Professional Documents

Culture Documents

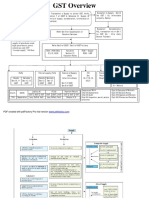

GST Overview

Uploaded by

prince2venkat0 ratings0% found this document useful (0 votes)

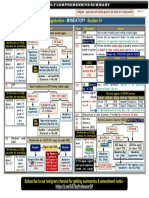

157 views17 pagesThe document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms related to GST such as aggregate turnover, taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover registration, classification of goods and services, levy of tax, time and place of supply, input tax credit, and compliance requirements. The document also maps the interrelationships between different aspects of GST such as liability, payment, refund, assessments, audits, inspections, and penalties.

Original Description:

GST

Original Title

Gst Flowchart Icai

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms related to GST such as aggregate turnover, taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover registration, classification of goods and services, levy of tax, time and place of supply, input tax credit, and compliance requirements. The document also maps the interrelationships between different aspects of GST such as liability, payment, refund, assessments, audits, inspections, and penalties.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

157 views17 pagesGST Overview

Uploaded by

prince2venkatThe document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms related to GST such as aggregate turnover, taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover registration, classification of goods and services, levy of tax, time and place of supply, input tax credit, and compliance requirements. The document also maps the interrelationships between different aspects of GST such as liability, payment, refund, assessments, audits, inspections, and penalties.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 17

GST Overview

Is Transaction a Supply to attract GST, Verify Exception to Supply - Sch III

Registration Sec 22, 23,24 No GST ( Ex, immovable

Check Definitions of Section 7 of CGST & Schedule III Supply (8

forms of supply, consideration, furtherance of property, Salary)

“aggregate turnover"

aggregate value of all taxable business)

supplies

“taxable supply” supply

leviable Exception: Consideration

“non-taxable supply” supply Refer Sch II for Classification of NIL, transaction not in Sch I

not leviable to tax Goods or Services no GST (Ex : Intra state

Sec 9(1)(2) excludes levy on Branch Transfer)

the supply of alcoholic liquor

for human consumption, the

supply of petroleum crude,

high speed diesel, petrol, Refer Sec 9 of CGST / Sec 5 of IGST for Levy

natural gas and ATF

“exempt supply” Nil Rate Rate ( HSN/SAC) Valuation RCM – Supply

0,5,12,18,28 Section 15 RCM - URP

Valuation Rules

PoPs Time of supply (ToS) Nature of Supply ITC Transitional Compliances

(NoS) Sec Provisions Chpt VII – Tax invoice

Goods Services Goods Services (Inter/Intra State) 16,17,18,19, Chapter XX VIII – Accounts & Records

Sec 10, 11 Sec 12, 13 Sec 12 Sec 13 20,21 IX – Returns

IGST IGST CGST CGST Sec 7 of IGST, X – Payment of Tax

Sec 9 of CGST XI – Refund

Department Work Chpt XV Demands & Recovery

Liability (A) ITC (B) Payment/Refund

Month GSTIN Chpt XII Assessments Chpt XVII Advance Ruling

CGST SGST IGST CGST SGST IGST CGST SGST IGST Chpt XIII Audit Chpt XVIII Appeals and Revision

TOS Registration Levy, PoPs & NoS Levy, PoPs & NoS Chapter X, XI Chpt XIV Inspection, search, seizure Chpt XIX Offences and Penalties

and arrest

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

“aggregate turnover" means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable

by a person on reverse charge basis,

“taxable supply” means a supply of goods or services or both which is leviable to tax under this Act;

“non-taxable supply” means a supply of goods or services or both which is not leviable to tax under this Act or under the Integrated

Goods and Services Tax Act;

Sec 9(1)(2) excludes levy on the supply of alcoholic liquor for human consumption, the supply of petroleum crude, high speed diesel,

petrol, natural gas and ATF

“exempt supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax

under section 11, or under section 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supply;

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

PDF created with pdfFactory Pro trial version www.pdffactory.com

You might also like

- GST Section ListDocument7 pagesGST Section ListRahul ThapaNo ratings yet

- One Day Before Exam - N23 NewDocument16 pagesOne Day Before Exam - N23 NewVikash AgarwalNo ratings yet

- JGarg's GST Certificate Course, Rs.6000, Extensive and DetailedDocument2 pagesJGarg's GST Certificate Course, Rs.6000, Extensive and DetailedGaurav GargNo ratings yet

- GSTR 9 & 9C-A Practical Approach: CA D.S.Agarwala & CA Vikash Kumar Banka Siliguri Branch of EIRC, Siliguri 11.08.2019Document71 pagesGSTR 9 & 9C-A Practical Approach: CA D.S.Agarwala & CA Vikash Kumar Banka Siliguri Branch of EIRC, Siliguri 11.08.2019Subrata PodderNo ratings yet

- Idt Compiler 2.0 CA Final New by CA Ravi AgarwalDocument402 pagesIdt Compiler 2.0 CA Final New by CA Ravi AgarwalAnisha PujNo ratings yet

- RMC No. 21-2022Document3 pagesRMC No. 21-2022Shiela Marie MaraonNo ratings yet

- CA - Inter GST Important Questions Answers Part 2 May2023Document12 pagesCA - Inter GST Important Questions Answers Part 2 May2023Vishal AgrawalNo ratings yet

- Tax Memo14-OCT-2015 PDFDocument43 pagesTax Memo14-OCT-2015 PDFMuhammad Sameer AzharNo ratings yet

- 18 GSTDocument1,042 pages18 GSTSwetaNo ratings yet

- Paper 11 NEW GST PDFDocument399 pagesPaper 11 NEW GST PDFsomaanvithaNo ratings yet

- GST Scanner by DG SirDocument41 pagesGST Scanner by DG SirvishnuvermaNo ratings yet

- Training On GST - CAG - 20180221 PDFDocument287 pagesTraining On GST - CAG - 20180221 PDFSuresh Kumar YathirajuNo ratings yet

- Inu 2216 Idt - Suggested AnswersDocument5 pagesInu 2216 Idt - Suggested AnswersVinil JainNo ratings yet

- Annual Return - Salem BranchDocument23 pagesAnnual Return - Salem BranchSureshkumarNo ratings yet

- Tax Revision Plan With Hrs and MarksDocument7 pagesTax Revision Plan With Hrs and MarksKukuNo ratings yet

- A Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered PersonsDocument8 pagesA Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered Personsजयकरण शर्माNo ratings yet

- Goods & Service Tax (GST) Is A Huge Reform For Indirect Taxation in IndiaDocument49 pagesGoods & Service Tax (GST) Is A Huge Reform For Indirect Taxation in IndiaGauharNo ratings yet

- GST Ready Reckoner 2020 - 10062020Document240 pagesGST Ready Reckoner 2020 - 10062020P S AmritNo ratings yet

- Understanding Indirect TaxDocument98 pagesUnderstanding Indirect TaxIndhuja MNo ratings yet

- Section - 24 GST REGDocument1 pageSection - 24 GST REGraj pandeyNo ratings yet

- 2.2016 Syllabus Paper-18 - Jan21 Indirect Tax Laws & Practice Study NotesDocument972 pages2.2016 Syllabus Paper-18 - Jan21 Indirect Tax Laws & Practice Study NotesRadhakrishnaraja RameshNo ratings yet

- Problem 5-1 QuarterDocument6 pagesProblem 5-1 QuarterAlexis KingNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- TCS Statement Details for DSV JewellersDocument1 pageTCS Statement Details for DSV Jewellerssuneet bansalNo ratings yet

- Harsh Shah - Input Tax Credit - 27!4!17-Ilovepdf-CompressedDocument63 pagesHarsh Shah - Input Tax Credit - 27!4!17-Ilovepdf-Compresseddinesh kasnNo ratings yet

- Chapter 4Document26 pagesChapter 4Kritika JainNo ratings yet

- Msme 22230723Document214 pagesMsme 22230723Selvakumar MuthurajNo ratings yet

- GSTR-9 AND GSTR-9C - InwardDocument18 pagesGSTR-9 AND GSTR-9C - InwardRahul KLNo ratings yet

- GST Audit PowerpointDocument62 pagesGST Audit PowerpointBiswakesh PatiNo ratings yet

- GSTR-9C ReconciliationDocument12 pagesGSTR-9C ReconciliationShrishti enterprisesNo ratings yet

- Finance Bill 2010Document51 pagesFinance Bill 2010riddhivakhariaNo ratings yet

- GST: Part I: Overview of GST, GST Model & Levy of TaxDocument67 pagesGST: Part I: Overview of GST, GST Model & Levy of TaxikballNo ratings yet

- GST Audit Report PDFDocument12 pagesGST Audit Report PDFSagar BadaniNo ratings yet

- Satish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Indirect TaxDocument5 pagesSatish Pradhan Dnyanasadhana College: Department of BMS Sample MCQ Questions Subject: Indirect TaxSallu SaleemNo ratings yet

- GSTV70P4 November 27 December 3 (PG 144) SamplechapterDocument2 pagesGSTV70P4 November 27 December 3 (PG 144) SamplechapterSatyakanth SunkaraNo ratings yet

- Iff 27aalcp0659e1zb 102022Document3 pagesIff 27aalcp0659e1zb 102022Agent Hero Pvt LtdNo ratings yet

- STReturn With Annexures 74131613Document22 pagesSTReturn With Annexures 74131613Usmän MïrżäNo ratings yet

- Input Tax Credit Under GSTDocument35 pagesInput Tax Credit Under GSTGiri SukumarNo ratings yet

- Original 1692010361 Cs Project Report TemplateDocument12 pagesOriginal 1692010361 Cs Project Report TemplatedeepakasopaNo ratings yet

- Paper 11Document27 pagesPaper 11kajal mundhraNo ratings yet

- CGST Act 2017Document63 pagesCGST Act 2017Vijai AnandNo ratings yet

- 201936173129323STFE Return 16 17 PDFDocument13 pages201936173129323STFE Return 16 17 PDFAsad ZahidNo ratings yet

- Bos 25158Document12 pagesBos 25158naman jainNo ratings yet

- Principles of Taxation Law Paper 5.3Document22 pagesPrinciples of Taxation Law Paper 5.3mg9433822No ratings yet

- Dipn 02Document38 pagesDipn 02Difanny KooNo ratings yet

- COOPER INDUSTRIES LTD 10-K (Annual Reports) 2009-02-24Document230 pagesCOOPER INDUSTRIES LTD 10-K (Annual Reports) 2009-02-24http://secwatch.com100% (1)

- GST Refund ProcessDocument5 pagesGST Refund ProcessG L SWAMYNo ratings yet

- GSTR-9C Reconciliation FormDocument12 pagesGSTR-9C Reconciliation Formdeepika pandeyNo ratings yet

- CA Final IDT A MTP 1 May 2024 Castudynotes ComDocument13 pagesCA Final IDT A MTP 1 May 2024 Castudynotes Comamanjain254No ratings yet

- STReturnWithAnnexures74845607August2018 PDFDocument5 pagesSTReturnWithAnnexures74845607August2018 PDFMahmood AkhtarNo ratings yet

- GST Readiness: A Roadmap for BusinessesDocument140 pagesGST Readiness: A Roadmap for BusinessesJeethender Kummari KuntaNo ratings yet

- Paper 11 New PDFDocument443 pagesPaper 11 New PDFAnand KumarNo ratings yet

- CA Final GST and Customs Flow Charts Nov 2018Document173 pagesCA Final GST and Customs Flow Charts Nov 2018Amar ShahNo ratings yet

- Iff 27aalcp0659e1zb 082022Document3 pagesIff 27aalcp0659e1zb 082022Agent Hero Pvt LtdNo ratings yet

- Final New Indirect Tax Laws Test 1 Detailed May Solution 1617180196Document10 pagesFinal New Indirect Tax Laws Test 1 Detailed May Solution 1617180196CAtestseriesNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- SAP Streaming - Analytics - Whats - New PDFDocument66 pagesSAP Streaming - Analytics - Whats - New PDFprince2venkatNo ratings yet

- Prazna SlamaDocument115 pagesPrazna SlamaDuke Togo100% (3)

- Customer Churn Prediction in Telecom Industry: Sourav Sarkar (Group 7)Document30 pagesCustomer Churn Prediction in Telecom Industry: Sourav Sarkar (Group 7)prince2venkat100% (1)

- Secret To Foolproof PresentationsDocument208 pagesSecret To Foolproof PresentationsAlex SeeNo ratings yet

- R Sravani: ResumeDocument2 pagesR Sravani: Resumeprince2venkatNo ratings yet

- GST OverviewDocument17 pagesGST Overviewprince2venkatNo ratings yet

- NITTE FormDocument1 pageNITTE Formprince2venkatNo ratings yet

- Tally interview accounting featuresDocument5 pagesTally interview accounting featuresprince2venkatNo ratings yet

- An Introductory Study On Time SeriesDocument67 pagesAn Introductory Study On Time Seriesdstar13No ratings yet

- O B I A 11.1.1.10.1 E A M A: Racle Usiness Ntelligence PplicationsDocument29 pagesO B I A 11.1.1.10.1 E A M A: Racle Usiness Ntelligence Pplicationsprince2venkatNo ratings yet

- Oracle BI Applications 11 1 1 9 2 Upgrade Guide PDFDocument92 pagesOracle BI Applications 11 1 1 9 2 Upgrade Guide PDFprince2venkatNo ratings yet

- Time SeriesDocument51 pagesTime Seriesprince2venkatNo ratings yet

- 10 Generation Family Tree FormDocument90 pages10 Generation Family Tree Formprince2venkatNo ratings yet

- Fresher - FinanceDocument1 pageFresher - FinanceLindsay SummersNo ratings yet

- ProjectDocument138 pagesProjectprince2venkatNo ratings yet

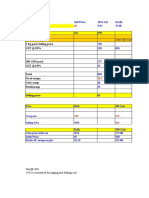

- Price Per Scoop: Sell Price 18% GST Profit 9.92 55.08Document9 pagesPrice Per Scoop: Sell Price 18% GST Profit 9.92 55.08prince2venkatNo ratings yet

- Functional Guy - Devendra Gulve - Data Flow For Order-To-Cash CycleDocument11 pagesFunctional Guy - Devendra Gulve - Data Flow For Order-To-Cash Cycleprince2venkatNo ratings yet

- Advance SQL Queries: Posted by Amar Alam at LabelsDocument3 pagesAdvance SQL Queries: Posted by Amar Alam at Labelsprince2venkatNo ratings yet

- Timeseries PDFDocument67 pagesTimeseries PDFprince2venkatNo ratings yet

- DV V3.0 New Features Overview: June 2017Document25 pagesDV V3.0 New Features Overview: June 2017prince2venkatNo ratings yet

- Order To Cash FlowDocument4 pagesOrder To Cash Flowprince2venkatNo ratings yet

- Hadoop Hdfs Commands Cheatsheet PDFDocument2 pagesHadoop Hdfs Commands Cheatsheet PDFprince2venkat67% (3)

- OTBI vs OBIA: Key Differences Between Oracle's Real-Time and Data Warehouse BI SolutionsDocument1 pageOTBI vs OBIA: Key Differences Between Oracle's Real-Time and Data Warehouse BI Solutionsprince2venkatNo ratings yet

- Time SeriesDocument4 pagesTime Seriesprince2venkatNo ratings yet

- New Features in Data Visualization Desktop 12.2.2 and OBIEE 12.2.1.2Document32 pagesNew Features in Data Visualization Desktop 12.2.2 and OBIEE 12.2.1.2prince2venkatNo ratings yet

- DB InstallDocument1 pageDB Installprince2venkatNo ratings yet

- Order To Cash Technical FlowDocument5 pagesOrder To Cash Technical Flowprince2venkatNo ratings yet

- Order To Cash Cycle Technical FlowDocument9 pagesOrder To Cash Cycle Technical Flowprince2venkatNo ratings yet

- Order To Cash Cycl1Document8 pagesOrder To Cash Cycl1prince2venkatNo ratings yet

- Strategic Marketing by Cravens and Piercy (9/e) : Chap-11 Pricing Strategy and ManagementDocument48 pagesStrategic Marketing by Cravens and Piercy (9/e) : Chap-11 Pricing Strategy and ManagementFahmiatul Jannat100% (1)

- Developing Effective Communications: Cadbury's Targeted CampaignsDocument10 pagesDeveloping Effective Communications: Cadbury's Targeted Campaignsviv3kswamyNo ratings yet

- BCG Building An Integrated Marketing and Sales Engine For B2B June 2018 NL Tcm9 196057Document8 pagesBCG Building An Integrated Marketing and Sales Engine For B2B June 2018 NL Tcm9 196057OIGRESNo ratings yet

- FAR.0724 - Trade and Other ReceivablesDocument12 pagesFAR.0724 - Trade and Other ReceivablesDenise Abbygale Ganzon100% (1)

- Research - India FMCG Sector: Liberty Shoes (Rs262) - BUYDocument15 pagesResearch - India FMCG Sector: Liberty Shoes (Rs262) - BUYVicky SarafNo ratings yet

- CH 07Document49 pagesCH 07ChristyNo ratings yet

- Appraising and Developing Yourself For An Entrepreneurial CareerDocument8 pagesAppraising and Developing Yourself For An Entrepreneurial CareerMaybelyn Umali Catindig100% (1)

- The Undercover Economist - ReviewDocument6 pagesThe Undercover Economist - ReviewVasu Gandhi100% (2)

- T Ax Invo Ice: Mukul Singh Mukul SinghDocument1 pageT Ax Invo Ice: Mukul Singh Mukul SinghMukul Singh100% (1)

- Marketing and Operation PlanDocument9 pagesMarketing and Operation PlanUme NaomiNo ratings yet

- PHysical Inventory in SAPDocument16 pagesPHysical Inventory in SAPVishnu Kumar SNo ratings yet

- What Is DumpingDocument36 pagesWhat Is DumpingMargieAnnPabloNo ratings yet

- Think and Grow RichDocument350 pagesThink and Grow RichEdet Bassey Essien100% (39)

- "Feed" Novel EssayDocument4 pages"Feed" Novel EssayAndrei VolcovNo ratings yet

- Accounting for Installment SalesDocument61 pagesAccounting for Installment SalesRiza Mae AlceNo ratings yet

- LT ContractsDocument4 pagesLT ContractsJon LeinsNo ratings yet

- Tanishq Jewellery Market ResearchDocument41 pagesTanishq Jewellery Market Researchrekha14vermaNo ratings yet

- PEPSIDocument64 pagesPEPSIManish Kumar0% (1)

- 04profit and LossDocument23 pages04profit and LossRajaDurai RamakrishnanNo ratings yet

- 17 Chap - Module 3 - Product LifecycleDocument7 pages17 Chap - Module 3 - Product LifecycleraisehellNo ratings yet

- Bawai's Group of RestaurantDocument14 pagesBawai's Group of RestaurantMarc Jason Cruz Delomen100% (1)

- Dixon Ticonderoga Case StudyDocument4 pagesDixon Ticonderoga Case StudyVineet SinghNo ratings yet

- CH 05Document68 pagesCH 05Lê JerryNo ratings yet

- Discuss and Identify The Key Affecting The Sales Organization and Sales Managers TodayDocument8 pagesDiscuss and Identify The Key Affecting The Sales Organization and Sales Managers TodayHas LizaNo ratings yet

- Literature Review and SurveyDocument4 pagesLiterature Review and SurveyBalkrishna KarmaNo ratings yet

- Types of businesses - advantages, disadvantages and financial planningDocument4 pagesTypes of businesses - advantages, disadvantages and financial planningEnea NastriNo ratings yet

- B2B Marketing Strategy for IT Solutions ProviderDocument27 pagesB2B Marketing Strategy for IT Solutions ProviderMuneeb Ur-RehmanNo ratings yet

- Ethical Issues in The Process of Determining Fair Price and Just WageDocument3 pagesEthical Issues in The Process of Determining Fair Price and Just WageIchu Patan-aoNo ratings yet

- Roll No.: 01 Name: Sonia Agarwal Email-IdDocument23 pagesRoll No.: 01 Name: Sonia Agarwal Email-IdSoniaagarwal2$No ratings yet

- VP Retail Store Operations in ST Louis MO Resume Karen DannerDocument3 pagesVP Retail Store Operations in ST Louis MO Resume Karen DannerKarenDannerNo ratings yet