insights as well as data support

from the Department of Non-Banking Supervision are gratefully scheduled commercial banks or SCBs (64 per cent)

acknowledged. The views expressed in this article are those of the authors and insurance companies (14 per cent) (RBI, 2014).2

and do not represent the views of the Reserve Bank of India.

1

All financial institutions not classified as banks, insurance corporations,

Mapping of the degree of interconnectedness showed

pension funds, public financial institutions, central banks or financial that NBFCs had the third largest bilateral exposures

auxiliaries; and as a narrow measure, finance companies, leasing companies,

factoring companies, money market mutual funds, fixed income funds, real after banks and mutual funds. Also, they were the

estate funds and securitisation vehicles. Financial auxiliaries consist of biggest receivers of funds, on a net basis, surpassing

financial corporations that are principally engaged in activities associated

with transactions or with providing the regulatory context for these

2

transactions but in circumstances that do not involve the auxiliary taking The remaining segments are mutual funds with a share of about 6 per

ownership of the financial assets and liabilities being transacted (System cent, specialised financial institutions (3 per cent), urban cooperative banks

of National Accounts, 2008). and regional rural banks (4 per cent) (RBI, 2014).

RBI Bulletin October 2017 91

article Non-Banking Finance Companies in India’s Financial Landscape

banks, signifying their systemic importance. (ND-SI) segment. Section 6 presents the sectoral

In the context of the slowdown in bank credit in the distribution of credit from NBFCs and implications for

wake of asset quality stress in recent years, double-digit the process of financial inclusion. Section 7 presents

growth in credit by NBFCs has distinctly emphasised salient indicators of the financial health of NBFCs and

their role as credit provider in India’s financial system. wherever possible compares them with the banking

Against this backdrop, this article explores recent system.3 Section 8 provides concluding observations

developments in the operations of NBFCs in India and the way forward.

across time as well as in a cross-country perspective, Section 2: A Cross Country Perspective

based on data from the FSB database and supervisory

There has been a steady expansion in the size

returns filed by NBFCs with the Reserve Bank. The rest

of the global shadow banking sector in recent years

of the article is divided into seven sections. Section

from US$ 31 trillion in 2010 to US$ 34 trillion in 2015

2 provides a comparative perspective of the Indian

(FSB, 2017).The size of India’s shadow banking sector

non-banking financial sector relative to counterparts

stood at US$ 436 billion, accounting for 1.3 per cent

in other countries. Section 3 provides an overview of

of the total global shadow banking assets in 2015

the structure of the non-banking financial institutions

(Chart 1). Shadow banking assets were placed at about

(NBFIs) sector in India. Section 4 discusses salient

14 per cent of total domestic financial assets in 2015

regulatory developments in this sector in recent

(Chart 2).

years, particularly those aimed at addressing stability

and inclusion. Section 5 analyses key indicators of Global shadow banking assets were primarily

the NBFCs sector’s balance sheet, particularly of the concentrated in the advanced economies (AEs),

NBFC-Non-Deposit taking Systemically Important particularly the United States and the United Kingdom.

Chart 1: Share of shadow banking assets-global position, 2015

Note: 1. Shadow banking is based on the economic function-based measure of 28 jurisdictions, which together accounted for about 80 per cent of global GDP and 90 per

cent of global financial assets.

2. Data for China pertain to 2014.

Source: Computed from FSB, Global Shadow Banking Monitoring Report 2016.

3

The business models of banks and NBFCs are inherently different. Banks lend to multiple segments, while generally, NBFCs specialise in lending to a

specific segment.

92 RBI Bulletin October 2017

Non-Banking Finance Companies in India’s Financial Landscape article

Chart 2: Shadow banking as a per cent of total financial assets, 2015

Note: 1. Shadow banking is based on the economic function-based measure.

2. Data for China are not available for 2015.

Source: FSB, Global Shadow Banking Monitoring Report 2016.

AEs accounted for about three-fourth of the global these economies, less risky shadow banking activities

shadow banking assets. The higher share of AEs in such as those undertaken by investment funds have

shadow banking activities could partly be attributed expanded rapidly in recent years (Monaghan, 2014).

to tighter regulation of mainstream banks and low Despite being a small player in the global shadow

interest rates. Although securitisation declined in banking business, India has stood out among both

Chart 3: GDP growth versus shadow banking growth rates, 2011- 2015

Note: 1. Average annual growth rate during 2011-2015, adjusted for exchange rate effects.

2. Bubble size shows the growth of shadow banking.

3. Growth rates for China and Russia are for 2011-14.

Source: FSB, Global Shadow Banking Monitoring Report, various issues.

RBI Bulletin October 2017 93

article Non-Banking Finance Companies in India’s Financial Landscape

AEs and emerging market and developing economies for NBFCs-D was introduced in 1997 to protect the

(EMDEs) in terms of high growth, after China and interests of depositors. A conscious policy was

Russia which reported growth rates exceeding 10 per pursued to discourage acceptance of deposits by

cent in shadow banking assets between 2011 and 2015 NBFCs so that only banks accept public deposits.

(Chart 3). The surge in growth of shadow banking in Hence, no new license has been given to NBFCs-D

China was primarily demand-driven, emanating from after 1997. NBFCs-ND were sub-divided into two

developers, local governments and small and medium

categories in 2006 - Systemically Important Non-

enterprises (SMEs), as access to bank credit became

Deposit taking NBFCs (NBFCs-ND-SI) and other Non-

restricted (Bottelier, 2015).

Deposit taking NBFCs (NBFCs-ND) based on asset

Section 3: Structure of the NBFIs Sector in India size.6 NBFCs with an asset size greater than `1 billion

The Reserve Bank regulates and supervises three were considered as NBFC-ND-SI. The threshold for

categories of NBFIs, viz. All-India financial institutions recognition of NBFCs-ND-SI was increased to `5

(AIFIs), primary dealers (PDs) and NBFCs (Chart 4).4 billion in 2014. This classification was made in order

Based on deposit mobilisation, NBFCs are to ensure greater regulatory control over NBFCs-ND-

classified into two major categories: NBFCs-D SI, which were expected to pose greater systemic

(deposit taking) and NBFCs-ND (non-deposit taking).5 risks on account of their larger size. NBFCs-ND-SI,

In view of the phenomenal increase in their number as a result, were subjected to stricter prudential

and deposits, a comprehensive legislative framework regulations as compared to NBFCs-ND.7

Chart 4: Non-banking financial institutions regulated by RBI

Non-Banking Financial Institutions

Non-Banking Financial Companies All India Financial Institutions Primary Dealers

NBFCs-D NBFCs-ND

Systemically

Other

Important

NBFCs-ND

NBFCs –ND

(NBFCs-ND)

(NBFCs-ND-SI)

Source: https://www.rbi.org.in/Scripts/FAQView.aspx?Id=92.

4

There are some other NBFIs regulated by different regulators other than the Reserve Bank, which are not covered in this article.

5

Residuary non-banking finance companies (RNBCs) constitute another category of NBFCs. The two RNBCs have stopped accepting deposits and are

in the process of repaying old deposits. Hence, they have not been mentioned separately in this article.

6

Data on other NBFCs-ND are not readily available. Henceforth, analysis of financial performance is focussed on NBFC-D and NBFC-ND-SI categories.

7

Illustratively, NBFCs-ND-SI were required to maintain minimum capital to risk-weighted assets ratio (CRAR).

94 RBI Bulletin October 2017

Non-Banking Finance Companies in India’s Financial Landscape article

The number of NBFCs-ND-SI increased till 2014 Table 1: Number of different types of NBFCs in India:

due to increased licences given to these entities end-March position

following notification of newer categories. Thereafter, Year NBFC-D NBFC-ND-SI NBFC-ND Total

there was a decline in their number mainly reflecting 2012 273 375 12,010 12,385

the increase in threshold asset size for defining 2013 254 418 11,553 12,225

2014 241 465 11,323 12,029

NBFCs-ND-SI (Table 1). NBFCs-ND-SI have become 2015 220 420 11,202 11,842

2016 202 209 11,271 11,682

significantly larger than NBFCs-D – their share in total 2017 (P) 178 218 11,126 11,522

assets of the two categories taken together was about P: Provisional.

Sources: 1. Report of Trend and Progress of Banking in India, various

86 per cent in 2017 (Chart 5). issues.

2. Supervisory returns, RBI.

Based on activities undertaken, NBFCs are

classified into 12 major categories8 (Table 2). While in the NBFC sector. Infrastructure Finance Companies

loan companies and investment companies have (NBFC-IFC) were defined as a separate category in

traditionally been the two core categories of the 2010. NBFC-IDFs were set up in 2011 to increase long-

NBFC sector, newer categories have been added to term debt financing of infrastructure projects as well

this sector over time in recognition of the growing as to alleviate asset liability mismatches arising out

diversification of financial intermediation and the of financing such projects. They were envisaged to

need for better regulatory oversight. Illustratively, take over loans provided for infrastructure projects

in 2006, ‘hire purchase’ and ‘equipment leasing’ based on Public Private Partnership (PPP) route which

categories were merged and categorised as Asset had completed one year of commercial operation.9

Finance Companies (AFCs) – the third major category NBFCs-MFI were also set up in 2011 in order to serve

Chart 5: Distribution of assets across NBFCs-ND-SI and NBFCs-D: end-March position

P: Provisional.

Source: 1. Report of Trend and Progress of Banking in India, various issues.

2. Supervisory returns, RBI.

8

Asset Reconstruction Companies (ARCs), set up for resolving Non-Performing Assets (NPAs) of banks and financial institutions, are also given registration

by the Reserve Bank under the provisions of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002

(SARFAESI Act). Hence, their business model is inherently different from other NBFCs. They are, therefore, not captured in Table 2.

9

Subsequently, in 2015, they were also allowed to undertake investments in non-PPP projects.

RBI Bulletin October 2017 95

article Non-Banking Finance Companies in India’s Financial Landscape

Table 2: Classification of NBFCs based on activities undertaken

Types of NBFCs Activity

1. Asset Finance Company (AFC) Financing of physical assets supporting productive/economic activity, including

automobiles, tractors and generators.

2. Loan Company Providing finance by extending loans or otherwise for any activity other than its

own but does not include an AFC.

3. Investment Company Acquiring securities for the purposes of selling.

4. Infrastructure Finance Company (NBFC-IFC) Providing infrastructure loans.

5. Systemically Important Core Investment Company (CIC-ND-SI) Acquiring shares and securities for investment in mainly equity shares.

6. Infrastructure Debt Fund (NBFC-IDF) For facilitating flow of long-term debt into infrastructure projects.

7. Micro Finance Institution (NBFC-MFI) Extending credit to economically disadvantaged groups as well support Micro,

Small and Medium Enterprises (MSMEs).

8. Factor (NBFC-Factor) Undertaking the business of acquiring receivables of an assignor or extending

loans against the security interest of the receivables at a discount.

9. NBFC- Non-Operative Financial Holding Company (NOFHC) For permitting promoter / promoter groups to set up a new bank.

10. Mortgage Guarantee Company (MGC) Undertaking mortgage activities.

11. Account Aggregator (NBFC-AA) Collecting and providing the information of customers’ financial assets in a

consolidated, organised and retrievable manner to the customer or others as

specified by the customer.

12. Non-Banking Financial Company – Peer to Peer Lending Platform Providing an online platform to bring lenders and borrowers together to help

(NBFC-P2P) mobilise unsecured finance.

Source: https://www.rbi.org.in/Scripts/FAQView.aspx?Id=92.

the needs of the micro finance sector and the under-

Table 3: Shares of NBFCs classified by activities in

served segments more effectively. The focus of the total assets of the NBFC sector: end-March position

regulations was more on strengthening the lending (Per cent)

and recovery practices in the sector, especially with Category 2012 2013 2014 2015 2016 2017

regard to the pricing of credit and multiple lending 1. Loan companies 31.2 28.9 28.6 28.0 33.2 36.2

operations leading to over borrowing. NBFC-Factors 2. NBFCs-IFC 30.8 32.1 34.0 35.4 27.1 31.5

3. AFCs 12.6 14.2 14.3 13.9 13.2 13.7

were notified in accordance with the Factoring Act,

4. Investment companies 22.3 21.4 19.7 17.7 22.4 12.6

2011 as they were required to be registered with the 5. NBFCs-MFI 1.6 1.9 1.9 2.4 2.8 3.0

Reserve Bank as NBFCs to commence their operations. 6. CICs-ND-SI 1.0 1.2 1.2 2.2 0.9 2.2

7. NBFCs-Factor 0.5 0.3 0.3 0.2 0.2 0.1

Notwithstanding the addition of newer categories 8. IDF-NBFCs 0.0 0.0 0.0 0.1 0.3 0.6

over time, loan companies remain the single largest Total 100.0 100.0 100.0 100.0 100.0 100.0

category, with a share of 36.2 per cent in total assets of Note: 1. Data are provisional.

NBFCs at end-March 2017. NBFCs-IFC emerged as the 2. NOFHC, MGC and NBFC-AA data are not captured in the Table

as they have a miniscule share in the total assets of the NBFC

second-largest category following the growing thrust sector.

Source: Supervisory returns, RBI.

on infrastructure financing. AFCs occupied the third

position constituting 13.7 per cent of total assets of Section 4: Regulatory Environment for NBFCs

NBFCs followed by investment companies. NBFCs- NBFCs were brought under the regulation of the

MFI, although accounting for only about 3 per cent Reserve Bank in 1964 by inserting Chapter III B in

of the NBFC sector’s assets at end-March 2017, have the Reserve Bank of India Act, 1934. In more recent

shown a steady rise in its share since their inception years, regulatory measures have been motivated by

(Table 3).

96 RBI Bulletin October 2017

Non-Banking Finance Companies in India’s Financial Landscape article

the objectives of financial stability, financial inclusion Table 4: Key indicators of NBFCs

and harnessing of specialised domain expertise. (Amount in ` billion)

As alluded to in the preceding section, one of Item 2014 2015 2016 2017

the key regulatory initiatives by the Reserve Bank 1. Share Capital 737 851 761 921

2. Reserves & Surplus 2,723 3,117 3,033 3,538

to improve the role of NBFCs in financial inclusion 3. Public Deposits 131 205 271 306

was the creation of NBFCs-MFI in 2011, following 4. Borrowings 10,142 12,237 12,263 13,748

5. Others 766 875 904 1,159

the recommendations by the Sub-Committee of the

Total Liabilities/Assets 14,499 17,284 17,231 19,671

Central Board of the Reserve Bank (Chairman: Shri (12.9) (13.9) (12.6) (12.9)

Y. H. Malegam). In 2015, guidelines for this segment 1. Loans & Advances 10,782 12,875 13,169 14,846

were revised, including the enhancement of the 2. Investments 2,159 2,603 2,253 2,673

3. Cash & Bank Balances 548 668 585 778

annual income limit for availing microfinance loans, 4. Others 1,010 1,138 1,225 1,375

increasing the limit of total indebtedness of the Financial Ratios (per cent )

borrower and rationalisation of income generation 1. Income to total assets 11.8 11.6 12.4 11.7

criteria following the recommendations of the 2. Cost to income ratio 52.9 52.1 50.4 49.4

3. Gross NPA to total advances 3.9 4.1 4.5 5.0

Committee on Comprehensive Financial Services 4. Net NPA to total advances 2.5 2.5 2.5 2.3

for Small Businesses and Low Income Households 5. Return on equity 9.0 10.3 7.9 6.8

(Chairman: Shri Nachiket Mor). As regards financial Note: 1. Data are provisional.

2. Figures in parentheses are percentages to GDP.

stability related concerns, a revised regulatory Source: 1. Financial Stability Report, various issues.

2. Supervisory returns, RBI.

framework was introduced in 2014 to ensure that only 3. Handbook of Statistics on the Indian Economy, various

strong entities exist in the NBFC sector. Accordingly, issues.

the minimum amount of net owned funds (NOF) for Section 5: Key Indicators of the NBFCs Sector

NBFCs registered before April 21, 1999 was stepped

Reflecting their ability to evolve as well as

up to `20 million from `2.5 million and the capital

innovate, NBFCs have recorded robust growth in recent

adequacy framework was further strengthened.10

years. Moreover, their balance sheet performance has

Furthermore, only rated NBFCs-D were allowed to

been better than banks on various parameters (Table

accept public deposits for enhanced depositors’

4). Credit by NBFCs-ND-SI has risen strongly in recent

protection. In order to plug regulatory gaps to minimise

years with a growth of 13 per cent in 2016-17 (Table

regulatory arbitrage, the prudential norms for NBFCs,

5). This is in contrast to the slowdown in bank credit

including asset classification and provisioning norms,

were harmonised with those for banks in a phased

Table 5: Credit growth of NBFCs and banks

manner. In September 2016, the Reserve Bank allowed (per cent)

the establishment of a new category of NBFCs NBFC- Year NBFCs-ND-SI Banks Private Sector Public Sector

Account Aggregator (AA) to provide a consolidated Banks Banks

view of individual investors’ financial asset holdings 2011-12 30.5 16.8 21.8 16.4

2012-13 23.7 14.0 18.5 12.0

on a single platform, even for entities falling under 2013-14 8.8 14.2 16.1 13.9

2014-15 15.0 9.3 18.6 7.8

the purview of different financial sector regulators. 2015-16 12.4 10.9 25.7 1.4

2016-17 (P) 13.0 5.4 17.1 0.6

Recently, the Reserve Bank issued guidelines for

regulating the NBFCs undertaking peer-to-peer (P2P) P: Provisional.

Source: 1. Report on Trend and Progress of Banking in India, Various

lending activities. Issues.

2. Handbook of Statistics on the Indian Economy, RBI.

10

All NBFCs-ND-SI and NBFCs-D were mandated to increase their Tier 1 3. Quarterly Statistics on Deposits and Credit of Scheduled

capital in a phased manner to 10 per cent by March 2017. Commercial Banks, RBI.

RBI Bulletin October 2017 97

article Non-Banking Finance Companies in India’s Financial Landscape

Chart 6: NBFCs-ND-SI credit as a per cent of GDP: end-March position

Note : 1. GDP data are based on 2011-12 base year.

2. NBFCs data for 2016 and 2017 are provisional.

Source : 1. Report on Trend and Progress of Banking in India, various issues.

2. Handbook of Statistics on the Indian Economy, various issues.

growth, especially in respect of public sector banks. a dip in 2015-16 due to a pick-up in bank credit as

As a result, the credit intensity, i.e., credit as per cent well as the conversion of Bandhan Financial Services

of GDP, of NBFCs-ND-SI has shown a steady increase,

and Infrastructure Development Finance Corporation

reaching 8 per cent in 2017 (Chart 6).

(IDFC), two major players in the NBFC sector, into

NBFCs-ND-SI credit has maintained a steady universal banks (Chart 7).11 Their share went up

share in total credit to the commercial sector barring sharply in 2016-17 reflecting growing intermediation.

Chart 7: Share of NBFCs-ND-SI in flow of resources to the commercial sector: end-March position

Source : RBI Annual Report,various issues.

11

The various bank and non-bank sources included: private placements by non-financial entities, housing finance companies and commercial papers

subscribed to by non-banks.

98 RBI Bulletin October 2017

Non-Banking Finance Companies in India’s Financial Landscape article

Among NBFCs-ND-SI, credit extension is the

Table 6: Growth rate of credit of major categories

main business for loan companies, NBFCs-IFC, NBFCs- of NBFCs

MFI, and AFCs. While all these categories of NBFCs Category 2012-13 2013-14 2014-15 2015-16 2016-17

posted double-digit growth till 2015-16, they showed Loan Companies 11.3 7.7 20.5 22.7 22.1

divergent patterns in 2016-17. Loan companies NBFCs-IFC 24.4 17.8 24.6 7.6 5.6

and NBFCs-IFC maintained positive credit growth, NBFCs-MFI 34.3 21.3 47.6 36.3 -3.4

whereas NBFCs-MFI and AFCs shrank their asset AFCs 30.0 10.4 13.2 23.1 -17.1

portfolios mainly due to conversion of large NBFCs- Note: Data are provisional.

Source: Supervisory returns, RBI.

MFI into small finance banks during the year (Table 6).

AFCs, which mainly lend to finance vehicles and retail

loans, were affected by the postponement of purchase at `306 billion at end-March 2017, though less than

decisions by their customers due to uncertainty in the one per cent of bank deposits.

wake of demonetisation (RBI, 2017).

Borrowings constitute about 71 per cent of total

Protection of depositors’ interests has been a liabilities of NBFCs-ND-SI. While banks have been

dominant objective of the Reserve Bank and, therefore, the main source of borrowings for NBFCs-ND-SI, they

there has been a conscious move to contain deposit have been increasingly replaced with market-based

mobilisation by NBFCs-D. Nevertheless, amount of instruments in recent years. In 2016-17, NBFCs-

public deposits mobilised by NBFCs-D has grown over ND-SI largely borrowed through debentures, which

time (Chart 8). As a share of total liabilities of NBFCs constituted nearly half of their total borrowings.

sector, it increased from 0.5 per cent in 2012 to 1.6 Borrowing through commercial paper too has

per cent by end-March 2017. In absolute terms, the increased over time, reflecting lower cost of raising

total deposit mobilisation by these institutions stood funds through these instruments (Chart 9).

Chart 8: Public deposits of NBFCs-D - amount and share in total liabilities: end-March position

P: Provisional.

Source: 1. Report on Trend and Progress of Banking in India 2012-13, RBI.

2. Statistical Tables Related to Banks in India, various issues, RBI.

3. Supervisory returns, RBI.

RBI Bulletin October 2017 99

article Non-Banking Finance Companies in India’s Financial Landscape

Chart 9: Borrowings of NBFCs-ND-SI: share and growth

P: Provisional.

Source: 1. Report on Trend and Progress of Banking in India, various issues.

2. Supervisory returns, RBI.

Section 6: Sectoral Distribution of NBFCs Credit credit by these companies, the share of retail credit

NBFCs-ND-SI have traditionally funded both has increased from 3.4 per cent in 2014-15 to 15.6

the industrial sector and the retail segment. While per cent in 2015-16 and 17.7 per cent in 2016-17

industry has received about two-thirds of the total (Chart 10).12

Chart 10: Sectoral distribution of credit of NBFCs-ND-SI: end-March position

Note: 1. Data are provisional.

2. Retail loans include retail housing, consumer durables and microfinance till 2015. They included housing loans, consumer durables,vehicle/auto loans, credit card

receivables, education loans, advances against fixed deposits, advances against shares/bonds etc. from 2016 onwards.

Source: Supervisory returns, RBI.

12

It may be mentioned that there was a significant change in December 2015 in the sectoral classification prescribed in the returns filed by NBFCs-ND-SI.

Thus, the data on sectoral credit before and after 2016 are not strictly comparable. The change in classification mainly pertained to retail loans, which

included only retail housing, consumer durables and microfinance till 2015. From 2016 onwards, retail loans include many new categories, such as vehicle/

auto loans, credit card receivables, education loans, advances against fixed deposits and advances against shares/bonds. The jump in the share of retail

loans with a corresponding fall in the share of ‘others’ – a miscellaneous category, needs to be seen in light of the change in the sectoral classification.

100 RBI Bulletin October 2017

Non-Banking Finance Companies in India’s Financial Landscape article

Several NBFCs-ND-SI specialise in financing niche

Chart 11: Share of MSEs in total credit:

segments, including the micro and small enterprises end-March position

(MSE), which particularly figure prominently in the

loan portfolios of NBFCs-MFI and loan companies.

Over recent years, there has been a steady growth in

the credit to MSE sector from these two categories

(Chart 11). This was mainly on account of the revision

in December 2015 in the returns filed by NBFCs, as

mentioned earlier.

NBFCs-IFC and NBFC-IDFs are the two major

categories within NBFCs-ND-SI which specialise

in infrastructure financing. In line with bank

credit, infrastructure credit growth of NBFCs-IFC

and NBFC-IDFs has decelerated in recent years Notes: 1.Data are provisional.

2. Data relate to NBFCs-MFI and loan companies only.

(Chart 12), attributed to industrial slowdown, Source: Supervisory returns, RBI.

particularly in the power sector as well as the conversion

of IDFC into a universal bank.13 Nevertheless, growth Section 7: Key Soundness Indicators of NBFCs

in infrastructure credit by NBFCs-IFC and NBFCs-IDF There has been a steady deterioration in asset

was higher than by banks, which, in fact, reported quality of NBFCs in recent years. Gross non-performing

credit contraction in 2016-17.14 assets (GNPA) ratio for NBFCs increased to 5.0 per

Chart 12: Growth of infrastructure finance: NBFCs-ND-SI and SCBs

Note: Data relate to NBFC-IFCs and NBFC-IDFs only.

Source: 1. Supervisory returns, RBI.

2. Handbook of Statistics on the Indian Economy, RBI.

13

Economic Survey, Government of India, various issues.

14

As highlighted in the Reserve Bank’s Annual Report 2016-17, the negative growth in bank credit to infrastructure was owing mainly to the high incidence

of stressed assets resulting in reduced lending to this sector following risk aversion.

RBI Bulletin October 2017 101

article Non-Banking Finance Companies in India’s Financial Landscape

Chart 13: Trend in NPA ratio - end-March position

P: Provisional.

Source: 1. Statistical Tables Related to Banks in India, various issues.

2. Report on Trend and Progress of Banking in India, various issues.

3. Financial Stability Report, various issues.

4. Supervisory returns, RBI.

cent at end-March 2017 from 2.9 per cent at end- deterioration in the financial system (Chart 14).

March 2012. The deterioration in asset quality could Compared to banks, however, NBFCs reported a fairly

partly be attributed to the change in NPA recognition higher RoA.

norms. Notwithstanding the recent deterioration,

The capital to risk-weighted assets ratio (CRAR)

their asset quality remained better than that of banks

of NBFCs has declined in recent years although it

(Chart 13).

was higher than the prescribed regulatory level of

Return on Assets (RoA) of NBFCs declined from 15 per cent, symbolising the soundness of the sector

2013 onwards in tandem with the asset quality (Chart 15).

Chart 14: Return on assets of NBFCs and banks - end-March position

P: Provisional.

Source: Supervisory returns, RBI.

102 RBI Bulletin October 2017

Non-Banking Finance Companies in India’s Financial Landscape article

Chart 15: CRAR of NBFCs and banks - end-March position

P: Provisional.

Source: Supervisory returns, RBI.

8. Conclusions and the Way Forward An assessment of the recent financial

India’s NBFC sector, which has shown robust performance of NBFCs suggests that they are emerging

growth in the recent years, is generically different as an important source of credit to micro and small

from shadow banks operating elsewhere in the world, enterprises and infrastructure. Although the capital

as this article has argued. position of NBFC sector remains strong, the gradual

deterioration in their asset quality points to the

The regulatory framework for NBFCs in India has

evolved over time in line with the growing functional need for greater monitoring. The growth of financial

diversification of the sector while keeping in view the technology (fintech) platforms presage even greater

objectives of depositors’ interest, financial inclusion scope and opportunities for the NBFC sector. New

and financial stability. At the same time, the shaping players in the field of P2P/business-to-business (B2B)/

and calibration of regulatory initiatives have been business-to-consumers (B2C) lending offer novel

influenced by considerations of harnessing sector- opportunities for NBFCs to evolve further and emerge

specific expertise and the proven abilities of these as an increasingly important component of India’s

institutions to serve niche segments. The creation of financial landscape.

different categories of NBFCs signifies this intention.

References

While allowing for diversification of the sector,

harmonisation of the regulatory framework for Bottelier, Pieter (2015), “Shadow Banking in China”,

NBFCs, both within the sector and with that for banks, World Bank 1818 H Association - Economics and

is being pursued to minimise regulatory arbitrage. Financial Chapters, June 17.

RBI Bulletin October 2017 103

article Non-Banking Finance Companies in India’s Financial Landscape

FSB (2015), Global Shadow Banking Monitoring Report Monaghan, Angela (2014), “Shadow banking system

- 2015, Financial Stability Board. a growing risk to financial stability – IMF”, The

Guardian, October 01.

- (2017), Global Shadow Banking Monitoring Report -

2016, Financial Stability Board. RBI (2014), Financial Stability Report, December,

Ghosh Swati, Mazo Ines Gonzalez del, and Ötker-Robe Reserve Bank of India, Mumbai.

İnci. (2012), “Chasing the Shadows: How Significant Is - (2017), Macroeconomic Impact of Demonetisation-

Shadow Banking in Emerging Markets?” World Bank A Preliminary Assessment, Reserve Bank of India,

Economic Premise, (88). Mumbai.

104 RBI Bulletin October 2017

You might also like

- Business Analytic in RetailDocument75 pagesBusiness Analytic in RetailMahmudur Rahman100% (5)

- Enterprise Data Management Data Governance PlanDocument36 pagesEnterprise Data Management Data Governance PlanSujin Prabhakar89% (9)

- Test Bank MidtermDocument56 pagesTest Bank MidtermmeriemNo ratings yet

- CRM Project PlanDocument12 pagesCRM Project Planwww.GrowthPanel.com100% (5)

- C_TCRM20_71 Exam: Introduction to SAP CRM QuestionsDocument51 pagesC_TCRM20_71 Exam: Introduction to SAP CRM QuestionsVikas KumarNo ratings yet

- Growth of NBFC Sector in IndiaDocument40 pagesGrowth of NBFC Sector in IndiaNirmal Kumar Kushwah67% (3)

- Equity Analysis ProjectDocument65 pagesEquity Analysis ProjectTanvir KhanNo ratings yet

- Equity Analysis ProjectDocument65 pagesEquity Analysis ProjectTanvir KhanNo ratings yet

- Sap SD Exclusive Study Materials - Sap SD Interview Questions and AnswersDocument17 pagesSap SD Exclusive Study Materials - Sap SD Interview Questions and AnswersSrinivasa Kirankumar100% (1)

- Accounting For Not-for-Profit Organisation: Business. Normally, TDocument63 pagesAccounting For Not-for-Profit Organisation: Business. Normally, TVinit MathurNo ratings yet

- Heritage 1Document32 pagesHeritage 1Tanvir KhanNo ratings yet

- Non-Banking Finance Companies in India's Financial LandscapeDocument18 pagesNon-Banking Finance Companies in India's Financial Landscapeshubham moonNo ratings yet

- Comparing NPAs of public and private banks in India focusing on weaker sectionsDocument11 pagesComparing NPAs of public and private banks in India focusing on weaker sectionsJitendra UdawantNo ratings yet

- Blackbook FinalDocument86 pagesBlackbook Finalgunesh somayaNo ratings yet

- Non-Performing Assets in Indian Public Sector Banks: An Analytical StudyDocument7 pagesNon-Performing Assets in Indian Public Sector Banks: An Analytical StudyHitesh ChawlaNo ratings yet

- Study on Non-Performing Assets in Indian Banking SectorDocument6 pagesStudy on Non-Performing Assets in Indian Banking SectorASWATHYNo ratings yet

- A Review Paper On Shadow Banking in India: August 2021Document25 pagesA Review Paper On Shadow Banking in India: August 2021kanak kathuriaNo ratings yet

- Impact of Efficiency On Voluntary Disclosure of Non-Banking Financial Company-Microfinance Institutions in IndiaDocument21 pagesImpact of Efficiency On Voluntary Disclosure of Non-Banking Financial Company-Microfinance Institutions in IndiaManisha ChourasiaNo ratings yet

- A Review of Role and Challenges of Non-Banking Financial Companies in Economic Development of IndiaDocument9 pagesA Review of Role and Challenges of Non-Banking Financial Companies in Economic Development of IndiaSushm GiriNo ratings yet

- Regulatory Aspects in NBFCS: Visions & Revisions: Prof. O.V. Nandimath, (Course Teacher)Document36 pagesRegulatory Aspects in NBFCS: Visions & Revisions: Prof. O.V. Nandimath, (Course Teacher)sparulsinhaNo ratings yet

- Banking 'Topic5 MohitGroverIImCALDocument11 pagesBanking 'Topic5 MohitGroverIImCAL05550No ratings yet

- Financial Inclusion in India An Appraisa PDFDocument11 pagesFinancial Inclusion in India An Appraisa PDFCristian Cucos CucosNo ratings yet

- Article On Fund ManagementDocument8 pagesArticle On Fund ManagementLizaNo ratings yet

- 03ar A0f83a4dDocument12 pages03ar A0f83a4dYerrolla MadhuravaniNo ratings yet

- .Non-Performing Assets (NPAS) in Indian Commercial BanksDocument5 pages.Non-Performing Assets (NPAS) in Indian Commercial BanksBinod Kumar SethaNo ratings yet

- RBM EditingDocument17 pagesRBM EditingsamNo ratings yet

- Non Performing AssetsDocument12 pagesNon Performing Assetsrahul singhNo ratings yet

- Mediating Effect of Service Quality on Non-Banking Financial InstitutionsDocument8 pagesMediating Effect of Service Quality on Non-Banking Financial InstitutionsGAYATHRINo ratings yet

- Mini Project Report: Shadow Banking in IndiaDocument17 pagesMini Project Report: Shadow Banking in IndiasamNo ratings yet

- Risk Assessment Model For Assessing NBFCsAsset FiDocument11 pagesRisk Assessment Model For Assessing NBFCsAsset FiNishit RelanNo ratings yet

- SynopsisDocument6 pagesSynopsisksinghmohit1997No ratings yet

- 3515-Article Text-6773-1-10-20201223Document10 pages3515-Article Text-6773-1-10-20201223BADDAM PARICHAYA REDDYNo ratings yet

- Banking On Non Banking Finance CompaniesDocument32 pagesBanking On Non Banking Finance Companiesappao vidyasagarNo ratings yet

- Tanishq MishraDocument6 pagesTanishq MishraAYUSH PANDEYNo ratings yet

- Indian Financial Industry ReportDocument18 pagesIndian Financial Industry ReportVishesh MehtaNo ratings yet

- Jurnal InternasionalDocument8 pagesJurnal InternasionalEdityaNo ratings yet

- AMNirupama Anatomy NBFCDocument38 pagesAMNirupama Anatomy NBFCRutuja SNo ratings yet

- Indian Financial System Components and Role in Economic GrowthDocument14 pagesIndian Financial System Components and Role in Economic Growthpritish mohantyNo ratings yet

- DISSERTATION RE NikhilDocument37 pagesDISSERTATION RE NikhilNikhil Ranjan50% (2)

- History and Evolution of NBFC Sector in IndiaDocument51 pagesHistory and Evolution of NBFC Sector in IndiaSWATHIKRISHNA RNo ratings yet

- Structure and Mechanism of Corporate Governance in The Indian Banking SectorDocument7 pagesStructure and Mechanism of Corporate Governance in The Indian Banking SectorIJAR JOURNALNo ratings yet

- Risks in Public Sector Banking: Identification and ManagementDocument4 pagesRisks in Public Sector Banking: Identification and Managementanupam99276No ratings yet

- SBI Financial InclusionDocument6 pagesSBI Financial Inclusionmanideep111100% (1)

- Core Banking Regulations in IndiaDocument17 pagesCore Banking Regulations in IndiaJoy ParekhNo ratings yet

- StrategyDocument13 pagesStrategyShashidhar AkkihebbalNo ratings yet

- The Economics of Shadow Banking Risks and Regulatory Challenges in The Context of IndiaDocument8 pagesThe Economics of Shadow Banking Risks and Regulatory Challenges in The Context of IndiaAakash GhanaNo ratings yet

- Analysis of Growth Prospects of Non BankDocument7 pagesAnalysis of Growth Prospects of Non Bankmahesh toshniwalNo ratings yet

- A Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector BankstDocument18 pagesA Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector BankstNavneet NandaNo ratings yet

- Banking Market Discipline in Indonesia An Empirical Test On Conventional and Islamic BankDocument15 pagesBanking Market Discipline in Indonesia An Empirical Test On Conventional and Islamic BankCandra ColivinnNo ratings yet

- Chapter 5Document24 pagesChapter 5asifanisNo ratings yet

- Proper ReportDocument56 pagesProper ReportvijaypratapsinghjaipurNo ratings yet

- Introduction To Indian Financial SystemDocument259 pagesIntroduction To Indian Financial SystemTera BoxNo ratings yet

- Format-Ijhss - An Analytical Study of Nbfcs and Its Impact On Financial Growth of The Nation - 1Document10 pagesFormat-Ijhss - An Analytical Study of Nbfcs and Its Impact On Financial Growth of The Nation - 1Impact JournalsNo ratings yet

- Bond Market Development in Bangladesh ADocument10 pagesBond Market Development in Bangladesh AA B M MoshiuddullahNo ratings yet

- Research Design: Chapter-1Document27 pagesResearch Design: Chapter-1AlexNo ratings yet

- Universal Banking LatestDocument189 pagesUniversal Banking LatestSony Bhagchandani50% (2)

- Emerging Challenges To Financial StabilityDocument13 pagesEmerging Challenges To Financial StabilityRao TvaraNo ratings yet

- Swati Raju Final ReportDocument62 pagesSwati Raju Final Reportshubham kumarNo ratings yet

- 0rbibulletin 6 PDFDocument122 pages0rbibulletin 6 PDFMani KalhanNo ratings yet

- The Economics of Shadow Banking - Risks and Regulatory Challenges in The Context of IndiaDocument3 pagesThe Economics of Shadow Banking - Risks and Regulatory Challenges in The Context of IndiaAakash GhanaNo ratings yet

- A Study On Analysis of Non-Performing Assets and Its Impact On Profitability: in The Context of Indian Banking SystemDocument5 pagesA Study On Analysis of Non-Performing Assets and Its Impact On Profitability: in The Context of Indian Banking SystemAnsh ShahNo ratings yet

- Indian Capital Markets and Financial SystemDocument19 pagesIndian Capital Markets and Financial SystemdeadlyrahulNo ratings yet

- Group4 MFIS Final ReportDocument10 pagesGroup4 MFIS Final ReportHEM BANSALNo ratings yet

- Future of Banking in IndiaDocument2 pagesFuture of Banking in IndiaKaran BherwaniNo ratings yet

- Impact of NonDocument30 pagesImpact of NonAmardeep SinghNo ratings yet

- Financial Ratio Analysis of Sbi (2009 - 2016) : S. Subalakshmi, S. Grahalakshmi and M. ManikandanDocument7 pagesFinancial Ratio Analysis of Sbi (2009 - 2016) : S. Subalakshmi, S. Grahalakshmi and M. ManikandanArchana Mohite100% (1)

- Challenges of Shadow Banking: Behavioural Finance and Value InvestingDocument9 pagesChallenges of Shadow Banking: Behavioural Finance and Value InvestingArnnava SharmaNo ratings yet

- 429663-performance-of-nbfcs-a-pre-and-post-covi-a084d920Document11 pages429663-performance-of-nbfcs-a-pre-and-post-covi-a084d920SeetanNo ratings yet

- R N P A R F C B - A S S I C BDocument19 pagesR N P A R F C B - A S S I C BAyona AduNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- HDFC Bank key highlightsDocument284 pagesHDFC Bank key highlightsTejas KarwaNo ratings yet

- Scanned by CamscannerDocument12 pagesScanned by CamscannerTanvir KhanNo ratings yet

- Eps 1Document30 pagesEps 1Tanvir KhanNo ratings yet

- NCFM SettingsDocument6 pagesNCFM SettingsGaurav PandeyNo ratings yet

- CamScanner Scans PDFs from PhotosDocument5 pagesCamScanner Scans PDFs from PhotosTanvir KhanNo ratings yet

- Ratio Analysis in HDFC BankDocument82 pagesRatio Analysis in HDFC BankTanvir KhanNo ratings yet

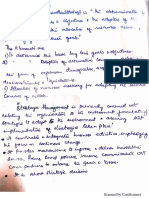

- Corporate Level PlanningDocument3 pagesCorporate Level PlanningTanvir KhanNo ratings yet

- Ratio Analysis in HDFC BankDocument82 pagesRatio Analysis in HDFC BankTanvir KhanNo ratings yet

- DEVIDEND DICISION... HDFC Bank-2015Document64 pagesDEVIDEND DICISION... HDFC Bank-2015Tanvir KhanNo ratings yet

- Finance and Accounting ServicesDocument4 pagesFinance and Accounting ServicesVishal DubeyNo ratings yet

- Dbms PracticalDocument8 pagesDbms PracticalTanvir KhanNo ratings yet

- Trial PMR Pahang 2010 English (p1)Document9 pagesTrial PMR Pahang 2010 English (p1)abdfattah50% (2)

- Ratio Analysis in HDFC BankDocument82 pagesRatio Analysis in HDFC BankTanvir KhanNo ratings yet

- SBI Capital Markets BIA RFPDocument11 pagesSBI Capital Markets BIA RFPTanvir KhanNo ratings yet

- IMF Guide: Structure, Functions and Role of the International Monetary FundDocument12 pagesIMF Guide: Structure, Functions and Role of the International Monetary FundTanvir KhanNo ratings yet

- Plant Location AnalysisDocument19 pagesPlant Location AnalysisTanvir KhanNo ratings yet

- SBI Capital Markets BIA RFPDocument11 pagesSBI Capital Markets BIA RFPTanvir KhanNo ratings yet

- Useful Excel For Beginners Course Table of Contents PDFDocument2 pagesUseful Excel For Beginners Course Table of Contents PDFTanvir KhanNo ratings yet

- SR. NO. Group Members Topic Group NumberDocument2 pagesSR. NO. Group Members Topic Group NumberTanvir KhanNo ratings yet

- SBI Capital Markets BIA RFPDocument11 pagesSBI Capital Markets BIA RFPTanvir KhanNo ratings yet

- Regional Economic IntegrationDocument9 pagesRegional Economic IntegrationAmbika GargNo ratings yet

- Operative Functions of HRM (In Hindi)Document9 pagesOperative Functions of HRM (In Hindi)Tanvir KhanNo ratings yet

- First Type of Financial Decisions: Investment Decision (In Hindi)Document8 pagesFirst Type of Financial Decisions: Investment Decision (In Hindi)Tanvir KhanNo ratings yet

- Introduction To DBMSDocument10 pagesIntroduction To DBMSTanvir KhanNo ratings yet

- Impact of Information Technology in The Service Delivery of Indian Insurance SectorDocument3 pagesImpact of Information Technology in The Service Delivery of Indian Insurance SectorTanvir KhanNo ratings yet

- Employee STSFCTNDocument3 pagesEmployee STSFCTNMitali KalitaNo ratings yet

- (Group Project - Marketing Plan) Group 10Document21 pages(Group Project - Marketing Plan) Group 10Tghusna FatmaNo ratings yet

- NEFIN Credential: Achieving Carbon Neutrality For YouDocument14 pagesNEFIN Credential: Achieving Carbon Neutrality For YouDieki Rian MustapaNo ratings yet

- How Business Drives ItDocument5 pagesHow Business Drives Itrajamohan2No ratings yet

- Welcon Pesticides 2020Document32 pagesWelcon Pesticides 2020hhaiderNo ratings yet

- Accounting for Managers Final Exam RatiosDocument7 pagesAccounting for Managers Final Exam RatiosGramoday FruitsNo ratings yet

- Pasdec Holdings Berhad (Assignment)Document22 pagesPasdec Holdings Berhad (Assignment)Nur IzaziNo ratings yet

- This Study Resource Was: Tourism and Hospitality MidtermDocument9 pagesThis Study Resource Was: Tourism and Hospitality MidtermMark John Paul CablingNo ratings yet

- 04 2014 Mcnally PDFDocument8 pages04 2014 Mcnally PDFNarayana MurthyNo ratings yet

- Personnel Planning and Recruiting: Part Two - Recruitment and PlacementDocument16 pagesPersonnel Planning and Recruiting: Part Two - Recruitment and PlacementUsman ShahzadNo ratings yet

- Autopilot Money Plus Extra Profit With Shopify MethodDocument5 pagesAutopilot Money Plus Extra Profit With Shopify Methodamodu oluNo ratings yet

- Inventory Practice ProblemDocument7 pagesInventory Practice ProblemDonna Zandueta-TumalaNo ratings yet

- Introduction To Industrial RelationsDocument14 pagesIntroduction To Industrial RelationsYvonne NjorogeNo ratings yet

- Store Sales 2011Document72 pagesStore Sales 2011Parveen NadafNo ratings yet

- CF Mid Term - Revision Set 3Document10 pagesCF Mid Term - Revision Set 3linhngo.31221020350No ratings yet

- Nazila Azizi CV FinalDocument7 pagesNazila Azizi CV FinalulearnasaidshahtestNo ratings yet

- Introduction To IPRDocument29 pagesIntroduction To IPRBalaji N100% (2)

- Proposal On Human Resource MagmtDocument15 pagesProposal On Human Resource MagmtKalayu KirosNo ratings yet

- CAMPOSOL Reports 121% Increase in EBITDA for 2016Document24 pagesCAMPOSOL Reports 121% Increase in EBITDA for 2016Albert PizarroNo ratings yet

- SAP BW/HANA Consultant Jyoti Swanjary ResumeDocument4 pagesSAP BW/HANA Consultant Jyoti Swanjary ResumeraamanNo ratings yet

- HRP - Monitoring and EvaluationDocument2 pagesHRP - Monitoring and EvaluationRichard SikiraNo ratings yet

- Overview of Indian Securities Market: Chapter-1Document100 pagesOverview of Indian Securities Market: Chapter-1tamangargNo ratings yet

- Organizational Skills: Keterampilan BerorganisasiDocument13 pagesOrganizational Skills: Keterampilan BerorganisasiMohd NajibNo ratings yet

- Annual Report 2020Document242 pagesAnnual Report 2020Thiuyah A/p RajandranNo ratings yet