Professional Documents

Culture Documents

Valuation Handbook

Uploaded by

Pedro DiasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Valuation Handbook

Uploaded by

Pedro DiasCopyright:

Available Formats

Market Results

Through 2016

ValuSource

800-825-8763 Preview Version

sales@valusource.com

www.valuationhandbook.com

www.valusource.com

2017

Valuation Handbook

U.S. Guide to Cost of Capital (Preview Version)

This document is an abbreviated “Preview Version” of the key year-end (December 31, 2016)

valuation data available in the hardcover 2017 Valuation Handbook – U.S. Guide to Cost of

Capital.

This document is made available to purchasers who have pre-ordered the 2017 Valuation

Handbook – U.S. Guide to Cost of Capital. The purpose of this document is to provide key year-

end 2016 valuation data to pre-order purchasers while the hardcover 2017 Valuation Handbook

– U.S. Guide to Cost of Capital is being printed.

The 2017 Valuation Handbook – U.S. Guide to Cost of Capital will ship in mid-March 2017, and

will include two sets of valuation data:

Data previously available in the SBBI® Valuation Yearbook; and

Data available in the Duff & Phelps Risk Premium Report.

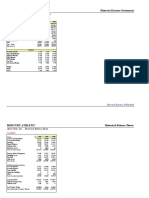

CRSP Deciles Size Premia Study: Key Variables

As of December 31, 2016

Yield (Risk-free Rate)

Long-term (20-year) U.S. Treasury Coupon Bond Yield 2.72%

Equity Risk Premium1

Long-horizon expected equity risk premium (historical) : large company stock total

returns minus long-term government bond income returns 6.94

Long-horizon expected equity risk premium (supply-side) : historical equity risk

premium minus price-to-earnings ratio calculated using three-year average earnings 5.97

Duff & Phelps recommended equity risk premium (conditional) : The Duff & Phelps

recommended ERP was developed in relation to (and should be used in conjunction

with) a 3.5% “normalized” risk-free rate.2 5.50

CRSP Deciles Size Premium3

Market Capitalization Market Capitalization Size Premium

of Smallest Company of Largest Company (Return in

Decile (in millions) (in millions) Excess of CAPM)

Mid-Cap 3-5 $2,392.689 – $10,711.194 1.02%

Low-Cap 6-8 569.279 – 2,390.899 1.75

Micro-Cap 9-10 2.516 – 567.843 3.67

Breakdown of CRSP Deciles 1-10

1-Largest $24,361.659 – $609,163.498 -0.35%

2 10,784.101 – 24,233.747 0.61

3 5,683.991 – 10,711.194 0.89

4 3,520.566 – 5,676.716 0.98

5 2,392.689 – 3,512.913 1.51

6 1,571.193 – 2,390.899 1.66

7 1,033.341 – 1,569.984 1.72

8 569.279 – 1,030.426 2.08

9 263.715 – 567.843 2.68

10-Smallest 2.516 – 262.891 5.59

Breakdown of CRSP 10th Decile

10a $127.296 – $262.891 4.09%

10w 190.553 – 262.891 3.10

10x 127.296 – 190.383 5.33

10b $2.516 – $127.279 8.64%

10y 73.561 – 127.279 7.21

10z 2.516 – 73.504 11.63

1

See Chapter 3 for complete methodology.

2

See Exhibit 3.19.

3

See Chapter 7 for complete methodology.

Note: Examples on how these variables can be used are found in Chapter 8.

Sources of underlying data: 1.) CRSP U.S. Stock Database and CRSP U.S. Indices Database © 2017 Center for Research in Security Prices (CRSP®),

University of Chicago Booth School of Business. 2.) Morningstar Direct database. Used with permission. All rights reserved. Calculations performed

by Duff & Phelps, LLC.

2017 Valuation Handbook – U.S. Guide to Cost of Capital (Preview Version) 19

You might also like

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideFrom EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideNo ratings yet

- DuffphelpsDocument1 pageDuffphelpsG ChaddiNo ratings yet

- Duffphelps RF Erp CRSP 5-21-2019Document1 pageDuffphelps RF Erp CRSP 5-21-2019G ChaddiNo ratings yet

- Duff and Phelps Report (HOVENSA Refinery)Document186 pagesDuff and Phelps Report (HOVENSA Refinery)A Renewal of VI PoliticsNo ratings yet

- Simple LBO ModelDocument14 pagesSimple LBO ModelSucameloNo ratings yet

- Creating Value From Mergers and Acquisitions - ToCDocument7 pagesCreating Value From Mergers and Acquisitions - ToCredaek0% (1)

- Danske Bank - Credit Research Bane Nor Eiendom As PDFDocument21 pagesDanske Bank - Credit Research Bane Nor Eiendom As PDFDiego García VaqueroNo ratings yet

- Lbo Model Long FormDocument6 pagesLbo Model Long FormadsadasMNo ratings yet

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenNo ratings yet

- Duff and Phelps Equity Risk PremiumDocument20 pagesDuff and Phelps Equity Risk PremiumAparajita SharmaNo ratings yet

- SSRN Id3550293 PDFDocument143 pagesSSRN Id3550293 PDFKojiro Fuuma100% (1)

- Apply Size Premium MetricsDocument4 pagesApply Size Premium MetricsmarianoveNo ratings yet

- Leverage Buyout - LBO Analysis: Investment Banking TutorialsDocument26 pagesLeverage Buyout - LBO Analysis: Investment Banking Tutorialskarthik sNo ratings yet

- 07 DCF Steel Dynamics AfterDocument2 pages07 DCF Steel Dynamics AfterJack JacintoNo ratings yet

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Document6 pagesDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezNo ratings yet

- Case Study Cost of CapitalDocument60 pagesCase Study Cost of CapitalcranpiseNo ratings yet

- 1993-00 A Closed-Form Solution For Options With Stochastic Volatility With Applications To Bond and Currency Options - HestonDocument17 pages1993-00 A Closed-Form Solution For Options With Stochastic Volatility With Applications To Bond and Currency Options - Hestonrdouglas2002No ratings yet

- Risk Premium DamodaranDocument208 pagesRisk Premium DamodaranVeronica GetaNo ratings yet

- 108 04 Merger Model AC Case Study AfterDocument2 pages108 04 Merger Model AC Case Study AfterPortgas H. NguyenNo ratings yet

- Mercury Athletic Historical Income StatementsDocument18 pagesMercury Athletic Historical Income StatementskarthikawarrierNo ratings yet

- Ib Case MercuryDocument9 pagesIb Case MercuryGovind Saboo100% (2)

- Colgate-Financial-Model-Solved-Wallstreetmojo ComDocument34 pagesColgate-Financial-Model-Solved-Wallstreetmojo Comapi-300740104No ratings yet

- M&A CaseDocument5 pagesM&A CaseRashleen AroraNo ratings yet

- Audit Committee Quality of EarningsDocument3 pagesAudit Committee Quality of EarningsJilesh PabariNo ratings yet

- Loan and Revolver For Debt Modelling Practice On ExcelDocument2 pagesLoan and Revolver For Debt Modelling Practice On ExcelMohd IzwanNo ratings yet

- GX Global Chemical 2017 ReportDocument20 pagesGX Global Chemical 2017 ReportarrivaNo ratings yet

- Bank ValuationsDocument20 pagesBank ValuationsHenry So E DiarkoNo ratings yet

- Mergers & AcquisitionsDocument2 pagesMergers & AcquisitionsRashleen AroraNo ratings yet

- Fitch Special Report US Private Equity Overview October 2010Document19 pagesFitch Special Report US Private Equity Overview October 2010izi25No ratings yet

- 13 Introduction To Insurance Financial StatementsDocument1 page13 Introduction To Insurance Financial StatementsOladipupo Mayowa PaulNo ratings yet

- JetBlue Airways IPO ValuationDocument15 pagesJetBlue Airways IPO ValuationThossapron Apinyapanja0% (2)

- Corp - Restructuring, Lbo, MboDocument54 pagesCorp - Restructuring, Lbo, MboRaveendra RaoNo ratings yet

- q2 Valuation Insights Second 2020 PDFDocument20 pagesq2 Valuation Insights Second 2020 PDFKojiro FuumaNo ratings yet

- Merger Model PP Allocation BeforeDocument100 pagesMerger Model PP Allocation BeforePaulo NascimentoNo ratings yet

- Competitive Advantage PeriodDocument6 pagesCompetitive Advantage PeriodAndrija BabićNo ratings yet

- Jazz Pharmaceuticals Investment Banking Pitch BookDocument20 pagesJazz Pharmaceuticals Investment Banking Pitch BookdaniellimzyNo ratings yet

- Company Valuation MultiplesDocument7 pagesCompany Valuation Multiplessebastianflyte77No ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- Lambda IndexDocument9 pagesLambda IndexTamanna ShaonNo ratings yet

- PG DCF ReportDocument28 pagesPG DCF Reportapi-515224062No ratings yet

- How Do Investment Banks Value Initial Public Offerings (Ipos) ?Document32 pagesHow Do Investment Banks Value Initial Public Offerings (Ipos) ?mumssrNo ratings yet

- Weeks 1 To 4 Fundamental AnalysisDocument166 pagesWeeks 1 To 4 Fundamental Analysismuller1234No ratings yet

- Datar MathewsDocument12 pagesDatar MathewsLukito Adi NugrohoNo ratings yet

- Starboard Darden Sept 2014 294 Slide Deck PPT PDF PresentationDocument294 pagesStarboard Darden Sept 2014 294 Slide Deck PPT PDF PresentationAla BasterNo ratings yet

- Financiam Modling FileDocument104 pagesFinanciam Modling FileFarhan khanNo ratings yet

- Wind Valuation ModelDocument87 pagesWind Valuation ModelprodiptoghoshNo ratings yet

- Tax Equity Financing and Asset RotationDocument38 pagesTax Equity Financing and Asset RotationShofiul HasanNo ratings yet

- Tax Equity Financing and Asset RotationDocument18 pagesTax Equity Financing and Asset RotationShofiul HasanNo ratings yet

- LBO Analysis CompletedDocument9 pagesLBO Analysis CompletedVenkatesh NatarajanNo ratings yet

- 10 BrazosDocument20 pages10 BrazosAlexander Jason LumantaoNo ratings yet

- Forecasting Debt and InterestDocument16 pagesForecasting Debt and InterestRnaidoo1972No ratings yet

- Carbonomics - Re-Imagining Big Oils - The Age of Transformation PDFDocument68 pagesCarbonomics - Re-Imagining Big Oils - The Age of Transformation PDFPhilip EffendyNo ratings yet

- 50 13 Pasting in Excel Full Model After HHDocument64 pages50 13 Pasting in Excel Full Model After HHcfang_2005No ratings yet

- Credit Risk: Pricing, Measurement, and ManagementFrom EverandCredit Risk: Pricing, Measurement, and ManagementRating: 1 out of 5 stars1/5 (2)

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- Financial Risk Modelling and Portfolio Optimization with RFrom EverandFinancial Risk Modelling and Portfolio Optimization with RRating: 4 out of 5 stars4/5 (2)

- Investment Environment and Investment Management Process-1Document1 pageInvestment Environment and Investment Management Process-1CalvinsNo ratings yet

- United States District Court Central District of California: 8:21-Cv-00403-Jvs-AdsxDocument114 pagesUnited States District Court Central District of California: 8:21-Cv-00403-Jvs-Adsxtriguy_2010No ratings yet

- Closing America's Infrastructure Gap:: The Role of Public-Private PartnershDocument42 pagesClosing America's Infrastructure Gap:: The Role of Public-Private PartnershrodrigobmmNo ratings yet

- Mary Kay Inventory - NSD Diana SumpterDocument6 pagesMary Kay Inventory - NSD Diana SumpterMaryKayVictims0% (1)

- Partnership & ClubsDocument8 pagesPartnership & ClubsGary ChingNo ratings yet

- Idec 8301381772Document1 pageIdec 8301381772denny palimbungaNo ratings yet

- Pakistan Water and Power Development Authority: (In Quadruplicate)Document2 pagesPakistan Water and Power Development Authority: (In Quadruplicate)AsadAli100% (1)

- Financial Performance of Retail Sector Companies in India-An AnalysisDocument7 pagesFinancial Performance of Retail Sector Companies in India-An Analysisaniket jadhavNo ratings yet

- Important Points of Our Notes/Books:: TH THDocument42 pagesImportant Points of Our Notes/Books:: TH THpuru sharmaNo ratings yet

- Overhead Costing - NotesDocument6 pagesOverhead Costing - NotesMohamed MuizNo ratings yet

- Islamic Banking: Financial Institutions and Markets Final ProjectDocument27 pagesIslamic Banking: Financial Institutions and Markets Final ProjectNaina Azfar GondalNo ratings yet

- For Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEADocument21 pagesFor Use With Business Analysis and Valuation 6e by Palepu, Healy and Peek (ISBN 9781473779075) © 2022 Cengage EMEAFilip PopovicNo ratings yet

- R1508D933901 - PS4S26-V1 Assessment PointDocument31 pagesR1508D933901 - PS4S26-V1 Assessment PointRue Spargo Chikwakwata100% (3)

- Module 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGDocument12 pagesModule 1.3 Understanding The Entity and Its Environment Including IC - For POSTINGMae Gamit LaglivaNo ratings yet

- Property Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693Document8 pagesProperty Valuation: Valuation Number: 1021106693NHC UPI: 1/02/11/06/693fido1983No ratings yet

- Strategy With MACD and ADX 21 5 2017Document3 pagesStrategy With MACD and ADX 21 5 2017Anant MalaviyaNo ratings yet

- Summary - Rule 68 71Document32 pagesSummary - Rule 68 71Allana NacinoNo ratings yet

- Reinstatement of Provision of Earnest Money Deposit (Er (D) in BidsDocument10 pagesReinstatement of Provision of Earnest Money Deposit (Er (D) in BidsDevesh Kumar PandeyNo ratings yet

- Intro To Income TaxDocument4 pagesIntro To Income TaxJennifer Arcadio100% (1)

- 10.digest. NG Cho Cio VS NG DiogDocument2 pages10.digest. NG Cho Cio VS NG DiogXing Keet LuNo ratings yet

- Bank of Maharashtra History INFORMATIONDocument3 pagesBank of Maharashtra History INFORMATIONbharatNo ratings yet

- Portfolio NestleDocument26 pagesPortfolio NestleSivapradha PalaniswamiNo ratings yet

- CFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameDocument20 pagesCFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameVaibhav SarinNo ratings yet

- Internship Report On ZahidJee Textile Mills LimitedDocument81 pagesInternship Report On ZahidJee Textile Mills LimitedDoes it Matter?100% (11)

- CH 21 TBDocument18 pagesCH 21 TBJessica Garcia100% (1)

- Margin of Safety Formula - Guide To Performing Breakeven AnalysisDocument4 pagesMargin of Safety Formula - Guide To Performing Breakeven AnalysisGerald HandersonNo ratings yet

- Fac1502 2022 TL101 3 BDocument18 pagesFac1502 2022 TL101 3 BLeané LandmanNo ratings yet

- Assignment On MoneybhaiDocument7 pagesAssignment On MoneybhaiKritibandhu SwainNo ratings yet

- Lira District Report of The Auditor General 2015 PDFDocument59 pagesLira District Report of The Auditor General 2015 PDFlutos2No ratings yet