Professional Documents

Culture Documents

Ewert2018 PDF

Uploaded by

sandraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ewert2018 PDF

Uploaded by

sandraCopyright:

Available Formats

Effects of Increasing Enforcement on

Financial Reporting Quality and Audit Quality

RALF EWERT* AND ALFRED WAGENHOFER*

*

University of Graz.

Accepted by Haresh Sapra. We thank an anonymous reviewer, Hans Christensen, Pingyang Gao, Ian

Gow, David Grünberger, Trevor Harris, Bjorn Jorgensen, Sebastian Kronenberger, Peter Pope, Joshua

Ronen, Stefan Schantl, Ulf Schiller, Cathy Schrand, participants at the GEABA Conference in

Hamburg, NYU Accounting Summer Camp, EIASM Workshop on Accounting and Regulation, IWP

Wissenschaftsforum, and seminar participants at Columbia University, University of Würzburg,

University of Cluj, London School of Economics, University Carlos III Madrid, University of Chicago,

University of North Carolina at Chapel Hill, London Business School, WHU – Otto Beisheim School of

Management, University of Chile, and University of Melbourne for helpful comments.

November 2018

Abstract

A widely held assumption in policy making and empirical research is that increasing the strength of

public enforcement improves financial reporting quality and audit quality. This paper provides a

more nuanced view. In a model with a manager who can manage earnings, a strategic auditor, and

an enforcement institution, we show that enforcement and auditing are complements in a weak

enforcement regime but can be substitutes in a strong regime. Although stronger enforcement

always mitigates earnings management, the effects of different instruments of strengthening

enforcement are ambiguous. We show that they can improve or impair financial reporting quality

and audit quality, depending on production risk, accounting system characteristics, and the scope of

auditing relative to enforcement.

JEL codes: G38; M41; M42; M48

Keywords: earnings management; enforcement; auditing; financial reporting quality; audit quality.

This article has been accepted for publication and undergone full peer review but has not been

through the copyediting, typesetting, pagination and proofreading process, which may lead to

differences between this version and the Version of Record. Please cite this article as doi:

10.1111/1475-679X.12251.

This article is protected by copyright. All rights reserved.

1. Introduction

Enforcement is an important element of the institutional framework that assures the quality of

financial reporting by listed companies. Empirical studies show that effective enforcement is as

crucial for efficient capital markets and is perhaps even more important than the quality of the

accounting standards themselves (e.g., Ball, Kothari, and Robin [2000], Christensen, Hail, and Leuz

[2013]). Most developed countries have established enforcement institutions, including the SEC’s

Division of Corporation Finance in the United States and national enforcement agencies in European

Union countries, which are coordinated and overseen by the European Securities and Markets

Authority (ESMA). The effectiveness of enforcement differs widely around the world (Brown,

Preiato, and Tarca [2014]), and regulators strive to improve it to foster capital market efficiency

(e.g., SEC [2000], EU [2004]).

A widely held assumption in policy making and empirical research is that greater enforcement is

desirable because it improves financial-reporting and audit quality, and several empirical studies

provide supporting evidence.1 Under this view, primarily the direct costs of enforcement limit its

desirability. Recent papers by Christensen, Liu, and Maffett [2017] and Florou, Morricone, and Pope

[2018] find support for high costs of enforcement to firms, exploiting a change of the enforcement

by the Financial Reporting Review Panel in the United Kingdom. Christensen, Liu, and Maffett [2017]

find that stronger enforcement reduces shareholder wealth. Florou, Morricone, and Pope [2018]

document that stronger enforcement increases audit effort, risk, and fees, particularly for firms

listed on the Alternative Investment Market.

The view that greater enforcement improves financial-reporting and audit quality implicitly is correct

if one assumes that it does not alter the auditor’s strategy. Once one considers direct and indirect

effects, the results can be different. Our paper analyzes the effects of stronger enforcement on

earnings management, financial-reporting and audit quality, and audit fees in an equilibrium setting.

We develop a model in which the owner of a firm hires a manager and a strategic auditor. The

compensation contract designed to motivate the manager to provide productive effort also creates

incentives for upward earnings management. The auditor strategically chooses an effort that

identifies and corrects errors in the preliminary financial report, based on a conjecture of earnings

management and enforcement outcomes. After publication of the audited financial report, the

enforcer investigates. It identifies remaining errors with some probability (the enforcement

intensity) and imposes penalties on the owner, manager, and auditor. Stronger enforcement is

achieved by increasing enforcement intensity or any of the penalties inflicted to the parties.

Our main finding is that auditing and enforcement are complements in a low-intensity enforcement

regime but can become substitutes in a strong regime. The auditor’s incentives to perform a high-

1

See Hope [2003], Ernstberger, Stich, and Vogler [2012], Christensen, Hail, and Leuz [2013], Brown, Preiato,

and Tarca [2014], and Silvers [2016].

This article is protected by copyright. All rights reserved.

quality audit increase with greater enforcement, because the expected penalty rises, and they

decrease with lower anticipated earnings management. In a low-intensity enforcement regime, the

direct effect, through the rise in the expected penalty dominates. In contrast, in a strong regime, the

reduction of earnings management dominates, so that the auditor lowers audit effort. We show

that, even if enforcement crowds out audit effort, earnings management always declines with

enforcement intensity. In contrast, strengthening enforcement, through increasing the penalties on

the manager or auditor, strictly mitigates earnings management. A higher penalty on the auditor

increases audit effort, whereas a higher penalty on the manager does the opposite, because it

discourages earnings management. Endogenizing the compensation contract, we show that the

owner benefits from stronger enforcement, because she can reduce incentive compensation, which

alleviates the manager’s incentives to manage earnings, but this effect is small, relative to the direct

effects.

We use the equilibrium strategies to examine the effects of strengthening enforcement on financial

reporting quality and on audit quality in equilibrium. Our results suggest that the effects depend on

the proxy for financial reporting quality. If it measures intentional errors only, as does the modified

Jones model (Dechow, Sloan, and Sweeney [1995]), then stronger enforcement always increases

financial reporting quality, because it mitigates earnings management. If it measures both

unintentional and intentional errors, as does the Dechow and Dichev [2002] model, then the impact

of stronger enforcement on financial reporting quality depends on the accounting system and the

production environment. The reason is that the accounting system is not perfect and produces

errors that lead to an understatement or overstatement of economic earnings. Through upward

earnings management, the manager makes more overstatements but fewer understatements. If the

corrective function of earnings management on average prevails, deterring it through stronger

enforcement reduces financial reporting quality. Another reason why financial reporting quality can

decline occurs if auditing is broader in scope than enforcement. If enforcement crowds out audit

effort, then the auditor produces less useful information, which decreases financial reporting

quality.

Audit quality can increase or decrease with stronger enforcement. An increase in enforcement

intensity or in the auditor’s penalty strictly increases audit quality in a weak enforcement regime but

can decrease it otherwise. There are two effects: a positive direct effect of the higher intensity or

penalty and a negative indirect effect from mitigating earnings management. Which one prevails

depends on the strength of the enforcement. An increase in the manager’s penalty strictly decreases

audit quality, because it alleviates audit effort. We show that audit fees and the number of

enforcement actions strictly increase with a higher enforcement intensity in a weak enforcement

regime, but that either can decrease otherwise. The number of enforcement actions strictly

decreases with higher penalties for the auditor, manager, or both. Yet the functional form of these

two measures does not fully correspond with that of financial-reporting and audit quality,

respectively.

The main empirical implications of our analyses are as follows. We show that different enforcement

instruments have different, sometimes ambiguous, implications on auditor’s behavior, financial

This article is protected by copyright. All rights reserved.

reporting quality, likelihood of enforcement actions, audit quality, and audit fees. If stronger

enforcement can be attributed to an increase of enforcement intensity or a specific penalty, the

implications of an increase in enforcement can be different. This suggests that the use of composite

indices to measure the strength of an enforcement regime2 may result in inconclusive findings,

because the empirical effects depend on the details by which a certain level of an index has been

reached. Moreover, we show that the predictions vary for different financial reporting proxies.

This paper contributes to recognize and better understand the interactions of earnings

management, auditing, and enforcement and on the resulting accounting outcomes, financial

reporting quality and audit quality. We are not aware of other analytical papers that explicitly study

the economic effects of enforcement and the interaction of enforcement and auditing. However,

this paper relates to several streams of literature that examine earnings management and auditing.

The paper’s productive setting relates to studies of production effort and earnings management in

multi-action agency models. For example, Feltham and Xie [1994] model productive effort and

earnings management (“window dressing”), which are simultaneously induced by the same

information system, and provide insights into the properties of an optimal information system in a

LEN setting. Glover and Levine [2018] assume the manager learns the actual outcome before

managing earnings and can only correct a wrong (low) report, thus allowing that earnings

management can be beneficial. In our paper, the manager can also bias a correct report, but

earnings management can still yield benefits on average. Laux and Laux [2009] study management

compensation by the board of directors, which also decides on oversight effort, and show that these

two decisions are related. Bertomeu, Darrough, and Xue [2017] consider production and earnings

management choices and focus on the optimal bias (conservatism) of the underlying accounting

system. Chan [2016] studies the effect of increasing internal controls on earnings management and

auditing. Laux and Stocken [2018] consider a similar setting but focus on the interaction between

accounting standards and enforcement. Enforcement in their model discovers noncompliance with

some probability and imposes a penalty that increases with stronger enforcement. None of these

papers consider auditing and enforcement jointly.

Other models study earnings management in rational expectations equilibria, in which a manager

biases financial reports to increase the market price of the firm (e.g., Fischer and Verrecchia [2000],

Ewert and Wagenhofer [2011] survey this literature). In these models, auditing and enforcement

implicitly drive the cost of earnings management. Königsgruber [2012] addresses enforcement in

such a model, with the added feature that the manager decides on the investment in a risky project.

He finds that stronger enforcement strictly increases reporting quality but may reduce investment

efficiency, due to over-deterrence of investment in viable projects.3 In contrast, we find that

2

See the composite index constructed by Brown, Preiato, and Tarca [2014].

3

Deng, Melumad, and Shibano [2012] find a related result for increasing auditor liability.

This article is protected by copyright. All rights reserved.

reporting quality can decrease; the reason is that we explicitly model the interaction between

auditing and enforcement.

The auditing literature analyzes audit strategies but does not explicitly consider enforcement. Most

of the papers model a strategic auditor, who maximizes expected utility by the choice of audit effort

(e.g., Antle [1982], Baiman, Evans, and Noel [1987]), as we do. Given that contingent audit fees are

not allowed in most jurisdictions, the motivation for auditors to exert effort in these models usually

results from the risk that the auditor may be held liable if an error is uncovered. Our enforcement

mechanism is explicitly based on its interaction with the audit results. Other papers assume that the

liability arises from shareholder litigation. In that case, the cost to the auditor depends on decisions

by shareholders and on the liability regime (e.g., Ewert [1999], Hillegeist [1999]). In a setting in

which the manager is interested in a high market price of the firm, Patterson, Smith, and Tiras [2016]

study how earnings management and audit effort change if the liability of management, of the

auditor, or of both increase. Other auditing literature considers internal controls implemented

before auditing happens (e.g., Smith, Tiras, and Vichitlekarn [2000], Pae and Yoo [2001]). Ye and

Simunic [2017] study the effect of audit oversight and its interaction with the liability regime on

audit effort and audit market structure.

The paper proceeds as follows. Section 2 describes the model and introduce the underlying

production technology, the accounting system, the discretion for earnings management, auditing,

and public enforcement. Section 3 establishes the equilibrium in the earnings management and

auditing game. Section 4 derives effects of varying the strength of enforcement on equilibrium

earnings management and audit effort. Section 5 examines how strengthening enforcement affects

financial reporting quality, number of enforcement actions, audit quality, and audit fees. Section 6

solves for the optimal compensation contract. Section 7 considers extensions to the model, and

Section 8 concludes with empirical implications.

2. Model

We develop a one-period agency model with the owners of a firm, a manager, an auditor, an audit

oversight institution, and an enforcement institution (the enforcer). In the following, we describe

these elements, their relations, and the production and information technology. The notation is

summarized in the appendix.

2.1. Production technology

The firm owns a production technology that requires the productive input of a manager (effort a),

which determines the outcome that accrues to the owner, together with random events that

capture other productive and environmental factors. The outcome can be the future terminal cash

flow or another output that the owner values. It is represented by a monetary amount x, where x

{xL, xH} and 0 ≤ xL < xH.

We consider a risk neutral owner representing the owners of the firm or the board of directors and

abstract from potential conflicts of interest among different owners or board members. The owner

This article is protected by copyright. All rights reserved.

hires a manager, who is risk neutral and protected by limited liability. The manager chooses a

productive effort a {aL, aH} and incurs a private cost of 0 for aL and V > 0 for aH. The effort

determines the probability with which low and a high output realize: xH occurs with probability p,

upon high effort aH, and with probability q, upon low effort aL, where 1 > p > q > 0. We assume that

the owner wants the manager to exert high productive effort aH, because otherwise there is no

agency problem. Then the expected productive outcome is (1 – p)xL + pxH.

The manager has a reservation utility of zero and, because of limited liability, the compensation paid

must be positive. We assume that x is not contractible or not observable to the owner and to the

manager by the time the manager receives the compensation. Compensation s() ≥ 0 is written on

the audited financial report r {rL, rH}. It is easy to see that a contract s(ri) that induces aH must

satisfy s(rL) < s(rH); that is, the owner pays more compensation if the report is good, because rH is

more likely to occur if the manager chose aH. Moreover, because the manager’s reservation utility is

0 and si ≥ 0, there is no need to overpay the manager, so that s(rL ) = 0 and s ≡ s(rH) > 0, which

reflects a simple bonus contract.

2.2. Accounting system

The firm operates an accounting system that produces a signal y { yL , yH } , where yL < yH, which

the manager privately observes. The signal y is a “raw earnings” number. The accounting system

reports the underlying outcome x imperfectly. Let denote the probability that yL is reported,

although the output is xH (the -error or understatement error), and the probability yH is reported,

although x = xL (the -error or overstatement error). The two errors are influenced by the underlying

uncertainty about the future outcome, accounting standards, and the quality of the firm’s

accounting processes. The probabilities and (0, 1 2) are exogenously given and common

knowledge.

After observing y, the manager can manage earnings and misrepresent the signal to achieve a

financial report m ≠ y. m is the preliminary financial report, which is subject to auditing (see below).

Earnings management includes the choice of probabilities bL ≡ b(yL) and bH ≡ b(yH) with which it is

successful in reporting mi ≠ yi, i = L, H. The cost of earnings management effort is 0 at bi = 0 and

increasing and convex in bi. It captures disutility from, for example, searching for earnings

management opportunities, future disadvantages, loss of reputation, or unethical behavior but not

enforcement penalties that we consider explicitly. We assume a quadratic cost function, vbi2 / 2 ,

where v is a constant scaling factor that is sufficiently high that bi < 1. We show below (Lemma 1)

that this contract induces earnings management only if yL occurs; that is, bH = 0 and bL ≥ 0. Figure 1

summarizes the information flow and indicates out-of-equilibrium strategies by dotted arrows.

This article is protected by copyright. All rights reserved.

Figure 1: Production and information structure

2.3. Auditing

The firm’s financial report is subject to mandatory auditing. The owner hires an auditor at the

beginning of the game. Before contracting, the auditor learns the precision of the accounting system

{, } and uses it to assess the audit risk and plan the audit procedures. After engagement but

before determining audit effort, the auditor receives the manager’s preliminary report m that is

subject to the audit.

The auditor chooses the audit effort, which equals the probability gi, i = L, H, that he observes the

accounting signal y. Providing gi is privately costly to the auditor with a cost of 1

2 kgi2 , where k > 0 is

a parameter that scales the quadratic cost and is sufficiently large to prevent perfect auditing (gi =

1). The audited financial report is as follows.

yi with probability gi ,

ri (1)

mi with probability (1 gi ).

The audit market consists of auditors with similar technologies and is competitive. Consistent with

typical audit regulations, we assume the auditor receives a noncontingent audit fee A > 0. In a

This article is protected by copyright. All rights reserved.

competitive audit market, A is the fee under which the auditor expects to break even on the

engagement; that is, A is determined endogenously.4

After accepting the engagement, the auditor’s objective is to minimize the expected cost of the audit

and of a penalty incurred from any remaining uncorrected errors that are uncovered by

enforcement.

2.4. Enforcement

A public enforcement institution independently investigates audited financial reports. Examples are

the SEC’s Division of Corporation Finance in the United States and national enforcement agencies in

European Union countries. A typical feature is that enforcement investigates financial reports of a

sample of firms after they were audited and published. The sample can be strictly random or chosen

based on some patterns ex ante.

We model public enforcement as a technology. An investigation uncovers the signal yj with some

probability f ∈ *0, 1+, which is uncorrelated with the auditor’s effort gi. We refer to f as the

enforcement intensity that is determined by the budget the enforcer has available for investigations.

For example, allocating a higher budget to the enforcer increases f. Without loss of generality, we

cast our analysis directly in terms of f.

If the enforcer detects yi, the investigation ends without a finding if the report ri equals yi (i = L, H);

otherwise the enforcer initiates an enforcement action, which imposes costs on all parties involved.

These costs include fines, penalties, potential legal liability as well as indirect effects, such as a

reputation loss, and they can be monetary or nonmonetary.

The costs of an enforcement action are penalties CO > 0 on the owner (the firm), C M > 0 on the

manager, and CA > 0 on the auditor. We assume these penalties are not excessive. If CO is large, the

owner will always prefer to induce the low effort aL, and the manager’s compensation can be set

independent of y, which provides no earnings management incentives and avoids enforcement

penalties. We assume fC

M

s to account for the manager’s limited liability and to avoid situations

in which the penalty is so high that the manager never overstates earnings (bL = 0). Since we vary f in

our subsequent analysis, we make the stronger sufficient condition CM ≤ s. A necessary condition for

gi < 1 is fCA/k < 1, and we assume C A / k 1 . Note that the enforcement intensity f and the

penalties CM and CA act as substitutes in determining enforcement strength.

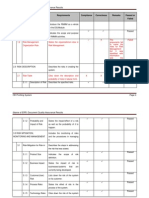

Figure 2 summarizes the sequence of events.

4

The equilibrium we establish does not depend on the competition in the audit market. Once the fee is fixed,

it does not affect the equilibrium strategies.

This article is protected by copyright. All rights reserved.

Figure 2: Timeline

Owner hires manager and engages auditor

Manager provides productive effort a

Manager observes accounting signal y and engages in earnings management b

Preliminary report m is released

Auditor chooses audit effort g, learns y with probability g, and corrects errors (m ≠ y)

Audited report r is published

Manager receives contractual compensation s(r)

Enforcer investigates audited report r, learns y with probability f, and initiates enforcement

action if r ≠ y

O M A

Owner, manager, and auditor suffer penalties C , C , and C respectively from enforcement

action

3. Equilibrium

In this section, we characterize the equilibrium earnings management and auditing strategy given an

incentive-compatible compensation contract. We endogenize the contract in Section 6. All formal

proofs are in the appendix.

The manager chooses bi after observing y = yi to maximize her expected utility, conjecturing the

auditor’s audit strategy gˆ L and gˆ H , where the hat denotes conjectures. The expected utilities are

v

E[U M yL ] prob(rH yL ) s prob(error yL )C M V bL2 ,

2 (2)

v

E[U M yH ] prob(rH yH ) s prob(error yH )C M V bH2 .

2

The terms are the conditional expected compensation, the expected enforcement cost, the disutility

of effort aH, V, and the disutility of earnings management. The probabilities depend on the

productive effort aH (which induces a success probability p > q), the accounting system errors and

, earnings management, and audit effort. They are stated in the proofs.

Lemma 1: Optimal earnings management is bH = 0 and

This article is protected by copyright. All rights reserved.

s CM

bL (1 gˆ H ) 1 f 0. (3)

v s

The lemma confirms that the manager overstates earnings if the initial signal is low, yL, but never

understates high earnings yH. Note that, because gˆ H < 1, even a perfect enforcement (f 1) cannot

fully deter upwards earnings management as long as CM < s.5

The probability of an enforcement action determines the expected cost of enforcement for each of

the parties involved. Observe that there is no risk of an enforcement action if the manager does not

manage earnings. Since the manager has only an incentive to overstate earnings, she manages

earnings bL if the accounting system reports yL. The auditor detects earnings management with

probability gH and corrects it. With probability (1 – gH), earnings management prevails and is

detected by the enforcer with probability f. Taken together, the ex ante probability that the enforcer

initiates an enforcement action and imposes enforcement costs is

prob(error) = prob(yL)bL(1 – gH)f . (4)

The auditor’s strategy is determined as follows. After accepting the audit engagement, the auditor

chooses gi to maximize his expected utility, conditional on the preliminary report mi, i = L, H,

k

U A mi A gi2 prob(error mi ) C A . (5)

2

The expected utility comprises the endogenously determined audit fee A, the cost of audit effort,

and the expected penalty of an enforcement action. Exerting higher effort reduces the probability of

an enforcement action but incurs higher disutility.

Lemma 2: The optimal audit effort levels for mL and mH are: gL = 0 and

prob(yL )bˆL CA

gH f . (6)

prob(yL )bˆL +prob(yH ) k

prob(yL mH )

A perfect Bayesian equilibrium in this manager-auditor game requires that the following conditions

hold, where i, j = L, H:

(i) {bi*} maximizes the manager’s conditional expected utility given conjectures {gˆ j };

5

For example, a clawback provision (e.g., Section 304 of the Sarbanes-Oxley Act and rule 954 of the Dodd-

M

Frank Act) of bonuses based on erroneous financial reports implies C = s, so full deterrence, bL = 0, would

occur for f = 1.

This article is protected by copyright. All rights reserved.

(ii) {g *j } maximizes the auditor’s conditional expected utility given conjectures {bˆi };

the conjectures are fulfilled, i.e., bˆi bi and gˆ j g j .

* *

(iii)

The next proposition establishes a unique equilibrium.

Proposition 1: For any s that induces aH, there exists a unique equilibrium with earnings management

s CM CA

bL* = (1 g H* ) 1 f > 0 and bH

*

= 0 and audit effort g *

L = 0 and g *

H = prob( y L mH ) f

v s k

> 0.

The equilibrium strategies equal those stated in Lemma 1 and 2 (equations (3) and (6)), after

replacing conjectures by the respective other party’s equilibrium strategies. We show in the proof

that this equilibrium is unique. The equilibrium strategies are stated implicitly because they depend

on each other in nontrivial ways.

4. Effects of strengthening enforcement on equilibrium strategies

In this section, we examine how strengthening enforcement affects equilibrium earnings

management bL* and audit effort g H* . We continue to assume an s that induces aH and consider

optimal contracting in Section 0.

Enforcement strength increases in the enforcement intensity f with which the enforcer detects

errors and in the enforcement penalties CO, CM, and CA that it imposes on the owner, manager, and

auditor. A regulator can increase enforcement intensity by increasing the (benevolent) enforcer’s

budget. Penalties are typically bounded from above by considerations that they must be

proportional to the crimes. We show how a variation of each of these parameters individually affects

the equilibrium outcomes. Because we do not include costs of enforcement (by increasing f) and

other considerations (such as the appropriateness of penalties in a legal system), we do not study

the optimal design of an enforcement regime.

4.1. Enforcement intensity

Our first key result is the effect of strengthening enforcement on the equilibrium strategies.

Proposition 2: Increasing enforcement intensity f has the following effects:

(i) bL* strictly decreases;

(ii) g H* strictly increases if f < f0 and strictly decreases if f > f0, where

1 s k

f 0 M g H* ( f 0 ) A . (7)

2C C

This article is protected by copyright. All rights reserved.

Proposition 2 (i) confirms the intuitive result that earnings management strictly decreases in f. Yet

this result is less obvious than it appears. Earnings management and audit effort interact in

equilibrium, so the effect of f on bL* depends on the endogenous behavior of g H* , which is

nonmonotonic.

Proposition 2 (ii) states that equilibrium audit effort g H* strictly increases for low f but can strictly

decrease for high f, depending on whether its maximum is attained within the feasible range of f.

Thus, the proposition establishes a complementary relation between audit effectiveness and

enforcement intensity if it is low and a substitutive relation, or crowding out, if it is high. To see this

result, note that higher f directly increases g H* because it raises the likelihood that the enforcer finds

earnings management. This again increases the expected penalty on the auditor. Then there is an

indirect effect: a higher f mitigates earnings management bL* , which reduces the likelihood that the

audit detects errors. This effect leads to a decrease in audit effort through a decrease in the

probability prob(yLmH) that the low accounting signal prevails, given that the manager’s report is

high. This probability is increasing and strictly concave in earnings management, which implies that

the effect of a lower bL* on prob(yLmH) is stronger the lower bL* becomes. As is apparent from the

expression (6) for the optimal audit effort, the marginal direct increase of g H* for higher f declines in

f, while the indirect negative effect grows. Thus, when earnings management is large, then

increasing f, starting from a low level, increases audit effort strongly and only slightly reduces the

probability prob(yLmH), which determines the auditor’s expected penalty; hence, the direct effect

dominates. When f is already high, then a further increase has a stronger effect on prob(yLmH),

inducing the auditor to exert less audit effort.

*

The enforcement intensity for which g H attains its unique maximum is

1 s k

f 0 M g H* ( f 0 ) A .

2C C

*

Equilibrium audit effort g H decreases in f for f > f0. Given our constraint that CM ≤ s, the value of f0

> 1/2. However, f0 can be greater than 1, so that there is no feasible interval of f in which audit effort

decreases in f. Note that enforcement intensity and enforcement penalties determine the strength

of enforcement. CM and CA drive the threshold f0 directly downward, although equilibrium audit

effort also depends on these penalties.

This article is protected by copyright. All rights reserved.

Figure 3: Enforcement intensity and equilibrium earnings management and audit effort

* *

Figure 3 plots the equilibrium earnings management bL and audit effort g H for the full range of

enforcement intensity f ∈ [0, 1]. The underlying parameter values are p = 0.3, = 0.05, = 0.05, s =

*

0.6, v = 10, CM = 0.5, and CA/k =1. Equilibrium earnings management bL always decreases in

*

enforcement f, whereas equilibrium audit effort g H increases in f up to f0 ≈ 0.62 and then

decreases.

4.2. Enforcement penalties

Enforcement strength increases in the magnitude of penalties of enforcement actions imposed on

the owner (CO), manager (CM), and auditor (CA), respectively.

Proposition 3: Increasing enforcement penalties has the following effects:

(i) bL* and g H* are unaffected by CO;

(ii) bL* and g H* strictly decrease in CM;

(iii) bL* strictly decreases in CA and g H* strictly increases in CA.

The owner’s penalty CO has no immediate effect on the reporting equilibrium because it affects

neither the manager’s nor the auditor’s expected utility directly. Its only effect is that it raises the

owner’s cost of motivating high productive effort aH, which ultimately can become so high that the

owner foregoes implementing aH and prefers the low effort aL, which can be induced by a fixed wage

contract that avoids earnings management altogether.

This article is protected by copyright. All rights reserved.

Proposition 3 (ii) states that the higher the manager’s penalty CM, the lower is equilibrium earnings

management. This effect is a direct consequence of the increasing strength of public enforcement.

However, the lower earnings management induces the auditor to reduce the audit effort in

equilibrium, which indirectly increases the manager’s incentives for earnings management again.

The proposition shows that the direct mitigating effect of a higher penalty on bL* prevails, thus

inducing a strict decrease of earnings management in equilibrium. That is, the intuition does not

hold that, to deter earnings management, one should reduce the manager’s penalty CM so as to

induce more earnings management and, with that, induce the auditor to work harder.

Proposition 3 (iii) states the effect of an increase of the auditor’s penalty CA. A higher penalty CA (or a

*

lower k) directly increases the incentive for the auditor to exert higher audit effort g H . The

increasing audit effort unambiguously reduces equilibrium earnings management. The relevant

parameter for the equilibrium strategies is the ratio CA/k, which reflects the relative importance of

the enforcement penalty relative to the level of the audit effort cost.

5. Effects on accounting outcomes

5.1. Financial reporting quality

An objective of enforcement is to improve the quality of mandatory financial reporting. Financial

reporting quality captures the notion of the usefulness of financial reports for investors’ decisions.

The empirical literature has developed several proxies for earnings quality, which attempt to capture

aspects of information usefulness. In our model, we distinguish two measures based on what is the

underlying benchmark: the (future) outcome x or the preliminary accounting report y. The first

measure captures all errors, intentional or unintentional, whereas the second captures only

intentional errors. Intentional errors arise through earnings management, whereas unintentional

ones include the base accounting errors and .6 For example, the earnings quality measure of

Dechow and Dichev [2002] includes both kinds of errors, whereas the modified Jones model

(Dechow, Sloan, and Sweeney [1995]) includes intentional errors only.

Our first measure defines financial reporting quality as the ex ante probability that the report

accurately informs about the productive outcome x; that is, rH = xH and rL = xL. Given the manager

takes the desired effort aH, this is

FRQ 1 prob(rL )prob(xH rL ) prob(rH )prob(xL rH )

(8)

1 prob(xH , rL ) prob( xL , rH ).

6

Francis, Olsson, and Schipper [2006] similarly distinguish between innate and discretionary sources for

earnings quality.

This article is protected by copyright. All rights reserved.

Here, prob(xH , rL ) is the probability that the report understates the outcome, and prob(xL , rH ) is

the probability that it overstates it. This FRQ definition assumes equal weights of understatement

and overstatement errors.7 The following result states the effect of an increase of the strength of

enforcement on FRQ.

Proposition 4: Financial reporting quality FRQ strictly increases in enforcement intensity f, in the

auditor’s penalty CA, and in the manager’s penalty CM if Q > 0; it strictly decreases in f, CA, and CM if Q

< 0, where

Q ≡ (1 p)(1 ) p . (9)

The proposition shows that FRQ either monotonically increases or decreases in f, in CA and CM,

depending on the sign of the term Q. To see this, we rewrite FRQ by inserting the probabilities,

which yields

FRQ 1 p (1 p) bL (1 g H ) (1 p)(1 ) p . (10)

Base accounting quality Change due to enforcement

FRQ depends on the base accounting quality that is determined by the - and -error and a term

that is affected by a change in equilibrium earnings management and audit effort, both of which are

influenced by enforcement strength. We show in the proof that the term bL (1 g H ) strictly

*

decreases in bL and thus strictly decreases in f, in CA, and in CM.8 The effect on FRQ is therefore

determined by the sign of Q.

Note that the ex ante probability of a report yL is

prob( yL ) (1 p)(1 ) p ,

which consists of two parts: (1 – p)(1 – ) is the probability that x = xL and y = yL, which is a correct

depiction of the economic outcome, while p is the probability that x = xH but the accounting system

falsely reports y = yL. If the manager manages earnings upon observing yL, she reports mH with

*

probability bL > 0. If x = xL, then earnings management disguises the originally correct signal yL,

which adds to an overstatement of the financial report. We call this bad earnings management.

Conversely, if x = xH, then the accounting signal y = yL is incorrect, and upwards earnings

management corrects the understatement error. We call this good earnings management. If Q < 0,

that is,

7

The cost of an under- or overstatement can vary with the individual decision problem in which the financial

report is used. Applying different weights does not qualitatively affect our results.

8 O

A variation of the owner’s penalty C has no direct effect (see Proposition 3 (i)).

This article is protected by copyright. All rights reserved.

(1 p)(1 ) p ,

then the probability that earnings management corrects an understatement error is greater than the

probability that it aggravates an overstatement error. According to Propositions 2 and 3,

strengthening enforcement through either increasing f, CA or CM strictly mitigates bL . Therefore, if

earnings management is bad, then less of it improves financial reporting quality; if it is good, then

less of it reduces financial reporting quality because it diminishes the error-correcting function of

earnings management.

Two notes are in order. First, stronger enforcement still fulfils a primary function, which is

deterrence of earnings management. And second, even if earnings management is good, it is not the

manager’s intent to do something good, but managing earnings still follows from the incentive to

increase compensation.

Figure 4 plots the financial reporting quality FRQ on enforcement intensity f ∈ [0, 1] and three

different productive probabilities p. The underlying parameter values are = 0.2, = 0.2, s = 0.6, v =

10, CM = 0.5, and CA/k =1. p = 0.8 is the knife-edge case in which Q = 0, which implies that FRQ is

unaffected by a change in enforcement strength. A lower p yields a Q > 0, so that earnings

management is bad, in which case increasing enforcement intensity monotonically increases FRQ.

p = 0.7 illustrates this. If p > 0.8, in the Figure p = 0.85, Q < 0 and earnings management is good, so

that FRQ decreases in f.

Figure 4: Enforcement intensity and financial reporting quality

This article is protected by copyright. All rights reserved.

The following corollaries state conditions under which Q is more likely to be negative, with the

consequence that FRQ decreases.

Corollary 1: FRQ is likely to decrease in f, CA, and CM (i.e., Q decreases),

(i) the greater p is;

(ii) the greater the errors and are.

The results follow immediately from the inspection of Q = (1 p)(1 ) p . First, firms that are

more likely to generate high output (high p) make erroneous understatements of accounting signals

more frequently, which are corrected by upward earnings management. Second, the less precise the

base accounting system is—that is, the larger the accounting errors and are—the lower is Q,

because there arise more instances that benefit from a correction.

While less precision tends to generate a negative effect of stronger enforcement on FRQ, accounting

bias has distinct effects depending on the situation. We parameterize conservative accounting by a

parameter ; higher implies higher conservatism. Let , , and denote with

Q the original term Q with and .

Corollary 2: (i) If p ½, greater conservatism strictly decreases FRQ if Q ≤ 0; otherwise the effect is

ambiguous.

(ii) If p < ½, greater conservatism strictly increases FRQ if Q 0; otherwise the effect is ambiguous.

To establish this result, we show in the proof that undetected earnings management bL (1 g H )

strictly decreases in conservatism . To see this, note that a greater increases prob(yL) and

decreases prob(yH) by the same amount, thus increasing prob(yL mH ) and consequently the audit

effort. Intuitively, under higher conservatism, the low accounting signal realizes more frequently and

raises the likelihood that a high preliminary report mH is the result of earnings management. The

auditor responds by increasing the audit effort. There is a countervailing effect because higher audit

effort reduces the manager’s optimal bias, but it is not sufficient to outweigh the positive impact of

.

The probability of understatement and overstatement errors depends on the probability p of the

high outcome xH. If p ½, more conservatism increases the sum of the accounting errors because

This article is protected by copyright. All rights reserved.

the increase in the understatement error is larger than the decrease in the overstatement error.9 As

before, the impact of earnings management depends on the relation between understatement and

overstatement errors. More conservatism reduces undetected earnings management, and FRQ

strictly decreases with greater if p ½ and Q < 0 because then earnings management is good. The

other statements of the corollary follow from a similar reasoning. Taken together, the effect of

conservatism on financial reporting quality depends on the parameters and can be ambiguous.10

Our second measure of financial reporting quality uses the preliminary accounting report y as

benchmark, which is unaffected by earnings management, and it focuses on the effects of auditing

and enforcement on earnings management. Define

FRQ EM 1 prob(rL )prob(yH rL ) prob(rH )prob(yL rH )

(11)

1 prob(yH , rL ) prob( yL , rH ),

where prob(yH , rL ) 0 and prob(yL , rH ) (1 p)bL (1 g H ) .

* *

Proposition 5: Financial reporting quality FRQEM strictly increases in f, CA, and CM.

This result follows directly from the fact that bL (1 g H ) strictly decreases in enforcement intensity f

* *

and the penalties CA and CM, which we have shown in Proposition 4. Since this definition does not

consider the - and -errors that arise in the accounting system, earnings management cannot

correct such errors, and earnings management is always undesirable. Reducing earnings

management thus unambiguously improves financial reporting quality FRQEM.

Comparing the results for both measures of financial reporting quality reveals different effects of

strengthening enforcement. While the effect on FRQEM, which captures earnings management only,

is consistent with conventional intuition, the effect on the more comprehensive FRQ depends on

circumstances, which are the production technology and the accounting system errors. Thus it is

9

This resembles the result in Gigler, Kanodia, Sapra, and Venugopalan [2009] on conservatism in a debt

contracting setting with no earnings management. They show that debt contract efficiency (which is their

measure of accounting quality) declines with more conservatism because the increase in understatement error

dominates the decrease in overstatement error. This result hinges on the assumption of a relatively high

expected outcome, which is akin to p ½ in Corollary 2 (i).

10

Chen, Hemmer, and Zhang [2007] study an agency model with earnings management, but they do not

consider auditing and enforcement. They show that a small amount of conservatism enhances earnings

informativeness and contracting efficiency. While their model’s specifics differ from ours, the impetus is that

conservative accounting mitigates earnings management, which is similar to Corollary 2.

This article is protected by copyright. All rights reserved.

important, in an empirical study, to fit the measure of financial reporting quality to the predictions

and testable hypotheses.

5.2. Likelihood of enforcement actions

A measure of enforcement intensity in empirical studies is the number of enforcement actions

among firms subject to enforcement. In our model, this proportion equals the likelihood that the

enforcer finds an error, which is the ex ante probability (see equation (4))

prob(error) prob( yL )bL* (1 g H* ) f .

An enforcement action occurs if the signal yL realizes, the manager succeeds in overstating earnings

and reports mH, and the auditor does not find the overstatement but the enforcer discovers y = yL.

Proposition 6: (i) An increase of the enforcement intensity f strictly increases the likelihood of an

enforcement action if f < f1 and strictly decreases it if f > f1, where f1 s 2C f 0 .

M

(ii) An increase in the penalties C M or C A strictly decreases the likelihood of an enforcement action.

The proposition suggests that using the likelihood of an enforcement action is a reliable measure for

enforcement strength only under specific circumstances. As we show above, bL (1 g H ) declines in

* *

f; hence increasing the enforcement intensity f causes countervailing effects on prob(error). If the

enforcement level is low, increasing f strictly increases the likelihood of an enforcement action.

However, if enforcement intensity increases, it mitigates earnings management and the likelihood of

an enforcement action decreases. We show in the proof that, due to these countervailing effects,

there exists a level f1 < f0 for which the likelihood of an enforcement action reaches a maximum. In

case f1 exceeds 1, the maximum is outside of the relevant range for f [0,1] and prob(error) strictly

increases for all feasible f.

The proposition further states that an increase in either of the penalties CM and CA strictly decreases

the likelihood of an enforcement action. With greater penalty CM, the manager reduces earnings

management, which implies that the basic need for a correction of the published financial

statements declines. The auditor responds by reducing his audit effort, but as the proof shows, this

effect is eventually not large enough to outweigh the impact of reduced earnings management. A

greater penalty CA induces the auditor to extend his audit effort, thus finding mistakes more

frequently. The manager responds by reducing earnings management. Here, both responses work in

the same direction, and both reduce the likelihood of an enforcement action.

Considering the relation between the likelihood of an enforcement action and financial reporting

quality, we note an enforcement action itself is not free of error. An enforcement action arises in

two distinct events. First, the actual outcome is xL, which is correctly reported by the accounting

system as signal yL. The manager succeeds at overstating earnings as mH. The auditor does not

observe y. Hence the report is rH, but the enforcer finds out yL and initiates an enforcement action.

The probability of this event is

This article is protected by copyright. All rights reserved.

(1 p)(1 )bL* (1 g H* ) f .

Second, the actual outcome is xH, which is incorrectly reported by the signal yL. The manager

succeeds at overstating earnings as mH. The auditor again does not observe y, but the enforcer finds

out yL and initiates an enforcement action. However, given x = xH, the enforcement action wrongly

corrects the (ex post) appropriate financial report. The probability of this event is

p bL* (1 g H* ) f .

Comparing the two probabilities, it is apparent that the error through enforcement is greater than

the corrective function if Q < 0, that is, when earnings management is good.

5.3. Audit quality and audit fees

We next examine the effect of a variation of enforcement strength on audit quality. Our measure for

audit quality is the audit effort the auditor expects to exert in equilibrium, because this effort

increases the probability that the auditor discovers earnings management. Other factors of the audit

technology or competency of the auditor are held constant in our model. Audit quality is defined as

AQ prob(mL )g L* prob(mH )g H*

0 (12)

prob(yL )b prob(yH ) g .

L

*

H

Proposition 7: (i) An increase of the enforcement intensity strictly increases audit quality AQ if f < f2

and strictly decreases it if f > f2, where f 2 f 0 .

(ii) Audit quality AQ strictly decreases in the penalty CM.

(iii) Audit quality AQ strictly increases in the penalty CA for small CA. It always strictly increases in CA if

prob(yH )

bL 2 f 1 0 , (13)

prob(yL )

where f min{1; f 0 ( Ck 1)}.

A

Audit quality AQ is a function of a weighted product of g H and bL , but it can be restated as a

function of bL alone, resulting in

CA

AQ prob(yL )b f .

L

k

A

The crucial term is bL fC , whose impact is ambiguous because bL strictly decreases in f and CA.

Proposition 7 (i) states that AQ is an inverse u-shaped function of enforcement intensity f. Intuitively,

this result follows from Proposition 2 that audit effort is inversely u-shaped. The difference is that

the maximum AQ is achieved at a lower f than the maximum of that of audit effort, that is, f2 < f0.

This article is protected by copyright. All rights reserved.

Therefore, the range of f for which AQ declines in enforcement intensity is greater than that of audit

effort. However, it is possible that f2 > 1 so that AQ always increases in f.

The only monotonic relation is stated in part (ii) of the proposition: AQ strictly decreases in the

manager’s penalty CM. An increase in CM mitigates earnings management, which induces a decrease

of the audit effort and lowers the probability of a high preliminary accounting report mH. Thus ex

ante, the audit effort strictly decreases in CM.

The impact of an increase in CA on audit quality is subtle. Since AQ = 0 if f = 0 or CA = 0 but is strictly

positive for positive f and CA, it strictly increases if CA is originally small. Otherwise, a further increase

of f can decrease audit quality. The behavior of AQ for a variation of CA depends on the ratio of the

probabilities of obtaining the high and low accounting signal, prob(yH ) prob(yL ) . If this ratio

exceeds a threshold, then audit quality always strictly increases in CA. This threshold is defined in

bL 2 f 1 bL 1 ,

implying that the condition (13) holds for a wide set of parameter values. For instance, if prob(yH)

prob(yL), then the condition is always fulfilled. Also, the less conservative the accounting system is,

the higher is prob(yH) and the lower is prob(yL), thus increasing the probability ratio. Intuitively,

audit quality is

AQ prob(mH )g H* .

Hence a less conservative accounting system increases the probability prob(mH) that the high

preliminary accounting signal obtains and the auditor exerts audit effort. This attaches a higher

weight to the positive impact of a greater CA on audit effort and a lower weight on the reduction of

the bias. When the probability ratio is large enough, the positive impact of CA on audit effort always

outweighs the negative impact on earnings management, and audit quality always strictly increases

in CA.

Empirical studies often use audit fees as a measure for (unobservable) audit quality. In our model,

the owner hires the auditor at the beginning of the game, and the audit fee is endogenously

determined in a competitive audit market with homogenous auditors. It is based on the anticipated

audit effort and the expected cost of an enforcement action. In equilibrium, the auditor’s conditional

utility given mH equals

k

U A mH A ( g H* ) 2 prob( yL mH )(1 g H* ) fC A

2

k

A g H* (2 g H* ).

2

If m = mL, the auditor exerts no effort, but because the manager has not managed earnings there is

no cost from enforcement in this case.

This article is protected by copyright. All rights reserved.

The auditor accepts the audit engagement if the expected utility is greater or equal to zero.

Therefore, the required audit fee equals the expected cost of auditing,

k

A prob mH g H* 2 g H*

2 (14)

k

prob yH prob yL b g H* 2 g H* .

L

2

Proposition 8: (i) An increase of the enforcement intensity strictly increases the audit fee A if f < f3

and strictly decreases it if f > f3, where f3 f 2 .

(ii) The audit fee A strictly decreases in the penalty CM.

(iii) The audit fee A strictly increases in the penalty CA for small CA. It always strictly increases in CA if

prob(yH )

bL 3 f 1 0

prob(yL )

where f min{1; f 0 ( Ck 1)}.

A

The functional form of the audit fee is determined by the induced changes on the equilibrium bL

*

and g H . Earnings management bL decreases in f, whereas the effect of f on g H depends on the

level of enforcement before f increases further. Proposition 2 (ii) establishes an inverse u-shaped

effect and a threshold value f0 that g H decreases in f if f > f0. A decrease, dg H df 0 , is a

*

sufficient condition that the equilibrium audit fee declines. Then increasing f not only reduces

earnings management but also the cost of the audit. Conversely, if dg H df 0 , then the cost of

*

audit effort rises and, with it, the necessary fee, whereas the lower earnings management reduces

audit effort again. We show in the proof that these effects result in the existence of a level f3 at

which the audit fee reaches a maximum and that this level is smaller than the enforcement intensity

that maximizes audit quality AQ (which is, in turn, smaller than the level that maximizes audit effort).

Thus, stronger enforcement increases audit fees only if public enforcement is sufficiently weak.

A higher managerial penalty CM strictly decreases the audit fee. This follows because a greater CM

reduces earnings management, which again reduces the probability of obtaining the high

preliminary report mH and audit effort.

An increase of the auditor’s penalty CA has a similar effect on the audit fee as it has on audit quality

(Proposition 7 (iii)), and the same intuition applies. The proposition states a sufficient condition that

A always strictly increases in CA. The only difference is that the required lower bound for P is slightly

greater than the corresponding threshold for audit quality AQ.

This article is protected by copyright. All rights reserved.

Figure 5: Enforcement intensity, audit quality, and audit fee

Figure 5 depicts how enforcement intensity affects equilibrium audit quality AQ and audit fee A. The

underlying parameter values are p = 0.3, = 0.05, = 0.05, s = 0.6, v = 10, CM = 0.5, and CA/k =1.

Audit quality and audit fee are inversely u-shaped in f because its primary determinant is the audit

*

effort g H . The audit fee also explicitly captures expected penalties from enforcement.

6. Optimal bonus contract

As we discuss in Section 0, the optimal compensation contract with the manager is a simple bonus

contract that pays s > 0 if r = rH and 0 if r = rL. The size of the bonus s is crucial to induce the manager

to exert productive effort aH, but it also provides incentives for the manager to manage earnings.

Highly sensitive management compensation, based on accounting numbers, has often been accused

of providing strong incentives for managers to manage earnings, and there have been several

corporate governance initiatives aimed at constraining management bonuses. Yet such constraints

would also discourage the manager’s productive effort.

We begin with recording the effects of the bonus s on earnings management and on audit effort in

equilibrium.

Corollary 3: Increasing the bonus s has the following effects:

*

(i) bL strictly increases;

*

(ii) g H strictly increases.

This article is protected by copyright. All rights reserved.

A greater s increases the incremental benefit of earnings management, which provides stronger

incentives to manage earnings. And the higher earnings management induces higher audit effort in

equilibrium. While the higher audit effort mitigates earnings management, which works against the

direct increase through higher s, the corollary establishes that the net effect is an increase in

earnings management, so the direct effect prevails.

In our analysis so far, we have assumed the bonus s is predetermined, which reflects the fact that, at

the beginning of the game, the owner hires the manager and writes the compensation contract.

Later, there is a change in the strength of enforcement, but the contract is unchanged. We now

derive the optimal contract, under the assumption that the owner can write a new contract or adjust

an existing contract, with the manager after a change in enforcement strength. We assume that the

owner is a Stackelberg leader in the game, that is, she writes the compensation contract ex ante, and

it is observable to the auditor.

The owner chooses s to maximize the expected utility,

E[U O aH ] (1 p) xL pxH prob(rH )s A prob(error)C O . (15)

Audit fee

Expected outcome Expected compensation Expected cost

of enforcement

It consists of the expected outcome, the manager’s expected compensation, the (equilibrium) audit

fee, and the expected cost of enforcement in case the enforcer detects an error in the financial

report and penalizes the owner at CO.

The manager’s reservation utility is always satisfied because of the limited liability constraint, that is,

s ≥ 0, and the reservation utility is normalized to 0. Because we assume the owner wants to

implement aH, the bonus must be sufficiently high to induce the manager to choose the productive

effort aH over aL. The manager’s incentive compatibility constraint is

E[U M aH ] E[U M aL ] .

The expected utility when choosing aH is

v

E[U M aH ] prob(rH )s V prob( yL ) bL*2 prob( yL )bL* (1 g H* ) fC M .

2

E[U M aL ] is the expected utility if the manager chooses the out-of-equilibrium effort aL and also

the out-of-equilibrium earnings management bLL bL ( g H aL ), 11 whereas the auditor still

* *

* *

conjectures (aH , bL ) and does not adjust the equilibrium audit strategy g H :

11 *

We prove in Proposition 9 that equilibrium earnings management is independent of a, i.e., bLL bL* .

This article is protected by copyright. All rights reserved.

v *2

E[U M aL ] prob(rH aL )s prob( yL aL ) bLL prob( yL aL )bLL

*

(1 g H* ) fC M .

2

The following result obtains.

Proposition 9: The optimal bonus is

V v

s bL2 . (16)

p q 1 2

Strengthening enforcement by increasing f, CM, or CA strictly decreases s*.

The optimal bonus compensates the manager for productive effort and earnings management. The

compensation for productive effort is just high enough to motivate the manager to induce her to

exert effort aH, and it is higher than the disutility V depending on (p – q), which is the difference in

productivity from the two actions and the precision of the accounting system (1 – – ). The bonus

includes full compensation for the induced earnings management.

Proposition 9 also shows that strengthening enforcement through either instrument, enforcement

intensity f or the penalties CM and CA, lowers the optimal bonus s*. Intuitively, the manager’s

expected utility depends on the information content of the financial report rH, which is affected by

* * *

the equilibrium strategies bL and g H . An increase in f or a penalty CM or CA decreases bL ; thus, the

owner can reduce the amount of the bonus and still motivate the manager to choose aH. The

owner’s penalty in case of an enforcement action, CO, does not affect the bonus. A higher CO

increases the owner’s expected cost of inducing high productive effort; hence, if CO grows too large,

the owner is better off paying flat compensation and inducing the manager to exert low effort aL,

which eliminates earnings management and avoids an enforcement action.

A lower optimal bonus also mitigates earnings management (Corollary 3), which has an indirect

effect on the equilibrium, because audit effort may go down. The next proposition assures that our

main results continue to hold when s* is endogenous.

Proposition 10: With an endogenous bonus s*, equilibrium earnings management bL and audit effort

g H behave as follows:

(i) bL strictly decreases in f, CM and CA.

(ii) An increase of the enforcement intensity f strictly increases the audit effort g H if f < f4

and strictly decreases it if f > f4.

(iii) g H strictly decreases in CM.

(iv) g H strictly increases in CA.

This article is protected by copyright. All rights reserved.

Proposition 10 (i) reflects the fact that the reduction of the bonus reinforces the direction of the

change in earnings management caused by the direct effect of an increase in the respective

parameter. Part (ii) confirms that the inverse u-shaped function of equilibrium audit effort in f holds

when s* is endogenous. The fact that s* strictly decreases in f reinforces a negative effect of

enforcement intensity on audit effort.12 Similarly, part (iii) of the proposition follows from the fact

that the optimal bonus strictly decreases in the penalty CM, thus reinforcing the negative direct

impact of CM on audit effort. Finally, part (iv) states that audit effort strictly increases in CA, which is

less obvious, as there are two countervailing effects of the penalty CA. Audit effort increases in CA

directly but decreases, due to the lower bonus. As we establish in the proof, the positive effect of

higher CA outweighs the negative effect.

As we show in Section 5, financial reporting quality and audit quality ultimately depend on the

behavior of bL for strengthening enforcement, Proposition 10 implies that our earlier results also

carry over to an endogenous contracting setting.

There may be contracts other than our simple bonus contract. For example, the contract can be

augmented with a clawback provision. That is, if the enforcer finds and publishes an error, the owner

can require the manager to repay a bonus. The manager’s expected compensation becomes

prob(rH )s prob(error) s ,

and the expected clawback prob(error)s increases the expected utility of the owner. The

introduction of a clawback provision does not alter our main results.

A more complex contract is a truth-telling contract, in which the owner requests a report yR from the

manager about y and makes compensation contingent on yR and r. Under the conditions underlying

the revelation principle, a payoff-equivalent truth-inducing contract can then be implemented,

which prevents earnings management. The auditor chooses the audit effort sequentially rationally

12

This suggests f4 < f0, i.e., with endogenous bonus, crowding out of auditing occurs already for lower f than

with fixed bonus, but the relation is subtler because in the setting of Proposition 2 (where we establish f0), the

bonus is set arbitrarily subject only to s CM and the manager’s incentive compatibility constraint. However,

we show in the proof of Proposition 10 that for each f and a corresponding bonus s*(f) for which crowding

would occur holding s*(f) constant, there is also crowding out with an endogenous bonus.

This article is protected by copyright. All rights reserved.

and exerts no effort. Enforcement is still effective because it is nonstrategic, but it will never find an

error, because the manager does not manage earnings; as a consequence, there is no enforcement

cost on the auditor. There is still a role for enforcement, because it improves contracting by making

it cheaper to induce truth-telling. The manager’s out-of-equilibrium strategy of managing earnings

becomes costlier with increased enforcement. But auditing is of no value and does not occur in such

a setting. Since we do observe earnings management and auditing in practice, the conditions for a

truth-telling contract are likely limited.

7. Extensions

7.1. Auditor generates additional information

We assume that auditing and public enforcement have basically the same audit or investigation

technologies available. That is, the auditor uncovers the raw earnings (signal y) with probability g,

which is determined by costly audit effort, and the enforcer uncovers the signal yj with probability f.

The probabilities g and f are uncorrelated. If g was nonstrategic, we would always have increasing

earnings-management deterrence by increasing either g or f. With a strategic choice of g by the

auditor, we show that earnings management still decreases but g and f are strategic complements

for low f and strategic substitutes for high f.

In reality, the scope and depth of an audit is greater than that of an enforcement investigation.13 An

audit comprises tests of controls and substantive procedures, including analytical procedures and

tests of details, for example, providing audit evidence of physical inventory, bank balances, loan

quality, and the like, to identify material misstatements. Enforcement does usually not perform tests

of internal controls or completeness of the bookkeeping system and inventory but instead focuses

on critical accounting positions, many of which are subject to high judgment. Thus, the scope of

enforcement is much more limited; in other words, the enforcer does not perform another audit.

Recall that our reporting system contains two kinds of errors: one is an intentional error introduced

by earnings management, but another comes from the imprecision of the accounting system to

capture the productive outcome x perfectly, symbolized by the -error and the -error. A key

determinant of - and -errors is the effectiveness of the firm’s internal controls. The effectiveness

of internal controls is subject to an assessment by the auditor, who has to report on control

weaknesses.

13

For the variety of audit activities, see Dye [1993, 1995], Schwartz [1997], Chan and Pae [1998], Pae and Yoo

[2001], Chan and Wong [2002], Laux and Newman [2010], and Ye and Simunic [2013, 2017].

This article is protected by copyright. All rights reserved.

In the following, we capture these differences by assuming that the auditor learns both the raw

accounting signal y and additional information about the true outcome x, for example, by probing

into the internal controls, thus effectively learning about - or -errors. For parsimony, we simply

assume that the auditor observes {x, y} with probability g. In practice, there are limits to learning x,

but all that we want to achieve is to model that auditing has more scope than enforcement.

To add structure, assume that, since x is always more informative than y, the auditor corrects the

financial report to include x rather than y whenever they are observed. The audited financial report

is as follows:

xi with probability gi

ri

mi with probability (1 gi ).

If the enforcer obtains yi, the investigation ends without a finding if the report ri equals yi (i = L, H);

otherwise the enforcer alleges an error. However, if the auditor discovered x during his audit, he can

present evidence that ri = xi, and the enforcer accepts this evidence and ends the investigation. If the

enforcer finds out yi ≠ rj and there is no evidence about x available, the enforcer states an error and

imposes penalties to the parties.

The inclusion of superior auditing does not alter the main results of the analysis. In particular,

*

Proposition 2 still holds, which states that increasing enforcement intensity f, bL strictly decreases

* *

and the behavior of g H is inversely u-shaped. That is, enforcement f and g H are complements for

low f and substitutes for high f.

The main difference lies in the effect of increasing enforcement intensity on financial reporting

quality FRQ. The next result describes the effects, where we hold the bonus s constant to be able to

compare it with Proposition 4.

Corollary 4: If auditing provides more information than enforcement investigations,

(i) FRQ can be nonmonotonic in enforcement intensity;

(ii) FRQ can decrease even if earnings management is bad as long as f is sufficiently high.

The corollary follows immediately from Proposition 4 and the fact that the information auditing can

*

provide depends on the level of audit effort g H . The probability of an error in the financial reports,

after auditing and enforcement, is the same as stated in (10), but the auditor’s corrective function by

substituting x for r is now valuable and improves FRQ in its own right. As long as a higher

*

enforcement intensity increases g H as well, it reinforces the improvement of FRQ that we describe

This article is protected by copyright. All rights reserved.

in Section 0. However, if enforcement crowds out auditing (i.e., g H* declines in f), the superior

corrective function of auditing is also reduced. In this case, FRQ can decrease, even if earnings

*

management is bad (Q > 0). The corrective effect is highest at the maximum g H at f = f0, and a

further increase in f reduces financial reporting quality by crowding out the auditor’s effort, which

must then be weighed against the direct benefit of the higher f in case of bad earnings management.

7.2. Audit oversight

In our main analysis, we assume that the incentives for the auditor to exert effort stem from the

expected penalty CA if the enforcer finds an error later. Recall the expected utility of the auditor

from (5) is

k

U A mi A gi2 prob(error mi ) C A ,

2

where the audit fee A is fixed already and avoiding CA is traded off against higher audit effort g. Since

audit fees are noncontingent in most jurisdictions, auditors face several other disciplining

mechanisms that substitute for the lack of continent fees, specifically audit oversight and legal

liability.

Audit oversight institutions, for example, the U.S. Public Company Accounting Oversight Board

(PCAOB), monitor auditors and can penalize them if they do not follow the auditing standards, even

if financial reports turn out to be correct later. We can include audit oversight parsimoniously by

assuming that it ensures that the auditor exerts a minimum audit effort level 0 < g < 1, regardless of

the audit risk of the client and strategic incentives.

Our main results are structurally unaffected by the introduction of g as long as the equilibrium audit

* *

effort g H > g . Otherwise the audit effort g H = g and is not chosen strategically any more. Hence

auditing with g makes it a technology just like our enforcement.

Legal liability arises through litigation by investors who relied on the audited report. Litigation is

typically triggered if an enforcement action was initiated or if it becomes apparent that the audited

report was wrong. If investors sue the manager and the auditor after an enforcement action, the

effect of legal liability is mainly an increase in CM and CA. If it is based on later indicators, litigation is

asymmetric in that investors sue only if the firm reported rH and the actual outcome turned out to

be xL (ignoring issues of hindsight).14 Litigation is another strategic decision that can affect our

results. The interrelation between enforcement and litigation is an interesting topic for further

research.

14

See Chan and Pae [1998] and Ewert [1999].

This article is protected by copyright. All rights reserved.

8. Empirical implications and conclusions

This paper challenges the conventional view that increasing enforcement of financial reporting

always increases financial reporting quality and audit quality. This view neglects the fact that the

strategies of managers and auditors are jointly determined in equilibrium and depend on each other.

Our main result is that increasing enforcement intensity increases audit effort if the enforcement

regime is relatively weak and decreases audit effort if the opposite is true. The reason for this

crowding out is that audit effort is driven not only by enforcement but also by the anticipated

earnings management, which is mitigated by stronger enforcement. This result has an immediate

consequence on audit effort, which therefore increases and then decreases in enforcement

intensity.

We show that financial reporting quality does not always improve with greater enforcement

strength. It mainly depends on the proxy for financial reporting quality. One reason why earnings

management can be good is that, by managing earnings upwards, it corrects understatement errors

that arise in the accounting processes. Alleviating earnings management can then have a negative

effect. Another reason is that enforcement is limited in scope, compared to auditing, and therefore

crowding out auditing diminishes financial reporting quality. Summarizing these results, we establish

that strengthening enforcement (before systemic enforcement costs) is desirable but “too much”

enforcement can become detrimental.

We also examine several empirical measures that relate to enforcement effectiveness and derive the

following predictions that can guide empirical tests.

Financial reporting quality (earnings quality): Our results suggest different predictions

dependent on the proxies used for earnings quality.

(i) If the proxy predominantly captures earnings management,15 stronger enforcement

increases financial reporting quality, because it unambiguously mitigates earnings

management.

(ii) If the proxy is comprehensive and captures both unintentional and intentional errors,16 the

predictions are ambiguous. Stronger enforcement tends to increase financial reporting quality

in firms or industries that have a low probability of success, in firms with more effective