Professional Documents

Culture Documents

Distinguish Between Tax and Fee

Uploaded by

Rishi AgarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Distinguish Between Tax and Fee

Uploaded by

Rishi AgarwalCopyright:

Available Formats

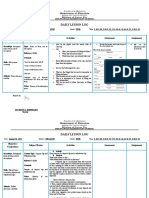

ACC 223: Taxation

Distinguish between Tax and Fee:

A government has several means of raising revenue in order to allow it to function. Among the two most

popular methods of raising revenue are to impose taxes and fees on various activities. Generally, taxes are

applied to various transactions, often as a percentage, as a means of raising revenue or, in some cases, as a

means of incentivizing behavior. Fees, unlike taxes, are directly linked to the cost of providing a service.

Tax Fee

Tax is the compulsory payment to the government Fee is the voluntary payment for getting service.

without getting any direct benefits.

If the element of revenue for general purpose of the While a fee is for payment of a specific benefit or

State predominates, the levy becomes a tax. privilege although the special to the primary

purpose of regulation in public interest.

In regard to tax, there is not and must not always In regard to fee, there is and must always be,

be, direct correlation between the tax and the correlation between the fee collected and the

service intended to be rendered. service intended to be rendered.

Tax is compulsory payment. Fee is the voluntary payment.

If tax is imposed on a person he has to pay it. On the other hand, fee is not paid if the person does

Otherwise he has to be panelized. not want to get the service.

In this case, tax payer does not expect any direct Fee payer can get direct benefit for paying fee.

benefit.

Examples: income tax, gift tax, wealth tax, VAT Examples: Stamp fee, driving license fee, Govt.

etc. registration fee etc.

After the above discussion we can say that, though there are some differences between tax and fee but

both of them play a vital role for collecting government revenue.

Course Teacher: Rejaul Karim, Lecturer,

Department of Business Administration, Varendra University; E-mail:rkarimreja@gmail.com

ACC 223: Taxation

Difference between Tax Avoidance and Tax Evasion:

Every individual assessee wants to escape from paying taxes, which encourages them to use various

means to avoid such payment. Tax Avoidance and Tax Evasion are two techniques which are used by

many people to reduce their tax liability. They do so by taking expert advice. Tax

Avoidance is completely lawful while Tax Evasion is considered as a crime in the whole world. In spite

of many differences in the two practices, people use them interchangeably which is incorrect. So, the

important differences between Tax Avoidance and Tax Evasion are given below.

BASIS OF TAX AVOIDANCE TAX EVASION

COMPARISON

Meaning Minimization of tax liability, by Reducing tax liability by using illegal ways

taking such means which do not is known as Tax Evasion.

violate the tax rules, is Tax

Avoidance.

Concept Taking unfair advantage of the Deliberate manipulations in accounts

shortcomings in the tax laws. resulting in fraud.

Type of means used Use of Justified means Use of such means that are forbidden by

law

Type of act Legal Criminal

Consequences The result of tax avoidance is Whereas the consequence of tax evasion, if

postponement of tax. the assessee is found guilty of doing so, is

either imprisonment or penalty or both.

Tax avoidance and Tax Evasion both are meant to ultimately reduce the tax liability but what makes the

difference is that the former is justified in the eyes of the law as it does not make any offense or breaks

any law. However, it is biased as the honest tax payers are not fools, but they can also make arrangements

for postponing unnecessary tax. If we talk about the latter, it is completely unjustified because it is a

fraudulent activity, because it involves the acts which are forbidden by the law and hence it is punishable.

Course Teacher: Rejaul Karim, Lecturer,

Department of Business Administration, Varendra University; E-mail:rkarimreja@gmail.com

You might also like

- Income Tax AuthoritiesDocument12 pagesIncome Tax AuthoritiesSweety Roy100% (1)

- General Provisions About BaggageDocument10 pagesGeneral Provisions About BaggageSunil VishwakarmaNo ratings yet

- 04 Powers of OfficersDocument3 pages04 Powers of OfficersAnantHimanshuEkka100% (1)

- 1) What Are The Powers and Duties of Probation OfficersDocument45 pages1) What Are The Powers and Duties of Probation Officersmaddy nogNo ratings yet

- Income Tax Authorities in India and Their PowersDocument1 pageIncome Tax Authorities in India and Their PowersAmit Srivastava76% (17)

- Set Off and Carry Forward of Losses Are Covered Under Income Tax Act 1961 From Section 70 To 74Document7 pagesSet Off and Carry Forward of Losses Are Covered Under Income Tax Act 1961 From Section 70 To 74Venugopal MantraratnamNo ratings yet

- Delegation of Taxing PowerDocument4 pagesDelegation of Taxing PowerMounika Kalakoti0% (1)

- Law of Taxation and The Constitution of India - IpleadersDocument1 pageLaw of Taxation and The Constitution of India - Ipleadersannpurna pathakNo ratings yet

- Procedure For Hearing and Deciding ClaimsDocument15 pagesProcedure For Hearing and Deciding ClaimsRudraksh kaushalNo ratings yet

- Liabilities of Public CorporationDocument1 pageLiabilities of Public Corporationmustaq ahmed100% (1)

- Picketing, Gherao and Bandh: SESSION 2017-2021Document22 pagesPicketing, Gherao and Bandh: SESSION 2017-2021Manik Singh Kapoor100% (1)

- Income From House Property-6Document9 pagesIncome From House Property-6s4sahithNo ratings yet

- Hearing and Deciding ClaimsDocument11 pagesHearing and Deciding ClaimsdushyantNo ratings yet

- Employees' Compensation Act, 1923Document51 pagesEmployees' Compensation Act, 1923Diksha SoinNo ratings yet

- Gandhian Principles of Non-Violent Conflict ResolutionDocument15 pagesGandhian Principles of Non-Violent Conflict Resolutionkaran raja100% (1)

- Federal Base of Taxing PowerDocument8 pagesFederal Base of Taxing Powermanjushree100% (1)

- Single and Multiple Tax System: Single Tax System MeansDocument4 pagesSingle and Multiple Tax System: Single Tax System Meanscandydoll5789% (9)

- Suits Filed by Aliens, by or Against Foreign Rulers and AmbassadorsDocument17 pagesSuits Filed by Aliens, by or Against Foreign Rulers and Ambassadorsaditi todariaNo ratings yet

- 1 Objectives of Child Labour LawDocument3 pages1 Objectives of Child Labour LawannnoyynnmussNo ratings yet

- Minimum Wages, Fair Wages, Living WagesDocument2 pagesMinimum Wages, Fair Wages, Living WagesHarsh Gupta100% (1)

- Law-of-contracts-II - LLB NotesDocument60 pagesLaw-of-contracts-II - LLB Notesd100% (1)

- Employment of Young Persons in FactoriesDocument6 pagesEmployment of Young Persons in FactoriesNARENDRA SINGH100% (2)

- Rehabiltation and Resettlement AwardDocument23 pagesRehabiltation and Resettlement AwardMG MaheshBabuNo ratings yet

- Supervision and Control TestDocument17 pagesSupervision and Control TesthariparmeshwarNo ratings yet

- Defences Available To Contemnor in Contempt ProceedingsDocument12 pagesDefences Available To Contemnor in Contempt Proceedingsharmanpreet kaurNo ratings yet

- Salient Features of The Employees Provident Funds and Miscellaneous Provisions Act, 1952Document3 pagesSalient Features of The Employees Provident Funds and Miscellaneous Provisions Act, 1952Fency Jenus67% (3)

- CAUSES of OFFENCE AGAINST CHILDDocument14 pagesCAUSES of OFFENCE AGAINST CHILDsanskriti jainNo ratings yet

- Difference Between Civil Contempt and Criminal Contempt Are Given Below: Civil ContemptDocument5 pagesDifference Between Civil Contempt and Criminal Contempt Are Given Below: Civil Contemptshanti priyaNo ratings yet

- Powers of IT AuthoritiesDocument21 pagesPowers of IT AuthoritiesRishika JainNo ratings yet

- Full Bench FormulaDocument8 pagesFull Bench FormulapillardvsgNo ratings yet

- Case Study PEDocument27 pagesCase Study PEHarshada SinghNo ratings yet

- THE CHARGE (Sec 211 To Sec 224) : ShardaDocument20 pagesTHE CHARGE (Sec 211 To Sec 224) : ShardaRohit GargNo ratings yet

- By KK State of Bombay V. The Hospital Mazdoor SabhaDocument13 pagesBy KK State of Bombay V. The Hospital Mazdoor Sabharagya0% (1)

- Case StudyDocument21 pagesCase StudyKiruba Anand100% (1)

- of Tax Law ProjectDocument23 pagesof Tax Law ProjectRajat choudhary100% (2)

- ProjectDocument7 pagesProjectSatyamNo ratings yet

- Income Tax Authorities Powers and DutiesDocument16 pagesIncome Tax Authorities Powers and Dutiesnandan velankarNo ratings yet

- Collection and Furnishing of Credit InformationDocument5 pagesCollection and Furnishing of Credit InformationRishi exportsNo ratings yet

- International Carriage by AirDocument6 pagesInternational Carriage by Airshakti ranjan mohanty100% (1)

- Administrative Law - Bhagat Raja Vs The Union of India 1967Document4 pagesAdministrative Law - Bhagat Raja Vs The Union of India 1967Sunil Sadhwani0% (1)

- The Indian Evidence Act: PRESUMPTION: The Words Presumption Means Things Taken For Granted. inDocument10 pagesThe Indian Evidence Act: PRESUMPTION: The Words Presumption Means Things Taken For Granted. inTaran SainiNo ratings yet

- Vigilantibus Non Dormientibus, Jura SubveniuntDocument4 pagesVigilantibus Non Dormientibus, Jura SubveniuntSanchitNo ratings yet

- Salient Features of The Advocates ActDocument12 pagesSalient Features of The Advocates ActRIDDHI PATHAK0% (1)

- LABOUR LAW Assignment WorkDocument17 pagesLABOUR LAW Assignment WorkJahnaviSinghNo ratings yet

- Salient Features of The Insurance Act, 1938Document3 pagesSalient Features of The Insurance Act, 1938Sriniwas ThakurNo ratings yet

- Guardianship Under Muslim LawDocument13 pagesGuardianship Under Muslim LawHimani Anand100% (2)

- Extinction of EasementsDocument6 pagesExtinction of Easementssai kiran gudisevaNo ratings yet

- Booz Allen & Hamilton Inc. V/S Sbi Home Finance Ltd. & OrsDocument13 pagesBooz Allen & Hamilton Inc. V/S Sbi Home Finance Ltd. & Orssanjana sethNo ratings yet

- Law Assignment - Bangalore Water Supply CaseDocument4 pagesLaw Assignment - Bangalore Water Supply CaseSiddhant SethiaNo ratings yet

- Analysis of Public Corporation As A State and Its Control MechanismDocument18 pagesAnalysis of Public Corporation As A State and Its Control MechanismCharlie Pushparaj100% (1)

- Revenue Receipts and Capital ReceiptsDocument17 pagesRevenue Receipts and Capital Receiptsvivek mishra100% (2)

- Clubbing of Income-10Document7 pagesClubbing of Income-10s4sahithNo ratings yet

- Powers Procedures and Duties of AuthoritiesDocument11 pagesPowers Procedures and Duties of AuthoritiesSamuel pereiraNo ratings yet

- Employer Liability For CompensationDocument6 pagesEmployer Liability For CompensationAdan HoodaNo ratings yet

- Expiry & Repeal of Statutes - IDocument79 pagesExpiry & Repeal of Statutes - IPrasun Tiwari100% (2)

- Indigent Person: A Study: 6.4 Civil Procedure Code and LimitationDocument19 pagesIndigent Person: A Study: 6.4 Civil Procedure Code and LimitationUditanshu Misra0% (1)

- Medical Benefit Council (The Employees State Insurance Act, 1948)Document2 pagesMedical Benefit Council (The Employees State Insurance Act, 1948)Adan Hooda100% (3)

- Industrial Disputes Act 1947: Awards and SettlementDocument8 pagesIndustrial Disputes Act 1947: Awards and SettlementSamuel pereiraNo ratings yet

- Distinguish Between Tax and FeeDocument2 pagesDistinguish Between Tax and FeePrachi Tripathi 42No ratings yet

- Difference Between Tax Avoidance and Tax EvasionDocument3 pagesDifference Between Tax Avoidance and Tax EvasionHay Jirenyaa100% (1)

- GreenplyDocument8 pagesGreenplyRishi AgarwalNo ratings yet

- Role of Bar Council of India in Legal Education: (Company Name)Document2 pagesRole of Bar Council of India in Legal Education: (Company Name)Rishi AgarwalNo ratings yet

- Life in Singapore - : Richa AgarwalDocument2 pagesLife in Singapore - : Richa AgarwalRishi AgarwalNo ratings yet

- SyllabusDocument6 pagesSyllabusRishi AgarwalNo ratings yet

- Chapter - Iv: Tip: To Quickly Find Your Search Term On This Page, Press CTRL+F or - F (Mac) and Use The Find BarDocument39 pagesChapter - Iv: Tip: To Quickly Find Your Search Term On This Page, Press CTRL+F or - F (Mac) and Use The Find BarRishi AgarwalNo ratings yet

- 5.1 The Basics of International Humanitarian LawDocument7 pages5.1 The Basics of International Humanitarian LawRishi AgarwalNo ratings yet

- Geneva Conventions and Additional ProtocolsDocument10 pagesGeneva Conventions and Additional ProtocolsRishi AgarwalNo ratings yet

- NCQC Answer Paper-1Document4 pagesNCQC Answer Paper-1Shyamal KumarNo ratings yet

- On PDMSDocument7 pagesOn PDMSatorresh090675No ratings yet

- Harsha Akka 013759 Unit 13 CRP Report PDFDocument94 pagesHarsha Akka 013759 Unit 13 CRP Report PDFMinda RajanNo ratings yet

- Employee WelfareDocument64 pagesEmployee WelfareJana DxNo ratings yet

- AGI 400 Series Data Sheet 4921240564 UKDocument19 pagesAGI 400 Series Data Sheet 4921240564 UKEdwin PinzonNo ratings yet

- ModelsDocument6 pagesModelsUJJWALNo ratings yet

- Csm-Form SchoolDocument2 pagesCsm-Form SchoolGERLY REYESNo ratings yet

- Middle Ages PacketDocument13 pagesMiddle Ages PacketJess Mtz100% (4)

- Introduction To Social WorkDocument3 pagesIntroduction To Social WorkSheherbano TariqNo ratings yet

- PsychosesDocument32 pagesPsychosesAnonymous zxTFUoqzklNo ratings yet

- PasswordsDocument40 pagesPasswordsŢîbuleac Oliviu75% (12)

- Goodman and Gilman's Sample ChapterDocument17 pagesGoodman and Gilman's Sample Chapteradnankhan20221984No ratings yet

- Esp32-Wroom-32se Datasheet enDocument26 pagesEsp32-Wroom-32se Datasheet enWesllen Dias SouzaNo ratings yet

- CSR ReportDocument13 pagesCSR Reportrishabh agarwalNo ratings yet

- The Relationship Between International Innovation Collaboration, Intramural R&D and Smes' Innovation Performance: A Quantile Regression ApproachDocument6 pagesThe Relationship Between International Innovation Collaboration, Intramural R&D and Smes' Innovation Performance: A Quantile Regression ApproachSurya DhNo ratings yet

- Assigment On Reliance Industry: Master of Business Administration (Talentedge)Document14 pagesAssigment On Reliance Industry: Master of Business Administration (Talentedge)Mayank MalhotraNo ratings yet

- Role of Women in Urban and Rural AreasDocument3 pagesRole of Women in Urban and Rural AreasUmair AltafNo ratings yet

- Cisco Wireless LAN Controller - Configuration Guide PDFDocument696 pagesCisco Wireless LAN Controller - Configuration Guide PDFMiguel MazaNo ratings yet

- Esr 2653Document9 pagesEsr 2653Uğur ErdoğanNo ratings yet

- August 30-Filling Out FormsDocument3 pagesAugust 30-Filling Out FormsJocelyn G. EmpinadoNo ratings yet

- Lenovo A516 Maintenance ManualDocument40 pagesLenovo A516 Maintenance Manualpradipto87No ratings yet

- Combat Patrol - GREY KNIGHTSDocument6 pagesCombat Patrol - GREY KNIGHTSJan PolisiakNo ratings yet

- Uttara Bank Sentence Correction Detailed Explanation FinalDocument5 pagesUttara Bank Sentence Correction Detailed Explanation FinalSajib ChakrabortyNo ratings yet

- Full Download Test Bank For Chemistry Principles and Reactions 8th Edition by Masterton PDF Full ChapterDocument34 pagesFull Download Test Bank For Chemistry Principles and Reactions 8th Edition by Masterton PDF Full Chapteryen.resiege.ffrq100% (15)

- LKPD Bahasa Inggris Kelas VII - Descriptive TextDocument1 pageLKPD Bahasa Inggris Kelas VII - Descriptive TextAhmad Farel HusainNo ratings yet

- Examination of Foot and Ankle JointDocument58 pagesExamination of Foot and Ankle JointSantosh KumarNo ratings yet

- Lesson Plan On Transport MechanismsDocument5 pagesLesson Plan On Transport Mechanismsjecel taray100% (4)

- Neurohealth Properties of Hericium Erinaceus MycelDocument11 pagesNeurohealth Properties of Hericium Erinaceus Myceldokan42No ratings yet

- TestDocument4 pagesTestAlina DushachenkoNo ratings yet

- Tài liệu tiếng Trung HSK5Document1 pageTài liệu tiếng Trung HSK5Nguyễn Ngọc Xuân NghiêmNo ratings yet