Professional Documents

Culture Documents

36 Planters Development Bank v. Lopez

Uploaded by

Basil MaguigadOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

36 Planters Development Bank v. Lopez

Uploaded by

Basil MaguigadCopyright:

Available Formats

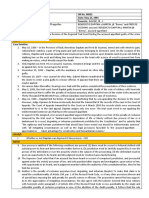

CivReb– Art.

1191– Maguigad - 36

PLANTERS DEVELOPMENT BANK vs. LOPEZ THE WELL-SETTLED RULE IS THAT RESCISSION WILL NOT

G.R. No. 186332 |October 23, 2013|BRION J., BE PERMITTED FOR A SLIGHT OR CASUAL BREACH OF THE

CONTRACT. THE QUESTION OF WHETHER A BREACH OF

FACTS CONTRACT IS SUBSTANTIAL DEPENDS UPON THE

ATTENDING CIRCUMSTANCES.

SPS. LOPEZ OBTAINED A LOAN FROM PLANTERS AND

THEY MORTGAGED THEIR LAND PLANTERS BREACH WAS CASUAL OR SLIGHT

Sps. Lopez obtained a real estate loan of P3M from Planters Planters Bank’s refusal to release the remaining balance was

Bank intended to finance the construction of a 4-story merely a slight or casual breach. Its breach is not sufficiently

dormitory building. The loan is payable for 14 years with fundamental to defeat the object of the parties in entering

21% interest per annum. Sps. mortgaged a parcel of land. into the loan agreement.

THE INTEREST RATE WAS INCREASED AND TERM • In this case, Planters Bank substantially

DECREASED complied with its obligation. It released P3.5M

The parties signed an amendment to the loan agreement of the P4.2M loan. Only P700k or 16.66% of the

increasing the interest rate to 23% and shortening the term loan was not released.

of the loan to 3 years. A second amendment was executed:

25% p.a. interest rate. Even assuming that Planters Bank substantially breached its

Meanwhile, Philippine economy deteriorated. The cost of obligation, the 4th paragraph of Art. 1191 of the Civil Code

construction increased. Sps. Lopez obtained an additional expressly provides that rescission is without prejudice to the

loan of P1.2M from Planters Bank. rights of third persons who have acquired the thing, in

accordance with Art. 1385, which states that rescission

PLANTERS UNILATERALLY INCREASED THE INTEREST cannot take place when the things which are the object

RATE of the contract are legally in the possession of third

3rd amendment was executed: loan was increased to P4.2M persons who did not act in bad faith.

and the interest rate is at 27% p.a., the term of the loan

became 1 year. Subsequently, Planters Bank unilaterally

increased the interest rate to 32% p.a. IN THIS CASE, THE MORTGAGED PROPERTIES HAD

ALREADY BEEN FORECLOSED. Respondents did not

SPS. FILED A COMPLAINT FOR RESCISSIOON OF LOAN overcome the presumption that the buyers bought the

AGREEMENT foreclosed properties in good faith. Sps. Lopez did not cause

Sps. Lopez failed to avail of the full amount of the loan the annotation of lis pendens at the back of the title of the

because Planters refused to release the remaining amount mortgaged lot.

of P700k. They filed a complaint for rescission of loan

agreement and for damages with the RTC. Furthermore, Sps. Lopez’s failure to pay the overdue loan

made them parties in default, not entitled to rescission

In defense, Planters Bank argued that its refusal to release under Art. 1191.

the loan was due to Sps. Lopez’s violations of the loan

agreement: (1) non-submission of accomplishment reports WHEREFORE, premises considered, the assailed amended

(2) construction of a 6-story building. Planters Bank decision dated July 30, 2007 and resolution dated February 5,

foreclosed the mortgaged properties. 2009 of the Court of Appeals are hereby REVERSED.

RTC ruled in favor of Planters Bank. It held that the Sps

had no right to rescind because they were not the

injured parties and that they violated the loan

agreement.

Sps. died during the pendency of the case. On appeal, CA

reversed the RTC ruling and held that Planters Bank’s refusal

to release the loan was a substantial breach of the contract.

Respondents (who substituted the Sps) filed an MR seeking

clarification of the ruling which did not declare the

rescission of the loan. The CA modified the dispositive

portion of its ruling. It declared the loan agreement

rescinded and ordered Planters Bank to return the amount

of P2.8M with interest and the foreclosed property.

ISSUE(S)

Whether or not rescission is proper? NO

RULING

You might also like

- 89planters Development Bank v. Lopez (Mier - Keith Jasper)Document2 pages89planters Development Bank v. Lopez (Mier - Keith Jasper)Keith Jasper MierNo ratings yet

- Heirs of Aurio T. Casiño barred by res judicataDocument2 pagesHeirs of Aurio T. Casiño barred by res judicataShine Dawn InfanteNo ratings yet

- Cook vs. Cook Case DigestDocument2 pagesCook vs. Cook Case DigestEloisa Salitrero0% (1)

- RTC Ruling on Land Ownership Upheld by CADocument12 pagesRTC Ruling on Land Ownership Upheld by CAGladys BantilanNo ratings yet

- SPCL Case DigestDocument7 pagesSPCL Case DigestlawYearNo ratings yet

- Multi Realty Development Corp V Makati Tuscany Condominium CorpDocument1 pageMulti Realty Development Corp V Makati Tuscany Condominium CorpBrian Duffy100% (1)

- Town Savings and Loan Bank vs. CADocument2 pagesTown Savings and Loan Bank vs. CANoo NooooNo ratings yet

- Heirs of Aurio T. Casino vs. DBP GR No. 204052-53, March 11, 2009Document2 pagesHeirs of Aurio T. Casino vs. DBP GR No. 204052-53, March 11, 2009Thea P PorrasNo ratings yet

- Dayrit v. NorquillaDocument2 pagesDayrit v. NorquillaJoselito BautistaNo ratings yet

- Iloilo Jar Corporation DigestDocument2 pagesIloilo Jar Corporation DigestLeo CantrellNo ratings yet

- Lim V NPC-Rule 13, Sec 11Document2 pagesLim V NPC-Rule 13, Sec 11mimisabaytonNo ratings yet

- GOPIAO V. METROPOLITAN BANK RULINGDocument3 pagesGOPIAO V. METROPOLITAN BANK RULINGNicole PTNo ratings yet

- Chapter 2 Handouts ADR 2 PDFDocument3 pagesChapter 2 Handouts ADR 2 PDFCamille BugtasNo ratings yet

- Criminal Law Book II by RENE CALLANTA Covers Crimes Against National SecurityDocument171 pagesCriminal Law Book II by RENE CALLANTA Covers Crimes Against National SecurityEinstein NewtonNo ratings yet

- Mahinay Vs Gako Case DigestDocument3 pagesMahinay Vs Gako Case DigestLou100% (1)

- Citibank V Tanco-Gabaldon DigestDocument3 pagesCitibank V Tanco-Gabaldon Digestmkab50% (2)

- Villa Rey Transit vs. Ferrer DigestDocument2 pagesVilla Rey Transit vs. Ferrer Digestw8ndblid100% (1)

- BOOKLIGHT, INC., PETITIONER, v. RUDY O. TIU, RESPONDENTDocument2 pagesBOOKLIGHT, INC., PETITIONER, v. RUDY O. TIU, RESPONDENTErikha AranetaNo ratings yet

- Galang v. WallisDocument2 pagesGalang v. WallisMikaela PamatmatNo ratings yet

- BPI's Liability for Unendorsed Checks DepositedDocument2 pagesBPI's Liability for Unendorsed Checks DepositedUrumi KanzakiNo ratings yet

- Serna Vs Dela CruzDocument1 pageSerna Vs Dela CruzWaRynbeth MaljatoNo ratings yet

- MACTAN ROCK INDUSTRIES, INC. v. GERMODocument2 pagesMACTAN ROCK INDUSTRIES, INC. v. GERMOChino SisonNo ratings yet

- Republic v. Asuncion PDFDocument2 pagesRepublic v. Asuncion PDFDane NuesaNo ratings yet

- Republic of The Philippines V. Jose Lubis Masongsong and JUANITO LUBIS MASONGSONG, G.R. No. 162846 September 22, 2005 FactsDocument2 pagesRepublic of The Philippines V. Jose Lubis Masongsong and JUANITO LUBIS MASONGSONG, G.R. No. 162846 September 22, 2005 FactsWARLYN DUMONo ratings yet

- Gashem Shookatbaksh V. Court of Appeals G.R. No. 97336 February 19, 1993 FactsDocument1 pageGashem Shookatbaksh V. Court of Appeals G.R. No. 97336 February 19, 1993 FactsAngela Louise SabaoanNo ratings yet

- CARMELITA V. DIZON versus JOSE LUIS K. MATTI, JRDocument3 pagesCARMELITA V. DIZON versus JOSE LUIS K. MATTI, JRJeNovaNo ratings yet

- NAMARCO vs. Federation United - GR No. L-2257 (Case Digest)Document2 pagesNAMARCO vs. Federation United - GR No. L-2257 (Case Digest)Leah Nina VillafloresNo ratings yet

- Bank of Commerce v. Heirs of Dela CruzDocument3 pagesBank of Commerce v. Heirs of Dela CruzIan Joshua RomasantaNo ratings yet

- Hutama Vs CitraDocument12 pagesHutama Vs CitraIvan Montealegre ConchasNo ratings yet

- Case Title: Saw V CA Citation: G.R. No. 90580 April 8, 1991Document2 pagesCase Title: Saw V CA Citation: G.R. No. 90580 April 8, 1991chrystel100% (2)

- Bonifacio Nakpil vs. Manila Towers Development Corp., GR No. 160867, Sept 20, 2006Document2 pagesBonifacio Nakpil vs. Manila Towers Development Corp., GR No. 160867, Sept 20, 2006Addy Guinal100% (3)

- Gonzalo Puyat and Sons, Inc V PNB DigestDocument2 pagesGonzalo Puyat and Sons, Inc V PNB Digestmaximum jica100% (1)

- Premiere Development Bank V FloresDocument3 pagesPremiere Development Bank V FloresLUNANo ratings yet

- 23 Sps Edrada V Sps RamosDocument2 pages23 Sps Edrada V Sps Ramoskhayis_bels100% (1)

- 9 Repuela V Estate of SpousesDocument2 pages9 Repuela V Estate of SpousesJuvial Guevarra Boston100% (1)

- Immediate execution of OMB dismissal ordersDocument2 pagesImmediate execution of OMB dismissal ordersSultan Kudarat State UniversityNo ratings yet

- Civil Procedure Case Digest (Silverio vs. FBCI and Perez vs. Manotok)Document3 pagesCivil Procedure Case Digest (Silverio vs. FBCI and Perez vs. Manotok)Maestro LazaroNo ratings yet

- Widow's Right to Repurchase Property Within 5 YearsDocument2 pagesWidow's Right to Repurchase Property Within 5 YearsNatsu DragneelNo ratings yet

- HEIRS OF FERNANDO Et Al VS HEIRS OF RAMOS Et AlDocument2 pagesHEIRS OF FERNANDO Et Al VS HEIRS OF RAMOS Et AlJax JaxNo ratings yet

- WERR CORPORATION INTERNATIONAL Vs HIGHLANDS PRIME INCDocument2 pagesWERR CORPORATION INTERNATIONAL Vs HIGHLANDS PRIME INCYrna CañaNo ratings yet

- JORGENETICS SWINE IMPROVEMENT CORPORATION, vs. THICK & THIN AGRI-PRODUCTS, INC.Document3 pagesJORGENETICS SWINE IMPROVEMENT CORPORATION, vs. THICK & THIN AGRI-PRODUCTS, INC.Shine Dawn InfanteNo ratings yet

- Land Sale During Patent Application InvalidDocument2 pagesLand Sale During Patent Application InvalidDeej JayNo ratings yet

- Case DigestDocument5 pagesCase DigestAlexylle Garsula de ConcepcionNo ratings yet

- Fuentes v. Office of The Ombudsman - MindanaoDocument2 pagesFuentes v. Office of The Ombudsman - MindanaoTrisha OrtegaNo ratings yet

- 680 vs. CADocument3 pages680 vs. CAJustin Luis Jalandoni100% (3)

- Continental Micronesia, Inc V Basco GR No 178382-83 Sept 23, 2015Document17 pagesContinental Micronesia, Inc V Basco GR No 178382-83 Sept 23, 2015Marge OstanNo ratings yet

- TIDCORP vs. Asia PacesDocument2 pagesTIDCORP vs. Asia PacesAdrian GorgonioNo ratings yet

- Villa Crista Monte Realty vs. Equitable PCI BankDocument1 pageVilla Crista Monte Realty vs. Equitable PCI BankabbywinsterNo ratings yet

- Aguilar V LightbringersDocument3 pagesAguilar V LightbringersGenesis LealNo ratings yet

- M.Y. San Biscuits, Inc. vs. Laguesma G.R. 95011 - April 22, 1991Document1 pageM.Y. San Biscuits, Inc. vs. Laguesma G.R. 95011 - April 22, 1991Praisah Marjorey PicotNo ratings yet

- Mapa Immunity Upheld Despite Failure to TestifyDocument2 pagesMapa Immunity Upheld Despite Failure to TestifyChugsNo ratings yet

- Berris vs. Abyadang RevisedDocument9 pagesBerris vs. Abyadang RevisedButternut23100% (1)

- Ty Vs People - Consideration NegoDocument2 pagesTy Vs People - Consideration NegoCarl MontemayorNo ratings yet

- Metrobank VS CPR PromotionsDocument2 pagesMetrobank VS CPR Promotionszane100% (2)

- 3 - People V DapitanDocument2 pages3 - People V DapitanGodfrey Ian MonteroNo ratings yet

- 53 Namarco vs. FederationDocument2 pages53 Namarco vs. FederationErwin SalosagcolNo ratings yet

- Family Code of The PhilippinesDocument2 pagesFamily Code of The PhilippinesDaddyDiddy Delos ReyesNo ratings yet

- Philippine bank's refusal to release loan balance breached contractDocument3 pagesPhilippine bank's refusal to release loan balance breached contractJosiah Balgos100% (1)

- Planters Bank vs Lopez HeirsDocument8 pagesPlanters Bank vs Lopez HeirsJobi BryantNo ratings yet

- Credit TXN Case Digests - Mar21Document10 pagesCredit TXN Case Digests - Mar21Jona Myka DugayoNo ratings yet

- 25 Kummer V PeopleDocument2 pages25 Kummer V PeopleBasil MaguigadNo ratings yet

- 25 Kummer V PeopleDocument2 pages25 Kummer V PeopleBasil MaguigadNo ratings yet

- Jurisdiction Over Falsification CaseDocument2 pagesJurisdiction Over Falsification CaseBasil MaguigadNo ratings yet

- 65 Okabe v. GutierrezDocument3 pages65 Okabe v. GutierrezBasil MaguigadNo ratings yet

- 64 People v. SandiganbayanDocument3 pages64 People v. SandiganbayanBasil Maguigad100% (1)

- Sample Revival of JudgmentDocument3 pagesSample Revival of Judgmentalexredrose100% (4)

- Ortiz Vs Kayanan DIGEST.Document1 pageOrtiz Vs Kayanan DIGEST.Ruwee O TupueNo ratings yet

- People v. de Grano: G.R. No. 167710 - June 5, 2009 - Peralta, J.Document4 pagesPeople v. de Grano: G.R. No. 167710 - June 5, 2009 - Peralta, J.Basil MaguigadNo ratings yet

- Gian Paulo Villaflor Vs - Dindo Vivar Y Gozon G.R. No. 134744 January 16, 2001 Doctrine: The IssuesDocument2 pagesGian Paulo Villaflor Vs - Dindo Vivar Y Gozon G.R. No. 134744 January 16, 2001 Doctrine: The IssuesBasil MaguigadNo ratings yet

- Dr. Rubi Li not liable for failure to disclose chemotherapy side effectsDocument2 pagesDr. Rubi Li not liable for failure to disclose chemotherapy side effectsBasil MaguigadNo ratings yet

- 59 Sps. ESTRADA vs. PHILIPPINE RABBIT BUS LINES, INC.Document4 pages59 Sps. ESTRADA vs. PHILIPPINE RABBIT BUS LINES, INC.Basil MaguigadNo ratings yet

- Warrants Issued for 64 Counts of FalsificationDocument2 pagesWarrants Issued for 64 Counts of FalsificationBasil MaguigadNo ratings yet

- 65 Okabe v. GutierrezDocument3 pages65 Okabe v. GutierrezBasil MaguigadNo ratings yet

- Ma. Gracia Hao & Danny Hao V People: FactsDocument2 pagesMa. Gracia Hao & Danny Hao V People: FactsBasil MaguigadNo ratings yet

- CHAN GOMASCO OF SITO BERDEDocument4 pagesCHAN GOMASCO OF SITO BERDEBasil Maguigad100% (1)

- 06 Leviste V CA and PeopleDocument3 pages06 Leviste V CA and PeopleBasil MaguigadNo ratings yet

- De Castro V Fernandez JR: G.R. No. 155041. February 14, 2007 - CARPIODocument1 pageDe Castro V Fernandez JR: G.R. No. 155041. February 14, 2007 - CARPIOBasil MaguigadNo ratings yet

- 59 Sps. ESTRADA vs. PHILIPPINE RABBIT BUS LINES, INC.Document4 pages59 Sps. ESTRADA vs. PHILIPPINE RABBIT BUS LINES, INC.Basil MaguigadNo ratings yet

- 05 Yao v. CIRDocument2 pages05 Yao v. CIRBasil MaguigadNo ratings yet

- People v. de Grano: G.R. No. 167710 - June 5, 2009 - Peralta, J.Document4 pagesPeople v. de Grano: G.R. No. 167710 - June 5, 2009 - Peralta, J.Basil MaguigadNo ratings yet

- CHAN GOMASCO OF SITO BERDEDocument4 pagesCHAN GOMASCO OF SITO BERDEBasil Maguigad100% (1)

- Warrants Issued for 64 Counts of FalsificationDocument2 pagesWarrants Issued for 64 Counts of FalsificationBasil MaguigadNo ratings yet

- 64 People v. SandiganbayanDocument3 pages64 People v. SandiganbayanBasil Maguigad100% (1)

- Civpro: Rule 24-28 Discovery Beyond Pre-TrialDocument1 pageCivpro: Rule 24-28 Discovery Beyond Pre-TrialBasil MaguigadNo ratings yet

- De Castro V Fernandez JR: G.R. No. 155041. February 14, 2007 - CARPIODocument1 pageDe Castro V Fernandez JR: G.R. No. 155041. February 14, 2007 - CARPIOBasil MaguigadNo ratings yet

- 06 Leviste V CA and PeopleDocument3 pages06 Leviste V CA and PeopleBasil MaguigadNo ratings yet

- Ma. Gracia Hao & Danny Hao V People: FactsDocument2 pagesMa. Gracia Hao & Danny Hao V People: FactsBasil MaguigadNo ratings yet

- 05 Pielago V PeopleDocument2 pages05 Pielago V PeopleBasil MaguigadNo ratings yet

- 05 - Samson vs. CADocument1 page05 - Samson vs. CABasil MaguigadNo ratings yet

- 06 People v. ArrojadoDocument2 pages06 People v. ArrojadoBasil MaguigadNo ratings yet

- Fas 140Document142 pagesFas 140nolandparkNo ratings yet

- A Study On Retail Loans, at UTI Bank Retail Asset CentreDocument74 pagesA Study On Retail Loans, at UTI Bank Retail Asset CentreBilal Ahmad LoneNo ratings yet

- Digest The Philippine Sugar Estates Development Co vs. POizatDocument1 pageDigest The Philippine Sugar Estates Development Co vs. POizatJureeBonifacioMudanzaNo ratings yet

- Concept PaperDocument48 pagesConcept Paperarchana_anuragiNo ratings yet

- HorngrenIMA14eSM ch07Document57 pagesHorngrenIMA14eSM ch07Aries Siringoringo50% (2)

- Banking & InsuranceDocument114 pagesBanking & Insurancemdawaiskhan89No ratings yet

- A Study On Income Tax Law & Accounting 2019Document26 pagesA Study On Income Tax Law & Accounting 2019Novelyn Hiso-anNo ratings yet

- 3Document139 pages3Tully HamutenyaNo ratings yet

- Assumption of MortgageDocument3 pagesAssumption of MortgageRon YhayanNo ratings yet

- Green-Banking NBLDocument39 pagesGreen-Banking NBLZordan Ri Z VyNo ratings yet

- 06 Berkenkotter V Cu UnjiengDocument2 pages06 Berkenkotter V Cu UnjiengpdasilvaNo ratings yet

- The Tools of Government A Guide To The New Governance 1st EditionDocument61 pagesThe Tools of Government A Guide To The New Governance 1st Editionwillie.getz795100% (37)

- Kairos LetterDocument2 pagesKairos LettersebeastyforeverNo ratings yet

- CDocument4 pagesCTiff DizonNo ratings yet

- Money Minders Forge Your Future 2Document36 pagesMoney Minders Forge Your Future 2api-576244922No ratings yet

- IEM Contract Termination Notice-Revised 2023 March 1Document4 pagesIEM Contract Termination Notice-Revised 2023 March 1Hank LeeNo ratings yet

- BKM CH 01 AnswersDocument4 pagesBKM CH 01 AnswersDeepak OswalNo ratings yet

- Factsheet Fiscakonto 3a enDocument2 pagesFactsheet Fiscakonto 3a enPetar NikolovNo ratings yet

- Case Digest No. 1Document3 pagesCase Digest No. 1Jonaselle FonsecaNo ratings yet

- Supreme Court upholds validity of chattel mortgage over houseDocument9 pagesSupreme Court upholds validity of chattel mortgage over houseMary Anne R. BersotoNo ratings yet

- June 20 2014Document48 pagesJune 20 2014fijitimescanadaNo ratings yet

- Mortgage Calculator Estimates Home Buying CostsDocument9 pagesMortgage Calculator Estimates Home Buying CostsMarkDeLoyolaNo ratings yet

- 5 Stage of Real Estate Investment PDFDocument6 pages5 Stage of Real Estate Investment PDFRashmi RahulNo ratings yet

- Supreme Court Rules Interest Rate Increases Without Consent Are VoidDocument2 pagesSupreme Court Rules Interest Rate Increases Without Consent Are VoidMarklawrence Fortes100% (1)

- Hongkong Bank Independent Union v. Hongkong and Shanghai Banking Corp. Ltd.Document12 pagesHongkong Bank Independent Union v. Hongkong and Shanghai Banking Corp. Ltd.Christopher Martin GunsatNo ratings yet

- Complaint On Senior Kansas Judge Richard Smith - Kansas Commission On Judicial Qualifications April 26 2019Document67 pagesComplaint On Senior Kansas Judge Richard Smith - Kansas Commission On Judicial Qualifications April 26 2019Conflict GateNo ratings yet

- 64.villaluz v. Land Bank of The Philippines, 814 SCRA 466Document13 pages64.villaluz v. Land Bank of The Philippines, 814 SCRA 466bentley CobyNo ratings yet

- Project Management For ConstructionDocument487 pagesProject Management For ConstructionEmmanuel Mends Fynn50% (2)

- My MPRDocument58 pagesMy MPRVasundhara BansalNo ratings yet

- Development Bank of The Philippines vs. CA, GR. 100937, March 21, 1994Document4 pagesDevelopment Bank of The Philippines vs. CA, GR. 100937, March 21, 1994Kimberly SendinNo ratings yet