Professional Documents

Culture Documents

Feasib Chap 5

Uploaded by

HaideBrocalesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Feasib Chap 5

Uploaded by

HaideBrocalesCopyright:

Available Formats

V.

FINANCE ASPECT

This chapter shows the cost of the proposed project and the sources of

financing. This also interprets the financial statements, which include statement of

comprehensive income, statement of financial position, statement of partner’s equity

and cash flow statements.

1. GENERAL ASSUMPTIONS INCLUDING PROJECT COST AND GANTT

CHART

1. The maximum annual capacity is ???? packs of 100g mushroom chicharons.

2. Annual production will increase 20% annually.

3. Depreciation is computed on straight-line basis.

4. All factory workers have spontaneous productions throughout the year.

5. The company hours will be from 8:00am - 12:00nn and will resume at 1:00pm

- 5:00pm which is 8 hours/day, Monday to Saturday.

6. In terms of leasing agreement, the depreciation of the building and its property

tax will be paid by the owner and not the leasee.

7. Rent expense will be allocated based on space allotment.

2. SPECIFIC ASSUMPTIONS ON COST OF GOODS SOLD ACCOUNTS

Raw materials will be purchased from local suppliers and price of raw materials and

indirect materials is expected to increase by 5% annually.

Direct raw materials will be restocked every three months. While indirect raw

materials will be replenished monthly direct raw materials end will be 10% of

available raw materials.

There will be no work in process inventory.

Finished goods at year end will be 5% of of total goods available for sale.

Direct and indirect labor labor will increase 5% annually.

Factory Overhead expense

a. Electricity Expense-….

b. Depreciation is allocated based on purpose and usage of the asset.

c. Repair and maintenance will be 5% of the total cost of machinery and

transportation vehicle. It is expected to increase 5% annually.

d. Water expense is www cubic meter per month. It is expected to

increase 10% annually. It is allocated based on ?????

e. Factory supplies is expected to increase by 10% annually, restocked

monthly and will have a 10% ending balance annually.

f. Gas, oil and lubricants will increase 10% annually.

3. SPECIFIC ASSUMPTIONS FOR SELLING AND ADMINISTRATIVE

ACCOUNTS

Sales and purchases are inclusive of Value Added Tax and the cost of vegetables

is tax exempt.

The price of mushroom chicharon will be based on incremental cost plus mark up.

Incremental cost of mushroom chicharon includes Direct Material, Direct Labor, and

Variable and Fixed Factor Overhead expenses.

1. Operating expense are the following:

a. Advertising expense is expected to increase 5% annually.

b. Sales supplies is expected to increase 5% annually and will have 20%

ending balance annually.

c. Office supplies is expected to increase 5% annually and will have 20%

ending balance annually.

d. Telephone expense will be P1,099 monthly plan with internet connection

and will increase …. annually. It will be equally allocated to selling and

Administrative.

e. SSS, Philhealth and Pag-ibig Contributions is based on the table…… and

will be based on monthly salaries and wages. (kelan due)

f. Taxes and licenses are expected to increase based on City Hall table.

g.

a. Partner’s salary is P5,000 monthly.

b. Fixed assets has no salvage value and estimated useful life as follows:

Machineries 10 years

Equipment 10 years

Leasehold Improvement 5 years

Delivery Vehicle 10 years

Furniture and Fixtures 10 years

1. Income tax rate is 30%. (TRAIN)

2. All working employees will be paid every 15th and 30th day of the month. (Every 3 years ang

increase)

4. PROJECTED FINANCIAL STATEMENTS

(excel pa)

5. SOURCES OF FINANCING

6. PROJECT EVALUATION

You might also like

- Guidelines Re Selling and Admi Expenses - 2014Document2 pagesGuidelines Re Selling and Admi Expenses - 2014HaideBrocalesNo ratings yet

- Naruto Reads Neji's Byakugan Training DiaryDocument2 pagesNaruto Reads Neji's Byakugan Training DiaryHaideBrocalesNo ratings yet

- Vat, Output Tax, Input Tax - 2014Document1 pageVat, Output Tax, Input Tax - 2014HaideBrocalesNo ratings yet

- Exercises - Simple Jes - MDSNG No. 2 - 2014Document2 pagesExercises - Simple Jes - MDSNG No. 2 - 2014HaideBrocalesNo ratings yet

- 二章 chapter twoDocument2 pages二章 chapter twoHaideBrocalesNo ratings yet

- Naruto Jinraiden - The Day The Wolf Howled PDFDocument73 pagesNaruto Jinraiden - The Day The Wolf Howled PDFHaideBrocalesNo ratings yet

- Job Application Letter in Word 41Document2 pagesJob Application Letter in Word 41HaideBrocalesNo ratings yet

- Lung Cancer: Causes, Treatments, and PreventionDocument1 pageLung Cancer: Causes, Treatments, and PreventionHaideBrocalesNo ratings yet

- Naruto Jinraiden - The Day The Wolf Howled PDFDocument73 pagesNaruto Jinraiden - The Day The Wolf Howled PDFHaideBrocalesNo ratings yet

- Shikamaru Investigates the Attack on NarutoDocument6 pagesShikamaru Investigates the Attack on NarutoKunal SonwaneNo ratings yet

- RR No. 8-2018Document27 pagesRR No. 8-2018deltsen100% (1)

- We Are The Servant of The Reign of GodDocument7 pagesWe Are The Servant of The Reign of GodHaideBrocalesNo ratings yet

- Reading and Writing Online Class vs. Face To FaceDocument4 pagesReading and Writing Online Class vs. Face To FaceHaideBrocales100% (1)

- 二章 chapter twoDocument2 pages二章 chapter twoHaideBrocalesNo ratings yet

- Naruto Reads Neji's Byakugan Training DiaryDocument2 pagesNaruto Reads Neji's Byakugan Training DiaryHaideBrocalesNo ratings yet

- Hokage's Mystery IllnessDocument17 pagesHokage's Mystery IllnessBianca Benj ZariNo ratings yet

- Sched 1 - 27Document25 pagesSched 1 - 27HaideBrocalesNo ratings yet

- V Finance Aspect2222.Docx FINALDocument6 pagesV Finance Aspect2222.Docx FINALHaideBrocalesNo ratings yet

- Projected Financial StatementsDocument13 pagesProjected Financial StatementsHaideBrocalesNo ratings yet

- Narrative Report 7.25.2015Document2 pagesNarrative Report 7.25.2015HaideBrocalesNo ratings yet

- Boruto - Naruto The MovieDocument98 pagesBoruto - Naruto The MovieHaideBrocalesNo ratings yet

- Schedule 28 - PAYROLL Employer's Contribution Employee's ContributionDocument1 pageSchedule 28 - PAYROLL Employer's Contribution Employee's ContributionHaideBrocalesNo ratings yet

- YEllDocument1 pageYEllHaideBrocalesNo ratings yet

- Narrative Report 7.24.2015Document2 pagesNarrative Report 7.24.2015HaideBrocales100% (1)

- V Finance Aspect2222Document19 pagesV Finance Aspect2222HaideBrocalesNo ratings yet

- Problem 2Document18 pagesProblem 2HaideBrocalesNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Practical Accounting One PDFDocument46 pagesPractical Accounting One PDFDea Lyn BaculaNo ratings yet

- Ve4psutoy Activity Chapter 8 Adjusting EntriesDocument3 pagesVe4psutoy Activity Chapter 8 Adjusting EntriesLyra Mae De BotonNo ratings yet

- Nagpur Improvement Trust: Owner's Copy Station Road, Sadar, NagpurDocument1 pageNagpur Improvement Trust: Owner's Copy Station Road, Sadar, NagpurAnilHumneNo ratings yet

- Ms. Shabana Tabusum, Daughter of MR - Zaheer Jan Residing at No. 7, Subbarayan StreetDocument2 pagesMs. Shabana Tabusum, Daughter of MR - Zaheer Jan Residing at No. 7, Subbarayan Streetfasul rahmanNo ratings yet

- Residential Tenancy Agreement: Standard FormDocument11 pagesResidential Tenancy Agreement: Standard FormKim Ling KuanNo ratings yet

- 8 - Heirs of Enrique Tan Sr. V Pollescas G.R. No. 145568 November 17 2005Document13 pages8 - Heirs of Enrique Tan Sr. V Pollescas G.R. No. 145568 November 17 2005Christine Marie EboNo ratings yet

- Apartment Sale Deed FormatDocument11 pagesApartment Sale Deed FormatDhaval Gohel100% (9)

- Mercedes N. Abella, Petitioner, vs. The Honorable Court of APPEALS, and CONRADO COLARINA, RespondentsDocument3 pagesMercedes N. Abella, Petitioner, vs. The Honorable Court of APPEALS, and CONRADO COLARINA, RespondentsJaja Ordinario Quiachon-AbarcaNo ratings yet

- 9-Reporting and Analyzing Long-Lived AssetsDocument67 pages9-Reporting and Analyzing Long-Lived Assetstibip12345100% (1)

- Master Lease Agreement SummaryDocument5 pagesMaster Lease Agreement SummaryMy SolutionNo ratings yet

- 14 PACULDO V CADocument2 pages14 PACULDO V CAJulius ManaloNo ratings yet

- Both EX270421Document6 pagesBoth EX270421Roy RowlandsNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- GST Introductory NotesDocument18 pagesGST Introductory NotesCA Ujjwal KumarNo ratings yet

- DTP PolicyDocument4 pagesDTP PolicyVamshi Krishna Reddy PathiNo ratings yet

- Gati LTD Vs Air India LTDDocument13 pagesGati LTD Vs Air India LTDAbhineet KaliaNo ratings yet

- House Agreement PDFDocument4 pagesHouse Agreement PDFlingesh SKA BMNo ratings yet

- Rental Agreement DivyasreeDocument4 pagesRental Agreement Divyasreedilip2904No ratings yet

- India Mumbai Industrial H2 2020Document2 pagesIndia Mumbai Industrial H2 2020mudit methaNo ratings yet

- Format of Financial Statements Under The Revised Schedule VIDocument97 pagesFormat of Financial Statements Under The Revised Schedule VIDebadarshi RoyNo ratings yet

- Business Tax IntroductionDocument5 pagesBusiness Tax IntroductionJessica MalijanNo ratings yet

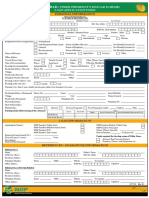

- NBP Karobar: Personal InformationDocument1 pageNBP Karobar: Personal InformationWasim NaqviNo ratings yet

- Sample Demand LetterDocument2 pagesSample Demand LetterPaul Nicholas A. Villania0% (1)

- Residential Lease AgreementDocument7 pagesResidential Lease AgreementpeteradrianNo ratings yet

- Lessee Accounting for Lease Extensions and ModificationsDocument5 pagesLessee Accounting for Lease Extensions and ModificationsikiNo ratings yet

- Smith Robinson Building Office Space Leasing FlyerDocument2 pagesSmith Robinson Building Office Space Leasing FlyertrumediaNo ratings yet

- Case Study Timeshare HotelDocument8 pagesCase Study Timeshare HotelMatthew YuNo ratings yet

- PhiladelphiaBusinessJournal May 11, 2018 PDFDocument80 pagesPhiladelphiaBusinessJournal May 11, 2018 PDFCraig EyNo ratings yet

- SEC TRANS Case Digests: Velez v. BalzarraDocument13 pagesSEC TRANS Case Digests: Velez v. BalzarraRodeleine Grace C. MarinasNo ratings yet

- Wo#086 - JCTDocument76 pagesWo#086 - JCTNurul Najwa Naqiyah MohammedNo ratings yet