Professional Documents

Culture Documents

Earnings Highlight - PRESCO PLC FY 2016

Uploaded by

Law0 ratings0% found this document useful (0 votes)

38 views1 pageEarnings Highlight - PRESCO PLC FY 2016

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEarnings Highlight - PRESCO PLC FY 2016

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views1 pageEarnings Highlight - PRESCO PLC FY 2016

Uploaded by

LawEarnings Highlight - PRESCO PLC FY 2016

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

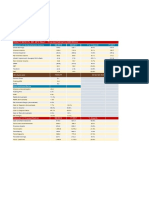

PRESCO PLC FY:2016 Result - Financial Highlights (NGN Billion)

Statement of Comprehensive Income FY 2016 FY 2015 Y-o-Y Growth

Gross Revenue 15.7 10.4 50.4%

Cost of Sales (4.4) (3.8) 15.5%

Gross profit 11.3 6.6 70.5%

Operating Expenses (4.6) (3.1) 46.6%

Operating Profit (EBIT) 6.7 3.5 91.9%

Gain on Biological Asset 24.7 1.1 2223.8%

Finance Cost (0.7) (0.7) -3.3%

PBT 31.2 4.2 641.0%

Taxation (9.5) (1.7) 451.4%

PAT 21.7 2.5 771.9%

Per share data PRESCO Corporate Actions

Current Price 47.00 Proposed Dividend NGN 1.50

Trailing EPS 21.74

BVPS 52.1 Dividend Yield 3.2%

Price multiples/Ratios

Shares outstanding(bn) 1.0 Qualification Date n/a

Trailing P/E 2.2x

P/BV 0.9x Closure Date n/a

RoAE 52.1%

RoAA 31.4% Payment Date n/a

Gross Profit Margin 72.0% 63.5%

NET Margin 138.3% 23.9% AGM Venue n/a

OPEX Margin 29.3% 30.0%

Cost of Sales Margin 28.0% 36.5% AGM Date n/a

Leverage 11.4% 19.4%

Statement of Financial Position FY 2016 FY 2015 Y-o-Y Growth

Inventories 1.4 1.1 28.5%

Trade and Other Receivables 1.1 2.8 -60.6%

Cash and Cash equivalents 2.6 0.9 194.8%

Total Assets 83.2 55.5 49.9%

Total Equity 52.1 31.4 66.2%

Total Borrowings 6.0 6.1 -2.0%

Total Liabilities 31.0 24.1 28.7%

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Adjustment and Impulse Control DisordersDocument19 pagesAdjustment and Impulse Control DisordersArchana50% (4)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Benokraitis, Benokraitis Nijole Vaicaitis - Marriages & Families - Changes, Choices, and Constraints-Pearson (2015)Document617 pagesBenokraitis, Benokraitis Nijole Vaicaitis - Marriages & Families - Changes, Choices, and Constraints-Pearson (2015)colleen100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Purnanandalahari p3D4Document60 pagesPurnanandalahari p3D4anilkumar100% (1)

- IRP 22 Risk Register 2015Document30 pagesIRP 22 Risk Register 2015Jeya Kumar100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- SPE-193424-MS Chevron 2018Document17 pagesSPE-193424-MS Chevron 2018LawNo ratings yet

- Trade GuideDocument41 pagesTrade GuideVictor BenNo ratings yet

- ATLAS CYLINDER LUBRICATOR MANUALDocument36 pagesATLAS CYLINDER LUBRICATOR MANUALKaleb Z king webNo ratings yet

- Captain EWT Program Management and ExecutionDocument12 pagesCaptain EWT Program Management and ExecutionLawNo ratings yet

- Avanto Magnet System Error MessagesDocument21 pagesAvanto Magnet System Error MessagesMuhammad Ahmad75% (4)

- MATH 8 QUARTER 3 WEEK 1 & 2 MODULEDocument10 pagesMATH 8 QUARTER 3 WEEK 1 & 2 MODULECandy CastroNo ratings yet

- Earnings Highlight - Access Bank Full Year 2017Document1 pageEarnings Highlight - Access Bank Full Year 2017LawNo ratings yet

- Spe 167573 MSDocument23 pagesSpe 167573 MSLawNo ratings yet

- The New BicycleDocument1 pageThe New BicycleLawNo ratings yet

- Earnings Highlight - Stanbic IBTC Full Year 2017Document1 pageEarnings Highlight - Stanbic IBTC Full Year 2017LawNo ratings yet

- Earnings Highlight - Wema Bank Full Year 2017Document1 pageEarnings Highlight - Wema Bank Full Year 2017LawNo ratings yet

- Earnings Highlight - Stanbic IBTC Full Year 2017Document1 pageEarnings Highlight - Stanbic IBTC Full Year 2017LawNo ratings yet

- Earnings Highlight - FIDELITY BANK Plc. 9M 2018Document1 pageEarnings Highlight - FIDELITY BANK Plc. 9M 2018LawNo ratings yet

- Earnings Highlight - DANGSUGAR PLC 9M 2016Document1 pageEarnings Highlight - DANGSUGAR PLC 9M 2016LawNo ratings yet

- Earnings Highlight - Guaranty Trust Bank PLC Fy 2018Document1 pageEarnings Highlight - Guaranty Trust Bank PLC Fy 2018LawNo ratings yet

- Earnings Highlight - Forte Oil Nigeria PLC Fy 2017Document1 pageEarnings Highlight - Forte Oil Nigeria PLC Fy 2017LawNo ratings yet

- Market Update For February 6, 2019Document3 pagesMarket Update For February 6, 2019LawNo ratings yet

- Earnings Highlight - Forte Oil Nigeria PLC Fy 2017Document1 pageEarnings Highlight - Forte Oil Nigeria PLC Fy 2017LawNo ratings yet

- Earnings Highlight - NESTLE FYDocument1 pageEarnings Highlight - NESTLE FYLawNo ratings yet

- Earnings Highlight - Forte Oil Nigeria PLC Fy 2017Document1 pageEarnings Highlight - Forte Oil Nigeria PLC Fy 2017LawNo ratings yet

- Forte Oil Nigeria FY2016 Results - Key Financial MetricsDocument1 pageForte Oil Nigeria FY2016 Results - Key Financial MetricsLawNo ratings yet

- Basics of Business Valuation MethodsDocument24 pagesBasics of Business Valuation MethodsLawNo ratings yet

- ExcelFormulas PDFDocument9 pagesExcelFormulas PDFLawNo ratings yet

- Valuation Factors&MethodsDocument10 pagesValuation Factors&MethodsPavan GVSNo ratings yet

- LBSDecember2018 ProshareDocument73 pagesLBSDecember2018 ProshareLawNo ratings yet

- Earnings Highlight - Okomu Oil PLC FY 2017Document1 pageEarnings Highlight - Okomu Oil PLC FY 2017LawNo ratings yet

- A Common Sense Approach To Analyzing Bank StocksDocument1 pageA Common Sense Approach To Analyzing Bank StocksLawNo ratings yet

- SPE-192942-MS - An Innovative Workflow For The Petrophysical Characterization of Tight Gas Reservoirs in Argentina PDFDocument21 pagesSPE-192942-MS - An Innovative Workflow For The Petrophysical Characterization of Tight Gas Reservoirs in Argentina PDFLawNo ratings yet

- SPE-192600-MS - Use of Multi Detector Pulsed Neutron Technologies To Address The Challenges With Saturation Surveillance in Rumaila, IraqDocument15 pagesSPE-192600-MS - Use of Multi Detector Pulsed Neutron Technologies To Address The Challenges With Saturation Surveillance in Rumaila, IraqLawNo ratings yet

- SPE-192600-MS - Use of Multi Detector Pulsed Neutron Technologies To Address The Challenges With Saturation Surveillance in Rumaila, IraqDocument15 pagesSPE-192600-MS - Use of Multi Detector Pulsed Neutron Technologies To Address The Challenges With Saturation Surveillance in Rumaila, IraqLawNo ratings yet

- IRP 22 Risk Register 2015Document11 pagesIRP 22 Risk Register 2015LawNo ratings yet

- Booklet English 2016Document17 pagesBooklet English 2016Noranita ZakariaNo ratings yet

- Course Introduction: Collection and Presentation of Data The Frequency Distribution Graphical Presentation of DataDocument61 pagesCourse Introduction: Collection and Presentation of Data The Frequency Distribution Graphical Presentation of DataShekinah Vingno LingcongNo ratings yet

- Participatory Assessment of Ragay Gulf Resources and SocioeconomicsDocument167 pagesParticipatory Assessment of Ragay Gulf Resources and SocioeconomicsCres Dan Jr. BangoyNo ratings yet

- Newly Constructed Masculinity' in Mahesh Dattani's Dance Like A ManDocument4 pagesNewly Constructed Masculinity' in Mahesh Dattani's Dance Like A ManIJELS Research JournalNo ratings yet

- Year 2 - Push and Pull FPDDocument18 pagesYear 2 - Push and Pull FPDRebecca LNo ratings yet

- VIACRYL VSC 6250w/65MP: Technical DatasheetDocument2 pagesVIACRYL VSC 6250w/65MP: Technical DatasheetPratik MehtaNo ratings yet

- Rise of NationalismDocument19 pagesRise of NationalismlolaNo ratings yet

- Theories of Translation12345Document22 pagesTheories of Translation12345Ishrat FatimaNo ratings yet

- ARTS 9 Q4 Week 1Document3 pagesARTS 9 Q4 Week 1Elaissa MaglanqueNo ratings yet

- ExportDocument18 pagesExportDolon MukherjeeNo ratings yet

- Black BeautyDocument70 pagesBlack BeautyMeryem DevirgenNo ratings yet

- Food 8 - Part 2Document7 pagesFood 8 - Part 2Mónica MaiaNo ratings yet

- GDcorrespondencecourselessons 165Document8 pagesGDcorrespondencecourselessons 165olly rathboneNo ratings yet

- Captive Screws - Cap Head: Hex. SocketDocument5 pagesCaptive Screws - Cap Head: Hex. SocketvikeshmNo ratings yet

- Goldenberg and Reddy (2017)Document10 pagesGoldenberg and Reddy (2017)Mariana ToniniNo ratings yet

- School readiness assessmentDocument10 pagesSchool readiness assessmentJave Gene De AquinoNo ratings yet

- Manage a micro business with BSB30315Document3 pagesManage a micro business with BSB30315Theo A W JacksonNo ratings yet

- Implementing a JITD system to reduce bullwhip effect and inventory costsDocument7 pagesImplementing a JITD system to reduce bullwhip effect and inventory costsRaman GuptaNo ratings yet

- My RepublicDocument4 pagesMy Republicazlan battaNo ratings yet

- Chair Locker Provides Storage and Space SavingsDocument32 pagesChair Locker Provides Storage and Space SavingsElza S. GapuzNo ratings yet

- College Physics Reasoning and Relationships 2nd Edition Nicholas Giordano Solutions ManualDocument36 pagesCollege Physics Reasoning and Relationships 2nd Edition Nicholas Giordano Solutions Manualshippo.mackerels072100% (22)

- Radiant Tube BurnersDocument18 pagesRadiant Tube BurnersRajeshNo ratings yet

- Henderson PresentationDocument17 pagesHenderson Presentationapi-577539297No ratings yet

- Messier 88Document3 pagesMessier 88Matheus RochaNo ratings yet